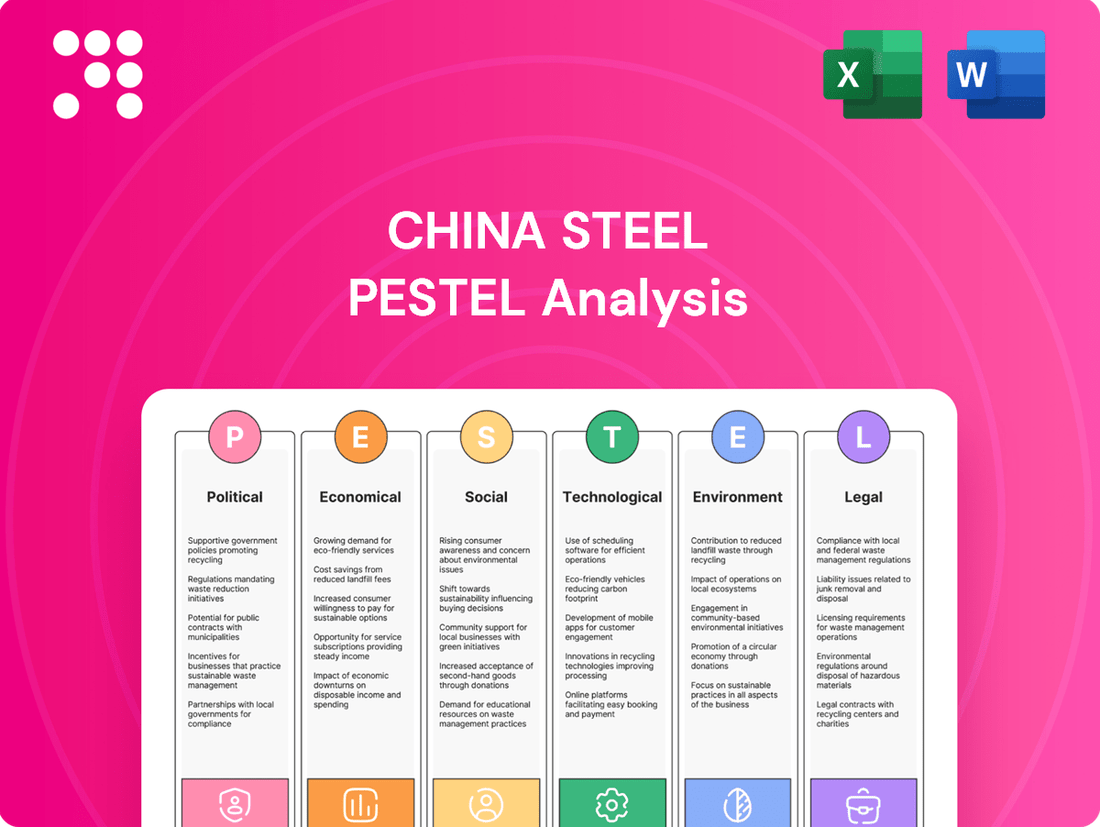

China Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Steel Bundle

Navigate the complex external forces shaping China Steel’s destiny with our comprehensive PESTLE analysis. From evolving political landscapes to critical technological advancements and environmental regulations, understand the full spectrum of influences. Equip yourself with actionable intelligence to refine your strategy and secure a competitive advantage. Purchase the full PESTLE analysis now and gain the clarity needed to make informed decisions.

Political factors

As a state-owned enterprise, China Steel Corporation's strategic direction and investment choices are heavily shaped by Taiwanese government policies and national economic goals. This connection offers stability and potential government support, but also means the company must align with political priorities and potential directives.

This government backing can provide a competitive advantage, particularly in specific markets or during periods of economic instability. For instance, in 2023, the Taiwanese government continued its focus on industrial upgrades and sustainability, which directly influences China Steel's R&D investments and operational strategies.

Geopolitical tensions between Taiwan and mainland China remain a critical political factor for China Steel Corporation. These dynamics directly influence trade routes and market access, with potential for disruptions impacting supply chains. For instance, any significant escalation could lead to increased shipping costs or even temporary port closures in the region, affecting raw material imports and finished product exports.

Global protectionist trends, including the imposition of anti-dumping duties and evolving trade agreements, significantly impact China Steel Corporation's (CSC) export performance and bottom line. For instance, in 2023, the European Union continued to maintain its steel import quotas, a measure that limits the volume of steel that can be imported from countries like China without facing higher tariffs. This directly affects CSC's ability to access key European markets.

Navigating these complex international trade landscapes is paramount. Potential tariffs imposed by major trading blocs, such as those considered by the United States on steel imports, can dramatically alter cost structures and market access for CSC. In 2024, the ongoing review of Section 232 tariffs in the US remains a critical factor to monitor for any steel producer with significant export ambitions.

