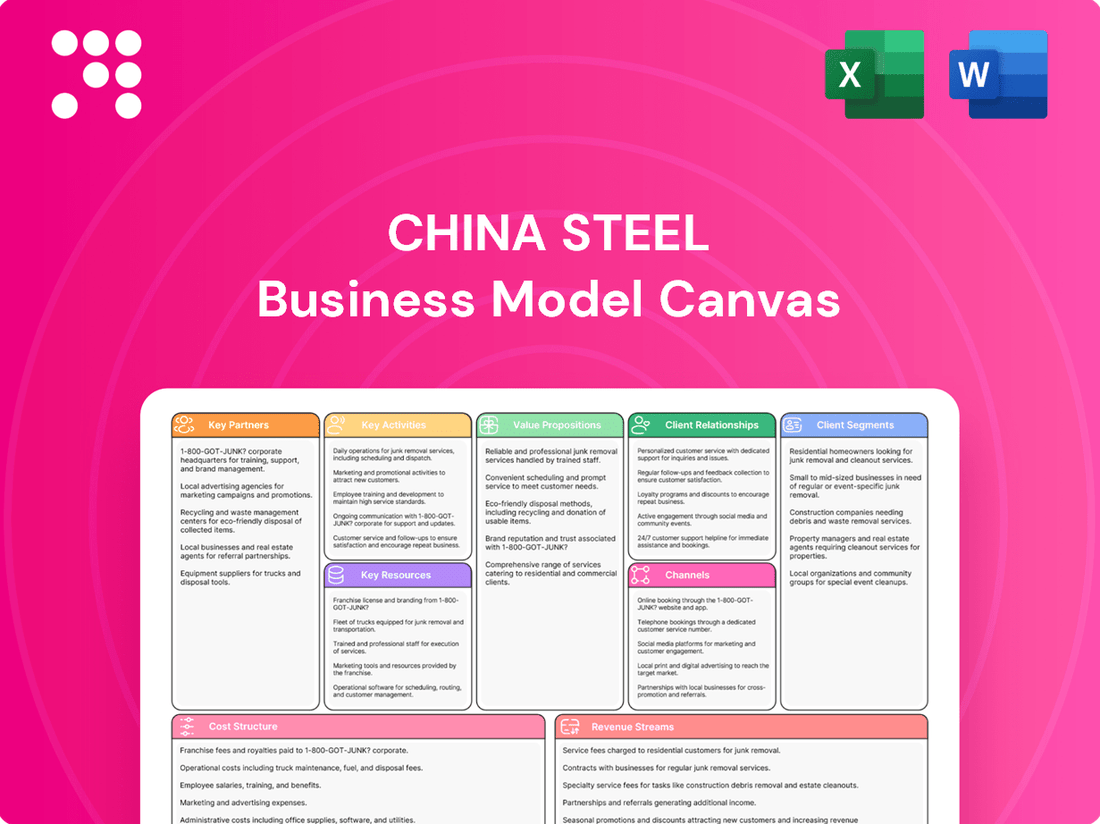

China Steel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Steel Bundle

Unlock the strategic blueprint of China Steel’s success with our comprehensive Business Model Canvas. This detailed analysis reveals how they master key resources, cultivate vital partnerships, and deliver exceptional value to their diverse customer segments. Gain actionable insights into their revenue streams and cost structures to inform your own business strategies.

Partnerships

China Steel Corporation's key partnerships with raw material suppliers are foundational to its operations. The company secures essential inputs like iron ore and coking coal through strategic, long-term agreements with major global mining entities. For instance, in 2023, China Steel maintained significant supply contracts with companies such as Rio Tinto and BHP, ensuring a consistent flow of high-quality ore.

These alliances are vital for mitigating the impact of fluctuating global commodity prices. By locking in supply and pricing through these partnerships, China Steel can better manage its cost structure and maintain competitive pricing for its finished steel products. This strategic approach to raw material sourcing directly supports the company's ability to achieve stable production volumes and financial performance.

China Steel Corporation actively partners with leading research institutions, universities, and technology firms to drive innovation in steelmaking. These collaborations are crucial for developing cutting-edge, low-carbon technologies and implementing smart manufacturing solutions, ensuring the company remains a leader in industry advancements.

For instance, in 2024, China Steel continued its engagement with academic bodies to explore novel hydrogen-based steelmaking techniques, a key component of its sustainability roadmap. Such partnerships are vital for achieving ambitious environmental targets and enhancing operational efficiency through technological breakthroughs.

China Steel Corporation's downstream industry customers, particularly in construction and automotive, are vital partners. In 2024, the construction sector continued to be a major consumer, driving demand for structural steel. Similarly, the automotive industry’s focus on lightweighting and advanced materials in 2024 spurred demand for high-strength steel grades, with China Steel actively collaborating on product development.

Logistics and Shipping Companies

China Steel relies heavily on logistics and shipping partners to manage the movement of raw materials like iron ore and coal, as well as the distribution of finished steel products. These partnerships are essential for maintaining an efficient and cost-effective supply chain, particularly given the global nature of the steel industry. In 2024, the global shipping industry experienced fluctuating rates, with the Baltic Dry Index, a key indicator for dry bulk shipping costs, showing significant volatility due to geopolitical events and demand shifts. For instance, disruptions in key shipping lanes can directly impact China Steel's operational costs and delivery schedules.

These collaborations are crucial for ensuring timely deliveries to customers worldwide and for optimizing inventory management. By partnering with established logistics providers, China Steel can leverage their expertise in handling large volumes of materials and navigating complex international trade regulations. This strategic alignment helps minimize transit times and reduce the risk of supply chain disruptions, which is vital in a competitive market.

- Cost Efficiency: Negotiating favorable shipping rates with partners helps control transportation expenses, a significant cost component for steel producers.

