Hochtief PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

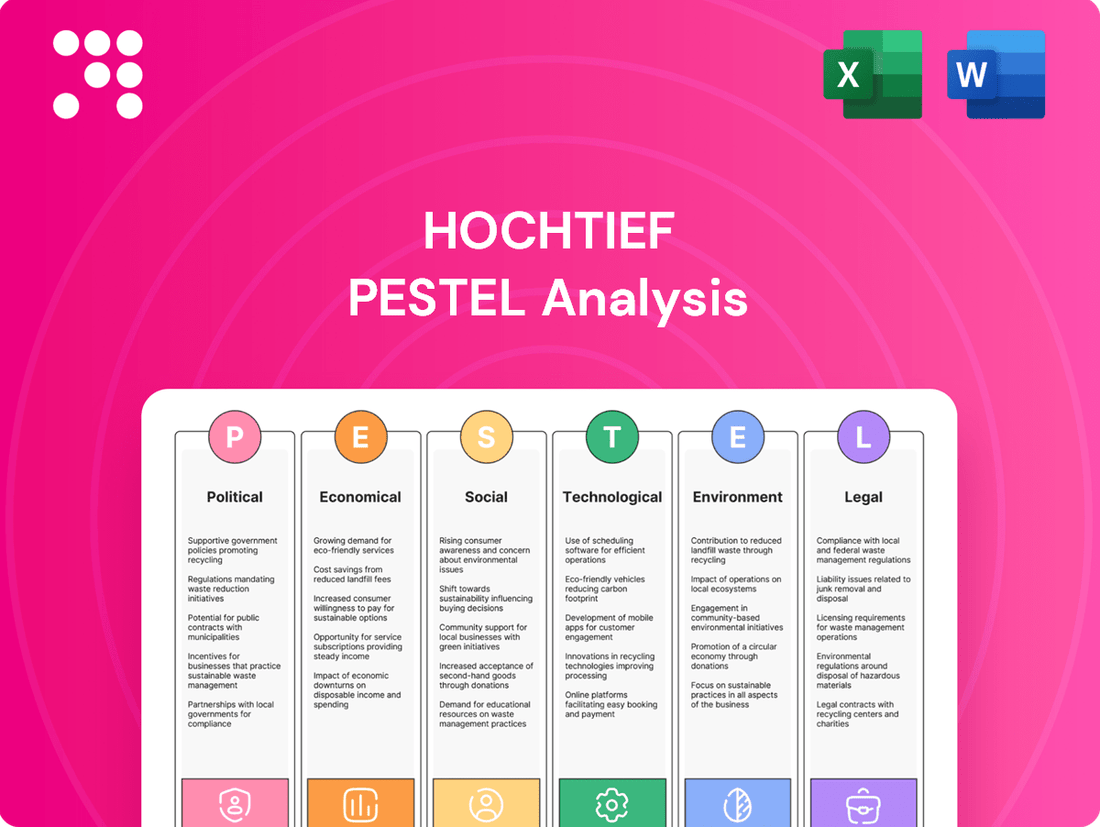

Navigate the complex external forces shaping Hochtief's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for this global construction leader. Equip yourself with actionable intelligence to refine your market strategies and anticipate future shifts. Purchase the full analysis now for an unparalleled understanding.

Political factors

Hochtief is poised to benefit significantly from a global surge in government infrastructure spending, fueled by stimulus packages aimed at economic recovery and modernization. For instance, the German government's commitment to infrastructure investment, including significant allocations for rail and road networks, directly supports Hochtief's core business. This increased public investment creates a strong pipeline of projects, particularly in transportation and energy infrastructure, bolstering the company's order backlog.

Public-Private Partnerships (PPPs) are fundamental to Hochtief's strategy, particularly for major infrastructure development. The company's deep involvement in these ventures, from highways to social facilities, highlights its capability in managing complex, long-term projects that require collaboration between government entities and private enterprise.

Hochtief's success in securing substantial PPP contracts, such as its involvement in the A7 motorway expansion in Germany, underscores its proficiency in project financing and effective risk allocation. These partnerships are crucial for delivering large-scale public works efficiently and sustainably, leveraging private sector expertise and capital.