Consequently, CSC must diligently monitor and adapt to these shifting trade policies to sustain its export competitiveness. The ability to anticipate and react to changes in tariffs and trade regulations is essential for maintaining market share and profitability in a dynamic global steel industry.

Industrial Policies and Regulations in Taiwan

Taiwan's industrial policies are a significant driver for heavy industries like China Steel Corporation (CSC). The government's focus on energy transition and environmental standards directly impacts CSC's operations and strategic planning. For instance, the Ministry of Economic Affairs has been actively promoting green manufacturing, with initiatives aimed at reducing carbon emissions in heavy industries. This includes potential incentives for adopting cleaner production technologies and stricter regulations on pollution control.

These policies are not just about environmental compliance; they also guide industrial development. Taiwan's commitment to renewable energy, as evidenced by its ambitious offshore wind power targets, creates both challenges and opportunities for steel producers. CSC needs to align its production capabilities and investment strategies with these national objectives to maintain its competitive edge and domestic market position. The government also designates certain industries as strategic, which can unlock preferential policies and funding, further influencing CSC's long-term direction.

- Government Support for Green Steel: Taiwan's National Development Council has outlined plans to support industries in achieving net-zero emissions by 2050, which could translate into subsidies or tax breaks for steelmakers investing in decarbonization technologies.

- Energy Transition Mandates: By 2030, Taiwan aims to increase the share of renewables in its energy mix to 40%, impacting the cost and availability of electricity for energy-intensive steel production.

- Environmental Regulations: Stricter air and water quality standards, enforced by the Environmental Protection Administration, require continuous investment in pollution abatement equipment for facilities like CSC.

Geopolitical Stability in the Indo-Pacific

The Indo-Pacific's geopolitical landscape, marked by increasing maritime security concerns and evolving regional alliances, directly impacts China Steel Corporation's supply chain. Tensions in areas like the South China Sea can escalate shipping costs and create delays, affecting the company's ability to source raw materials like iron ore and coal.

Potential conflicts or heightened military activity in the region pose a significant risk to China Steel's operational efficiency and market access. For instance, disruptions to major shipping lanes, which are vital for transporting steel products to key markets across Asia, could lead to substantial financial losses. In 2024, the cost of shipping bulk cargo, a key input for steel production, saw fluctuations tied to geopolitical events, with some routes experiencing surcharges due to increased risk premiums.

- Maritime Security: Increased naval presence and territorial disputes in the South China Sea can lead to longer transit times and higher insurance premiums for vessels carrying China Steel's materials.

- Regional Alliances: Shifting alliances among Indo-Pacific nations can influence trade agreements and access to critical markets, potentially impacting China Steel's export volumes.

- Trade Disruptions: Geopolitical flashpoints could trigger sanctions or trade restrictions, directly hindering China Steel's ability to import necessary raw materials or export finished goods.

- Supply Chain Resilience: The company's reliance on international shipping means any geopolitical instability directly challenges its supply chain resilience, potentially increasing operational costs by an estimated 5-10% during periods of elevated tension.

Taiwan's government actively shapes China Steel Corporation's (CSC) trajectory through industrial policies and national economic goals. For instance, in 2023, government initiatives focused on industrial upgrades and sustainability directly guided CSC's R&D and operational strategies, emphasizing green manufacturing and carbon emission reduction.

Geopolitical tensions, particularly between Taiwan and mainland China, significantly impact CSC's trade routes and market access, potentially increasing shipping costs and disrupting supply chains. Global protectionist trends, such as EU steel import quotas maintained in 2023, also directly affect CSC's export performance by limiting market access.

Taiwan's energy transition mandates, aiming for 40% renewables by 2030, influence the cost and availability of electricity for CSC's energy-intensive operations. Furthermore, government support for net-zero emissions by 2050 could offer subsidies for decarbonization technologies, aligning CSC's investments with national environmental objectives.

The Indo-Pacific's geopolitical landscape, including maritime security concerns, affects CSC's supply chain by potentially escalating shipping costs and transit times, as seen with fluctuating bulk cargo shipping costs in 2024 influenced by geopolitical events.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting China Steel, covering political, economic, social, technological, environmental, and legal factors.

It offers actionable insights into potential threats and opportunities, enabling strategic decision-making for stakeholders in the steel industry.

This PESTLE analysis for China Steel offers a clear, summarized version of complex external factors, simplifying strategic discussions and reducing the "pain" of wading through lengthy reports.