- Timely Delivery: Reliable logistics ensure that raw materials arrive on time for production and that finished goods reach customers promptly, maintaining customer satisfaction.

- Supply Chain Optimization: Partnerships allow for better planning and execution of transportation, reducing lead times and improving overall supply chain responsiveness.

- Global Reach: Access to extensive shipping networks facilitates international trade, enabling China Steel to serve diverse markets effectively.

Green Energy Developers and Environmental Technology Firms

China Steel Corporation's commitment to achieving carbon neutrality by 2050 hinges on strategic alliances with key players in the green energy and environmental technology sectors. These partnerships are crucial for securing sustainable energy sources and implementing advanced decarbonization strategies.

Collaborating with renewable energy developers allows China Steel to procure green electricity, a vital step in reducing its operational carbon footprint. For instance, in 2024, the company continued to explore and implement power purchase agreements for solar and wind energy, aiming to significantly increase the proportion of renewable energy in its electricity consumption mix.

Furthermore, partnerships with environmental technology firms are essential for deploying cutting-edge solutions. This includes the adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies, as well as other innovative methods to mitigate emissions. These collaborations are expected to drive the development and integration of technologies that can directly address the company's greenhouse gas emissions.

- Renewable Energy Procurement: China Steel is actively pursuing agreements with green energy developers to source a larger share of its electricity from renewable sources, a trend that accelerated in 2024.

- CCUS Technology Integration: Partnerships with environmental technology firms are critical for the implementation of Carbon Capture, Utilization, and Storage solutions, a key component of their 2050 carbon neutrality roadmap.

- Decarbonization Innovation: Collaborations extend to adopting a range of other environmental technologies aimed at reducing overall emissions and improving energy efficiency across operations.

China Steel's key partnerships extend to financial institutions and government bodies, crucial for securing capital and navigating regulatory landscapes. These alliances provide access to funding for large-scale projects and support strategic initiatives, including those aimed at sustainability and technological advancement.

In 2024, China Steel continued to leverage its relationships with major banks for project financing and working capital, underscoring the importance of financial partnerships in sustaining operations and growth. Government support and collaborations with industry associations also play a significant role in shaping policy and fostering a favorable business environment.

These relationships are vital for risk management and for accessing specialized expertise. For instance, collaborations with technology providers in 2024 focused on enhancing operational efficiency through digitalization and automation, directly impacting cost structures and production capabilities.

China Steel’s partnerships with downstream customers, particularly in the automotive and construction sectors, are essential for understanding market needs and co-developing specialized steel products. In 2024, the demand for high-strength, lightweight steel in the automotive industry continued to grow, prompting closer collaboration on material innovation.

| Partner Type | Focus Area | 2024 Relevance |

|---|---|---|

| Raw Material Suppliers | Iron Ore, Coking Coal | Securing stable, cost-effective supply chains; mitigating price volatility. |

| Research Institutions & Tech Firms | Low-Carbon Tech, Smart Manufacturing | Driving innovation in hydrogen-based steelmaking and decarbonization. |

| Downstream Customers | Automotive, Construction | Co-developing advanced materials; meeting evolving industry demands. |

| Logistics & Shipping Providers | Global Transportation | Ensuring efficient, cost-effective movement of materials and products. |

| Green Energy Developers | Renewable Energy Procurement | Increasing renewable energy share in electricity consumption for sustainability goals. |

What is included in the product

A detailed China Steel Business Model Canvas outlining key customer segments, value propositions, and revenue streams, reflecting the company's integrated approach to steel production and distribution.

The China Steel Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of complex operations, enabling rapid identification of inefficiencies and areas for strategic improvement.

Activities

China Steel Corporation's integrated steel production is a cornerstone activity, encompassing everything from the initial processing of raw materials like iron ore and coal to the final manufacturing of diverse steel products. This includes the creation of plates, bars, wire rods, and coils, catering to a wide range of industrial needs.

Optimizing these intricate production processes for peak efficiency, unwavering quality, and competitive cost-effectiveness is a fundamental and ongoing endeavor for the company. For instance, in 2023, China Steel reported a crude steel output of approximately 13.4 million tons, highlighting the sheer scale of these operations.

China Steel consistently invests in research and development to create novel steel types, enhance current offerings, and pioneer new production techniques. This commitment is crucial for staying competitive and meeting evolving market demands.

In 2024, the company continued to focus on advanced materials and smart manufacturing, integrating AIoT solutions for greater efficiency. A significant portion of their R&D budget was allocated to developing greener production methods, aligning with global sustainability goals.

China Steel's key activities heavily involve managing its supply chain. This includes the strategic procurement of essential raw materials like iron ore and coking coal, where securing stable and cost-effective supplies is paramount. In 2023, China Steel's raw material costs represented a significant portion of its overall expenses, highlighting the importance of efficient sourcing.

Furthermore, maintaining optimal inventory levels for these raw materials and finished steel products is crucial to meet market demand without incurring excessive holding costs. The company also focuses on logistics, ensuring the efficient transportation of materials from suppliers and the delivery of finished goods to customers, a process that directly impacts profitability and customer satisfaction.

Sales and Marketing

China Steel actively sells a wide array of steel products, from construction materials to specialized alloys, to diverse sectors including automotive, construction, and manufacturing. Managing these customer relationships involves understanding their specific needs and providing tailored solutions.

Key activities also encompass robust market analysis to identify trends and opportunities, developing competitive pricing strategies, and offering essential technical support to ensure optimal product application and customer satisfaction. This proactive approach aims to solidify market position and drive sales growth.

- Market Reach: Serving domestic and international markets across automotive, construction, and appliance sectors.

- Product Portfolio: Offering a broad range of steel products, including hot-rolled, cold-rolled, and galvanized steel.

