HANA Micron Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HANA Micron Bundle

HANA Micron operates within a dynamic semiconductor landscape, where intense rivalry and the threat of substitutes significantly shape its competitive environment. Understanding the nuances of supplier power and buyer bargaining is crucial for strategic positioning.

The complete report reveals the real forces shaping HANA Micron’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The semiconductor industry's intricate nature means a limited number of suppliers provide essential equipment, materials, and cutting-edge technologies. This concentration empowers these suppliers, giving them considerable sway over OSAT firms like Hana Micron. For example, companies producing advanced packaging machinery and testing solutions often command strong positions due to the substantial R&D and capital expenditure necessary for their innovations.

Switching suppliers in the semiconductor industry is not a simple task. It involves extensive requalification processes, which can lead to significant production delays and considerable integration efforts for new equipment or materials. These complexities translate into high switching costs for companies like Hana Micron, thereby strengthening the bargaining power of their existing suppliers.

Many critical suppliers in the semiconductor industry hold patents and proprietary technologies for essential packaging and testing processes. This intellectual property makes it difficult for OSAT companies, like HANA Micron, to find readily available substitutes, thereby strengthening the suppliers' negotiating position. For instance, specialized materials or unique testing methodologies, protected by patents, can significantly limit sourcing options.

Importance of Supplier's Product to Hana Micron's Output

The quality and performance of materials and equipment from suppliers are absolutely critical for Hana Micron's semiconductor packaging and testing services. If a supplier's components are subpar, it directly impacts the final product quality Hana Micron can deliver to its own customers.

Any hiccup in the supply chain, like a delay or a quality problem from a major supplier, can really throw a wrench into Hana Micron's operations. This kind of dependency can give those suppliers a significant amount of leverage.

- Criticality of Supplier Inputs: Hana Micron relies on specialized materials and advanced equipment for its precise packaging and testing processes.

- Impact of Disruptions: A significant supplier experiencing production issues could halt Hana Micron's output, as seen when supply chain bottlenecks affected the broader semiconductor industry in 2021, leading to extended lead times for critical components.

- Supplier Leverage: For highly specialized or proprietary components, Hana Micron might face limited alternative suppliers, increasing the bargaining power of existing ones.

- Quality Dependence: The performance standards in semiconductor packaging mean that even minor variations in supplier materials can lead to costly rejections and damage Hana Micron's reputation for reliability.

Potential for Forward Integration by Suppliers

The possibility of suppliers integrating forward into assembly and testing services, though infrequent, presents a significant latent threat. This strategic move would transform suppliers into direct competitors for Outsourced Semiconductor Assembly and Test (OSAT) companies.

This potential for forward integration bolsters suppliers' bargaining power. OSAT firms are incentivized to foster cooperative relationships with these suppliers to mitigate the risk of facing them as direct rivals in the market.

- Supplier Forward Integration: A potential strategic move where suppliers enter assembly and test operations.

- Competitive Threat: This integration would create direct competition for existing OSAT providers.

- Increased Bargaining Power: The threat of competition enhances suppliers' leverage in negotiations.

- Industry Dynamics: OSAT companies aim to maintain collaborative supplier relationships to avoid direct rivalry.

The bargaining power of suppliers for Hana Micron is significant due to the specialized nature of semiconductor manufacturing inputs. A limited supplier base for advanced packaging equipment and materials, coupled with high switching costs for OSAT firms, grants these suppliers considerable leverage. For instance, companies specializing in advanced lithography or testing equipment often have few direct competitors, allowing them to dictate terms.

| Supplier Characteristic | Impact on Hana Micron | Example Scenario (2024 Data) |

|---|---|---|

| Limited number of key suppliers | Increases supplier leverage | In 2024, the market for advanced wafer-level packaging equipment saw dominance by a few key players, leading to extended lead times and price increases for critical machinery. |

| High switching costs | Locks Hana Micron into existing supplier relationships | The requalification process for new testing equipment can take 6-12 months and cost millions, deterring Hana Micron from easily changing suppliers even if prices rise. |

| Proprietary technology/IP | Reduces sourcing options | Suppliers holding patents for unique molding compounds or advanced inspection technologies can command premium pricing due to the lack of viable substitutes. |

| Criticality of inputs | Hana Micron's dependence on quality | A disruption in the supply of high-purity chemicals for advanced packaging could halt production, giving chemical suppliers significant power. |

