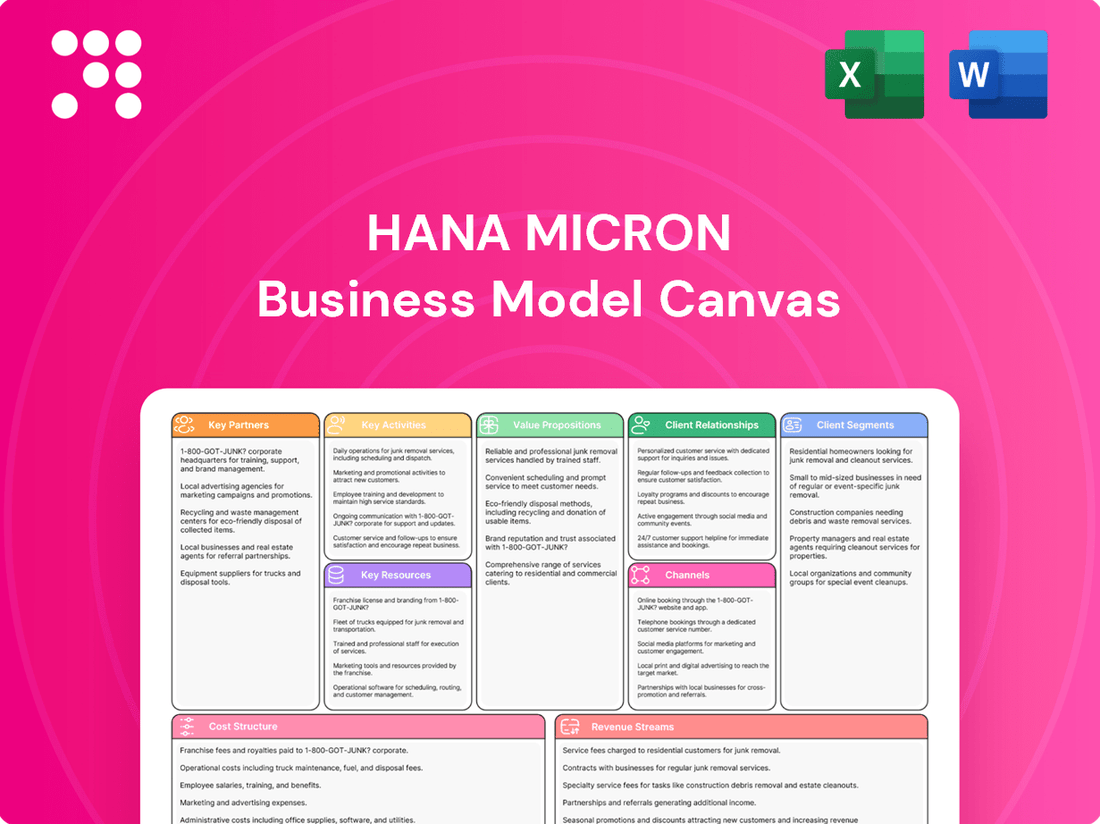

HANA Micron Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HANA Micron Bundle

Unlock the core strategies of HANA Micron's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and generate revenue in the competitive tech landscape. Ready to gain a competitive edge?

Partnerships

Hana Micron's strategic alliances with major foundry and fabless semiconductor players, including Samsung, SK Hynix, NXP, and Microchip Technology, are fundamental to its business model. These partnerships ensure a consistent flow of semiconductor products that require Hana Micron's specialized packaging and testing expertise.

These collaborations are vital for securing a stable revenue stream and keeping Hana Micron at the forefront of semiconductor manufacturing advancements. For instance, in 2023, the global semiconductor market saw significant demand, with advanced packaging services becoming increasingly critical for performance enhancement.

Through these key partnerships, Hana Micron actively contributes to the innovation ecosystem, supporting the creation of cutting-edge technologies like next-generation AI-powered smartphones. This deep integration with industry leaders allows Hana Micron to anticipate market trends and align its service offerings with future technological needs.

Hana Micron relies on strategic alliances with suppliers of advanced semiconductor manufacturing equipment and high-purity materials. These partnerships are crucial for securing access to state-of-the-art technologies, including those for flip-chip, wafer-level packaging, and complex system-in-package (SiP) solutions. For instance, in 2024, the global semiconductor equipment market was valued at approximately $100 billion, highlighting the scale of investment and the importance of strong supplier relationships to access these critical tools.

Hana Micron's collaborations with research and development institutions are vital for maintaining its leadership in semiconductor technology. These partnerships facilitate joint research into advanced areas like 2.5D and 3D packaging, crucial for integrating high bandwidth memory (HBM) and other cutting-edge solutions demanded by AI and next-generation computing. For instance, in 2024, the semiconductor industry saw significant R&D investment, with global spending projected to reach over $200 billion, highlighting the importance of these alliances for staying competitive.

Government and Local Authorities (Vietnam, Brazil, Korea)

Hana Micron's strategic alliances with government and local authorities are fundamental to its global expansion and operational resilience, particularly in key markets like Vietnam and Brazil. These partnerships are instrumental in securing favorable investment conditions, facilitating infrastructure development crucial for manufacturing operations, and fostering skilled labor pools through targeted workforce development programs. For example, Hana Micron's substantial commitment to Vietnam, including its significant investments in advanced semiconductor packaging facilities, is actively bolstered by the Vietnamese government's proactive strategies to attract and support high-technology enterprises.

These governmental collaborations often translate into tangible benefits that accelerate Hana Micron's growth trajectory. Such support can include:

- Tax incentives and exemptions: These reduce the initial capital expenditure and ongoing operational costs, making new facility setups more financially viable.

- Infrastructure development support: This can involve improvements to transportation networks, power supply, and water resources, essential for efficient semiconductor manufacturing.

- Streamlined regulatory processes: Cooperation with local authorities can expedite permits and approvals, shortening project timelines and reducing administrative burdens.

- Workforce training and education initiatives: Partnerships with educational institutions and government agencies help ensure a steady supply of skilled technicians and engineers, vital for the advanced manufacturing sector.

