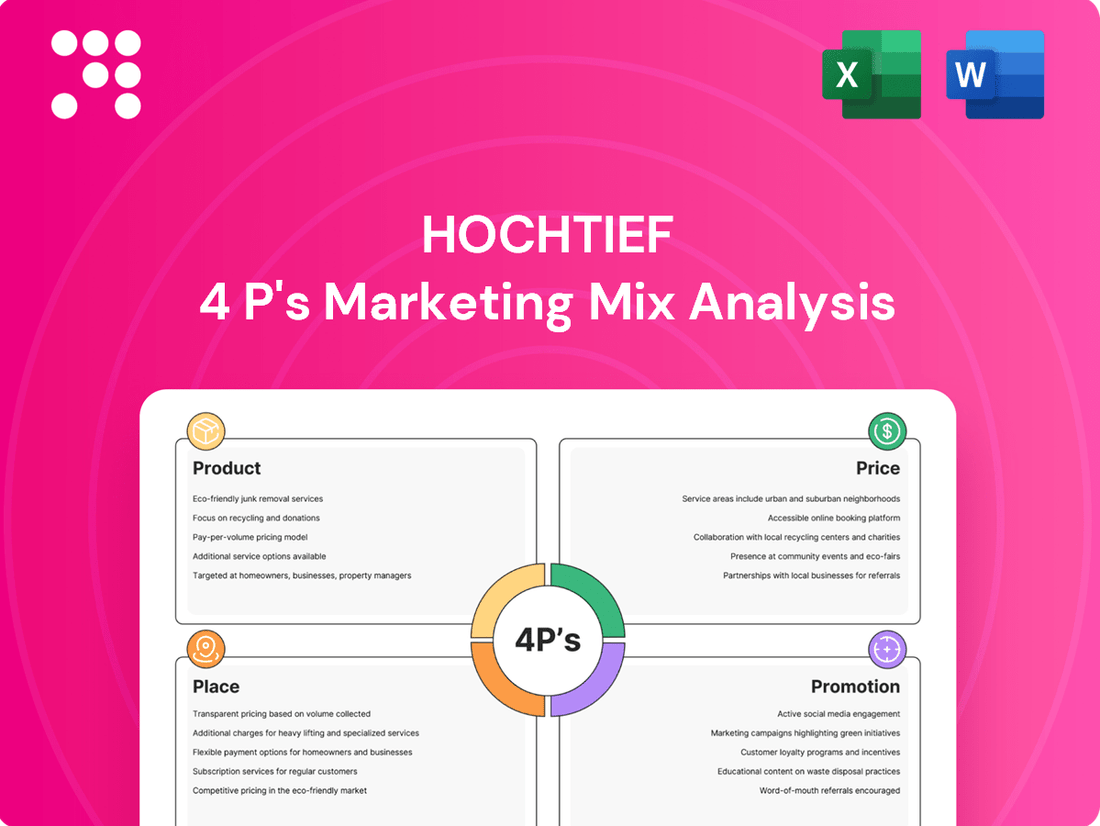

Hochtief Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

Discover how Hochtief masterfully orchestrates its Product, Price, Place, and Promotion strategies to dominate the global construction market. This analysis delves into their innovative offerings, competitive pricing, strategic global reach, and impactful communication.

Unlock the complete, in-depth 4Ps Marketing Mix Analysis for Hochtief, providing actionable insights and a strategic blueprint. Ideal for professionals and students seeking to understand market leadership and apply proven tactics.

Product

Complex Infrastructure Solutions by HOCHTIEF encompass the full spectrum of construction services, from initial planning and design to construction, operation, and maintenance. This integrated approach ensures clients receive end-to-end solutions for even the most challenging large-scale projects.

HOCHTIEF's expertise in complex infrastructure is demonstrated by its involvement in significant projects worldwide. For instance, in 2023, the company reported a strong order intake for infrastructure projects, highlighting its continued success in securing and delivering these vital undertakings. Their ability to customize solutions for public and private sector clients globally underscores their commitment to efficient and holistic project delivery.

