HANA Micron SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HANA Micron Bundle

HANA Micron's competitive edge lies in its specialized semiconductor packaging and testing services, a critical bottleneck in the industry. However, navigating the volatile global chip market and intense competition presents significant challenges.

Want the full story behind HANA Micron's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hana Micron's comprehensive service suite is a significant strength, offering a complete turnkey solution for semiconductor packaging and testing. This end-to-end capability covers wafer testing, assembly, and final testing, providing a seamless experience for clients across a broad spectrum of semiconductor devices. Their extensive expertise spans diverse packaging technologies, including flip chip, laminate, lead frame, and wafer-level processes, positioning them as a highly adaptable partner in the complex semiconductor ecosystem.

Hana Micron is actively broadening its manufacturing capabilities by establishing and growing production facilities worldwide. Key expansion efforts are focused on Vietnam and Brazil, complementing its existing operations in Korea.

The company has made a substantial commitment to Vietnam, earmarking over $1 billion for chip production investments scheduled through 2025. This strategic move significantly boosts their overall manufacturing capacity.

This global expansion not only diversifies Hana Micron's geographical footprint but also strategically positions the company to capitalize on growing demand in various emerging markets.

HANA Micron benefits from robust relationships with key Korean semiconductor giants, including Samsung and SK Hynix, securing a stable base of business. These established partnerships are fundamental to their operational stability and market position.

The company is strategically broadening its customer base by forging connections with U.S. fabless semiconductor firms like NXP and Microchip Technology. This proactive client diversification is essential for reducing dependency on a few large customers and enhancing their international market reach.

Expertise in Advanced Packaging Technologies

Hana Micron demonstrates profound expertise in advanced packaging technologies, a crucial area for today's high-performance computing and AI. Their capabilities span flip-chip, wafer-level packaging, and System-in-Package (SiP) solutions. The company's recent focus on advanced packaging for High-Bandwidth Memory (HBM) chips, vital for AI accelerators, positions them strongly in a rapidly growing market segment.

This specialization directly addresses the increasing demand for more integrated and powerful semiconductor solutions. For instance, the HBM market is projected to see substantial growth, with analysts estimating it could reach tens of billions of dollars by the late 2020s, underscoring the strategic importance of Hana Micron's advancements in this space.

- Advanced Packaging Capabilities: Expertise in flip-chip, wafer-level packaging, and SiP.

- HBM Specialization: Development of advanced packaging for High-Bandwidth Memory, critical for AI.

- Market Alignment: Addresses the growing industry need for sophisticated semiconductor packaging.

- Future Growth Potential: Positioned to capitalize on the expanding AI and high-performance computing markets.

Commitment to R&D and Innovation

Hana Micron’s dedication to research and development is a significant strength, evident in their substantial investments aimed at uncovering new avenues for growth. This focus on innovation is central to their ambition of becoming a premier global semiconductor back-end process provider.

The company is actively enhancing its testing business, a key area for future development. Simultaneously, Hana Micron is strategically expanding its non-memory product portfolio, targeting high-demand sectors such as automotive electronics, which represents a substantial market opportunity.

- R&D Investment: Hana Micron consistently allocates significant capital to R&D, fueling its innovation pipeline.

- Global Ambition: The company’s vision is to lead the global semiconductor back-end process market through continuous innovation.

- Strategic Expansion: Focus on strengthening testing capabilities and diversifying into high-growth non-memory segments like automotive electronics.

Hana Micron's advanced packaging expertise, particularly in High-Bandwidth Memory (HBM) for AI, positions it at the forefront of a rapidly expanding market. This specialization directly addresses the increasing demand for integrated and powerful semiconductor solutions, with the HBM market projected for substantial growth in the coming years.

The company’s commitment to global expansion, with over $1 billion invested in Vietnam through 2025, significantly bolsters its manufacturing capacity. This strategic diversification into emerging markets like Vietnam and Brazil, alongside existing Korean operations, enhances its ability to meet global demand and reduces geographical risk.

