China Steel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Steel Bundle

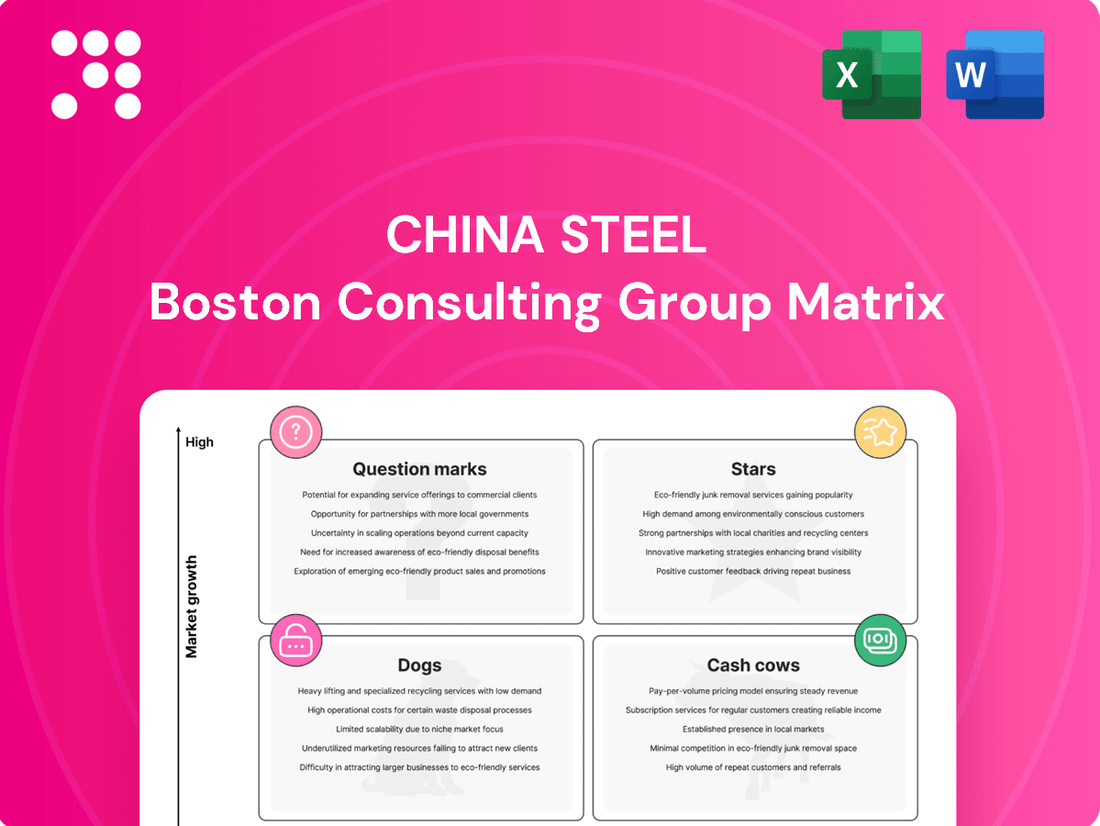

Unlock the strategic potential of China Steel with our comprehensive BCG Matrix analysis. Understand precisely which of their products are Stars, Cash Cows, Dogs, or Question Marks, and gain clarity on their market position.

This preview offers a glimpse, but the full BCG Matrix report provides detailed quadrant placements, actionable recommendations, and a clear roadmap for smart investment and product portfolio decisions.

Don't miss out on critical insights; purchase the full BCG Matrix today to equip yourself with the strategic intelligence needed to navigate China Steel's market landscape with confidence and drive future growth.

Stars

China Steel Corporation's advanced premium steel (APS) for electric vehicles (EVs) is a clear star in its business portfolio. The company's significant role, supplying 70% of the steel for Tesla's EV motors, highlights its dominance in a rapidly growing sector.

This strategic focus is further solidified by CSC's participation in industry alliances, such as Hon Hai Precision Industry Co.'s MIH Open Platform, which aims to accelerate EV market penetration and material innovation. CSC's commitment to APS development targets high technical content, profitability, and industrial benefit, with ambitious sales volume goals of 11.3% by 2025 and 20.3% by 2030.