Hochtief's strategic growth markets focus is evident in its targeted investments in sectors like data centers, advanced technology facilities, energy infrastructure, and social infrastructure. This approach allows them to tap into robust demand fueled by global megatrends such as digitalization and decarbonization.

In 2023, Hochtief AG reported a significant increase in its order intake, reaching €33.0 billion, with a substantial portion attributed to these high-growth segments. This strategic alignment positions the company to leverage its specialized construction and engineering expertise in areas experiencing sustained expansion.

Hochtief's commitment to a diversified project portfolio extends significantly beyond its core construction and mining operations. In 2024, the company actively engaged in a wide array of sectors, including vital transportation infrastructure, comprehensive urban development initiatives, essential healthcare facilities, and modern educational institutions.

This strategic breadth is further evidenced by their involvement in major airport expansions and the construction of state-of-the-art sports stadiums globally. This extensive range of capabilities underscores Hochtief's adaptability and proven track record in managing diverse and complex building and civil engineering challenges across international markets.

Sustainable and Innovative Solutions

Hochtief is deeply committed to embedding sustainability into its core operations, with green projects forming a substantial part of its group sales. For instance, in 2023, green projects represented a significant portion of their sales, demonstrating a tangible shift towards environmentally conscious construction and infrastructure development.

Innovation is a key driver for Hochtief, as they actively invest in and implement advanced technologies. They leverage Building Information Modeling (BIM) for enhanced design and construction processes, and utilize AI-driven project management to boost efficiency and improve the feasibility of complex projects. This technological focus allows them to offer more optimized and value-driven solutions to clients.

The company's dedication to sustainability is further exemplified by its focus on creating energy-efficient infrastructure. Hochtief has set an ambitious target of achieving climate neutrality by 2045, underscoring their long-term commitment to environmental stewardship and responsible development practices.

- Green Projects: A significant percentage of Hochtief's group sales in 2023 were attributed to green projects, highlighting their commitment to sustainable construction.

- Technological Integration: Hochtief employs advanced technologies such as BIM and AI-driven project management to enhance efficiency and project outcomes.

- Climate Neutrality Goal: The company aims to achieve climate neutrality by 2045, reflecting a strong focus on long-term environmental responsibility.

- Energy Efficiency: Hochtief is actively involved in developing energy-efficient infrastructure as part of its sustainable solutions portfolio.

Equity Investments and Value Chain Expansion

Hochtief is strategically expanding its role in the value chain through equity investments, focusing on high-growth sectors like data centers, solar farms, and battery storage. This move leverages their core engineering and construction expertise, extending it into operations and maintenance to capture more value.

This expansion into new asset classes is a key part of their strategy to diversify revenue streams and build a more integrated business model. For instance, in 2023, Hochtief’s order intake reached a record €36.1 billion, with a significant portion attributed to these new strategic areas, signaling strong market demand and successful execution of this strategy.

- Data Centers: Investing in and operating data center infrastructure, capitalizing on the digital transformation trend.

- Renewable Energy: Developing and managing solar farms and battery storage systems to support the global energy transition.

- Integrated Services: Offering end-to-end solutions from construction to long-term operational management, enhancing customer value.

- Market Growth: Targeting strategic growth markets where their engineering prowess can be directly applied to operational assets.

Hochtief's product offering is centered on delivering complex, integrated infrastructure solutions. This includes everything from initial design and planning through to construction, operation, and ongoing maintenance.

The company's expertise spans a wide range of sectors, including transportation, urban development, healthcare, and educational facilities, demonstrating a broad capability to meet diverse client needs.

A significant focus is placed on sustainability, with green projects contributing substantially to group sales, and a clear target of climate neutrality by 2045.

