Carlyle Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlyle Group Bundle

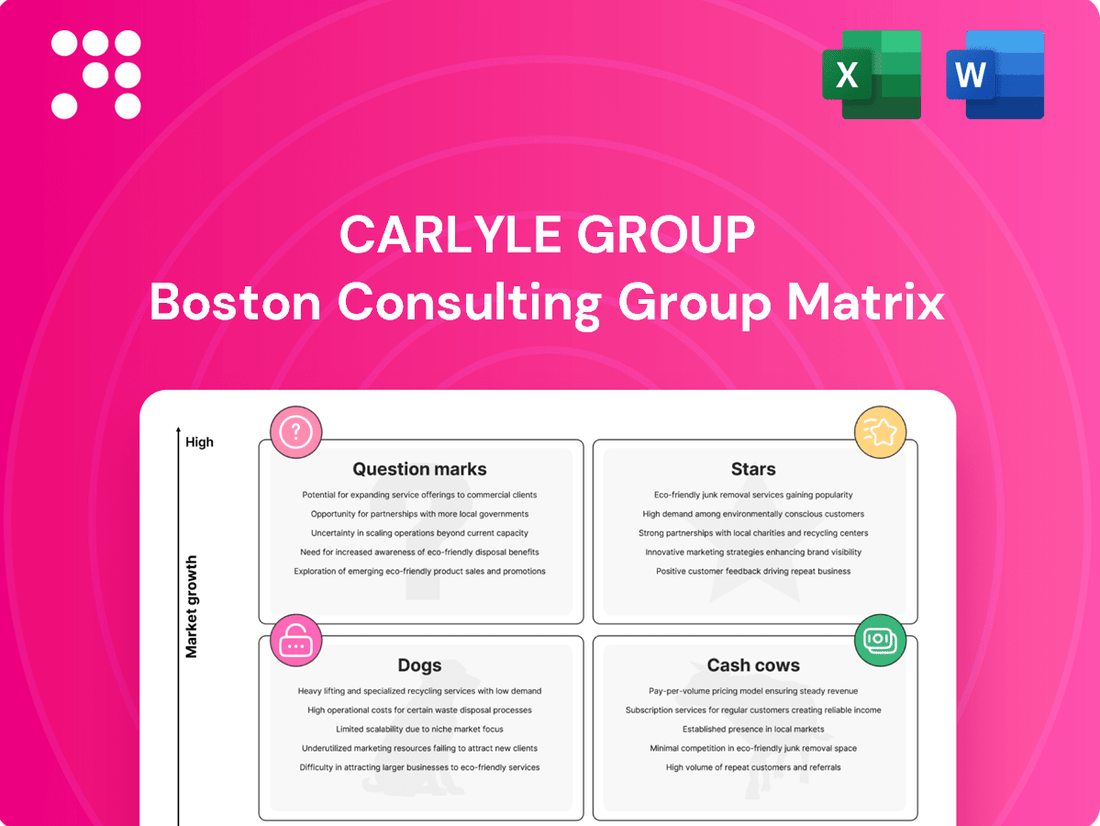

The Carlyle Group's BCG Matrix offers a critical lens to understand its diverse portfolio. By categorizing its investments into Stars, Cash Cows, Dogs, and Question Marks, we can begin to see the strategic positioning of its key ventures.

This initial glimpse is just the start of unlocking actionable intelligence. Purchase the full BCG Matrix report to gain a comprehensive quadrant-by-quadrant analysis, revealing the true potential and challenges within Carlyle's holdings.

Equip yourself with the data-driven insights needed to make informed capital allocation decisions and navigate the complexities of the investment landscape. Get the full report now for a complete strategic roadmap.

Stars

Carlyle's Global Credit platform is a key growth engine, reflecting a strong market appetite for alternative credit. In 2024, this segment experienced robust expansion, with fee revenues climbing 17% and fee-related earnings surging by roughly 32% compared to the previous year. This performance underscores the platform's increasing importance within Carlyle's overall business structure.

By late 2024, the Global Credit segment managed a substantial $190 billion in assets under management. The platform also attracted significant capital, with $17.3 billion in fundraising inflows during the same period. This influx of capital highlights investor confidence and the attractiveness of Carlyle's diverse credit offerings.

The success of Carlyle's Global Credit platform can be attributed to the high demand for specialized alternative credit solutions and the breadth of its investment strategies. Offerings such as private credit and asset-backed finance have resonated well with investors seeking yield and diversification in the current market environment.

