China Steel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Steel Bundle

China Steel faces a complex competitive landscape, with significant pressure from buyer bargaining power and the threat of substitutes. Understanding these forces is crucial for navigating the steel industry.

The complete report reveals the real forces shaping China Steel’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key raw material suppliers for China Steel Corporation, particularly for essential inputs like iron ore and coking coal, significantly shapes supplier bargaining power. When a few global players dominate the supply of these critical materials, they gain considerable leverage over pricing and contract conditions.

In fiscal year 2024/2025, global iron ore prices are anticipated to decline, driven by weakening demand and the emergence of new supply sources. Conversely, coking coal prices are expected to remain volatile but largely stable around current levels, presenting ongoing cost considerations for China Steel.

China Steel Corporation's bargaining power of suppliers is significantly influenced by switching costs. If China Steel faces high costs when changing suppliers, perhaps due to specialized raw materials or long-term supply agreements, then suppliers gain more leverage. For instance, if a new supplier requires extensive retooling of China Steel's production lines, that cost would be a barrier to switching, strengthening the supplier's position.

In 2023, the global steel industry experienced price volatility. China Steel, like its peers, likely navigated this by managing its supplier relationships. Diversifying its supplier base across different regions and securing raw materials through forward contracts or other hedging mechanisms are strategies that can mitigate the impact of individual supplier power. This approach aims to ensure more predictable input costs and reduce vulnerability to supply chain disruptions.

The availability of substitute inputs significantly impacts the bargaining power of suppliers for companies like China Steel. If alternative raw materials or production processes can be readily adopted, it reduces a steelmaker's dependence on a specific supplier, thereby weakening that supplier's leverage. For instance, advancements in electric arc furnace (EAF) technology, which relies heavily on scrap steel, could lessen the reliance on virgin iron ore and coking coal, key inputs for integrated steelmakers such as China Steel that primarily use blast furnaces. This shift could dilute the power of traditional raw material suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into steel production presents a significant strategic consideration for China Steel Corporation. Should major raw material suppliers, such as large mining conglomerates, decide to enter the steel manufacturing market themselves, they would directly compete with China Steel. This would fundamentally alter the supply-demand dynamics and empower these suppliers considerably.

While forward integration is a capital-intensive undertaking, it's not an insurmountable barrier for well-capitalized entities. For instance, in 2024, global mining giants continued to report robust profits, with some showing earnings before interest, taxes, depreciation, and amortization (EBITDA) exceeding tens of billions of US dollars, indicating the financial capacity for such strategic shifts. This financial strength allows them to explore diversification and value chain expansion.

Currently, this threat remains more of a long-term strategic risk rather than an immediate operational challenge for China Steel. However, the potential for suppliers to leverage their control over essential inputs like iron ore and coking coal by becoming steel producers themselves cannot be underestimated in future market analyses.

- Forward Integration Risk: Suppliers entering steel production directly challenges China Steel's market position.

- Capital Intensity: High upfront investment is a barrier, but achievable for major mining firms.

- Strategic Consideration: A potential future threat requiring ongoing monitoring by China Steel.

- Supplier Financial Strength: In 2024, many large mining companies demonstrated significant financial capacity, evidenced by multi-billion dollar EBITDA figures, making forward integration a plausible, albeit not immediate, strategic option.

Importance of Raw Materials to China Steel's Cost Structure

Raw materials represent a significant portion of China Steel Corporation's overall production expenses. This high dependency means suppliers of key inputs like iron ore and coking coal wield considerable influence over the company's cost structure and profitability. For instance, in 2023, the cost of iron ore alone accounted for approximately 50-60% of the total raw material expenditure for many major steel producers globally, a figure that directly impacts China Steel's bottom line.

The bargaining power of suppliers is amplified by the current economic climate. Global inflation and volatile energy prices have driven up the cost of essential raw materials for steel production. This upward pressure on input costs makes it imperative for China Steel to manage its supplier relationships effectively to mitigate the impact on its profit margins.

- Significant Cost Component: Raw materials constitute a substantial percentage of China Steel's total production costs, granting suppliers considerable leverage.

- Inflationary Pressures: Rising global inflation in 2024 continues to push up the prices of essential steelmaking inputs like iron ore and coking coal.