What is included in the product

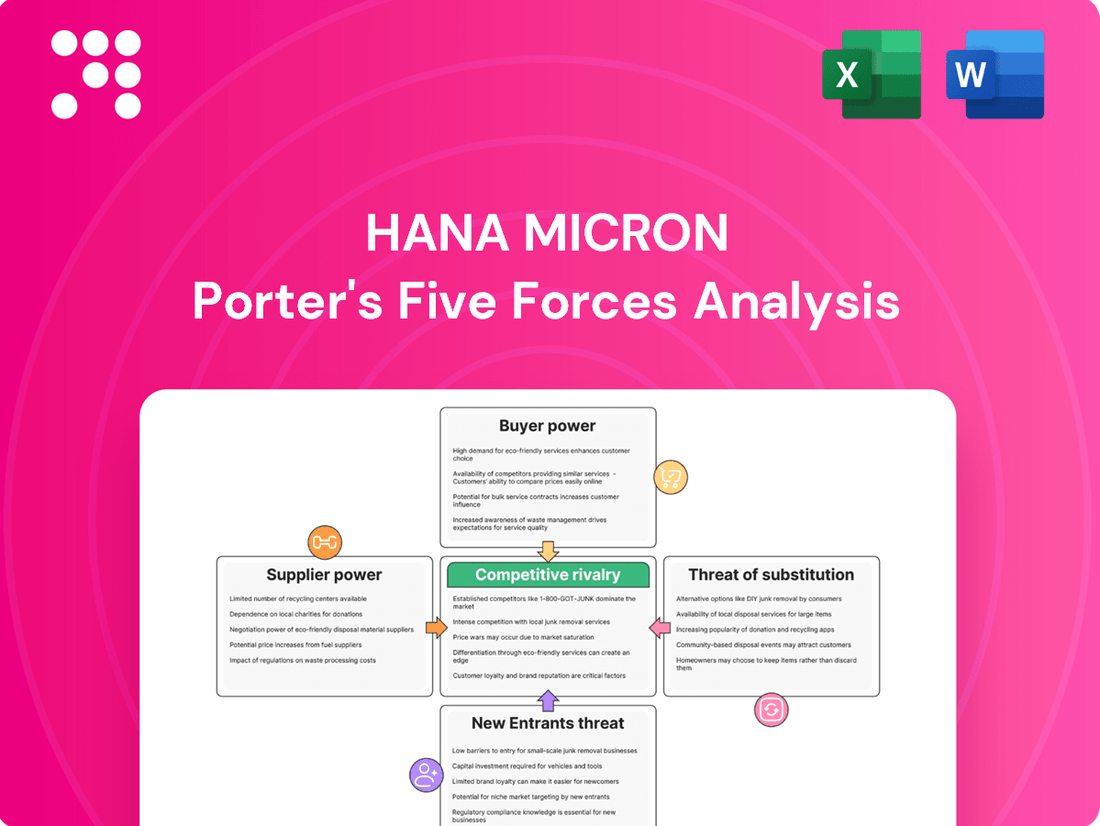

This analysis unpacks the competitive forces impacting HANA Micron, from the threat of new entrants and substitutes to the bargaining power of buyers and suppliers, offering strategic insights into its market position.

Effortlessly identify and prioritize competitive threats with a visual representation of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Hana Micron's position as an OSAT provider means its customer base is largely comprised of major semiconductor players, including integrated device manufacturers (IDMs) and fabless companies. These are often giants in the industry, such as Samsung and SK Hynix, whose substantial order volumes grant them significant leverage.

The sheer size of these clients, like Samsung, a leading semiconductor manufacturer with billions in annual revenue, translates directly into considerable bargaining power. Their ability to place large orders means they can often negotiate more favorable terms, impacting pricing and service level agreements for Hana Micron.

Customers in the semiconductor sector, especially those serving fast-paced markets like consumer electronics, are acutely aware of price. They actively push for cost reductions, creating significant pressure on companies like Hana Micron to maintain competitive pricing, which can squeeze their profit margins.

