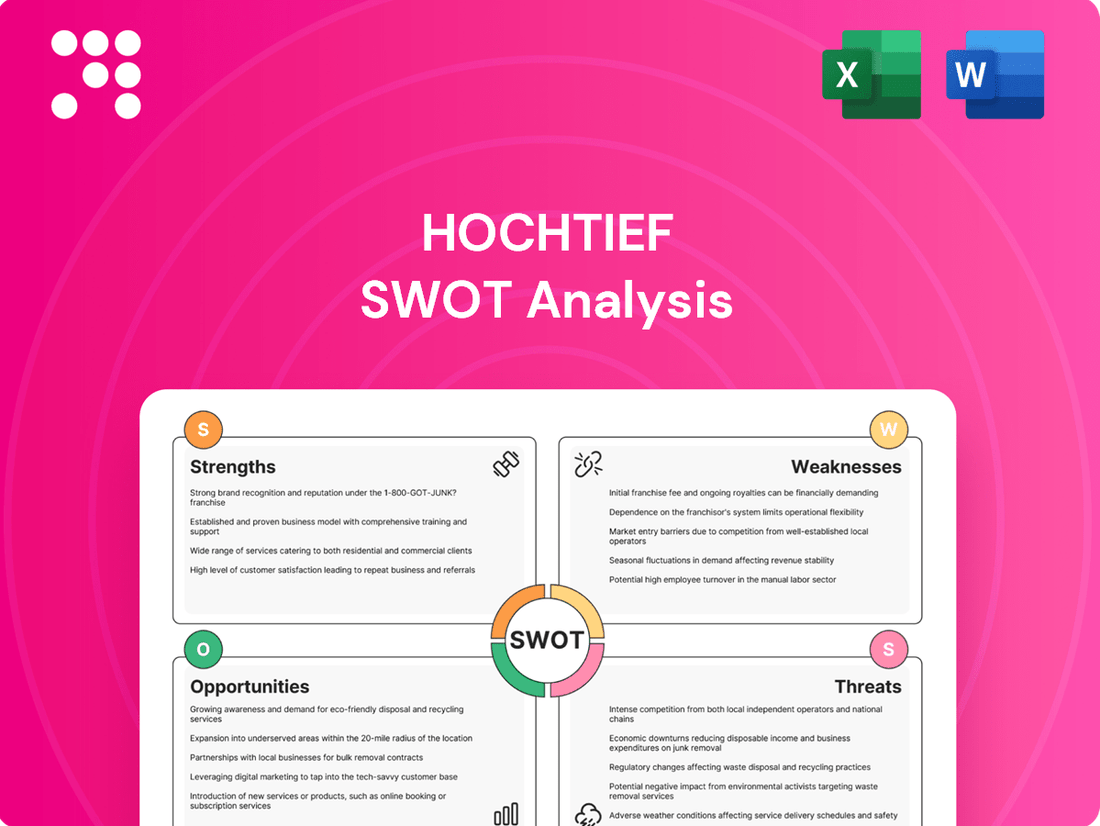

Hochtief SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

HOCHTIEF's strengths lie in its global presence and diversified project portfolio, but its reliance on large-scale infrastructure projects presents significant market risks. Opportunities for growth exist in emerging markets and sustainable construction, yet competitive pressures and economic downturns pose considerable threats.

Want the full story behind HOCHTIEF's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

HOCHTIEF's global leadership is a significant strength, underscored by its substantial international presence. Key subsidiaries like Turner in the USA and CIMIC in the Asia-Pacific region, alongside HOCHTIEF Europe, contribute to a robust geographical diversification. This spread significantly reduces the company's reliance on any single market, ensuring a broad and stable revenue base across diverse infrastructure segments.

The company's expertise is a major asset, covering complex projects in vital areas such as transportation, energy, and urban infrastructure. This broad capability allows HOCHTIEF to serve a wide array of public and private clients across the globe, demonstrating its capacity to handle challenging and large-scale developments. For instance, CIMIC's significant contributions to infrastructure projects in Australia, a region experiencing strong investment, highlight this operational breadth.

HOCHTIEF has shown impressive financial strength, with sales and net profit climbing significantly in 2024 and continuing this upward trend into the first quarter of 2025.

The company closed 2024 with an all-time high order backlog of €67.6 billion, which further expanded to €70.2 billion by March 2025.

This substantial backlog, with more than 85% secured through lower-risk contracts, offers a solid foundation for predictable future earnings and revenue streams.