- Energy Cost Volatility: Fluctuations in energy prices directly impact the cost of processing and transporting raw materials, further strengthening supplier bargaining power.

- Profitability Impact: The high proportion of raw material costs makes China Steel particularly vulnerable to price increases, directly affecting its profitability.

The bargaining power of suppliers for China Steel is substantial due to the concentrated nature of raw material sourcing and the critical role these inputs play in production costs. This leverage is further amplified by global economic factors like inflation.

| Factor | Impact on China Steel | 2024/2025 Outlook |

|---|---|---|

| Supplier Concentration | Few dominant suppliers of iron ore and coking coal exert pricing power. | Global iron ore prices expected to decline; coking coal prices stable but volatile. |

| Switching Costs | High costs to change suppliers increase their leverage. | Specialized materials or retooling needs can make switching difficult. |

| Raw Material Cost Share | Raw materials, like iron ore (50-60% of costs for global producers in 2023), significantly impact China Steel's expenses. | Inflation in 2024 continues to drive up input costs, pressuring profit margins. |

What is included in the product

This analysis details the competitive forces impacting China Steel, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the steel industry.

Instantly visualize the competitive landscape of China Steel with a dynamic, interactive dashboard, revealing key pressures and opportunities.

Streamline strategic planning by pinpointing the most impactful forces affecting China Steel, enabling targeted and effective interventions.

Customers Bargaining Power

China Steel Corporation's customer concentration significantly impacts buyer bargaining power. Large industrial clients, such as those in construction, shipbuilding, and automotive manufacturing, often purchase substantial volumes of steel, giving them leverage to negotiate favorable pricing and terms. For instance, the construction industry is a primary driver of steel demand, and its health directly influences the bargaining position of construction firms when sourcing materials.

In 2024, the automotive sector's demand for steel is projected to see continued growth, further solidifying the bargaining power of major automotive manufacturers. These high-volume buyers can exert pressure on suppliers like China Steel for cost reductions and customized product specifications, especially when alternative suppliers are available or when their own profit margins are squeezed.

The costs customers incur when shifting from China Steel Corporation to a rival directly influence their bargaining power. For standard steel grades, these switching costs are generally minimal, empowering customers to readily choose the lowest-priced option. This can be seen in the broader commodity steel market where price is often the primary differentiator.

However, for specialized steel products that require specific engineering, certifications, or integration into complex manufacturing processes, the switching costs for customers can be significantly higher. For instance, if a customer relies on China Steel's high-strength automotive steel that is precisely engineered for a particular vehicle model, changing suppliers would necessitate retooling, extensive testing, and potential redesigns, thereby increasing their dependence on China Steel and reducing their bargaining leverage.

Customer price sensitivity significantly influences their bargaining power with China Steel. When steel represents a large portion of a customer's production costs, they become more attuned to price fluctuations and actively seek lower prices, especially if their own market is competitive.

In 2024, the global steel market has experienced notable price volatility. For instance, benchmark rebar prices in China saw fluctuations, with some periods indicating a downward trend influenced by weaker-than-expected demand and ample supply. This environment amplifies customer sensitivity, as even small price changes can impact their profitability.

The overall weak demand in Asian steel markets and increased export pressure from China have further heightened customer price sensitivity. Buyers are more empowered to negotiate favorable terms, knowing that alternative suppliers exist and that the market is not robustly supporting higher price points.

Threat of Backward Integration by Customers

Customers' capacity to integrate backward, meaning they could produce steel themselves, diminishes their dependence on suppliers like China Steel Corporation. This capability represents a significant long-term strategic threat, as it directly challenges the supplier's market position.

While the immense capital investment and technical expertise required for steelmaking present a barrier, large consumers in sectors such as automotive or construction might consider backward integration. This strategic move could be driven by a desire for greater supply chain control and cost predictability.

- Threat of Backward Integration: Customers can threaten to produce steel themselves, reducing reliance on suppliers.

- Capital Intensity: High capital requirements for steel production act as a deterrent for most customers.

- Strategic Assurance: Large buyers, like automotive manufacturers, might pursue integration for supply security.

- Long-Term Impact: This threat, while often theoretical, can influence pricing and supplier relationships over time.

