Hochtief Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

Curious about Hochtief's strategic positioning? This glimpse into their BCG Matrix highlights key product areas, but the full report unlocks the complete picture of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the full version to gain actionable insights and a clear roadmap for optimizing their portfolio and driving future growth.

Stars

HOCHTIEF is making significant strides in the data center sector, a market experiencing robust expansion. By the close of 2024, their order backlog in this area surpassed €8 billion, accounting for more than 12% of their entire backlog. This highlights their substantial engagement in building these critical digital infrastructure hubs.

The company is evolving its strategy beyond just construction to include ownership and operation of data centers, demonstrating a commitment through substantial equity investments. This vertical integration positions them to capture more value across the data center lifecycle.

Recent achievements, like securing a contract valued at over US$10 billion for Meta's massive data center campus in Louisiana, clearly showcase HOCHTIEF's dominant market position. This success is fueled by the accelerating demand for data center capacity, driven by advancements in artificial intelligence and the ongoing digitalization of economies worldwide.

Energy Transition Infrastructure, a key area within HOCHTIEF's strategic focus, includes vital projects like solar farms, battery energy storage systems (BESS), and electric vehicle (EV) charging networks. This segment is experiencing robust growth, fueled by the global push towards decarbonization. For instance, the global BESS market alone was projected to reach USD 149.4 billion by 2030, demonstrating substantial investment potential.

HOCHTIEF is strategically positioning itself in this burgeoning market by developing renewable energy assets and essential grid infrastructure. Their involvement extends to critical metals, with active participation in various lithium projects across multiple continents, highlighting a commitment to securing the raw materials necessary for the energy transition.

The surge in demand for artificial intelligence and digitalization is fueling significant investment in advanced technology and semiconductor facilities. HOCHTIEF recognizes this as a key growth area, actively evaluating a robust pipeline of projects. This strategic focus leverages their established market presence in this high-growth sector.

HOCHTIEF is poised to benefit from the sector's rapid expansion, having secured new projects in vital markets such as the United States, Malaysia, and Germany. For instance, in 2024, the global semiconductor manufacturing equipment market was projected to reach over $100 billion, highlighting the immense scale of opportunities within this industry.

Social Infrastructure (Healthcare and Education)

HOCHTIEF's social infrastructure segment, encompassing healthcare and education, demonstrates robust potential within the BCG matrix. Subsidiaries like Turner in the United States are recognized leaders in these construction markets, driven by favorable demographic trends and increasing urbanization.

Turner's consistent ranking as the top construction manager in US healthcare underscores its significant market penetration. The company's ongoing success in securing major projects, such as hospital expansions and new university research facilities, highlights strong demand and HOCHTIEF's substantial share in this growth area.

- Leading Market Position: Turner is consistently ranked number one for construction management in the US healthcare sector.

- Strong Demand Drivers: Growth is fueled by demographic shifts and urbanization, increasing the need for healthcare and educational facilities.

- Project Wins: HOCHTIEF, through Turner, is actively securing significant projects like hospital expansions and university research buildings.

- Growth Potential: These sectors represent a growing demand area with substantial future opportunities for HOCHTIEF.

Digitalization in Construction and Smart Project Delivery

HOCHTIEF is at the forefront of digital transformation in construction, significantly investing in technologies like Building Information Modeling (BIM) and modular construction. This strategic adoption enhances project efficiency and sustainability, contributing to their strong market position.

Their commitment to smart project delivery, exemplified by initiatives such as Construct-X, allows HOCHTIEF to leverage technology for a distinct competitive edge. This focus on digital innovation is crucial in an industry that is rapidly modernizing.

- Digitalization Adoption: HOCHTIEF actively implements BIM, modular construction, and smart project delivery.

- Efficiency Gains: These technologies demonstrably reduce waste and boost operational efficiency on projects.

- Market Positioning: Their digital leadership solidifies HOCHTIEF's status as an industry innovator.

- Strategic Focus: The Construct-X project highlights their dedication to technological advantage.

HOCHTIEF's data center business, with an order backlog exceeding €8 billion by the end of 2024, positions it as a strong contender in the "Stars" category of the BCG matrix. This segment is characterized by high growth, driven by AI and digitalization, and HOCHTIEF's increasing involvement in ownership and operation further solidifies its market leadership.

