HANA Micron PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HANA Micron Bundle

Navigate the complex external landscape impacting HANA Micron with our expert PESTEL Analysis. Understand how political stability, economic shifts, and technological advancements are shaping the semiconductor industry. Equip yourself with crucial intelligence to anticipate challenges and seize opportunities. Download the full analysis now and gain a decisive market advantage.

Political factors

Geopolitical tensions, especially the ongoing US-China trade friction and export controls, significantly impact the semiconductor sector, a critical area for Hana Micron. These global dynamics can disrupt supply chains and restrict market access, creating uncertainty for companies operating in this space.

South Korea, where Hana Micron is based, is actively addressing these challenges. The government is implementing domestic support measures and encouraging the diversification of production networks to build resilience against external shocks.

For instance, in 2024, South Korea announced substantial investments in its domestic semiconductor ecosystem, aiming to reduce reliance on foreign suppliers and bolster national technological sovereignty. This strategic move is designed to provide a more stable operating environment for companies like Hana Micron.

The South Korean government's commitment to the semiconductor sector is a significant political factor. Initiatives like the K-CHIPS Act are designed to provide substantial tax credits for research and development and facility investments, alongside efforts to simplify regulatory processes.

These policies are crucial for strengthening the domestic semiconductor ecosystem. They include significant financial backing and strategic moves to attract skilled talent, directly benefiting companies like HANA Micron that operate within South Korea.

Governments globally are increasingly prioritizing semiconductor manufacturing as a critical component of national security. This has spurred significant investment in domestic production capabilities, aiming to reduce reliance on foreign suppliers. For instance, the US CHIPS and Science Act, enacted in 2022, allocated over $52 billion to incentivize semiconductor manufacturing and research within the United States.

This global push for supply chain resiliency presents a dual-edged sword for companies like Hana Micron. On one hand, it opens avenues for new facility development and strategic partnerships in regions actively seeking to bolster their semiconductor ecosystems. On the other hand, it can lead to increased competition and potential trade barriers as nations champion their own domestic industries, impacting global investment decisions and market access.

International Trade Agreements and Tariffs

Changes in international trade agreements and the potential for new tariffs, particularly those discussed by figures like former US President Trump, can significantly influence the cost of imported goods and essential raw materials for semiconductor manufacturing. Hana Micron, operating as a global entity, must diligently track these evolving trade policies to accurately assess their impact on its pricing strategies and overall market competitiveness.

For instance, the ongoing trade tensions between major economies could lead to increased duties on components or finished products, directly affecting Hana Micron's cost of goods sold. The semiconductor industry relies heavily on a global supply chain, making it particularly vulnerable to protectionist measures.

- Global Semiconductor Trade Value: The global semiconductor market was valued at approximately $600 billion in 2023 and is projected to reach over $1 trillion by 2030, highlighting the significant volume of international trade involved.

- Potential Tariff Impact: A hypothetical 10% tariff on imported semiconductor manufacturing equipment could add billions to industry costs annually, impacting companies like Hana Micron.

- Supply Chain Vulnerability: Disruptions caused by trade disputes can lead to shortages of critical materials, such as specialty chemicals or advanced packaging substrates, essential for Hana Micron's operations.

Regulatory Environment and Compliance

The political climate significantly influences Hana Micron's operational landscape through its impact on regulations. For instance, evolving environmental standards, such as those concerning semiconductor manufacturing waste, necessitate ongoing investment in compliance technologies and processes. In 2024, global semiconductor trade policies continued to be a focal point, with nations implementing measures to bolster domestic production, potentially affecting Hana Micron's supply chain and market access.

Navigating diverse national and international regulations presents a considerable challenge for a company with Hana Micron's global footprint. Intellectual property protection, a critical concern in the technology sector, varies considerably by jurisdiction, requiring robust legal strategies to safeguard innovations. The Semiconductor Industry Association reported in early 2025 that compliance costs for advanced manufacturing facilities can add several percentage points to overall operational expenses.

Key regulatory considerations for Hana Micron include:

- Semiconductor manufacturing environmental standards: Adherence to regulations concerning water usage, chemical disposal, and emissions.

- Intellectual property laws: Protecting patents and trade secrets across different countries.

