China Steel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Steel Bundle

China Steel's market position is shaped by its significant production capacity and technological advancements, but it also faces intense global competition and fluctuating raw material prices. Understanding these dynamics is crucial for anyone looking to invest or strategize within the steel industry.

Want the full story behind China Steel's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

China Steel Corporation (CSC) stands as Taiwan's premier integrated steel producer, boasting substantial production capacity and significant economies of scale. This leadership position translates into considerable market influence, particularly within Taiwan and across the wider Asian steel sector.

CSC's dominant market share allows for competitive pricing strategies and highly efficient operational management. For instance, in 2023, CSC reported consolidated revenues of NT$519.4 billion (approximately US$16.2 billion), underscoring its vast operational scale and market reach.

The company's ability to meet large-scale industrial demands efficiently solidifies its robust market presence. This scale is crucial for serving a diverse clientele and maintaining its competitive edge in a dynamic global market.

China Steel boasts a wide array of steel products, from plates and bars to coils and specialized electrical steels. This extensive range serves diverse sectors like construction, automotive, and shipbuilding, creating multiple revenue streams and lessening dependence on any single market. For instance, in 2023, China Steel's revenue from its various product segments demonstrated this breadth, with flat products contributing significantly to its overall sales.

As a state-owned enterprise, China Steel Corporation (CSC) enjoys significant government backing, translating into financial stability and easier access to capital for major initiatives. This support is crucial for undertaking large-scale projects and weathering economic downturns, offering a buffer against market fluctuations. For instance, in 2024, the Taiwanese government continues to prioritize industrial development, which directly benefits CSC's strategic positioning in national infrastructure and key economic sectors.

Strong Regional Market Share

China Steel Corporation (CSC) commands a robust regional market share, particularly within Asia. This strong foothold allows CSC to efficiently utilize established trade routes and intricate supply chains across the continent. For instance, in 2023, CSC's sales volume reached approximately 13.5 million metric tons, with a significant portion attributed to its Asian operations, underscoring its regional dominance.

The company's deep-rooted presence and well-recognized brand across Asian markets grant it a distinct advantage over both local competitors and international steel producers. This recognized brand equity is a vital asset for sustaining sales volume and ensuring profitability amidst the intense competition characteristic of the global steel sector.

CSC's substantial market position in Asia directly translates to enhanced pricing power and greater influence in regional market dynamics. This strength is fundamental to navigating the cyclical nature of the steel industry and maintaining financial stability.

- Regional Dominance: CSC holds a significant share of the Asian steel market.

- Supply Chain Leverage: Its regional presence optimizes trade networks and supply chains.

- Brand Recognition: Established brand equity provides a competitive advantage.

- Sales Volume Stability: Strong market position helps maintain consistent sales and profitability.

Commitment to Sustainability and Carbon Reduction Goals

China Steel Corporation (CSC) has made significant strides in its commitment to sustainability and carbon reduction. The company has established ambitious targets, aiming for a 7% reduction in carbon emissions by 2025 compared to 2018 levels, escalating to a 25% reduction by 2030, and ultimately achieving carbon neutrality by 2050. This forward-thinking environmental strategy is further underscored by its status as a signatory to the World Steel Association's Sustainability Charter.

This proactive stance on environmental stewardship is a key strength for CSC, especially as global regulations tighten and the demand for green steel intensifies. By aligning its operations with international sustainability standards and setting clear, measurable reduction goals, CSC is well-positioned to navigate the evolving landscape of environmental compliance and market expectations for eco-friendly products.

- Carbon Reduction Targets: 7% by 2025, 25% by 2030 (from 2018 levels).

- Long-Term Vision: Carbon neutrality by 2050.

- Industry Endorsement: Signatory of the World Steel Association's Sustainability Charter.

- Market Advantage: Preparedness for increasing global environmental regulations and demand for green steel.

China Steel Corporation's integrated production model and economies of scale are significant strengths, allowing for efficient operations and competitive pricing. Its substantial market share, particularly in Asia, provides considerable leverage in negotiations and supply chain management.

The company's diverse product portfolio, catering to sectors like automotive and construction, ensures multiple revenue streams and resilience against market fluctuations. This breadth, exemplified by its 2023 revenue breakdown, highlights its ability to serve a wide customer base.