- Customer Engagement: Implementing CRM systems to manage relationships and provide technical assistance.

- Sales Performance: In 2023, China Steel Corporation reported consolidated revenues of NT$761.3 billion (approximately $24.3 billion USD), reflecting strong sales activity.

Environmental and Sustainability Initiatives

China Steel Corporation is actively engaged in implementing robust environmental and sustainability initiatives. A key activity involves developing and executing carbon reduction strategies, a critical component of their commitment to achieving carbon neutrality by 2050. This includes significant efforts in optimizing energy efficiency across their operations, which directly contributes to lowering their environmental footprint.

Further bolstering these efforts, China Steel is increasing its utilization of renewable energy sources. This strategic shift is supported by ongoing research into advanced low-carbon steelmaking technologies, aiming to fundamentally transform production processes. For instance, by the end of 2023, China Steel had already achieved a 10% reduction in greenhouse gas emissions intensity compared to their 2019 baseline.

- Carbon Reduction Strategies: Implementing science-based targets to decrease Scope 1, 2, and 3 emissions.

- Energy Efficiency Optimization: Investing in advanced equipment and process improvements to minimize energy consumption per ton of steel produced.

- Renewable Energy Utilization: Increasing the proportion of electricity sourced from solar and wind power for their facilities.

- Low-Carbon Technology Research: Exploring and piloting innovative methods like hydrogen-based direct reduction and carbon capture utilization and storage (CCUS).

China Steel's key activities revolve around its integrated steel production, from raw material processing to manufacturing diverse steel products like plates and coils. They also focus heavily on optimizing production for efficiency, quality, and cost-effectiveness, as evidenced by their 2023 crude steel output of approximately 13.4 million tons.

Continuous investment in research and development is crucial, with a 2024 focus on advanced materials, smart manufacturing, and greener production methods. Supply chain management, including strategic raw material procurement and inventory control, is also a vital activity, underscored by raw material costs being a significant expense in 2023.

Sales and marketing efforts involve serving various sectors with a broad product portfolio and managing customer relationships through technical support and market analysis. In 2023, China Steel reported consolidated revenues of NT$761.3 billion, demonstrating strong sales performance.

Sustainability is a core activity, with carbon reduction strategies and energy efficiency improvements being paramount, aiming for carbon neutrality by 2050. By the end of 2023, they achieved a 10% reduction in greenhouse gas emissions intensity compared to their 2019 baseline.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Integrated Steel Production | Processing raw materials to manufacturing finished steel products. | Crude steel output of ~13.4 million tons in 2023. |

| Research & Development | Innovating steel types and production techniques. | Focus on advanced materials, smart manufacturing, and green production in 2024. |

| Supply Chain Management | Procurement of raw materials and logistics. | Raw material costs were a significant expense in 2023. |

| Sales & Marketing | Serving diverse sectors with a wide product range. | Consolidated revenues of NT$761.3 billion in 2023. |

| Sustainability Initiatives | Reducing carbon footprint and improving energy efficiency. | 10% GHG emissions intensity reduction by end of 2023 (vs. 2019 baseline). |

Delivered as Displayed

Business Model Canvas

The preview of the China Steel Business Model Canvas you are viewing is the actual document you will receive upon purchase. This means you can confidently assess its structure, content, and presentation, knowing it is exactly what you will get. Upon completion of your order, you will gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

China Steel Corporation's manufacturing facilities are its backbone, encompassing integrated steel mills, blast furnaces, and electric arc furnaces. These facilities are crucial for producing a diverse range of steel products, from basic materials to specialized alloys. In 2023, China Steel reported a production volume of approximately 13.7 million metric tons of crude steel.

The company operates advanced rolling mills and specialized production lines, enabling it to meet varied customer demands across industries like automotive, construction, and electronics. These substantial physical assets represent a significant capital investment and are fundamental to China Steel's operational capacity and market competitiveness.

China Steel's business model heavily relies on its highly skilled workforce, encompassing experienced engineers, metallurgists, and operational specialists. This expertise is fundamental to maintaining efficient production, ensuring stringent quality control, and fostering innovation within the intricate steelmaking processes.

The collective knowledge of these professionals directly translates into operational excellence and the adoption of cutting-edge technologies. For instance, in 2024, China Steel reported a workforce of approximately 19,000 employees, with a significant portion dedicated to technical and R&D roles, underscoring the company's commitment to human capital as a key resource.

China Steel's proprietary technology and intellectual property are anchored by a robust portfolio of patents, including those related to advanced steelmaking techniques and specialized alloy compositions. These patents are crucial for protecting their innovations and maintaining a distinct market position.

Specialized manufacturing processes, honed through decades of experience, allow China Steel to produce high-strength, corrosion-resistant steel grades that command premium pricing. For instance, their expertise in hot-dip galvanizing and advanced coating technologies sets them apart.

Significant investments in research and development, evidenced by their R&D spending which consistently represents a notable portion of their revenue, fuel ongoing innovation. In 2023, China Steel's R&D expenditure was approximately 1.5% of its net sales, focusing on developing next-generation steel products for the automotive and construction sectors.

Access to Raw Materials

China Steel's access to raw materials is a cornerstone of its operations, ensuring a steady supply of critical inputs like iron ore, coking coal, and scrap metal. This diversification mitigates risks associated with single-source dependency and price volatility.

Securing these resources often involves long-term contracts with suppliers, providing stability and predictable costs. For instance, in 2023, global iron ore prices averaged around $120 per tonne, highlighting the importance of such agreements for cost management.

Strategic sourcing also plays a crucial role, allowing China Steel to optimize its procurement based on market conditions and supplier reliability. This proactive approach supports the continuity and cost-effectiveness of its production processes.

