Carlyle Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlyle Group Bundle

The Carlyle Group, a titan in private equity, leverages its vast global network and diversified investment strategies as significant strengths. However, it faces challenges from increasing regulatory scrutiny and the inherent volatility of the financial markets, which could impact its operational efficiency and profitability.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Carlyle Group's strength lies in its highly diversified investment portfolio, encompassing private equity, credit, and real assets. This broad reach, managing $453 billion in assets under management as of March 31, 2025, significantly reduces exposure to any single market downturn. The strategic balance across its key segments, including Global Private Equity, Global Credit, and Investment Solutions, underpins its robust financial stability and consistent revenue generation.

Carlyle Group's strength lies in its exceptional fundraising abilities, consistently attracting significant capital from a broad spectrum of investors like sovereign wealth funds and pension funds. The firm concluded 2024 with an impressive $41 billion in raised capital and continued this momentum into 2025, securing $14 billion in the first quarter, totaling $50 billion over the past year. This strong fundraising capacity enables Carlyle to engage with and execute large-scale, intricate investment strategies.

Carlyle Group boasts a formidable global presence, operating from 29 offices across four continents. As of March 31, 2025, the firm managed an impressive $453 billion in assets under management (AUM), underscoring its significant international footprint and robust brand reputation. This expansive reach is a key strength, enabling Carlyle to attract substantial capital from institutional investors worldwide and tap into diverse deal flows.

Growth in Credit and Solutions Platforms

Carlyle's Global Credit segment has experienced robust expansion, with Assets Under Management (AUM) climbing almost 30% in 2024 to reach $194 billion. This growth is further evidenced by a 28% year-over-year increase in fee-related earnings for the first quarter of 2025, highlighting the segment's increasing profitability.

The Global Investment Solutions business, particularly its secondaries platform, is also a key growth driver, effectively compensating for more moderate performance in the firm's private equity operations. This diversification demonstrates Carlyle's ability to adapt its strategy to market dynamics.

Under current leadership, Carlyle is strategically prioritizing credit, insurance, and asset-backed finance. These areas represent significant new avenues for earnings and overall firm growth, reflecting a deliberate shift in focus to capitalize on evolving market opportunities.

- Significant AUM Growth: Global Credit AUM increased by nearly 30% in 2024, reaching $194 billion.

- Strong Fee-Related Earnings: Fee-related earnings in Global Credit rose by 28% year-over-year in Q1 2025.

- Strategic Focus Shift: Carlyle is actively expanding in credit, insurance, and asset-backed finance.

- Diversification Benefits: Growth in these segments helps offset slower expansion in private equity.

Strategic Focus on Emerging Growth Areas

Carlyle Group is strategically focusing on high-growth sectors, demonstrating a forward-looking approach. The firm is actively investing in private wealth, asset-backed finance, insurance, and the rapidly expanding AI, data, and cloud transformation markets. This diversification is key to capturing future revenue streams.

A significant move is the planned launch of a new wealth platform by late 2025. This initiative aims to broaden Carlyle's fundraising capabilities by tapping into the growing private wealth segment. It signals a commitment to evolving its business model to meet changing investor demands.

Further solidifying this focus, Carlyle recently acquired a majority stake in Adastra Group SE. Adastra is an IT consultancy specializing in AI and cloud solutions, a sector experiencing substantial growth. This acquisition directly enhances Carlyle's expertise and presence in critical technology areas.

These strategic initiatives position Carlyle to effectively capitalize on evolving market opportunities and maintain a competitive edge in the dynamic financial landscape. The firm's proactive engagement in these growth areas is a testament to its adaptive strategy.

Carlyle's diversified investment strategy, spanning private equity, credit, and real assets, is a core strength. This broad approach, managing $453 billion in assets as of March 31, 2025, mitigates risk and ensures stable revenue. The firm's ability to attract substantial capital, raising $50 billion over the past year ending Q1 2025, fuels its capacity for large-scale investments.

| Segment | AUM (as of March 31, 2025) | 2024 AUM Growth | Q1 2025 Fee-Related Earnings Growth |