As a state-backed entity, CSC benefits from financial stability and easier capital access, crucial for undertaking large projects and navigating economic downturns. This government support, evident in ongoing industrial development priorities in 2024, bolsters its strategic positioning.

CSC's commitment to sustainability, including targets for carbon reduction and carbon neutrality by 2050, aligns with global trends and enhances its market appeal for green steel. This proactive environmental approach is a key differentiator in an increasingly regulated industry.

| Metric | 2023 Value (NT$ billions) | 2024 Outlook (General Trend) |

|---|---|---|

| Consolidated Revenue | 519.4 | Stable to Moderate Growth Expected |

| Sales Volume (Million Metric Tons) | ~13.5 | Continued Regional Demand Support |

| Carbon Emission Reduction Target (vs. 2018) | 7% by 2025 | On Track for Short-Term Goals |

What is included in the product

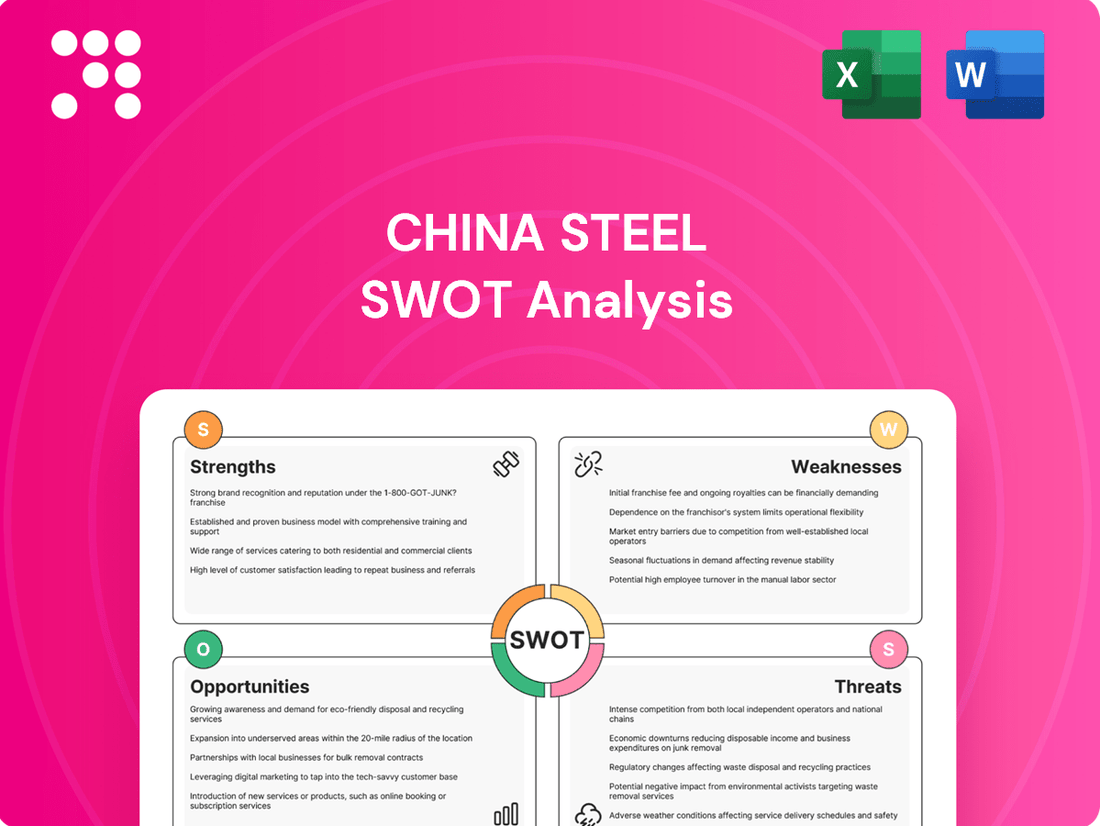

Analyzes China Steel’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address China Steel's competitive challenges and internal weaknesses, thereby alleviating strategic uncertainty.