HOCHTIEF's deliberate focus on high-growth sectors like data centers, advanced technology, and the energy transition is a significant strength. The company recently secured a substantial contract for a Meta data center campus in Louisiana, highlighting its success in this booming area. This strategic direction aligns perfectly with global trends towards digitalization and decarbonization, positioning HOCHTIEF for future expansion.

Commitment to Sustainability and Digitalization

HOCHTIEF’s dedication to sustainability is evident in its Sustainability Plan 2025, which targets climate neutrality by 2045. This plan includes ambitious interim goals for reducing greenhouse gas emissions and embedding circular economy principles across its operations.

The company actively incorporates Environmental, Social, and Governance (ESG) criteria into its financial decision-making processes. This commitment ensures that sustainability is a core consideration in strategic investments and operational planning.

Digitalization is a key enabler of HOCHTIEF's sustainability efforts. By employing technologies like Building Information Modeling (BIM) and artificial intelligence (AI), the company is significantly boosting operational efficiency and actively working to minimize its environmental footprint.

- Sustainability Plan 2025: Climate neutrality by 2045 with interim GHG reduction targets.

- ESG Integration: ESG criteria are systematically embedded into financial decisions.

- Digitalization for Efficiency: BIM and AI are utilized to enhance project delivery and environmental performance.

Proven Expertise in Complex Projects and PPPs

HOCHTIEF's extensive history, spanning over 150 years, has cultivated deep expertise in managing intricate infrastructure endeavors. This experience encompasses the full project lifecycle, from initial conception and design through to ongoing operation and upkeep.

The company demonstrates significant strength in public-private partnerships (PPPs). HOCHTIEF's strategic approach involves targeting projects with reduced risk profiles, frequently incorporating risk-sharing agreements. This focus enhances its ability to successfully deliver complex projects and strengthens its standing in the market.

- 150+ years of experience in complex infrastructure development.

- **Specialization in the entire value chain** of infrastructure projects.

- **Proven track record in Public-Private Partnerships (PPPs)**.

- **Strategic focus on lower-risk contracts** with risk-sharing mechanisms.

HOCHTIEF's robust financial performance is a key strength, evidenced by its impressive sales and profit growth throughout 2024 and continuing into early 2025. The company's order backlog reached an all-time high of €67.6 billion at the end of 2024, further increasing to €70.2 billion by March 2025, with over 85% secured through lower-risk contracts, ensuring stable future revenue.

The company's strategic focus on high-growth sectors like data centers and the energy transition, exemplified by a recent major contract for a Meta data center campus, positions it well for future expansion. This aligns with global trends towards digitalization and decarbonization, creating significant opportunities for continued success.

HOCHTIEF's commitment to sustainability, outlined in its Sustainability Plan 2025 aiming for climate neutrality by 2045, and the integration of ESG criteria into financial decisions, demonstrates a forward-thinking approach. The use of digitalization tools like BIM and AI further enhances operational efficiency and environmental performance.

With over 150 years of experience, HOCHTIEF possesses deep expertise across the entire infrastructure project lifecycle and a strong track record in public-private partnerships (PPPs), often securing lower-risk contracts with risk-sharing agreements.

| Metric | 2024 (End) | Q1 2025 |

|---|---|---|

| Order Backlog | €67.6 billion | €70.2 billion |

| Low-Risk Contracts in Backlog | > 85% | > 85% |

What is included in the product

Delivers a strategic overview of Hochtief’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework to identify and address Hochtief's strategic challenges and leverage its competitive advantages.

Weaknesses

The construction and infrastructure industry is closely tied to the health of the overall economy. This means HOCHTIEF's performance can be significantly affected by factors like rising inflation, higher interest rates, and any general slowdown in global economic activity. For instance, a sustained economic downturn in major markets such as the Americas or Asia Pacific could lead to reduced demand for new projects and put pressure on HOCHTIEF's earnings.

The global construction sector, including HOCHTIEF's operational areas, continues to grapple with significant skilled labor shortages. This scarcity is exacerbated by an aging workforce, with many experienced professionals nearing retirement. For instance, in Germany, a key market for HOCHTIEF, the construction trade association reported a deficit of around 250,000 skilled workers in early 2024, a figure projected to grow.

These workforce challenges directly impact HOCHTIEF's project execution. The inability to secure sufficient skilled personnel can lead to project delays, pushing back timelines and potentially incurring penalties. Furthermore, the increased demand for a limited pool of talent drives up labor costs, squeezing profit margins and affecting overall project profitability.

The construction industry, including HOCHTIEF, faces significant headwinds from supply chain disruptions and fluctuating material costs. Geopolitical instability and escalating energy prices, as seen throughout 2023 and into early 2024, have directly impacted the availability and price of essential construction materials like steel and cement.