|---|---|---|---|

| Global Credit | $194 billion | ~30% | 28% |

| Global Private Equity | N/A | N/A | N/A |

| Investment Solutions | N/A | N/A | N/A |

What is included in the product

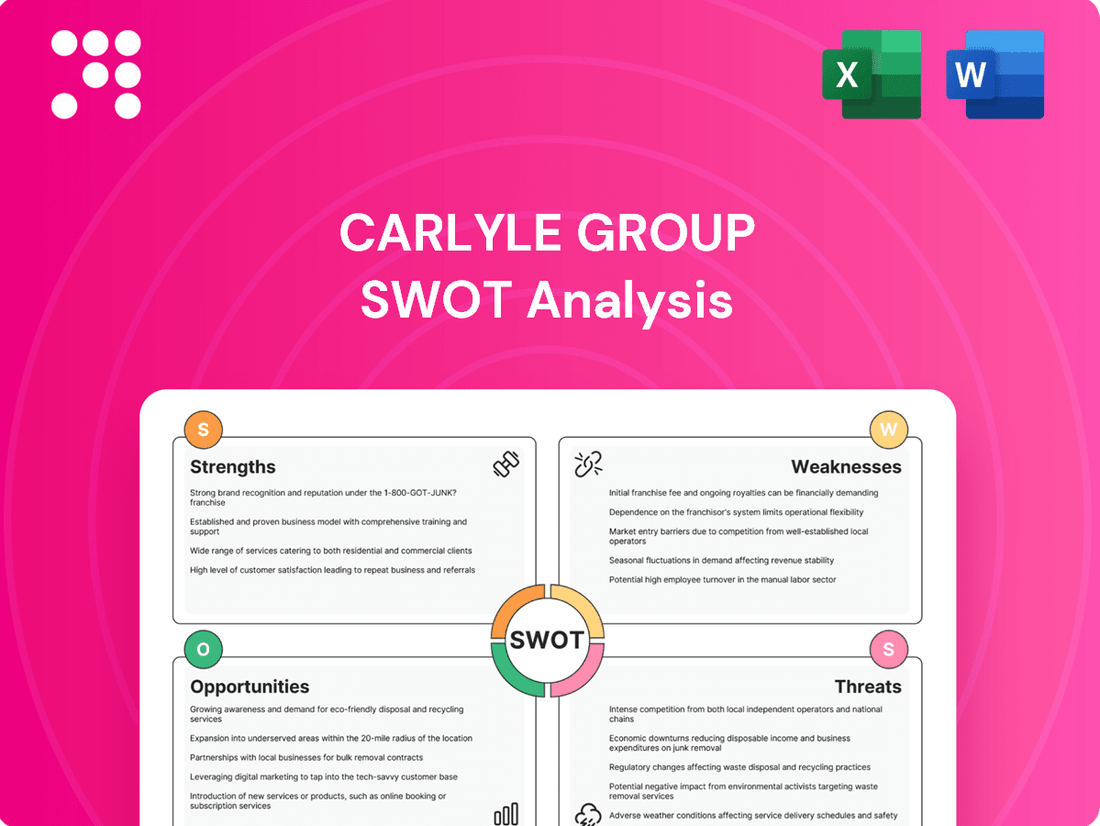

Delivers a strategic overview of Carlyle Group’s internal and external business factors, identifying key strengths like its diversified investment strategies and brand recognition, while also highlighting weaknesses such as operational complexity and reliance on fundraising cycles, alongside opportunities in emerging markets and private credit, and threats from increased competition and regulatory changes.

Offers a clear, actionable framework to address Carlyle's competitive landscape and internal challenges.

Weaknesses

Carlyle Group's investment performance shows a mixed picture. While its Credit and Investment Solutions segments demonstrated robust growth, with a 3% appreciation noted in late 2024, the Global Private Equity segment lagged, experiencing only 1% growth in the same period.

Furthermore, a modest decline in fees is projected for Global Private Equity in 2025. This uneven performance across different asset classes suggests that not all areas of the business are contributing equally to overall returns, which could affect investor sentiment towards specific strategies.

Carlyle's financial results are closely tied to when it can successfully sell its investments, known as realizations, and the overall health of the market. This means that even if the company is performing well internally, a tough market can delay profitable exits.

For instance, in the fourth quarter of 2024, Carlyle experienced a slight miss on its distributable earnings per share. This was primarily due to lower-than-anticipated asset sales and weaker fee-related earnings, highlighting the direct impact of market conditions on its performance metrics.

If market volatility persists or the environment for mergers and acquisitions slows down, it becomes harder for Carlyle to achieve profitable exits. This can directly impact the performance fees it earns, a crucial component of its overall financial success.

The alternative asset management landscape is fiercely competitive, with giants like Blackstone, KKR, and Apollo Global Management actively pursuing similar deals and investor mandates. This crowded field can inflate asset prices, squeeze profitability, and complicate efforts to secure and keep investor commitments, potentially affecting Carlyle's ability to meet its fundraising goals.

Potential for Fundraising Misses

While Carlyle Group has demonstrated strong fundraising capabilities, achieving ambitious targets, such as its stated goal of $40 billion for 2025, could encounter challenges. Economic uncertainties and evolving investor preferences may create headwinds, potentially impacting the firm's ability to consistently meet its inflow objectives for the fiscal year.

