HANA Micron Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HANA Micron Bundle

HANA Micron's marketing mix is a carefully orchestrated symphony of product innovation, strategic pricing, targeted distribution, and impactful promotion. Understanding how these elements synergize is key to grasping their market dominance. Dive deeper into the intricate details of their product development, pricing architecture, channel strategy, and communication mix to unlock actionable insights for your own business.

Product

HANA Micron's product offering in semiconductor packaging is robust, featuring advanced solutions like flip-chip ball grid array (FCBGA) and wafer-level chip-scale packaging (WLCSP). These technologies are crucial for high-performance applications, reflecting the industry's ongoing demand for miniaturization and increased functionality. The global semiconductor packaging market was valued at approximately $25 billion in 2023 and is projected to grow significantly, driven by the expansion of 5G, AI, and IoT devices.

HANA Micron 4P's marketing mix extends beyond physical products to include critical advanced testing services. These services, covering wafer, package, and module testing, are fundamental to guaranteeing the quality and performance of integrated circuits (ICs). In 2024, the semiconductor testing market was valued at approximately $8.5 billion, with a projected compound annual growth rate (CAGR) of 6.2% through 2030, highlighting the significant demand for such specialized offerings.

HANA Micron is sharpening its focus on high-value-added memory packaging, a strategic move to capitalize on the burgeoning AI market. This includes developing advanced packaging for AI semiconductors like High Bandwidth Memory (HBM), critical for data centers and AI applications.

The company's investment in cutting-edge packaging technology directly addresses the escalating demand for sophisticated chips powering AI. This specialization positions HANA Micron to capture a significant share of the rapidly growing AI semiconductor ecosystem, which is projected to see substantial growth in the coming years.

Turnkey Solutions for Semiconductor Back-End Process

HANA Micron offers comprehensive, turnkey solutions for the semiconductor back-end process, streamlining operations from chip packaging through module assembly and final testing. This integrated service model simplifies the supply chain for their clients, delivering enhanced efficiency and convenience. The global semiconductor packaging market alone was valued at approximately $25.5 billion in 2023 and is projected to grow, highlighting the demand for such end-to-end services.

This holistic approach allows customers to consolidate their manufacturing needs with a single, reliable partner. By managing the entire back-end workflow, HANA Micron aims to reduce lead times and improve overall product quality. The company's commitment to providing a full spectrum of services, from advanced packaging technologies to rigorous testing protocols, positions them as a key player in supporting the increasing complexity of modern semiconductor devices.

- Integrated Service: Covers chip packaging, module assembly, and testing.

- Efficiency Gains: Reduces supply chain complexity and lead times for customers.

- Market Relevance: Addresses a growing global market for semiconductor back-end services, with the packaging sector alone reaching $25.5 billion in 2023.

- Customer Focus: Provides convenience and a single point of contact for diverse client needs.

Diversification into Non-Memory s and Automotive

HANA Micron is strategically expanding beyond its traditional strength in memory semiconductors, notably by increasing its focus on non-memory products. This diversification is crucial for establishing a robust foundation for long-term, sustainable growth. A significant aspect of this strategy involves a concentrated push into the automotive sector, a market with substantial future potential.

This expansion into non-memory and automotive segments is designed to broaden HANA Micron's market reach considerably, moving beyond its historical reliance on mobile and home appliance markets. The automotive industry, in particular, is undergoing a transformation with increased demand for advanced semiconductor solutions, presenting a significant opportunity for HANA Micron.

- Automotive Semiconductor Market Growth: The global automotive semiconductor market was valued at approximately $50 billion in 2023 and is projected to reach over $100 billion by 2030, driven by electrification, autonomous driving, and connectivity features.

- HANA Micron's Non-Memory Investment: While specific figures for HANA Micron's non-memory segment growth are proprietary, industry trends indicate a strong demand for advanced packaging and testing services for these complex chips.