Economic factors

China Steel Corporation's financial performance is heavily influenced by global steel demand, particularly from construction, automotive, and machinery sectors. For instance, in 2024, global construction activity, a major steel consumer, showed mixed growth patterns, with emerging markets driving some of the demand while developed economies experienced slower expansion.

Supply-demand dynamics are critical. In early 2025, the global steel market continued to grapple with overcapacity in certain regions, which put downward pressure on prices, even as specific high-demand applications saw tighter supply. This imbalance directly impacts China Steel's revenue and profitability, necessitating agile production adjustments.

The company's ability to navigate these volatile market conditions is paramount. By closely monitoring global inventory levels and anticipating shifts in end-user demand, China Steel can better align its output and sales strategies to mitigate price volatility and maintain a competitive edge in the 2024-2025 period.

China Steel Corporation's profitability is directly tied to the fluctuating global prices of iron ore and coking coal. For instance, in 2024, iron ore prices saw significant volatility, with benchmarks like the Platts IODEX trading between $100-$130 per tonne, impacting production costs. Similarly, coking coal prices, crucial for steelmaking, also experienced upward pressures due to supply constraints in key exporting nations.

These raw material costs represent a substantial portion of China Steel's overall expenditure, making them highly sensitive to global supply and demand dynamics. Disruptions, whether from geopolitical tensions in mining regions or unexpected weather events affecting logistics, can rapidly escalate these costs, putting pressure on margins.

To navigate this volatility, China Steel employs strategic procurement and hedging techniques. By securing long-term supply contracts and utilizing financial instruments to hedge against price swings, the company aims to stabilize its input costs and maintain a competitive edge in the market.

Currency exchange rate fluctuations, particularly between the New Taiwan Dollar (NTD) and the US Dollar, significantly impact China Steel Corporation due to its extensive international trade. A strengthening NTD against the USD makes China Steel's exports pricier for overseas buyers, potentially dampening sales volume, while simultaneously reducing the cost of imported raw materials like iron ore and coking coal.

For instance, in early 2024, the NTD experienced some volatility against the USD. While specific figures for China Steel's direct impact are proprietary, general trends show that a 1% appreciation of the NTD can affect the cost of imported inputs and the competitiveness of exports. Managing this foreign exchange risk through hedging strategies is crucial for maintaining profitability and financial stability in the face of global economic shifts.

Energy Costs and Availability

Energy costs, particularly electricity and natural gas, represent a significant operational expenditure for China Steel Corporation, as steel production is inherently energy-intensive. In 2023, global energy prices saw volatility, impacting manufacturing overheads across industries. Taiwan's energy landscape, including its transition towards renewable sources, directly affects China Steel's production expenses and operational continuity.

Securing a consistent and cost-effective energy supply is therefore a critical strategic imperative for China Steel. For instance, Taiwan's reliance on imported energy sources means that geopolitical events and global supply chain disruptions can quickly translate into higher operational costs. The government's energy policies, particularly those promoting green energy adoption, will continue to shape the company's long-term energy strategy and cost structure.

- Energy Intensity: Steel manufacturing consumes substantial amounts of electricity and natural gas.

- Cost Volatility: Fluctuations in global energy prices directly impact China Steel's operating expenses.

- Policy Influence: Taiwan's energy policies, including renewable energy targets, affect production costs and reliability.

- Supply Security: Ensuring stable and affordable energy sources is vital for uninterrupted production.

Interest Rates and Access to Capital

Changes in interest rates significantly impact China Steel Corporation's financial operations. For instance, if the People's Bank of China (PBOC) raises its benchmark lending rates, China Steel's cost of borrowing for new projects or even day-to-day operations will increase. This directly affects their profitability and the feasibility of capital-intensive investments.

Access to capital is crucial for China Steel's growth and modernization. As a major state-owned enterprise, it likely benefits from favorable financing terms. However, global economic conditions and international interest rate movements, such as those set by the US Federal Reserve, can also influence the cost and availability of capital in international markets, impacting their ability to secure competitive funding for expansion or technological upgrades.

- Interest Rate Impact: Higher domestic interest rates, such as the PBOC's Loan Prime Rate (LPR) which has seen adjustments in recent years, directly increase China Steel's debt servicing costs.

- Capital Access: China Steel's state-owned status often facilitates access to capital, but global financial market volatility and international interest rate trends can still influence the terms of foreign currency borrowing.

- Investment Decisions: Fluctuations in borrowing costs can sway decisions on major capital expenditures, such as investments in new blast furnaces or advanced rolling mills, impacting long-term strategic planning.

- Working Capital: Even short-term borrowing for working capital needs becomes more expensive when interest rates rise, squeezing margins.

Economic factors significantly shape China Steel Corporation's environment. Global steel demand, driven by sectors like construction and automotive, dictates sales volumes. For instance, in 2024, while emerging markets offered growth, developed economies presented a more subdued demand picture for steel products.