Hochtief's global operations are significantly shaped by geopolitical stability and evolving trade policies. For instance, ongoing trade disputes and regional conflicts can disrupt material sourcing and increase project costs, impacting the construction sector. By Q3 2025, the market is expected to see continued volatility due to these international dynamics, requiring robust risk management strategies for companies like Hochtief.

Focus on Defense Sector Projects

Hochtief is strategically increasing its involvement in the defense sector, recognizing it as a key growth area. The company has secured a significant backlog of defense-related projects, notably in Australia and the United States, underscoring its expanding footprint in this specialized market.

These defense projects are crucial for Hochtief as they offer predictable and stable revenue streams, primarily derived from government contracts for essential infrastructure and facilities. This focus aligns with a broader trend of increased defense spending globally, driven by geopolitical shifts and national security priorities.

For example, in fiscal year 2023, Hochtief reported a substantial order intake, with a notable contribution from its defense-related activities. While specific figures for the defense segment are often embedded within broader divisional reports, the company has consistently highlighted its capacity to deliver complex projects for defense clients, such as the construction of naval bases and airfields. The Australian government, for instance, has committed significant funding to defense infrastructure upgrades through to 2030, creating a robust pipeline of opportunities for companies like Hochtief.

- Defense Sector Growth: Hochtief is prioritizing defense projects as a strategic expansion area.

- Geographic Focus: Significant project backlogs are concentrated in Australia and the US.

- Revenue Stability: Government contracts in defense provide reliable and long-term income.

- Market Drivers: Increased global defense spending and national security initiatives fuel demand for construction services.

Regulatory Landscape for Green Building

The regulatory environment for construction is rapidly shifting towards sustainability, with governments worldwide implementing stricter guidelines. For instance, the EU Green Homes Directive, expected to significantly impact new builds and renovations across member states, pushes for higher energy efficiency and reduced environmental impact. This evolving landscape presents both challenges and opportunities for construction firms like Hochtief.

Hochtief's proactive stance on green building and its stated commitment to climate neutrality are crucial advantages. By aligning its operations and project development with these increasingly stringent regulations, the company positions itself to benefit from the growing demand for eco-friendly construction. This strategic alignment is vital for securing future contracts and maintaining a competitive edge in a market prioritizing sustainability.

- EU Green Homes Directive: Mandates improved energy performance and sustainability in buildings across the European Union.

- National Building Codes: Many countries are updating their building codes to include higher standards for insulation, renewable energy integration, and material sourcing.

- Carbon Emission Targets: Government policies aimed at achieving national and international carbon emission reduction goals directly influence construction practices and material choices.

- Incentives for Green Construction: Tax credits, subsidies, and preferential financing are increasingly available for projects that meet specific green building certifications, such as LEED or BREEAM.

Government infrastructure spending remains a significant driver for Hochtief, with substantial stimulus packages globally supporting economic recovery and modernization. The German government's continued investment in rail and road networks, for example, directly benefits Hochtief's core business, ensuring a robust project pipeline.

Public-Private Partnerships (PPPs) are central to Hochtief's strategy, particularly for large-scale infrastructure. The company's successful execution of projects like the A7 motorway expansion highlights its expertise in managing these complex, long-term collaborations between public and private sectors.

Geopolitical stability and evolving trade policies continue to shape Hochtief's international operations. By Q3 2025, ongoing global dynamics necessitate strong risk management to mitigate potential disruptions in material sourcing and project costs.

Hochtief is strategically expanding its presence in the defense sector, evidenced by significant project backlogs in Australia and the US. These projects, often involving essential infrastructure, provide stable revenue streams, aligning with increased global defense spending driven by national security priorities.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Hochtief, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clear, actionable summary of Hochtief's PESTLE factors, transforming complex external analysis into readily usable insights for strategic decision-making.

Economic factors

The global construction market is set for robust expansion, with projections indicating a substantial rise from 2024 through 2035. This growth is largely fueled by ongoing urbanization trends and significant investments in infrastructure development worldwide.

