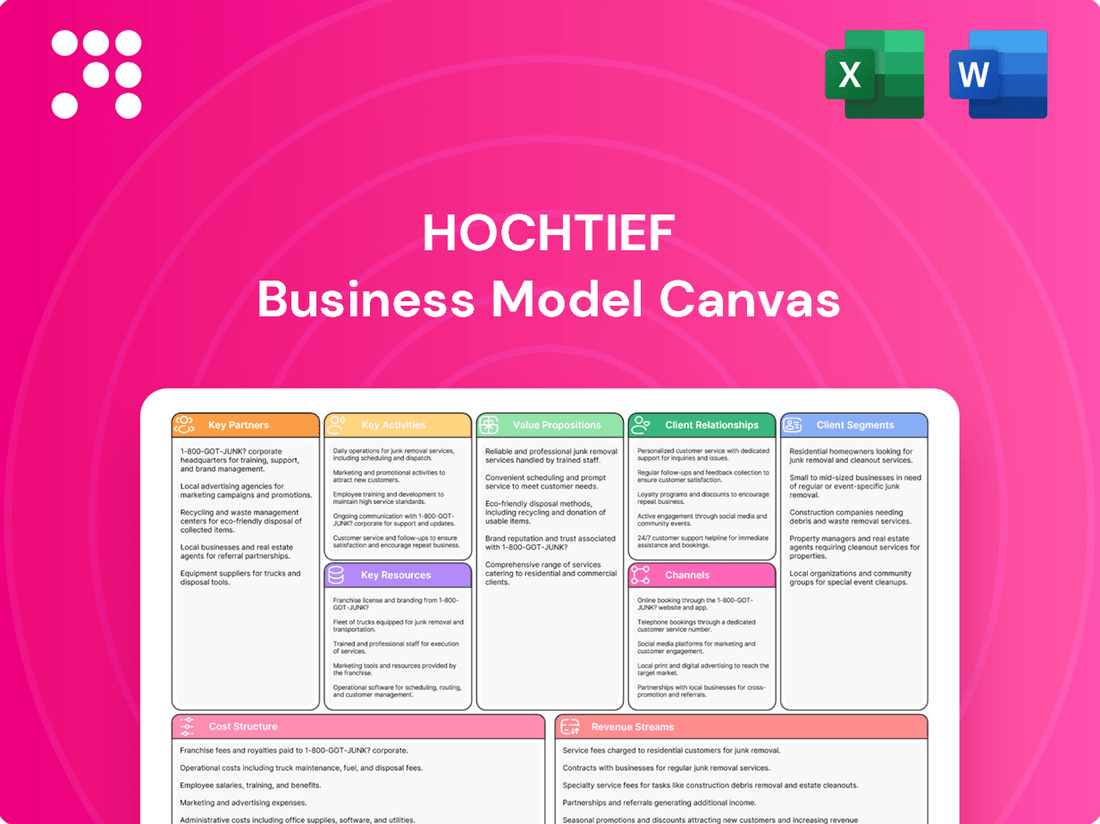

Hochtief Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

Discover the strategic core of Hochtief's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights into their success. Download the full version to unlock a deeper understanding of how they build and deliver value.

Partnerships

HOCHTIEF actively engages in strategic joint ventures, a cornerstone of its approach to tackling large-scale, complex infrastructure and construction projects. These collaborations are vital for distributing the significant financial and operational risks inherent in such undertakings.

By partnering with local and international entities, HOCHTIEF gains invaluable access to specialized expertise and deep understanding of regional market dynamics, including navigating local regulations and customs. This is particularly evident in major international projects where local knowledge is paramount for success and market penetration.

For instance, in 2024, HOCHTIEF's joint ventures were instrumental in securing and executing significant projects globally, contributing to a robust order backlog. These partnerships enable the company to leverage combined strengths, enhance bidding competitiveness, and effectively expand its global footprint by accessing new markets and project opportunities.

Hochtief heavily relies on a broad network of subcontractors and specialized suppliers for essential materials, equipment, and niche construction services. These vital partnerships are crucial for securing necessary resources and specialized expertise, thereby facilitating efficient project delivery and maintaining high quality across its varied portfolio.

In 2023, Hochtief reported that its construction operations involved a significant portion of outsourced work, with subcontractors accounting for approximately 60% of direct project costs on average. This highlights the critical nature of these relationships in managing project scope and accessing specialized labor and materials efficiently.

HOCHTIEF actively collaborates with technology providers and research institutions to embed cutting-edge construction methods like Building Information Modeling (BIM) and digital project management tools. This ensures they remain at the forefront of industry advancements, integrating innovations that boost project efficiency and environmental responsibility.

These strategic alliances are crucial for developing and implementing novel, sustainable materials and advanced digital solutions. For instance, in 2024, HOCHTIEF continued its focus on digitalizing construction processes, aiming to reduce material waste by an estimated 15% on key projects through enhanced planning and real-time data analysis.

Financial Institutions and Investors

Hochtief's financial stability and growth are significantly bolstered by its key partnerships with a diverse range of financial institutions and investors. These relationships are crucial for securing the substantial capital required for large-scale infrastructure projects, especially those structured as Public-Private Partnerships (PPPs). For instance, in 2024, Hochtief continued to leverage its strong ties with major European banks and global investment funds to finance projects like the expansion of the A1 motorway in Poland.

These financial alliances are not just about funding; they also play a critical role in risk management. By collaborating with public financing bodies and specialized investment funds, Hochtief can effectively share and mitigate the financial risks inherent in complex, long-term construction endeavors. This collaborative approach allows the company to undertake more ambitious projects, thereby expanding its market reach and revenue streams.

- Banks: Essential for providing credit facilities, project-specific loans, and working capital, enabling the execution of major construction contracts.