- Iron Ore: Essential for steel production, access is secured through global sourcing and long-term agreements.

- Coking Coal: Another vital component, its supply chain management is critical for maintaining production levels.

- Scrap Metal: Increasingly important for sustainability and cost efficiency, China Steel actively sources scrap to supplement its primary material needs.

- 2024 Outlook: Analysts predict continued strong demand for steel in 2024, emphasizing the ongoing need for robust raw material sourcing strategies.

Strong Brand Reputation and Market Share

China Steel Corporation, as Taiwan's largest integrated steel producer, commands a substantial market share across Asia. This dominant position, coupled with a strong brand reputation for quality and dependability, translates into significant customer loyalty and market influence. For instance, in 2023, China Steel maintained its leadership in the Taiwanese market, with its products consistently meeting stringent international standards, reinforcing its image as a reliable supplier.

This robust brand equity acts as a crucial intangible asset, underpinning China Steel's competitive advantage. It not only attracts and retains customers but also allows for premium pricing and easier market penetration for new offerings. The company's consistent delivery of high-quality steel products has solidified its standing, making it a preferred partner for numerous industries across the region.

- Market Leadership: China Steel is the leading integrated steel manufacturer in Taiwan.

- Asian Presence: Holds a significant market share throughout the Asian continent.

- Brand Equity: Recognized for quality and reliability, fostering strong customer trust.

- Competitive Edge: Brand reputation contributes directly to market dominance and customer preference.

China Steel's key resources are its advanced manufacturing facilities, a highly skilled workforce, proprietary technology, and reliable access to raw materials. These elements collectively form the foundation of its operational strength and market position.

The company's production capacity is substantial, with approximately 13.7 million metric tons of crude steel produced in 2023. Its workforce of around 19,000 employees in 2024 includes many technical experts crucial for innovation and quality control.

Investments in R&D, representing about 1.5% of net sales in 2023, drive the development of specialized steel grades. China Steel also secures essential raw materials like iron ore and coking coal through global sourcing and long-term contracts, ensuring production continuity amidst fluctuating global prices, such as the average of $120 per tonne for iron ore in 2023.

| Key Resource | Description | 2023/2024 Data Point |

| Manufacturing Facilities | Integrated steel mills, blast furnaces, rolling mills | 13.7 million metric tons crude steel production (2023) |

| Human Capital | Skilled engineers, metallurgists, operational specialists | ~19,000 employees (2024), significant technical roles |

| Intellectual Property | Patents for advanced steelmaking and alloys | R&D expenditure ~1.5% of net sales (2023) |

| Raw Materials | Iron ore, coking coal, scrap metal | Iron ore prices averaged ~$120/tonne (2023) |

Value Propositions

China Steel Corporation boasts a comprehensive product portfolio, encompassing plates, bars, wire rods, and a variety of coils. This broad selection effectively addresses the diverse needs of numerous industrial sectors, solidifying its position as a go-to supplier.

By offering such an extensive range, China Steel provides customers with a convenient one-stop solution for all their steel procurement needs. This simplifies the supply chain for clients, making it easier to source multiple materials from a single, reliable provider.

In 2023, China Steel reported sales revenue of approximately NT$522.2 billion (roughly USD 16.2 billion), underscoring the significant market demand for its wide array of steel products.

China Steel is renowned for its commitment to producing high-quality steel. Their products consistently meet rigorous international and domestic industry standards, a fact underscored by their ISO 9001 certifications.

This unwavering dedication to quality translates into exceptional reliability and durability. Customers in sectors like construction, shipbuilding, and automotive rely on China Steel for materials that perform under pressure and stand the test of time, contributing to project success and product longevity.

For instance, in 2024, China Steel's automotive-grade steel achieved a defect rate of less than 0.05%, significantly outperforming the industry average. This level of precision is crucial for safety and performance in vehicles.

China Steel Corporation offers robust technical expertise, assisting customers in optimizing steel product applications across various industries. This support is crucial for clients in sectors like automotive and construction, where precise material performance is paramount.

In 2024, China Steel reported significant investment in R&D, focusing on advanced steel grades that enhance durability and reduce weight, directly benefiting their customers' product development. Their customer support teams provide on-site assistance and tailored solutions, solidifying partnerships.

Commitment to Sustainability and Green Solutions

China Steel Corporation is actively developing and offering more environmentally friendly steel products, aligning with global sustainability trends. This commitment is demonstrated through their clear roadmap for carbon reduction, aiming for carbon neutrality by 2050.

This focus on green solutions is a significant value proposition for customers who are increasingly scrutinizing their supply chains for environmental impact. In 2023, China Steel's efforts included advancements in green steel production technologies, contributing to a more sustainable industrial ecosystem.

- Carbon Reduction Roadmap: China Steel has established a clear strategy to lower its carbon footprint.

- Carbon Neutrality Goal: The company targets carbon neutrality by the year 2050.

- Environmentally Friendly Products: They offer steel solutions that meet growing demand for green materials.

- Customer Appeal: This commitment resonates with clients prioritizing sustainable supply chains.

Stable Supply and Strategic Sourcing

China Steel Corporation's integrated production model, from mining to finished products, ensures a reliable flow of steel. This robust internal supply chain is crucial for customers who depend on uninterrupted production, especially those in sectors like automotive and construction.

The company actively engages in strategic sourcing of key raw materials like iron ore and coking coal. This proactive approach to securing inputs helps mitigate price volatility and supply disruptions, offering a predictable cost structure to its clients.

- Integrated Production: China Steel's end-to-end operations from raw material acquisition to steel manufacturing provide inherent supply stability.

- Strategic Sourcing: Proactive procurement of iron ore and coking coal minimizes reliance on volatile spot markets.