The company's strategic investments and significant project wins, such as the US$10 billion Meta contract, underscore its dominant position in a rapidly expanding market. This strong performance in a high-growth sector clearly aligns with the characteristics of a Star within the BCG framework.

HOCHTIEF's focus on advanced technology and semiconductor facilities also falls into the Star category. The global semiconductor manufacturing equipment market alone was projected to exceed $100 billion in 2024, indicating substantial growth potential in which HOCHTIEF is actively participating.

The company's robust pipeline of projects in this area, secured in key markets like the United States, Malaysia, and Germany, further reinforces its Star status. This segment benefits from the increasing demand for advanced computing power and digital infrastructure.

| BCG Category | HOCHTIEF Segment | Growth Rate | Market Share | Key Drivers |

|---|---|---|---|---|

| Stars | Data Centers | High | High | AI, Digitalization, Cloud Computing |

| Stars | Advanced Technology & Semiconductor Facilities | High | High | Demand for computing power, AI infrastructure |

What is included in the product

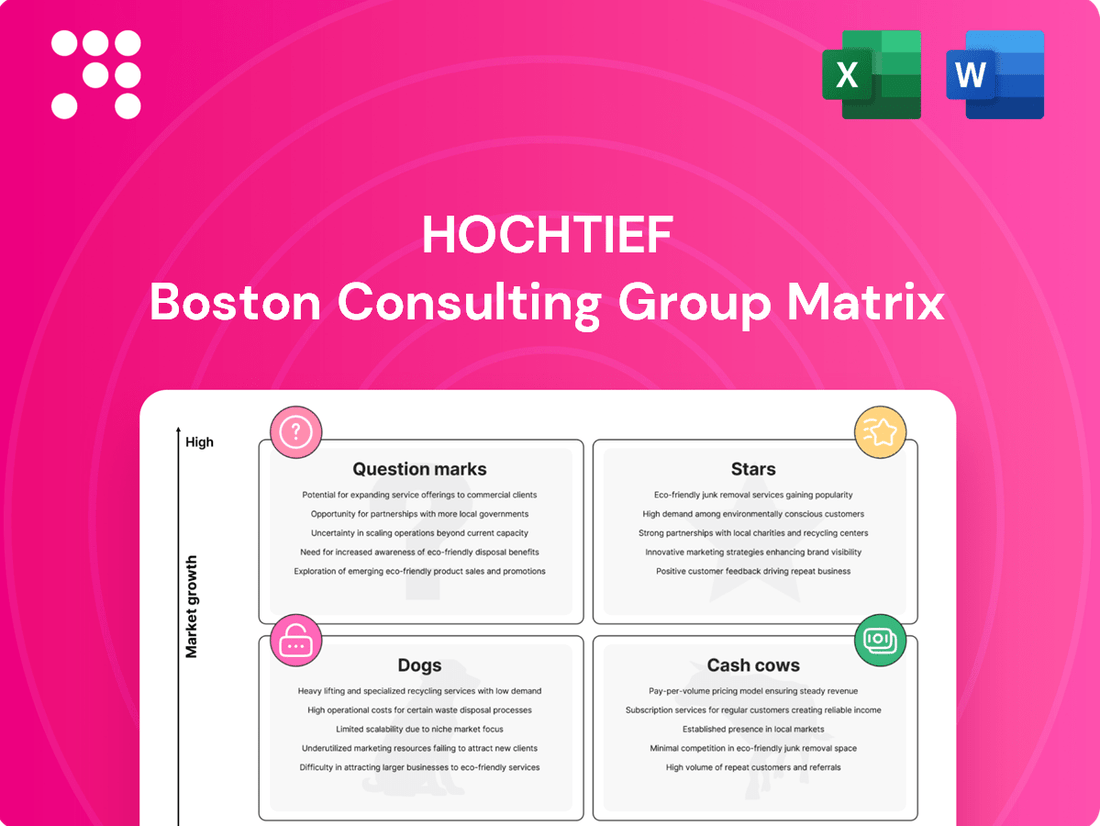

This BCG Matrix overview analyzes HOCHTIEF's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

A clear visual representation of Hochtief's business units, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

HOCHTIEF's 20% stake in Abertis positions the toll road operator as a significant Cash Cow within its portfolio. Abertis generates stable, mature revenue streams from its extensive concessions globally, offering consistent cash flow despite modest growth expectations.