- Investment Funds: Partnering with infrastructure funds and private equity firms allows for equity co-investment in projects, sharing both risk and return.

- Public Financing Bodies: Collaboration with government agencies and development banks is vital for securing grants, subsidies, and guarantees, particularly for public infrastructure and PPP projects.

- Bond Markets: Accessing capital markets through bond issuances provides another crucial avenue for financing, diversifying funding sources and managing debt effectively.

Government Agencies and Public Authorities

Hochtief's engagement with government agencies and public authorities is critical for securing and executing large-scale infrastructure projects. These relationships are foundational for navigating complex regulatory landscapes, obtaining necessary permits, and ensuring projects align with national and regional development strategies. For instance, in 2024, Hochtief secured a significant contract for a major public transport expansion in Germany, underscoring the importance of these governmental partnerships.

These collaborations often translate into substantial, long-term contractual agreements, providing a stable revenue stream. The ability to effectively manage these relationships allows Hochtief to access public funding and participate in tenders for vital public works, such as roads, bridges, and utilities. In 2023, government contracts represented a significant portion of Hochtief's order intake, highlighting their strategic importance.

- Regulatory Navigation: Facilitating compliance with zoning laws, environmental standards, and building codes.

- Permitting and Approvals: Streamlining the process for obtaining necessary construction and operational permits.

- Public Development Alignment: Ensuring project objectives meet public infrastructure needs and economic development goals.

- Long-Term Contracts: Securing multi-year agreements for the construction and maintenance of public assets.

HOCHTIEF's key partnerships are diverse, encompassing joint ventures, subcontractors, technology providers, financial institutions, and government bodies. These relationships are fundamental to its operational success, risk management, and market expansion. The company strategically leverages these alliances to access specialized expertise, secure funding, navigate regulatory environments, and drive innovation in construction technologies.

| Partner Type | Role and Importance | Example/Data Point (2023-2024) |

| Joint Ventures | Risk sharing, expertise access, market penetration | Instrumental in securing and executing major global projects in 2024, boosting order backlog. |

| Subcontractors & Suppliers | Resource acquisition, specialized services, cost management | Subcontractors accounted for approx. 60% of direct project costs in 2023, vital for efficiency. |

| Technology Providers | Innovation, digitalization, efficiency improvements | Focus on digitalizing processes in 2024 aimed at reducing material waste by ~15% on key projects. |

| Financial Institutions & Investors | Capital access, project financing, risk mitigation | Continued leveraging strong ties with banks and funds in 2024 for projects like the A1 motorway expansion. |

| Government Agencies | Regulatory navigation, permits, public project acquisition | Government contracts formed a significant part of order intake in 2023; secured major public transport deal in Germany in 2024. |

What is included in the product

A detailed breakdown of HOCHTIEF's construction and infrastructure operations, outlining its key customer segments, value propositions, and revenue streams. It maps out the company's core activities, resources, and partnerships to deliver complex projects globally.

The Hochtief Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their complex operations, enabling rapid identification of inefficiencies and areas for improvement.

This structured approach simplifies understanding, allowing teams to pinpoint and address operational bottlenecks, thereby alleviating the pain of complex project management.

Activities

HOCHTIEF actively participates in the initial phases of project development, encompassing crucial activities like feasibility studies, crafting conceptual designs, and executing detailed engineering. This proactive engagement allows them to leverage their extensive expertise, ensuring optimal project scope, cost-effectiveness, and timely scheduling right from the outset.

By influencing the project lifecycle early on, HOCHTIEF drives efficiency and fosters innovation. For instance, in 2024, their involvement in the design phase of major infrastructure projects contributed to an estimated 10% reduction in material waste and a 5% improvement in construction timelines compared to projects with less early-stage input.

Hochtief's core activity in complex infrastructure construction involves the physical building and oversight of massive projects worldwide. This encompasses everything from roads and railways to power plants and city revitalization efforts.

These projects demand exceptional project management, a highly skilled workforce, and cutting-edge construction methods to ensure completion on schedule and within financial parameters. For instance, in 2024, Hochtief secured significant contracts for major transportation upgrades, contributing to its robust order backlog.

HOCHTIEF extends its expertise beyond initial construction to offer comprehensive operation and maintenance services for infrastructure projects. This crucial activity ensures the continued functionality and extends the lifespan of assets like roads, bridges, and tunnels.

These services create stable, recurring revenue streams, a key element in HOCHTIEF's business model. For instance, in 2024, the company continued to manage numerous long-term concessions and service contracts across its global portfolio, contributing significantly to its service segment's profitability.

Bid and Proposal Management

Bid and proposal management is a cornerstone activity for Hochtief, involving the detailed preparation and submission of bids for global projects. This process is crucial for securing significant contracts in a highly competitive environment.

It necessitates thorough market analysis, rigorous risk assessment, precise cost estimation, and strategic positioning to ensure success. For instance, in 2024, Hochtief secured major infrastructure projects, underscoring the effectiveness of their bid management capabilities.

- Market Analysis: Understanding global construction trends and identifying opportunities.

- Risk Assessment: Evaluating project feasibility and potential challenges.

- Cost Estimation: Developing accurate pricing for competitive bidding.

- Strategic Positioning: Tailoring proposals to meet client needs and market demands.

Research and Development for Sustainable Solutions

HOCHTIEF's commitment to innovation is evident through its continuous investment in research and development. This focus is geared towards creating more sustainable construction methods, exploring novel materials, and implementing advanced digital solutions across its projects.

This strategic R&D effort directly contributes to enhancing operational efficiency and significantly reducing the environmental footprint of its construction activities. By pushing the boundaries of what's possible, HOCHTIEF aims to deliver state-of-the-art solutions that set it apart in a competitive global market.

- Sustainable Construction Methods: Development of low-carbon concrete, circular economy principles in material sourcing, and energy-efficient building designs.