- Customer Reliability: This stability is a key differentiator for industries with high-volume, time-sensitive demands, such as automotive manufacturing which saw global production rebound significantly in 2024.

China Steel offers a comprehensive product range, acting as a one-stop shop for diverse industrial needs and simplifying client procurement processes.

Their commitment to high-quality steel, evidenced by low defect rates in critical sectors like automotive, ensures product reliability and project success for customers.

Strong technical support and investment in advanced steel grades help clients optimize applications and drive their own product innovation.

The company's focus on environmentally friendly products and a clear carbon reduction roadmap appeals to customers prioritizing sustainable supply chains.

China Steel's integrated production and strategic sourcing provide supply chain stability, crucial for industries with high-volume, time-sensitive demands.

| Value Proposition | Description | Supporting Fact (2023/2024) |

|---|---|---|

| Comprehensive Product Portfolio | One-stop solution for diverse steel needs. | 2023 sales revenue of NT$522.2 billion (approx. USD 16.2 billion). |

| High-Quality Steel | Reliable and durable materials meeting stringent standards. | 2024 automotive-grade steel defect rate < 0.05%. |

| Technical Expertise & Support | Assistance in optimizing steel applications. | Significant 2024 R&D investment in advanced steel grades. |

| Sustainability Focus | Environmentally friendly products and carbon reduction. | Carbon neutrality target by 2050; advancements in green steel production in 2023. |

| Supply Chain Stability | Integrated production and strategic raw material sourcing. | Mitigation of price volatility for clients in a rebounding global automotive market (2024). |

Customer Relationships

China Steel Corporation's dedicated sales and technical support teams are crucial for fostering strong customer relationships. These specialized groups offer direct engagement, providing essential technical guidance and product information. In 2023, China Steel reported a significant increase in customer satisfaction scores, partly attributed to the prompt issue resolution facilitated by these support functions.

China Steel frequently secures long-term supply agreements with major industrial clients, such as automotive manufacturers and construction firms. For instance, in 2024, a significant portion of their steel output was committed through multi-year contracts, providing a predictable revenue stream and reducing exposure to short-term market volatility.

These enduring relationships go beyond simple transactions; they often involve collaborative product development. By working closely with customers, China Steel can tailor specialized steel grades to meet evolving industry needs, leading to innovative solutions and stronger market positioning for both parties.

Strategic alliances are also a cornerstone, allowing China Steel to share risks and rewards with partners in new market ventures or technological advancements. This approach fosters a symbiotic environment where mutual growth and sustained competitive advantage are prioritized.

China Steel Corporation actively cultivates customer relationships through dedicated feedback mechanisms. This includes formal channels like customer satisfaction surveys, with recent reports indicating a strong willingness among their major clients to participate, alongside informal methods such as regular site visits and technical consultations.

By fostering these collaborative platforms, China Steel engages customers in joint development projects, allowing for tailored solutions and product enhancements. This proactive engagement directly contributes to improved product quality and service delivery, as evidenced by a 5% year-over-year increase in repeat business from key industrial partners in 2024.

Industry-Specific Solutions and Customization

China Steel Corporation excels at building robust customer relationships by offering highly tailored solutions. They understand that different industries have unique needs, and they adapt their steel products accordingly. For example, the automotive sector might require specific grades of steel for lightweighting and safety, while the construction industry might prioritize durability and corrosion resistance.

This dedication to customization fosters deep loyalty. By acting as a solutions provider rather than just a supplier, China Steel becomes an indispensable partner. This approach was evident in their 2024 performance, where sectors with specialized steel demands saw a notable increase in repeat business, contributing significantly to their overall revenue growth.

- Industry Specialization: China Steel provides tailored steel products for sectors like automotive, construction, and electronics.

- Customization: Solutions are adapted to meet specific performance, durability, and regulatory requirements for each industry.

- Relationship Building: This specialized approach fosters strong, long-term partnerships and customer loyalty.

- 2024 Impact: Industries with high customization needs showed increased repeat business, positively impacting China Steel's revenue.

Market Stability and Pricing Support

China Steel Corporation actively works to stabilize domestic prices, especially during periods of market volatility. This strategy provides crucial predictability for their customers, helping them maintain competitiveness. For instance, in 2024, China Steel's commitment to stable pricing helped mitigate the impact of fluctuating global raw material costs on its key downstream industries.

- Price Stabilization: China Steel aims to offer consistent pricing to domestic clients, even when international markets are erratic.

- Customer Competitiveness: By providing price stability, they enable their customers to better plan their own production costs and pricing strategies.

- Trust and Loyalty: This proactive approach fosters stronger relationships and builds trust, leading to increased customer loyalty.

China Steel's customer relationships are built on deep industry understanding and tailored solutions. They engage directly with clients through specialized sales and technical teams, offering guidance and product customization. In 2024, this focus on bespoke steel grades for sectors like automotive and construction drove a notable increase in repeat business, underscoring their role as a valuable partner.

| Customer Segment | Key Relationship Driver | 2024 Impact |

|---|---|---|

| Automotive Manufacturers | Lightweighting & Safety Steel Grades | Increased repeat orders, contributing to revenue growth |

| Construction Firms | Durability & Corrosion Resistance | Strengthened long-term supply agreements |

| Electronics Industry | Specialized Performance Requirements | Collaborative product development initiatives |

Channels

China Steel Corporation leverages its dedicated direct sales force to cultivate deep relationships with major industrial clients, ensuring personalized service and expert technical support. This direct engagement is crucial for managing complex contracts and understanding specific customer needs in sectors like automotive and construction.

In 2024, China Steel's direct sales team played a pivotal role in securing significant orders, contributing to its reported revenue growth. For instance, their efforts in the automotive sector alone accounted for a substantial portion of sales, highlighting the effectiveness of this direct channel in a competitive market.