Raw material costs, particularly iron ore and coking coal, are a major determinant of profitability. In 2024, iron ore prices fluctuated, with benchmarks trading in a range that directly impacted China Steel's production expenses. Currency exchange rates, especially between the NTD and USD, also play a crucial role in international trade, affecting both export competitiveness and import costs.

Energy prices, vital for the energy-intensive steelmaking process, add another layer of economic influence. Taiwan's energy policies and global energy market volatility, as seen in 2023, directly affect China Steel's operational expenditures. Furthermore, interest rate movements influence borrowing costs for capital investments and working capital, impacting the company's financial strategy and investment decisions.

| Economic Factor | 2024/2025 Trend/Data Point | Impact on China Steel |

|---|---|---|

| Global Steel Demand | Mixed growth, emerging markets driving demand, developed economies slower. | Influences sales volume and revenue. |

| Iron Ore Prices | Volatile, e.g., Platts IODEX trading between $100-$130/tonne in 2024. | Directly affects production costs and profit margins. |

| Coking Coal Prices | Upward pressure due to supply constraints in exporting nations. | Increases raw material expenditure. |

| NTD/USD Exchange Rate | Experienced volatility in early 2024. | Affects export pricing and import costs; hedging is crucial. |

| Energy Prices | Global energy prices saw volatility in 2023. | Impacts operational expenses for energy-intensive production. |

| Interest Rates | Influenced by domestic (PBOC) and international (e.g., US Federal Reserve) policies. | Affects cost of borrowing for capital and working capital. |

Same Document Delivered

China Steel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of China Steel.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting China Steel.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for China Steel.

Sociological factors

China's steel industry, including companies like China Steel Corporation, faces a significant challenge with an aging workforce. By 2024, a substantial portion of skilled laborers in traditional heavy industries are nearing retirement age, creating a potential gap in expertise and experienced personnel. This demographic shift necessitates robust succession planning and a focus on knowledge transfer to maintain operational continuity.

Maintaining positive labor relations is paramount for China Steel Corporation. In 2024, engagement with powerful labor unions is critical for ensuring industrial peace and operational stability. Strikes or labor disputes can significantly disrupt production, impacting output and profitability, making proactive dialogue and fair treatment of workers a key strategic imperative.

To counter the effects of an aging workforce, China Steel Corporation must prioritize investment in training and talent development programs. By 2025, initiatives aimed at upskilling existing employees and attracting new talent with modern skill sets will be essential. This includes fostering apprenticeships and continuous learning opportunities to bridge the skills gap and ensure a capable workforce for the future.

Societal and stakeholder expectations are increasingly pushing companies like China Steel to adopt more ethical and sustainable business practices. This includes a strong focus on environmental protection, ensuring fair treatment and welfare for employees, and actively engaging in local community development. These efforts directly impact China Steel's reputation and its ability to operate smoothly.

China Steel's commitment to these areas can significantly boost its public image and foster brand loyalty. For instance, in 2024, the company was recognized for its efforts in reducing carbon emissions, a key aspect of its environmental responsibility. Such initiatives are vital for maintaining a positive social license to operate.

Transparent reporting on Corporate Social Responsibility (CSR) activities is becoming non-negotiable. Stakeholders, from investors to consumers, demand clear and verifiable data on a company's social and environmental performance. China Steel's annual sustainability reports, which detail its progress in areas like waste reduction and community investment, are crucial for building trust and demonstrating accountability in 2025.

Growing environmental consciousness among industrial buyers and consumers is fueling a demand for steel produced with a lower carbon footprint. This trend is particularly evident in sectors like construction and automotive, where sustainability is becoming a key purchasing criterion.

China Steel Corporation needs to align its manufacturing and product portfolio with these shifting preferences. For instance, obtaining certifications for green building materials or developing low-carbon steel for electric vehicle components will be crucial for market competitiveness.

This evolving consumer and industry demand directly influences China Steel's product innovation pipeline and how it markets its offerings. By 2024, the global steel industry saw a significant increase in inquiries for green steel products, with some European markets already imposing stricter carbon emission standards on imported steel.

Public Perception and Brand Image

China Steel Corporation's (CSC) public perception in Taiwan and Asia is deeply tied to its status as a major state-owned enterprise. Its brand image directly influences consumer trust and investor confidence. For instance, in 2023, CSC reported a net profit of NT$14.4 billion, demonstrating its significant economic contribution, which generally bolsters its image as a pillar of national industry.