In 2024, Abertis continued to demonstrate resilience, with its European toll road network, a core asset, showing steady traffic volumes and revenue generation. The company's focus on operational efficiency and strategic reinvestment in its existing concessions, such as upgrades to Spanish and Italian routes, underpins its strong profitability and reliable cash contribution to HOCHTIEF.

Turner, HOCHTIEF's US subsidiary, is a powerhouse in general and green building across the United States, holding the top spot in rankings. While some of its ventures are high-growth Stars, a significant portion of its business involves traditional commercial and public building contracts in established US markets.

These mature market projects are the bedrock of Turner's cash flow, consistently producing substantial and reliable earnings. They demand less investment in new market development compared to burgeoning sectors, which translates into impressive profit margins and robust cash generation for HOCHTIEF.

For instance, in 2024, the US construction market, particularly for commercial and public buildings, continued to show resilience. Turner's established presence and expertise in these areas allowed it to capitalize on ongoing infrastructure upgrades and commercial development, contributing significantly to HOCHTIEF's overall profitability.

CIMIC Group's contract mining services, primarily through its subsidiary Thiess, represent a significant cash cow within the HOCHTIEF Group's portfolio. Thiess, a cornerstone of CIMIC's operations in the Asia-Pacific region, consistently delivers robust revenue and profit contributions, underscoring its stable performance.

The longevity and scale of Thiess's mining contracts, particularly its strong presence in Australia, ensure a predictable and substantial cash flow. In 2023, CIMIC reported that its mining segment, which Thiess is a major part of, generated significant earnings, reflecting the segment's maturity and consistent demand for its services.

Long-Term Operation and Maintenance Contracts

HOCHTIEF's long-term operation and maintenance (O&M) contracts for infrastructure projects represent a significant cash cow. These agreements, often for major transportation and urban developments, generate stable, predictable revenue. For instance, in 2024, HOCHTIEF's O&M segment continued to benefit from its extensive portfolio of such contracts, contributing a consistent stream of income.

These O&M services are characterized by lower capital expenditure needs compared to new construction projects. This allows them to act as reliable cash generators from established assets. The predictable nature of these cash flows supports the company's overall financial stability.

- Stable Revenue Streams: Long-term O&M contracts provide predictable, recurring income.

- Low Capital Intensity: These services require less investment for growth, boosting cash generation.

- Mature Asset Monetization: They effectively monetize the value of completed infrastructure assets.

- Contribution to HOCHTIEF's Portfolio: In 2024, the O&M segment remained a vital contributor to HOCHTIEF's financial performance, underscoring its cash cow status.

Public-Private Partnerships (PPPs) for Operational Assets

For public-private partnerships (PPPs) where the construction phase has concluded, HOCHTIEF shifts its focus to the long-term operation and maintenance of these assets, securing consistent concession-based revenue streams. These established PPP projects, which can include vital infrastructure like highways or essential social facilities, are characterized by their predictable and often high-margin cash flows.

HOCHTIEF's expertise in project finance and robust risk management capabilities are crucial in ensuring these operational assets consistently deliver strong financial returns. For instance, in 2024, the company continued to benefit from its portfolio of mature PPP assets, contributing significantly to its stable earnings profile.

- Stable Revenue Streams: Mature PPP assets generate predictable income through long-term concession agreements.

- High Margins: Operational phases of PPPs typically yield higher profit margins compared to construction.

- Risk Management: HOCHTIEF's financial and risk management skills are key to maximizing returns from these assets.

- Portfolio Diversification: The company's involvement in various infrastructure sectors provides a diversified and resilient revenue base.

HOCHTIEF's investments in mature, stable businesses like its stake in Abertis and its operation and maintenance contracts are prime examples of Cash Cows. These ventures generate consistent, predictable cash flows with limited need for further investment, providing a solid foundation for the company's financial health. Turner's established US construction business and CIMIC Group's contract mining services, particularly Thiess in Australia, also fit this profile, leveraging their market positions for reliable earnings.