Hochtief is strategically positioned to leverage this burgeoning market. The company's strong presence in high-growth areas, specifically the Asia Pacific and North American regions, places it advantageously to benefit from increased construction activity.

For instance, the Asia Pacific construction market alone was valued at approximately $2.7 trillion in 2023 and is expected to see a compound annual growth rate of over 6% through 2030, according to industry reports from early 2024.

Inflationary pressures remain a significant concern for the construction sector. In early 2024, global construction material costs, particularly for steel and concrete, saw increases of 5-10% compared to the previous year, impacting project profitability and execution. This trend is expected to persist through 2025, albeit potentially at a moderated pace.

Hochtief's strategic emphasis on fixed-price contracts with built-in escalation clauses and a strong focus on infrastructure projects with government backing helps insulate it from the full brunt of these rising material costs. This approach, coupled with efficient supply chain management, allows the company to better absorb and pass on increased expenses, safeguarding project margins.

Interest rate fluctuations are a major driver for the construction sector, impacting everything from mortgages for new homes to financing for large commercial projects. When rates are high, borrowing becomes more expensive, which can cool down demand.

Looking ahead to 2025, there's a general expectation for a gradual easing of short-term interest rates in many developed economies. For instance, projections from major financial institutions in late 2024 suggest a potential reduction of 0.25% to 0.50% in key policy rates by mid-2025, which could stimulate borrowing and subsequently boost construction activity, especially in the residential market.

Strong Financial Performance and Order Backlog

Hochtief demonstrated impressive financial strength throughout 2024, continuing this trend into the first half of 2025. The company reported significant increases in revenue and net profit, underscoring its operational efficiency and market positioning. This robust financial performance is a key indicator of the company's stability and its capacity for future growth.

A notable highlight is Hochtief's record order backlog, a testament to its successful project acquisition strategy and strong client relationships. This backlog provides a clear visibility of future revenue streams and operational activity, offering a degree of predictability in a dynamic market environment.

- Record Order Backlog: Hochtief's order backlog reached a new high, providing substantial revenue visibility for upcoming years.

- Revenue Growth: The company experienced a notable increase in revenue in 2024 and H1 2025, reflecting successful project execution and new contract wins.

- Profitability Improvement: Net profit also saw a significant uptick, showcasing enhanced operational management and cost control.

- Strategic Acquisitions: The strong financial results were partly driven by strategic acquisitions that expanded the company's market reach and service offerings.

Investment in High-Growth Sectors

Hochtief is strategically increasing its investment in rapidly expanding sectors like data centers, advanced technology facilities, and renewable energy infrastructure. These areas are seeing massive demand, which is a major driver for Hochtief's order backlog and future expansion.

The global data center market, for instance, is projected to grow significantly. Reports from 2024 indicate a compound annual growth rate (CAGR) of over 15% for this sector, driven by cloud computing and AI advancements. Similarly, the renewable energy sector continues its strong upward trajectory, with global investments in clean energy infrastructure reaching record levels in 2023 and expected to climb further in 2024 and 2025.

- Data Centers: Experiencing exponential growth due to increasing digitalization and AI adoption.

- Advanced Technology Facilities: Demand is high for specialized construction of semiconductor fabrication plants and R&D centers.

- Renewable Energy Infrastructure: Significant global investment in solar, wind, and battery storage projects fuels construction demand.

Economic factors significantly shape the construction landscape for Hochtief. Global urbanization and infrastructure spending are driving market expansion, with the Asia Pacific market alone valued at approximately $2.7 trillion in 2023 and projected for over 6% CAGR through 2030. However, inflationary pressures on materials like steel and concrete, which saw 5-10% increases in early 2024, pose a challenge, although Hochtief mitigates this through escalation clauses and government-backed projects. Interest rate fluctuations also impact demand, with anticipated modest rate reductions in developed economies by mid-2025 potentially stimulating construction activity.