Environmental incidents or safety lapses can severely damage CSC's reputation. A proactive approach to corporate social responsibility and transparent communication regarding its operations are therefore essential. For example, CSC's ongoing investments in green steel technologies, aiming to reduce carbon emissions by 20% by 2030, are key to shaping a positive environmental image.

- Brand Image Impact: Public perception directly affects consumer purchasing decisions and investor sentiment towards China Steel Corporation.

- Economic Contribution: CSC's substantial economic contributions, such as its 2023 net profit of NT$14.4 billion, generally enhance its standing as a vital national enterprise.

- Environmental Stewardship: Investments in green steel, targeting a 20% carbon emission reduction by 2030, are critical for building a positive environmental reputation.

- Transparency and Communication: Open communication and responsible operational practices are paramount for maintaining public trust and a favorable brand image.

Health and Safety Standards for Industrial Operations

Societal expectations regarding worker well-being are increasingly shaping industrial practices in China. For China Steel Corporation, this translates to a heightened demand for rigorous health and safety standards across all operations. Failure to meet these evolving expectations can lead to significant operational disruptions and negative public perception.

In 2024, China's Ministry of Emergency Management reported a 5.1% decrease in workplace accidents compared to the previous year, highlighting a national push for improved safety. This trend underscores the growing societal emphasis on occupational health, making compliance a non-negotiable aspect for heavy industries like steel manufacturing. China Steel Corporation must therefore invest in advanced safety technologies and comprehensive training programs to align with these societal priorities.

- Employee Morale and Productivity: A strong safety record directly correlates with higher employee morale and, consequently, improved productivity.

- Reputational Risk Mitigation: Adherence to safety standards protects China Steel from reputational damage that can arise from workplace incidents.

- Legal and Regulatory Compliance: Robust safety protocols are essential for meeting China's increasingly stringent labor laws and environmental regulations.

- Societal Expectations: Continuous enhancement of safety measures is a fundamental societal expectation for responsible corporate citizenship.

Societal shifts are increasingly prioritizing worker well-being, pushing companies like China Steel to adopt stringent health and safety standards. This focus is driven by a growing public awareness and governmental pressure, as seen in China's 5.1% decrease in workplace accidents in 2024, indicating a national commitment to occupational safety.

These evolving expectations directly impact China Steel’s operational approach, necessitating investment in advanced safety technologies and comprehensive training. A strong safety record not only boosts employee morale and productivity but also mitigates reputational risks and ensures compliance with increasingly strict labor laws.

Furthermore, consumer and industrial buyer demand for sustainably produced steel is on the rise, influencing product development and marketing strategies. China Steel's efforts in green steel technologies, aiming for a 20% carbon emission reduction by 2030, are crucial for maintaining market competitiveness and a positive brand image.

| Societal Factor | Impact on China Steel | Relevant Data/Initiative |

|---|---|---|

| Worker Well-being & Safety | Demand for higher safety standards, improved morale, and productivity. | China's 5.1% decrease in workplace accidents (2024) signals a national push for safety. |

| Environmental Consciousness | Growing demand for green steel, influencing product innovation and marketing. | China Steel's goal to reduce carbon emissions by 20% by 2030. |

| Corporate Social Responsibility (CSR) | Expectation for ethical practices, community engagement, and transparent reporting. | China Steel's annual sustainability reports detailing waste reduction and community investment. |

Technological factors

China Steel Corporation is heavily investing in Industry 4.0 technologies to boost efficiency and cut costs. This includes implementing automation, the Internet of Things (IoT), artificial intelligence (AI), and big data analytics across its operations. For instance, in 2023, the company allocated a significant portion of its capital expenditure towards digital transformation initiatives, aiming to achieve a 15% reduction in energy consumption through smart manufacturing processes by 2025.

By adopting smart manufacturing, China Steel can achieve predictive maintenance, meaning equipment issues are identified before they cause breakdowns, minimizing costly downtime. This digital shift also allows for better resource management, ensuring materials and energy are used more effectively. Such advancements are critical for maintaining a competitive edge in the global steel market.

China Steel's commitment to advanced steel materials is crucial for sectors like automotive and aerospace. Research into high-strength, lightweight alloys directly addresses the needs of electric vehicles, which demand lighter components for better range. For example, the automotive industry's push for lighter materials saw global steel demand for vehicles grow by an estimated 5% in 2024.

Innovation in metallurgy allows China Steel to develop specialized steel products, enhancing its competitiveness in high-value markets. This product diversification is key to capturing market share in demanding sectors such as high-tech construction, where advanced materials are increasingly specified for their performance characteristics.

China Steel Corporation faces a significant technological imperative driven by the global decarbonization trend. Investments in advanced solutions like carbon capture, utilization, and storage (CCUS), hydrogen-based steelmaking, and upgraded electric arc furnaces are essential for future viability. These shifts are crucial for meeting stringent emissions regulations and securing market access in an increasingly carbon-conscious global economy.