While HOCHTIEF actively pursues advanced sourcing methods to mitigate these risks, the persistent volatility can still erode project margins and lead to unexpected cost escalations. For instance, the global cement price index saw a notable increase of approximately 8% year-over-year in Q4 2023, a trend that continued into the first half of 2024, directly affecting project budgets.

Integration Risks from Acquisitions and Joint Ventures

HOCHTIEF’s growth strategy, heavily reliant on acquisitions like the 2023 acquisition of Dornan and the integration of Flatiron-Dragados, introduces significant integration risks. These can manifest as challenges in harmonizing different corporate cultures, IT systems, and operational processes, potentially hindering expected synergies and impacting financial results.

Managing joint ventures also presents complexities. For instance, in 2024, HOCHTIEF is involved in several large-scale joint ventures for infrastructure projects. The success of these ventures hinges on effective collaboration and shared strategic alignment, but disagreements or differing operational approaches can lead to delays and cost overruns.

- Integration Challenges: Merging acquired companies like Dornan requires significant management attention to ensure smooth operational transitions and cultural alignment, which can strain resources.

- Joint Venture Dependencies: The performance of HOCHTIEF’s large projects often depends on the successful execution by its joint venture partners, introducing external risks to project timelines and profitability.

- Synergy Realization: Failure to achieve projected cost savings or revenue enhancements from acquisitions can negatively impact HOCHTIEF's profitability and return on investment.

Dependency on Specific Natural Resources and Regulatory Compliance

Hochtief's operations are inherently tied to the availability of specific natural resources like sand, gravel, and water. Fluctuations in their supply or price, driven by environmental concerns or geopolitical factors, can directly impact project costs and timelines. For instance, increased demand for sustainable building materials could necessitate sourcing from more distant or expensive locations.

The construction sector faces increasing scrutiny regarding its environmental footprint, placing Hochtief under the purview of evolving regulations. New policies, such as those aimed at enhancing biodiversity protection or imposing stricter greenhouse gas (GHG) emission targets for construction activities, could significantly raise compliance costs. For example, a hypothetical 10% increase in compliance costs due to new environmental legislation could impact project profitability.

- Resource Dependency: Reliance on natural resources like aggregates and water makes Hochtief vulnerable to supply disruptions and price volatility.

- Regulatory Burden: Evolving environmental laws, including biodiversity protection and GHG emission standards, can increase operational expenses and project lead times.

- Compliance Costs: Adhering to new environmental mandates may require investment in new technologies or processes, potentially adding to project budgets.

- Project Delays: Stricter environmental reviews or permitting processes could lead to unforeseen project schedule extensions.

Hochtief's reliance on acquisitions, such as the 2023 purchase of Dornan, introduces integration risks. Merging diverse corporate cultures, IT systems, and operational processes can strain resources and hinder the realization of expected synergies, potentially impacting financial performance.

The company's involvement in numerous joint ventures presents inherent dependencies. Disagreements or differing operational approaches among partners in large infrastructure projects, common in 2024, can lead to project delays and cost overruns, impacting overall profitability.

Failure to achieve projected cost savings or revenue enhancements from these acquisitions can negatively impact HOCHTIEF's profitability and return on investment, a key concern for investors monitoring post-acquisition performance.

Hochtief's dependence on natural resources like aggregates and water makes it susceptible to supply disruptions and price volatility, which can directly impact project costs and timelines.

Same Document Delivered

Hochtief SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Hochtief's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Hochtief SWOT analysis, allowing for customization and integration into your business planning.

Opportunities

The global infrastructure market is booming, fueled by governments pouring money into projects, cities expanding, and the urgent need to update old systems. This presents a massive opportunity for HOCHTIEF to expand its reach and secure new projects worldwide.

The United States, in particular, is a key growth area thanks to the Infrastructure Investment and Jobs Act (IIJA). This legislation alone is expected to allocate approximately $1.2 trillion by 2026, with a significant portion dedicated to transportation and energy infrastructure, areas where HOCHTIEF has strong expertise.

The digital revolution, especially the rapid advancement of Artificial Intelligence (AI), is driving an unprecedented surge in demand for data centers and sophisticated technology infrastructure. This trend is a significant opportunity for companies like HOCHTIEF.

HOCHTIEF is strategically positioned to capitalize on this booming sector. The company reported a substantial increase in its order backlog for data center projects, reflecting strong market demand and its growing expertise in this specialized construction area. For instance, by the end of 2023, HOCHTIEF's order intake for data centers saw significant growth, contributing to its overall robust performance.