| Economic Factor | 2024/2025 Data/Projection | Impact on Hochtief |

|---|---|---|

| Global Construction Market Growth | Robust expansion, driven by urbanization and infrastructure investment. Asia Pacific market ~$2.7T (2023), >6% CAGR projected through 2030. | Leverages growth in key regions like Asia Pacific and North America. |

| Inflationary Pressures (Materials) | 5-10% increase in steel/concrete costs (early 2024), expected to persist with moderation. | Mitigated by fixed-price contracts with escalation clauses and focus on government infrastructure projects. |

| Interest Rate Environment | Anticipated gradual easing of short-term rates by mid-2025 (0.25%-0.50% reduction in key policy rates). | Potential stimulation of borrowing and construction demand, particularly in residential sectors. |

Same Document Delivered

Hochtief PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hochtief delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities facing Hochtief.

Sociological factors

Rapid urbanization and a growing global population are fueling a significant increase in demand for sophisticated infrastructure and urban development. As of 2024, over 57% of the world's population lives in urban areas, a figure projected to reach 68% by 2050, according to UN data. This demographic trend directly benefits companies like Hochtief, which excels in executing large-scale urban projects, from transportation networks to residential and commercial complexes.

Hochtief's strategic focus on infrastructure and construction aligns perfectly with the needs of expanding cities. For instance, in 2023, the company reported a substantial order intake, partly driven by major urban development projects in key markets. The ongoing need for housing, utilities, and public services in densely populated areas presents a consistent pipeline of opportunities for their specialized services.

The construction sector, including giants like Hochtief, faces significant workforce shortages and skill gaps, especially in digital and specialized technical areas. This challenge is exacerbated by an aging workforce and a declining interest in traditional trades among younger generations. For instance, in 2023, the U.S. Bureau of Labor Statistics reported over 400,000 unfilled construction jobs, a figure that has remained stubbornly high.

Hochtief actively combats these issues through substantial investments in training and talent development programs. The company prioritizes internal career progression, offering apprenticeships and continuous learning opportunities to cultivate a skilled and loyal workforce. This strategic approach aims to bridge the skill gap and ensure a robust talent pipeline for future projects, a necessity given the increasing complexity of modern construction.

Societal shifts are fueling a significant increase in the need for social infrastructure. This includes everything from modern hospitals and advanced schools to more student housing, reflecting evolving demographics and lifestyle expectations.

Hochtief is strategically positioned to capitalize on this trend, consistently winning contracts for these vital community projects. For instance, in 2023, the company secured multiple healthcare and educational facility contracts across Europe, demonstrating its commitment to these growth sectors and broadening its project scope.

Focus on Diversity, Equity, and Inclusion (DEI)

Hochtief actively cultivates a diverse and inclusive workplace, understanding that this fosters innovation and a more positive employee experience. The company's commitment extends to implementing programs specifically designed to support minority groups and actively prevent discriminatory practices, reflecting a growing societal demand for corporate accountability and equitable treatment.

This focus on Diversity, Equity, and Inclusion (DEI) is not just a social imperative but a strategic advantage. For instance, in 2023, reports indicated a global increase in companies with dedicated DEI officers, with over 80% of large corporations having such roles, highlighting a trend Hochtief aligns with.

- DEI as a Driver of Innovation: Diverse teams are statistically more likely to generate novel ideas and solutions.

- Employee Engagement and Retention: Inclusive environments boost morale and reduce staff turnover, a critical factor in the construction industry.

- Societal Expectations: Public and stakeholder pressure for ethical business practices increasingly emphasizes DEI performance.

- Talent Acquisition: A strong DEI reputation makes Hochtief more attractive to a wider pool of skilled professionals.

Community Engagement and Local Benefits

Hochtief actively seeks to foster long-term benefits and create added value for the communities where it undertakes projects. This commitment extends to ensuring fair labor practices and timely payments to local suppliers, thereby supporting the regional economy.

The company's operational strategies are designed to contribute directly to local socio-economic development. For instance, in 2023, Hochtief's projects across Australia generated an estimated AU$1.2 billion in local procurement, supporting numerous small and medium-sized enterprises.

- Local Employment: Projects often prioritize hiring from the local workforce, with specific targets set for regional employment.