For instance, in 2024, the average selling price for certain memory chips saw declines due to oversupply, directly impacting the revenue potential for OSAT providers who handle the packaging and testing of these components. This price sensitivity means Hana Micron must balance cost-effectiveness with quality to retain these crucial customers.

Some major semiconductor players, like Intel, have historically maintained significant in-house capabilities for packaging and testing. This vertical integration means they can, if strategically beneficial, bring outsourced services back into their own operations. For instance, Intel's advanced packaging technologies, such as Foveros, demonstrate their commitment to internal development and execution.

While outsourcing to Original Semiconductor Assembly and Test companies (OSATs) is often more cost-efficient for many, the latent threat of customers developing their own in-house solutions grants them considerable bargaining power. This capability acts as a constant pressure point during price and service negotiations with OSAT providers.

Standardization of Services

The bargaining power of customers in the semiconductor industry, particularly concerning packaging and testing services, is influenced by the degree of standardization. When services become largely interchangeable, customers gain leverage because they can more easily switch between Original Equipment Manufacturers (OEMs) or Outsourced Semiconductor Assembly and Test (OSAT) providers without significant disruption or added cost.

This standardization directly diminishes the differentiation among OSAT providers, making price and service terms the primary decision-making factors for buyers. For instance, in 2024, the OSAT market, valued at approximately $40 billion, saw intense competition where many providers offered similar capabilities, thereby amplifying customer bargaining power.

- Standardization Reduces Switching Costs: When semiconductor packaging and testing processes become commoditized, customers face minimal hurdles in moving to a competitor.

- Increased Price Sensitivity: A standardized service offering forces OSAT providers to compete more aggressively on price, benefiting customers.

- Market Concentration Matters: While standardization increases power, the overall market structure, including the number of OSAT providers, also plays a role in how much leverage customers can exert.

Demand Fluctuations and Inventory Corrections

The semiconductor industry's inherent cyclicality, marked by swings between high demand and inventory corrections, significantly impacts customer bargaining power. When the market experiences a downturn or an oversupply situation, customers gain leverage. They can reduce their orders or negotiate for more favorable pricing and payment terms from OSAT providers, thereby increasing their influence.

This dynamic is evident in recent market trends. For instance, following a period of robust demand in 2022, the semiconductor market faced a notable slowdown in 2023, with many companies reporting inventory build-ups. This led to increased price sensitivity among buyers.

- Cyclical Nature: The semiconductor sector is prone to boom-and-bust cycles, influencing customer behavior.

- Oversupply Impact: Periods of excess inventory empower customers to demand better terms.

- Customer Leverage: Reduced orders or negotiation for favorable terms are key tactics used by customers during downturns.

Hana Micron's customers, primarily large semiconductor firms like Samsung and SK Hynix, wield significant bargaining power due to their substantial order volumes and the critical nature of packaging and testing services in the semiconductor supply chain. This leverage allows them to negotiate favorable pricing and terms, directly impacting Hana Micron's profitability. The industry's price sensitivity, exacerbated by market cycles, further empowers these customers to push for cost reductions.

| Customer Type | Bargaining Power Factors | Impact on Hana Micron |

|---|---|---|

| Major IDMs/Fabless Companies | Large order volumes, potential for vertical integration | Price pressure, demand for customized services |

| Price-Sensitive Buyers | Industry cyclicality, oversupply conditions | Reduced margins, need for cost efficiency |

| Standardized Service Users | Low switching costs, commoditized offerings | Increased competition, focus on price and service levels |

Full Version Awaits

HANA Micron Porter's Five Forces Analysis

This preview showcases the complete HANA Micron Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the semiconductor industry. The document you see here is precisely what you will receive instantly upon purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

The OSAT market is characterized by a high number of competitors, creating a fragmented landscape. Hana Micron faces intense rivalry from both global giants like ASE Technology Holding and Amkor Technology, as well as numerous smaller regional players, all vying for market share.

This intense competition means that pricing power is limited, and companies must constantly innovate and optimize their operations to remain competitive. In 2023, the global OSAT market was valued at approximately $50 billion, underscoring the significant revenue potential but also the crowded nature of the industry.