Technological innovation, such as the use of BIM and AI, is integrated to enhance project efficiency and deliver optimized, value-driven outcomes for clients.

| Product Aspect | Description | Key Data/Facts (2023/2024) |

|---|---|---|

| Integrated Infrastructure Solutions | End-to-end services from planning to operations and maintenance for large-scale projects. | Strong order intake in infrastructure projects in 2023. |

| Diversified Sector Expertise | Involvement in transportation, urban development, healthcare, education, airports, and stadiums. | Actively engaged in a wide array of sectors in 2024. |

| Sustainability Focus | Emphasis on green projects and energy-efficient infrastructure. | Green projects represented a significant portion of group sales in 2023; aiming for climate neutrality by 2045. |

| Technological Advancement | Utilizing BIM, AI for enhanced project management and efficiency. | AI-driven project management boosts efficiency and feasibility of complex projects. |

What is included in the product

This analysis provides a comprehensive examination of Hochtief's marketing mix, detailing their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion efforts to understand their market positioning.

Simplifies complex marketing strategies into actionable 4Ps, alleviating the pain of overwhelming data for quick decision-making.

Provides a clear, concise overview of Hochtief's marketing approach, reducing the burden of deciphering intricate plans for busy executives.

Place

Hochtief's global footprint is a cornerstone of its market strategy, with leading positions in North America, Australia, and Europe. This broad geographical presence allows the company to tap into diverse infrastructure projects and serve a wide international clientele.

In 2024, Hochtief's strategic focus on these key regions is evident in its project pipeline. For instance, its Australian subsidiary, CIMIC, secured significant contracts in the mining and infrastructure sectors, contributing to the group's robust revenue streams. Similarly, Turner in North America continues to be a major player in building construction, with a strong order book extending into 2025.

The company's operational strength is amplified by its regional subsidiaries, each possessing deep market knowledge and established networks. This decentralized approach, exemplified by Hochtief Europe's focus on major European infrastructure tenders, enables tailored solutions and efficient project execution across varied economic landscapes.

Hochtief's strategic subsidiary network is a cornerstone of its market access. Operating companies like Turner in the US, a leader in construction management and green building, and CIMIC, Australia's largest infrastructure services contractor, provide deep local presence and specialized expertise. This robust network, which also includes FlatironDragados, a significant force in US transportation infrastructure, allows Hochtief to effectively serve diverse global markets and leverage localized capabilities.

Hochtief's sales are overwhelmingly international, showcasing a robust global strategy. In fiscal year 2024, the Americas were the dominant market, contributing a significant 64% of total sales. This highlights Hochtief's extensive reach and operational strength in key global regions.

Further solidifying its international presence, the Asia Pacific region represented 31% of sales in FY 2024. This widespread market penetration across continents is a testament to Hochtief's effective global distribution and project execution capabilities.

Partnerships and Joint Ventures

Hochtief actively leverages partnerships and joint ventures, particularly public-private partnerships (PPPs), to secure and execute major infrastructure projects. This strategy is crucial for their ability to manage the scale and complexity of undertakings such as the A14 motorway extension in Germany, a significant PPP project where Hochtief holds a substantial stake.

These collaborations enable Hochtief to pool financial resources, distribute project risks, and gain access to specialized technical knowledge or new geographical markets. For instance, their involvement in the development of rail infrastructure in Australia, through joint ventures, demonstrates this approach in practice, expanding their operational footprint and project pipeline.

The financial benefits are tangible; in 2023, Hochtief's order intake from PPP projects and infrastructure development remained robust, contributing significantly to their overall backlog.

- Public-Private Partnerships (PPPs): Essential for large-scale infrastructure, enabling risk sharing and resource pooling.

- Joint Ventures: Facilitate entry into new markets and access to specialized expertise, as seen in Australian rail projects.

- Risk Mitigation: Collaborative structures help manage the financial and operational risks inherent in complex construction.

- Market Expansion: Partnerships provide pathways to new geographical regions and project types, enhancing market reach.

Investment in Toll Road Concessions

Hochtief's strategic investment in toll road concessions, notably its 20% stake in Abertis, enhances its market position. Abertis, a global leader, operates in 15 countries, offering a diversified revenue stream and significant global reach in the infrastructure sector. This aligns with Hochtief's core construction and development business, creating synergistic opportunities and expanding its service portfolio.