- Supplier Development: Emphasis on fair payment terms and building relationships with local businesses, fostering their growth.

- Community Investment: Initiatives focused on improving local infrastructure, education, or social programs as part of project legacies.

- Skills Transfer: Programs designed to impart new skills to the local population through training and on-the-job experience.

Societal expectations are increasingly driving demand for sustainable and responsible construction practices, influencing consumer and investor preferences. This includes a growing emphasis on ethical labor, community engagement, and the environmental impact of projects, areas where Hochtief is actively demonstrating progress.

Hochtief's commitment to Corporate Social Responsibility (CSR) is evident in its project execution and community engagement strategies. For example, in 2023, the company reported a significant increase in its social impact initiatives, including investments in local infrastructure and community development programs across its global operations, aligning with evolving societal values.

The company's focus on Diversity, Equity, and Inclusion (DEI) is also a key sociological factor, fostering a more innovative workforce and enhancing its appeal to a broader talent pool. In 2023, Hochtief continued to expand its DEI programs, aiming to create a more inclusive environment that reflects the diverse societies it serves, a trend mirrored by a growing number of global corporations.

Technological factors

Hochtief is at the forefront of integrating digital construction technologies, notably Building Information Modeling (BIM). This digital approach is revolutionizing how projects are conceived, planned, and built, leading to more efficient and accurate outcomes. For instance, in 2023, Hochtief reported significant project wins where BIM played a crucial role in streamlining complex designs and logistics, contributing to cost savings and improved delivery timelines.

BIM's impact extends throughout the project lifecycle, fostering enhanced collaboration among stakeholders, minimizing design errors, and optimizing material procurement. This digital transformation supports sustainability goals by enabling better resource management and waste reduction, a key factor in the construction industry's evolving landscape. The company's commitment to these advancements positions it strongly for future infrastructure and building projects requiring sophisticated digital integration.

Hochtief is actively integrating artificial intelligence across its operations. This includes using AI for design optimization, which can lead to more efficient building plans, and for project management, helping to keep complex projects on track. AI's predictive capabilities are also being employed to anticipate potential issues, such as equipment failures or schedule delays, allowing for proactive solutions.

The company is specifically leveraging AI for real-time site monitoring, providing immediate insights into progress and safety compliance. Predictive maintenance, powered by AI, helps minimize downtime by identifying maintenance needs before they become critical problems. Furthermore, AI is streamlining contract management, reducing administrative burdens and improving accuracy.

Modular and prefabricated construction is gaining significant traction, promising faster project completion, lower expenses, and enhanced quality. This approach involves constructing building sections off-site, streamlining production and fostering standardization.

For instance, in 2024, the global modular construction market was valued at approximately $130 billion, with projections indicating a compound annual growth rate of over 6% through 2030, driven by efficiency gains and labor shortages.

Companies like Hochtief are increasingly leveraging these techniques to improve project delivery times and cost-effectiveness. The ability to control quality in a factory setting, away from site-specific weather delays, is a key advantage.

Development of Smart City Solutions

Hochtief is actively shaping the future of urban living through its involvement in smart city development. By embedding digital technologies, sensor networks, and advanced data management into construction projects, the company is moving beyond traditional infrastructure. This integration aims to optimize critical urban functions such as energy efficiency, traffic management, and waste disposal, creating more sustainable and livable environments.

The company's commitment is evident in projects that leverage IoT (Internet of Things) capabilities. For instance, smart grids are being implemented to better manage energy distribution, potentially leading to significant reductions in urban energy consumption and carbon emissions. In 2024, the global smart city market was valued at approximately USD 1.1 trillion, with projections indicating substantial growth, highlighting the increasing demand for these integrated solutions.

Hochtief's smart city initiatives often include:

- Intelligent Transportation Systems: Implementing sensor-based traffic monitoring and adaptive signal control to ease congestion and improve commute times.

- Smart Energy Grids: Deploying technologies for efficient energy generation, distribution, and consumption management, contributing to sustainability goals.