AlpInvest, a key component of Carlyle Group's Global Investment Solutions, experienced significant expansion in 2024. Fee revenues saw a substantial 30% surge, while fee-related earnings nearly doubled in the fourth quarter of 2024 when compared to the same period in 2023.

The momentum continued into early 2025, with AlpInvest reporting record fee-related earnings in the first quarter, almost doubling from the previous year. Assets under management (AUM) also reached a new high of $89 billion, marking a 12% increase.

This strong performance is largely driven by robust inflows into AlpInvest's secondaries platform, portfolio finance, and its global wealth strategy, underscoring its leading position in a dynamic and expanding market segment.

Carlyle Group is heavily invested in technology and AI, focusing on IT services that drive data, cloud, and AI advancements. A prime example is their July 2025 acquisition of a majority stake in Adastra Group, a move that underscores their commitment to scaling these specialized companies.

The firm has also secured substantial funding for its European technology ventures, aiming to capture growth in critical sectors such as cybersecurity, digital transformation, and cleantech. This strategic allocation of capital demonstrates Carlyle's confidence in the burgeoning technology landscape.

Opportunistic Credit Funds

Carlyle's opportunistic credit strategy is a significant growth engine, underscored by the successful final close of its third Carlyle Credit Opportunities Fund (CCOF III) in late 2024. This fund secured $7.1 billion, marking a substantial increase of nearly 30% compared to its predecessor.

This capital raise reflects robust investor demand for strategies focused on providing essential capital to businesses facing intricate challenges. The opportunistic credit sector continues to demonstrate its resilience and appeal to investors seeking attractive risk-adjusted returns.

The firm's commitment to this space is evident in its deployment history, having allocated approximately $22 billion since 2017 across various targeted industry verticals. This track record highlights Carlyle's expertise in identifying and capitalizing on opportunities within the credit markets.

- Fundraising Success: CCOF III closed at $7.1 billion in late 2024, a nearly 30% increase from its predecessor.

- Strategic Capital Deployment: The fund aims to provide capital to companies in complex situations.

- Market Confidence: The significant capital raise signals strong investor belief in Carlyle's opportunistic credit strategy.

- Deployment Track Record: Carlyle has deployed nearly $22 billion in opportunistic credit since 2017 across targeted industries.

Global Wealth Strategy

Carlyle Group is significantly bolstering its global wealth strategy, recognizing the burgeoning demand from individual investors for private market access.

This strategic push is yielding tangible results, with Q1 2025 reportedly seeing a 40% surge in fundraising for its wealth management initiatives. Furthermore, assets held within Carlyle's Evergreen products have experienced an impressive 70% year-over-year expansion, underscoring the effectiveness of their approach.

- Fundraising Growth: Q1 2025 fundraising for global wealth strategy up 40%.

- Evergreen Assets: Year-over-year increase of 70% in Evergreen product assets.

- Market Focus: Targeting high-growth retail channels and private wealth distribution.

- Investor Trend: Catering to increasing individual investor demand for private market exposure.

Stars in the BCG matrix represent high-growth, high-market-share businesses. For Carlyle, this would translate to segments experiencing rapid expansion and where they hold a dominant position. These are the areas where significant investment is typically warranted to maintain leadership and capitalize on future growth potential.

The Global Credit platform, with its 17% fee revenue growth and 32% fee-related earnings surge in 2024, alongside substantial AUM of $190 billion, exhibits Star-like characteristics. Similarly, AlpInvest's impressive 30% fee revenue growth and near doubling of fee-related earnings in Q4 2024, pushing AUM to $89 billion, also aligns with the Star profile.

Carlyle's strategic focus on technology and AI, exemplified by the Adastra Group acquisition in July 2025, points to emerging Stars. The firm's significant capital allocation to European tech ventures further reinforces this. These areas are characterized by high growth potential and Carlyle's proactive investment to secure market share.

The Opportunistic Credit strategy, evidenced by the $7.1 billion CCOF III close in late 2024, also demonstrates Star qualities. This segment benefits from strong investor demand and Carlyle's established track record of deploying capital effectively in complex situations, indicating high growth and market leadership.

What is included in the product

Strategic assessment of Carlyle's portfolio, classifying business units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Carlyle Group BCG Matrix offers a clear, one-page overview, instantly identifying underperforming "Dogs" and guiding strategic divestment to alleviate financial strain.