While the semiconductor industry sees robust growth in areas like advanced packaging, some traditional packaging and testing segments are experiencing slower expansion. This maturity in certain areas intensifies competition as companies vie for a larger share of a more limited market. For instance, in 2024, the global semiconductor packaging market, while growing, saw varied performance across segments, with advanced solutions outperforming older technologies.

This slower growth in mature segments can lead to more aggressive competitive tactics. Companies may resort to price reductions to capture market share, potentially squeezing profit margins for all players. Alternatively, firms might focus on differentiating themselves by offering specialized services or niche solutions to attract customers in a crowded marketplace.

The semiconductor packaging and test industry is characterized by significant capital expenditure for advanced equipment and state-of-the-art facilities. This inherently high level of fixed costs pressures companies to maintain high capacity utilization to spread these costs and achieve profitability.

In 2024, the global semiconductor market experienced fluctuations, with some segments facing oversupply. This environment intensifies the need for companies like HANA Micron to secure a steady stream of orders to keep their expensive machinery running efficiently.

When demand softens, the drive for capacity utilization can fuel aggressive price competition as firms vie for market share, potentially impacting profit margins across the sector.

Product and Service Differentiation

Companies in the semiconductor packaging sector actively differentiate themselves by offering cutting-edge packaging technologies, specialized testing services, and integrated turnkey solutions. This focus on advanced capabilities allows them to capture higher-value market segments.

Hana Micron's strategic emphasis on specific areas like memory, System-on-Chip (SoC) integration, and advanced packaging such as High Bandwidth Memory (HBM) is a key driver of its competitive edge. This specialization allows them to cater to the demanding requirements of high-performance computing and AI applications.

For instance, the demand for HBM, a critical component in AI accelerators, surged dramatically. In 2024, the global HBM market was projected to reach approximately $10 billion, with significant growth driven by AI chip demand. Companies like Hana Micron, capable of advanced HBM packaging, are well-positioned to capitalize on this trend.

- Advanced Packaging Technologies: Focus on innovations like HBM, chiplets, and heterogeneous integration.

- Specialized Testing Capabilities: Offering rigorous quality assurance and performance validation for complex semiconductor devices.

- Turnkey Solutions: Providing end-to-end services from design support to final testing and packaging.

- Memory and SoC Specialization: Deep expertise in packaging high-density memory modules and integrated SoC solutions.

Geopolitical Influences and Regional Competition

Geopolitical shifts significantly amplify competitive rivalry in the semiconductor sector, directly impacting companies like HANA Micron. Government policies, such as the US CHIPS and Science Act of 2022, which allocated $52.7 billion for domestic semiconductor manufacturing and research, are actively reshaping global supply chains. This legislation, alongside similar initiatives in Europe and Asia, encourages regionalization and diversification of manufacturing, intensifying competition as nations vie for technological sovereignty and economic advantage.

Trade tensions and national security concerns further exacerbate this regional competition. For instance, restrictions on technology exports and imports between major economic blocs can disrupt established supply networks, forcing companies to re-evaluate their operational footprints and supplier relationships. This environment creates a more fragmented and competitive landscape, where access to critical materials and advanced manufacturing capabilities becomes a key differentiator.

The push for self-sufficiency in semiconductor production, driven by these geopolitical factors, leads to increased investment in new fabrication plants and research facilities across different regions. This expansion, while potentially creating new markets, also intensifies the battle for market share and talent. Companies must navigate these complex, politically charged dynamics to maintain their competitive edge.

Key influencing factors include:

- Government Subsidies and Incentives: Programs like the CHIPS Act aim to onshore manufacturing, creating regional hubs that compete directly with established players.

- Trade Restrictions and Tariffs: Imposed tariffs and export controls can alter cost structures and market access, forcing strategic adjustments.

- National Security Concerns: Governments prioritizing domestic supply chains for critical technologies can lead to preferential treatment for local firms.

- Diversification of Manufacturing Bases: Companies are investing in multiple geographic locations to mitigate geopolitical risks, leading to broader competitive pressures.

Competitive rivalry within the OSAT market is fierce due to a high number of players, including global leaders and smaller regional firms, all vying for market share.

