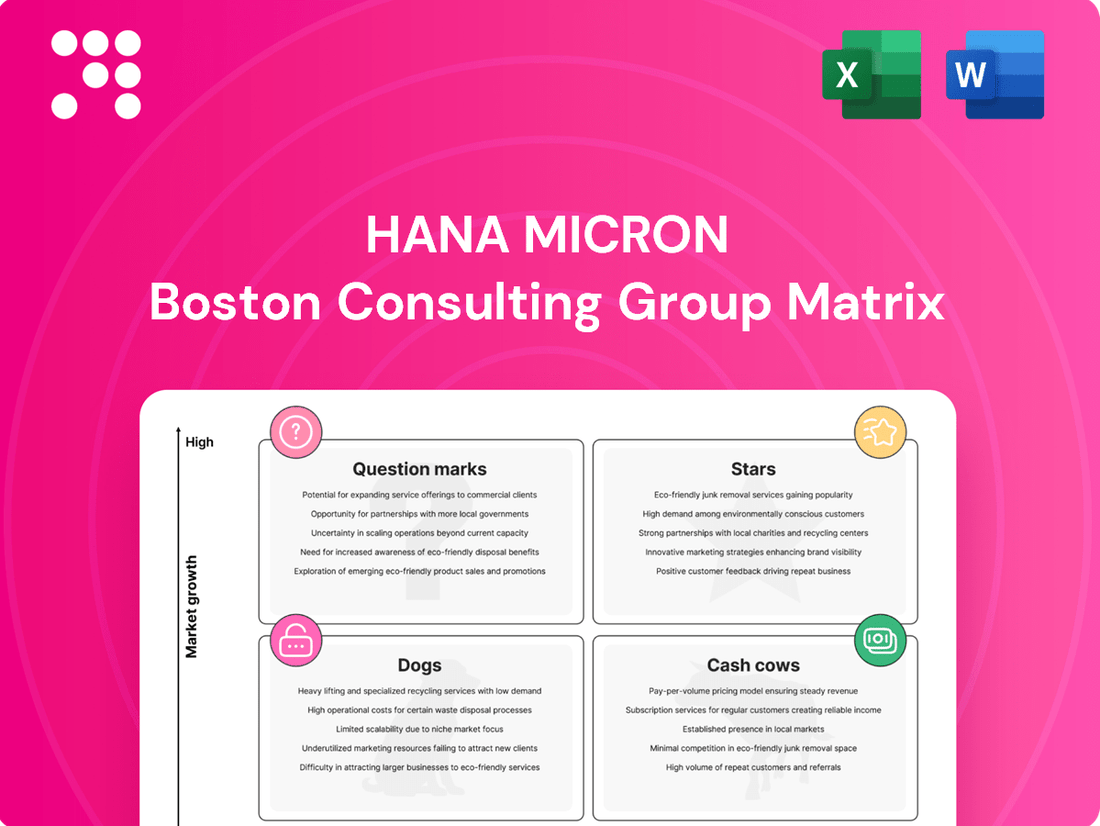

HANA Micron Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HANA Micron Bundle

Uncover the strategic positioning of HANA Micron's product portfolio with our comprehensive BCG Matrix analysis. This essential tool categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual of their market performance and potential.

Ready to transform this insight into action? Purchase the full BCG Matrix report to gain detailed quadrant placements, actionable recommendations, and a strategic roadmap for optimizing HANA Micron's investments and product development.

Stars

Hana Micron is making significant strides in advanced 2.5D packaging, a critical technology for powering high-performance AI chips like Nvidia's H100. This strategic focus places them squarely in a rapidly expanding market, fueled by the immense demand for generative AI and High Bandwidth Memory (HBM).

Their commitment to this cutting-edge area is a clear indicator of their ambition to secure a substantial portion of future market share. The broader semiconductor industry is anticipated to expand by 15% in 2025, with memory segments, particularly HBM for AI applications, expected to surge by over 24%.