- Fundraising Target Ambition: Carlyle's aim to raise $40 billion by 2025 highlights a significant growth objective.

- Economic Headwinds: Broader economic volatility and shifts in investor sentiment can directly affect capital deployment and fundraising success.

- Instances of Shortfalls: Recent market observations suggest that some fundraising efforts have not fully met initial targets, signaling potential challenges in consistent inflow achievement.

Regulatory and Compliance Risks

Carlyle operates in a complex global landscape, making it susceptible to a wide array of regulatory and compliance risks. The firm must navigate differing rules and expectations across numerous countries where it conducts business. This constant need for adaptation can be challenging and resource-intensive.

The firm faced a notable compliance issue in early 2025, being fined $5.6 million for recordkeeping failures. This event underscores the ongoing vigilance required to meet regulatory standards and the potential financial repercussions of missteps.

Increased regulatory oversight, a trend observed across the financial industry, poses a significant weakness. Such scrutiny can lead to higher operational costs as firms invest in enhanced compliance systems and personnel. Furthermore, potential shifts in financial regulations could introduce new complexities and necessitate costly adjustments to business practices.

- Evolving Regulatory Scrutiny: Carlyle's global presence exposes it to diverse and changing regulatory environments.

- Recordkeeping Failures: A $5.6 million fine in early 2025 highlights specific compliance challenges.

- Increased Oversight Costs: Heightened regulatory attention can drive up operational expenses.

- Potential for Regulatory Change: Future shifts in financial laws may require significant adaptation and investment.

Carlyle's investment performance shows unevenness, with its Global Private Equity segment experiencing slower growth at 1% compared to a 3% appreciation in Credit and Investment Solutions in late 2024. This disparity, coupled with a projected modest decline in fees for Global Private Equity in 2025, indicates that not all business areas are contributing equally to overall returns.

The firm's reliance on successful investment realizations means that market volatility and a slowdown in mergers and acquisitions, as seen in Q4 2024's lower-than-anticipated asset sales impacting distributable earnings per share, can directly hinder profitable exits and performance fee generation.

Carlyle faces intense competition from major players like Blackstone and KKR, which can inflate asset prices and pressure profitability, potentially impacting its ability to secure investor commitments and meet fundraising goals, such as its $40 billion target for 2025.

Recent compliance issues, including a $5.6 million fine in early 2025 for recordkeeping failures, highlight the significant risks associated with navigating diverse global regulations and the potential for increased operational costs due to heightened oversight.

Same Document Delivered

Carlyle Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It offers a comprehensive look at The Carlyle Group's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

Carlyle is making a concerted push into the private wealth sector, aiming to broaden its investor base and secure new capital sources. This strategic move is underscored by plans for a new wealth platform by late 2025.

The firm's Global Wealth Assets Under Management (AUM) have seen substantial year-over-year increases, reflecting a clear commitment to capturing a share of this burgeoning market. This expansion allows Carlyle to access a growing segment of high-net-worth individuals seeking alternative investment opportunities.

Carlyle Group is well-positioned to capitalize on the robust demand for private credit, a sector that has shown strong performance. The firm's Global Credit unit experienced significant inflows and revenue growth throughout 2024 and into the first quarter of 2025, indicating sustained market interest.

Furthermore, Carlyle's strategic expansion of its insurance solutions, particularly through its Fortitude business, offers another substantial avenue for growth. Management anticipates continued positive momentum in both credit and insurance segments throughout 2025, underscoring these as key opportunities.

Carlyle Group has a strong history of making strategic acquisitions, notably expanding into AI, data, and cloud transformations. A prime example is their acquisition of Adastra Group SE in July 2025, highlighting a commitment to high-growth technology sectors. This focus allows Carlyle to bolster its portfolio by capitalizing on emerging market trends and driving value through enhanced operational efficiencies.

Increased Exit Activity and Capital Deployment

Carlyle anticipates a robust increase in exit opportunities throughout 2025, projecting $4 billion to $5 billion in divestments from its private equity holdings. This strategic focus on realizing value from existing investments is a key driver for future capital deployment.

The firm's substantial dry powder, standing at $84 billion as of the first quarter of 2025, provides significant capacity to act on attractive investment prospects. This financial flexibility allows Carlyle to pursue new deals as market conditions evolve and valuations become more favorable.

- Projected 2025 Exits: $4 billion to $5 billion from private equity portfolio.

- Dry Powder (Q1 2025): $84 billion available for new investments.

- Strategic Advantage: Well-positioned to capitalize on improving market conditions and attractive valuations.