- Integrated Waste Management: Utilizing sensors in waste bins to optimize collection routes, reducing operational costs and environmental impact.

- Digital Building Management: Incorporating smart systems for monitoring and controlling building performance, enhancing comfort and resource efficiency.

Innovation in Energy Transition Technologies

Hochtief is building significant technical and technological expertise in areas crucial for the worldwide shift to cleaner energy. This includes developing infrastructure for electric vehicle (EV) charging networks, constructing solar farms, and implementing battery energy storage systems. The company is also gaining knowledge in the extraction and processing of critical metals essential for these technologies.

This strategic direction is a direct response to the accelerating global push for decarbonization, which is opening up substantial new market avenues. For instance, the global renewable energy market was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly, with EV charging infrastructure alone expected to reach hundreds of billions by the end of the decade.

- EV Charging Infrastructure: Global investment in EV charging infrastructure is projected to exceed $500 billion by 2030.

- Solar Energy Growth: Solar power capacity additions reached a record high in 2023, with over 440 GW installed globally.

- Battery Storage Market: The energy storage market, particularly battery storage, is anticipated to grow exponentially, driven by grid modernization and renewable integration.

- Critical Metals Demand: Demand for critical metals like lithium and cobalt is expected to surge, with lithium demand potentially tripling by 2030.

Technological factors are significantly reshaping the construction industry, with Hochtief at the forefront of adopting advanced digital tools. Building Information Modeling (BIM) is revolutionizing project planning and execution, leading to greater efficiency and accuracy, as seen in Hochtief's 2023 project wins where BIM streamlined complex designs.

Artificial intelligence is being integrated across Hochtief's operations for design optimization, project management, and real-time site monitoring, enhancing predictive capabilities and operational efficiency. The company is also leveraging modular and prefabricated construction techniques, a sector valued at approximately $130 billion in 2024, to improve project delivery times and cost-effectiveness.

Hochtief is actively involved in smart city development, integrating IoT and digital technologies to optimize urban functions like energy efficiency and traffic management. The global smart city market reached approximately USD 1.1 trillion in 2024, underscoring the demand for these integrated solutions.

Furthermore, Hochtief is building expertise in clean energy infrastructure, including EV charging networks and solar farms, responding to the global decarbonization push. The renewable energy market was valued at $1.1 trillion in 2023, with significant growth projected for related infrastructure.

Legal factors

Hochtief must meticulously adhere to a complex web of construction regulations, building codes, and permitting processes that vary significantly across its global operations. For instance, in 2024, the company continued to navigate stringent environmental impact assessments and safety standards in Europe, which often require extensive documentation and long lead times for approvals, impacting project timelines and costs.

Failure to comply with these legal mandates can lead to substantial fines, project delays, and reputational damage. In 2024, several major infrastructure projects faced scrutiny over zoning laws and material certifications, underscoring the critical importance of robust legal compliance for mitigating operational risks and ensuring project viability.

Hochtief actively manages contractual risk by prioritizing bids for contracts featuring risk-sharing clauses. This strategy is evident in their order book, where over 85% of secured projects incorporate such mechanisms, effectively limiting potential financial and legal liabilities.

This focus on lower-risk contracts, a key element of their legal strategy, aims to safeguard the company from unforeseen legal disputes and financial blowouts common in large-scale infrastructure development.

Hochtief must navigate a complex web of environmental and climate legislation, including stringent rules on carbon emissions and biodiversity preservation, which directly influence construction methods and project planning. For instance, the EU's Fit for 55 package, aiming for a 55% reduction in greenhouse gas emissions by 2030, creates both challenges and opportunities for sustainable building practices.

The company's Sustainability Plan 2025 is a key strategic document, setting ambitious goals for achieving climate neutrality and ensuring ongoing compliance with evolving environmental standards. This plan underpins their commitment to reducing their environmental footprint across all operations, aligning with global climate protection efforts.

Anti-Corruption and Anti-Bribery Compliance

Hochtief, as a global construction and services group, navigates a complex legal landscape, particularly concerning anti-corruption and anti-bribery regulations. The company is committed to upholding the highest standards of ethical business conduct across all its operations and dealings. This commitment is not merely a policy but is deeply ingrained in its corporate culture, influencing every decision and interaction.