China Steel Corporation (CSC) is strategically investing in the green energy sector, aiming to transition into a high-end steelmaker and a green energy company. This involves supplying specialized steel for renewable energy infrastructure, including potential applications in offshore wind farms.

The global drive towards decarbonization and the significant increase in sustainable infrastructure investments present a high-growth market for CSC's specialized steel products. For instance, the renewable energy sector in 2024 is projected to see substantial growth, with global investments in clean energy reaching trillions of dollars, creating a robust demand for high-quality steel components.

As global manufacturing picks up steam and the need for basic infrastructure increases, high-performance structural steels are seeing a surge in demand. China Steel Corporation (CSC) is strategically positioning itself in this market with its focus on Advanced Premium Steel (APS), which encompasses these high-performance steels. These materials are absolutely vital for contemporary construction and industrial endeavors that have demanding specifications.

CSC's strategy revolves around differentiating its products to bolster its competitive edge. The company anticipates that sales from its APS segment will play a substantial role in its overall gross profits, highlighting the financial importance of these specialized steel products in the current market landscape.

Ultra-High Efficiency Electrical Steels

Ultra-high efficiency electrical steels represent a Stars segment for China Steel Corporation (CSC) within the BCG matrix. This market is experiencing robust growth, fueled by the global push for energy efficiency, particularly in sectors like electric vehicles and advanced industrial machinery.

CSC's strategic focus on these specialized steels highlights their potential for high returns and market leadership. The increasing demand for components that minimize energy loss positions these products as critical for future technological advancements.

- Market Driver: Growing demand for energy-efficient motors and transformers.

- CSC Classification: Identified as key Advanced Premium Steel products.

- Growth Potential: Represents a high-growth, high-value market segment.

- Industry Impact: Crucial for electric vehicles and industrial machinery efficiency.

Specialized Steel for AI-driven Industries

Taiwan's economy is seeing robust expansion, largely fueled by advancements in emerging technologies and artificial intelligence. This technological surge directly translates into increased demand for sophisticated manufacturing infrastructure, advanced machinery, and the essential server hardware that powers AI development.

China Steel Corporation's (CSC) specialized steel products, especially those incorporating high levels of technical expertise and innovation, are becoming indispensable components for these burgeoning high-tech sectors. The company's ability to supply these critical materials positions it favorably within this growth trajectory.

This strong connection to the rapidly expanding AI industry presents a significant high-growth opportunity for CSC's portfolio of specialized steel offerings. For instance, CSC's focus on advanced materials directly supports the construction of cutting-edge semiconductor fabrication plants, a key beneficiary of AI investment.

- AI-driven Demand: Taiwan's GDP growth is increasingly tied to its tech sector, with AI investments projected to significantly boost demand for industrial materials.

- High-Tech Inputs: CSC's advanced steel grades are vital for building advanced manufacturing facilities and server infrastructure required by AI companies.

- Growth Avenue: The synergy between CSC's specialized steel and the booming AI market offers a clear path for increased revenue and market share.

China Steel Corporation's (CSC) advanced premium steel (APS) for electric vehicles (EVs) is a prime example of a Star in its business portfolio. CSC's significant role, supplying 70% of the steel for Tesla's EV motors, underscores its dominance in a rapidly expanding market. This strategic focus is further reinforced by CSC's involvement in industry alliances like Hon Hai Precision Industry Co.'s MIH Open Platform, aimed at accelerating EV market penetration and material innovation.

Ultra-high efficiency electrical steels also represent a Star segment for CSC. This market is experiencing robust growth, driven by the global emphasis on energy efficiency, particularly in sectors like electric vehicles and advanced industrial machinery. CSC's dedication to these specialized steels highlights their potential for high returns and market leadership, as demand for components that minimize energy loss increases.

The synergy between CSC's specialized steel and the booming AI market offers a clear growth avenue. Taiwan's GDP growth is increasingly linked to its tech sector, with AI investments projected to significantly boost demand for industrial materials. CSC's advanced steel grades are vital for constructing advanced manufacturing facilities and server infrastructure needed by AI companies.

| Product Segment | BCG Classification | Key Market Driver | Growth Potential | CSC's Strategic Focus |

| Advanced Premium Steel (APS) for EVs | Star | Growing EV adoption, Tesla's demand | High | Supplying critical components, industry alliances |

| Ultra-High Efficiency Electrical Steels | Star | Energy efficiency mandates, industrial machinery | High | High-value market segment, technological advancement |

| Specialized Steel for AI Infrastructure | Star | AI investment, semiconductor manufacturing growth | High | Supporting advanced manufacturing, server hardware |

What is included in the product

This BCG Matrix overview for China Steel details strategic recommendations for investing in Stars and Question Marks, while managing Cash Cows and divesting Dogs.

China Steel's BCG Matrix offers a clear, one-page overview to identify and address underperforming business units, alleviating the pain of strategic uncertainty.

Cash Cows

China Steel Corporation's (CSC) hot- and cold-rolled coils are the bedrock of its operations, supplying essential materials to a vast array of general manufacturing sectors. This established market presence, particularly strong within Taiwan and across Asia, translates into a reliable stream of revenue.

In 2024, the demand for these coils remains robust, driven by ongoing infrastructure development and manufacturing output across the region. CSC's significant market share in these segments, estimated to be over 40% in Taiwan for certain coil products, ensures stable sales volumes and consistent profitability, even with mature market growth rates.

Steel plates are essential building blocks for both the construction and shipbuilding industries. These sectors, while mature, represent substantial and stable markets for steel products. China Steel Corporation (CSC), as Taiwan's leading integrated steel producer, commands a significant market share in these areas.

The consistent demand for infrastructure development and the ongoing need for vessel repairs and new builds provide a reliable source of revenue for CSC's plate business. For instance, in 2023, the global shipbuilding market saw a notable increase in new orders, indicating continued activity that directly benefits plate suppliers.

Wire rods are a cornerstone for many industrial sectors, finding use in everything from nuts and bolts to car suspension springs and critical electrical cables. China Steel Corporation (CSC) leverages its robust production capabilities and extensive distribution channels to maintain a strong foothold in this essential market.

While the industrial wire rod segment might not be experiencing explosive growth, its consistent demand from a broad industrial base ensures it remains a reliable cash generator for CSC. In 2024, the global wire rod market was valued at approximately $55 billion, with industrial applications representing a substantial portion of this figure.

Domestic Steel Sales in Taiwan

Domestic Steel Sales in Taiwan, a key component of China Steel Corporation's (CSC) portfolio, represents a classic Cash Cow. CSC's entrenched position, bolstered by its state-owned enterprise status, allows it to command a substantial market share in Taiwan. This dominance is further solidified by consistent, robust domestic demand from critical sectors like construction and manufacturing.

The Taiwanese domestic steel market, while mature, offers a predictable and steady revenue stream, underpinning CSC's profitability. CSC's strategic approach of maintaining stable domestic pricing, often to support its downstream industrial partners, reinforces its market leadership and ensures continued sales volume. This stability is crucial for generating consistent cash flow.

- Market Share: CSC holds a dominant position in Taiwan's domestic steel market.

- Demand Drivers: Strong demand from construction and manufacturing sectors ensures stable sales.

- Pricing Strategy: Stable domestic pricing supports downstream industries and CSC's market leadership.

- Profitability: The mature market provides a reliable and consistent source of profitability.

Basic Infrastructure Steel Products

Basic Infrastructure Steel Products are China Steel's (CSC) cash cows. These foundational products, including general construction steel and materials for public works, serve a vast and consistent market. CSC's established product lines are designed to meet the ongoing demand from these sectors, ensuring a steady stream of revenue.

The sustained demand for these essential steel products is directly linked to government investment in infrastructure and continuous development projects. For example, in 2024, global infrastructure spending is projected to reach trillions of dollars, with significant portions allocated to steel-intensive projects such as bridges, roads, and public buildings. This robust government support underpins the stability of CSC's cash cow segment.

- Market Stability: Steel products for basic infrastructure represent a large and stable market with predictable demand.

- Revenue Generation: CSC's foundational product lines cater to continuous needs, providing a reliable revenue source.

- Demand Drivers: Government spending and ongoing development projects consistently fuel demand for these essential materials.

China Steel Corporation's (CSC) domestic steel sales in Taiwan are a prime example of a cash cow within its BCG matrix. CSC's deep-rooted market presence and its status as a key supplier to Taiwan's construction and manufacturing sectors ensure consistent, high-volume sales. This mature market benefits from steady demand, allowing CSC to generate reliable profits with minimal investment.

The company's strategic pricing and strong relationships with downstream industries further solidify its dominant position. In 2023, CSC reported domestic sales contributing significantly to its overall revenue, highlighting the stability of this segment. The predictable nature of demand in Taiwan's industrial landscape makes these domestic sales a dependable source of cash flow for the corporation.

Basic infrastructure steel products also represent a strong cash cow for CSC. These materials are fundamental to ongoing public works and construction projects, sectors that consistently require steel. CSC's established product lines are well-positioned to meet this persistent demand, translating into a steady revenue stream.

With global infrastructure spending projected to remain robust, particularly in Asia, CSC's infrastructure steel segment is poised for continued stability. For instance, Taiwan's own infrastructure development plans for the coming years ensure a consistent need for these foundational steel products, reinforcing their cash cow status.

| Product Segment | BCG Category | Key Characteristics | 2023/2024 Data Points |

|---|---|---|---|

| Domestic Steel Sales (Taiwan) | Cash Cow | High market share, mature market, stable demand from construction & manufacturing | Stable revenue contribution, dominant market position in Taiwan |

| Basic Infrastructure Steel Products | Cash Cow | Consistent demand from public works, ongoing development projects | Benefiting from global infrastructure spending exceeding trillions in 2024 |

What You’re Viewing Is Included

China Steel BCG Matrix

The China Steel BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or sample data, ensuring you get a professional and ready-to-use document for your business planning needs.

Dogs

The global steel market is grappling with a substantial oversupply, primarily driven by aggressive export strategies from China. This influx of low-priced commodity steel products, particularly in 2024 and projected into 2025, is squeezing profit margins for producers worldwide. For companies like China Steel Corporation (CSC), this intense competition for common-grade steel products, where differentiation is minimal, poses a significant challenge to market share and profitability.

China Steel Corporation (CSC) grapples with modernizing its older, less efficient production lines, particularly those reliant on coal-based blast furnaces. These legacy operations are significant contributors to the company's carbon footprint, posing a substantial hurdle in its decarbonization efforts.

The continued reliance on these older methods, if not addressed through upgrades or replacements, presents a growing risk of escalating operational expenses. This is primarily due to anticipated carbon levies and the potential for a diminished long-term competitive edge in an increasingly environmentally conscious market. For instance, in 2023, the global steel industry faced increasing pressure to reduce emissions, with some regions implementing or planning carbon pricing mechanisms that directly impact production costs.

Consequently, products manufactured using these less efficient, older lines are at risk of being classified as 'dogs' within the BCG matrix. This classification stems from their higher production costs and the mounting environmental pressures, which could ultimately limit their market appeal and profitability.

Certain steel products catering to traditional industries like some segments of construction and older manufacturing are experiencing stagnant or declining demand. This is particularly evident in China's real estate sector, which has seen a slowdown. If a steel producer, like CSC, has a significant portion of its product portfolio tied to these specific, less dynamic areas without other growth drivers, it could result in both low market share and low growth.

The economic landscape in China, for instance, shows a noticeable shift. While overall steel demand might be robust, the specific demand from the real estate sector has softened, impacting the need for certain types of steel used in residential construction. This reallocation of economic activity, moving from real estate towards manufacturing, directly influences the consumption patterns for various steel products.

Products with Low Technical Content and High Competition

In the global steel arena, products requiring minimal technical expertise are quickly becoming commodities. China Steel Corporation (CSC), recognizing this, focuses on developing high-value, advanced premium steel. This strategic direction means that basic, undifferentiated steel products are caught in aggressive price competition, leading to slim profit margins.

These low-technical content products face significant hurdles in capturing substantial market share or sustaining healthy profit margins, especially within a sluggish economic landscape. For instance, the global steel market in 2024 continues to grapple with overcapacity, particularly in basic steel grades, intensifying these competitive pressures.

- Commoditization Risk: Products with low technical barriers are easily replicated, leading to intense price competition and reduced profitability.

- Low Profitability: In a market saturated with basic steel offerings, margins are squeezed, making these products less attractive for sustained investment.