- Trade policies and tariffs: Managing the impact of import/export duties and trade agreements on raw materials and finished goods.

- Data privacy regulations: Compliance with laws like GDPR and similar frameworks for customer and operational data.

Government support for the semiconductor industry remains a dominant political factor. South Korea's K-CHIPS Act, providing tax credits and regulatory simplification, aims to bolster domestic capabilities, directly benefiting companies like Hana Micron. This national focus on technological sovereignty is evident in 2024 investments designed to reduce reliance on foreign suppliers.

Global geopolitical tensions, particularly US-China trade friction, continue to shape semiconductor supply chains. These dynamics necessitate diversification strategies, as highlighted by South Korea's efforts to build resilience against external shocks. The Semiconductor Industry Association noted in early 2025 that compliance costs for advanced manufacturing facilities can add several percentage points to operational expenses.

International trade agreements and potential tariffs pose risks to Hana Micron's cost structure and market access. The semiconductor sector's reliance on global supply chains makes it vulnerable to protectionist measures, impacting the cost of raw materials and equipment. The global semiconductor market, valued around $600 billion in 2023, underscores the scale of these trade-related impacts.

What is included in the product

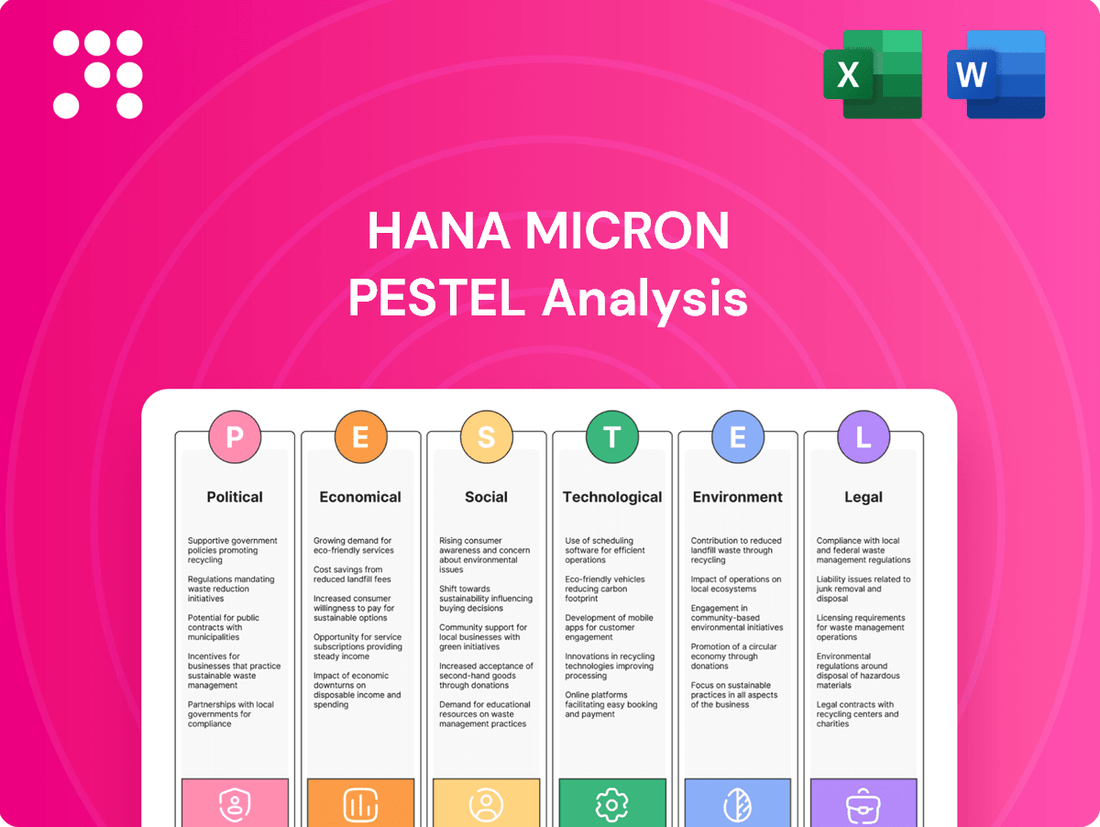

The HANA Micron PESTLE analysis comprehensively examines the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This detailed evaluation provides actionable insights for strategic decision-making, enabling HANA Micron to anticipate challenges and capitalize on emerging opportunities.