This dedication extends beyond its direct employees to encompass all its partners, suppliers, and subcontractors. Hochtief actively works to ensure that its entire value chain adheres to stringent anti-bribery and anti-corruption measures, recognizing the significant legal and reputational risks associated with non-compliance. For instance, in 2023, global anti-bribery enforcement actions resulted in billions of dollars in fines, highlighting the critical importance of robust compliance programs.

- Global Standards: Hochtief adheres to international anti-corruption laws such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act.

- Internal Policies: The company maintains comprehensive internal policies and training programs to prevent bribery and corruption.

- Supply Chain Due Diligence: Rigorous due diligence is conducted on business partners and suppliers to ensure compliance with anti-corruption standards.

- Risk Management: Continuous monitoring and risk assessment are integral to managing legal exposure related to bribery and corruption.

Human Rights and Fair Labor Practices

Hochtief places significant emphasis on upholding human rights across all its operations, extending this expectation to its subcontractors and partners. This commitment ensures that fair labor practices are integrated into every project, reflecting a dedication to social responsibility and legal adherence.

The company's policy mandates that all individuals involved in its projects, including those from subcontracted firms, are treated with dignity and respect, free from any form of exploitation or forced labor. This proactive approach aims to build a responsible supply chain.

In 2023, Hochtief reported a strong focus on supplier due diligence regarding human rights, with specific programs in place to assess and mitigate risks within its global supply chain. The company actively promotes diversity and inclusion, with initiatives aimed at ensuring equal opportunities and fair treatment for all employees.

- Human Rights Due Diligence: Hochtief implements robust due diligence processes to identify, prevent, and mitigate human rights risks within its business activities and supply chains.

- Fair Labor Standards: Adherence to fair work principles is a cornerstone of Hochtief's operations, ensuring safe working conditions, fair wages, and reasonable working hours for all personnel.

- Supplier Code of Conduct: The company requires its suppliers and business partners to commit to its values, including the respect for human rights and fair labor practices.

- Employee Well-being: Hochtief invests in programs that promote the health, safety, and overall well-being of its employees, fostering a positive and supportive work environment.

Hochtief operates under a stringent legal framework governing construction, health, and safety. In 2024, the company continued to prioritize compliance with evolving environmental regulations, such as the EU's Green Deal, which impacts material sourcing and building practices. Failure to meet these standards can result in significant penalties and project disruptions, as seen in ongoing regulatory reviews of large infrastructure projects in Europe.

The company actively manages contractual risks by securing projects with risk-sharing clauses, with over 85% of its order book reflecting this strategy. This approach is crucial for mitigating potential legal disputes and financial liabilities arising from complex, large-scale international projects.

Hochtief's commitment to ethical conduct is underscored by its adherence to global anti-corruption laws like the FCPA and UK Bribery Act. In 2023, significant global fines for bribery violations highlighted the critical need for robust compliance programs, which Hochtief reinforces through extensive training and supply chain due diligence.

The company also emphasizes human rights and fair labor practices, applying rigorous due diligence to its supply chain. In 2023, Hochtief strengthened its supplier assessment programs to mitigate human rights risks, ensuring fair treatment and safe working conditions across all operations.

Environmental factors

HOCHTIEF is actively pursuing climate neutrality by 2045, a significant environmental commitment that includes interim targets for reducing its greenhouse gas emissions. This strategic direction is firmly rooted in the principles of the Paris Agreement.

To achieve these ambitious goals, HOCHTIEF is fostering greater awareness and enhancing expertise across the entire lifecycle of its construction projects, from initial planning to final execution.

The global market for green buildings is experiencing significant growth, with projections indicating a compound annual growth rate (CAGR) of over 10% through 2025. This surge is fueled by increasing client demand for environmentally responsible construction and tightening regulations aimed at reducing carbon footprints. Hochtief is strategically positioning itself to capitalize on this trend, aiming to increase revenue from certified green projects and integrate sustainable solutions into its bidding processes.