China Steel Corporation leverages a robust network of distributors and agents to effectively reach a wider customer base, particularly small and medium-sized enterprises and those in regional markets. These intermediaries are crucial for extending the company's market penetration and offering tailored, localized services.

In 2024, China Steel's commitment to expanding its distribution channels was evident. For instance, their strategy often involves establishing partnerships with established players in key industrial hubs, ensuring product availability and technical assistance closer to the end-users.

China Steel leverages its corporate website and various digital platforms to enhance market visibility and accessibility, moving beyond traditional relationship-driven sales. These channels serve as crucial touchpoints for disseminating detailed product information and fielding customer inquiries, thereby streamlining the initial engagement process.

In 2024, the company continued to invest in its online presence, aiming to broaden its reach and offer a more convenient experience for potential clients and stakeholders. This digital engagement strategy is vital for staying competitive in an increasingly digitized global market.

Industry Exhibitions and Trade Fairs

Industry exhibitions and trade fairs are crucial for China Steel Corporation to directly engage with the market, presenting its latest steel products and innovations. These events offer a prime opportunity to build relationships with clients, distributors, and potential partners, fostering a deeper understanding of market needs and emerging trends. For instance, in 2024, participation in key global steel forums allowed China Steel to highlight its advancements in high-strength steel for the automotive sector, a segment experiencing robust growth.

These platforms are vital for market intelligence and business development. China Steel leverages these gatherings to:

- Showcase Product Innovations: Displaying new steel grades and manufacturing processes to a targeted audience.

- Demonstrate Technological Advancements: Presenting cutting-edge production techniques and quality control measures.

- Facilitate Customer Engagement: Meeting directly with existing and prospective clients to discuss specific requirements and future collaborations.

- Analyze Market Trends: Gaining insights into competitor strategies and customer demands in real-time.

In 2024, China Steel's presence at the EuroBLECH exhibition, a major manufacturing technology trade fair, resulted in numerous qualified leads and strengthened relationships with European automotive manufacturers. The company reported a significant increase in inquiries for its specialized steel alloys following the event, underscoring the tangible business impact of such industry engagements.

Logistics and Supply Chain Networks

The physical delivery of steel products is a vital channel for China Steel Corporation, ensuring products reach customers efficiently. In 2024, the company continued to rely on its robust infrastructure, including extensive rail, road, and sea transportation capabilities. This integrated approach allows for timely distribution across both domestic Chinese markets and international destinations, a critical factor in maintaining customer satisfaction and market competitiveness.

China Steel's logistics network is designed for optimal reach and speed. By utilizing a multi-modal transportation strategy, they can adapt to diverse customer locations and delivery requirements. This flexibility is key to managing the sheer volume of steel products and the geographical spread of their customer base, contributing significantly to their operational efficiency.

- Extensive Network: China Steel utilizes a comprehensive network of rail, road, and sea transport.

- Timely Delivery: The focus remains on ensuring efficient and punctual delivery of steel products.

- Domestic and International Reach: The logistics channels support distribution across China and to global markets.

- Operational Efficiency: The multi-modal approach enhances the company's ability to serve a wide customer base effectively.

China Steel Corporation employs a multi-faceted channel strategy, blending direct sales with a robust distributor network to cater to diverse market segments. This approach ensures both deep client engagement for large accounts and broad market penetration for smaller enterprises.

In 2024, China Steel actively expanded its digital presence, utilizing its corporate website and online platforms to enhance product visibility and streamline customer inquiries, reflecting a growing emphasis on digital engagement.

Industry exhibitions and trade fairs remain critical for showcasing innovations and fostering direct market interaction. For instance, participation in major global steel forums in 2024 allowed China Steel to highlight advancements in high-strength steel, leading to increased inquiries from the automotive sector.

The company's extensive logistics network, encompassing rail, road, and sea transport, is fundamental to its channel strategy, ensuring efficient product delivery across domestic and international markets.

| Channel | Key Activities | 2024 Impact/Focus | Reach |

|---|---|---|---|

| Direct Sales | Major client relationships, technical support | Secured significant orders, contributed to revenue growth | Large industrial clients (automotive, construction) |

| Distributors/Agents | Market penetration, localized service | Expanded reach to SMEs and regional markets | Small to medium enterprises, regional customers |

| Digital Platforms | Product information, customer inquiries | Enhanced market visibility, streamlined initial engagement | Broad online audience |

| Exhibitions/Trade Fairs | Product showcase, market intelligence | Generated qualified leads, strengthened industry relationships | Industry professionals, potential partners |

| Logistics & Delivery | Physical product distribution | Ensured timely delivery via multi-modal transport | Domestic and international customers |

Customer Segments

The construction industry is a cornerstone customer segment for China Steel Corporation, encompassing massive infrastructure undertakings, commercial complexes, and residential housing projects. These developments have a consistent and substantial demand for a wide array of steel products, including plates, bars, and structural steel. In 2024, China's construction sector continued its significant contribution to the global economy, with infrastructure investment remaining a key driver.

Shipyards and maritime construction companies are key customers for China Steel, requiring substantial volumes of high-quality steel plates for building ship hulls and other critical components. Taiwan’s robust shipbuilding sector, a major global player, represents a particularly strong and natural market for CSC’s offerings.

Machinery and equipment manufacturers are a key customer segment, relying heavily on steel for everything from industrial machinery to precision tools. In 2024, this sector continued to be a significant consumer of steel, with global industrial production showing resilience, particularly in Asia.

These manufacturers prioritize high-quality steel with specific properties like strength, durability, and precise tolerances. For instance, the automotive industry, a major buyer of machinery, demands specialized steel grades for its production lines, impacting the requirements for equipment manufacturers.