In 2024, these segments continued to be significant profit drivers. Abertis's European toll roads maintained steady traffic, while Turner benefited from ongoing US infrastructure spending. CIMIC's mining operations, especially in Australia, showed resilience, underscoring the mature and dependable nature of these revenue streams.

The operational phases of HOCHTIEF's public-private partnerships (PPPs) also contribute as Cash Cows, offering high-margin, predictable income from completed infrastructure assets. These mature concessions are vital for HOCHTIEF's stable earnings, demonstrating effective monetization of long-term investments.

| Business Segment | Primary Cash Cow Asset/Activity | 2024 Performance Indicator | Cash Flow Contribution |

|---|---|---|---|

| Investments | Abertis (20% Stake) | Stable European toll road traffic | Consistent, predictable income |

| Construction (US) | Turner - Mature Commercial/Public Buildings | Resilience in US construction market | Substantial, reliable earnings |

| Mining Services (APAC) | CIMIC Group (Thiess) - Australia | Strong presence in mature mining contracts | Robust revenue and profit |

| Infrastructure Operations | HOCHTIEF O&M Contracts | Extensive portfolio of long-term agreements | Predictable, recurring income |

| Public-Private Partnerships | Operational Phases of Mature PPPs | Benefit from mature assets | High-margin, stable earnings |

What You’re Viewing Is Included

Hochtief BCG Matrix

The preview you are currently viewing showcases the definitive Hochtief BCG Matrix report that you will receive immediately after completing your purchase. This means you can confidently assess the comprehensive analysis and professional formatting, knowing that the purchased version will be identical, free from any watermarks or demo limitations, and ready for immediate strategic application.

Dogs

Non-strategic, smaller-scale local projects at HOCHTIEF would likely fall into the 'Dogs' category of the BCG matrix. These ventures typically possess low market share within their specific local context and exhibit limited growth prospects, especially when compared to HOCHTIEF's global infrastructure ambitions.

These projects may not align with HOCHTIEF's core strategy of tackling complex, large-scale infrastructure, and thus, might not leverage the company's extensive global expertise or achieve economies of scale. For instance, in 2023, HOCHTIEF's revenue was €29.2 billion, with a significant portion driven by major international projects, underscoring the scale of their strategic focus.

Consequently, these smaller local projects could tie up valuable resources and capital with potentially minimal returns, offering little strategic advantage. The company's strategic direction, as evidenced by its substantial investments in areas like renewable energy infrastructure and digital transformation, prioritizes opportunities with greater scale and higher growth potential.

Legacy Ventures with Declining Returns represent older projects within Hochtief's portfolio that are nearing the end of their lifecycle. These ventures no longer offer significant follow-on work or substantial strategic value, leading to diminished profitability and cash generation.

These projects, having passed their initial high-growth phases, often require considerable management attention for ongoing maintenance or limited extensions, yet contribute minimally to overall growth. For instance, a mature infrastructure project completed in the early 2010s might now only involve routine upkeep, yielding low margins compared to new, innovative ventures.

In 2024, Hochtief's focus remains on divesting or minimizing investment in such legacy assets to reallocate resources towards more promising growth areas. The company's strategy prioritizes innovation and sustainability, making ventures with declining returns less attractive for continued capital allocation.

Divested civil engineering sub-segments within Hochtief's Engineering and Construction segment, following the transfer of Flatiron into a joint venture, represent areas that may have been strategically streamlined. This move, while causing a nominal sales decrease in the segment, allowed for a focus on more robust growth opportunities. These divested activities, if not aligning with the company's strategic growth objectives or possessing competitive market positions, would be categorized as Divested Civil Engineering Sub-segments.

Operations in Highly Commoditized Construction Niches

In highly fragmented and competitive construction sub-markets where services are commoditized, HOCHTIEF may face intense price pressure and lower profit margins. If the company operates in any such niche without a distinct competitive advantage or significant market share, these activities could be categorized as **Dogs**.