Product Differentiation and Importance to Customer Success

China Steel Corporation's product differentiation significantly influences customer bargaining power. When the company offers highly specialized steel products that are crucial for a customer's specific performance requirements or unique design, it inherently limits the customer's ability to negotiate for lower prices or more favorable terms.

China Steel manufactures a broad spectrum of steel products, including those tailored for particular applications. For instance, their electrical steels are vital for the efficiency of power generation and transmission equipment, while their high-performance structural steels are essential for demanding construction projects, thereby reducing the substitutability for these customers.

- Specialized Products Reduce Customer Leverage: When China Steel provides steel grades critical for a customer's proprietary manufacturing processes or product performance, customers have less power to switch suppliers.

- Electrical Steels: These are vital for the energy sector, where performance and reliability are paramount, giving China Steel a stronger position with buyers in this segment.

- High-Performance Structural Steels: Used in advanced construction and infrastructure, these specialized steels cater to specific engineering needs, limiting customer options.

- Impact on 2024 Negotiations: In 2024, the demand for these specialized steels, particularly for renewable energy infrastructure and advanced manufacturing, has remained robust, allowing China Steel to maintain stronger pricing power with key clients in these sectors.

The bargaining power of customers for China Steel is substantial, particularly due to customer concentration and price sensitivity. Large industrial buyers in sectors like automotive and construction can leverage their volume to negotiate favorable pricing and terms. In 2024, the automotive sector's continued demand growth for steel further solidifies the leverage of major manufacturers, who can pressure suppliers for cost reductions and specific product features.

Switching costs for standard steel grades are minimal, allowing customers to easily opt for lower-priced alternatives, a common scenario in the commodity steel market. However, for specialized steel products requiring precise engineering and certifications, switching costs increase significantly, reducing customer bargaining power. Customer price sensitivity is heightened in 2024 due to market volatility; for example, benchmark rebar prices in China have fluctuated, impacting buyer willingness to accept higher price points.

| Customer Segment | 2024 Demand Influence | Bargaining Power Driver |

|---|---|---|

| Automotive Manufacturers | Projected growth | High volume, customization demands |

| Construction Industry | Primary demand driver | Price sensitivity, commodity nature of standard grades |