Hana Micron benefits from strong, established relationships with major Korean semiconductor players such as Samsung and SK Hynix, ensuring a stable revenue stream. Concurrently, it is actively cultivating new partnerships with U.S. fabless firms like NXP and Microchip Technology, broadening its customer base and reducing reliance on a few key clients.

Significant investment in research and development fuels Hana Micron's drive to become a leading global back-end semiconductor process provider. The company is strategically enhancing its testing capabilities and expanding its non-memory product portfolio, with a particular focus on high-demand sectors like automotive electronics.

| Strength | Description | Supporting Data/Impact |

|---|---|---|

| Advanced Packaging Expertise | Proficiency in flip-chip, wafer-level packaging, and System-in-Package (SiP). | Crucial for high-performance computing and AI; specialization in HBM for AI accelerators. |

| Global Manufacturing Expansion | Investing over $1 billion in Vietnam through 2025; expanding operations in Brazil. | Increases overall manufacturing capacity and diversifies geographical footprint. |

| Key Customer Relationships | Strong ties with Samsung and SK Hynix; developing relationships with NXP and Microchip Technology. | Secures stable business and reduces dependency on a few large customers. |

| R&D and Diversification Focus | Substantial R&D investments; enhancing testing capabilities and expanding non-memory products (e.g., automotive). | Drives innovation and targets high-growth market segments. |