Provides a concise version of the HANA Micron PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The global semiconductor market is on a robust upward trajectory, with projections indicating sales could hit a record $700 billion in 2025. This surge is largely fueled by the insatiable demand for technologies powering artificial intelligence, advanced computing, and the widespread adoption of 5G networks.

For Hana Micron, a specialist in semiconductor packaging and testing, this market expansion translates into significant growth potential. The company is well-positioned to capitalize on the increasing need for sophisticated packaging solutions that support the high-performance chips essential for these burgeoning tech sectors.

The burgeoning demand for consumer electronics, such as smartphones and personal computers, is a significant driver for Hana Micron. In 2024, global smartphone shipments were projected to reach 1.17 billion units, a 3.5% increase from the previous year, highlighting continued consumer appetite for these devices.

Furthermore, the exponential growth in AI accelerators and data centers presents a substantial opportunity. The AI hardware market alone was valued at approximately $20 billion in 2023 and is expected to grow at a CAGR of over 35% through 2030, according to various market research reports. These sectors are voracious consumers of the memory, System-on-Chip (SoC), and integrated circuits that Hana Micron specializes in packaging and testing.

Global inflation, hovering around 4.8% in early 2024 according to IMF projections, coupled with fluctuating interest rates, directly impacts consumer purchasing power and the overall economic climate. This, in turn, affects the demand for semiconductor products, a key component for Hana Micron's offerings.

Hana Micron must closely track these macroeconomic shifts. For instance, a continued rise in interest rates could increase borrowing costs for the company and its clients, potentially delaying investment in new technologies and dampening demand for advanced memory solutions throughout 2024 and into 2025.

Capital Expenditures and Investment Trends

The semiconductor industry is inherently capital-intensive, with significant investments needed for cutting-edge fabrication plants and research into next-generation technologies. These expenditures are crucial for maintaining a competitive edge and meeting the ever-increasing global demand for chips.

Industry forecasts for 2025 point to sustained, high levels of capital investment. For instance, global semiconductor capital expenditures were projected to reach around $200 billion in 2024, with a significant portion of this continuing into 2025, driven by the need to expand manufacturing capacity and develop advanced nodes. This trend creates substantial opportunities for companies like Hana Micron that provide essential services and solutions within this ecosystem.

- Global semiconductor capital expenditures: Projected to remain robust in 2025, following an estimated $200 billion in 2024.

- Key investment drivers: Expansion of manufacturing capacity and development of advanced semiconductor nodes.

- Opportunity for Hana Micron: Increased demand for services supporting facility expansion and technology upgrades.

Supply Chain Resilience and Inventory Levels

Maintaining robust supply chains is paramount for semiconductor manufacturers like HANA Micron, particularly given ongoing geopolitical uncertainties. These disruptions can significantly impact production schedules and component availability.

Market-wide inventory normalization is anticipated to stimulate fresh demand in 2025. As businesses work to bring their stock levels back to optimal ranges, this trend is expected to foster a more positive market sentiment.

- Supply Chain Disruptions: Geopolitical events, such as trade restrictions and regional conflicts, continue to pose risks to global semiconductor supply chains, affecting raw material sourcing and finished goods distribution.

- Inventory Correction: Following a period of oversupply in certain segments, many tech companies are actively managing their inventory levels, which is expected to create buying opportunities as demand recovers.

- Market Outlook: Analysts project a gradual improvement in semiconductor demand throughout 2025, driven by the need for companies to replenish depleted or imbalanced inventory, signaling a potential rebound for the industry.

Economic factors present a dual-edged sword for Hana Micron. While the projected $700 billion global semiconductor sales in 2025, driven by AI and 5G, offer immense opportunity, inflation around 4.8% in early 2024 and fluctuating interest rates could dampen consumer spending and increase borrowing costs. The industry's capital-intensive nature, with an estimated $200 billion in global semiconductor capital expenditures in 2024, requires significant investment, which could be strained by tighter monetary policy.