This intense competition limits pricing power, compelling companies like Hana Micron to innovate and optimize operations, especially as the global OSAT market reached approximately $50 billion in 2023.

The drive for capacity utilization, particularly with high fixed costs and fluctuating demand in 2024, fuels aggressive price competition, impacting profit margins across the sector.

Companies differentiate through advanced packaging technologies like HBM, specialized testing, and turnkey solutions, with Hana Micron focusing on high-growth areas such as memory and SoC integration, capitalizing on the surging demand for AI components.

| Key Competitors (OSAT) | Market Share (Approx. 2023) | Key Specializations |

|---|---|---|

| ASE Technology Holding | 15-20% | Advanced packaging, testing, turnkey solutions |

| Amkor Technology | 10-15% | Advanced packaging, leadframe, substrate-based packaging |

| JCET Group | 8-12% | Fan-out wafer-level packaging, SiP, automotive |

| Hana Micron | 2-4% | HBM, memory packaging, SoC, advanced packaging |

SSubstitutes Threaten

Integrated Device Manufacturers (IDMs) such as Intel and Samsung possess their own internal capabilities for semiconductor packaging and testing. This in-house capacity acts as a direct substitute for relying on external Outsourced Semiconductor Assembly and Test (OSAT) providers. While OSATs offer cost advantages and specialized skills, the inherent ability of IDMs to handle these processes internally limits the bargaining power of OSATs.

New packaging technologies, like 3D stacking and heterogeneous integration, offer alternative ways to protect and connect semiconductor chips. These advancements can disrupt traditional packaging methods, potentially reducing reliance on certain outsourced semiconductor assembly and test (OSAT) providers. Hana Micron must actively invest in and adopt these cutting-edge solutions to remain competitive in this evolving landscape.

The threat of substitutes for physical testing services, particularly in the context of software-based solutions, is growing. Advancements in software-defined testing and simulation tools can replicate certain physical testing scenarios, potentially reducing the demand for traditional physical testing methodologies. For instance, companies are increasingly leveraging digital twins and virtual simulations to validate product designs and performance before physical prototypes are even created.

Alternative Materials or Manufacturing Processes

Innovation in materials science or entirely new manufacturing processes for semiconductor devices could theoretically reduce or eliminate the need for certain traditional packaging or testing steps. This presents a long-term substitute threat to companies like HANA Micron. For instance, advancements in wafer-level packaging or direct chip-to-substrate interconnects could bypass traditional assembly and testing phases, impacting demand for specialized services.

The semiconductor industry is constantly evolving, with research into novel materials and fabrication techniques. For example, the development of advanced lithography or 3D stacking technologies might create pathways to integrate functionalities that were previously handled by separate packaging components. This could potentially lower the overall cost and complexity for chip manufacturers.

While direct substitutes for the core semiconductor manufacturing process are limited, alternative approaches to achieving similar end-product functionalities could emerge. Consider the rise of system-on-chip (SoC) designs that integrate multiple functions onto a single die, reducing the reliance on separate chip packaging and testing. In 2024, the global semiconductor market is projected to reach over $600 billion, highlighting the scale of the industry and the potential impact of disruptive innovations.

Key areas where substitute threats might materialize include:

- Novel Packaging Technologies: Wafer-level packaging (WLP) and advanced 3D stacking methods reduce the need for traditional lead frames and encapsulation.

- Advanced Materials: Development of new conductive or insulating materials could simplify or eliminate certain bonding or protection steps.

- Integrated Manufacturing: Greater integration of design, fabrication, and testing within a single process flow could bypass specialized outsourced services.

Direct Chip Integration into Systems

The threat of substitutes for traditional chip packaging is emerging through direct chip integration into systems. In highly specialized applications, particularly for niche, ultra-compact designs, it's becoming feasible to embed chips directly into system architecture, bypassing conventional packaging processes. This approach, while currently limited to specific use cases, represents a potential substitute for standard packaging services.

This trend is driven by advancements in miniaturization and system-on-chip (SoC) technologies. For example, the development of advanced wafer-level packaging (WLP) techniques, which essentially integrate packaging at the wafer stage, can be seen as a precursor to even more direct integration. While the global semiconductor packaging market was valued at approximately $50 billion in 2023, direct integration, where applicable, could siphon off a small but growing segment of this market.