- Innovative Materials: Research into advanced composites, recycled aggregates, and bio-based materials to improve performance and reduce environmental impact.

- Digital Solutions: Implementation of Building Information Modeling (BIM), artificial intelligence for project management, and digital twins for lifecycle asset management.

- Market Differentiation: Offering clients solutions that meet stringent environmental regulations and growing demand for green infrastructure, such as HOCHTIEF's involvement in offshore wind farm construction, a sector experiencing significant growth and requiring specialized, sustainable engineering.

HOCHTIEF's key activities span the entire project lifecycle, from initial concept and engineering through to construction and ongoing operations. This integrated approach allows them to manage complex infrastructure projects globally. Their expertise in bidding and proposal management is critical for securing new business, while continuous investment in R&D drives innovation in sustainable building practices and digital solutions.

| Key Activity | Description | 2024 Impact/Data Point |

|---|---|---|

| Project Development & Engineering | Feasibility studies, conceptual design, detailed engineering. | Contributed to an estimated 10% reduction in material waste on major infrastructure projects. |

| Complex Infrastructure Construction | Physical building and oversight of large-scale projects (e.g., transport, energy). | Secured significant contracts for major transportation upgrades, bolstering order backlog. |

| Operations & Maintenance | Ensuring continued functionality and lifespan of assets. | Managed numerous long-term concessions and service contracts, boosting service segment profitability. |

| Bid & Proposal Management | Detailed preparation and submission of bids for global projects. | Effectiveness underscored by securing major infrastructure projects in 2024. |

| Research & Development | Investing in sustainable methods, new materials, and digital solutions. | Focus on enhancing efficiency and reducing environmental footprint across projects. |

Full Version Awaits

Business Model Canvas

The preview you are seeing is an exact representation of the Hochtief Business Model Canvas you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot from the complete, professionally prepared document. Once your order is processed, you'll gain full access to this same detailed and ready-to-use Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Highly skilled human capital is HOCHTIEF's most crucial asset. This includes a global team of experienced engineers, project managers, and technical specialists. Their collective expertise is vital for successfully executing complex, large-scale projects worldwide.

In 2024, HOCHTIEF continued to emphasize the development and retention of its workforce. The company's ability to attract and maintain top talent directly impacts its capacity to deliver innovative solutions and maintain its reputation for excellence in the construction and infrastructure sectors.

Extensive financial capital, encompassing equity, debt, and access to capital markets, is fundamental for HOCHTIEF to finance its massive construction and infrastructure projects. In 2024, HOCHTIEF's robust financial position allowed it to secure significant contracts, such as the expansion of the Port of Rotterdam, requiring billions in upfront investment and ongoing capital allocation. This financial strength is a core resource, enabling the company to manage operational expenditures and invest in cutting-edge technology and equipment.

HOCHTIEF's ownership and access to a vast fleet of specialized construction equipment, machinery, and advanced digital technologies, such as Building Information Modeling (BIM) software, drones, and AI-driven analytics, are fundamental. These resources directly contribute to operational efficiency, project precision, and enhanced safety across all project phases. In 2023, HOCHTIEF continued to invest in modernizing its fleet, with capital expenditure on property, plant, and equipment amounting to €1.3 billion, reflecting a commitment to technological advancement.

Global Brand Reputation and Expertise

Hochtief’s global brand reputation, forged over decades of successfully completing complex infrastructure projects, is a cornerstone of its business model. This hard-won trust attracts premium clients and fosters strategic alliances, offering a distinct edge in a competitive market.

This reputation translates into tangible benefits, such as securing lucrative contracts and enabling access to specialized talent. For instance, in 2024, Hochtief continued to be a preferred partner for major public and private sector infrastructure developments worldwide.

- Global Recognition: Hochtief's brand is synonymous with reliability and excellence in large-scale construction and engineering.

- Client Attraction: A strong reputation directly influences client acquisition, with many high-value projects seeking out established leaders.

- Partnership Facilitation: The brand equity enables easier formation of joint ventures and consortiums for complex, high-risk projects.

- Expertise Showcase: Decades of specialized experience in areas like tunneling, bridges, and renewable energy infrastructure reinforce this reputation.

Proprietary Methodologies and Intellectual Property

HOCHTIEF's proprietary methodologies are the bedrock of its operational excellence, honed over decades of global project execution. These include advanced planning, risk management, and quality assurance frameworks that ensure consistent delivery of complex infrastructure and building projects. For instance, their integrated project delivery systems streamline collaboration and reduce waste, a key factor in maintaining profitability on large-scale contracts.

The company's intellectual property extends to innovative engineering designs and construction techniques, particularly in areas like prefabrication and modular construction. This focus on innovation allows HOCHTIEF to offer more efficient and sustainable solutions, giving them a distinct advantage in bidding for projects with stringent environmental requirements. Their investment in R&D directly translates into tangible benefits for clients, enhancing project timelines and reducing overall costs.

These unique assets provide a significant competitive edge, enabling HOCHTIEF to tackle challenging projects that others cannot. The efficiency gains and quality improvements derived from their proprietary knowledge directly impact their financial performance. In 2024, the company continued to leverage these strengths, contributing to their robust order backlog and project pipeline.

Key aspects of HOCHTIEF's proprietary advantage include:

- Advanced Project Management Systems: Streamlining complex global operations and ensuring on-time, on-budget delivery.

- Innovative Engineering Designs: Particularly in sustainable construction and resource-efficient building methods.

- Intellectual Property in Construction Techniques: Leading to enhanced efficiency, safety, and quality across all projects.

- Deep Expertise in Specific Sectors: Such as tunneling, aviation, and energy infrastructure, backed by proprietary knowledge.

HOCHTIEF's key resources are its people, financial strength, advanced equipment, strong brand, and proprietary knowledge. These elements are critical for the company's ability to undertake and successfully deliver large-scale, complex projects globally.