Inventory normalization is anticipated to spur demand in 2025, as companies replenish stock. However, geopolitical uncertainties continue to pose risks to supply chains, potentially impacting Hana Micron's operational efficiency and component availability. Navigating these economic currents effectively will be crucial for Hana Micron to leverage the sector's growth while mitigating potential headwinds.

| Economic Factor | 2024 Projection/Status | 2025 Outlook | Impact on Hana Micron |

|---|---|---|---|

| Global Semiconductor Sales | On track for strong growth | Projected to reach $700 billion | Increased demand for packaging & testing services |

| Inflation (Global) | Around 4.8% (early 2024) | Uncertain, potential moderation | May affect consumer spending and chip demand |

| Interest Rates | Fluctuating | Monitored closely | Impacts borrowing costs and investment decisions |

| Capital Expenditures (Semiconductor Industry) | Estimated $200 billion | Sustained high levels | Opportunities in supporting facility expansion & tech upgrades |

| Inventory Levels | Normalization expected | Stimulate fresh demand | Creates buying opportunities as demand recovers |

Same Document Delivered

HANA Micron PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of HANA Micron.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting HANA Micron.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for HANA Micron.

Sociological factors

The semiconductor industry is grappling with a significant global talent deficit, especially for highly skilled engineers and specialized technicians. This shortage poses a direct risk to growth trajectories within the sector. For instance, reports from 2024 indicated a projected shortfall of over 100,000 skilled workers in the U.S. semiconductor workforce by 2030, underscoring the urgency of the situation.

Hana Micron, like its industry peers, must proactively tackle this challenge. Strategic investments in comprehensive workforce development programs, including robust upskilling and reskilling initiatives, are crucial. Furthermore, broadening recruitment efforts to tap into diverse and often underutilized talent pools will be essential to meet the escalating demand for specialized expertise in the coming years.

Consumer demand is increasingly leaning towards devices that are not just smart, but also deeply integrated into our lives. Think about the growing popularity of AI-powered personal assistants and the seamless connectivity offered by the Internet of Things (IoT). This shift means a greater need for sophisticated semiconductors that can handle complex processing and data management.

The rollout of 5G technology is a major catalyst here, enabling faster communication and more responsive applications. For a company like Hana Micron, this translates into a demand for advanced packaging solutions that can support the higher performance and miniaturization required by next-generation smartphones, wearables, and smart home devices. For instance, the global 5G infrastructure market, which directly fuels device demand, was projected to reach $147.4 billion in 2024, highlighting the scale of this technological transformation.

Employee retention is a significant challenge across the tech industry, with studies in late 2024 indicating that over 30% of tech workers consider leaving their jobs annually due to limited career advancement or rigid work structures. Hana Micron's commitment to fostering a supportive workplace, emphasizing career development and offering flexible work arrangements, directly addresses this trend, aiming to boost its employee retention rates.

The company's dedication to sustainable growth and transparent communication with all stakeholders, including its employees, mirrors a broader industry shift. In 2025, surveys show that companies prioritizing employee well-being and diversity are 25% more likely to attract top talent and experience lower turnover compared to their less inclusive counterparts.

Demographic Shifts and Aging Workforce

The semiconductor industry, including companies like HANA Micron, faces the challenge of an aging workforce in key manufacturing regions. This demographic trend can strain talent availability, as experienced engineers and technicians approach retirement.

To counter this, HANA Micron and its peers must implement proactive strategies. These include robust recruitment drives targeting younger talent pools and developing comprehensive retention programs for their seasoned employees. Such initiatives are crucial for maintaining a skilled labor pipeline.

- Talent Gap: Reports indicate a growing shortage of skilled labor in advanced manufacturing, with the semiconductor sector being particularly affected.

- Retirement Trends: A significant percentage of experienced semiconductor professionals are projected to retire in the coming years, exacerbating the talent crunch.

- Investment in Training: Companies are increasing investment in apprenticeship and upskilling programs to bridge the knowledge gap left by retiring workers and train new entrants.

Social Responsibility and Ethical Practices

Consumers and investors are increasingly demanding that companies act responsibly and ethically. This includes looking closely at how workers are treated and whether supply chains are transparent. For Hana Micron, this means their reputation and the trust stakeholders place in them are directly tied to these social factors. For instance, in 2024, a significant percentage of global investors indicated that ESG (Environmental, Social, and Governance) factors heavily influence their investment decisions, with social aspects like labor practices being a key concern.