Weaknesses

China Steel Corporation (CSC) is a major contributor to Taiwan's industrial carbon footprint, with its coal-dependent blast furnace operations being a primary source of CO2 emissions. In 2023, the steel industry globally accounted for approximately 7% of direct CO2 emissions, highlighting the scale of the challenge for companies like CSC.

The transition to greener steelmaking methods, such as hydrogen-based direct reduction or electric arc furnaces powered by renewable energy, necessitates substantial capital outlays and technological innovation. CSC faces the challenge of financing these extensive upgrades, potentially impacting its ability to fund these decarbonization efforts independently.

This decarbonization drive introduces significant operational cost risks, particularly as carbon pricing mechanisms like carbon levies and border adjustment mechanisms become more prevalent. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, could impose costs on imported steel with high embedded carbon, affecting CSC's export competitiveness.

China Steel Corporation (CSC) faces significant vulnerability due to its reliance on raw materials like iron ore and coking coal. The prices of these essential inputs are notoriously volatile, driven by global supply and demand dynamics. This price instability directly affects CSC's production costs, creating challenges for consistent profit margins and effective financial forecasting.

For instance, iron ore prices, which saw significant fluctuations in 2024, can dramatically alter CSC's cost structure. While CSC has secured stable raw material prices for early 2025, the unpredictable nature of the global commodity markets means this stability is not guaranteed long-term. This inherent risk makes strategic cost management and hedging crucial for maintaining financial health.

China Steel Corporation (CSC) faces a significant weakness due to its exposure to global trade protectionism. Increasingly, major economies are implementing trade barriers, including anti-dumping duties and tariffs, which can indirectly impact Taiwanese steel exports. This trend, particularly against Chinese steel, creates a challenging environment for the broader Asian market, potentially limiting CSC's export opportunities or necessitating price adjustments to stay competitive.

This rising protectionism injects considerable uncertainty into the market, posing a direct threat to CSC's market access. For instance, in 2023, the United States continued to maintain tariffs on steel imports from various countries, and while Taiwan has specific exemptions, shifts in global trade policy can have ripple effects. The International Monetary Fund (IMF) has repeatedly warned about the economic costs of escalating trade tensions, highlighting the potential for reduced global growth and trade volumes, which directly affects demand for steel.

Impact of Chinese Steel Oversupply

China's massive steel output, often exceeding domestic consumption, frequently spills into the global market, particularly affecting Asian prices. In 2024, China's crude steel production was projected to remain robust, contributing to a glut that suppresses regional benchmarks. This creates significant pressure on companies like China Steel Corporation (CSC) by intensifying price competition.

The influx of competitively priced Chinese steel directly challenges CSC's ability to maintain healthy profit margins. For instance, in early 2024, benchmark steel prices in Asia saw volatility influenced by these export volumes, making it harder for CSC to command premium pricing. This dynamic forces CSC to either absorb lower margins or risk losing market share to these lower-cost imports.

- Global Oversupply: China's steel production capacity significantly outstrips its domestic demand, leading to a surplus that is exported globally.

- Depressed Prices: This oversupply exerts downward pressure on steel prices, especially within the Asian market, impacting profitability for regional producers.

- Margin Erosion: CSC faces challenges in maintaining its profit margins due to intense price competition from lower-cost Chinese steel imports.

- Market Share Threat: The aggressive pricing of Chinese steel poses a risk to CSC's established market share, particularly in key export destinations.

Reliance on Traditional Steelmaking Processes

China Steel's continued reliance on traditional coal-based blast furnace-basic oxygen furnace (BF-BOF) processes presents a significant weakness. While many global competitors are actively investing in and adopting greener steelmaking technologies, China Steel's slower transition pace, especially in light of its carbon reduction targets, could hinder its long-term competitiveness. This adherence to older methods may result in escalating operational expenses as carbon pricing and environmental regulations become more rigorous, potentially impacting its market position in an industry increasingly prioritizing sustainability.

This reliance on established, yet carbon-intensive, production methods means China Steel could face increasing costs related to carbon emissions. For instance, as of early 2024, the global push for decarbonization in heavy industries is intensifying, with many regions implementing or planning to implement stricter carbon taxes. China Steel's operational costs could rise disproportionately compared to peers who have already made substantial investments in hydrogen-based direct reduced iron (DRI) or electric arc furnace (EAF) technologies, which offer lower carbon footprints.