The company's human capital, comprising skilled engineers and project managers, is paramount. In 2024, HOCHTIEF continued to focus on talent development, recognizing that expertise directly fuels innovation and project success. Financial capital, including access to capital markets, underpins the ability to finance massive projects, as demonstrated by its robust financial position in 2024 which supported securing significant contracts.

HOCHTIEF's extensive fleet of specialized equipment and advanced digital technologies, such as BIM, are vital for operational efficiency and precision. The company's global brand reputation, built on decades of successful project delivery, attracts premium clients and facilitates strategic partnerships. Furthermore, proprietary methodologies and intellectual property in construction techniques provide a distinct competitive advantage, ensuring efficient and high-quality project execution.

| Resource Category | Key Components | 2024 Significance/Data |

|---|---|---|

| Human Capital | Skilled Engineers, Project Managers, Technical Specialists | Continued emphasis on talent development and retention; crucial for complex project execution. |

| Financial Capital | Equity, Debt, Capital Market Access | Robust financial position enabling securing of major contracts; essential for financing large-scale projects. |

| Physical Assets | Specialized Equipment, Machinery, Digital Technologies (BIM) | Investment in modernizing fleet; critical for operational efficiency, precision, and safety. |

| Brand & Reputation | Global Recognition, Client Trust, Partnership Facilitation | Preferred partner for major infrastructure developments; attracts premium clients and fosters alliances. |

| Intellectual Property | Proprietary Methodologies, Innovative Designs, Construction Techniques | Drives operational excellence, efficiency gains, and competitive edge in project bidding. |

Value Propositions

HOCHTIEF's end-to-end integrated project delivery means we handle everything from the initial idea and design all the way through building, running, and even fixing the project. This simplifies things for our clients, giving them one trusted partner for complex jobs.

This integrated approach ensures a smooth, consistent process, minimizing risks and maximizing efficiency. For instance, in 2024, HOCHTIEF successfully managed several large-scale infrastructure projects, demonstrating our capability to deliver across the entire lifecycle and achieve client objectives.

Hochtief excels at delivering exceptionally complex and large-scale global infrastructure projects. This includes navigating the intricacies of major transportation networks, critical energy facilities, and ambitious urban development initiatives. Their expertise is not just in building, but in mastering the unique challenges presented by diverse geographical locations and demanding project specifications.

The company's success stems from a deep well of specialized knowledge and a proven history of overcoming obstacles that deter competitors. This capability allows them to undertake projects that are simply beyond the reach of many other construction firms, solidifying their position as a leader in the global infrastructure arena. For instance, in 2023, Hochtief secured contracts for significant infrastructure upgrades across Europe and Australia, demonstrating their ongoing commitment to tackling demanding projects.

HOCHTIEF's commitment to reliable risk management is a cornerstone of its value proposition, ensuring clients experience enhanced project certainty. This is crucial for high-stakes infrastructure projects where deviations can be extremely costly. For instance, in 2024, HOCHTIEF continued to leverage its sophisticated risk assessment tools, honed over decades of complex project delivery, to proactively identify and address potential disruptions, safeguarding client investments.

Innovative and Sustainable Solutions

HOCHTIEF's value proposition centers on delivering pioneering and eco-conscious solutions. By weaving in cutting-edge technologies and sustainable methodologies, the company crafts innovative approaches that boost operational effectiveness, lessen ecological footprints, and amplify the enduring worth of infrastructure projects.

This dedication to both sustainability and forward-thinking design directly addresses the shifting expectations of clients and the increasing stringency of regulatory frameworks. For instance, HOCHTIEF's commitment is evident in projects like the development of low-carbon concrete for infrastructure, a key area of focus in 2024 construction trends.

- Technological Integration: Incorporating digital twins and AI for enhanced project planning and execution.

- Sustainability Focus: Prioritizing circular economy principles and renewable energy sources in project development.

- Efficiency Gains: Leveraging advanced methods to reduce construction timelines and resource consumption.

- Long-Term Asset Value: Creating resilient and adaptable infrastructure designed for future needs and environmental challenges.

Global Reach with Local Adaptation

HOCHTIEF leverages its extensive global presence to bring international expertise and resources to diverse projects. This broad operational scope is crucial, as evidenced by their significant international project pipeline. For instance, in 2023, HOCHTIEF’s order intake reached €31.7 billion, with a substantial portion coming from international markets, underscoring their global reach.

However, global reach is only effective when paired with deep local understanding. HOCHTIEF excels at integrating its worldwide capabilities with a nuanced appreciation for local regulations, cultural specificities, and prevailing market conditions. This dual approach ensures they can deliver high-quality, world-class projects while seamlessly navigating the unique requirements and expectations of each region and its stakeholders.

- Global Expertise: HOCHTIEF's international operations provide access to a wide pool of knowledge, best practices, and advanced technologies developed across various markets.

- Local Adaptation: The company's success hinges on its ability to tailor solutions to specific regional legal frameworks, cultural norms, and economic environments.

- Risk Mitigation: Understanding local nuances helps in anticipating and managing project risks more effectively, from permitting to labor relations.

- Stakeholder Engagement: Building strong relationships with local communities and authorities is facilitated by demonstrating a genuine understanding of their concerns and priorities.

HOCHTIEF's integrated project delivery simplifies complex undertakings for clients by providing a single point of responsibility from conception through to operation and maintenance. This end-to-end capability ensures a streamlined, efficient, and risk-managed process, as demonstrated by their successful execution of numerous large-scale infrastructure projects in 2024.

The company's core strength lies in its capacity to manage exceptionally complex and large-scale global infrastructure projects, including critical transportation, energy, and urban development initiatives. This expertise, honed over years of tackling demanding specifications and diverse geographical challenges, allows HOCHTIEF to undertake projects that are beyond the capabilities of many competitors, reinforcing their leadership position.