Hana Micron's focus on creating social value and proactively managing risks is a smart move. This commitment resonates with the growing trend of integrating ESG principles into core business strategies. By prioritizing these areas, Hana Micron not only mitigates potential reputational damage but also positions itself favorably in a market where social consciousness is becoming a critical differentiator. Reports from 2024 highlight that companies with strong ESG performance often experience better financial returns and lower cost of capital.

- Consumer Demand: A 2024 survey found that over 60% of consumers are more likely to purchase from brands that demonstrate strong ethical practices.

- Investor Focus: ESG investments reached trillions of dollars globally by early 2025, with social factors playing a crucial role in fund allocation.

- Supply Chain Scrutiny: Incidents of supply chain disruptions due to labor issues in 2024 led to significant financial losses for several major corporations, emphasizing the need for transparency.

- Hana Micron's Alignment: The company's stated commitment to social value aligns with these market trends, aiming to build long-term stakeholder trust.

Sociological factors significantly impact Hana Micron's operational landscape, particularly concerning talent acquisition and retention. The industry faces a pronounced global talent deficit, with projections in 2024 indicating a shortfall of over 100,000 skilled workers in the U.S. semiconductor sector by 2030, directly affecting growth. Furthermore, employee retention remains a critical challenge; by late 2024, over 30% of tech workers considered leaving their jobs annually due to limited career advancement or rigid structures.

Consumer and investor expectations are increasingly shaped by corporate social responsibility. In 2024, a substantial portion of global investors stated that ESG factors, including labor practices, heavily influence their decisions, with ESG investments reaching trillions by early 2025. This trend means Hana Micron's commitment to social value and transparent labor practices is vital for building stakeholder trust and mitigating reputational risks.

| Sociological Factor | Impact on Hana Micron | Supporting Data (2024/2025) |

|---|---|---|

| Talent Shortage | Hinders expansion and innovation due to lack of skilled engineers. | Projected U.S. semiconductor workforce deficit of >100,000 by 2030. |

| Employee Retention | Increases operational costs and reduces productivity. | >30% of tech workers consider leaving jobs annually (late 2024). |

| Social Responsibility Demand | Affects brand reputation and investor confidence. | >60% of consumers favor ethical brands (2024 survey); ESG investments in trillions (early 2025). |

Technological factors

Advancements in advanced packaging, such as 2.5D/3D integration and hybrid bonding, are critical for pushing past the slowdowns in traditional Moore's Law scaling. These technologies are essential for boosting performance in demanding areas like high-performance computing (HPC) and artificial intelligence (AI). Hana Micron, as a key player in semiconductor packaging services, must integrate these cutting-edge solutions to maintain its competitive edge in the rapidly evolving market.

The surge in Artificial Intelligence (AI) and High-Performance Computing (HPC) is a significant technological driver, directly fueling demand for advanced semiconductor solutions. Hana Micron's expertise in memory, System-on-Chip (SoC), and integrated circuit packaging is critical for powering these increasingly complex applications.

For instance, the global AI chip market was projected to reach over $100 billion by 2026, with HPC infrastructure being a major contributor to this growth. Hana Micron's advanced packaging technologies are essential for integrating the high-density memory and processing units required for AI training and inference, as well as for HPC simulations.

The relentless drive for smaller, more powerful devices is fueling miniaturization and heterogeneous integration, where different chips like processors and memory are combined into a single package. This trend is particularly strong in areas like advanced mobile devices and AI accelerators, demanding cutting-edge packaging solutions.

Hana Micron's comprehensive offerings, from wafer testing to advanced assembly, are essential for enabling these complex, integrated designs. For instance, their advanced packaging technologies are crucial for high-density interconnect (HDI) substrates and 2.5D/3D packaging, which are key to achieving the performance gains required by next-generation electronics.

Automation and Manufacturing Process Innovation

Hana Micron's commitment to manufacturing competitiveness hinges on its adoption of automation and advanced process control. These technologies are vital for the high-volume semiconductor industry, directly impacting precision, production speed, and the overall yield of finished products. By integrating these innovations, Hana Micron aims to streamline its operations and deliver more efficient services to its clients.