Beyond construction, HOCHTIEF also sees opportunities for equity investments in data center development. This dual approach allows the company to benefit from both the construction phase and the long-term value appreciation of these critical digital assets, further solidifying its role in the evolving technological landscape.

The global push for energy transition and decarbonization creates substantial opportunities for HOCHTIEF. This includes a growing demand for renewable energy installations, like solar and wind farms, as well as sustainable infrastructure projects. For instance, the International Energy Agency (IEA) projected in early 2024 that global renewable capacity additions would reach nearly 500 gigawatts in 2024, a significant increase from previous years, directly benefiting companies like HOCHTIEF involved in construction and development.

HOCHTIEF's strategic alignment with sustainable solutions positions it well to capitalize on increased investments in clean energy. The company's expertise in green building and sustainable urban development aligns with market trends and regulatory pressures favoring environmentally conscious construction. This focus is crucial as many governments worldwide are setting ambitious net-zero targets, driving demand for green construction services and materials.

Leveraging Digitalization and Innovation in Construction

The construction industry is rapidly embracing digital tools, presenting significant growth avenues. Advancements like Artificial Intelligence (AI), machine learning, Building Information Modeling (BIM), and 3D printing are set to revolutionize how projects are planned, executed, and managed, leading to increased efficiency and cost savings. For instance, BIM adoption has been shown to reduce rework by up to 50% on complex projects. HOCHTIEF's ongoing commitment to digital transformation positions it to capitalize on these trends.

HOCHTIEF's strategic investments in digitalization are a key opportunity to solidify its market position and win more lucrative projects. By integrating cutting-edge technologies, the company can offer enhanced value to clients, differentiate itself from competitors, and improve overall project delivery. The global construction technology market is projected to reach $150 billion by 2028, indicating substantial room for growth.

- Enhanced Efficiency: AI and machine learning can optimize resource allocation and scheduling, potentially reducing project timelines by 10-20%.

- Cost Reduction: BIM implementation has demonstrated an average cost saving of 5-10% through better clash detection and reduced material waste.

- Improved Project Outcomes: 3D printing in construction offers faster build times and the potential for novel designs, improving structural integrity and sustainability.

- Competitive Advantage: HOCHTIEF's early adoption of these technologies allows it to secure higher-value contracts and lead in innovation.

Public-Private Partnerships and Alternative Financing Models

The growing reliance on public-private partnerships (PPPs) and the demand for novel financing solutions in infrastructure projects present significant opportunities for HOCHTIEF. The company's integrated approach, covering development, financing, construction, and operation, is well-suited to capitalize on these evolving models.

HOCHTIEF's ability to manage complex projects within PPP frameworks allows it to tap into a growing global market. For instance, the infrastructure investment gap remains substantial, with projections indicating trillions needed globally over the coming decades, creating a fertile ground for PPPs.

- Global infrastructure investment needs are projected to exceed $94 trillion by 2040, according to the Global Infrastructure Hub, highlighting the scale of opportunity for PPPs.

- HOCHTIEF's established track record in delivering large-scale infrastructure projects, often utilizing complex financing structures, positions it favorably to secure and execute new PPP contracts.

- The company's financial strength and access to capital markets are crucial for undertaking projects requiring substantial upfront investment, a common characteristic of PPPs.

The global infrastructure market is experiencing robust growth, driven by government stimulus and the need for modernization, creating substantial opportunities for HOCHTIEF to expand its project portfolio worldwide.

The United States' Infrastructure Investment and Jobs Act (IIJA) alone is set to inject approximately $1.2 trillion by 2026, with a significant portion allocated to transportation and energy infrastructure, areas where HOCHTIEF possesses strong expertise.

The burgeoning demand for data centers, fueled by advancements in AI and digital technologies, presents a lucrative avenue for HOCHTIEF, which has seen a notable increase in its order backlog for such specialized projects.

HOCHTIEF's strategic focus on sustainability aligns perfectly with the global energy transition, positioning it to benefit from increased investments in renewable energy infrastructure and green building projects, as the IEA projected nearly 500 GW of renewable capacity additions globally in 2024.

The construction industry's embrace of digital tools like AI and BIM offers HOCHTIEF opportunities for enhanced efficiency and cost reduction, with BIM adoption potentially reducing rework by up to 50% and the construction technology market projected to reach $150 billion by 2028.

The increasing reliance on public-private partnerships (PPPs) and innovative financing solutions for infrastructure development provides HOCHTIEF with a significant opportunity, given its integrated business model and proven track record in managing complex, large-scale projects.