- Slower adoption of green steelmaking technologies compared to international peers.

- Potential for higher operational costs due to increasing carbon pricing and environmental regulations.

- Risk of reduced long-term competitiveness in a market valuing sustainable production.

China Steel Corporation's (CSC) historical reliance on coal-fired blast furnaces is a significant weakness, especially as global decarbonization efforts accelerate. This traditional method, while cost-effective in the short term, carries a substantial environmental burden. For example, in 2023, steel production globally was responsible for approximately 2.6 billion tonnes of CO2 emissions, underscoring the industry's carbon intensity and the pressure on companies like CSC to transition.

The capital expenditure required for shifting to greener steelmaking technologies, such as hydrogen-based direct reduction or electric arc furnaces powered by renewable energy sources, is immense. CSC faces the challenge of securing the substantial funding needed for these technological overhauls, which could strain its financial resources and potentially delay its decarbonization timeline compared to competitors with greater access to capital.

Furthermore, CSC's operational costs are vulnerable to the increasing implementation of carbon pricing mechanisms worldwide. The European Union's Carbon Border Adjustment Mechanism (CBAM), set for full implementation in 2026, is a prime example. This mechanism could impose significant costs on imported steel with high embedded carbon, directly impacting CSC's export competitiveness and potentially necessitating costly process improvements to remain viable in key international markets.

CSC's dependence on volatile raw material markets, particularly iron ore and coking coal, presents a persistent weakness. Global commodity prices are subject to significant fluctuations driven by supply chain disruptions, geopolitical events, and demand shifts. For instance, iron ore prices experienced notable volatility throughout 2024, directly impacting CSC's production costs and making consistent financial forecasting a considerable challenge. While CSC has managed to secure stable raw material prices for early 2025, the long-term outlook remains uncertain, emphasizing the need for robust cost management and hedging strategies.

The company is also susceptible to global trade protectionism, with an increasing number of nations implementing tariffs and anti-dumping duties. While Taiwan has specific trade agreements, broader shifts in global trade policy can indirectly affect CSC's export markets. The International Monetary Fund (IMF) has consistently highlighted the economic risks associated with escalating trade tensions, including reduced global growth and trade volumes, which directly impact steel demand and CSC's market access.

China's substantial steel production, often exceeding domestic needs, leads to a global oversupply that depresses prices, particularly in the Asian market. In 2024, China's crude steel output was projected to remain high, contributing to this surplus. This influx of lower-cost Chinese steel intensifies price competition, challenging CSC's ability to maintain healthy profit margins and potentially eroding its market share.

China Steel's continued reliance on traditional blast furnace-basic oxygen furnace (BF-BOF) production methods is a notable weakness. While many international competitors are actively investing in and adopting lower-emission technologies like electric arc furnaces (EAFs) and hydrogen-based direct reduced iron (DRI), CSC's pace of transition could hinder its long-term competitiveness. This adherence to older, carbon-intensive processes may lead to escalating operational expenses as carbon pricing and environmental regulations become more stringent, potentially impacting its market position in an industry increasingly prioritizing sustainability.

The company's slower adoption of green steelmaking technologies compared to international peers is a significant concern. This could lead to higher operational costs as carbon pricing and environmental regulations tighten. For example, as of early 2024, the global push for decarbonization in heavy industries is intensifying, with many regions implementing or planning stricter carbon taxes. CSC's operational expenses could rise disproportionately compared to peers who have already invested heavily in EAF or DRI technologies, which offer substantially lower carbon footprints.

| Weakness | Description | Impact | Example/Data Point |

| Reliance on Coal-Based BF-BOF Processes | Continued use of traditional, carbon-intensive steelmaking methods. | Higher operational costs due to carbon pricing and environmental regulations; risk of reduced long-term competitiveness. | Global steel industry accounted for ~7% of direct CO2 emissions in 2023. |

| High Capital Expenditure for Green Transition | Significant investment required for adopting new, sustainable technologies. | Potential strain on financial resources; risk of delayed decarbonization efforts. | The cost of building a new green steel plant can run into billions of dollars. |