The semiconductor sector is increasingly reliant on sophisticated automation to manage complex manufacturing workflows. For instance, in 2024, the global semiconductor manufacturing equipment market was projected to reach over $130 billion, with a significant portion driven by automation solutions. Hana Micron's strategic investments in this area are therefore critical for maintaining its edge.

- Automation: Enhancing precision and speed in semiconductor fabrication processes.

- Process Control: Innovations in real-time monitoring and adjustment to boost yield.

- Competitiveness: Direct link between technological adoption and market position.

- Industry Trend: Semiconductor equipment market growth underscores the importance of automation.

Development of New Materials and Interconnects

The semiconductor industry is seeing rapid advancements in materials science, with innovations like glass interposers and copper-copper hybrid bonding poised to revolutionize chip packaging. These new interconnect technologies offer improved performance and density for next-generation devices.

Hana Micron must actively integrate these cutting-edge material and interconnect solutions into its service portfolio. This strategic adoption is crucial for the company to remain competitive and meet the evolving demands of advanced semiconductor manufacturing. For instance, the global semiconductor market was valued at approximately $584 billion in 2023 and is projected to reach $1.1 trillion by 2030, highlighting the significant growth potential and the need for technological adaptation.

- Glass Interposers: Offering superior electrical performance and thermal management compared to traditional silicon interposers.

- Copper-Copper Hybrid Bonding: Enabling finer pitch interconnects and higher density packaging, critical for advanced heterogeneous integration.

- Market Demand: The increasing complexity of AI chips, advanced computing, and mobile devices drives the need for these next-generation packaging solutions.

Technological advancements are reshaping the semiconductor landscape, with a strong emphasis on heterogeneous integration and advanced packaging solutions like 2.5D/3D integration and hybrid bonding. These innovations are crucial for overcoming the limitations of traditional Moore's Law scaling, directly impacting the performance of AI and HPC applications. Hana Micron's role in delivering these sophisticated packaging services is paramount to its competitive standing.

The escalating demand for AI and HPC capabilities is a primary technological catalyst, driving the need for advanced semiconductor solutions. Hana Micron's expertise in memory, SoC, and IC packaging is indispensable for powering these increasingly sophisticated systems. The global AI chip market, projected to exceed $100 billion by 2026, underscores this trend, with HPC infrastructure being a significant contributor.

Miniaturization and the integration of diverse chip types into single packages are key technological trends, particularly for advanced mobile devices and AI accelerators. Hana Micron's comprehensive packaging services, including wafer testing and advanced assembly, are vital for enabling these complex, integrated designs. Their work with HDI substrates and 2.5D/3D packaging is central to achieving the performance gains required by next-generation electronics.

Automation and advanced process control are fundamental to manufacturing competitiveness in the high-volume semiconductor industry, directly influencing precision, production speed, and yield. Hana Micron's investments in these areas are critical for streamlining operations and enhancing service efficiency. The global semiconductor manufacturing equipment market, projected to exceed $130 billion in 2024, highlights the significant role of automation.

| Technological Factor | Description | Impact on Hana Micron | Market Relevance (2024-2025) |

| Advanced Packaging | 2.5D/3D integration, hybrid bonding | Enables higher performance for AI/HPC, competitive necessity | Critical for meeting next-gen device demands |

| AI & HPC Demand | Increased need for powerful chips | Drives demand for Hana Micron's packaging expertise | AI chip market projected >$100B by 2026 |

| Miniaturization & Integration | Combining diverse chip types | Requires advanced packaging solutions from Hana Micron | Key for advanced mobile and AI accelerators |

| Automation & Process Control | Enhancing manufacturing efficiency | Improves precision, speed, and yield for Hana Micron | Semiconductor equipment market >$130B in 2024 |

Legal factors

Intellectual property protection is paramount for Hana Micron in the fiercely competitive semiconductor sector, particularly with ongoing geopolitical tensions. Navigating intricate IP laws is essential to secure innovations in advanced packaging and testing services, a market projected to reach $100 billion by 2028. Failure to adequately safeguard proprietary technologies could lead to significant financial and market share losses.