Leveraging Global Capital Markets Recovery

Carlyle Group is well-positioned to capitalize on a recovering global capital markets environment. Expectations point to a significant uptick in dealmaking and Initial Public Offerings (IPOs) in the United States throughout 2024 and into 2025, a trend that directly benefits private equity firms like Carlyle.

The firm's strategic focus on enhancing alignment around transaction fee generation is a key enabler for this opportunity. Furthermore, Carlyle's demonstrated appetite for large leveraged buyouts indicates its readiness to deploy capital effectively as market liquidity and investor confidence improve.

- Increased Deal Flow: Projections suggest a robust increase in M&A activity and IPOs in the US, potentially reaching levels not seen since 2021, driven by pent-up demand and stabilizing economic conditions.

- Fee Generation Focus: Carlyle's emphasis on aligning its business model with transaction fees means it can directly profit from the anticipated surge in deal volume.

- Large Buyout Capacity: The firm's willingness to undertake substantial leveraged buyouts positions it to capture significant market share in a recovering market where larger deals become more feasible.

- Investor Confidence Rebound: A general improvement in investor sentiment is expected to translate into greater capital availability for private equity funds, supporting Carlyle's fundraising and investment strategies.

Carlyle is expanding into the private wealth sector with a new platform planned for late 2025, aiming to broaden its investor base and secure new capital. The firm's Global Wealth Assets Under Management (AUM) have seen significant year-over-year increases, indicating a strong push into this growing market. Carlyle is also poised to benefit from robust demand for private credit, with its Global Credit unit experiencing notable inflows and revenue growth through early 2025.

The firm's insurance solutions, particularly through Fortitude, represent another key growth opportunity, with management expecting continued positive momentum in both credit and insurance segments throughout 2025. Carlyle's strategic acquisitions, such as Adastra Group SE in July 2025, highlight a focus on high-growth technology sectors like AI and cloud transformations. Furthermore, Carlyle anticipates a strong increase in exit opportunities, projecting $4 billion to $5 billion in divestments from its private equity holdings in 2025, supported by $84 billion in dry powder as of Q1 2025.

| Opportunity Area | Key Data/Projection | Strategic Implication |

|---|---|---|

| Private Wealth Expansion | New platform by late 2025; growing Global Wealth AUM | Access to broader investor base and new capital sources |

| Private Credit Demand | Significant inflows and revenue growth in Global Credit (2024-Q1 2025) | Capitalizing on strong market performance and sustained interest |

| Insurance Solutions | Continued positive momentum expected in Fortitude business (2025) | Further diversification and growth avenue |

| Technology Sector Focus | Acquisition of Adastra Group SE (July 2025) | Leveraging high-growth trends in AI, data, and cloud |

| Exit Opportunities & Dry Powder | Projected $4-5 billion in 2025 exits; $84 billion dry powder (Q1 2025) | Capacity for new investments and value realization from existing portfolio |

Threats

Ongoing market volatility and macroeconomic uncertainties, including elevated interest rates and the specter of economic slowdowns, present significant challenges for Carlyle Group. These conditions can depress the valuation of private assets and hinder the group's capacity to divest investments advantageously, potentially impacting management and performance fees.

For instance, persistent inflation and the Federal Reserve's aggressive rate hikes in 2023-2024 have increased borrowing costs, making leveraged buyouts more expensive and potentially dampening deal volumes. This environment directly affects Carlyle's ability to generate attractive returns and realize gains from its portfolio companies.

The alternative asset management landscape is becoming more crowded, intensifying the fight for both investor capital and promising investment opportunities. This heightened competition makes it harder for firms like Carlyle to stand out and secure the best deals.

Major competitors, including Blackstone, KKR, and Apollo Global Management, are actively raising substantial capital. For instance, Blackstone reported a record $100 billion in capital raised in the first half of 2024 alone. This aggressive fundraising by peers can drive up asset prices and potentially squeeze returns for all market participants, including Carlyle.

The alternative asset management sector, including firms like Carlyle Group, is increasingly subject to regulatory oversight. New rules concerning fees, operational transparency, and investment strategies could emerge, potentially impacting profitability and business models. For instance, Carlyle faced a $100,000 fine from the SEC in late 2023 for recordkeeping and compliance failures, underscoring the real-world consequences of non-compliance.

These evolving regulations can translate into higher operational expenses due to enhanced compliance measures and reporting requirements. Furthermore, certain investment approaches or fee structures that were previously permissible might face limitations, potentially restricting Carlyle's strategic flexibility and ability to generate returns.