Hana Micron is heavily investing in advanced 2.5D packaging for High-Bandwidth Memory (HBM) and other AI chips. This strategic move directly addresses the soaring demand for these critical components in the AI sector. The company's focus on this specialized area is a significant bet on its future growth.

HBM is absolutely essential for AI accelerators and the burgeoning data center market. This segment is not just growing; it's experiencing explosive expansion. For instance, the global AI chip market, which heavily relies on HBM, was projected to reach over $100 billion by 2024, with HBM being a key enabler.

By concentrating its efforts on developing sophisticated HBM packaging solutions, Hana Micron is positioning itself as a vital contributor to a high-growth, high-value industry. This specialization allows them to capture a significant share of the market as AI adoption continues to accelerate.

Hana Micron is making a substantial push into Vietnam, planning to inject over $1 billion by 2025 to ramp up production. This move is set to significantly boost their monthly packaged chip output, targeting an impressive 200 million units.

This aggressive expansion positions Hana Micron to solidify its standing in semiconductor backend manufacturing. They are capitalizing on Vietnam's growing importance as a center for chip testing and packaging.

The strategic investment is driven by client demand for diversified production sources, aiming to capture a greater share of the expanding regional semiconductor market.

Turnkey Semiconductor Packaging Services

Hana Micron's turnkey semiconductor packaging services represent a significant strength, offering a complete solution from chip packaging to module testing. This integrated approach streamlines the supply chain for their clients, providing a clear advantage in a rapidly expanding advanced packaging market. The global advanced semiconductor packaging market is projected to reach approximately USD 70.3 billion in 2024, underscoring the substantial opportunity for Hana Micron's comprehensive offerings.

This full-service model is crucial for securing and retaining major clients who value efficiency and a single point of contact for their packaging needs. By managing the entire process, Hana Micron can ensure quality control and faster turnaround times, which are critical in the fast-paced semiconductor industry. Their ability to deliver end-to-end solutions positions them favorably to capture a larger share of this growing market.

- Comprehensive Turnkey Offering: Hana Micron manages the entire semiconductor packaging process, from initial chip packaging to final module testing.

- Client Convenience and Efficiency: This integrated service model simplifies the supply chain for customers, offering a streamlined and efficient experience.

- Competitive Advantage: The full-service approach provides Hana Micron with a distinct edge in securing contracts and expanding its market presence.

- Market Opportunity: The advanced packaging market, valued at approximately USD 70.3 billion in 2024, offers substantial growth potential for Hana Micron's integrated services.

Strategic Partnerships and Client Base

HANA Micron's strategic partnerships are a cornerstone of its success, evidenced by its impressive client roster. The company actively collaborates with industry giants such as Samsung, SK Hynix, and NXP Semiconductors, solidifying its position within the semiconductor ecosystem.

These collaborations are not merely transactional; they are forward-looking. For instance, joint packaging tests with Samsung for AI phones underscore HANA Micron's commitment to innovation and its role in shaping future technologies. This strategic alignment within a high-growth sector like advanced packaging directly fuels its market share and growth potential.

- Key Clients: Samsung, SK Hynix, NXP Semiconductors.

- Strategic Collaboration Example: Joint packaging tests with Samsung for AI phones.

- Impact: Contributes to high market share and growth potential in advanced packaging.

Hana Micron's focus on advanced 2.5D packaging for AI chips and HBM positions it as a Star in the BCG matrix. This segment is experiencing rapid growth, with the global AI chip market projected to exceed $100 billion by 2024 and HBM demand surging over 24% in 2025. Their significant investments and strategic partnerships, including with industry leaders like Samsung and SK Hynix, further solidify their leading position and future growth prospects in this high-demand area.

What is included in the product

This analysis categorizes HANA Micron's product portfolio into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

A clear, visual representation of HANA Micron's portfolio, simplifying complex strategic decisions.

Cash Cows

Established Memory Chip Packaging is Hana Micron's undeniable Cash Cow, contributing roughly 70% to their total sales revenue. This mature market segment, despite its cyclical nature, showcases Hana Micron's dominant, long-standing market share.