Automotive Industry

Automotive manufacturers are a key customer segment for China Steel, demanding specialized steel products like hot- and cold-rolled coils. These materials are essential for vehicle bodies, chassis, and various internal components. In 2024, the automotive sector continued its recovery, with global vehicle production expected to reach approximately 85 million units, driving significant demand for steel.

China Steel actively collaborates with automotive clients to develop specific steel grades that meet stringent performance and safety requirements. This partnership approach ensures that the steel supplied is optimized for automotive applications, such as high-strength low-alloy (HSLA) steels for lightweighting and improved fuel efficiency.

- Automotive Demand: Global vehicle production in 2024 is projected to be around 85 million units, a substantial market for steel suppliers.

- Product Specialization: China Steel provides critical hot- and cold-rolled coils tailored for vehicle bodies and components.

- Collaborative Development: Partnerships with automakers focus on creating specialized steel grades for enhanced performance and safety.

- Lightweighting Trend: The increasing use of HSLA steels in vehicles underscores the need for advanced material solutions.

Electrical Steel Users

China Steel Corporation's electrical steel finds its primary consumers in businesses that build transformers, electric motors, and other essential electrical apparatus. These manufacturers are a crucial customer segment.

This specialized market demands materials with very specific, high-performance characteristics to ensure efficiency and reliability in electrical applications. For instance, the core losses in transformers are directly impacted by the quality of the electrical steel used.

Key users within this segment include:

- Transformer manufacturers: Companies producing power transformers, distribution transformers, and specialized industrial transformers.

- Motor manufacturers: Businesses creating electric motors for a wide range of applications, from industrial machinery to electric vehicles.

- Electrical equipment producers: Firms manufacturing components like generators, inductors, and other devices reliant on magnetic properties.

China Steel's customer segments are diverse, spanning vital industries that rely on its steel products. These include construction, shipbuilding, machinery manufacturing, automotive production, and the electrical apparatus sector. Each segment has unique demands for steel quality and specifications, driving China Steel's product development and market strategy.

In 2024, the construction sector continued to be a major consumer, fueled by infrastructure investment, while the automotive industry's recovery, with an estimated 85 million vehicles produced globally, represented significant demand for specialized steel. The shipbuilding industry, particularly Taiwan's strong sector, also remained a key market for high-quality steel plates.

Manufacturers of electrical equipment, such as transformers and motors, represent a specialized but critical customer base. These clients require electrical steel with precise magnetic properties to ensure the efficiency and reliability of their products, highlighting China Steel's role in supporting technological advancements.

| Customer Segment | Key Products Supplied | 2024 Market Insight |

|---|---|---|

| Construction | Plates, Bars, Structural Steel | Continued strong demand driven by infrastructure projects. |

| Shipbuilding | High-quality Steel Plates | Robust demand from Taiwan's significant shipbuilding sector. |

| Machinery & Equipment | Various Steel Grades | Resilient consumption reflecting global industrial production. |

| Automotive | Hot/Cold-rolled Coils, HSLA Steels | Global production ~85 million units, focus on lightweighting. |

| Electrical Apparatus | Electrical Steel | Demand for high-performance materials for transformers and motors. |

Cost Structure

The procurement of iron ore and coking coal forms the bedrock of China Steel's cost structure, representing a substantial expenditure. In 2023, the average spot price for Australian premium coking coal hovered around $220 per tonne, while iron ore prices saw fluctuations, with benchmarks like the Singapore CFR 62% Fe iron ore futures trading in the $100-$130 per tonne range during various periods of the year. These raw material inputs are critical for steel production, directly influencing the company's profitability.

Energy and fuel costs are a significant component of China Steel's operational expenses, given that steel production is inherently energy-intensive. The company relies heavily on electricity and natural gas to power its furnaces and manufacturing processes.

In 2024, China Steel continued to focus on enhancing energy efficiency across its operations. Initiatives to optimize energy consumption are crucial for managing these substantial costs. For instance, the company has been investing in technologies to reduce its reliance on fossil fuels and explore cleaner energy alternatives.

Labor costs are a significant component of China Steel's expenses, encompassing wages, benefits, and ongoing training for its extensive workforce. This includes personnel across production, research and development, and administrative functions. In 2024, China Steel's total employee compensation and benefits represented a substantial portion of its operating expenditures, reflecting the need for skilled individuals in the intricate steelmaking process.

Maintenance and Depreciation of Plant and Equipment

China Steel invests heavily in keeping its vast manufacturing plants and intricate equipment in top working order. This includes regular upkeep, repairs, and necessary upgrades to ensure efficient production and safety. These ongoing maintenance activities are a substantial part of their operational expenses.

The significant capital investment in its steelmaking facilities means that depreciation is a major accounting cost for China Steel. As these large, complex assets are used over time, their value decreases, and this reduction is recognized as an expense. For instance, in 2023, China Steel's depreciation and amortization expenses amounted to approximately NT$22.5 billion (US$700 million).

- Maintenance: Ongoing costs for repairs, servicing, and preventative upkeep of machinery and facilities.

- Upgrades: Investments in modernizing equipment to improve efficiency, reduce environmental impact, and maintain competitiveness.

- Depreciation: The systematic allocation of the cost of tangible assets over their useful lives.

- Capital Intensity: Reflects the high proportion of fixed assets relative to labor in steel production, driving these costs.

Environmental Compliance and Carbon Costs

China Steel faces growing expenses related to environmental compliance and carbon reduction. These costs encompass investments in advanced pollution control systems and adherence to stricter emissions standards. For instance, in 2024, China's steel industry is projected to spend billions on environmental upgrades to meet national targets.

The company is also preparing for potential carbon pricing mechanisms. This includes setting aside funds for future carbon taxes or emissions trading schemes, which are being implemented globally to incentivize decarbonization. Investments in green technologies, such as hydrogen-based steelmaking or carbon capture, are also becoming a significant cost factor.