What is included in the product

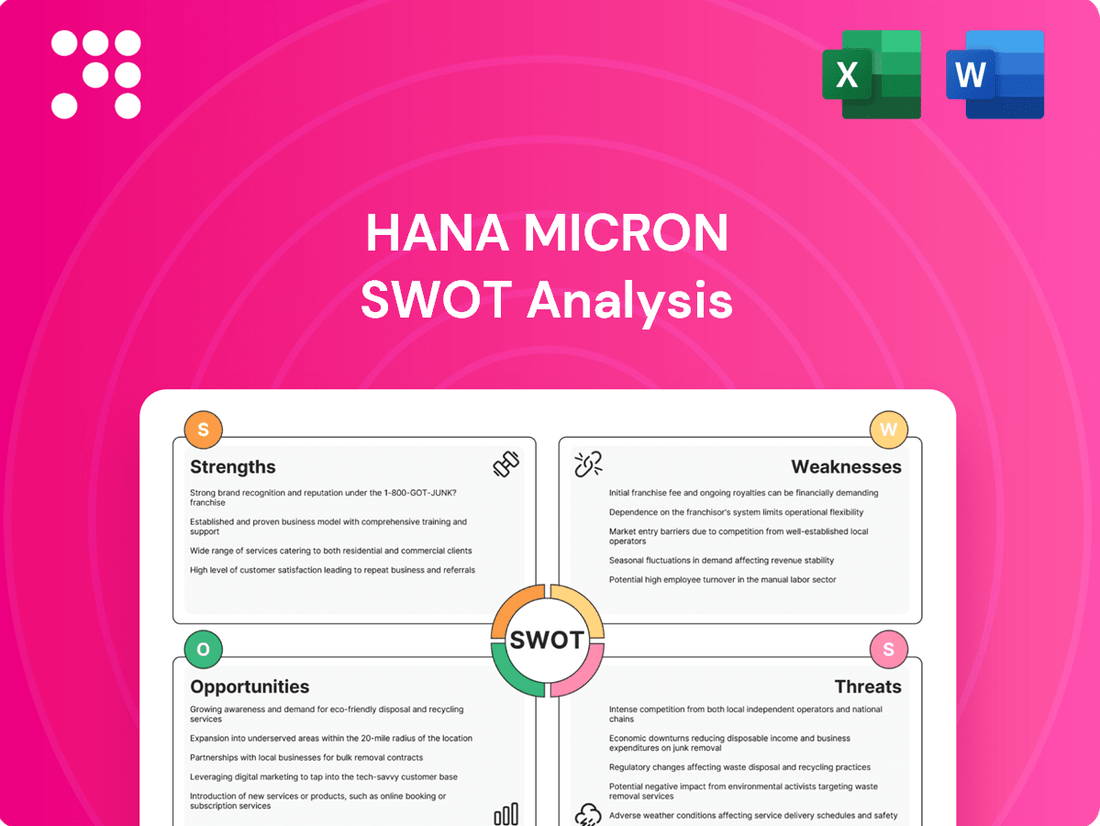

Analyzes HANA Micron’s competitive position through key internal and external factors, detailing its strengths in memory technology, weaknesses in market diversification, opportunities in AI and cloud computing, and threats from intense competition and supply chain disruptions.

Offers a clear visual representation of HANA Micron's competitive landscape, simplifying complex market dynamics for actionable insights.

Weaknesses

Despite an uptick in sales, Hana Micron faced profitability challenges, reporting a net loss of KRW 23,801.45 million for the fiscal year ending December 31, 2024. This figure represents a worsening of the previous year's loss.

Further highlighting these struggles, the trailing twelve months (TTM) net income as of March 31, 2025, stood at -$6.571 million, with an Earnings Per Share (EPS) of -161.65 KRW. These financial metrics point to significant hurdles in achieving profitability and operational efficiency.

Such consistent net losses can erode investor confidence and potentially limit the company's ability to secure future funding or investments needed for growth and development.

Hana Micron's significant reliance on imported manufacturing equipment, estimated at around 70%, presents a notable weakness. This dependency on foreign suppliers for essential machinery leaves the company vulnerable to supply chain disruptions and potential delays in acquiring the latest technological advancements.

Furthermore, currency fluctuations can directly impact procurement costs, potentially increasing Hana Micron's operational expenses. This reliance also suggests a potential limitation on the company's agility in responding to market changes or rapidly upgrading its production capabilities.

Hana Micron is currently experiencing considerable opposition from minority shareholders concerning a proposed spin-off. This plan is viewed by many investors as a strategy that disproportionately benefits the largest shareholder by consolidating their control, rather than offering equitable advantages to the broader investor base.

This internal friction and the resulting governance questions can indeed tarnish Hana Micron's public image and potentially depress its stock valuation. For instance, in early 2024, similar shareholder disputes in other tech firms led to an average stock underperformance of 8% in the six months following public announcements of such disagreements.

Perception of Hierarchical Structure in Korean Ecosystem

Hana Micron, like many Korean firms, operates within an ecosystem where hierarchical structures are still prevalent. This can be a disadvantage when trying to foster agile, cross-border partnerships essential in the fast-paced semiconductor industry.

The legacy of large Korean conglomerates, known for their top-down management, can translate into slower decision-making processes and less flexibility. This contrasts with the more fluid, network-based collaborations seen among many international competitors.

This perceived rigidity might limit Hana Micron's ability to quickly adapt to evolving global market demands and secure the diverse international talent and technological integrations needed to stay ahead.

- Hierarchical Structure: Korean semiconductor ecosystem still shows strong hierarchical tendencies.

- Global Comparison: This contrasts with more collaborative, network-driven models of international competitors.

- Impact on Flexibility: Such structures can impede rapid decision-making and adaptability in global markets.

- Collaboration Challenges: May hinder broader international partnerships and integration of diverse technologies.

Intense Competition from Larger Industry Players

Hana Micron faces substantial challenges due to intense competition from larger, established global players in the Outsourced Semiconductor Assembly and Test (OSAT) market. Companies like ASE Group, Amkor Technology, and JCET possess greater scale, resources, and market penetration, creating significant pressure on Hana Micron.

This disparity in size impacts Hana Micron's ability to compete effectively on pricing, secure large market share, and maintain leadership in technological advancements. For instance, ASE Group, a dominant force in the OSAT sector, reported revenues of approximately $7.2 billion in 2023, dwarfing Hana Micron's operational scale.

The competitive landscape necessitates continuous investment in advanced technologies and operational efficiencies for Hana Micron to maintain its position. Failure to keep pace with the innovation and cost advantages of larger competitors could limit future growth opportunities and market influence.