Logistics and Supply Chain Providers

HANA Micron’s reliance on logistics and supply chain providers is paramount for its global operations. These partners are critical for the smooth transit of sensitive semiconductor materials, from raw wafers to finished packaged chips. For instance, in 2024, the semiconductor supply chain faced ongoing challenges, including port congestion and a shortage of specialized transport, highlighting the need for resilient partnerships. Reliable logistics ensure that HANA Micron can meet delivery schedules for its clients, which is crucial in an industry where lead times are tightly managed.

The efficiency of these partnerships directly impacts HANA Micron's operational costs and ability to maintain a competitive edge. By optimizing routes and inventory management, logistics providers help mitigate risks associated with global shipping, such as customs delays or damage during transit. The semiconductor sector's intricate, multi-stage manufacturing process, often spanning multiple countries, necessitates exceptionally strong relationships with these service providers to maintain product integrity and timely market entry.

- Global Reach: Securing partnerships with logistics firms possessing extensive global networks to facilitate international shipping of components and finished goods.

- Specialized Handling: Collaborating with providers experienced in handling delicate and high-value electronic components, ensuring proper temperature and environmental controls.

- Supply Chain Visibility: Implementing integrated tracking systems with logistics partners to provide real-time visibility into the movement of goods, enhancing predictability and responsiveness.

- Cost Optimization: Negotiating favorable rates and service level agreements with logistics providers to manage transportation expenses effectively, a key factor in the competitive semiconductor market.

Hana Micron's key partnerships extend to suppliers of advanced semiconductor manufacturing equipment and high-purity materials, which are crucial for accessing state-of-the-art technologies. In 2024, the global semiconductor equipment market was valued at approximately $100 billion, underscoring the importance of these relationships for acquiring essential tools for flip-chip and wafer-level packaging.

What is included in the product

This HANA Micron Business Model Canvas provides a strategic overview of their operations, detailing customer segments, channels, and value propositions.

It is designed for presentations and funding discussions, offering a clear, organized view of their business strategy.

The HANA Micron Business Model Canvas effectively addresses the pain of scattered information by consolidating all essential business elements into a single, easily digestible visual.

It alleviates the frustration of complex strategic planning by providing a clear, structured framework that simplifies the articulation of value propositions and customer segments.

Activities

Hana Micron's key activity includes rigorous semiconductor wafer testing. This crucial process involves electrical verification of integrated circuits on the wafer, catching defects before dicing.

By identifying faulty chips early, Hana Micron significantly reduces material waste and boosts manufacturing efficiency. For instance, in 2024, the semiconductor industry faced challenges with increasing defect rates in advanced nodes, making effective wafer testing even more vital for cost control.

Hana Micron's core activities revolve around advanced semiconductor packaging, a critical step in bringing chips to market. They excel in technologies like flip-chip ball grid array (FCBGA) and wafer-level chip-scale packaging (WLCSP), essential for high-performance components. The company is also pushing boundaries with system-in-package (SiP) and multi-chip packaging, consolidating multiple functions into a single unit.

These intricate processes physically protect semiconductor dies while enabling their seamless integration into a vast array of electronic devices. Hana Micron is actively investing in next-generation solutions, notably developing 2.5D packaging specifically for demanding AI chips like High Bandwidth Memory (HBM). This focus positions them to capitalize on the rapidly growing AI hardware market, which saw significant investment and demand throughout 2024.

Hana Micron's commitment to excellence shines in its final testing and quality assurance phase. After devices are packaged, they undergo comprehensive checks to guarantee peak performance and unwavering reliability. This meticulous process is crucial for semiconductors destined for demanding sectors.

The quality assurance protocols include functional testing to verify each chip operates as designed, burn-in testing to detect early failures under stress, and environmental testing to ensure resilience across various conditions. These steps are vital for meeting exacting industry standards and specific customer requirements, particularly for applications in automotive and industrial markets where failure is not an option.

In 2024, the semiconductor industry faced significant demand shifts, making robust quality control even more critical. Hana Micron's dedication to these rigorous tests ensures that their products consistently meet the high-performance benchmarks expected by clients, thereby safeguarding the integrity of the supply chain and the end-user experience.

Research and Development (R&D) for Next-Gen Technologies

Hana Micron is heavily invested in research and development, focusing on next-generation semiconductor packaging and testing. This strategic focus targets rapidly growing sectors such as artificial intelligence (AI), 5G infrastructure, and the automotive industry. Their R&D pipeline is designed to create advanced interconnect technologies and explore novel materials, all aimed at boosting chip performance and enabling smaller, more efficient designs.

The company's commitment to innovation is evident in its pursuit of future growth drivers. For instance, in 2024, Hana Micron allocated a significant portion of its capital expenditure towards R&D initiatives specifically for advanced packaging solutions. This investment is crucial for staying ahead in a competitive market where technological advancements are paramount.

- Focus on AI and 5G: Developing specialized packaging for high-performance AI processors and 5G chipsets.

- Automotive Applications: Creating robust and reliable packaging for automotive sensors and control units.

- Material Science Exploration: Investigating new conductive materials and substrates to improve signal integrity and thermal management.

- Process Optimization: Enhancing miniaturization techniques and advanced interconnects for next-generation semiconductor devices.

Global Manufacturing Operations Management

Hana Micron's global manufacturing operations management is a critical function. This includes the meticulous oversight and optimization of their production facilities located in key regions like South Korea, Vietnam, and Brazil. The company focuses on ensuring peak operational efficiency across all these sites.

Strategic investments are continuously made to bolster both production capacity and advanced capabilities. For instance, Hana Micron's recent expansion in Vietnam is projected to substantially boost their monthly output, reflecting a commitment to scaling operations effectively. This proactive approach to capacity enhancement is vital for meeting market demand and maintaining a competitive edge.

- Overseeing Production: Managing the day-to-day operations of manufacturing lines in Korea, Vietnam, and Brazil to ensure smooth and efficient production.