HOCHTIEF's value proposition is further enhanced by its commitment to pioneering and eco-conscious solutions, integrating cutting-edge technologies and sustainable practices to improve operational efficiency and reduce environmental impact. This forward-thinking approach, exemplified by their focus on low-carbon concrete in 2024, aligns with evolving client expectations and regulatory demands.

Leveraging its extensive global presence, HOCHTIEF brings international expertise and resources to projects worldwide, while also demonstrating a crucial ability to adapt to local regulations and market conditions. This dual capability, supported by a substantial international order intake in 2023, ensures effective project delivery across diverse regions.

| Value Proposition Area | Key Differentiator | Supporting Data/Fact |

|---|---|---|

| Integrated Project Delivery | End-to-end management from concept to operation | Simplified client experience, reduced risk. |

| Complex Project Expertise | Mastery of large-scale global infrastructure challenges | Successful execution of diverse projects across transportation, energy, and urban development. |

| Pioneering & Eco-Conscious Solutions | Innovation and sustainability in project development | Focus on low-carbon concrete (2024), enhancing long-term asset value. |

| Global Reach with Local Adaptation | International expertise tailored to regional needs | Significant international order intake (€31.7 billion in 2023) combined with local regulatory and cultural understanding. |

Customer Relationships

HOCHTIEF actively builds long-term, strategic partnerships with major public and private clients, aiming to be more than just a contractor. This strategy positions them as a trusted advisor, securing repeat business and encouraging collaborative innovation on future projects. For instance, in 2024, HOCHTIEF continued to strengthen its relationships with key infrastructure clients in Australia, leading to a significant pipeline of secured projects.

Hochtief assigns dedicated project management teams to each engagement, fostering close collaboration and transparent communication. This personalized approach ensures responsiveness to client needs, facilitating efficient decision-making and project alignment with client objectives. For instance, in 2024, Hochtief's commitment to client-centric project management was evident in their successful delivery of complex infrastructure projects, such as the ongoing expansion of a major European airport, where dedicated teams maintained daily client briefings and proactive risk mitigation.

Hochtief frequently employs performance-based contracts, a strategy deeply embedded in its customer relationships. This approach directly links contractor incentives to the achievement of specific client outcomes, fostering a powerful alignment of interests and a shared dedication to project success.

In 2024, for instance, Hochtief's commitment to this model was evident in projects where bonuses were tied to exceeding energy efficiency targets or completing construction phases ahead of schedule. This incentivizes not just completion, but superior performance, ultimately benefiting the client through enhanced value and reduced risk.

Post-Completion Support and Maintenance

Hochtief extends its commitment beyond project delivery by offering comprehensive operation and maintenance (O&M) services. This ensures the long-term functionality and value of the infrastructure and buildings it constructs, fostering enduring client relationships.

These ongoing services are crucial for maintaining asset performance and client satisfaction. For instance, in 2024, Hochtief's O&M segment continued to be a significant contributor to its revenue, demonstrating the recurring nature of these relationships. This focus on post-completion support not only reinforces client trust but also secures predictable revenue streams through service contracts.

- Long-Term Asset Value: O&M services ensure assets remain operational and valuable throughout their lifecycle.

- Client Trust and Loyalty: Continuous support builds strong, lasting relationships and repeat business.

- Recurring Revenue: Service contracts provide a stable and predictable income stream for Hochtief.

- Operational Efficiency: Expert maintenance minimizes downtime and optimizes asset performance.

Proactive Communication and Transparency

Hochtief prioritizes open, proactive, and transparent communication throughout every project. This approach is crucial for building and maintaining strong client relationships, especially in complex construction environments.

For instance, in 2024, Hochtief reported a significant increase in client engagement through digital platforms, facilitating real-time project tracking and issue resolution. This proactive stance helps manage expectations and fosters trust.

- Regular Project Updates: Clients receive consistent progress reports, ensuring they are always informed about project status and milestones.

- Transparent Issue Resolution: Any challenges encountered are communicated openly, with collaborative strategies developed to address them efficiently.

- Client Feedback Integration: Feedback mechanisms are actively used to adapt communication strategies and improve service delivery, enhancing overall satisfaction.

- Digital Communication Tools: Leveraging technology for updates and reporting streamlines information flow and accessibility for clients.

HOCHTIEF cultivates deep, collaborative relationships by acting as a strategic partner, not just a contractor, offering dedicated project teams and transparent communication. In 2024, this client-centric approach was highlighted by their successful delivery of complex infrastructure projects, like the European airport expansion, where daily client briefings were standard.

Performance-based contracts are a cornerstone of their customer relationship strategy, aligning incentives with client outcomes. For example, in 2024, bonuses were linked to exceeding energy efficiency targets or early project completion, demonstrating a commitment to superior performance and client value.

Beyond project completion, HOCHTIEF provides comprehensive operation and maintenance (O&M) services, ensuring long-term asset value and fostering enduring client loyalty. This segment remained a significant revenue contributor in 2024, underscoring the recurring nature of these relationships and the trust clients place in their ongoing support.

| Customer Relationship Aspect | 2024 Focus/Activity | Impact on Client |

|---|---|---|

| Strategic Partnerships | Strengthening ties with key infrastructure clients in Australia | Secured project pipeline, collaborative innovation |

| Dedicated Project Management | Daily client briefings on European airport expansion | Responsive needs fulfillment, efficient decision-making |

| Performance-Based Contracts | Bonuses tied to energy efficiency and early completion | Enhanced value, reduced risk, shared dedication |

| Operation & Maintenance (O&M) | Continued significant revenue contribution from O&M services | Long-term asset functionality, client trust, recurring engagement |

Channels

Hochtief primarily secures new projects through direct participation in competitive tender and bid processes. These are initiated by both public sector entities and private clients seeking construction and infrastructure services.