| Shipbuilding | Significant steel consumer | Potential for bulk discounts |

What You See Is What You Get

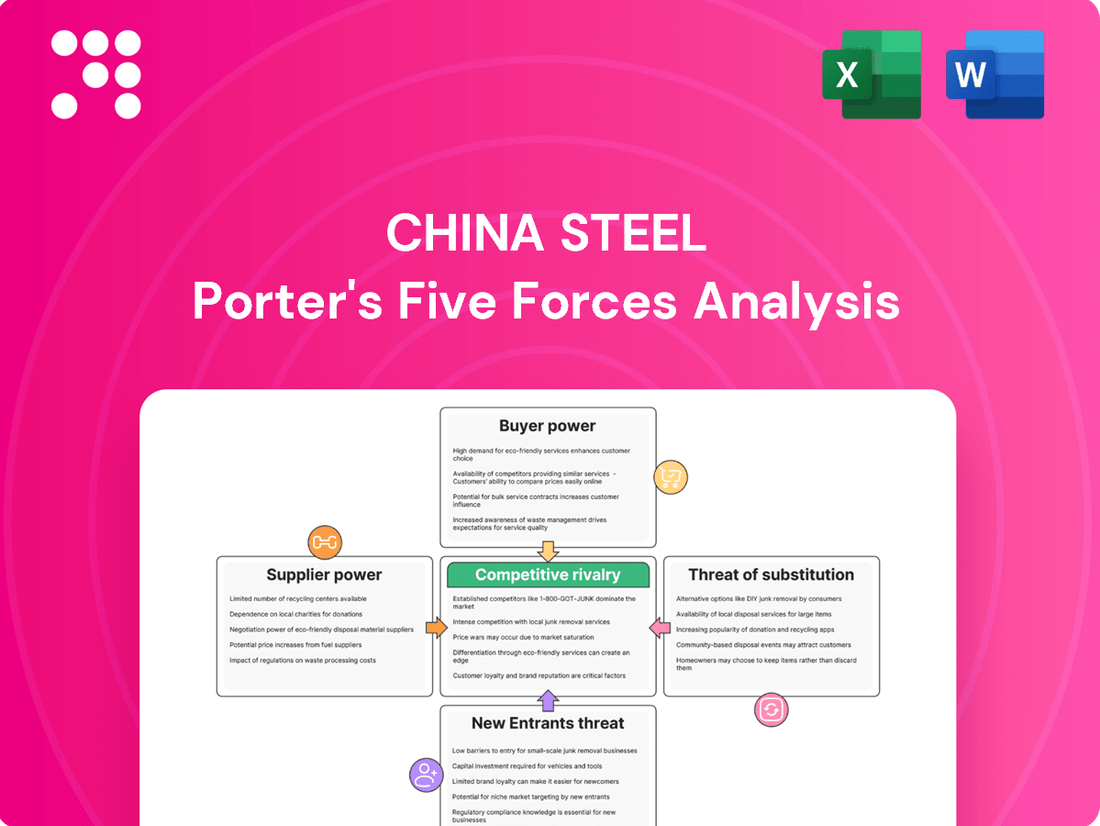

China Steel Porter's Five Forces Analysis

This preview showcases the comprehensive China Steel Porter's Five Forces Analysis, detailing the competitive landscape of the industry. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Rivalry Among Competitors

The competitive rivalry within the steel industry, particularly in Asia, is fierce due to the sheer number and substantial size of market participants. This concentration means companies must constantly innovate and manage costs to stay ahead.

The Asian steel market is characterized by a multitude of significant players, with China, Japan, and South Korea being major contributors to this competitive landscape. For instance, in 2023, China's crude steel output alone accounted for over 55% of the global total, underscoring its dominant position and the intense competition it generates regionally.

China's role as a leading steel exporter intensifies this rivalry, frequently sparking trade disputes as other nations grapple with the influx of competitively priced Chinese steel. This dynamic forces other steel producers to be highly strategic in their pricing and market access efforts.

A slow industry growth rate, especially when combined with existing overcapacity, really heats up the competition in the steel sector. Companies find themselves battling harder for every bit of market share.

The global steel market felt this pressure in 2025. For instance, global steel production actually dipped in June 2025 when you compare it to the same month in 2024. This trend continued into the first half of 2025, showing a general oversupply situation across the board.

In such an environment, the focus often shifts. Companies might prioritize just moving more product, even if it means accepting lower profits per ton, simply to keep their operations running and maintain their position in the market.

The steel industry, including China Steel Corporation, often grapples with high product homogeneity. This means that many steel products are seen as interchangeable, similar to commodities. When products are so alike, buyers tend to focus on price as the main deciding factor, leading to intense price wars among competitors.

China Steel, while offering diverse products, still has many offerings that fall into this commodity category. For instance, in 2024, the Asian hot-rolled coil market experienced considerable price drops. This decline was largely driven by an oversupply situation, coupled with various protectionist trade policies implemented by different countries, further intensifying price competition.

Exit Barriers and Industry Stability

High exit barriers significantly influence competitive rivalry in the steel industry. These barriers include substantial investments in fixed assets like blast furnaces and rolling mills, specialized labor requiring extensive training, and considerable social implications, particularly for state-owned enterprises which may face pressure to maintain employment. These factors often compel even unprofitable firms to remain operational, contributing to persistent overcapacity and intensifying competition.

The capital-intensive nature of steel production means companies are inherently hesitant to cease operations, even when facing financial difficulties. This reluctance fuels ongoing competition, as firms strive to utilize their existing infrastructure rather than incur losses from shutdowns. For instance, in 2024, global steel production capacity remained elevated, with many producers continuing operations despite fluctuating demand and pricing pressures.

- High Fixed Asset Investment: The steel sector demands massive capital outlay for plants and equipment, making divestment financially prohibitive.

- Specialized Labor and Skills: A highly trained workforce with specific metallurgical and engineering expertise is difficult to reallocate or retrain, increasing exit costs.

- Social and Political Considerations: State-owned enterprises, prevalent in many steel markets, often face pressure to avoid layoffs, acting as a de facto barrier to exit.