- Dominant Competitors: ASE Group, Amkor Technology, and JCET hold significant market share and resources.

- Scale Disadvantage: Hana Micron operates on a smaller scale compared to these global giants.

- Competitive Pressures: This leads to challenges in pricing, market share acquisition, and technological leadership.

- Revenue Disparity: ASE Group's 2023 revenue of around $7.2 billion highlights the scale difference.

Hana Micron's profitability remains a significant weakness, evidenced by a net loss of KRW 23,801.45 million for fiscal year 2024 and a TTM net income of -$6.571 million as of March 31, 2025. This persistent unprofitability erodes investor confidence and hampers future funding prospects. The company's substantial 70% reliance on imported manufacturing equipment also exposes it to supply chain risks and currency-related cost increases, limiting its operational agility.

Internal friction with minority shareholders over a proposed spin-off, perceived as benefiting the largest shareholder disproportionately, creates governance concerns and can negatively impact stock valuation. Furthermore, Hana Micron's hierarchical corporate culture, common in Korea, may slow decision-making and hinder agile, cross-border collaborations essential in the competitive semiconductor industry.

The company also faces intense competition from larger, well-resourced global OSAT players like ASE Group, which reported approximately $7.2 billion in revenue in 2023. This scale disadvantage pressures Hana Micron on pricing, market share, and technological advancement, necessitating significant ongoing investment to remain competitive.

What You See Is What You Get

HANA Micron SWOT Analysis

The preview you see is the actual HANA Micron SWOT analysis document you'll receive upon purchase. This ensures transparency and that you get exactly what you expect—a professional, comprehensive report.

You're viewing a live preview of the actual SWOT analysis file for HANA Micron. The complete, detailed version of this document becomes available immediately after your purchase.

Opportunities

The global Outsourced Semiconductor Assembly and Test (OSAT) market is booming, with projections indicating it will reach USD 91.29 billion by 2034, growing at a 7.8% compound annual growth rate from 2025. Another forecast suggests an even higher valuation of USD 114 billion by 2034, with a CAGR of 9.00% during the same period. This robust expansion creates a favorable environment for Hana Micron, directly increasing the demand for its specialized semiconductor packaging and testing services.

The accelerating adoption of AI, 5G, and advanced automotive technologies is creating a significant surge in demand for sophisticated semiconductor packaging. These innovations require specialized solutions to handle increased data processing and connectivity demands, directly benefiting companies like Hana Micron that focus on advanced packaging.

Hana Micron's strategic investments, particularly in High-Bandwidth Memory (HBM) packaging crucial for AI accelerators, place it at the forefront of this growth. The global advanced packaging market is projected to reach over $70 billion by 2027, with AI and automotive segments being key drivers, offering substantial opportunities for Hana Micron.

Global trade dynamics are pushing for supply chain diversification, positioning South Korean firms like Hana Micron as key players in building compliant semiconductor manufacturing networks. This geopolitical shift offers a significant opportunity for Hana Micron to leverage its expertise and expand its market share.

Hana Micron's ambitious expansion plans in Vietnam, targeting over $1 billion in investment by 2025, are strategically timed to capitalize on this trend. This expansion establishes a vital manufacturing base, enhancing its ability to serve global markets with resilient and compliant supply chain solutions.

Increasing Outsourcing by Fabless Semiconductor Companies

The semiconductor industry is seeing a significant rise in outsourcing by fabless companies. This is driven by the increasing complexity of chip designs and the need for advanced, cost-effective packaging. Hana Micron, with its robust turnkey solutions and specialized knowledge, is perfectly positioned to capitalize on this trend, catering to the growing demand for external support in chip manufacturing.

The global Outsourced Semiconductor Assembly and Test (OSAT) market is projected to grow substantially. For instance, it was valued at approximately $35 billion in 2023 and is expected to reach over $50 billion by 2028, reflecting a compound annual growth rate of around 8-10%. This expansion highlights the increasing reliance on OSAT providers like Hana Micron.