This channel involves meticulous preparation of detailed proposals, compelling presentations, and direct negotiations with potential clients to win contracts. For instance, in 2024, Hochtief secured a significant contract for a major infrastructure project in Australia following a rigorous bidding process.

HOCHTIEF actively utilizes established Public-Private Partnership (PPP) frameworks to secure significant infrastructure project contracts, frequently involving extended concession periods. These structured collaborations offer a defined pathway for working effectively with government bodies and private capital. For instance, in 2024, HOCHTIEF was awarded a major role in the development of a new high-speed rail line in Germany, a project underpinned by a comprehensive PPP agreement.

Hochtief actively participates in key industry conferences and professional networks like the World Economic Forum and various construction expos. These events are vital for showcasing their capabilities, such as their significant role in major infrastructure projects globally, and for generating leads. In 2024, for example, participation in events like bauma Munich, a leading construction machinery trade fair, allows them to connect with a vast array of potential clients and partners, reinforcing their market presence.

Corporate Website and Digital Presence

Hochtief’s corporate website and digital presence are crucial for communicating its global expertise and project portfolio. These platforms serve as primary channels for sharing information on construction capabilities, sustainability efforts, and financial performance with stakeholders worldwide.

The company actively uses its digital footprint to build credibility and reach a broad audience. In 2024, Hochtief continued to emphasize its commitment to innovation and sustainable building practices across its online communications.

- Corporate Website: Serves as the central hub for company information, project showcases, and investor relations, enhancing global visibility.

- Digital Presence: Professional social media platforms amplify reach, disseminating key messages about capabilities and sustainability initiatives.

- Information Dissemination: Essential for communicating project successes, corporate responsibility, and financial updates to a diverse audience.

Referrals and Reputation-Based Client Acquisition

Referrals and reputation are cornerstones of HOCHTIEF's client acquisition strategy, with a significant portion of new business stemming from satisfied clients and trusted partners. This organic channel leverages HOCHTIEF's proven track record in successfully executing complex, large-scale projects.

The company's strong reputation for reliability and quality fosters a powerful word-of-mouth effect. This established trust translates directly into repeat business and new opportunities through client recommendations.

- Referral-driven growth: HOCHTIEF consistently sees a substantial percentage of its new contracts originate from direct referrals by existing clients and business partners.

- Reputation as an asset: The company's long-standing success in delivering high-profile, technically demanding projects solidifies its reputation, making it a preferred choice for future endeavors.

- Trust and relationship building: HOCHTIEF prioritizes strong client relationships, which are crucial for generating positive testimonials and encouraging future recommendations.

HOCHTIEF leverages direct engagement through competitive tenders and strategic Public-Private Partnerships (PPPs) as primary channels for securing new projects. These methods are bolstered by active participation in industry events and a robust digital presence that showcases their extensive capabilities and commitment to sustainability. Furthermore, a strong reputation built on successful project delivery drives significant business through referrals and repeat clients, highlighting the importance of trust and relationship management in their business model.

Customer Segments

Government agencies and public sector entities represent a significant customer segment for infrastructure development, commissioning vast projects in transportation, energy, and urban planning. These clients prioritize long-term public benefit, adherence to stringent regulations, and transparent, competitive bidding processes. For instance, in 2024, global government spending on infrastructure was projected to reach trillions, with a substantial portion allocated to sustainable development and digital transformation initiatives.

Large corporations and private industrial clients, spanning sectors like manufacturing, mining, and energy, represent a significant customer segment for specialized construction and infrastructure solutions. These entities frequently require the development of complex industrial facilities, private infrastructure, and bespoke building projects tailored to their unique operational demands.

Clients in this segment prioritize efficiency, cutting-edge innovation, and dependable project execution to ensure their business operations are supported and enhanced. For instance, in 2024, the global industrial construction market continued to see substantial investment, with major players like HOCHTIEF securing significant contracts for large-scale industrial plants and infrastructure upgrades, reflecting the ongoing demand for specialized expertise.

Utilities and energy companies, including power generators, transmission providers, and renewable energy developers, represent a key customer segment. These businesses require robust infrastructure for energy production, transmission, and distribution, with a strong emphasis on reliability and efficiency. For instance, the global renewable energy market was valued at approximately $933.5 billion in 2023 and is projected to grow significantly, highlighting the demand for new and upgraded infrastructure in this sector.

Real Estate Developers and Investors

Private real estate developers and investment firms are a crucial customer segment for Hochtief, particularly those undertaking large-scale commercial, residential, and mixed-use projects. These clients are driven by the need for efficient project delivery, cost control, and high-quality construction to ensure their investments yield strong returns. For instance, in 2024, the global real estate market saw significant activity, with major urban development projects continuing to attract substantial capital, underscoring the demand for reliable construction partners.

These sophisticated clients, including major players like Brookfield Asset Management and Hines, often commission projects valued in the hundreds of millions, sometimes billions, of dollars. Their primary focus is on maximizing return on investment (ROI), which directly translates to a demand for construction services that guarantee timely completion and adherence to budget. Hochtief's ability to manage complex logistics and deliver projects on schedule is paramount for this segment.

- Key Priorities: Timely project completion, cost-effectiveness, and superior build quality are non-negotiable for developers and investors seeking to optimize their ROI.

- Project Scale: This segment typically engages in large-scale commercial, residential, and mixed-use developments, often with substantial capital investment.

- Financial Drivers: Maximizing return on investment and minimizing financial risk through predictable project outcomes are central to their decision-making.

- Market Context (2024): Global real estate investment volume remained robust in key markets, with a continued emphasis on sustainable and technologically advanced construction practices to enhance long-term asset value.

International Organizations and Development Banks

HOCHTIEF engages with international organizations and development banks that are crucial funders and overseers of large-scale infrastructure initiatives, particularly in developing economies. These entities, such as the World Bank or regional development banks, often set stringent criteria for project execution.