Cash Cows

Carlyle's flagship U.S. buyout funds are considered cash cows within their BCG matrix. Despite a more modest 1% growth projected for late 2024, these funds are vital for generating significant fee-related earnings and distributable earnings for the firm. Their maturity and Carlyle's established market position ensure consistent management fees, making them a stable revenue source.

Carlyle's core real estate funds, a key component of its Global Private Equity segment, generate consistent fee income. This stability stems from their strong market presence in established real estate sectors.

These funds are vital for Carlyle's overall portfolio, offering predictable revenue streams. For instance, the group saw substantial inflows into its U.S. real estate operations during the second quarter of 2024, underscoring the ongoing investor confidence in this segment.

Carlyle Group's investments in infrastructure and natural resources, falling under its Global Private Equity segment, are positioned as Cash Cows. These are stable, long-term asset classes known for generating predictable cash flows, a hallmark of Cash Cow businesses.

Within these sectors, Carlyle has seen increasing contributions from asset-backed finance and renewable energy to its capital markets revenue. This trend highlights their function as consistent income generators, reflecting a mature market with steady demand that supports reliable earnings.

Asset-Backed Finance (ABF) Strategies

Carlyle Group's asset-backed finance (ABF) strategies are a key component of its Global Credit platform, demonstrating robust growth and consistent cash flow generation. These strategies are designed to capitalize on mature and predictable asset pools, thereby securing reliable earnings. The firm's involvement in significant transactions underscores the importance of this segment.

A prime example of Carlyle's ABF activity is its participation in the $10 billion purchase of student loans alongside KKR in 2024. This substantial deal highlights the scale and strategic focus on these asset classes. Such transactions are instrumental in generating significant fee income for the firm.

- Significant 2024 Transaction: Carlyle participated in a $10 billion student loan purchase with KKR.

- Predictable Cash Flows: ABF strategies tap into mature asset pools for consistent earnings.

- Fee Income Generation: This segment is a substantial contributor to Carlyle's fee-related earnings.

- Global Credit Platform Growth: ABF represents a growing and important area within Carlyle's credit operations.

Legacy Fund Management Fees

Legacy fund management fees represent a significant cash cow for Carlyle Group. These are the ongoing management fees generated from older, fully deployed funds across their private equity, credit, and real assets businesses. These established funds provide a stable and predictable revenue stream.

These legacy funds require minimal new capital deployment or extensive marketing efforts. This allows them to consistently generate fee-related earnings with relatively low additional investment from Carlyle. This predictable income forms a solid baseline of recurring revenue for the firm.

For instance, as of the first quarter of 2024, Carlyle reported total Assets Under Management (AUM) of $425 billion. A substantial portion of this AUM is likely tied to these mature funds, contributing significantly to their fee-related earnings.

- Stable Revenue: Ongoing management fees from mature, fully deployed funds.

- Low Investment Needs: These funds require minimal additional capital or marketing.

- Predictable Earnings: They provide a consistent baseline of fee-related earnings.

- Contribution to Profitability: These cash cows support overall firm profitability and operational stability.

Carlyle's flagship U.S. buyout funds are considered cash cows within their BCG matrix, generating significant fee-related earnings. Despite a modest 1% growth projection for late 2024, these mature funds offer a stable revenue source through consistent management fees.

These funds are vital for Carlyle's overall portfolio, providing predictable revenue streams. Carlyle saw substantial inflows into its U.S. real estate operations during the second quarter of 2024, underscoring investor confidence.

Carlyle Group's asset-backed finance strategies are a key component of its Global Credit platform, demonstrating robust growth and consistent cash flow generation. These strategies capitalize on mature and predictable asset pools, securing reliable earnings.

A prime example of Carlyle's ABF activity is its participation in the $10 billion purchase of student loans alongside KKR in 2024, highlighting the scale and strategic focus on these asset classes which are instrumental in generating significant fee income.

| Segment | BCG Classification | Key Characteristics | 2024 Data/Notes |

|---|---|---|---|

| U.S. Buyout Funds | Cash Cow | Mature, stable fee generation | Projected 1% growth (late 2024) |

| Core Real Estate Funds | Cash Cow | Consistent fee income, strong market presence | Substantial Q2 2024 inflows |

| Asset-Backed Finance (ABF) | Cash Cow | Predictable cash flows, mature asset pools | Participated in $10B student loan purchase (2024) |

What You’re Viewing Is Included

Carlyle Group BCG Matrix

The preview of the Carlyle Group BCG Matrix you are currently viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, is ready for immediate use in your business planning and decision-making processes. You can be confident that the full version will be delivered directly to you, without any alterations or demo content, ensuring you have a professionally formatted and actionable BCG Matrix report.