Performance and Realization Challenges in Private Equity

Carlyle's private equity segment is facing headwinds, with projections indicating slower growth and anticipated fee declines in 2025. This performance dip, particularly if key funds like Carlyle Partners VIII underperform, could significantly hinder future fundraising efforts and erode investor confidence in this foundational business area. For instance, in Q1 2024, Carlyle reported a 3% decline in fee-related earnings (FRE) year-over-year, partly attributed to asset mix shifts within its private equity strategies.

The realization of investments within private equity portfolios presents a critical challenge. If Carlyle struggles to exit investments at favorable valuations, it directly impacts the performance metrics that LPs (Limited Partners) use to assess the firm's capabilities. This can create a ripple effect, making it more difficult to attract capital for new funds, especially when compared to competitors demonstrating stronger recent performance. The firm's Assets Under Management (AUM) in private equity stood at $155 billion as of March 31, 2024, a figure that relies heavily on successful exits to demonstrate value creation.

- Slower Growth Projections: Carlyle's private equity business anticipates slower growth and potential fee declines by 2025.

- Fund Performance Impact: Underperformance in flagship funds like Carlyle Partners VIII could jeopardize future fundraising and investor trust.

- Realization Challenges: Difficulty in exiting investments at optimal valuations directly impacts reported performance and future capital allocation.

- Investor Confidence: Stagnant or declining returns in private equity can erode investor confidence, making capital raising more arduous.

Geopolitical Risks and Global Trade Tensions

Geopolitical risks, including political instability and escalating trade tensions, pose a significant threat to Carlyle Group's global operations. These factors can inject considerable uncertainty into international markets, directly impacting the performance of Carlyle's diverse portfolio of overseas investments. For instance, ongoing trade disputes, such as those impacting supply chains and manufacturing hubs, can create headwinds for portfolio companies reliant on international trade.

While Carlyle has stated a limited direct exposure to tariff risks, the broader geopolitical landscape significantly influences the global economic climate and, consequently, investor sentiment. A slowdown in global growth driven by these tensions could lead to reduced deal flow and pressure on asset valuations across the private equity sector. The firm's extensive global footprint means it is inherently exposed to the ripple effects of such international disruptions.

- Trade Tensions: Continued trade disputes between major economic blocs can disrupt international supply chains and increase costs for portfolio companies, impacting profitability.

- Political Instability: Unforeseen political events in key operating regions can lead to regulatory changes, currency fluctuations, or even asset seizures, directly threatening investment values.

- Global Economic Slowdown: Heightened geopolitical risks can trigger a broader economic downturn, reducing investor appetite for new deals and potentially devaluing existing assets.

Intensified competition within the alternative asset management sector, marked by aggressive fundraising from rivals like Blackstone, KKR, and Apollo, poses a significant threat. This heightened competition can inflate asset prices and compress returns for all players, including Carlyle. For example, Blackstone's record $100 billion capital raise in the first half of 2024 exemplifies the scale of this competitive pressure.

The increasing regulatory scrutiny across the alternative asset management industry presents another challenge. Potential new rules concerning fees, transparency, and investment strategies could impact Carlyle's profitability and operational flexibility. This is highlighted by Carlyle's own $100,000 SEC fine in late 2023 for compliance issues, underscoring the real-world costs of regulatory missteps.

Slower growth projections and potential fee declines in Carlyle's private equity segment by 2025 are concerning. Underperformance in key funds, such as Carlyle Partners VIII, could deter future fundraising and erode investor confidence. The firm's Q1 2024 fee-related earnings (FRE) already showed a 3% year-over-year decline, partly due to asset mix shifts.

Geopolitical instability and trade tensions create global economic uncertainty, directly affecting Carlyle's international investments. Disruptions to supply chains and reduced global growth due to these tensions can negatively impact portfolio company performance and overall deal flow, as seen with ongoing trade disputes affecting manufacturing hubs.

| Threat Category | Specific Challenge | Impact on Carlyle | Supporting Data/Example |

| Competition | Aggressive fundraising by peers | Increased asset prices, compressed returns | Blackstone raised $100B in H1 2024 |

| Regulation | Evolving compliance requirements | Higher operational costs, restricted strategies | Carlyle's $100K SEC fine (late 2023) |

| Market Conditions | Slower PE growth, fee declines | Reduced fundraising, eroded investor confidence | Carlyle's 3% FRE decline (Q1 2024) |

| Geopolitics | Trade tensions, instability | Portfolio performance, deal flow reduction | Impact on supply chains in manufacturing hubs |

SWOT Analysis Data Sources

This Carlyle Group SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial filings, comprehensive market research reports, and insights from reputable industry publications to ensure a well-rounded and informed perspective.