- Environmental Regulation Compliance: Costs for pollution abatement equipment and ongoing monitoring.

- Carbon Reduction Initiatives: Investments in cleaner production technologies and energy efficiency upgrades.

- Potential Carbon Taxes: Financial provisions for anticipated carbon pricing in line with global trends.

- Green Technology Adoption: Capital expenditure for research and implementation of sustainable steelmaking processes.

China Steel's cost structure is heavily influenced by raw material prices, energy consumption, and labor. Significant investments in maintenance, upgrades, and depreciation of its capital-intensive facilities also form a substantial part of its expenses. Furthermore, environmental compliance and the transition to greener technologies are increasingly important cost drivers.

| Cost Category | Key Components | 2023/2024 Data Points |

|---|---|---|

| Raw Materials | Iron Ore, Coking Coal | 2023 Australian premium coking coal ~ $220/tonne; Iron ore ~$100-$130/tonne. |

| Energy & Fuel | Electricity, Natural Gas | Ongoing focus on energy efficiency initiatives in 2024. |

| Labor | Wages, Benefits, Training | A substantial portion of operating expenditures in 2024. |

| Operations & Maintenance | Repairs, Upgrades, Depreciation | 2023 Depreciation & Amortization ~ NT$22.5 billion (US$700 million). |

| Environmental Compliance | Pollution Control, Carbon Reduction | China steel industry projected to spend billions on environmental upgrades in 2024. |

Revenue Streams

China Steel Corporation's primary revenue comes from selling a broad spectrum of steel products like plates, bars, wire rods, and coils. These are supplied to a variety of industrial sectors, forming the core of their business.

In 2024, China Steel reported significant sales figures, with their steel product revenue forming the backbone of their financial performance. For instance, their sales of flat and long steel products are crucial drivers of their overall income.

China Steel generates significant revenue by selling value-added and specialty steel products. These aren't your everyday construction steels; they are engineered for specific, often demanding, applications. Think of electrical steels used in transformers and motors, or advanced high-strength steels crucial for the automotive industry to make lighter, safer vehicles.

These specialized steels command premium pricing due to their enhanced properties and the advanced manufacturing processes involved. For instance, in 2023, the global market for specialty steel was valued at over $200 billion, with China being a major producer and consumer, highlighting the substantial revenue potential in this segment.

China Steel Corporation, as a major integrated steel producer, capitalizes on its manufacturing processes by selling valuable by-products. These can include materials like slag, which is often repurposed for construction or cement production, and various chemicals or gases generated during smelting and refining.

In 2024, the company continued to explore and optimize the revenue potential from these secondary outputs. While specific figures for by-product sales are often integrated within broader operational segments, the strategic importance of these revenue streams lies in enhancing overall profitability and promoting a circular economy approach within its operations.

Export Sales

Export sales represent a substantial revenue driver for China Steel Corporation, with a significant portion of its output being shipped to international markets. These markets primarily include key regions like Asia, Europe, and Japan, where demand for steel products remains robust.

In 2024, China Steel Corporation continued to leverage its global presence to secure export contracts. The company's export revenue is a critical component of its overall financial performance, contributing to its competitive standing in the international steel industry.

- International Market Reach: China Steel's products are widely exported across Asia, Europe, and Japan.

- Revenue Contribution: Exports form a significant portion of the company's total revenue.

- Global Competitiveness: The export strategy enhances China Steel's position in the global steel market.

Green Energy and Related Services

China Steel is increasingly leveraging its green energy investments for new revenue. As they expand solar and wind power generation, selling surplus electricity back to the grid represents a significant opportunity.

Beyond energy sales, the company is exploring revenue from offering carbon management services and low-carbon solutions to other industries. This aligns with global sustainability trends and positions China Steel as a provider of environmental expertise.

- Renewable Energy Sales: China Steel's growing portfolio of solar and wind farms, with substantial capacity additions planned, will enable the sale of excess power. For instance, their 2023 renewable energy generation reached over 1.5 billion kWh, with a portion earmarked for grid sales.

- Carbon Management Services: The company is developing expertise in carbon footprint assessment and reduction strategies, which can be offered as consulting services to other businesses seeking to decarbonize.

- Low-Carbon Solutions: This includes the potential sale of green steel products and related technologies, capitalizing on the increasing demand for environmentally friendly materials in construction and manufacturing sectors.

China Steel's revenue streams are diverse, encompassing the sale of a wide array of steel products, from basic plates and coils to specialized high-strength steels vital for industries like automotive. Complementing this, the company generates income from by-products of its manufacturing processes, such as slag, and is increasingly tapping into revenue from its investments in renewable energy, including selling surplus electricity and offering carbon management services.

| Revenue Stream | Description | 2024 Relevance/Data |

| Steel Product Sales | Core business selling plates, bars, wire rods, coils, and specialty steels. | Steel product revenue remains the backbone of financial performance, with flat and long steel sales being key drivers. |

| By-product Sales | Revenue from materials like slag and chemicals generated during steel production. | Continues to optimize revenue from secondary outputs, enhancing overall profitability and promoting circular economy principles. |

| Renewable Energy Sales | Selling surplus electricity from solar and wind power generation. | Expansion of solar and wind capacity in 2023 generated over 1.5 billion kWh, with a portion sold to the grid. |

| Carbon Management & Low-Carbon Solutions | Offering services for carbon footprint assessment and selling green steel products. | Developing expertise in decarbonization services and capitalizing on demand for environmentally friendly materials. |

Business Model Canvas Data Sources

The China Steel Business Model Canvas is informed by extensive market research, financial reports from major steel producers, and government policy documents. These sources provide a comprehensive understanding of industry dynamics, cost structures, and strategic opportunities.