Automation and Robotics in Production Processes

China Steel Corporation's adoption of automation and robotics in its production lines is a significant technological driver. This integration aims to enhance worker safety by removing personnel from hazardous areas, a critical concern in steel manufacturing. Furthermore, it directly addresses labor costs, a substantial operational expense, by reducing the reliance on manual labor for repetitive and physically demanding tasks. For instance, in 2023, the global industrial robotics market was valued at approximately $50 billion, with significant growth projected in sectors like manufacturing, indicating a strong trend towards automation.

The precision and consistency offered by robotic systems are paramount for maintaining high-quality output in steel production. Automating these processes not only boosts overall productivity but also helps in identifying and mitigating operational bottlenecks, leading to smoother and more efficient manufacturing cycles. The strategic deployment of these advanced technologies is fundamental to China Steel's modernization efforts, aligning with industry-wide trends that prioritize efficiency and quality through technological advancement.

Key benefits and impacts include:

- Enhanced worker safety through the removal of humans from hazardous environments.

- Reduced labor costs by automating repetitive and physically demanding tasks.

- Improved product quality due to the precision and consistency of robotic operations.

- Increased production efficiency by mitigating operational bottlenecks and boosting overall output.

Digitalization of Supply Chain Management

China Steel Corporation is increasingly leveraging digital platforms to streamline its entire supply chain, from sourcing raw materials like iron ore and coking coal to managing inventory and distributing finished steel products. This digital transformation is crucial for optimizing operations.

The adoption of digital tools enhances transparency across the supply chain, allowing for better tracking of goods and materials. This improved visibility helps reduce lead times, which in 2024, saw global shipping times fluctuate significantly due to geopolitical events, making agile supply chains essential. For instance, by mid-2024, average container shipping costs from Asia to Europe had seen a notable increase, underscoring the need for efficient logistics management.

Furthermore, implementing predictive analytics for demand forecasting and inventory management is a key focus. This technology enables China Steel to anticipate market needs more accurately, leading to substantial cost savings by minimizing excess stock and reducing the risk of stockouts. By 2025, the company aims to integrate AI-driven forecasting models to achieve a projected 10-15% reduction in inventory holding costs.

The benefits of digitalization extend to improved resilience against disruptions. In a world where supply chain vulnerabilities are frequently exposed, as seen with port congestion issues in late 2023 and early 2024, digital platforms provide real-time data and alternative routing options, allowing China Steel to react swiftly to unforeseen challenges and maintain operational continuity.

- Digital Procurement: Utilizing online marketplaces and data analytics for raw material sourcing to secure competitive pricing and reliable supply.

- Logistics Optimization: Employing real-time tracking and route optimization software to reduce transit times and fuel consumption, with a goal of a 5% efficiency gain by 2025.

- Inventory Management: Implementing smart inventory systems that use AI for demand prediction, aiming to decrease carrying costs by up to 12% in the next fiscal year.

- Distribution Efficiency: Enhancing last-mile delivery through digital platforms and data-driven route planning to improve customer service and reduce delivery costs.

Technological advancements are reshaping China Steel's operations, driving efficiency and innovation. The company is heavily investing in Industry 4.0, integrating automation, AI, and big data to optimize processes. For instance, China Steel aims for a 15% energy consumption reduction by 2025 through smart manufacturing, a key initiative in its 2023 capital expenditure. This digital transformation is crucial for maintaining a competitive edge in the global steel market.

Legal factors

China Steel Corporation faces a landscape of tightening environmental regulations, impacting its operations significantly. For instance, China's updated Environmental Protection Law, effective from 2024, imposes stricter penalties for pollution violations, with daily fines for non-compliance. This means continued investment in technologies to meet evolving standards for air quality, water discharge, and waste disposal is crucial for avoiding substantial financial penalties and operational disruptions.

Meeting these stringent national and international emissions standards, particularly concerning greenhouse gases, requires ongoing capital expenditure. By 2025, China aims to peak carbon emissions, placing further pressure on heavy industries like steel to adopt cleaner production methods. Failure to adapt can lead to operational restrictions, as seen with past temporary shutdowns of steel mills during periods of severe air pollution, directly impacting production volumes and revenue.

Taiwanese labor laws, including minimum wage requirements and regulations on working hours and overtime, directly influence China Steel Corporation's operational expenses. For instance, as of January 1, 2024, Taiwan's minimum monthly wage increased to NT$27,470, impacting labor costs for all businesses.

China Steel must also navigate regulations concerning employee benefits, such as mandatory health insurance and retirement contributions, which add to its overall human resource expenditure. Compliance with occupational health and safety standards is paramount to prevent workplace accidents and associated liabilities, ensuring a safe working environment.