These areas typically require substantial effort for minimal returns and are not aligned with HOCHTIEF's focus on complex, high-value projects. For instance, in 2024, the global construction market experienced varied performance across segments, with some commoditized areas like basic infrastructure maintenance seeing tighter margins due to increased competition and material cost volatility. HOCHTIEF's strategy aims to steer clear of such low-margin segments.

- Dogs represent business units or markets with low growth and low market share.

- In construction, this could translate to operating in niche segments with intense price competition and limited differentiation.

- HOCHTIEF's focus is on leveraging its expertise in complex, large-scale projects to avoid the low profitability often associated with commoditized construction services.

Outdated Construction Methodologies or Niche Services

Segments or services reliant on older, less efficient construction methods, failing to integrate digitalization or advanced materials, would be classified as Dogs within the HOCHTIEF BCG Matrix. As the construction industry increasingly prioritizes sustainable and digital solutions, the demand for traditional, less innovative approaches is likely to decline.

These areas would face significant challenges in maintaining market share and profitability, as they fail to leverage HOCHTIEF's core strengths in cutting-edge construction technologies and practices. For instance, a segment focused solely on traditional brick-and-mortar construction without incorporating prefabrication or BIM (Building Information Modeling) might fall into this category.

- Declining Market Share: These services experience a shrinking customer base as clients demand more modern, efficient, and sustainable building solutions.

- Low Profitability: Inefficient processes and lack of technological adoption lead to higher costs and reduced margins compared to more advanced competitors.

- Limited Growth Potential: The inherent nature of outdated methodologies restricts scalability and future market penetration.

Projects characterized by low market share in niche, commoditized construction segments, or those employing outdated methodologies that hinder efficiency and innovation, would be classified as Dogs. These ventures typically offer limited growth prospects and struggle with profitability due to intense competition and the absence of a distinct competitive advantage.

HOCHTIEF's strategic imperative is to avoid such low-margin activities, focusing instead on leveraging its expertise in large-scale, complex infrastructure projects. For example, in 2024, the global construction market saw continued demand for digitally integrated and sustainable solutions, further marginalizing less innovative approaches.

These "Dog" segments may require significant management attention but yield minimal strategic value or financial returns, diverting resources from more promising growth areas. HOCHTIEF's 2023 revenue of €29.2 billion underscores its focus on large-scale, high-impact international projects, a stark contrast to the limited potential of "Dog" ventures.

The company's strategic direction, evidenced by investments in renewable energy and digital transformation, prioritizes opportunities with substantial scale and growth potential, actively moving away from areas with declining returns or limited competitive positioning.

Question Marks

Early-stage smart city integrated solutions, while a potential high-growth area for HOCHTIEF, currently represent a question mark in the BCG matrix. These ventures, involving novel technologies and urban planning, are in their infancy with developing market adoption. For instance, pilot projects for autonomous public transport or integrated energy management systems are still in the proof-of-concept phase, with limited revenue streams and uncertain market share.

HOCHTIEF is strategically investing in a European network of decentralized edge data centers, a move that positions them within a rapidly evolving market segment. This initiative aligns with the broader data center industry, which is classified as a Star in the BCG Matrix due to its consistent high growth and market share.

The edge data center niche, however, represents an emerging market for HOCHTIEF. While the overall data center sector shines, this specific focus on smaller, distributed facilities is still developing. HOCHTIEF is actively building its footprint and market share here, recognizing the significant growth potential in this nascent area.

Currently, edge data centers are not a dominant contributor to HOCHTIEF's overall portfolio, placing them in a position of a Question Mark or potentially moving towards a Star as the market matures and their investment yields results. The company's proactive approach suggests a calculated bet on future market leadership in this specialized segment of the data infrastructure landscape.

HOCHTIEF's engagement in nascent R&D for highly specialized advanced materials places these initiatives squarely in the Question Mark category of the BCG Matrix. These are cutting-edge areas where the company is exploring novel material properties and applications, aiming to unlock future market opportunities.

While the exact financial figures for these nascent R&D projects are typically proprietary and not publicly disclosed, the strategic intent is clear: to invest in areas with high potential but uncertain immediate returns. For instance, companies in the advanced materials sector often see R&D spending as a significant portion of their revenue, with some established players allocating 5-10% of their turnover to innovation. HOCHTIEF's speculative investments here are geared towards identifying the next generation of high-demand materials.