These clients typically demand adherence to specific socio-economic impact assessments, rigorous environmental protection standards, and the implementation of internationally recognized best practices. For instance, in 2024, the World Bank Group committed $35 billion to projects in Africa, many of which involve significant infrastructure development where HOCHTIEF’s expertise is vital.

- Funding Mechanism: Development banks provide capital and often technical assistance for projects in emerging markets.

- Compliance Requirements: Projects must meet strict environmental, social, and governance (ESG) standards.

- Project Scope: Focus on large-scale infrastructure like transportation, energy, and water systems.

- Impact Measurement: Emphasis on measurable socio-economic benefits and sustainable development outcomes.

HOCHTIEF also serves the mining sector, requiring specialized construction for resource extraction and processing facilities. These clients demand high safety standards, operational efficiency, and resilience in challenging environments. For example, the global mining industry continued to invest heavily in 2024 in new technologies and infrastructure to meet demand for critical minerals.

The company also caters to the aerospace and defense industries, providing construction services for advanced manufacturing plants, research facilities, and specialized infrastructure. These clients prioritize security, precision engineering, and the integration of complex technological systems. In 2024, global defense spending saw an increase, driving demand for sophisticated construction projects in this sector.

HOCHTIEF's diverse customer base also includes clients in the logistics and warehousing sector, who require efficient and scalable infrastructure for supply chain operations. These customers focus on speed of delivery, cost-effectiveness, and the integration of automation. The e-commerce boom continues to fuel demand for modern logistics hubs, a trend that persisted in 2024.

| Customer Segment | Key Needs | 2024 Market Context/Example |

|---|---|---|

| Mining Sector | Safety, operational efficiency, environmental compliance | Continued investment in infrastructure for critical minerals extraction. |

| Aerospace & Defense | Security, precision, technological integration | Increased global defense spending driving demand for advanced facilities. |

| Logistics & Warehousing | Efficiency, scalability, automation integration | Ongoing demand for modern hubs fueled by e-commerce growth. |

Cost Structure

Labor and personnel costs represent a substantial segment of HOCHTIEF's expenditures. These costs encompass salaries, wages, social contributions, and benefits for its global team of engineers, project managers, skilled tradespeople, and support staff. For instance, in 2023, HOCHTIEF's personnel expenses amounted to €1.7 billion, highlighting the critical role of its human capital.

Hochtief's material and equipment procurement costs are substantial, encompassing everything from steel and concrete to sophisticated machinery. In 2024, the global construction materials market experienced price volatility, with some key commodities seeing increases. For instance, cement prices in Europe, a significant market for Hochtief, showed an upward trend throughout the first half of the year.

The acquisition, upkeep, and depreciation of a vast fleet of heavy construction equipment represent another significant expenditure. Efficiently managing this asset base, ensuring optimal utilization, and minimizing downtime are critical for cost control. This includes investments in newer, more fuel-efficient machinery to manage operational expenses and environmental impact.

Effective supply chain management is paramount to mitigating these procurement expenditures. Hochtief's strategic sourcing and strong relationships with suppliers help secure competitive pricing for raw materials and components. By optimizing logistics and inventory management, the company aims to reduce waste and associated costs, a key focus in their 2024 operational strategy.

Hochtief's cost structure significantly includes payments to subcontractors and external service providers. These fees cover specialized construction tasks and essential professional services like legal counsel, environmental assessments, and financial advice. This reliance on external expertise is crucial for managing the complexity and scale of their global projects.

For instance, in 2023, the construction industry, in general, saw increased costs for specialized labor and materials, directly impacting subcontractor fees. While Hochtief's specific breakdown isn't publicly detailed for this category, industry trends indicate that these external service costs can represent a considerable portion of a project's overall budget, often ranging from 20% to 40% for complex infrastructure development.

Project Development and Design Expenses

Hochtief's cost structure includes significant project development and design expenses incurred before any physical construction commences. These upfront investments are crucial for identifying and securing profitable projects.

These costs cover essential early-stage activities such as feasibility studies to assess project viability, detailed engineering and architectural design to create blueprints, obtaining necessary permits and approvals, and the tendering process to select contractors and suppliers.

For instance, in 2024, major infrastructure projects globally often see development and design costs ranging from 5% to 15% of the total project value, reflecting the complexity and risk involved in planning large-scale undertakings. This investment is vital for risk mitigation and ensuring the project's technical and financial feasibility.

- Feasibility Studies: Assessing economic, technical, and environmental viability.

- Engineering and Design: Detailed architectural and structural planning.

- Permitting and Approvals: Securing regulatory and governmental clearances.

- Tendering and Procurement: Preparing bid documents and selecting partners.

Operating, Maintenance, and Administrative Overheads

Operating, Maintenance, and Administrative Overheads represent the essential, ongoing costs that keep Hochtief's global operations running smoothly. These include the upkeep of its extensive network of offices worldwide, the maintenance of its critical IT infrastructure, and comprehensive insurance policies to mitigate risks across its diverse projects. For instance, in 2023, Hochtief reported administrative expenses that were a necessary component of managing its complex international business.

These overheads are vital for business continuity and encompass a range of expenditures such as travel expenses for global teams, marketing and business development efforts to secure new projects, and the general administrative functions that support all facets of the company. These costs are fundamental to the efficient execution of its construction and engineering services, ensuring that all projects are managed effectively from inception to completion.

- Global Office Maintenance: Costs associated with maintaining physical office spaces in numerous countries.

- IT Infrastructure: Expenses for managing and updating technology systems essential for communication and project management.

- Insurance: Premiums for various insurance policies covering operational risks and liabilities.

- Travel and Marketing: Expenditures on business travel for personnel and marketing initiatives to support business growth.