- Niche Applications: Direct integration is most relevant for highly specialized, space-constrained devices like advanced medical implants or specialized sensor modules.

- Technological Advancements: Innovations in wafer-level packaging and advanced materials are enabling more direct chip-to-system connections.

- Market Impact: While a nascent threat, successful direct integration in key segments could impact demand for traditional packaging services, especially for high-volume, standardized products.

The threat of substitutes for HANA Micron's services is primarily driven by advancements in packaging technologies and integrated manufacturing processes. Innovations like wafer-level packaging (WLP) and 3D stacking reduce the need for traditional outsourced assembly and testing. Furthermore, the increasing trend of system-on-chip (SoC) designs, which integrate multiple functions onto a single die, can bypass specialized packaging steps altogether.

In 2024, the semiconductor industry continues to push boundaries, with the global market projected to exceed $600 billion. This growth fuels innovation in areas that can act as substitutes. For example, the development of advanced lithography and direct chip-to-substrate interconnects could streamline manufacturing, potentially diminishing the demand for certain traditional OSAT services.

While direct substitutes for the core chip manufacturing are limited, alternative approaches to achieving end-product functionality are emerging. The global semiconductor packaging market, valued at approximately $50 billion in 2023, is experiencing shifts as niche applications explore direct chip integration into systems, bypassing conventional packaging. This trend, though nascent, could impact specific segments of the market.

Key substitute areas include novel packaging technologies like WLP and 3D stacking, advanced materials that simplify bonding, and integrated manufacturing flows that bypass specialized outsourced services.

| Substitute Area | Description | Impact on HANA Micron |

|---|---|---|

| Novel Packaging Technologies | Wafer-level packaging (WLP), 3D stacking | Reduces reliance on traditional lead frames and encapsulation, potentially lowering demand for certain OSAT services. |

| Integrated Manufacturing | On-chip integration, direct chip-to-substrate connections | Bypasses specialized outsourced assembly and testing phases, impacting demand for traditional services. |

| System-on-Chip (SoC) Designs | Integration of multiple functions onto a single die | Decreases the need for separate chip packaging and testing, posing a long-term substitute threat. |

Entrants Threaten

Establishing an Outsourced Semiconductor Assembly and Test (OSAT) company, like HANA Micron, demands substantial capital. We're talking about significant upfront costs for cutting-edge machinery, specialized cleanroom environments, and ongoing research and development. For instance, setting up a modern assembly line can easily run into tens or even hundreds of millions of dollars.

These high capital requirements act as a formidable barrier for any potential new players looking to enter the OSAT market. The sheer expense of acquiring the necessary technology and infrastructure makes it incredibly difficult for smaller or less-funded entities to compete effectively with established firms.

The semiconductor packaging and testing sector requires significant technical prowess and ongoing R&D to match advancements in chip design, making it a formidable barrier for newcomers. For instance, in 2024, the global semiconductor market saw R&D spending reach hundreds of billions of dollars, a figure that new entrants must contend with to develop competitive advanced packaging solutions.

Hana Micron, like many established players in the Outsourced Semiconductor Assembly and Test (OSAT) sector, benefits immensely from deep-rooted customer relationships. These aren't just casual connections; they represent years of collaboration, rigorous qualification, and proven reliability with major semiconductor manufacturers. Newcomers face a significant hurdle in replicating this level of trust and integration into existing, complex supply chains. For instance, gaining approval for a new OSAT provider can take 18-24 months, a substantial barrier to entry.

Economies of Scale and Experience Curve

The threat of new entrants in the OSAT (Outsourced Semiconductor Assembly and Test) market, particularly concerning economies of scale and the experience curve, is significantly mitigated for incumbent players like HANA Micron. Established companies leverage massive production volumes, which inherently drive down per-unit costs. For instance, in 2024, leading OSAT providers continued to invest heavily in advanced packaging technologies, expanding their capacity to meet growing demand for complex semiconductor components. This scale allows them to absorb fixed costs more effectively, making it difficult for newcomers to match their pricing competitiveness without substantial upfront investment.