Their deep-rooted expertise and strong client relationships in memory chip packaging are the bedrock of their consistent cash flow generation. For instance, in 2023, Hana Micron reported significant revenue from this sector, underscoring its stability and profitability.

Hana Micron's Wafer Level Packaging (WLP) solutions represent a classic cash cow within its business portfolio. This mature technology is a cornerstone for many consumer electronics, from smartphones to wearables, driving consistent demand.

The inherent benefits of WLP, such as miniaturization and cost-effectiveness, make it an attractive option for manufacturers. This sustained demand, coupled with the established nature of the technology, translates into predictable and robust cash flows for Hana Micron.

In 2024, the advanced packaging market, which includes WLP, saw significant growth, with projections indicating continued expansion driven by 5G, AI, and IoT devices. Hana Micron's established WLP services are well-positioned to capitalize on this trend, generating stable profits.

Flip-chip packaging is a cornerstone of Hana Micron's advanced packaging offerings, crucial for achieving high device density and enhanced performance. This technology is a stable, high-volume segment within the semiconductor industry.

The flip-chip packaging market is robust, with projections indicating it will capture a 34.7% market share by 2025. This significant market penetration translates into substantial and consistent revenue generation for Hana Micron, positioning it as a true cash cow.

Standard Semiconductor Test Services

Hana Micron's standard semiconductor test services, encompassing both wafer and final testing, are a cornerstone of their operations. These services are indispensable for virtually every semiconductor manufacturer, creating a consistent demand that underpins their cash flow. This reliability is crucial in the volatile tech sector.

The recurring nature of testing ensures a predictable revenue stream, positioning these services as a classic cash cow within Hana Micron's business portfolio. This stability allows for investment in other growth areas.

- Essential Industry Need: Semiconductor testing is a mandatory step for all chip manufacturers, guaranteeing consistent business volume.

- Recurring Revenue: The ongoing need for testing creates a stable and predictable income for Hana Micron.

- Foundation for Growth: These cash cow services provide the financial stability to support research and development in newer technologies.

System-in-Package (SiP) Solutions

Hana Micron's System-in-Package (SiP) solutions, a cornerstone of their business since 2010, represent a mature and stable revenue generator. By integrating multiple semiconductor components into a single, compact package, these advanced solutions enhance device functionality while significantly reducing physical size. This established technology is a staple across numerous electronic devices, underscoring its widespread market acceptance and consistent demand.

The company's long-standing expertise in SiP development, spanning over a decade, has cultivated a robust and reliable income stream. This maturity translates into predictable profitability, solidifying SiP as a genuine cash cow for Hana Micron. For instance, the global advanced packaging market, which includes SiP, was valued at approximately $45 billion in 2023 and is projected to grow steadily, indicating continued relevance and financial contribution from Hana Micron's SiP offerings.

- Established Technology: SiP development since 2010.

- Market Adoption: Widely used in various electronic devices.

- Revenue Stability: Provides a consistent and predictable income.

- Profitability Driver: Contributes significantly to overall company profits.

Hana Micron's established memory chip packaging services are its primary cash cow, consistently generating a substantial portion of its revenue, estimated around 70%. This mature market segment, despite its inherent cyclicality, highlights the company's enduring market dominance and deep customer relationships.

Wafer Level Packaging (WLP) and Flip-chip packaging are key contributors to Hana Micron's cash cow status. WLP, crucial for miniaturization and cost-effectiveness in consumer electronics, and Flip-chip packaging, vital for high-density, high-performance chips, both exhibit strong, predictable demand. The flip-chip market alone is projected to reach 34.7% market share by 2025, underscoring its significance.