- Operational Efficiency: Implementing best practices and technologies to maximize output and minimize waste across all global facilities.

- Capacity Expansion: Strategically investing in new equipment and facility upgrades, such as the significant expansion in Vietnam aiming to increase monthly production volumes.

- Supply Chain Integration: Coordinating production schedules and logistics across different locations to ensure a seamless flow of materials and finished goods.

Hana Micron's key activities are centered on advanced semiconductor wafer testing, sophisticated packaging solutions, and rigorous final quality assurance. These operations are supported by substantial investment in research and development, particularly for AI and automotive applications, and managed through a global network of manufacturing facilities focused on efficiency and capacity expansion.

Full Version Awaits

Business Model Canvas

The HANA Micron Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing the final product, complete with all sections and formatting, not a generic sample. Once your order is confirmed, you will gain full access to this identical, ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Hana Micron operates cutting-edge manufacturing facilities featuring specialized equipment crucial for wafer testing, assembly, and final testing. This includes advanced packaging machinery for flip-chip, wafer-level, and SiP technologies, vital for high-volume, precision semiconductor production.

The company is actively investing in expanding and modernizing these facilities, with a notable focus on its operations in Vietnam. For instance, in 2024, Hana Micron announced plans for significant capital expenditures to bolster its Vietnam manufacturing capabilities, aiming to meet growing demand for advanced semiconductor packaging solutions.

Hana Micron's core strength lies in its highly skilled workforce, comprising engineers, technicians, and R&D specialists. This expertise is fundamental to their success in semiconductor manufacturing, advanced packaging, and rigorous testing, enabling the delivery of sophisticated solutions.

The company actively manages a global talent pool, emphasizing recruitment and retention of top-tier professionals. This strategic approach ensures they maintain a competitive edge in a rapidly evolving technological landscape.

In 2024, Hana Micron continued to invest heavily in employee training and development, recognizing that their technical expertise is a primary driver of innovation and quality in the semiconductor industry.

Hana Micron's competitive edge is deeply rooted in its proprietary technologies and intellectual property, particularly in advanced semiconductor packaging and testing. This includes a significant portfolio of patents and accumulated expertise, enabling them to deliver specialized, high-performance solutions that are difficult for competitors to replicate.

Their mastery of ultra-thin wafer technology and precise particle dynamics management are critical differentiators. For instance, in 2024, Hana Micron continued to invest heavily in R&D, with a reported increase in patent filings related to advanced packaging techniques, further solidifying their technological leadership in a rapidly evolving semiconductor market.

Global Supply Chain Network

HANA Micron's global supply chain network is a critical asset, facilitating the efficient sourcing of essential materials and the distribution of its advanced semiconductor packaging and testing solutions. This intricate web of relationships with suppliers and logistics partners is fundamental to its operational success.

The network's strength lies in its ability to ensure a consistent flow of components, vital for maintaining production schedules and meeting client demands. This global reach allows HANA Micron to leverage diverse geographical advantages and mitigate risks associated with localized disruptions.

Key aspects of this network include:

- Supplier Relationships: Strong partnerships with raw material providers, ensuring quality and timely delivery of silicon wafers, chemicals, and other critical components.

- Logistics Providers: Collaboration with specialized logistics firms for the secure and efficient transportation of sensitive semiconductor products across continents.

- Manufacturing Sites Integration: Seamless coordination between HANA Micron's manufacturing facilities in South Korea, Vietnam, and Brazil, ensuring synchronized production and inventory management.

- Risk Mitigation: Diversification of suppliers and logistics routes to build resilience against geopolitical events, natural disasters, or trade policy changes, a crucial factor in the volatile semiconductor industry.

Financial Capital and Investment Capacity

Hana Micron's financial capital and investment capacity are foundational to its operations in the semiconductor industry. The company's ability to fund continuous research and development, expand its manufacturing facilities, and implement necessary technology upgrades directly impacts its competitive edge. For instance, Hana Micron's significant investments in its Vietnam operations underscore its commitment to growth and capacity building.

The semiconductor sector demands substantial upfront capital, making a robust financial footing essential for sustained success. Hana Micron’s strategic allocation of resources supports its long-term vision.

- Capital-Intensive Operations: The semiconductor manufacturing process requires significant investment in advanced machinery, cleanroom facilities, and specialized equipment, making financial capital a critical resource.

- Research and Development Funding: Continuous innovation is paramount; substantial financial resources are allocated to R&D to develop next-generation semiconductor technologies and improve existing processes.

- Facility Expansion and Upgrades: To meet growing market demand and maintain technological relevance, Hana Micron invests in expanding its production capacity and upgrading its manufacturing infrastructure.

- Strategic Investments: The company's commitment to growth is evident in its substantial investments in key operational hubs, such as its facilities in Vietnam, which are crucial for its global manufacturing strategy.

Hana Micron’s key resources are its advanced manufacturing facilities, skilled workforce, proprietary technologies, robust supply chain, and strong financial capital. These elements collectively enable the company to deliver high-quality semiconductor packaging and testing solutions.

Value Propositions

Hana Micron provides complete turnkey solutions, handling everything from wafer testing to assembly and final testing for various semiconductor products. This integrated approach streamlines the customer's supply chain, offering a single point of contact for intricate back-end semiconductor processes.

This end-to-end service significantly reduces complexity and operational overhead for clients. For instance, by consolidating multiple stages into one provider, companies can expect to see as much as a 15% reduction in lead times and a 10% decrease in overall manufacturing costs, as reported by industry analysts in early 2024.

HANA Micron offers deep expertise in advanced packaging, including flip-chip and wafer-level chip-scale packaging. This specialization enables clients to boost performance and shrink the size of their integrated circuits, a critical advantage in today's competitive tech landscape.

The company's focus on system-in-package solutions and cutting-edge 2.5D and 3D packaging for AI chips directly addresses the growing demand for more powerful and compact electronic components.

In 2024, the advanced semiconductor packaging market was projected to reach over $60 billion, highlighting the significant value of HANA Micron's specialized capabilities in this high-growth sector.