Data privacy and security regulations are increasingly critical for Hana Micron, especially as semiconductors are embedded in more devices. For instance, the European Union's General Data Protection Regulation (GDPR) sets a high bar for data protection, impacting how companies handle personal data. Hana Micron must ensure its operations, from design to manufacturing, comply with these evolving global standards to maintain trust and avoid significant penalties.

International trade regulations and export controls, especially concerning advanced semiconductor technology, significantly shape global supply chains and market access for companies like Hana Micron. These intricate rules can dictate Hana Micron's capacity to operate in specific regions or acquire essential materials and equipment, directly affecting its operational flexibility and market reach.

For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continually updates its export control lists, impacting the flow of sensitive technologies. In October 2023, further restrictions were placed on advanced chip manufacturing equipment and certain AI chips destined for China, a key market for many semiconductor players. Hana Micron must navigate these evolving regulations to ensure compliance and maintain its competitive edge in the global market.

Labor Laws and Employment Regulations

Hana Micron must navigate a complex web of labor laws across its global operations. Ensuring compliance with minimum wage standards, working hour limits, and employee benefits is paramount. For instance, in South Korea, where Hana Micron has significant operations, the minimum wage for 2024 is set at 9,860 KRW per hour, a 2.5% increase from the previous year, impacting labor costs.

The semiconductor industry faces a persistent talent shortage, making adherence to fair talent acquisition practices crucial. This includes transparent hiring processes and competitive compensation to attract and retain skilled workers. In 2024, the global demand for semiconductor engineers was projected to exceed supply by over 30%, highlighting the competitive landscape for talent.

Key legal considerations for Hana Micron include:

- Compliance with local minimum wage laws and overtime regulations in all operating regions.

- Adherence to health and safety standards to ensure safe working conditions for all employees.

- Ensuring fair employment practices, including non-discrimination in hiring and promotion.

- Managing employee contracts and termination procedures according to legal requirements.

Environmental Compliance and Industry-Specific Regulations

Environmental compliance is a significant legal hurdle for semiconductor manufacturers like Hana Micron. The industry faces strict rules regarding air emissions, water consumption, and the disposal of hazardous materials. For instance, regulations like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) dictate the materials used in electronic components, impacting supply chains and manufacturing processes.

Hana Micron must navigate a complex web of environmental legislation to operate legally and sustainably. Proactive adoption of eco-friendly practices not only ensures compliance but also mitigates potential fines and reputational damage. The company's commitment to environmental stewardship is crucial for long-term operational viability and stakeholder trust.

- RoHS and REACH Compliance: Adherence to regulations limiting the use of hazardous substances in electronics, directly impacting material sourcing and product design.

- Emissions Standards: Meeting stringent air and water quality standards, requiring investment in advanced pollution control technologies.

- Waste Management: Implementing robust protocols for handling and disposing of chemical waste generated during semiconductor fabrication, a critical area for environmental protection.

- Water Usage Restrictions: Complying with regulations on water intake and discharge, particularly in water-scarce regions where many semiconductor facilities are located.

Hana Micron operates within a stringent legal framework governing intellectual property, data privacy, and international trade, particularly concerning advanced technologies. Compliance with regulations like GDPR and evolving export controls, such as those from the U.S. BIS impacting China, is crucial for market access and avoiding penalties. Navigating these complex legal landscapes directly influences Hana Micron's operational strategies and global competitiveness.

Environmental factors

The semiconductor industry, including companies like Hana Micron, is under growing scrutiny for its environmental impact. Manufacturing semiconductors is an energy-intensive process, contributing significantly to global carbon emissions. For instance, the production of a single chip can require substantial amounts of electricity, often sourced from fossil fuels.

Hana Micron, in line with industry trends and global sustainability mandates, is actively working to mitigate its carbon footprint. The company's sustainability reports detail efforts to improve energy efficiency in its manufacturing facilities and explore renewable energy sources. This focus is driven by both regulatory pressures and increasing investor demand for environmentally responsible operations, aiming to align with net-zero targets by 2050.

Semiconductor manufacturing, including processes used by companies like Hana Micron, is incredibly water-intensive. Fabricating chips demands massive quantities of ultrapure water, raising significant environmental concerns, especially in areas already facing water shortages. For instance, the global semiconductor industry is projected to consume billions of gallons of water annually, a figure expected to rise with increased production.