- Industry Overcapacity: Persistent overcapacity, a common issue in the steel sector, is exacerbated by firms being unable to exit, leading to price wars and reduced profitability for all players.

Strategic Objectives of Competitors

Competitors in the steel industry exhibit a wide array of strategic objectives. State-owned enterprises, for instance, often prioritize national strategic goals and employment stability alongside profitability. In contrast, private entities are typically driven primarily by profit maximization, which can result in unpredictable competitive actions and pricing strategies.

China Steel, as a state-owned enterprise, navigates this complex landscape with objectives that may extend beyond pure financial returns. This can influence its market strategies, investment decisions, and responses to competitive pressures, potentially differentiating it from privately held rivals.

The Chinese steel sector is actively undergoing structural reforms, a significant factor shaping global trade dynamics and competitive intensity. These reforms aim to consolidate capacity, improve efficiency, and address overproduction, directly impacting the strategies and operational focus of all players, including China Steel and its international competitors.

- Divergent Motivations: State-owned steel firms may balance profit with social mandates like job creation, while private firms prioritize shareholder value.

- Strategic Flexibility: China Steel's state backing could offer a different risk appetite and investment horizon compared to purely market-driven competitors.

- Reform Impact: China's ongoing steel sector consolidation, as of mid-2024, is reshaping global supply and demand, intensifying rivalry.

- Global Competition: In 2023, China remained the world's largest steel producer, accounting for over 50% of global output, highlighting the scale of competition.

The competitive rivalry in the steel industry, particularly around China Steel, is intense due to numerous large players and significant overcapacity. Product homogeneity drives price wars, as seen with Asian hot-rolled coil prices in 2024. High exit barriers, like massive fixed asset investments and labor considerations, keep even struggling firms operational, fueling persistent competition.

| Factor | Description | Impact on Rivalry |

|---|---|---|

| Number of Competitors | Asia has many large steel producers, including China, Japan, and South Korea. | High rivalry, forcing cost management and innovation. |

| Industry Growth Rate | Slow growth, especially with existing overcapacity. | Intensifies competition for market share. |

| Product Differentiation | Steel products are often seen as commodities. | Price becomes a key differentiator, leading to price wars. |

| Exit Barriers | High fixed asset costs, specialized labor, and social factors. | Firms stay in production, contributing to overcapacity and sustained rivalry. |

SSubstitutes Threaten

The threat of substitutes for China Steel's products is influenced by the relative price and performance of alternative materials. For instance, in the automotive sector, aluminum offers significant lightweighting benefits, which can improve fuel efficiency. While steel remains a cost-effective and robust option for many applications, the increasing focus on sustainability and specific performance needs drives adoption of materials like advanced plastics and composites.

Customer propensity to substitute for steel is a significant factor, driven by evolving needs in sectors like automotive. Design flexibility and manufacturing compatibility with alternative materials directly influence this willingness. For instance, the push for lighter vehicles in 2024, especially with the growth of electric vehicles, has seen increased adoption of advanced high-strength steel and aluminum, impacting demand for traditional steel products.

Technological advancements are constantly improving the performance and lowering the cost of substitute materials for steel. For instance, ongoing R&D in advanced composites and high-strength alloys is making them increasingly competitive in sectors like automotive and aerospace, where weight reduction and durability are paramount. In 2024, the global advanced composites market was projected to reach over $20 billion, showcasing their growing appeal.

Life Cycle Costs and Environmental Impact

The growing emphasis on life cycle costs, which now explicitly include environmental impact and sustainability, presents a significant threat of substitution for traditional steel in China. As businesses and governments increasingly focus on decarbonization, materials offering lower carbon footprints or enhanced recyclability are becoming more attractive. For instance, by 2024, the global steel industry's emissions were estimated to be around 2.6 billion tonnes of CO2, representing approximately 7% of total global direct CO2 emissions, highlighting the pressure for alternatives.

This shift is driving demand for greener materials. Industries aiming for circular economy principles may opt for substitutes that align better with these goals, potentially impacting steel demand. For example, the development of advanced composites and bio-based materials is accelerating, offering lighter weight and reduced embodied energy in certain applications.

- Growing demand for low-carbon alternatives: Industries are actively seeking materials with a smaller environmental footprint to meet sustainability targets.