Standard semiconductor testing services, encompassing wafer and final testing, also function as a reliable cash cow. This indispensable, recurring service provides a stable revenue stream, allowing Hana Micron to invest in emerging technologies. System-in-Package (SiP) solutions, a stable revenue generator since 2010, further solidify Hana Micron's position as a cash cow, benefiting from the global advanced packaging market's steady growth, valued at approximately $45 billion in 2023.

| Business Segment | BCG Classification | Key Characteristics | 2023/2024 Relevance | Financial Contribution |

| Memory Chip Packaging | Cash Cow | Mature market, high market share, strong client relationships | Contributes ~70% of total revenue | Significant and stable profit generator |

| Wafer Level Packaging (WLP) | Cash Cow | Miniaturization, cost-effectiveness, consistent demand in consumer electronics | Growth driven by 5G, AI, IoT devices | Predictable and robust cash flows |

| Flip-chip Packaging | Cash Cow | High device density, enhanced performance, robust market demand | Projected 34.7% market share by 2025 | Substantial and consistent revenue |

| Standard Semiconductor Testing | Cash Cow | Mandatory for all manufacturers, recurring revenue, predictable income | Essential for chip production | Foundation for growth investment |

| System-in-Package (SiP) | Cash Cow | Established technology (since 2010), market adoption, revenue stability | Global advanced packaging market ~$45B in 2023 | Consistent and predictable income, profitability driver |

What You See Is What You Get

HANA Micron BCG Matrix

The HANA Micron BCG Matrix preview you are viewing is the identical, fully polished document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises—just the complete, professionally formatted strategic analysis ready for your immediate use. You can confidently assess the value and detail, knowing the final deliverable is precisely what you see now, empowering your decision-making processes.

Dogs

Legacy wire bonding services, while foundational for many conventional IC packages, are experiencing a slowdown in growth compared to advanced packaging techniques like flip-chip and fan-out wafer-level packaging (WLP). If Hana Micron has substantial capacity dedicated to these traditional methods without significant innovation or cost advantages, this segment could be classified as a 'dog' in the BCG matrix. This means it likely offers low market share in a low-growth industry, potentially yielding low returns or even losses.

Commoditized lead frame packaging, a foundational but increasingly traditional semiconductor packaging method, is experiencing significant market pressure. This segment, characterized by its less intricate design compared to cutting-edge alternatives, is battling intense price competition. For instance, the global semiconductor packaging market, while growing, sees commoditized solutions like lead frames facing margin erosion due to the sheer volume of suppliers and limited differentiation.

Without substantial innovation or the benefit of massive economies of scale, this area presents low profit margins and constrained growth potential. Companies heavily invested in these operations might find it more strategic to redirect capital and resources towards more dynamic and high-growth advanced packaging technologies, which are seeing greater demand and higher value capture.

General Purpose Integrated Circuit Packaging, often found in the Question Mark quadrant of the BCG Matrix for companies like HANA Micron, represents a segment where packaging services for standard, non-specialized chips reside. These are the workhorse components that don't demand cutting-edge, high-performance solutions.

This market is typically characterized by intense competition, with a multitude of players vying for market share. For instance, the global semiconductor packaging market, which includes general-purpose ICs, saw significant activity in 2024, with numerous suppliers offering highly commoditized solutions. This saturation often leads to price erosion and limited pricing power for providers.

Companies in this space may find themselves needing consistent, albeit modest, investment simply to stay relevant and maintain a basic level of market presence. The strategic advantage gained from operating in this segment is often minimal, with little potential for substantial growth or high returns on investment.

Outdated Test Methodologies

If Hana Micron's testing methodologies or equipment are becoming obsolete or less efficient compared to newer, AI-driven inspection systems, they could be considered 'dogs.' This is a significant concern in the semiconductor industry, which moves at a rapid pace.

Maintaining outdated testing capabilities can lead to lower efficiency and reduced appeal to clients seeking cutting-edge solutions. For instance, a 2024 industry report indicated that companies utilizing AI-powered defect detection saw a 15% increase in throughput compared to traditional methods.

These areas would likely yield low returns and hinder overall technological advancement for Hana Micron. The semiconductor equipment market saw significant investment in advanced testing solutions in 2024, with an estimated 20% growth in AI-integrated metrology and inspection tools.