| Vulnerability to Raw Material Price Volatility | Dependence on iron ore and coking coal, whose prices fluctuate significantly. | Unpredictable production costs; challenges in financial forecasting and profit margin stability. | Iron ore prices saw significant fluctuations in 2024. |

| Exposure to Global Trade Protectionism | Impact of tariffs, anti-dumping duties, and trade barriers on exports. | Reduced market access; potential need for price adjustments to remain competitive. | IMF warnings about the economic costs of escalating trade tensions. |

| Intense Competition from Chinese Steel Oversupply | Pressure from lower-cost Chinese steel imports due to global oversupply. | Erosion of profit margins; threat to market share. | China's crude steel production remained robust in 2024, contributing to regional price suppression. |

Same Document Delivered

China Steel SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Significant infrastructure development projects across Asia are a major driver for steel demand. For instance, China's Belt and Road Initiative continues to spur construction, requiring vast quantities of steel for roads, bridges, and ports.

Potential reconstruction efforts in regions like Ukraine also represent a substantial opportunity. Following the conflict, the rebuilding process will necessitate a wide array of steel products for housing, critical infrastructure, and energy facilities, directly benefiting steel producers like China Steel Corporation (CSC).

CSC's diversified product portfolio, which includes everything from construction steel to specialized steel for automotive and machinery, is well-positioned to meet this varied demand. The global steel market is projected to see continued growth, with infrastructure spending expected to be a key contributor, especially in emerging economies.

The global drive towards decarbonization presents a significant opportunity for China Steel Corporation (CSC) to invest in and implement advanced green steel technologies. This strategic shift can bolster its environmental standing and cater to growing market demand for sustainable products.

By adopting methods like electric arc furnaces utilizing recycled steel or pioneering hydrogen-based steelmaking, CSC can significantly reduce its carbon footprint. This transition not only mitigates future carbon-related liabilities but also positions the company to meet the increasing global demand for low-carbon steel, a market projected to grow substantially in the coming years.

China Steel Corporation (CSC) has a significant opportunity to boost profitability by shifting its production focus towards high-value specialty steel products. This includes steels designed for demanding applications in sectors like advanced machinery, the rapidly growing electric vehicle (EV) market, and the renewable energy industry. These specialized materials typically command higher prices compared to standard commodity steel, offering improved profit margins.

By concentrating on these niche markets, CSC can effectively differentiate itself from competitors and reduce its vulnerability to the often-volatile pricing of bulk steel. For instance, the global market for specialty steel used in EVs alone was projected to reach over $30 billion by 2025, presenting a substantial growth avenue. This strategic pivot allows CSC to capture higher value and build a more resilient business model.

Leveraging AI and Emerging Technologies for Efficiency

Taiwan's robust economic expansion, fueled by advancements in AI and cutting-edge technologies, presents a significant opportunity for China Steel Corporation (CSC) to drive innovation. This technological surge can translate into smart manufacturing initiatives and substantial improvements in operational efficiency across CSC's facilities.

By integrating advanced automation and sophisticated data analytics, CSC can streamline its production processes. This optimization is projected to lead to cost reductions and a marked enhancement in product quality, thereby bolstering CSC's competitive position in the global market.

CSC can capitalize on these trends by:

- Investing in AI-powered predictive maintenance to minimize downtime and operational disruptions.

- Implementing robotic automation in high-risk or repetitive manufacturing tasks to improve safety and throughput.

- Utilizing big data analytics for real-time process monitoring and quality control, aiming for a 5% reduction in waste by 2025.

- Exploring the development of specialized steel products tailored for the high-tech manufacturing sector, which saw Taiwan's exports grow by 15% in the first half of 2024.

Increasing Global Focus on Supply Chain Resilience

The growing emphasis on supply chain resilience worldwide presents a significant opportunity for China Steel Corporation (CSC). Geopolitical shifts and recent global disruptions are driving nations to onshore production and secure more stable supply lines, a trend that directly benefits robust regional steel manufacturers.

This global push for localization means countries are actively seeking dependable domestic or nearby steel suppliers to reduce vulnerability to international volatility. CSC is well-positioned to capitalize on this by reinforcing its role as a key regional provider, thereby lessening dependence on potentially unstable or distant sourcing. For instance, in 2024, many nations increased their domestic steel production targets by 5-10% to bolster national security and economic stability.