- Circular economy principles: Materials that are easily recyclable or biodegradable are gaining favor over traditional steel in specific sectors.

- Technological advancements in substitutes: Innovations in composites, advanced plastics, and bio-materials are creating viable alternatives to steel in construction and automotive sectors.

- Regulatory pressures and incentives: Government policies promoting green procurement and carbon pricing can further encourage the adoption of substitute materials.

Specific Industry Applications at Risk

China Steel Corporation faces varying threats from substitutes across its customer base. Industries like automotive and aerospace are increasingly adopting lightweight materials, such as advanced composites and aluminum alloys, to improve fuel efficiency and performance. For example, by 2024, the global automotive lightweight materials market is projected to reach over $200 billion, indicating a significant shift away from traditional steel in certain applications.

While construction remains a robust market for structural steel, there's a growing interest in alternative materials. Innovations in engineered timber and high-performance concrete offer potential substitutes for steel in certain building applications, particularly in sustainable construction initiatives. Despite this, steel's inherent strength, durability, and recyclability continue to make it a preferred choice for many large-scale projects.

- Automotive Sector: Increased adoption of aluminum alloys and carbon fiber composites for weight reduction and fuel economy.

- Aerospace Sector: Continued reliance on advanced composites and titanium alloys for their superior strength-to-weight ratios.

- Construction Sector: Emerging use of engineered timber (like cross-laminated timber) and advanced concrete formulations as potential substitutes in specific structural applications.

The threat of substitutes for China Steel is amplified by the increasing adoption of lightweight materials like aluminum and advanced composites, particularly in the automotive sector. For instance, by 2024, the global automotive lightweight materials market was projected to exceed $200 billion, reflecting a significant trend. While steel maintains advantages in cost and strength for many applications, the drive for fuel efficiency and sustainability in 2024 continues to fuel interest in these alternatives.

Technological advancements are making substitute materials more competitive. Innovations in composites and high-strength alloys are enhancing their appeal in sectors like aerospace and automotive, where weight reduction is critical. The global advanced composites market, valued at over $20 billion in 2024, illustrates this growing market penetration.

Environmental concerns and life cycle costs are also pushing industries towards substitutes with lower carbon footprints. As decarbonization efforts intensify, materials offering enhanced recyclability or reduced embodied energy are becoming more attractive, impacting traditional steel demand. The steel industry's significant CO2 emissions, estimated at around 7% of global direct emissions by 2024, underscore this pressure.

| Industry Sector | Primary Substitutes | Key Drivers for Substitution | 2024 Market Insight |

|---|---|---|---|

| Automotive | Aluminum alloys, Carbon fiber composites | Weight reduction, Fuel efficiency, Electric vehicle (EV) range | Automotive lightweight materials market projected >$200 billion |

| Aerospace | Advanced composites, Titanium alloys | Strength-to-weight ratio, Fuel efficiency | Continued growth in composite use for aircraft structures |

| Construction | Engineered timber, Advanced concrete | Sustainability, Green building initiatives | Increased interest in CLT and sustainable materials |

Entrants Threaten

The capital requirements for establishing a new integrated steel plant in China are immense, acting as a formidable barrier to entry. Building a modern, efficient facility capable of competing with established players, including China Steel, demands billions of dollars in investment. This includes costs for land acquisition, advanced blast furnaces, rolling mills, environmental control systems, and logistics infrastructure.

For instance, a new greenfield integrated steel plant in China could easily cost upwards of $5 billion to $10 billion or more, depending on its scale and technological sophistication. These substantial upfront costs deter many potential new entrants who may lack the necessary financial backing or access to large-scale financing. This financial hurdle significantly limits the number of new companies that can realistically enter the Chinese steel market.

Established steel giants, including China Steel Corporation, leverage significant economies of scale. This means they can produce steel at a much lower cost per unit due to their massive production volumes and efficient operations. For instance, in 2023, China Steel Corporation’s annual crude steel output was approximately 14.7 million metric tons, a scale that new entrants would find incredibly difficult and expensive to replicate.