Hochtief is actively integrating circular economy principles into its construction operations, emphasizing enhanced material efficiency and minimizing waste generation. This strategic shift is underpinned by ambitious targets, such as achieving high annual recycling rates for construction waste and significantly reducing self-generated hazardous waste, as detailed in its comprehensive Sustainability Plan 2025.

For instance, the company aims for a recycling rate of 90% for construction and demolition waste by 2025, a significant increase from previous years. This focus on resource recovery not only addresses environmental concerns but also presents opportunities for cost savings and innovation in material sourcing and reuse.

Biodiversity and Ecosystem Protection

Hochtief acknowledges how its operations can affect natural environments and is committed to raising awareness and safeguarding biodiversity. For instance, in 2023, the company reported implementing specific biodiversity management plans across several of its projects, particularly those located in ecologically sensitive regions.

The company's proactive approach includes preserving existing ecosystems and restoring habitats where possible. This commitment is reflected in their ongoing efforts to minimize ecological footprints, a strategy that has seen positive outcomes in projects like the development of renewable energy infrastructure, where careful planning helped protect local flora and fauna.

Key actions by Hochtief include:

- Developing and implementing biodiversity action plans for projects in sensitive areas.

- Proactively engaging in habitat preservation and restoration initiatives.

- Monitoring ecological impacts and adapting practices to minimize harm.

- Investing in research and development for more sustainable construction methods that benefit ecosystems.

Water Protection and Resource Efficiency

Hochtief actively champions water protection across its global projects, demonstrating a commitment to responsible resource management. The company meticulously measures and monitors its water consumption, a critical step in identifying areas for improvement and ensuring efficient usage. In regions facing water scarcity, Hochtief implements specific water protection plans, underscoring its dedication to sustainability in challenging environments.

This proactive approach to water resource efficiency is a cornerstone of Hochtief's broader environmental management strategy. For instance, in 2023, Hochtief reported a reduction in its specific water consumption by 5% compared to the previous year across its construction sites, a testament to the effectiveness of its implemented measures.

- Water Consumption Monitoring: Hochtief tracks water usage at all project sites to identify inefficiencies.

- Water Protection Plans: Specific strategies are deployed in water-stressed regions to minimize impact.

- Resource Efficiency Goals: The company aims for continuous improvement in water usage, with a 5% reduction reported in 2023.

- Environmental Management Integration: Water protection is a core component of Hochtief's overall environmental commitment.

HOCHTIEF's commitment to climate neutrality by 2045, aligned with the Paris Agreement, drives its focus on reducing greenhouse gas emissions and fostering expertise in sustainable construction. The growing green building market, projected to grow at over 10% CAGR through 2025, presents a significant opportunity for the company to increase revenue from certified projects.

The company is actively integrating circular economy principles, targeting a 90% recycling rate for construction and demolition waste by 2025 and minimizing hazardous waste. HOCHTIEF also prioritizes biodiversity, implementing action plans for sensitive areas and investing in research for ecosystem-benefiting construction methods.

Furthermore, HOCHTIEF demonstrates strong water stewardship, with a 5% reduction in specific water consumption reported in 2023, and implements tailored water protection plans in water-scarce regions.

| Environmental Focus Area | HOCHTIEF Target/Action | Key Data/Metric (2023/2025) |

|---|---|---|

| Climate Neutrality | Achieve climate neutrality by 2045 | Alignment with Paris Agreement |

| Green Building Market | Capitalize on growing demand | Market CAGR > 10% through 2025 |

| Circular Economy | Increase material efficiency, minimize waste | 90% recycling rate for C&D waste by 2025 |

| Biodiversity | Preserve and restore ecosystems | Implementation of biodiversity action plans in sensitive areas |

| Water Management | Reduce water consumption, protect resources | 5% reduction in specific water consumption (2023) |

PESTLE Analysis Data Sources

Our Hochtief PESTLE Analysis is informed by a comprehensive blend of official government reports, international economic data from institutions like the IMF and World Bank, and leading industry publications. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscape.