China Steel Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Steel Bundle

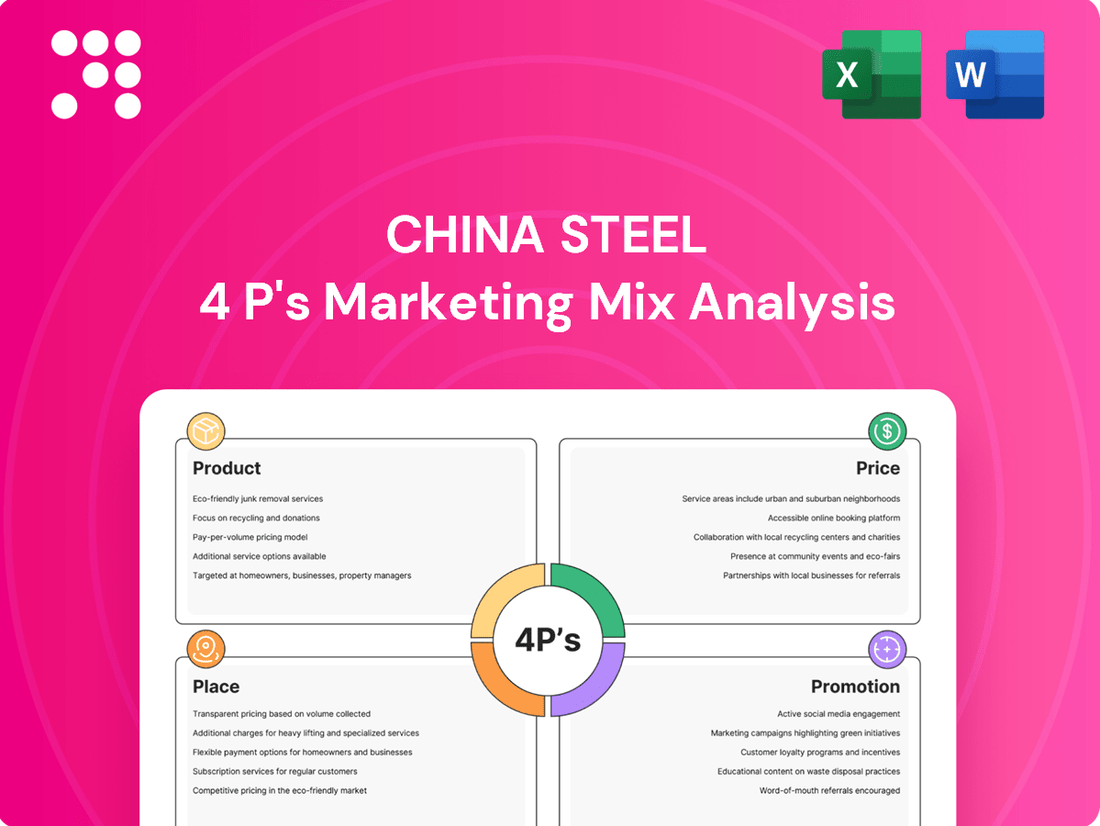

China Steel's marketing strategy is a fascinating case study in how a global industrial giant leverages its 4Ps. From its diverse product portfolio to its strategic pricing, expansive distribution, and targeted promotions, understanding these elements is key to grasping their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering China Steel's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the steel industry.

Product

China Steel Corporation (CSC) boasts a wide array of steel products, encompassing plates, bars, wire rods, hot- and cold-rolled coils, and specialized electrical steels. This extensive product line allows CSC to address the varied needs of numerous industries, from construction to automotive manufacturing.

This diverse steel portfolio is a key strength for CSC, enabling it to serve a broad customer base and adapt to different market demands. For instance, in 2023, CSC reported that its sales of flat steel products, which include coils, represented a significant portion of its revenue, underscoring the importance of this segment within its diverse offerings.

By offering such a comprehensive range, CSC not only strengthens its market position but also diversifies its revenue streams. This strategy helps mitigate the risks that could arise from over-reliance on any single steel product category, ensuring greater stability and resilience in its operations.

China Steel Corporation (CSC) is strategically shifting towards a high value-added steel focus, driven by its 'dual cores and three transformation strategies'. This means moving away from basic steel production to more specialized and advanced products.

In 2024, CSC demonstrated this commitment by completing 30 new product development projects. A significant portion of these, 17, were classified as Advanced Premium Steel (APS), highlighting the company's investment in innovation and higher-margin offerings.

The success of this strategy is evident in CSC's order book. By the end of 2024, orders for APS and other high-end steel products accounted for 11.1% and 51.8% of their total orders, respectively. This indicates a growing market acceptance and a clear move towards product differentiation to bolster its competitive edge.

China Steel Corporation's (CSC) products are foundational to major industries, including construction, shipbuilding, machinery, and automotive. This deep integration means CSC's specialized steel is consistently in demand, as these sectors rely heavily on its output for their own production processes. For instance, CSC's high-strength steel is vital for building skyscrapers and bridges, while its corrosion-resistant alloys are essential for shipbuilding in 2024, a sector that saw global order growth.

By customizing its steel offerings to meet the precise and often demanding specifications of these industries, CSC reinforces its role as an indispensable supplier. For example, the automotive sector in 2025 is increasingly focused on lightweight, high-tensile strength steels to improve fuel efficiency and safety, a need CSC actively addresses with its advanced product lines. This focus on industry-specific solutions ensures CSC remains a critical partner in the supply chains of these vital economic engines.

Quality and Performance Assurance

China Steel Corporation (CSC) places paramount importance on quality and performance assurance as an integrated steel producer. This commitment is evident in their rigorous quality control measures implemented at every stage of production, from raw material sourcing to the final product. For example, in 2023, CSC's commitment to excellence was reflected in their continued high ratings in customer satisfaction surveys within the industrial sector, particularly among automotive and construction clients who depend on the precise material properties of CSC's steel for their own demanding manufacturing processes. This unwavering focus on delivering reliable performance serves as a crucial competitive advantage in the global steel market.

CSC's dedication to quality translates directly into tangible benefits for its industrial customers. By ensuring consistent and predictable material characteristics, CSC helps its clients minimize production defects and maintain the integrity of their end products. This reliability is especially critical for sectors like automotive manufacturing, where even minor variations in steel strength or ductility can have significant safety and performance implications. In 2024, CSC continued to invest in advanced testing and certification protocols, ensuring their products meet and exceed international standards, thereby fostering strong, long-term partnerships built on trust and dependable performance.

The emphasis on high-performance steel is a strategic differentiator for CSC in a highly competitive landscape. This focus not only meets the immediate needs of their clients but also anticipates future market demands for more durable and efficient materials. CSC's research and development efforts are continuously geared towards enhancing product performance, such as improving corrosion resistance or increasing tensile strength. For instance, their development of specialized steel grades for high-rise construction projects in 2023 highlighted their ability to innovate and deliver solutions that offer superior structural integrity and longevity, reinforcing their position as a trusted supplier.

- Stringent Quality Control: CSC implements comprehensive quality checks throughout the entire production lifecycle.

- Client Trust: Consistent material properties build confidence among industrial clients, reducing their manufacturing risks.

- Market Differentiation: Reliable performance is a key factor that sets CSC apart from competitors.

- Product Innovation: Ongoing R&D focuses on enhancing steel performance for advanced applications.

Innovation and Green Development

China Steel Corporation (CSC) is actively pursuing innovation and green development as core elements of its marketing strategy. This commitment is demonstrated through significant investments in reducing its environmental footprint and pioneering sustainable production techniques. For instance, CSC is focusing on developing advanced technologies, such as novel catalyst formulations specifically designed to lower carbon emissions. This forward-thinking approach not only aligns with global environmental goals but also resonates strongly with a growing customer base that prioritizes sustainability in their purchasing decisions.

The company's dedication to intelligent manufacturing further underpins its innovation drive. By integrating smart technologies into its production processes, CSC aims to enhance efficiency, optimize resource utilization, and improve product quality. This strategic focus on technological advancement ensures CSC’s long-term viability and competitive edge in an evolving market. For example, in 2023, CSC reported a 5% reduction in its carbon intensity compared to 2022 levels, a testament to its ongoing green initiatives.

- Technological Innovation: Development of new catalyst formulations for carbon reduction and promotion of intelligent manufacturing.

- Green Development: Commitment to reducing carbon emissions and developing sustainable production methods.

- Customer Appeal: Meeting the increasing demand from environmentally conscious customers.

- Performance Data: Achieved a 5% reduction in carbon intensity in 2023.

China Steel Corporation (CSC) offers a diverse range of steel products, from basic plates and coils to specialized electrical steels, catering to industries like construction and automotive. The company is strategically shifting towards high value-added and advanced premium steel (APS) products, with 17 out of 30 new product developments in 2024 classified as APS. By the end of 2024, APS and other high-end steels represented 11.1% and 51.8% of total orders, respectively, demonstrating a successful product differentiation strategy.

| Product Category | 2023 Sales Significance | 2024 Focus | 2024 Order Share (APS/High-End) |

|---|---|---|---|

| Flat Steel (Coils) | Significant Revenue Driver | Continued High Demand | N/A |

| Advanced Premium Steel (APS) | Growing Segment | Major R&D Investment (17 new products) | 11.1% |

| Specialized Electrical Steels | Key for Specific Industries | Innovation for Enhanced Performance | N/A |

| High-Strength & Corrosion-Resistant Steels | Essential for Construction & Shipbuilding | Meeting Automotive Lightweighting Trends | 51.8% (Combined High-End) |

What is included in the product

This analysis provides a comprehensive examination of China Steel's marketing mix, detailing its Product offerings, pricing strategies, distribution Place, and promotional efforts.

It serves as a valuable resource for understanding China Steel's market positioning and competitive approach, offering insights for strategic planning and benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of extensive analysis for China Steel.

Provides a clear, structured framework for understanding China Steel's 4Ps, reducing confusion and enabling faster decision-making.

Place

China Steel Corporation commands a substantial presence across Asia, bolstered by its status as Taiwan's premier integrated steel producer. Its market strategy emphasizes robust domestic sales, complemented by adaptable export activities that respond to prevailing market dynamics, securing a significant regional market share.

China Steel Corporation (CSC) primarily engages in direct sales, targeting large industrial clients. This direct approach fosters enduring partnerships and encourages collaborative technical development, allowing CSC to act as a high-value steel solutions provider. For instance, in 2023, CSC's direct sales channels were instrumental in securing significant orders from major automotive manufacturers, contributing to their overall revenue growth.

China Steel strategically develops its distribution channels by establishing robust marketing networks and actively pursuing overseas business expansion. This approach aims to create a resilient supply chain capable of serving both domestic and international markets effectively.

The company explores opportunities to set up coil centers or dedicated sales bases in promising international regions. This proactive step allows China Steel to be more responsive to evolving customer demands and to capitalize on emerging market potential.

Optimized Logistics and Inventory Management

Optimized logistics and inventory management are crucial for China Steel Corporation (CSC) to maintain its competitive edge. Efficient handling of raw materials and finished steel products directly impacts delivery times and overall cost structure. CSC's commitment to smooth shipments and rapid order fulfillment underscores the importance of these operational aspects.

For a major steel producer like CSC, effective inventory control prevents stockouts and minimizes holding costs, ensuring that customer demand is met promptly. This operational efficiency is a cornerstone of their customer service strategy and contributes significantly to profitability.

- Timely Delivery: CSC's logistics aim for prompt deliveries, crucial in the fast-paced construction and manufacturing sectors.

- Cost Reduction: Efficient inventory management reduces warehousing expenses and minimizes waste, boosting financial performance.

- Customer Satisfaction: Reliable supply chains and quick order processing enhance customer loyalty and market reputation.

- Operational Efficiency: Streamlined logistics and inventory systems are vital for maintaining high production output and profitability.

Strategic Port Access and Export Competitiveness

Taiwan's strategic island location provides China Steel Corporation (CSC) with excellent port access, streamlining exports to key Asian markets like Malaysia, China, Vietnam, and India. This logistical advantage is critical for maintaining competitive pricing and timely delivery.

The current economic climate, characterized by a strong US dollar and a weaker New Taiwan Dollar (NTD), significantly boosts CSC's export competitiveness. This currency advantage directly translated into stronger first-quarter sales for 2025, as domestic steel became more attractive to international buyers.

- Strategic Location: Taiwan's position facilitates efficient shipping to major Asian economies.

- Currency Advantage: A strong USD/weak NTD enhances export pricing power.

- 2025 Q1 Performance: Favorable exchange rates contributed to robust sales figures in early 2025.

China Steel Corporation leverages Taiwan's strategic island location to optimize its distribution. This geographical advantage, coupled with efficient port access, facilitates seamless exports to major Asian economies, including China, Vietnam, and India. The company's focus on establishing international sales bases and coil centers further enhances its ability to serve diverse markets directly and respond swiftly to regional demand shifts.

| Distribution Channel | Key Markets | Logistical Advantage | 2023/2024 Focus |

|---|---|---|---|

| Direct Sales to Industrial Clients | Taiwan, Asia | Strong domestic network, collaborative partnerships | Securing orders from automotive and construction sectors |

| Export Activities | Malaysia, China, Vietnam, India | Taiwan's port access, favorable currency exchange rates | Expanding overseas presence, exploring new sales bases |

| Distribution Networks | Regional and Global | Resilient supply chain development | Enhancing responsiveness to customer demands |

Preview the Actual Deliverable

China Steel 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of China Steel's 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know precisely what you're buying.

Promotion

China Steel Corporation's (CSC) promotion strategy in its B2B marketing is deeply rooted in cultivating robust relationships with its industrial clients. This approach emphasizes direct engagement, offering specialized technical support, and actively participating in collaborative problem-solving to forge lasting partnerships.

CSC focuses on enhancing its customer relationship management systems to foster client loyalty and encourage repeat business, a critical aspect for a company serving large-scale manufacturers.

For instance, CSC's investment in digital platforms for customer interaction and technical support, alongside dedicated account management teams, aims to strengthen these B2B bonds. In 2023, CSC reported significant growth in its key industrial sectors, underscoring the effectiveness of its relationship-driven promotion tactics.

China Steel Corporation (CSC) actively participates in key international and regional industry trade shows and conferences. For instance, in 2024, CSC showcased its high-strength steel products at the Beijing International Automotive Exhibition, a significant event for the automotive sector. This strategic presence allows CSC to highlight its advanced premium steel offerings and technological innovations to a targeted B2B audience.

These industry gatherings serve as vital platforms for CSC to foster direct engagement with potential and existing clients, facilitating crucial networking opportunities. By demonstrating its manufacturing capabilities and product differentiation, CSC aims to solidify its market position. For example, at the 2025 European Steel Summit, CSC's exhibition booth focused on their sustainable steel solutions, drawing significant interest from European automakers seeking to meet their ESG targets.

China Steel Corporation (CSC) actively promotes its technical expertise, positioning itself as a solutions provider rather than just a supplier of steel. This involves offering comprehensive technical support, engaging in collaborative product development with clients, and showcasing the tangible performance advantages of their steel in diverse applications.

This value-added strategy is crucial for differentiating CSC in a competitive market and fostering deeper, more resilient client relationships. For instance, CSC's commitment to innovation was evident in 2024 with the development of advanced high-strength steel grades tailored for the automotive sector, contributing to lighter and safer vehicles.

Corporate Reputation and Sustainability Initiatives

China Steel Corporation (CSC), as a prominent state-owned enterprise in Asia's steel sector, leverages its robust corporate reputation as a key promotional element. Its dedication to sustainability and corporate social responsibility (CSR) significantly bolsters its brand image. This commitment is actively communicated through its annual Sustainability Reports, highlighting green and low-carbon development strategies. For instance, in its 2023 Sustainability Report, CSC detailed a 5.7% reduction in greenhouse gas emissions intensity compared to 2022, demonstrating tangible progress in its environmental stewardship.

CSC's focus on eco-friendly practices resonates strongly with environmentally aware stakeholders, including customers and investors. This proactive approach to sustainability not only enhances its market appeal but also strengthens its relationships with partners who prioritize ethical and responsible business conduct. The company's investment in green technologies, such as its hydrogen energy research, further solidifies its image as a forward-thinking industry leader.

The company's promotional efforts are amplified by its public commitment to various sustainability goals. These include:

- Reducing carbon footprint: Targeting a 20% reduction in CO2 emissions by 2030 compared to 2018 levels.

- Promoting circular economy: Increasing the utilization rate of recycled materials in production processes.