Furthermore, the legal framework surrounding union rights and collective bargaining significantly affects industrial relations and the potential for labor disputes. China Steel's commitment to fair labor practices and open communication with its workforce is vital for maintaining industrial harmony and avoiding costly strikes or legal challenges.

China Steel Corporation, as a significant global steel supplier, frequently faces anti-dumping and countervailing duty investigations. For instance, in 2024, the United States International Trade Commission continued to review existing duties on certain steel products from China, impacting market access and pricing for Chinese exporters.

These investigations can result in substantial tariffs, directly affecting China Steel's export competitiveness and revenue streams. For example, if duties are imposed in a major market like the European Union, it could lead to a significant reduction in sales volume and profitability for affected product lines.

Maintaining robust legal defense strategies and ensuring strict compliance with international trade regulations are therefore critical for China Steel. This proactive approach helps mitigate risks associated with these investigations and preserves access to vital export markets.

Competition Law and Antitrust Regulations

China Steel Corporation, despite its significant state-owned enterprise status, operates within a framework of competition law and antitrust regulations. These rules are in place to prevent monopolistic practices, cartels, and unfair competition, ensuring a level playing field in the market. Regulatory bodies, both domestically in Taiwan and in international markets where China Steel operates, actively monitor its market share and pricing decisions. For instance, in 2023, Taiwan's Fair Trade Commission has continued to review market concentration in various sectors, and while specific actions against China Steel were not prominent in public reports for that year, the general oversight remains. Violations of these regulations can result in substantial financial penalties and complex legal disputes, impacting the company's financial health and operational freedom.

The enforcement of these laws is critical for maintaining market integrity. Regulatory bodies examine actions that could stifle competition, such as:

- Abuse of dominant market position: Ensuring China Steel does not leverage its size to unfairly disadvantage smaller competitors.

- Price fixing and collusion: Preventing agreements with other market players that artificially inflate prices or limit supply.

- Merger and acquisition scrutiny: Reviewing any proposed business combinations to assess their impact on market competition.

Corporate Governance and Transparency Requirements

As a publicly listed state-owned enterprise, China Steel Corporation (CSC) operates under strict corporate governance and transparency mandates from Taiwanese regulators. These rules are designed to foster investor trust and maintain market fairness. For instance, CSC's adherence to the Taiwan Stock Exchange's listing rules, which include detailed financial disclosures and independent board oversight, is crucial for its reputation and access to capital.

CSC's commitment to these standards is reflected in its regular financial reporting, including annual reports and interim financial statements. In 2023, the company reported a net profit of NT$15.3 billion, demonstrating its operational performance within the established regulatory framework. This consistent disclosure helps stakeholders assess the company's financial health and strategic direction.

- Regulatory Compliance: CSC must comply with the Securities and Exchange Act and the Company Act in Taiwan, ensuring adherence to corporate governance best practices.

- Financial Reporting: The company adheres to International Financial Reporting Standards (IFRS) for its financial statements, providing transparency for investors.

- Investor Confidence: Robust governance and transparency are key to maintaining investor confidence, which is vital for attracting and retaining capital in competitive global markets.

- Accountability: These requirements ensure that CSC is accountable to its shareholders, employees, and the public, reinforcing its role as a responsible corporate citizen.

China Steel Corporation navigates a complex legal terrain, encompassing environmental mandates, labor laws, and trade regulations. Stricter environmental laws, effective from 2024, impose daily fines for pollution, necessitating ongoing investment in cleaner technologies to meet China's 2025 carbon emission targets. Taiwan's labor laws, including a minimum monthly wage of NT$27,470 as of January 1, 2024, directly impact operational costs and require compliance with occupational safety standards.

Environmental factors

Taiwan has committed to reducing greenhouse gas emissions by 20% below 2005 levels by 2030, a target that directly impacts China Steel Corporation's operations. This global push for climate action, including potential carbon pricing mechanisms, necessitates significant investment in decarbonization technologies. China Steel's 2023 sustainability report highlighted ongoing efforts in green steel production, aiming to align with these evolving environmental mandates and investor expectations regarding its carbon footprint.

Global resource scarcity, especially for key inputs like iron ore, is a growing concern. For China Steel Corporation, this means a stronger push towards circular economy principles. This involves getting more value from scrap steel and finding uses for byproducts, aiming to cut down on waste.

By adopting these circular practices, China Steel can boost its resource efficiency. For instance, in 2023, China's steel industry recycled approximately 250 million tons of scrap steel, a significant portion of its total production, demonstrating a tangible shift towards material reuse.