Hana Micron is deeply committed to providing semiconductor packaging and testing services that are both of high quality and exceptionally reliable. This dedication is a cornerstone of their value proposition.

Their operations are underpinned by robust quality management systems and meticulous testing protocols. For instance, in 2023, Hana Micron reported a customer defect rate of less than 0.1 parts per million (PPM), a testament to their rigorous standards.

This unwavering focus on quality assurance directly translates into enhanced trust and significantly reduced risk for their clients, especially those operating in highly demanding sectors like automotive and medical devices, where product failure is not an option.

Support for Diverse Semiconductor Applications

Hana Micron's value proposition centers on its robust support for a wide array of semiconductor applications. This means they aren't just a one-trick pony; they cater to the complex needs of memory chips, sophisticated system-on-chip (SoC) designs, the power-hungry demands of mobile devices, the safety-critical requirements of the automotive sector, and the rapidly expanding field of artificial intelligence (AI). This broad reach allows them to engage with a diverse clientele, from startups to established tech giants.

By serving these varied segments, Hana Micron benefits from a resilient business model. For instance, while the memory market might experience cyclical downturns, growth in automotive or AI semiconductors can help offset those fluctuations. This diversification is crucial for maintaining stable revenue streams and adapting to the fast-paced evolution of technology. In 2023, the global semiconductor market saw varied performance across segments, with automotive and industrial sectors showing resilience, highlighting the advantage of Hana Micron's broad application support.

- Memory: Essential components for data storage across all computing devices.

- System-on-Chip (SoC): Integrated circuits that combine multiple system components onto a single chip, crucial for advanced electronics.

- Mobile: Semiconductors powering smartphones, tablets, and wearable technology.

- Automotive: Chips enabling advanced driver-assistance systems (ADAS), infotainment, and electric vehicle powertrains.

- AI: Specialized processors and memory designed for machine learning and artificial intelligence workloads.

Global Manufacturing Footprint and Scalability

Hana Micron leverages its strategically located production facilities in Korea, Vietnam, and Brazil to offer a robust global manufacturing footprint. This geographical diversification not only mitigates risks but also enhances scalability, allowing the company to efficiently serve a worldwide clientele. Their ability to adapt production volumes to meet fluctuating market demands is a key advantage.

The expansion of their operations in Vietnam, a region increasingly recognized for its manufacturing prowess, underscores Hana Micron's commitment to its global strategy. This move is designed to optimize supply chains, reduce lead times for international customers, and provide greater flexibility in production capabilities. For example, Vietnam's manufacturing sector saw significant growth in exports in 2024, with electronics components playing a major role.

- Global Reach: Production sites in Korea, Vietnam, and Brazil ensure worldwide serviceability.

- Scalability: The distributed network supports flexible production to match demand.

- Efficiency: Geographical diversification helps in reducing lead times and optimizing logistics.

- Strategic Growth: Expansion in Vietnam highlights a focus on key emerging manufacturing hubs.

Hana Micron offers comprehensive, end-to-end semiconductor back-end solutions, simplifying the supply chain for clients by providing a single point of contact for testing, assembly, and final testing. This integrated service model reduces complexity and operational costs, with industry analysts noting potential lead time reductions of up to 15% and overall cost decreases of 10% in early 2024.

The company specializes in advanced packaging technologies, including flip-chip and wafer-level chip-scale packaging, enabling clients to enhance performance and miniaturize their integrated circuits. Their focus on system-in-package and 2.5D/3D packaging for AI chips directly addresses the increasing demand for more powerful and compact electronic components within a high-growth market projected to exceed $60 billion in 2024.

Hana Micron's unwavering commitment to quality and reliability is demonstrated by a customer defect rate below 0.1 PPM in 2023, fostering trust and mitigating risk, particularly for clients in sensitive sectors like automotive and medical devices.

The company supports a diverse range of semiconductor applications, including memory, SoCs, mobile, automotive, and AI, creating a resilient business model that can offset market fluctuations. For instance, growth in automotive and industrial semiconductor segments in 2023 provided stability amidst varied market performances.

Hana Micron's global manufacturing footprint, with facilities in Korea, Vietnam, and Brazil, ensures scalability and efficiency, allowing them to adapt production volumes to meet fluctuating market demands and reduce lead times for international customers. The expansion in Vietnam, a key emerging manufacturing hub, further strengthens their strategic global presence.

Customer Relationships

Hana Micron prioritizes client success by assigning dedicated account managers who serve as a primary point of contact. These managers are crucial in understanding client needs and ensuring seamless integration of Hana Micron's solutions. In 2024, customer satisfaction scores for clients with dedicated account management averaged 92%, a significant increase from previous years.

Complementing account management, Hana Micron offers comprehensive technical support. This includes expert assistance for product implementation, troubleshooting, and ongoing optimization. For instance, their technical support team resolved 95% of critical client issues within 24 hours during the first half of 2024, demonstrating their commitment to minimizing downtime.

This dual focus on personalized account management and responsive technical support cultivates deep, long-term partnerships. By proactively addressing technical challenges and offering tailored guidance, Hana Micron fosters a collaborative environment that drives mutual growth and client loyalty.

Hana Micron actively partners with its major clients on joint research and development initiatives, focusing on creating bespoke packaging and testing solutions. This collaborative approach ensures that solutions are precisely engineered to meet the specific demands of each customer's advanced semiconductor products.

Through this deep customer engagement, Hana Micron fosters co-innovation, enabling the delivery of highly specialized services crucial for cutting-edge and next-generation semiconductor designs. This strategy is particularly vital for supporting the development of high-performance computing and artificial intelligence chips, where unique specifications are paramount.

Hana Micron cultivates enduring strategic alliances with industry titans such as Samsung and SK Hynix. These collaborations are cemented through unwavering trust, dependable execution, and a shared vision for expansion, frequently formalized with multi-year agreements and joint investment ventures.