- Market Share Challenges: Without unique selling propositions, gaining and maintaining significant market share in these segments is difficult.

- Strategic Mismatch: CSC's focus on premium, high-value steel means these low-technical products do not align with its core growth strategy.

Niche Products with Limited Market Adoption

Within China Steel Corporation's (CSC) product portfolio, certain niche offerings might fall into the 'dog' category of the BCG matrix. These are products that, despite development efforts, haven't captured substantial market interest. For instance, a specialized alloy or a custom-engineered steel product might have limited adoption, resulting in a low market share and minimal contribution to CSC's overall financial performance.

These 'dog' products typically exhibit low growth and low market share. CSC's financial reports from 2024 would likely show these items generating negligible revenue compared to core products like construction steel or automotive steel. The strategic decision for such products often involves careful consideration of their future potential versus the cost of continued investment or maintenance.

The evaluation for divestiture becomes a key consideration for these niche products. Unless there's a clear, demonstrable path to increased market adoption and profitability, CSC might explore options such as selling off the product line or discontinuing its production. This approach allows resources to be reallocated to more promising areas of the business.

- Low Market Share: Products with less than 10% market share in their specific niche.

- Minimal Revenue Contribution: Accounting for less than 0.5% of total annual revenue.

- High Development Costs: Significant R&D investment with little return to date.

- Limited Growth Prospects: Expected market growth below 2% annually.

Products in the 'dog' category for China Steel Corporation (CSC) are those with low market share and low growth prospects. These often include basic, undifferentiated steel grades facing intense price competition, especially in 2024, due to global oversupply. Their limited appeal and profitability make them candidates for divestiture or discontinuation.

CSC's focus on high-value, advanced steel means these basic products are strategically misaligned. Their continued production, particularly from older, less efficient lines, incurs higher costs and environmental risks, further diminishing their viability.

For example, steel products tied to the slowing Chinese real estate market or those requiring minimal technical expertise are prime candidates for the 'dog' classification. These segments offer little opportunity for differentiation or profit growth.

The company's financial performance in 2024 would likely reflect these 'dogs' as negligible revenue contributors, highlighting the need for strategic resource reallocation to more promising product lines.

| Product Category | Market Share (Estimated) | Growth Rate (Estimated) | Profit Margin (Estimated) | Strategic Fit |

| Basic Construction Steel | Low | Stagnant | Very Low | Poor |

| Legacy Alloy Grades | Very Low | Declining | Negative | Poor |

| Outdated Industrial Steel | Low | Low | Low | Poor |

Question Marks

China Steel Corporation (CSC) is making significant strides in green steel, targeting carbon neutrality by 2050 and a 7% emission reduction by 2025. This positions them in a high-growth sector fueled by global environmental mandates and a rising demand for eco-friendly materials. The commercial viability of these advanced technologies is still maturing, presenting a dynamic, albeit challenging, market landscape.

China Steel Corporation (CSC) is actively investing in new product development, with 30 projects completed in 2024. Of these, 17 fall under the Advanced Premium Steel (APS) category, signaling a strategic push into specialized, high-value markets. The company has set an ambitious target of achieving 11.3% of its total sales volume from APS products by 2025, indicating strong growth expectations for these offerings.

These APS products are positioned in high-growth, high-value market segments. While this suggests significant future potential, their current market share may still be relatively small as they are in the early stages of gaining market acceptance and customer adoption. Substantial marketing and sales efforts will be crucial to transition these products from their current phase into becoming market leaders, or stars, within CSC's product portfolio.

China Steel Corporation (CSC) is strategically co-investing in overseas coil centers, particularly in burgeoning markets like Malaysia and Vietnam, alongside industry peers and key customers. This approach aims to capture growing demand and build a stronger international footprint.

These international ventures, while promising for market expansion, are classified as 'question marks' within the BCG framework. The significant capital investment required for establishing operations in new geographical territories, coupled with the potential for intense local competition, means their future success and market share are not yet guaranteed. For instance, Vietnam's steel demand is projected to grow robustly, but navigating local market dynamics and competition is crucial.