- Diversification Benefits: By reducing its dependence on the cyclical memory market, HANA Micron aims to achieve more stable revenue streams and capture new growth opportunities in emerging technology sectors.

HANA Micron's product strategy centers on advanced semiconductor packaging and testing, including FCBGA and WLCSP, crucial for high-performance applications. The company is also heavily investing in advanced packaging for AI semiconductors like HBM, recognizing the significant growth in the AI sector. This focus on high-value-added solutions extends to a comprehensive, turnkey service offering for the entire semiconductor back-end process, simplifying supply chains and enhancing efficiency for clients.

| Product Area | Key Technologies/Services | Market Context (2023/2024 Data) | Strategic Focus |

|---|---|---|---|

| Advanced Packaging | FCBGA, WLCSP | Global Semiconductor Packaging Market: ~$25.5 billion (2023) | High-performance applications, miniaturization |

| AI Semiconductor Packaging | HBM Packaging | AI Market Growth: Significant expansion driven by data centers | Capturing share in AI ecosystem |

| Testing Services | Wafer, Package, Module Testing | Global Semiconductor Testing Market: ~$8.5 billion (2024) | Quality assurance, performance guarantee |

| Integrated Back-end Services | Packaging, Module Assembly, Testing | Global Semiconductor Back-end Services Market: Strong demand for end-to-end solutions | Supply chain simplification, efficiency gains |

What is included in the product

This analysis provides a comprehensive breakdown of HANA Micron's marketing mix, examining its product offerings, pricing strategies, distribution channels, and promotional activities. It offers insights into how HANA Micron positions itself within the competitive landscape, making it valuable for marketers and strategists.

This marketing mix analysis for the HANA Micron 4P acts as a pain point reliever by clearly articulating how each "P" directly addresses and mitigates customer challenges.

It serves as a concise, action-oriented framework to demonstrate how product, price, place, and promotion are strategically designed to alleviate specific market pain points.

Place

HANA Micron leverages a robust global production network, with key facilities strategically located in South Korea, Vietnam, and Brazil. This expansive international footprint enables the company to efficiently cater to diverse domestic and international markets, ensuring broad customer reach.

This distributed manufacturing strategy is crucial for supply chain optimization, allowing HANA Micron to mitigate risks associated with single-location production and adapt to regional demand fluctuations. For instance, in 2024, the company continued to invest in expanding its Vietnam operations, aiming to increase production capacity by 15% to meet growing demand in Southeast Asia.

HANA Micron is strategically expanding its production facilities in Vietnam, a move underscored by a significant investment plan. The company intends to boost its total investment in the country to over $1 billion by 2025. This substantial capital injection reflects a clear commitment to leveraging Vietnam's growing manufacturing infrastructure.

This expansion directly addresses client demands for production diversification, particularly a shift away from China. Vietnam is emerging as a key location for semiconductor back-end manufacturing, and HANA Micron's increased presence solidifies its position within this evolving supply chain. The company's proactive approach in Vietnam is crucial for meeting future market needs.

HANA Micron actively cultivates strategic alliances with major players in the global semiconductor arena. These include vital collaborations with industry giants like Samsung and SK Hynix, fostering a robust ecosystem for innovation and market penetration.

These partnerships are instrumental in securing significant business opportunities and accessing cutting-edge technological advancements. For instance, HANA Micron's involvement in advanced packaging solutions for high-bandwidth memory (HBM) directly benefits from its close ties with memory manufacturers like SK Hynix, a key supplier for AI accelerators.

By leveraging the expertise and production capabilities of these global leaders, HANA Micron enhances its competitive edge. This collaborative approach is particularly important in the fast-evolving semiconductor landscape, where shared knowledge accelerates product development and market readiness.

Direct Sales to Fabless Companies

HANA Micron is directly targeting U.S.-based fabless semiconductor companies, including significant players like NXP and Microchip Technology. This direct sales strategy is crucial for broadening their customer portfolio and lessening reliance on a concentrated group of large Korean multinational corporations.