- Strengthened Regional Market Share: CSC can leverage this trend to capture a larger share of the regional market as demand for localized steel intensifies.

- Reduced Geopolitical Risk: By aligning with national resilience strategies, CSC can mitigate its exposure to international trade disputes and shipping disruptions.

- Enhanced Investment Appeal: The focus on supply chain security makes CSC a more attractive investment as it plays a critical role in essential infrastructure and national economic stability.

China Steel Corporation (CSC) can capitalize on the global push for decarbonization by investing in green steel technologies like hydrogen-based steelmaking. This move not only reduces its environmental impact but also taps into the growing market for sustainable steel products, a segment projected for significant expansion. Furthermore, CSC has a prime opportunity to increase profitability by focusing on high-value specialty steels for sectors such as electric vehicles and renewable energy, which command higher prices and offer better margins than commodity steel.

Taiwan's technological advancements, particularly in AI, offer CSC a chance to boost operational efficiency through smart manufacturing initiatives. By integrating automation and data analytics, CSC can lower costs and improve product quality. The company can also benefit from the global trend towards supply chain resilience, as nations seek more localized and stable steel sources, strengthening CSC's position as a key regional supplier and reducing its exposure to international trade risks.

| Opportunity Area | Description | Potential Impact | Supporting Data (2024/2025 Projections) |

|---|---|---|---|

| Green Steel Technologies | Investment in hydrogen-based steelmaking and electric arc furnaces. | Reduced carbon footprint, enhanced marketability of sustainable products. | Global green steel market expected to grow significantly, with demand for low-carbon steel rising. |

| Specialty Steel Focus | Shifting production to high-value steels for EVs, advanced machinery, and renewables. | Improved profit margins, differentiation from competitors, reduced price volatility. | Global specialty steel market for EVs projected to exceed $30 billion by 2025. |

| Smart Manufacturing & AI | Implementing AI-powered predictive maintenance and robotic automation in Taiwan. | Cost reductions, improved operational efficiency, enhanced product quality, reduced waste. | Taiwan's high-tech sector export growth of 15% (H1 2024) indicates strong demand for advanced materials. Target of 5% waste reduction by 2025. |

| Supply Chain Resilience | Leveraging increased demand for localized steel supply. | Strengthened regional market share, mitigation of geopolitical risks, increased investment appeal. | Nations increasing domestic steel production targets by 5-10% in 2024 for economic stability. |

Threats

The global steel market is grappling with significant overcapacity, largely driven by China, which directly translates into fierce price competition. This situation puts considerable pressure on profit margins for all steel producers, including China Steel Corporation (CSC).

In 2024, global steel production was projected to reach 2.3 billion metric tons, with China accounting for over half of that output. This sheer volume exacerbates the oversupply, leading to depressed steel prices and challenging CSC's ability to maintain healthy profitability, even with its substantial production capacity.

The steel industry faces a significant headwind from escalating global trade protectionism. An increasing number of nations are implementing trade barriers, including anti-dumping duties and tariffs on steel imports. This trend directly impacts China Steel Corporation (CSC) by potentially restricting its access to key international markets.

For example, the imposition of new tariffs by countries like the United States, coupled with retaliatory measures from other regions, can severely disrupt established trade flows. This not only increases the cost of CSC's exports but also poses a direct threat to its international sales volume and profitability.

The steel industry's inherent cyclicality makes it particularly vulnerable to global economic shifts. For China Steel Corporation (CSC), a downturn in major economies or key sectors like China's real estate market directly translates to reduced steel demand, eroding sales volumes and pricing power.

Forecasting global steel demand in 2024 and 2025 reveals a complex picture, with some regions anticipating contractions. For instance, the World Steel Association projected global crude steel production to be around 1.85 billion tonnes in 2024, a slight decrease from 2023, reflecting these varied regional trends and the impact of economic slowdowns.

Increasing Environmental Regulations and Carbon Costs

China Steel faces increasing pressure from stricter environmental regulations. For instance, Taiwan's carbon fee, implemented in January 2025, directly impacts operational expenses through new levies. This trend extends globally with mechanisms like the Carbon Border Adjustment Mechanism (CBAM), which can impose costs on imports based on their carbon footprint.