New companies entering the market would face immense challenges in matching these cost efficiencies. Without achieving similar production volumes, they would operate at a significant cost disadvantage, making it hard to compete on price. This is especially true in an industry already grappling with global overcapacity, where every cost advantage matters.

New steel producers face substantial hurdles in securing consistent and affordable access to vital raw materials like iron ore and coking coal. Existing, established players often benefit from long-term contracts and diversified sourcing strategies, giving them a significant cost advantage and supply chain stability. For instance, in 2024, global iron ore prices saw fluctuations, making it harder for newcomers to lock in favorable terms compared to those with existing supplier relationships.

Government Policy and Regulation

Government policies significantly influence the threat of new entrants in China's steel industry. Stringent environmental regulations, for instance, can raise compliance costs, acting as a barrier for new players who may lack the capital for advanced pollution control technologies. As of early 2024, China has continued to enforce strict environmental standards, impacting operational costs for all steel producers.

Trade protection measures, such as tariffs and anti-dumping duties imposed by China or on Chinese steel exports, can also deter new entrants. These measures create uncertainty and increase the cost of importing raw materials or exporting finished goods, making it harder for newcomers to compete. For example, the EU's ongoing safeguard measures on steel imports, which include quotas, indirectly affect the global competitive landscape, including potential entrants into the Chinese market.

Furthermore, state support for existing Chinese steel enterprises, through subsidies or preferential policies, can create an uneven playing field. This support can lower the effective cost of production for established firms, making it more challenging for new, unsubsidized entrants to gain market share. The Chinese government's focus on consolidating and upgrading its steel sector, while aiming for higher quality and efficiency, may involve continued support for strategically important domestic players.

- Environmental Regulations: China's commitment to reducing carbon emissions and improving air quality leads to stricter environmental standards for steel production, increasing capital expenditure for new entrants.

- Trade Protectionism: Tariffs and anti-dumping duties, both within China and internationally, can escalate costs and create market access challenges for new steel producers.

- State Support: Government subsidies and preferential policies for existing, often state-owned, steel enterprises can create significant cost advantages, raising the barrier to entry for new, independent companies.

Brand Loyalty and Switching Costs for Customers

While steel might seem like a basic commodity, China Steel has cultivated strong customer loyalty through consistent product quality and dependable supply chains. This makes it challenging for new players to lure away existing clients.

New entrants face the hurdle of overcoming these established preferences. They would likely need to engage in aggressive pricing strategies or offer demonstrably superior service to gain traction, which can significantly increase their initial costs.

- China Steel's Dominance: China Steel holds a substantial market share in Taiwan for its core steel products, indicating a strong existing customer base that new entrants must contend with.

- Brand Equity: Years of reliable service and quality have built brand equity, creating a psychological barrier for customers considering switching to an unknown supplier.

- Switching Costs: Beyond price, customers may face costs associated with re-qualifying new suppliers, adjusting production processes, or potential disruptions to their operations if they switch from a trusted provider like China Steel.

The threat of new entrants into China's steel market is generally low, primarily due to extremely high capital requirements and established economies of scale. For instance, building a new integrated steel plant in China can cost upwards of $5 billion to $10 billion, a significant barrier for potential newcomers. Existing players, like China Steel, benefit from massive production volumes, with China Steel producing around 14.7 million metric tons of crude steel annually in 2023, making it difficult for new entrants to match their cost efficiencies.

Government policies, including stringent environmental regulations and trade protection measures, further deter new entrants by increasing compliance costs and market access challenges. For example, China's continued enforcement of strict environmental standards in early 2024 raises capital expenditure for new facilities. Moreover, state support for existing Chinese steel enterprises can create an uneven playing field, as these firms may receive subsidies or preferential policies, lowering their effective production costs.

Customer loyalty and brand equity also pose a challenge for new entrants. China Steel has cultivated strong customer relationships through consistent quality and reliable supply chains, making it difficult for new players to attract existing clients. Customers may also face switching costs, such as re-qualifying suppliers or potential operational disruptions, which further solidifies the position of established companies.

Porter's Five Forces Analysis Data Sources

Our China Steel Porter's Five Forces analysis is built upon a robust foundation of data, including official government statistics, industry association reports, and financial filings from major steel producers. This ensures a comprehensive understanding of market dynamics and competitive pressures.