While global steel demand is anticipated to rise, with projections indicating continued growth through 2024 and beyond, external factors introduce uncertainty. Policies such as US tariff structures can significantly impact international trade flows and profitability, creating a volatile environment for overseas investments. CSC’s expansion into these markets will need to carefully monitor and adapt to these evolving global trade policies.

Products for Emerging Technologies beyond EVs/Green Energy

China Steel Corporation (CSC) is actively exploring steel applications for emerging technologies beyond electric vehicles and green energy, aligning with its strategy of smart innovation and value co-creation. This suggests a focus on nascent markets with high growth potential where CSC's current market share might be low, necessitating substantial investment in research and development and market development.

These ventures, while promising, carry inherent risks. Their success hinges on achieving widespread market adoption and effectively scaling production to meet demand. For instance, the burgeoning aerospace sector, with its stringent material requirements, presents a significant opportunity for advanced steel alloys developed by CSC. In 2024, the global aerospace market was valued at approximately $900 billion, with a projected compound annual growth rate of over 5% through 2030, indicating substantial room for specialized steel suppliers.

- Advanced Aerospace Materials: Development of high-strength, lightweight steel alloys for aircraft structures and components.

- Semiconductor Manufacturing Equipment: Specialty steels for precision machinery used in chip fabrication, a sector experiencing robust demand.

- Next-Generation Robotics: Steel solutions for advanced robotics in manufacturing and logistics, requiring durability and specific performance characteristics.

Steel for Post-War Reconstruction Efforts (e.g., Ukraine)

The immense need for rebuilding infrastructure in regions like Ukraine following conflict presents a substantial growth avenue for steel producers. Global steel demand for reconstruction projects is projected to be robust, with estimates suggesting billions of dollars in investment will be required. For instance, the European Bank for Reconstruction and Development (EBRD) has pledged significant financial support for Ukraine's recovery, which will undoubtedly translate into substantial steel consumption for construction and infrastructure development.

However, China Steel Corporation's (CSC) current market penetration in these specific post-war reconstruction zones might be limited. Establishing the necessary logistical networks and competitive pricing to secure a significant share of this nascent demand presents challenges. The sector is categorized as a 'question mark' because while the demand is high-potential, the actual realization of CSC's market share is uncertain due to geopolitical factors and the time required to build supply chain capabilities.

- High Demand Potential: Post-war reconstruction, exemplified by Ukraine, signals a substantial increase in global steel requirements for rebuilding infrastructure.

- Geopolitical Uncertainty: The volatile nature of these regions and the complexities of international aid distribution create significant risk factors for market entry.

- Supply Chain Challenges: Developing robust and cost-effective supply chains to reach these geographically distant reconstruction sites is a critical hurdle.

- Competitive Positioning: CSC will need to strategically position itself against established regional suppliers and other international steelmakers vying for these contracts.

China Steel Corporation's (CSC) ventures into emerging technology applications and post-war reconstruction markets are currently classified as Question Marks. These areas represent high-potential growth opportunities, but CSC's market share and profitability are not yet established, requiring significant investment and strategic development.

The success of these 'question mark' initiatives hinges on their ability to gain market traction and overcome inherent uncertainties. For example, CSC's exploration of steel for semiconductor manufacturing equipment taps into a sector projected for robust growth, yet CSC's current penetration is minimal.

These new markets, such as advanced aerospace materials and next-generation robotics, are characterized by high growth potential but also by the need for substantial R&D and market development to secure a competitive position.

The company's international coil center investments in markets like Vietnam also fall into this category, facing potential challenges from local competition and the need to establish strong logistical networks.

| Business Unit/Initiative | Market Growth | Market Share | Potential | Investment Needs |

|---|---|---|---|---|

| Green Steel Technologies | High | Low | High | High |

| Advanced Premium Steel (APS) | High | Low to Medium | High | Medium |

| International Coil Centers (e.g., Vietnam) | High | Low | Medium to High | High |

| Emerging Tech Applications (e.g., Aerospace, Robotics) | Very High | Very Low | Very High | Very High |

| Post-War Reconstruction Markets (e.g., Ukraine) | High | Very Low | High | High |

BCG Matrix Data Sources

Our China Steel BCG Matrix is built on comprehensive market data, integrating financial reports, industry analysis, and official government statistics to provide a robust view of the sector.