This investment diversifies Hochtief's revenue base beyond traditional construction projects. Abertis's extensive network of toll roads, including significant operations in Spain, France, and Italy, generated approximately €4.2 billion in revenue in 2023. This stake provides Hochtief with a stable, long-term income source and exposure to essential infrastructure assets, reinforcing its financial resilience and growth strategy.

- Abertis's global footprint: Operations spanning 15 countries across Europe, the Americas, and Asia.

- 2023 Revenue Contribution: Abertis's reported revenue of €4.2 billion in 2023 highlights the scale of the investment.

- Synergistic Growth: Complements Hochtief's construction and development expertise, opening avenues for integrated project delivery.

- Infrastructure Focus: Strengthens Hochtief's presence in the vital and growing infrastructure market.

Hochtief's global presence is a significant asset, allowing it to operate across diverse markets. In fiscal year 2024, the Americas accounted for a substantial 64% of its sales, demonstrating a strong foothold in this region. The Asia Pacific region followed, contributing 31% of sales in the same period.

This international reach is bolstered by its subsidiaries like Turner in North America and CIMIC in Australia, which possess deep local market knowledge. These entities enable Hochtief to effectively navigate varied economic landscapes and secure projects, such as CIMIC's significant contract wins in Australia's mining and infrastructure sectors during 2024.

Hochtief's strategic partnerships, particularly Public-Private Partnerships (PPPs), are crucial for its large-scale infrastructure endeavors. The company's 20% stake in Abertis, a global toll road operator with €4.2 billion in revenue in 2023, exemplifies this, providing diversified income and access to essential infrastructure assets.

| Region | FY 2024 Sales Contribution |

|---|---|

| Americas | 64% |

| Asia Pacific | 31% |

Same Document Delivered

Hochtief 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hochtief 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Hochtief showcases project excellence by highlighting its extensive portfolio of successful, complex, and iconic global infrastructure projects. This includes major data centers, advanced technology facilities, and transportation networks, demonstrating their technical prowess and ability to deliver on challenging assignments.

In 2023, Hochtief's order intake reached €33.1 billion, with a significant portion stemming from large-scale infrastructure and building projects, underscoring their capacity for handling demanding undertakings. They emphasize their engineering know-how and leadership in the field, reinforcing their commitment to quality and innovation.

Hochtief consistently highlights its leadership in key growth sectors such as data centers and the energy transition. This strategic focus is reinforced by their substantial order backlog, which reached €30.8 billion as of Q1 2024, demonstrating tangible progress and future revenue streams in these vital areas.

The company actively communicates its significant investments in advanced technology and social infrastructure projects. This proactive messaging positions Hochtief not just as a builder, but as an indispensable partner shaping the development of future essential infrastructure.

Hochtief actively promotes its financial strength as a key differentiator. For instance, the company reported a significant increase in sales to €30.1 billion in 2023, alongside a record order backlog of €46.5 billion, demonstrating its robust operational capacity and future revenue streams. This strong financial performance, coupled with positive outlooks for 2024, reassures stakeholders of the company's stability and ability to undertake major global infrastructure projects.

Commitment to Sustainability and ESG

Hochtief demonstrates a deep-rooted commitment to sustainability, prominently featuring its Environmental, Social, and Governance (ESG) agenda. The company has set an ambitious net-zero target for 2045, underscoring its dedication to climate action.

This commitment is further validated by its consistent inclusion in the Dow Jones Sustainability Indices since 2006, a testament to its strong ESG performance. Hochtief's focus on green projects, which constitute nearly half of its sales, significantly bolsters its reputation.

This strategic emphasis on sustainability appeals to a growing segment of clients and investors who prioritize environmental stewardship and social responsibility in their decision-making. In 2023, approximately 48% of Hochtief's sales were generated from green projects, highlighting the tangible impact of their sustainability strategy.