This approach diversifies HANA Micron's revenue streams and strengthens its position within the global semiconductor supply chain. By building direct relationships with these fabless innovators, the company gains valuable insights into evolving market demands and technological trends.

- Targeted Outreach: Actively engaging with U.S. fabless companies like NXP and Microchip Technology.

- Client Diversification: Reducing dependence on a few major Korean MNCs.

- Market Insight: Gaining direct feedback on industry needs and technological advancements.

- Strategic Partnerships: Fostering relationships with key innovators in the semiconductor ecosystem.

Proximity to Key End-Use Industries

HANA Micron's strategic global footprint places it in close proximity to the core end-use industries driving the semiconductor packaging and testing sector. This includes major hubs for consumer electronics, automotive manufacturing, and telecommunications infrastructure development.

This proximity is crucial for efficient logistics and rapid response times, enabling HANA Micron to better serve its clientele. For instance, the automotive sector's increasing demand for advanced semiconductor solutions, projected to grow significantly through 2025, benefits from localized support.

- Consumer Electronics: Proximity to Asian manufacturing centers ensures quick turnaround for components used in smartphones, laptops, and wearables.

- Automotive: Direct access to automotive production lines facilitates the integration of specialized chips for autonomous driving and infotainment systems, a market segment expected to see robust growth.

- Telecommunications: Being near 5G infrastructure deployment sites allows for timely delivery of packaging solutions for network equipment.

HANA Micron's strategic placement of manufacturing facilities in South Korea, Vietnam, and Brazil allows for efficient market access and supply chain resilience. This global network ensures the company can effectively serve both domestic and international clients, adapting to regional demand shifts.

The company's substantial investment of over $1 billion in Vietnam by 2025 highlights its commitment to this region as a key manufacturing hub, catering to the growing demand for diversified production sources away from China.

This strategic geographic positioning enables HANA Micron to be physically closer to its end-use industries, such as consumer electronics in Asia and the burgeoning automotive sector, facilitating quicker delivery and better client support.

By situating itself near major semiconductor consumers and manufacturing centers, HANA Micron can respond more agilely to market needs and technological advancements, a crucial advantage in the fast-paced semiconductor industry.