- Growing Demand: Fabless semiconductor companies are increasingly outsourcing to specialized OSAT providers to manage complex manufacturing processes and reduce capital expenditure.

- Market Growth: The OSAT market is experiencing robust growth, with projections indicating continued expansion driven by advanced packaging technologies and increased semiconductor demand.

- Hana Micron's Position: Hana Micron’s comprehensive service offerings, from design support to final testing, align directly with the needs of fabless firms seeking integrated solutions.

Adoption of Emerging Packaging Technologies

The semiconductor industry's swift embrace of advanced packaging like 2.5D/3D integration and fan-out wafer-level packaging (FOWLP) creates a substantial growth avenue. Hana Micron's proactive investment and development in these next-generation solutions position it for technological leadership.

This strategic focus allows Hana Micron to tap into emerging market segments demanding higher performance and smaller form factors.

- Market Growth: The advanced packaging market, including FOWLP and 2.5D/3D, is projected to reach over $10 billion by 2025, driven by AI, 5G, and high-performance computing.

- Technological Advancement: Hana Micron's commitment to R&D in heterogeneous integration, a key component of advanced packaging, can lead to differentiated product offerings.

- Competitive Edge: Early adoption and expertise in these technologies can provide a significant competitive advantage, attracting new customers and partnerships.

Hana Micron is well-positioned to benefit from the increasing demand for outsourced semiconductor assembly and testing (OSAT) services. The global OSAT market is projected to reach USD 91.29 billion by 2034, growing at a 7.8% CAGR from 2025, presenting a significant opportunity for expansion.

The surge in AI, 5G, and automotive technologies is driving the need for advanced packaging solutions, an area where Hana Micron is making strategic investments, particularly in HBM packaging. This focus aligns with the advanced packaging market's projected growth to over $70 billion by 2027.

Geopolitical shifts are encouraging supply chain diversification, benefiting South Korean firms like Hana Micron. The company's substantial investment in Vietnam by 2025 further strengthens its ability to serve global markets with resilient supply chains.

The trend of fabless companies outsourcing complex chip designs and packaging processes also presents a key opportunity. Hana Micron's comprehensive turnkey solutions cater directly to this growing demand, solidifying its role as a key partner.

Threats

The semiconductor packaging sector is a crowded arena, with major global players vying for market dominance. Hana Micron operates within this landscape where the top ten companies collectively hold a substantial market share, indicating fierce competition.

This intense rivalry often translates into significant price pressure across the industry. Companies are frequently compelled to lower prices to secure business, which can directly impact profit margins for all participants, including Hana Micron.

Consequently, Hana Micron faces the challenge of increased competition for crucial clients. This dynamic can hinder revenue growth and put pressure on the company's overall profitability as it navigates the need to remain competitive on pricing.

The semiconductor sector's inherent cyclicality poses a significant threat, amplified by its sensitivity to global economic health. A slowdown in consumer spending, which has seen a moderation in growth in many developed economies through late 2024 and into 2025, directly translates to reduced demand for the electronic devices that rely on Hana Micron's packaging and testing services.

For instance, a projected global GDP growth rate of around 2.7% for 2025, down from earlier optimistic forecasts, signals potential headwinds. This economic deceleration could curb consumer appetite for smartphones, PCs, and other electronics, directly impacting Hana Micron's order volumes and profitability.

The semiconductor sector demands relentless innovation, with technological shifts occurring at a breakneck pace. For HANA Micron, falling behind on advancements like 2.5D/3D integration or novel materials could quickly make current offerings outdated.

The financial burden of this constant R&D is substantial. For instance, industry-wide semiconductor R&D spending is projected to reach over $100 billion annually by 2025, a significant investment that HANA Micron must also contend with to remain competitive.