- Community engagement: Supporting local communities through various social welfare programs and initiatives.

- Supply chain responsibility: Ensuring ethical and sustainable practices throughout its entire supply chain.

Investor Relations and Public Announcements

China Steel Corporation (CSC) prioritizes open communication with its investors. This includes regular investor conferences and timely public announcements, which collectively showcase the company's stability and outlook. For instance, during their 2024 investor briefings, CSC highlighted a robust order book for their specialty steel products, signaling sustained demand.

These communications are crucial for building stakeholder confidence. By sharing financial reports, details on board meeting outcomes, and strategic updates, CSC offers transparency into its operations. This information directly informs investment decisions and reinforces trust in the company's long-term vision.

CSC's commitment to investor relations can be seen in their consistent reporting cadence. For the first quarter of 2024, CSC reported a net profit of NT$5.6 billion, a significant increase year-over-year, demonstrating the positive impact of their strategic initiatives on financial performance.

Key aspects of CSC's investor relations strategy include:

- Regular Investor Conferences: Facilitating direct engagement with analysts and investors to discuss performance and future plans.

- Transparent Financial Reporting: Providing timely and accurate financial statements, such as their 2023 annual report which detailed a 15% growth in revenue.

- Public Announcements: Disseminating important corporate news, including new project developments and market strategies, ensuring all stakeholders are informed.

- Shareholder Meeting Updates: Communicating key decisions and resolutions from shareholder meetings, fostering corporate governance.

China Steel Corporation (CSC) leverages its strong industry presence and technical expertise as key promotional tools. By showcasing advanced steel solutions at events like the 2024 Beijing International Automotive Exhibition and the 2025 European Steel Summit, CSC highlights its product differentiation and innovation to a targeted B2B audience.

The company actively promotes its role as a solutions provider through comprehensive technical support and collaborative product development, as seen in their 2024 development of advanced high-strength steel grades for the automotive sector.

CSC's commitment to sustainability, evidenced by a 5.7% reduction in greenhouse gas emissions intensity in 2023 and investments in green technologies, enhances its brand image and appeals to environmentally conscious stakeholders.

Furthermore, CSC maintains transparent investor relations through regular conferences and timely announcements, such as reporting a Q1 2024 net profit of NT$5.6 billion, reinforcing stakeholder confidence in its financial stability and strategic direction.

| Promotional Activity | Key Focus | Example/Data Point (2023-2025) |

| Industry Trade Shows | Product Innovation & Technical Capabilities | Showcased high-strength steel at 2024 Beijing International Automotive Exhibition; highlighted sustainable solutions at 2025 European Steel Summit. |

| Technical Support & Collaboration | Solutions Provider Positioning | Developed advanced high-strength steel grades for automotive in 2024; offers comprehensive technical support. |

| Sustainability & CSR | Brand Image & Stakeholder Appeal | Reported 5.7% GHG emissions intensity reduction in 2023; investing in hydrogen energy research. |

| Investor Relations | Transparency & Financial Performance | Reported NT$5.6 billion net profit in Q1 2024; 2023 annual report detailed 15% revenue growth. |

Price

China Steel Corporation navigates a fiercely competitive Asian steel landscape, making strategic pricing crucial for market position. For instance, the company announced stable domestic prices for January and Q1 2025, a move designed to support local clients in managing their raw material expenses and securing new business.

China Steel Corporation (CSC) likely leverages value-based pricing for its Advanced Premium Steel (APS) and other high-value-added products. This strategy aligns pricing with the superior performance, bespoke customization, and advanced technological innovation that these steel grades offer to specialized industries.

By emphasizing these premium offerings, CSC can achieve more favorable pricing and enhanced profitability, particularly within niche markets where the unique attributes of their steel are critical. For instance, in 2024, the automotive sector’s demand for lightweight, high-strength steel for electric vehicles, a key area for APS, continued to drive premium pricing opportunities.

Steel prices are intrinsically tied to the cost of key inputs such as iron ore and coking coal, alongside broader global supply and demand forces. For instance, iron ore prices saw significant fluctuations in early 2024, with benchmarks trading around $100-$130 per tonne, impacting production costs.