Hana Micron, operating in regions that may experience water stress, needs robust strategies for water management. This includes implementing advanced water recycling technologies within its fabrication plants to minimize fresh water intake. Initiatives focused on water conservation and replenishing local water sources are crucial for ensuring long-term operational viability and environmental responsibility.

The semiconductor industry, including companies like Hana Micron, is a significant contributor to waste, particularly hazardous chemicals and electronic waste (e-waste). In 2023, the global e-waste generation reached an estimated 62 million metric tons, according to the UN's Global E-waste Monitor 2024. Effective waste management is therefore paramount.

Hana Micron's proactive approach to diverting waste from landfills and embracing circular economy principles is not just about environmental responsibility; it's also a strategic alignment with growing global sustainability demands. This focus is increasingly important as regulatory pressures and investor expectations around ESG (Environmental, Social, and Governance) factors continue to rise.

Use of Hazardous Materials and Pollution Control

The semiconductor industry, including companies like Hana Micron, relies on a variety of hazardous chemicals for its manufacturing processes. These can include strong acids, solvents, and etching gases, which, if not managed meticulously, pose significant risks to both air and water quality. For instance, the Environmental Protection Agency (EPA) reported in 2023 that semiconductor fabrication plants are among the largest industrial users of certain volatile organic compounds (VOCs).

Hana Micron must therefore prioritize the implementation of stringent pollution control technologies. This includes advanced wastewater treatment systems capable of neutralizing or removing harmful chemicals before discharge, as well as sophisticated air filtration and scrubbing systems to capture emissions. The company's commitment to environmental stewardship is crucial, especially as regulatory bodies worldwide are tightening emission standards. Reports from early 2024 indicate increased scrutiny on industrial emissions, with potential fines for non-compliance.

Furthermore, a forward-thinking approach involves actively researching and adopting less hazardous chemical alternatives. This not only reduces environmental impact but can also lead to safer working conditions and potentially lower waste disposal costs. The drive towards greener chemistry within the semiconductor sector is gaining momentum, with industry collaborations aiming to develop sustainable material alternatives by 2025.

Key considerations for Hana Micron regarding hazardous materials and pollution control include:

- Investment in state-of-the-art wastewater treatment facilities.

- Deployment of advanced air emission control technologies.

- Ongoing research and development into safer, alternative chemical compounds.

- Ensuring strict adherence to evolving environmental regulations and reporting requirements.

Energy Consumption and Renewable Energy Adoption

Semiconductor manufacturing, including operations like those at Hana Micron, is notoriously energy-intensive. This reality is driving a significant push towards adopting renewable energy sources to power these facilities. For instance, the International Energy Agency (IEA) reported in 2024 that the semiconductor industry's energy demand is projected to rise substantially, making the transition to cleaner power critical for sustainability goals.

Hana Micron is actively investigating and implementing cleaner energy technologies to mitigate its environmental footprint. This strategic shift aims to reduce reliance on traditional, carbon-emitting power sources for its manufacturing processes. By exploring options like solar and wind power, Hana Micron is aligning its operations with global sustainability trends and regulatory pressures, as evidenced by increasing corporate commitments to renewable energy targets observed throughout 2024 and into 2025.

- Industry Energy Demand: The global semiconductor industry's energy consumption is expected to grow significantly, highlighting the urgency for renewable energy adoption.

- Hana Micron's Strategy: The company is exploring and adopting cleaner energy technologies to power its operations and reduce environmental impact.

- Sustainability Focus: This shift contributes to a more sustainable manufacturing process, aligning with broader environmental goals and corporate responsibility initiatives.

The semiconductor industry, including Hana Micron, faces increasing environmental scrutiny due to its significant energy and water consumption. Manufacturing chips is energy-intensive, contributing to carbon emissions, with the industry's energy demand projected to rise substantially by 2030. Hana Micron is actively pursuing renewable energy sources and improving energy efficiency in its facilities to address this, aligning with global net-zero targets.

PESTLE Analysis Data Sources

Our PESTLE Analysis for HANA Micron is built upon a robust foundation of data from leading economic indicators, technological trend reports, and government regulatory databases. We integrate insights from industry-specific market research and geopolitical analyses to ensure comprehensive coverage.