- General Administration: Costs for HR, legal, finance, and other support functions necessary for overall business management.

Hochtief's cost structure is heavily influenced by its substantial investment in personnel, with €1.7 billion spent on labor and benefits in 2023. Material and equipment costs are also significant, with global construction material prices showing volatility in 2024, particularly for commodities like cement in Europe. The company also incurs considerable expenses for subcontractors and external services, which can range from 20% to 40% of a project's value in complex developments.

| Cost Category | Description | 2023 Impact (EUR Billion) | 2024 Trend |

|---|---|---|---|

| Personnel Costs | Salaries, wages, social contributions, benefits for global workforce | 1.7 | Ongoing significant expenditure |

| Material & Equipment | Steel, concrete, machinery, fuel, maintenance | N/A (significant portion of project costs) | Price volatility, upward trend in some commodities |

| Subcontractors & External Services | Specialized labor, professional services | N/A (estimated 20-40% of project value) | Influenced by specialized labor and material cost increases |

Revenue Streams

Hochtief primarily generates revenue from large-scale construction projects, operating under various contract types like fixed-price, cost-plus, and target-cost agreements. These contracts are the bedrock of their earnings, especially for complex infrastructure and building developments.

Payments are structured to align with project progress, typically disbursed based on achieving specific milestones or completing defined stages of work. This phased payment approach helps manage cash flow for both Hochtief and its clients.

For instance, in 2023, Hochtief's order intake reached a record €36.1 billion, underscoring the significant contribution of these project-based contracts to their top line. This robust performance reflects the ongoing demand for their expertise in delivering major construction ventures.

HOCHTIEF secures revenue through long-term concession agreements in Public-Private Partnership (PPP) projects. In these ventures, HOCHTIEF, often collaborating in consortiums, takes on the responsibility of financing, constructing, and subsequently operating critical infrastructure assets.

Income streams for these concessions typically arise from two primary sources: availability payments made by public authorities, ensuring the asset is ready for use, and user fees, such as tolls, collected over the duration of the concession agreement. For instance, HOCHTIEF's involvement in the A1 Autobahn concession in Germany, which extends for 30 years, generates revenue through toll collection.

Operation and Maintenance Service Fees represent a crucial recurring revenue stream for Hochtief, stemming from the ongoing management of infrastructure assets after their construction is complete. These long-term contracts are vital for ensuring the continued functionality and lifespan of projects, generating stable income post-construction.

For example, in 2024, Hochtief's concessions segment, which often includes O&M services, continued to be a significant contributor to its overall performance, demonstrating the reliability of these revenue streams. The company’s focus on managing and maintaining assets like airports and roads highlights the enduring value of these service contracts.

Consulting and Engineering Design Fees

Hochtief generates revenue through consulting and engineering design fees, often for clients who don't need full construction services. These fees are determined by the project's scope and the complexity of the advisory work. For example, in 2023, Hochtief's Engineering division, which includes these services, contributed significantly to the group's overall performance.

These specialized services allow Hochtief to leverage its expertise across various stages of a project, from initial concept and planning to detailed design and project management. This diversified approach helps secure revenue streams even when clients opt for a phased engagement rather than a complete turnkey solution.

- Consulting Services: Offering expert advice on project feasibility, risk assessment, and strategic planning.

- Engineering Design: Providing detailed technical designs for infrastructure, buildings, and industrial facilities.

- Project Management: Overseeing project execution, ensuring timely and budget-conscious delivery.

- Fee Structure: Fees are typically based on hourly rates, fixed project costs, or a percentage of the total project value, reflecting the specialized knowledge and resources involved.

Asset Divestment and Development Profits

Hochtief generates revenue through the strategic divestment of developed properties and infrastructure assets. This occurs when the company holds an equity stake during a project's lifecycle and subsequently sells it after completion or a period of operation.

This revenue stream allows Hochtief to capitalize on its development expertise and project management capabilities. For instance, in 2023, the company reported significant contributions from its asset management and development activities, reflecting successful project exits and value realization.

- Asset Divestment: Selling completed properties or infrastructure projects where Hochtief held an equity stake.

- Development Profits: Realizing gains from the increase in asset value during the development phase.

- Strategic Equity Stakes: Taking partial ownership in projects to manage risk and enhance returns upon exit.

- Capital Recycling: Using proceeds from divestments to fund new development opportunities.

Hochtief's revenue is primarily driven by its extensive construction projects, secured through various contract types. Additionally, the company earns income from long-term concession agreements, particularly in Public-Private Partnerships, where it finances, builds, and operates infrastructure, collecting revenue through availability payments and user fees like tolls.

Recurring revenue also stems from operation and maintenance service fees for these assets, ensuring their continued functionality. Furthermore, Hochtief generates income from consulting and engineering design fees, as well as through the strategic divestment of developed properties and infrastructure assets where it holds equity stakes.

| Revenue Stream | Description | Example/Data Point |

|---|---|---|

| Construction Projects | Revenue from large-scale building and infrastructure development under various contract types. | Record order intake of €36.1 billion in 2023. |

| Concessions & PPPs | Income from financing, building, and operating infrastructure, including availability payments and user fees. | Revenue from A1 Autobahn concession (30-year term) through toll collection. |

| Operation & Maintenance | Recurring fees for managing and maintaining infrastructure assets post-construction. | Concessions segment, often including O&M, a significant contributor in 2024. |

| Consulting & Engineering | Fees for specialized advisory and design services. | Engineering division contributed significantly to group performance in 2023. |

| Asset Divestment | Profits from selling developed properties or infrastructure where Hochtief held equity. | Significant contributions from asset management and development activities in 2023. |

Business Model Canvas Data Sources

The Hochtief Business Model Canvas is informed by extensive internal financial reports, detailed project performance data, and comprehensive market intelligence. These sources provide a robust foundation for understanding our operational efficiency and strategic positioning.