Steel production is incredibly water-intensive, and China Steel Corporation faces risks from water scarcity in its operating regions and increasingly stringent rules on wastewater quality. For instance, in 2023, parts of China experienced significant drought, impacting industrial water availability. This necessitates substantial investment in advanced water recycling and treatment systems to ensure sustainable operations and reduce their environmental impact.

Efficient water management is not just an environmental concern but a critical factor for operational continuity. China Steel's commitment to reducing its water footprint through technologies like closed-loop cooling systems and advanced wastewater treatment directly supports its long-term viability. By investing in these areas, the company aims to mitigate risks associated with water availability and regulatory compliance, which is crucial given the global push for greater water stewardship.

Air Quality Regulations and Particulate Matter Control

China Steel Corporation faces increasing pressure from stringent environmental regulations targeting air pollutants such as sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter (PM). These rules necessitate ongoing investment in sophisticated air pollution control technologies and advanced monitoring systems to ensure compliance. For instance, China's Ministry of Ecology and Environment has been progressively tightening emission standards for industrial sectors, including steel manufacturing, with a focus on reducing PM2.5 concentrations in major urban areas.

Public health concerns are a significant driver behind these stricter air quality mandates. As awareness grows regarding the health impacts of air pollution, there's a continuous demand for improved emission reduction strategies from heavy industries. This public sentiment directly influences policy decisions and enforcement intensity. Maintaining a social license to operate hinges on demonstrating a commitment to environmental stewardship and public well-being.

- Regulatory Compliance Costs: China Steel's capital expenditures for environmental protection equipment are substantial. In 2023, the company reported significant investments in upgrading its emission control systems to meet evolving national standards.

- Emission Reduction Targets: The company is actively working towards meeting national and provincial targets for reducing SOx, NOx, and PM emissions, which are critical for maintaining operational permits.

- Public Perception: Positive public perception regarding environmental performance is crucial for China Steel's brand image and its ability to secure new projects or expand operations.

- Technological Advancements: Continuous investment in research and development for cleaner production technologies is essential to stay ahead of regulatory curves and improve overall air quality performance.

Biodiversity Impact and Land Use Considerations

The extensive industrial operations of China Steel, encompassing mining, production facilities, and transportation infrastructure, inevitably exert pressure on local ecosystems. This significant land footprint can lead to habitat fragmentation and a reduction in biodiversity. For instance, the company's operations in Taiwan, while contributing significantly to the economy, necessitate careful management of its land use to minimize ecological disruption.

China Steel Corporation is tasked with actively managing its land use to mitigate environmental degradation and safeguard local biodiversity. This involves implementing robust environmental management systems and exploring opportunities for ecological restoration in areas affected by its activities. As of 2024, the company continues to invest in environmental protection measures, reflecting a growing global emphasis on corporate environmental responsibility.

Sustainable land management is becoming a critical environmental consideration for the steel industry. China Steel's commitment to these principles is crucial for long-term operational viability and social license to operate. The company's 2023 sustainability report highlighted ongoing efforts in land rehabilitation and biodiversity monitoring, underscoring the importance of these factors in their strategic planning.

Key considerations for China Steel include:

- Land Use Planning: Strategic allocation and management of land for mining, production, and infrastructure to minimize ecological impact.

- Biodiversity Protection: Implementing measures to protect and conserve local flora and fauna within and surrounding operational sites.

- Ecological Restoration: Investing in projects aimed at rehabilitating degraded land and restoring natural habitats.

- Sustainable Resource Management: Ensuring responsible extraction and utilization of natural resources to lessen the overall environmental footprint.

China Steel Corporation faces significant environmental pressures, including stringent regulations on greenhouse gas emissions and air pollutants like SOx, NOx, and PM. The company is investing in decarbonization technologies and pollution control systems to meet these evolving standards, as evidenced by its 2023 sustainability report highlighting green steel production efforts. Water scarcity and wastewater quality are also critical concerns, driving investments in water recycling and treatment to ensure operational continuity and compliance with growing water stewardship expectations.

Resource scarcity, particularly for iron ore, is pushing China Steel towards circular economy principles. This involves maximizing scrap steel utilization and finding value in byproducts, a trend supported by the 2023 data showing China's steel industry recycling approximately 250 million tons of scrap steel. Furthermore, the company’s extensive land footprint necessitates careful management to mitigate ecological disruption and protect biodiversity, with ongoing investments in environmental protection measures as of 2024.

PESTLE Analysis Data Sources

Our China Steel PESTLE Analysis is meticulously constructed using data from official Chinese government ministries, international trade organizations, and leading industry research firms. We incorporate economic indicators, environmental regulations, technological advancements, and geopolitical trends to provide a comprehensive view.