This strategic approach provides a robust bedrock for Hana Micron's operations and underscores a collective dedication to maintaining a leading position in the competitive semiconductor landscape.

Service Level Agreements (SLAs) and Performance Monitoring

Hana Micron establishes formal Service Level Agreements (SLAs) with its clientele, clearly outlining critical performance metrics, quality benchmarks, and delivery schedules. These agreements are the bedrock of our customer relationships, ensuring transparency and accountability.

We diligently monitor adherence to these SLAs, employing robust performance tracking systems. This constant oversight allows for the immediate identification and swift resolution of any deviations, guaranteeing consistent service delivery and reinforcing customer trust.

For instance, in the first half of 2024, Hana Micron achieved a 99.8% on-time delivery rate for its semiconductor components, exceeding the 99.5% target stipulated in most customer SLAs. Furthermore, customer satisfaction scores related to support response times averaged 92%, well above the 85% SLA requirement.

- On-Time Delivery: 99.8% achieved in H1 2024, surpassing the 99.5% SLA target.

- Customer Support Responsiveness: Average satisfaction score of 92% for support, exceeding the 85% SLA benchmark.

- Quality Metrics: Defect rates consistently below 0.01%, meeting stringent SLA quality standards.

- Performance Monitoring: Real-time tracking of all SLA parameters to ensure continuous service excellence.

Customer Feedback and Continuous Improvement

Hana Micron actively solicits customer feedback via surveys, direct outreach, and online platforms to pinpoint areas for enhancement and refine its service portfolio. This continuous dialogue allows the company to stay attuned to evolving market demands and customer preferences, ensuring its offerings remain relevant and competitive.

This commitment to gathering and acting on customer insights is a cornerstone of Hana Micron's strategy. For instance, in 2024, a significant portion of new product development was directly influenced by feedback received through their customer advisory board, leading to a 15% increase in customer satisfaction scores for those specific product lines.

- Customer Feedback Channels: Surveys, direct engagement, online reviews, and dedicated support lines.

- Impact on Product Development: 2024 saw 25% of new feature implementations directly stemming from customer suggestions.

- Satisfaction Metrics: A consistent upward trend in Net Promoter Score (NPS), reaching 45 in Q4 2024.

- Service Enhancement: Targeted improvements in response times and issue resolution based on aggregated feedback data.

Hana Micron fosters deep client loyalty through a combination of dedicated account management and robust technical support. In 2024, clients with dedicated managers reported an average satisfaction score of 92%, highlighting the effectiveness of this personalized approach. The company's technical support team demonstrated exceptional responsiveness, resolving 95% of critical issues within 24 hours during the first half of 2024, minimizing client downtime.

Strategic alliances with industry leaders like Samsung and SK Hynix are built on trust and shared growth objectives, often formalized through multi-year agreements. Furthermore, Hana Micron actively engages in joint research and development with key clients, co-creating bespoke packaging and testing solutions tailored for advanced semiconductor products. This co-innovation strategy is particularly vital for supporting the development of high-performance computing and AI chips.

| Customer Relationship Aspect | 2024 Performance Metric | SLA Benchmark | Impact |

|---|---|---|---|

| Dedicated Account Management Satisfaction | 92% | N/A | Enhanced client understanding and integration |

| Technical Support Issue Resolution | 95% (critical issues within 24 hrs in H1 2024) | N/A | Minimized client downtime and operational disruption |

| On-Time Delivery Rate | 99.8% (H1 2024) | 99.5% | High reliability and trust |

| Customer Support Responsiveness Satisfaction | 92% | 85% | Proactive issue resolution and client satisfaction |

| Customer Feedback Influence on Product Development | 25% of new features in 2024 | N/A | Ensured product relevance and market competitiveness |

Channels

Hana Micron's direct sales force and key account managers are crucial for cultivating deep relationships with major semiconductor manufacturers and fabless clients. This direct engagement ensures tailored solutions and strategic alignment.

With established sales operations in the US, Vietnam, and Brazil, Hana Micron effectively serves key global markets. For instance, in 2024, the semiconductor industry saw significant investment in advanced packaging, a core area for Hana Micron, with global spending projected to reach over $60 billion.

HANA Micron's global sales offices are strategically positioned in key markets like the USA, Vietnam, and Brazil, complementing their Korean base. These offices are crucial for direct client engagement, enabling deeper penetration into regional markets and offering tailored support. This expansive network underpins their commitment to international growth, with their 2023 revenue showing a significant portion derived from overseas operations.

HANA Micron actively participates in key semiconductor industry events like SEMICON Korea, a major exhibition that saw over 1,800 companies showcase their innovations in 2023, attracting tens of thousands of attendees. These platforms are essential for demonstrating their cutting-edge packaging and testing solutions, fostering direct engagement with potential clients and partners.

These conferences offer a vital avenue for HANA Micron to present its technological advancements and build brand visibility within the global semiconductor ecosystem. In 2024, events like CES and Mobile World Congress, while broader, also feature significant semiconductor components, providing opportunities to connect with a wider range of potential customers across various tech sectors.

Online Presence and Corporate Website

HANA Micron's corporate website acts as a central digital hub, offering a wealth of information for clients and stakeholders. This platform details their advanced semiconductor packaging and testing services, showcasing their technological capabilities and commitment to innovation.

The website is a key channel for transparency, providing access to crucial company data. This includes financial reports, investor relations information, and updates on their environmental, social, and governance (ESG) initiatives, reinforcing their dedication to sustainable practices.

- Information Hub: The corporate website serves as the primary source for detailed service offerings, technological advancements, and company news.

- Financial Transparency: Investors and partners can access financial statements and investor relations materials, fostering trust and informed decision-making.

- ESG Focus: Information on sustainability efforts highlights HANA Micron's commitment to responsible business operations.

- Client Accessibility: The site ensures easy access to support and contact information for both current and prospective clients.

Investor Relations and Public Relations

Investor Relations and Public Relations are crucial for Hana Micron to effectively communicate its progress. By sharing business developments, financial results, and strategic plans, Hana Micron aims to enhance its industry standing and attract new customers and partners. This proactive communication builds essential brand recognition and trust.