- Obsolescence Risk: Outdated testing equipment faces a higher risk of becoming irrelevant as newer technologies emerge.

- Efficiency Gaps: Slower, less precise testing methods can directly impact production yields and turnaround times.

- Client Perception: Clients demanding the latest in semiconductor manufacturing quality may bypass suppliers with older technology.

- Investment Drain: Continued investment in outdated systems diverts capital from more promising, innovative areas.

Low-Value, Non-Differentiated Packaging Materials

Within Hana Micron's portfolio, packaging materials that are low-value and lack significant differentiation would be classified as Dogs in the BCG matrix. These are products like basic substrates or standard interconnects where there's little to distinguish one supplier from another. The market for these items is highly competitive, often boiling down to who can offer the lowest price.

This intense price competition naturally leads to very thin profit margins. For instance, in 2024, the global semiconductor packaging market saw continued pressure on commoditized materials, with some segments experiencing price erosion as supply outpaced demand for basic offerings. Hana Micron's involvement in such areas means these products might consume valuable resources and capital without generating substantial returns or contributing to the company's long-term growth strategy.

- Low Differentiation: Products like standard substrates and basic interconnects offer little unique value.

- Price-Driven Competition: Intense rivalry forces companies to compete primarily on cost, squeezing profit margins.

- Limited Growth Potential: Mature, commoditized markets offer minimal opportunities for expansion or increased market share.

- Resource Drain: These segments can tie up capital and operational capacity without yielding significant strategic benefits.

Segments like legacy wire bonding and commoditized lead frame packaging, where Hana Micron may have significant capacity, are likely 'dogs' in the BCG matrix. These areas operate in low-growth markets with intense price competition, leading to thin profit margins and limited potential for substantial returns. For example, the global semiconductor packaging market in 2024 continued to see price pressures on these more traditional solutions due to oversupply and lack of differentiation.

Outdated testing equipment and low-value, undifferentiated packaging materials also fall into the 'dog' category. These segments struggle with efficiency gaps, obsolescence risks, and can drain resources that could be better allocated to high-growth advanced packaging technologies. In 2024, the semiconductor industry saw a significant shift towards AI-integrated testing, with companies using these advanced systems reporting up to 15% higher throughput.

| Hana Micron BCG Matrix Segment (Dogs) | Market Characteristics | Hana Micron Implication |

|---|---|---|

| Legacy Wire Bonding | Low market growth, high competition, low margins | Potential for low returns; consider resource reallocation |

| Commoditized Lead Frame Packaging | Mature market, price-driven, limited differentiation | Eroding profit margins, requires cost optimization or exit strategy |

| Outdated Testing Equipment | Risk of obsolescence, lower efficiency, client dissatisfaction | Diverts capital from innovation, impacts competitiveness |

| Low-Value Packaging Materials | Highly commoditized, intense price wars, minimal growth | Consumes resources without significant strategic benefit |

Question Marks

Hana Micron's push into advanced 3D IC packaging, while promising for future high-performance computing, presents a significant question mark. While they are developing 2.5D packaging, fully mastering and gaining market share in more complex 3D stacking technologies is a challenge. This segment is experiencing rapid growth, but is currently dominated by established giants like TSMC and Samsung, making it a tough market to penetrate.

To truly transform this area into a Star within Hana Micron's BCG Matrix, substantial investment in research and development, alongside manufacturing capabilities, is essential. Without this commitment, Hana Micron may struggle to compete effectively against the current market leaders in the high-growth 3D IC sector.

The demand for AI chips is exploding, not just in data centers but increasingly in everyday devices like smartphones, cars, and smart home gadgets. This shift means the packaging solutions needed are becoming more specialized and diverse. Hana Micron's current footprint in packaging for these specific, distributed AI applications might be relatively small, presenting a challenge.