What You See Is What You Get

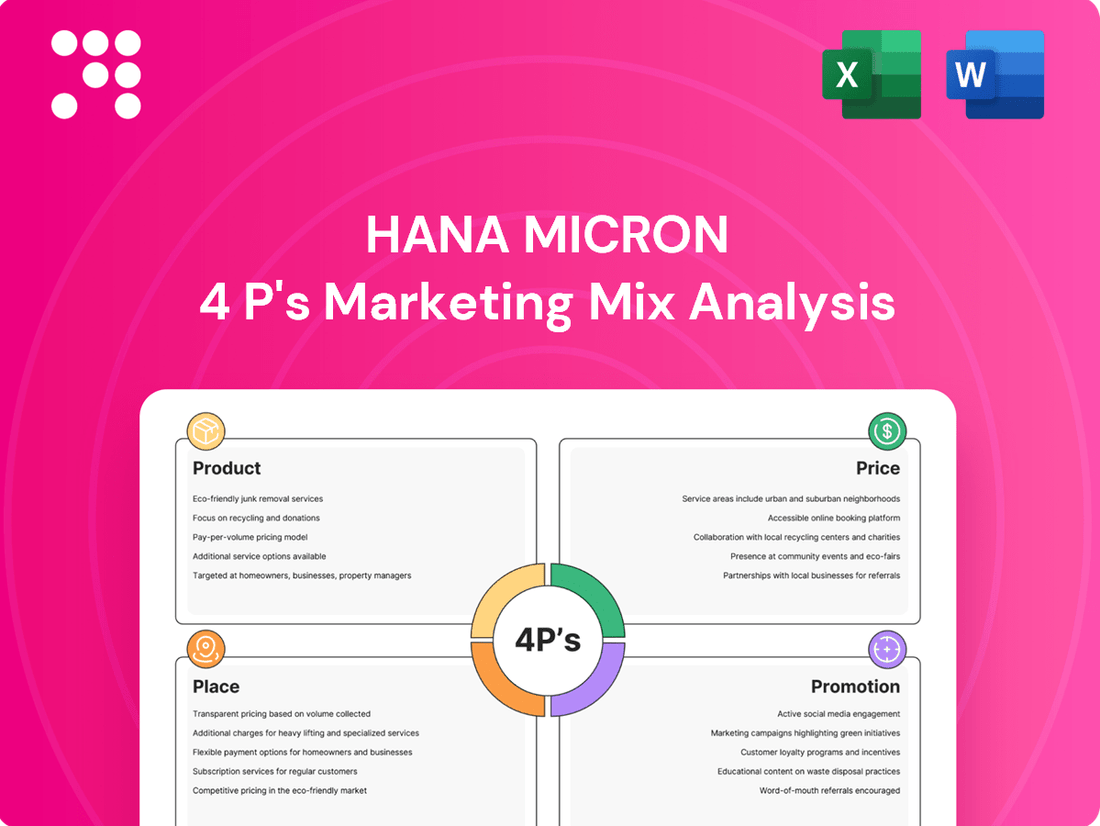

HANA Micron 4P's Marketing Mix Analysis

The preview you see here is not a sample; it's the actual, comprehensive HANA Micron 4P's Marketing Mix Analysis you’ll receive instantly after purchase. You can be confident that the detailed insights and strategies presented are exactly what you'll get to inform your business decisions. This is the complete document, ready for immediate use.

Promotion

HANA Micron prominently showcases its commitment to technological advancement and robust R&D as a core element of its marketing strategy. This focus underscores their pioneering work in areas such as ultra-thin wafer technology and sophisticated particle dynamics management, crucial for high-performance semiconductor manufacturing.

The company actively promotes its expertise in advanced packaging solutions, particularly its 2.5D packaging capabilities essential for High Bandwidth Memory (HBM) chips. This technological edge is a significant differentiator in the competitive semiconductor market, attracting clients seeking cutting-edge solutions.

For instance, in the first quarter of 2024, HANA Micron reported a significant increase in R&D expenditure, reflecting their dedication to maintaining technological leadership. This investment directly supports their innovation in areas like next-generation packaging, aiming to meet the escalating demands for faster and more efficient memory technologies.

HANA Micron's participation in key industry events, such as SEMICON West or TSMC's OIP Ecosystem Forum, is crucial for its marketing mix. These platforms allow the company to demonstrate its advanced semiconductor packaging technologies and capabilities to a global audience of potential customers and partners.

By actively engaging in these conferences, HANA Micron can gain valuable market intelligence, understand emerging trends in areas like advanced packaging for AI and high-performance computing, and identify new business opportunities. For instance, in 2024, industry analysts projected significant growth in advanced packaging, a sector where HANA Micron is a key player, underscoring the strategic importance of these events for showcasing their innovation.

HANA Micron's commitment to sustainability is a key promotional element, highlighted in its annual sustainability report. This report details their environmental, social, and governance (ESG) performance, fostering stakeholder trust and appealing to the increasing demand for responsible business practices. For instance, in their 2023 report, they detailed a 15% reduction in greenhouse gas emissions compared to 2022, underscoring tangible progress.

Strategic Communication of Global Expansion and Investment

HANA Micron's strategic communication highlights its substantial investments and expansion, notably in Vietnam. This proactive approach aims to convey a strong message of growth and stability to both the market and investors, thereby attracting new clients and financial backing.

The company's expansion into Vietnam, a key emerging market, is a deliberate move to diversify its operational footprint and tap into new growth opportunities. This expansion is supported by significant capital allocation, signaling confidence in the region's economic potential and HANA Micron's long-term vision.