China Steel Corporation (CSC) adopts a flexible pricing strategy, directly incorporating shifts in raw material expenses and market conditions to buffer against inflationary pressures. This approach allows CSC to remain competitive and manage financial risks effectively in a volatile environment.

CSC actively tracks global steel demand projections, with forecasts for 2024 indicating a modest global growth of around 1.7% according to the World Steel Association, and adjusts its operational and sales strategies to align with these anticipated market shifts.

Impact of Economic Conditions and Tariffs

China Steel Corporation's (CSC) pricing strategy is heavily influenced by external economic forces. Global economic growth trends, fluctuations in interest rates, and evolving trade policies, particularly new tariffs, all play a critical role in CSC's pricing decisions. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a figure that directly impacts steel demand and, consequently, CSC's pricing power.

CSC has opted to maintain flat pricing for its steel products, a move aimed at stabilizing costs for its downstream customers. This decision reflects an understanding of the current volatile global trade environment. The company acknowledges the inherent uncertainties in international trade patterns and is committed to assisting its clients in navigating these complexities.

Key economic and trade factors affecting CSC's pricing include:

- Global Economic Outlook: Projections for global GDP growth directly correlate with steel consumption and pricing power.

- Interest Rate Environment: Changes in interest rates impact borrowing costs for manufacturers and construction projects, influencing demand for steel.

- Trade Policies and Tariffs: The imposition of tariffs, such as those seen in various international markets, can distort trade flows and necessitate price adjustments. For example, the U.S. imposed Section 232 tariffs on steel imports, impacting global supply chains and pricing benchmarks.

- Raw Material Costs: While not directly a tariff, the cost of key inputs like iron ore and coking coal, often influenced by global supply and demand dynamics and geopolitical events, also dictates CSC's pricing floor.

Long-Term Contracts and Bulk Discounts

China Steel Corporation (CSC), operating within a business-to-business framework, strategically leverages long-term contracts and bulk discounts. This is a crucial element in its pricing strategy, particularly when dealing with major industrial clients. These arrangements are designed to secure substantial order volumes and cultivate enduring partnerships, ensuring a predictable revenue stream for CSC.

This pricing approach offers significant advantages by fostering market stability and providing a reliable sales forecast for CSC. For instance, CSC's commitment to long-term supply agreements, often spanning multiple years, allows clients to hedge against price volatility and guarantee material availability. This stability is particularly valued in industries like automotive and construction, where consistent material supply is paramount.

- Securing Stable Demand: Long-term contracts help CSC maintain consistent sales volumes, insulating it from short-term market fluctuations.

- Customer Loyalty: Bulk discounts incentivize larger orders and encourage repeat business, strengthening client relationships.

- Predictable Revenue: These agreements provide CSC with greater certainty regarding future revenue, aiding in financial planning and investment decisions.

China Steel Corporation (CSC) balances stable domestic pricing with value-based strategies for premium products, aiming to support clients and capture higher margins. For example, CSC maintained flat domestic prices for Q1 2025, reflecting a commitment to client stability amidst global economic uncertainties.

The company's pricing is directly influenced by raw material costs, with iron ore prices fluctuating around $100-$130 per tonne in early 2024, impacting production expenses.

CSC's pricing strategy also incorporates global demand forecasts, such as the World Steel Association's 2024 projection of modest global growth around 1.7%, and external economic factors like the IMF's 3.2% global growth forecast for 2024.

Long-term contracts and bulk discounts are key to CSC's B2B pricing, securing stable demand and customer loyalty. This approach provides revenue predictability, crucial for financial planning in a volatile market.

| Pricing Factor | 2024/2025 Data Point | Impact on CSC Pricing |

|---|---|---|

| Domestic Price Stability | Q1 2025 flat pricing | Supports client cost management |

| Premium Product Pricing | Automotive demand for lightweight steel | Enables higher margins for APS |

| Raw Material Costs | Iron ore: $100-$130/tonne (early 2024) | Influences production costs and pricing floor |

| Global Economic Growth | IMF projection: 3.2% (2024) | Correlates with steel demand and pricing power |

4P's Marketing Mix Analysis Data Sources

Our China Steel 4P's analysis is grounded in a comprehensive review of industry reports, government statistics, and company financial disclosures. We also incorporate data from trade publications and market research firms to capture pricing trends, production capacities, and distribution networks.