The success of these Question Marks hinges on their ability to transition from experimental phases to commercially viable products. If these R&D efforts yield breakthroughs that create new markets or significantly disrupt existing ones, they could evolve into Stars, generating substantial future revenue and market share for HOCHTIEF.

New Geographic Market Entries for Specific Project Types

Entering new, smaller geographic markets for specialized project types positions HOCHTIEF in a "question mark" category within its strategic matrix. This strategy involves building initial market share and brand recognition for a niche offering in regions where the company currently has minimal presence.

The potential for significant growth exists in these nascent markets, but current penetration is low. This necessitates substantial upfront investment for market establishment and brand building. For instance, HOCHTIEF’s 2024 performance highlighted expansion into emerging infrastructure markets, where initial project wins are crucial for future growth.

- High Growth Potential: Emerging markets often exhibit rapid economic development, driving demand for specialized construction services.

- Low Current Market Share: Initial entry means a small or non-existent customer base for the specific project type.

- Significant Investment Required: Building brand awareness, establishing local partnerships, and securing initial projects demand considerable capital outlay.

- Strategic Risk: Success is not guaranteed, and the company must carefully select markets and project types to mitigate risks.

Pioneering Niche Defense Infrastructure Projects

Pioneering niche defense infrastructure projects represent a category where HOCHTIEF might be exploring potential '?' within its strategic framework. The defense sector itself is a significant growth area for the company, evidenced by a substantial order backlog. However, focusing on highly specialized or novel defense infrastructure, such as advanced cyber-resilient facilities or unique operational support structures, positions these projects as potentially high-growth but currently nascent markets.

These ventures are characterized by their pioneering nature, often involving cutting-edge security protocols or untested operational concepts. While they hold the promise of significant returns if they gain widespread adoption and prove successful, their current market share is likely small and still in development. For example, HOCHTIEF's involvement in projects requiring highly secure, self-sufficient operational bases for emerging defense technologies would fall into this niche.

- Market Position: Emerging, small market share with high growth potential.

- Project Characteristics: Technologically advanced, unique security or operational requirements, unproven widespread adoption.

- Strategic Implication: Potential for high returns if successful, but carries inherent market development risks.

- Example Areas: Advanced cyber-resilient facilities, specialized support for new defense technologies.

HOCHTIEF's exploration into smart city integrated solutions, particularly in areas like autonomous public transport and integrated energy management, currently falls into the Question Mark category. These ventures are in their early stages, with limited revenue and uncertain market adoption, representing a high-growth potential but unproven market share.

The company's strategic investments in decentralized edge data centers also represent a Question Mark, despite the overall data center industry being a Star. This niche is still developing for HOCHTIEF, requiring significant investment to build market share and brand recognition.

HOCHTIEF's R&D in advanced materials, while promising high future returns, is also a Question Mark due to its nascent stage and uncertain commercial viability. These speculative investments aim to identify next-generation materials, mirroring industry trends where R&D spending can range from 5-10% of revenue for established players.

Entering new, smaller geographic markets for specialized projects also places HOCHTIEF in a Question Mark position. These efforts require substantial upfront investment to establish a presence and build brand awareness, as seen in their 2024 expansion into emerging infrastructure markets.

| Business Area | BCG Category | Description | Key Characteristics | Strategic Focus |

|---|---|---|---|---|

| Smart City Integrated Solutions | Question Mark | Early-stage ventures in autonomous transport, energy management. | High growth potential, low current market share, uncertain adoption. | Market development, pilot project success. |

| Edge Data Centers | Question Mark | Developing niche within the broader data center market. | Emerging market, requires investment, potential for future growth. | Building footprint, securing market share. |

| Advanced Materials R&D | Question Mark | Cutting-edge research into novel material properties. | High potential returns, uncertain commercialization, significant R&D investment. | Breakthrough identification, commercial viability testing. |

| Niche Geographic Markets | Question Mark | Expansion into new regions for specialized projects. | Low initial penetration, high growth potential, requires market establishment investment. | Brand building, securing initial projects. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, integrating financial performance, industry growth rates, and competitive landscape analysis to provide actionable strategic insights.