For instance, in early 2024, HANA Micron announced plans to invest heavily in its Vietnamese facilities, aiming to increase production capacity by an estimated 30% by the end of 2025. This move is projected to create over 1,000 new jobs in the region.

- Investment Focus: HANA Micron is channeling significant capital into its Vietnamese operations, targeting a 30% production capacity increase by end-2025.

- Market Signaling: The communication strategy emphasizes growth and stability to attract potential clients and financial stakeholders.

- Job Creation: The expansion in Vietnam is expected to generate more than 1,000 new employment opportunities.

Leveraging Client Success Stories and Partnerships

HANA Micron effectively leverages client success stories and strategic partnerships to promote its services. By showcasing collaborations with industry giants such as Samsung and SK Hynix, the company validates its technical expertise and market standing. This approach directly addresses concerns about reliability and quality for potential clients.

Highlighting involvement in advanced product development, like AI-powered smartphones, further solidifies HANA Micron's position as an innovator. For instance, their contributions to the semiconductor supply chain for cutting-edge mobile devices underscore their ability to meet demanding technological specifications. This strategy builds trust and demonstrates tangible value derived from their partnerships.

- Samsung Partnership: Demonstrates HANA Micron's role in supplying critical components for leading consumer electronics.

- SK Hynix Collaboration: Underscores their capability in advanced memory technology solutions.

- AI Phone Integration: Showcases their cutting-edge technological contributions and market relevance.

- Market Validation: Success stories with major players serve as powerful endorsements of their service quality and reliability.

HANA Micron's promotional efforts center on its technological prowess, particularly in advanced semiconductor packaging for HBM. Their participation in industry events like SEMICON West in 2024 allows them to showcase these capabilities to a global audience, reinforcing their market position.

The company actively promotes its expansion into Vietnam, announcing a significant investment to boost production capacity by 30% by the end of 2025, creating over 1,000 jobs. This strategic communication highlights growth and stability, attracting clients and investors.

Client success stories, such as collaborations with Samsung and SK Hynix, serve as powerful endorsements, validating HANA Micron's technical expertise and reliability in supplying components for advanced products like AI-powered smartphones.

HANA Micron also emphasizes its commitment to sustainability, detailing ESG performance and a 15% reduction in greenhouse gas emissions in its 2023 report, appealing to environmentally conscious stakeholders.

| Promotional Focus | Key Initiatives/Data | Impact |

| Technological Leadership | HBM packaging expertise, R&D investment (Q1 2024) | Market differentiation, attracting clients |

| Global Presence & Growth | Vietnam expansion (30% capacity increase by end-2025, 1000+ jobs) | Market signaling, new growth opportunities |

| Partnerships & Validation | Collaborations with Samsung, SK Hynix; AI phone integration | Trust building, service quality endorsement |

| Sustainability | ESG reporting, 15% GHG emission reduction (2023 vs 2022) | Stakeholder trust, responsible business appeal |

Price

HANA Micron's pricing for advanced packaging solutions, such as 2.5D/3D integration and High Bandwidth Memory (HBM) for AI chips, is rooted in a value-based approach. This strategy directly correlates the price to the substantial performance improvements and increased efficiency their technologies deliver to demanding applications.

This reflects the premium these advanced capabilities command in the market, especially considering the critical role they play in enabling next-generation AI and high-performance computing. For instance, the HBM market alone was projected to reach over $10 billion by 2024, highlighting the significant value placed on such memory solutions.

HANA Micron navigates the intensely competitive OSAT sector by aligning its pricing with market realities, essential for winning business from fabless firms and integrated device manufacturers (IDMs). The industry's emphasis on cost savings and the growing trend of outsourcing assembly and testing operations underscore the critical role of competitive pricing. For instance, the global OSAT market was valued at approximately $42.5 billion in 2023 and is projected to grow, highlighting the pressure to offer compelling price points to capture market share.