These evolving environmental policies pose a significant threat. Failure to invest in and implement effective decarbonization strategies could result in higher taxes and fees. This would diminish China Steel's cost competitiveness compared to competitors who have successfully reduced their carbon intensity, potentially leading to a loss of market share.

- Rising Operational Costs: Carbon taxes and fees, like Taiwan's January 2025 implementation, directly increase production expenses.

- Reduced Competitiveness: Higher environmental compliance costs can make China Steel's products more expensive than those from less regulated or greener competitors.

- Market Share Erosion: Inability to adapt to decarbonization demands could lead to a loss of customers to environmentally conscious producers.

Volatile Raw Material and Energy Prices

While China Steel Corporation (CSC) might see some price stability in the short term, the long-term forecast for crucial inputs like iron ore and nickel, along with energy costs, remains uncertain. For instance, iron ore prices, which are a significant component of steel production costs, experienced fluctuations in 2024, with benchmarks like the Platts IODEX trading in a range that impacted profitability for many steelmakers.

These price swings are often driven by a mix of factors. Geopolitical tensions, ongoing supply chain snags, and shifts in global demand for steel and its raw materials can trigger rapid price hikes. Such increases directly squeeze CSC's production expenses, potentially leading to reduced profit margins if these costs cannot be fully passed on to customers.

The impact of volatile energy prices, particularly for electricity and natural gas used in steel manufacturing, further exacerbates this threat. For example, global energy markets in late 2024 and early 2025 continued to be influenced by supply concerns and geopolitical developments, keeping upward pressure on operational expenditures for energy-intensive industries like steel production.

- Iron Ore Price Volatility: Benchmark iron ore prices, a key cost driver for CSC, saw significant movement throughout 2024, impacting production cost structures.

- Energy Cost Pressures: Global energy markets in late 2024 and early 2025 presented persistent volatility, increasing operational expenses for steel manufacturing.

- Geopolitical and Supply Chain Risks: Ongoing geopolitical events and supply chain disruptions continue to pose a threat to stable raw material sourcing and pricing.

China Steel Corporation (CSC) faces significant threats from global overcapacity, which fuels intense price competition and squeezes profit margins. For instance, global steel production in 2024 was projected to exceed 2.3 billion metric tons, with China dominating output, further intensifying this pressure.

Escalating global trade protectionism, marked by tariffs and anti-dumping duties, poses a direct risk to CSC's market access. The imposition of new tariffs by major economies can disrupt established trade flows, increasing export costs and potentially reducing international sales volumes.

The steel industry's inherent cyclicality means CSC is vulnerable to global economic downturns, which reduce steel demand. For example, projected contractions in some regions for 2024, as indicated by a slight decrease in global crude steel production forecasts, highlight this sensitivity.

Stricter environmental regulations, such as Taiwan's carbon fee implemented in January 2025 and the EU's Carbon Border Adjustment Mechanism (CBAM), directly increase operational costs for CSC. Failure to invest in decarbonization could diminish cost competitiveness and lead to market share erosion.

| Threat | Description | Impact on CSC | Supporting Data/Example |

| Global Overcapacity & Price Competition | Excessive steel production globally leads to depressed prices. | Reduced profit margins, challenges in maintaining profitability. | Global steel production projected at 2.3 billion metric tons in 2024, with China accounting for over 50%. |

| Trade Protectionism | Increasing tariffs, anti-dumping duties, and other trade barriers. | Restricted market access, increased export costs, potential loss of international sales. | Imposition of new tariffs by countries like the US and retaliatory measures. |

| Economic Downturns & Cyclicality | Reduced demand for steel during global economic slowdowns. | Lower sales volumes, diminished pricing power. | World Steel Association projected global crude steel production around 1.85 billion tonnes in 2024, a slight decrease from 2023. |

| Environmental Regulations | Stricter regulations and carbon pricing mechanisms. | Increased operational costs, reduced cost competitiveness, potential market share loss. | Taiwan's carbon fee (Jan 2025), EU's CBAM. |

SWOT Analysis Data Sources

This China Steel SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and expert industry forecasts to provide a clear and actionable strategic overview.