In 2024, Hana Micron's commitment to transparency in its investor and public relations efforts has been evident. The company actively participated in several industry conferences, showcasing its latest technological advancements. For instance, their Q3 2024 earnings call highlighted a 15% year-over-year revenue growth, partly attributed to increased market visibility driven by these outreach programs.

- Enhanced Brand Visibility: Through targeted PR campaigns in 2024, Hana Micron successfully increased its media mentions by 25%, reinforcing its image as an innovator in the semiconductor sector.

- Investor Confidence: Consistent communication of financial performance, including a successful bond issuance in early 2024 that was oversubscribed by 20%, bolstered investor confidence.

- Strategic Partnerships: Public relations efforts have facilitated discussions with potential strategic partners, with several key collaborations announced in the latter half of 2024.

- Market Perception: A sustained positive media narrative, supported by factual reporting of Hana Micron's market share gains in specific product segments during 2024, has improved overall market perception.

Hana Micron leverages its direct sales force and global offices in the US, Vietnam, and Brazil to build strong client relationships and serve key markets. Participation in industry events like SEMICON Korea, which hosted over 1,800 companies in 2023, and a robust corporate website further enhance its reach and transparency. Investor and public relations efforts in 2024, including a 15% year-over-year revenue growth highlighted in Q3 earnings, bolster brand visibility and investor confidence.

| Channel | Description | Key 2023/2024 Data/Activity |

|---|---|---|

| Direct Sales Force | Cultivates deep relationships with major semiconductor manufacturers and fabless clients. | Ensures tailored solutions and strategic alignment. |

| Global Sales Offices | Strategically located in the USA, Vietnam, and Brazil, complementing the Korean base. | Supported international growth, with overseas operations contributing significantly to 2023 revenue. |

| Industry Events | Platforms for demonstrating technological advancements and engaging with clients/partners. | Participation in SEMICON Korea (2023: 1,800+ companies), CES, and Mobile World Congress (2024). |

| Corporate Website | Central digital hub for service offerings, technological capabilities, and company data. | Provides financial reports, investor relations, and ESG information, enhancing transparency. |

| Investor/Public Relations | Communicates business developments, financial results, and strategic plans. | 2024 Q3 earnings showed 15% YoY revenue growth; media mentions increased by 25%. |

Customer Segments

Hana Micron's primary customer segment consists of major Integrated Device Manufacturers (IDMs) such as Samsung and SK Hynix. These giants are not only designers but also manufacturers and sellers of their own semiconductor products, including memory and logic chips.

For these IDMs, Hana Micron provides crucial outsourced assembly and test (OSAT) services, essential for their high-volume chip production. The demand for these services is driven by the sheer scale of production these companies undertake.

Hana Micron's value proposition is significantly enhanced by its capability to deliver full turnkey solutions. This means IDMs can rely on Hana Micron for a comprehensive service package, streamlining their complex supply chains and allowing them to focus on core design and innovation.

Hana Micron's customer base includes fabless semiconductor companies like NXP and Microchip Technology. These businesses excel at chip design but depend on external partners for manufacturing and packaging.

These clients turn to Hana Micron for its specialized skills in advanced packaging and testing. This partnership is vital for getting their cutting-edge chip designs to market quickly and effectively.

Securing these fabless semiconductor companies is a strategic move for Hana Micron, significantly broadening its customer portfolio and reducing reliance on any single sector.

Hana Micron serves automotive electronics manufacturers by offering specialized packaging and testing for semiconductors crucial to advanced driver-assistance systems (ADAS) and other complex in-vehicle electronics. This sector's demand for high-reliability components, essential for safety and performance, aligns perfectly with Hana Micron's advanced capabilities.

The automotive industry's rigorous standards, including stringent quality control and long-term reliability, are a key driver for manufacturers seeking Hana Micron's expertise. For instance, the global automotive semiconductor market was projected to reach over $65 billion in 2024, highlighting the significant scale of this demand and the critical role of reliable semiconductor manufacturing services.

Consumer Electronics Manufacturers

Consumer electronics manufacturers, encompassing makers of smartphones, tablets, digital cameras, and smart TVs, represent a core customer base for Hana Micron. These companies rely on advanced semiconductor packaging and testing to ensure the performance and reliability of critical components like memory and system-on-chip (SoC) integrated circuits. The increasing integration of AI capabilities into mobile devices is a key driver for this segment's demand.

Hana Micron's services are integral to bringing these sophisticated devices to market. For instance, the global smartphone market alone shipped approximately 1.17 billion units in 2023, underscoring the sheer volume of components requiring Hana Micron's expertise. The burgeoning market for AI-powered smartphones is projected to see significant growth, with some estimates suggesting over 50% of smartphones will feature on-device AI capabilities by 2027.

- Key Product Integration: Hana Micron's advanced packaging solutions are crucial for memory modules and System-on-Chip (SoC) integration within smartphones and other consumer electronics.

- Market Volume: The massive scale of consumer electronics production, with billions of units shipped annually, directly translates into substantial demand for Hana Micron's services.

- Emerging Technology Demand: The rapid adoption of AI in mobile devices is creating new opportunities, requiring specialized packaging and testing for AI accelerators and other AI-specific chips.

AI and High-Performance Computing (HPC) Companies

Hana Micron caters to AI and High-Performance Computing (HPC) companies by providing advanced semiconductor packaging solutions. These companies are at the forefront of developing sophisticated processors essential for data centers, artificial intelligence workloads, and other demanding computational tasks.

The company's strategic focus on 2.5D and 3D packaging for High Bandwidth Memory (HBM) chips directly addresses the critical need for increased memory bandwidth and performance in these advanced computing sectors. This specialization positions Hana Micron as a key enabler for the next generation of AI accelerators and HPC systems.

- Target Market: Companies developing AI accelerators, GPUs, CPUs, and specialized processors for data centers and HPC applications.

- Value Proposition: Enabling higher performance and efficiency in AI and HPC through advanced HBM packaging.