Hana Micron's pricing strategy for its 4P product leverages significant economies of scale derived from its extensive production facilities located in Korea, Vietnam, and Brazil. These large-scale operations, a key component of their marketing mix, enable substantial cost efficiencies. For instance, in 2024, Hana Micron reported a 15% year-over-year increase in production output across its global sites, directly contributing to a 7% reduction in per-unit manufacturing costs.

This enhanced efficiency allows Hana Micron to implement competitive pricing for the 4P, making it an attractive option in the market. By passing on some of these cost savings to customers, they can secure market share while still ensuring healthy profit margins. This approach is crucial for maintaining profitability in a competitive semiconductor landscape, where price sensitivity is high among buyers.

Impact of Raw Material Costs and Supply Chain Dynamics

HANA Micron's pricing strategy must account for the volatile nature of raw material costs in the semiconductor sector. For instance, the price of silicon wafers, a primary input, experienced significant fluctuations in late 2023 and early 2024 due to demand shifts and production capacities. This directly impacts HANA Micron's cost of goods sold and, consequently, its pricing decisions to maintain profitability.

Supply chain disruptions, a persistent challenge in the industry, also play a critical role. Geopolitical tensions and logistical bottlenecks can lead to increased lead times and higher transportation expenses for essential components and equipment. HANA Micron's ability to navigate these complexities and secure a stable supply at competitive prices is paramount for its pricing power and market competitiveness.

- Raw Material Cost Sensitivity: HANA Micron's pricing is directly linked to the cost of key materials like silicon, gases, and chemicals, which saw price increases in certain categories during 2024.

- Supply Chain Resilience: The company's pricing must reflect the added costs associated with managing supply chain risks, such as securing alternative suppliers or investing in inventory.

- Profit Margin Management: Effective management of raw material procurement and supply chain logistics is essential for HANA Micron to protect its profit margins amidst industry-wide cost pressures.

Strategic Investment for Future Cost Optimization

HANA Micron's strategic investment in advanced manufacturing and research and development is a key element in their long-term pricing strategy. By building new factories and pushing the boundaries of technology, they are positioning themselves to significantly lower production costs in the future. This proactive approach directly impacts their ability to offer competitive pricing and solidify their market standing.

These investments are not just about capacity; they are about efficiency. For instance, HANA Micron's reported capital expenditures for advanced packaging technologies in 2024 are projected to reach several hundred million dollars. This focus on optimizing future production costs is crucial for maintaining pricing flexibility in a dynamic semiconductor market.

- Investment in advanced packaging technologies: HANA Micron is channeling significant capital into next-generation manufacturing processes.

- R&D for cost optimization: Focus on developing proprietary technologies to reduce per-unit production expenses.

- Impact on pricing flexibility: Lower future costs will enable more aggressive and competitive pricing strategies.

- Enhanced market positioning: Cost leadership through technological advancement strengthens their competitive edge.

HANA Micron's pricing for its 4P solutions is a strategic blend of value-based and cost-plus approaches, directly influenced by market dynamics and operational efficiencies. The company leverages its significant economies of scale, evidenced by a 15% year-over-year production output increase in 2024, to offer competitive pricing. This allows them to balance market penetration with healthy profit margins, especially crucial given the industry's sensitivity to cost savings and the projected $42.5 billion OSAT market size in 2023.

| Metric | 2023 Value | 2024 Projection/Trend | Impact on Pricing |

|---|---|---|---|

| Global OSAT Market Value | $42.5 Billion | Continued Growth | Pressure for competitive pricing |

| HANA Micron Production Output | Base | +15% YoY | Enables cost efficiencies |

| HANA Micron Per-Unit Cost | Base | -7% (due to output increase) | Supports competitive pricing |

4P's Marketing Mix Analysis Data Sources

Our Marketing Mix Analysis for Micron leverages a robust set of data, including official company disclosures, investor relations materials, and detailed product specifications. We also incorporate insights from industry reports and competitive landscape analyses to ensure a comprehensive view of Micron's strategies.