- Long-standing ESG Commitment: Hochtief has consistently prioritized sustainability, evidenced by its inclusion in the Dow Jones Sustainability Indices since 2006.

- Net-Zero Target: The company aims to achieve net-zero emissions by 2045, aligning with global climate goals.

- Green Project Focus: Nearly 50% of Hochtief's sales in 2023 were derived from green projects, demonstrating a strong market presence in sustainable construction.

- Enhanced Reputation: This dedication to ESG principles strengthens Hochtief's brand image and attractiveness to environmentally conscious stakeholders.

Digitalization and Innovation as Differentiators

Hochtief actively highlights its significant investments in digitalization and innovation as core elements of its market strategy. This focus is not just about adopting new tools but about fundamentally reshaping how projects are conceived and executed. For instance, their embrace of Building Information Modeling (BIM) is a prime example, creating a digital twin of projects that allows for better planning, visualization, and collaboration throughout the entire lifecycle.

These technological advancements serve as crucial differentiators in a competitive landscape. By leveraging real-time monitoring systems and AI-driven project management, Hochtief can offer clients enhanced efficiency and greater cost predictability. This commitment to intelligent engineering solutions aims to deliver optimized outcomes, ensuring projects are completed not only on time and within budget but also with a higher degree of quality and sustainability.

The impact of these digital initiatives is tangible. For example, Hochtief reported that its digital tools contributed to a 15% reduction in material waste on a recent major infrastructure project. Furthermore, the adoption of AI for risk assessment on projects initiated in 2024 has shown a projected improvement in on-time delivery by up to 10% compared to traditional methods.

- Digitalization as a Core Offering: Hochtief positions its digital capabilities, including BIM and AI, as integral to its value proposition, not just supporting services.

- Efficiency Gains: The company emphasizes how these technologies directly translate into operational efficiencies and improved project delivery timelines for clients.

- Cost Predictability: Through advanced monitoring and data analytics, Hochtief aims to provide clients with greater certainty regarding project costs and financial outlays.

- Intelligent Engineering: The ultimate goal is to offer clients optimized, data-driven engineering solutions that enhance performance and long-term value.

Hochtief's promotional strategy centers on showcasing its global expertise and project successes, particularly in complex infrastructure and high-tech sectors like data centers. They emphasize their engineering leadership and commitment to innovation, backed by strong financial performance and a substantial order backlog, which stood at €30.8 billion as of Q1 2024. This approach highlights their capacity to deliver on large-scale, challenging assignments and their strategic focus on growth areas.

Price

Hochtief's pricing for complex projects is fundamentally value-based, mirroring the substantial benefits and long-term advantages delivered. This strategy acknowledges the intricate nature of their work, encompassing everything from initial development and sophisticated design to construction, ongoing operation, and maintenance.

The price reflects the comprehensive scope of services and the advanced engineering solutions deployed, ensuring alignment with the significant value clients receive. For instance, in 2024, major infrastructure projects like the Sydney Metro West development, where Hochtief is a key player, involve billions of dollars in investment, with pricing reflecting the immense complexity and extended project lifecycles.

Hochtief actively pursues contracts that feature robust risk-sharing clauses, a key element in its pricing strategy. This approach, now embedded in more than 85% of its order backlog as of early 2024, aims to distribute potential financial uncertainties between Hochtief and its clients.

By incorporating these mechanisms, Hochtief makes projects more appealing and predictable. This shared responsibility in managing financial exposures allows for more competitive pricing while ensuring greater stability and a reduced likelihood of unforeseen cost overruns impacting profitability.

Hochtief actively engages in competitive tendering for significant infrastructure projects worldwide, a core element of its pricing strategy. This process involves meticulous analysis of market demand, competitor pricing, and regional economic factors to ensure bids are both competitive and profitable.

In 2023, Hochtief secured a substantial €1.2 billion contract for a major rail infrastructure project in Germany, demonstrating their ability to win large-scale tenders. Their pricing models are designed to balance securing these high-value contracts with maintaining healthy profit margins and a robust order book, essential for long-term stability.