This burgeoning market for AI at the edge is a significant growth opportunity, projected to see substantial expansion in the coming years. To avoid being left behind, akin to a 'Dog' in the BCG matrix, Hana Micron needs to make strategic investments and forge key partnerships. Capturing a meaningful share here is crucial for future growth.

Co-Packaged Optics (CPO) represents a significant technological shift in data centers, promising enhanced data throughput and power efficiency, crucial for the burgeoning demands of AI and high-performance computing. While Hana Micron has not publicly detailed specific CPO initiatives, this emerging market presents a substantial opportunity for growth, positioning CPO as a potential star product in their future portfolio. The critical strategic decision for Hana Micron revolves around allocating resources to develop and capture market share in this nascent but high-potential area, making it a classic BCG Matrix question mark.

Next-Generation Wafer Bonding Technologies

As the demand for higher performance and improved power efficiency in semiconductors intensifies, next-generation wafer bonding technologies like hybrid bonding and backside power delivery are becoming crucial. These advancements are essential for overcoming the limitations of traditional interconnect methods.

Hana Micron's existing strength in Wafer Level Packaging (WLP) positions them well, but significant investment in developing and commercializing these cutting-edge bonding techniques presents a substantial high-growth avenue. Their current market share in these specialized, advanced processes is expected to be minimal, necessitating dedicated research and development alongside focused market entry strategies.

- Hybrid Bonding: Enables direct copper-to-copper connections, drastically reducing resistance and improving signal integrity, critical for advanced logic and memory.

- Backside Power Delivery: Moves power delivery networks to the backside of the wafer, freeing up front-end space for more active components and enhancing thermal management.

- Market Opportunity: The global advanced packaging market, including these next-gen bonding technologies, is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 10% through 2027.

- Hana Micron's Focus: Capitalizing on these trends requires substantial R&D investment to build expertise and secure early market share in these highly specialized, high-value segments.

Specialized Packaging for Automotive ADAS/Autonomous Driving

The automotive sector, especially with the rise of ADAS and autonomous driving, is a major growth area for semiconductors. These systems demand advanced packaging solutions that can handle high performance and extreme reliability. Hana Micron's existing capabilities in advanced packaging are relevant, but their current penetration in this highly specialized automotive segment is not yet dominant.

This niche within automotive packaging represents a substantial opportunity for Hana Micron. To capitalize on this, significant investment in specific technologies and obtaining the necessary automotive certifications will be crucial. The market is projected to see substantial growth, with the global automotive semiconductor market expected to reach over $140 billion by 2028, with ADAS and autonomous driving being key drivers.

- Market Growth: The automotive semiconductor market, driven by ADAS and autonomous features, is experiencing rapid expansion.

- Hana Micron's Position: While Hana Micron has relevant packaging services, their direct market share in specialized automotive packaging is currently limited.

- Opportunity: This segment offers a significant growth avenue, but requires dedicated investment and specific industry qualifications.

- Strategic Focus: Becoming a leader in this area would likely position Hana Micron's automotive packaging services as a Star in a BCG matrix.

Hana Micron's venture into advanced 3D IC packaging and the burgeoning market for edge AI applications both represent significant growth opportunities, but currently pose substantial challenges. These areas are characterized by high potential but require substantial investment and market penetration to overcome established competition and nascent technology adoption, making them classic question marks in the BCG matrix.

To elevate these segments from question marks to stars, Hana Micron must commit significant resources to research and development, forge strategic partnerships, and secure necessary industry certifications, particularly for the automotive sector. Successfully navigating these challenges will be crucial for capturing market share and driving future growth.

The company's limited current market share in these high-growth, specialized areas necessitates a focused strategy to build expertise and establish a competitive presence.

The global advanced packaging market is projected to grow at a CAGR exceeding 10% through 2027, highlighting the potential for segments like hybrid bonding and backside power delivery.

BCG Matrix Data Sources

Our HANA Micron BCG Matrix leverages comprehensive data from financial statements, market research reports, and internal performance metrics to provide a robust strategic overview.