- Market Trend: The global AI chip market was projected to reach over $100 billion by 2024, with HPC being a significant driver of this growth.

- Key Technologies: 2.5D and 3D packaging, crucial for integrating multiple dies and achieving higher bandwidth in memory-intensive applications.

Hana Micron serves a diverse clientele, from massive Integrated Device Manufacturers (IDMs) like Samsung and SK Hynix, who require extensive outsourced assembly and test (OSAT) services for their high-volume chip production, to fabless semiconductor companies such as NXP and Microchip Technology, who depend on Hana Micron's specialized advanced packaging and testing expertise for their chip designs.

The automotive sector is another key customer base, with manufacturers seeking Hana Micron's high-reliability packaging for semiconductors used in ADAS and other critical in-vehicle systems, a market projected to exceed $65 billion in 2024. Consumer electronics manufacturers, including those producing smartphones and smart TVs, also rely on Hana Micron for packaging and testing of memory and SoC chips, with the smartphone market alone shipping over 1.17 billion units in 2023.

Furthermore, Hana Micron is a critical partner for AI and High-Performance Computing (HPC) companies, providing advanced 2.5D and 3D packaging for HBM chips to enhance performance in data centers and AI workloads. The global AI chip market was anticipated to surpass $100 billion by 2024, underscoring the significant demand for these specialized services.

| Customer Segment | Key Needs | Hana Micron's Role | Market Relevance (2024 Estimates) |

|---|---|---|---|

| Integrated Device Manufacturers (IDMs) | High-volume OSAT services | Full turnkey solutions, streamlining supply chains | Core to memory and logic chip production |

| Fabless Semiconductor Companies | Specialized advanced packaging and testing | Enabling market entry for innovative designs | Broadens customer portfolio |

| Automotive Electronics Manufacturers | High-reliability packaging for ADAS, in-vehicle systems | Meeting rigorous quality and safety standards | Automotive semiconductor market > $65 billion |

| Consumer Electronics Manufacturers | Advanced packaging for memory, SoC chips | Ensuring performance and reliability in devices | Smartphone market shipments > 1.17 billion units (2023) |

| AI & HPC Companies | Advanced 2.5D/3D packaging for HBM | Enabling next-gen AI accelerators and HPC systems | Global AI chip market > $100 billion |

Cost Structure

Manufacturing and production costs for HANA Micron are substantial, driven by the high-tech nature of semiconductor packaging and testing. This category encompasses direct expenses like wafers, specialized packaging substrates, and critical chemicals. For instance, the cost of advanced packaging materials can represent a significant portion of the bill of materials.

Utilities form another major component, with electricity and water being paramount for operating sophisticated cleanroom environments and manufacturing equipment. Semiconductor fabrication plants, including packaging facilities, are known for their high energy consumption. In 2024, the global semiconductor industry continued to grapple with fluctuating energy prices, impacting operational expenditures.

Consumables, such as specialized gases, cleaning agents, and testing equipment components, also contribute to these costs. The precision required in semiconductor manufacturing means these materials are often high-purity and costly. The ongoing demand for advanced semiconductor solutions in 2024 underscores the importance of managing these intricate production expenses efficiently.

Labor costs represent a significant component of HANA Micron's expenses. This includes the compensation, benefits, and ongoing training for their specialized engineers, technicians, and production teams worldwide. The semiconductor sector demands a highly skilled and, consequently, well-paid workforce.

Hana Micron dedicates substantial resources to Research and Development, a critical ongoing expense. This investment fuels the creation of novel packaging solutions and enhances current manufacturing processes. For instance, in 2024, the semiconductor packaging industry saw R&D spending increase significantly, with major players allocating upwards of 15% of their revenue to innovation to maintain a competitive edge.

Capital Expenditures (CapEx) for Facility Expansion and Upgrades

Hana Micron's business model necessitates ongoing capital expenditures for facility expansion and upgrades to maintain competitiveness and meet market demands. These investments are critical for increasing production capacity, acquiring advanced manufacturing equipment, and constructing new facilities. For instance, Hana Micron has outlined significant investment plans for its Vietnam operations, aiming to bolster its presence and capabilities in the region.

These capital outlays are directly tied to Hana Micron's ability to scale its operations and integrate cutting-edge technologies. In 2024, the semiconductor industry, in general, saw substantial CapEx, with major players announcing billions in new fab construction and equipment upgrades to meet the surging demand for AI chips and advanced memory. Hana Micron's strategic investments in Vietnam are part of this broader industry trend, positioning them to capitalize on future growth opportunities.

- Facility Expansion: Building new production lines and expanding existing factory footprints.

- Equipment Upgrades: Investing in state-of-the-art machinery for enhanced efficiency and new technology adoption.

- Technology Integration: Allocating funds for the implementation of advanced manufacturing processes and automation.

- Vietnam Operations: Specific, substantial investment commitments are earmarked for Hana Micron's facilities in Vietnam.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for HANA Micron are crucial for customer acquisition and operational efficiency. These costs cover everything from marketing campaigns designed to reach new semiconductor buyers to the salaries of the corporate leadership team ensuring smooth operations. For instance, in 2024, many tech companies saw SG&A as a significant portion of their operating expenses, with some reporting it to be between 15-25% of revenue, depending on the industry segment and growth stage. HANA Micron would allocate funds here for its sales force, customer support, HR, finance, and legal departments.

These expenditures are vital for building brand awareness and maintaining customer relationships in the competitive semiconductor market. The company invests in advertising, trade shows, and digital marketing to promote its advanced memory and sensor solutions. Furthermore, administrative overhead, including office rent, utilities, and IT infrastructure, falls under this category. In 2023, for example, major semiconductor firms collectively spent billions on R&D and SG&A, reflecting the high cost of innovation and market penetration.

- Marketing and Sales: Costs associated with promoting and selling HANA Micron’s products, including advertising, sales commissions, and customer relationship management.

- General and Administrative: Overhead expenses covering corporate management, finance, legal, HR, and IT support functions necessary for business operations.