Supply Chain Vulnerabilities and Geopolitical Tensions

Ongoing geopolitical tensions and trade disputes present a significant threat to Hana Micron's global operations. These can disrupt the flow of essential materials and components, potentially increasing manufacturing costs. For instance, the ongoing semiconductor trade restrictions between the US and China, which intensified in 2023 and are expected to continue influencing market dynamics through 2025, could directly impact Hana Micron's access to key suppliers or markets.

Regional conflicts and political instability in critical manufacturing or sourcing regions could lead to unforeseen operational halts or significant cost escalations. The heightened tensions in Eastern Europe, for example, have already demonstrated the potential for widespread supply chain disruptions affecting various industries, including technology. This volatility can create barriers to international trade, impacting Hana Micron's ability to efficiently move products and raw materials across borders.

- Supply Chain Disruptions: Geopolitical events can interrupt the availability of critical raw materials like rare earth elements or specialized manufacturing equipment, leading to production delays and increased costs.

- Trade Barriers: Tariffs, export controls, and sanctions imposed due to trade disputes can directly increase the cost of goods sold and limit market access for Hana Micron's products.

- Increased Operational Costs: Navigating complex geopolitical landscapes often requires higher spending on logistics, compliance, and risk management, thereby impacting profit margins.

Significant Capital Expenditure Requirements

The semiconductor packaging industry demands massive investments, with advanced equipment and state-of-the-art facilities costing hundreds of millions of dollars. Hana Micron's strategy, including its reliance on imported machinery and aggressive growth targets, means it faces substantial capital expenditure needs. For instance, building a new advanced packaging facility can easily run into the hundreds of millions, impacting cash flow and potentially hindering swift adaptation to market changes if profitability is under pressure.

These significant capital outlays pose a considerable threat. Hana Micron's financial flexibility could be constrained by these ongoing requirements, especially if they encounter unexpected downturns or need to pivot quickly. The sheer scale of investment needed for cutting-edge packaging technologies, such as advanced substrate manufacturing or specialized testing equipment, can strain even well-established companies.

- High Capital Intensity: Semiconductor packaging operations require substantial upfront investment in specialized machinery and cleanroom facilities, often running into hundreds of millions of dollars for a single advanced line.

- Expansion Costs: Hana Micron's expansion plans, particularly into new markets or advanced packaging technologies, will necessitate significant capital injections for new equipment and facility upgrades.

- Financial Strain Risk: Large capital expenditures can strain financial resources, potentially limiting the company's ability to invest in R&D or respond to competitive pressures if profitability falters.

Hana Micron faces intense competition from established global players in the semiconductor packaging sector, leading to price pressures that can erode profit margins. The industry's cyclical nature, tied to global economic health, presents a risk of reduced demand, especially with forecasts indicating slower GDP growth in 2025. Furthermore, the rapid pace of technological advancement necessitates substantial R&D investment, with industry-wide spending projected to exceed $100 billion annually by 2025, a significant cost for Hana Micron to match.

Geopolitical tensions and trade disputes are significant threats, potentially disrupting supply chains for critical materials and increasing operational costs. For instance, ongoing US-China trade restrictions are expected to continue impacting market dynamics through 2025. The high capital intensity of semiconductor packaging, requiring hundreds of millions for advanced facilities, also poses a risk, potentially straining Hana Micron's financial flexibility and ability to adapt to market shifts.

| Threat Category | Specific Risk | 2024/2025 Data/Projection |

|---|---|---|

| Competition | Price Pressure | Intensified due to market consolidation; top ten companies hold substantial market share. |

| Market Dynamics | Economic Slowdown Impact | Projected global GDP growth around 2.7% for 2025, impacting consumer electronics demand. |

| Technology | R&D Investment Needs | Industry-wide R&D spending projected over $100 billion annually by 2025. |

| Geopolitics | Supply Chain Disruptions | Ongoing US-China trade restrictions influencing market dynamics through 2025. |

| Financial | High Capital Expenditure | Building advanced packaging lines can cost hundreds of millions of dollars. |

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, drawing from HANA Micron's official financial filings, comprehensive market research reports, and insights from industry experts to ensure a robust and accurate strategic assessment.