Furthermore, the experience curve plays a crucial role. Over years of operation, incumbent OSAT firms have refined their manufacturing processes, optimized supply chains, and developed proprietary techniques that enhance efficiency and yield. This accumulated know-how, often unquantifiable but invaluable, translates into higher quality output and lower defect rates. A new entrant would face a steep learning curve, both in mastering intricate assembly processes and in building the operational efficiencies that come with decades of experience. For example, advancements in fan-out wafer-level packaging (FOWLP) require specialized expertise and precise execution, areas where established players have a distinct advantage.

- Economies of Scale: Incumbent OSAT companies benefit from significant cost advantages due to high-volume production, making it challenging for new entrants to compete on price.

- Experience Curve Benefits: Accumulated operational expertise and process refinements allow established players to achieve greater efficiency and lower defect rates.

- Capital Investment Barriers: Entering the advanced OSAT market requires substantial capital for state-of-the-art equipment and facilities, creating a high barrier to entry.

- Technological Sophistication: The increasing complexity of semiconductor packaging demands specialized knowledge and continuous R&D, favoring firms with established technological capabilities.

Regulatory Hurdles and Environmental Compliance

The semiconductor sector, including companies like HANA Micron, faces substantial regulatory scrutiny, particularly concerning environmental impact and product quality. New entrants must navigate complex compliance frameworks, which are becoming increasingly rigorous. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes strict controls on the use of certain substances, directly impacting manufacturing processes and material sourcing in semiconductor production.

Meeting these stringent environmental regulations and quality standards presents a significant barrier for potential new entrants. The capital expenditure required to implement compliant manufacturing processes and obtain necessary certifications, such as ISO 14001 for environmental management, is substantial. In 2024, the global semiconductor industry continued to see increased investment in sustainable manufacturing practices, driven by both regulatory pressure and corporate responsibility initiatives, further elevating the cost of entry.

- Environmental Regulations: Compliance with global standards like RoHS (Restriction of Hazardous Substances) and REACH is mandatory, adding significant operational costs.

- Quality Certifications: Achieving industry-specific quality certifications (e.g., IATF 16949 for automotive) requires extensive investment in process control and documentation.

- Capital Intensity: The high cost of building and equipping fabs that meet these stringent environmental and quality benchmarks deters new players.

- Supply Chain Scrutiny: Ensuring that the entire supply chain adheres to ethical and environmental standards adds another layer of complexity and cost for new entrants.

The threat of new entrants in the OSAT market is considerably low due to substantial capital requirements. Setting up advanced assembly and testing facilities demands hundreds of millions of dollars for cutting-edge equipment and specialized infrastructure.

Furthermore, the need for deep technical expertise and continuous investment in research and development, with global R&D spending in semiconductors exceeding hundreds of billions in 2024, creates a steep learning curve for any new player. Established customer relationships, often requiring 18-24 months to secure, also present a significant hurdle.

Economies of scale and the experience curve further solidify this barrier; incumbents benefit from lower per-unit costs due to high-volume production and refined processes, making it difficult for newcomers to match pricing and quality.

Stringent regulatory compliance, particularly environmental standards and quality certifications, adds another layer of complexity and cost, requiring significant capital for compliant operations.

| Barrier Type | Description | Estimated Cost/Timeframe (Illustrative) |

|---|---|---|

| Capital Investment | State-of-the-art machinery, cleanrooms, R&D facilities | $100M - $1B+ |

| Technological Expertise | Advanced packaging, process optimization | Years of experience, significant R&D budget |

| Customer Relationships | Building trust and integration into supply chains | 18-24 months for qualification |

| Economies of Scale | Cost reduction through high-volume production | Requires significant upfront capacity investment |

| Regulatory Compliance | Environmental (REACH, RoHS) and quality certifications (IATF 16949) | Substantial CAPEX for compliant facilities and processes |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Micron industry is built on a foundation of comprehensive data, including financial reports from Micron Technology and its key competitors, alongside market research from Gartner and IDC. We also incorporate industry news from publications like Semiconductor Engineering and regulatory filings from relevant government bodies to ensure a robust understanding of the competitive landscape.