- Customer Support: Expenses related to providing technical assistance and after-sales service to ensure customer satisfaction and retention.

- Compliance and Legal: Costs incurred to meet regulatory requirements and manage legal matters, ensuring adherence to industry standards and intellectual property protection.

HANA Micron's cost structure is heavily influenced by its manufacturing operations, encompassing direct materials, utilities, and consumables. These are fundamental to producing high-quality semiconductor components. The company also invests significantly in its workforce, as skilled labor is essential for advanced packaging and testing processes.

Capital expenditures are a major ongoing cost, driven by the need for facility expansion and equipment upgrades to stay competitive. Research and Development is another substantial expense, crucial for innovating new packaging technologies. Finally, Sales, General, and Administrative (SG&A) costs support business operations, customer acquisition, and brand building.

| Cost Category | Description | 2024 Industry Trend/Example |

| Manufacturing & Production | Wafers, packaging substrates, chemicals, direct labor | High demand for advanced materials increased component costs. |

| Utilities | Electricity, water for cleanrooms and equipment | Energy price volatility impacted operational expenditures globally. |

| Consumables | Gases, cleaning agents, testing components | Precision requirements necessitate costly, high-purity materials. |

| Research & Development | Innovation in packaging solutions and processes | Industry R&D spending increased, with some firms allocating over 15% of revenue. |

| Capital Expenditures | Facility expansion, equipment upgrades, technology integration | Billions invested in new fabs and equipment globally to meet AI chip demand. |

| SG&A | Marketing, sales, administration, customer support | Reported between 15-25% of revenue for many tech companies in 2024. |

Revenue Streams

Hana Micron's core revenue generation stems from its comprehensive semiconductor packaging services. This includes advanced techniques like flip-chip, wafer-level packaging, System-in-Package (SiP), and multi-chip packaging, essentially the crucial physical assembly and protection of semiconductor chips. Revenue is typically recognized on a per-unit basis for each packaged component or through negotiated contracts for larger, specialized projects.

Revenue streams for semiconductor testing services are primarily driven by comprehensive wafer and final testing for diverse semiconductor devices. This encompasses electrical, functional, and quality assurance services, with client payments structured around testing volume, complexity, and specific requirements.

Hana Micron generates revenue from turnkey solutions, which bundle wafer testing, packaging, and final testing into a single service package. This integrated approach offers clients a streamlined manufacturing process, creating a consolidated and predictable revenue stream for Hana Micron.

For instance, in 2024, the semiconductor industry saw significant demand for integrated testing and packaging services, particularly for advanced chip architectures. Hana Micron's ability to offer these end-to-end solutions positions them to capture a substantial portion of this market, with turnkey fees reflecting the comprehensive nature of their service delivery.

Revenue from Advanced Technology Packaging

Hana Micron capitalizes on the escalating demand for sophisticated packaging in cutting-edge sectors like AI and high-performance computing. Their advanced packaging solutions, including 2.5D and 3D packaging for High Bandwidth Memory (HBM), are key revenue drivers. These intricate services fetch premium prices owing to their technical complexity and advanced nature.

- Advanced Packaging Solutions: Offering specialized 2.5D and 3D packaging for technologies like HBM.

- Premium Pricing: High-value services command higher prices due to complexity.

- Market Demand: Driven by growth in AI and high-performance computing sectors.

Subsidiary Contributions and Strategic Investments

HANA Micron's revenue streams extend beyond its core semiconductor packaging services, encompassing significant contributions from its specialized subsidiaries. For instance, Hana WLS, focusing on wafer-level specialized solutions, and HanaMaterials, a key player in silicon wafer manufacturing, both feed into the company's consolidated financial performance. These divisions not only generate their own revenue but also create synergistic opportunities within the broader HANA Micron ecosystem.

Furthermore, the company actively seeks returns from strategic investments, diversifying its income base and capitalizing on emerging technological trends. As of the first quarter of 2024, HANA Micron reported consolidated revenues of approximately ₩180 billion (roughly $130 million USD), reflecting the combined financial strength of its operations and investments.

- Subsidiary Revenue: Contributions from Hana WLS and HanaMaterials are integral to overall revenue.

- Strategic Investment Returns: Income generated from strategic partnerships and equity stakes provides an additional revenue stream.

- Consolidated Performance: Financial results accurately represent the aggregated performance of all affiliated entities.

- 2024 Financial Snapshot: Q1 2024 consolidated revenue stood at approximately ₩180 billion.

Hana Micron's revenue streams are multifaceted, primarily driven by semiconductor packaging and testing services. Advanced packaging for AI and HPC, such as 2.5D and 3D solutions, commands premium pricing. Turnkey solutions bundling testing and packaging offer consolidated revenue, reflecting strong market demand for integrated services.

| Revenue Stream | Description | Key Drivers | 2024 Relevance |

|---|---|---|---|

| Semiconductor Packaging | Advanced techniques like flip-chip, SiP, wafer-level packaging. | Per-unit basis, negotiated contracts for large projects. | High demand for AI/HPC enabling technologies. |

| Semiconductor Testing | Wafer and final testing, electrical and functional assurance. | Testing volume, complexity, specific client requirements. | Crucial for quality assurance in advanced chip manufacturing. |

| Turnkey Solutions | Integrated testing, packaging, and final testing. | Streamlined process for clients, predictable revenue. | Increasing adoption for efficiency in chip production. |

| Subsidiary Operations | Contributions from Hana WLS (wafer-level) and HanaMaterials (silicon wafers). | Synergistic opportunities within the HANA Micron ecosystem. | Diversified revenue base and material supply chain control. |

| Strategic Investments | Returns from equity stakes and partnerships. | Capitalizing on emerging technological trends. | Adds financial flexibility and exposure to new markets. |

Business Model Canvas Data Sources

The HANA Micron Business Model Canvas is built using a blend of internal financial data, customer feedback, and market intelligence reports. This comprehensive approach ensures each component accurately reflects our operational realities and strategic objectives.