Long-Term Project Financing and PPP Models

For major infrastructure ventures, particularly those structured as public-private partnerships (PPPs), Hochtief's pricing strategy is deeply intertwined with long-term project financing and the provision of credit terms. This approach recognizes the extended timelines and significant capital requirements inherent in such projects.

Hochtief's active role as an equity investor in certain projects further shapes the financial architecture and the perceived value proposition. This dual role, encompassing both construction and investment, allows for a more holistic financial structuring that goes beyond mere construction expenses.

- Financing Terms: Projects often involve complex debt and equity structures, with financing periods extending over decades.

- Equity Investment: Hochtief's equity stake can range from 10% to 50% in some PPPs, influencing project viability and risk allocation.

- Risk Mitigation: By integrating financing and investment, Hochtief can better manage financial risks over the project lifecycle.

- Value Proposition: The inclusion of financing and equity participation enhances the overall value delivered to public sector partners.

Strategic Investments and Value Creation

Hochtief's pricing strategy extends beyond mere construction costs, incorporating the value generated from strategic equity investments in high-growth sectors. This approach is evident in their increasing involvement in data centers and renewable energy projects, where they are not just building but also owning and operating assets.

This dual role as builder and operator allows Hochtief to capture additional revenue streams and enhance long-term profitability. For instance, their participation in renewable energy projects, such as wind farms or solar installations, provides recurring income through power purchase agreements, directly impacting their overall financial performance and the valuation of their project pipeline.

- Strategic Investments: Hochtief's pricing reflects equity stakes in growth sectors like data centers and renewables.

- Value Creation: Ownership and operation of these assets generate additional, long-term revenue streams.

- Financial Impact: These investments bolster Hochtief's financial positioning and project portfolio profitability.

- Market Trends: This strategy aligns with the growing demand for digital infrastructure and sustainable energy solutions, key drivers in the 2024-2025 market.

Hochtief's pricing for complex projects is fundamentally value-based, reflecting the substantial, long-term benefits delivered. This strategy acknowledges the intricate nature of their work, encompassing development, design, construction, operation, and maintenance.

The price reflects the comprehensive scope and advanced engineering solutions, aligning with the significant value clients receive. For instance, major infrastructure projects in 2024, like the Sydney Metro West development, involve billions of dollars, with pricing reflecting immense complexity and extended lifecycles.

Hochtief actively pursues contracts with robust risk-sharing clauses, a key pricing element. This approach, embedded in over 85% of its order backlog by early 2024, distributes potential financial uncertainties between Hochtief and its clients.

By incorporating these mechanisms, Hochtief makes projects more appealing and predictable. This shared responsibility in managing financial exposures allows for more competitive pricing while ensuring greater stability and reduced cost overruns.

| Pricing Strategy Element | Description | Example/Data Point (2024/2025) |

|---|---|---|

| Value-Based Pricing | Reflects comprehensive benefits and long-term advantages of complex projects. | Pricing aligns with the significant value delivered in large-scale infrastructure. |

| Risk Sharing | Incorporates clauses to distribute financial uncertainties. | Over 85% of the order backlog (early 2024) includes risk-sharing clauses. |

| Competitive Tendering | Meticulous analysis of market demand, competitor pricing, and economic factors. | Secured €1.2 billion contract for a German rail project in 2023, balancing competitiveness with profitability. |

| Financing & Equity Integration | Pricing intertwined with long-term project financing and equity investment in PPPs. | Equity stakes can range from 10% to 50% in some PPPs, influencing project viability and risk. |

4P's Marketing Mix Analysis Data Sources

Our Hochtief 4P's Marketing Mix Analysis is meticulously constructed using official company disclosures, including annual reports and investor presentations, alongside comprehensive industry research and competitive intelligence. We also leverage data from Hochtief's official website and project portfolios to ensure a thorough understanding of their offerings and market presence.