Threats

The global construction market is a crowded arena, with major players like Ferrovial, Strabag, and Skanska constantly vying for projects. This fierce rivalry puts significant pressure on profit margins, compelling companies like Hochtief to innovate continuously and offer competitive bids to win new contracts.

Ongoing inflationary pressures continue to impact the construction sector, with Hochtief facing increased material and labor costs. For instance, the Producer Price Index for construction inputs in the US saw a significant rise in late 2023 and early 2024, directly affecting project budgets.

High interest rates, while showing signs of moderation, still pose a threat by increasing financing costs for new developments and potentially dampening investor appetite for large-scale infrastructure projects, a key market for Hochtief.

Persistent volatility in interest rates can create uncertainty in project planning and execution, impacting Hochtief's profitability and ability to secure favorable financing for its global operations.

Heightened geopolitical tensions and a rise in trade protectionism present a significant threat, potentially disrupting global supply chains and increasing material costs for HOCHTIEF. For instance, the ongoing trade disputes between major economies in 2024 could lead to unexpected tariffs on construction materials, directly impacting project budgets and timelines. This volatility also risks dampening demand for large-scale infrastructure projects in regions heavily reliant on international trade, affecting HOCHTIEF's order book.

Regulatory and Environmental Policy Changes

Evolving environmental regulations, particularly concerning greenhouse gas (GHG) emissions and biodiversity, present a significant threat. Stricter GHG inventory plans could necessitate substantial investments in sustainable construction practices and materials, potentially increasing project costs for HOCHTIEF. For instance, the European Union's Green Deal initiatives and national climate targets are driving up the demand for low-carbon construction, impacting traditional methods.

Furthermore, enhanced biodiversity protection policies, such as those aimed at preserving natural habitats during infrastructure development, may lead to longer project timelines and require costly mitigation measures. Failure to proactively adapt to these shifts in environmental policy could not only affect the viability of HOCHTIEF's projects but also damage its public image and stakeholder trust. In 2023, the construction sector globally faced increased scrutiny regarding its environmental footprint, with a growing number of projects experiencing delays due to environmental impact assessments and permitting processes related to biodiversity concerns.

- Increased Compliance Costs: Stricter environmental standards directly translate to higher operational expenses for materials, technology, and reporting.

- Project Delays: Environmental impact assessments and permitting processes, especially those involving biodiversity, can significantly lengthen project schedules.

- Reputational Risk: Non-compliance or perceived environmental negligence can severely harm HOCHTIEF's brand image and ability to secure future contracts.

- Impact on Project Viability: Escalating environmental requirements might make certain traditional projects financially unfeasible without significant adaptation.

Talent Retention and Succession Planning

HOCHTIEF faces a significant challenge in retaining skilled talent and planning for future leadership, especially as its workforce ages. The construction sector, including HOCHTIEF, requires a diverse skill set encompassing traditional technical expertise, digital proficiency, and strong managerial capabilities. This demand for a blend of skills makes it harder to find and keep the right people for critical roles.

The aging workforce trend is a widespread concern in the construction industry. For example, in Germany, where HOCHTIEF has a strong presence, the average age of skilled construction workers has been steadily increasing, with many approaching retirement age in the coming years. This demographic shift directly impacts the availability of experienced personnel to lead and execute complex projects.

The need for a mix of technical, digital, and managerial skills is crucial for HOCHTIEF's future success. Without robust succession planning, the company might struggle to fill senior positions with individuals possessing the necessary modern competencies. This could hinder project staffing and the continuity of leadership, potentially affecting operational efficiency and strategic execution.

- Aging Workforce: A significant portion of the experienced workforce in construction is nearing retirement age, creating a knowledge and skills gap.

- Skill Gap: There's a growing demand for individuals with a blend of traditional construction skills, digital literacy (e.g., BIM, AI in construction), and advanced project management capabilities.

- Succession Planning Challenges: Identifying and developing future leaders who possess these diverse skill sets is a complex and ongoing challenge for companies like HOCHTIEF.

- Impact on Operations: Difficulty in staffing projects with qualified personnel and maintaining leadership continuity can directly affect project timelines and overall business performance.

Hochtief faces intense competition from global players like Ferrovial and Skanska, which pressures profit margins and necessitates continuous innovation. Rising inflation, particularly in material and labor costs, as seen with US construction input price increases in late 2023 and early 2024, directly impacts project budgets. Furthermore, persistent interest rate volatility creates uncertainty in financing and project planning, potentially dampening investor appetite for large infrastructure projects.

SWOT Analysis Data Sources

This analysis leverages comprehensive data from Hochtief's official financial reports, extensive market research, and expert industry commentary to provide a robust and insightful SWOT assessment.