Dogs

Certain niche or older private equity funds within Carlyle's portfolio, particularly those in slow-growth sectors or consistently lagging behind benchmarks, may represent the 'Dogs' in a BCG-like analysis. These funds can immobilize significant capital without delivering the expected returns or attracting fresh investment, consequently impacting distributable earnings. For instance, Carlyle's private equity segment reported a decrease in distributable earnings during the fourth quarter of 2024, a trend that could be partly attributed to such underperforming assets.

Non-core, legacy assets targeted for divestiture, often acquired in earlier investment cycles, are those that no longer fit Carlyle Group's evolving strategic direction or operate within industries experiencing decline. These assets are typically found in the 'Dog' quadrant of the BCG Matrix, characterized by low market share and low growth potential.

Carlyle is actively working to exit these types of investments, with a stated goal of achieving $4 billion to $5 billion in asset sales and initial public offerings from its private equity portfolio during 2025. This strategic divestment plan is designed to unlock capital from investments that are either experiencing slow growth or are underperforming relative to the firm's broader objectives.

Within Carlyle's robust Global Credit platform, certain sub-strategies might be considered "Dogs" if they operate in highly commoditized markets. These areas often face intense competition and minimal differentiation, leading to thinner profit margins.

For instance, if a particular credit strategy focuses on widely available, undifferentiated corporate debt, it could struggle to stand out. In 2024, the private credit market saw continued growth, but also increasing competition, with deal volumes in broadly syndicated loans remaining significant, potentially pressuring returns for less specialized players.

Such commoditized segments would likely yield minimal returns on invested effort for Carlyle, making them less attractive compared to more niche or innovative credit solutions that command higher fees and attract more capital. This is a key consideration when evaluating the overall portfolio's strategic positioning.

Small, Unscaled Emerging Market Ventures

Small, unscaled emerging market ventures within Carlyle's portfolio, especially those in regions where the firm hasn't yet established a strong foothold or market share, could be categorized as Dogs. These ventures, characterized by stalled or uncertain growth prospects, may not justify continued capital allocation. For instance, if a venture in a less developed market, despite Carlyle's global expansion efforts into areas like Japan and India, fails to gain traction, it risks becoming a capital trap.

These "Dog" ventures typically exhibit low market share in a low-growth market. Carlyle's strategy might involve divesting such assets to free up capital for more promising opportunities. As of early 2024, private equity firms, including Carlyle, are increasingly scrutinizing their portfolios for underperforming assets, with a focus on optimizing capital deployment in a more challenging economic environment.

- Low Market Share: Ventures with a minimal presence in their respective emerging markets.

- Stagnant Growth: Limited or negative revenue growth and profitability.

- Capital Intensive: Require ongoing investment without clear returns, posing a risk of capital erosion.

- Divestment Potential: Candidates for sale or liquidation to redeploy capital.

Investments with Significant Geopolitical or Regulatory Headwinds

Investments facing significant geopolitical or regulatory headwinds, particularly those heavily reliant on specific international markets or subject to rapidly evolving compliance landscapes, can transition into Dogs within the BCG matrix. For instance, a renewable energy project in a region experiencing sudden trade sanctions or a drastic shift in environmental policy might see its market access severely curtailed. This can lead to a sharp decline in projected revenues and profitability, making it difficult to justify continued investment or even maintain existing operations.

These external pressures can cripple growth prospects. Consider the hypothetical scenario of a technology firm whose core product relies on components manufactured in a country that suddenly imposes export restrictions. This disruption could halt production, spike costs, and make it nearly impossible to meet demand, effectively stalling any growth trajectory. The inability to generate attractive returns due to these uncontrollable factors necessitates a critical re-evaluation of the investment's strategic position.

For example, in 2024, certain investments in the semiconductor industry faced significant challenges due to heightened geopolitical tensions and export controls imposed by various nations. Companies with supply chains heavily concentrated in affected regions experienced production delays and increased costs, impacting their ability to capture market share. This illustrates how geopolitical instability can directly translate into diminished market access and profitability, pushing such ventures towards the Dog quadrant.

- Geopolitical Risk Impact: Investments in regions with high political instability or potential for conflict may experience operational disruptions, asset seizure, or sudden market exits.

- Regulatory Uncertainty: Changes in trade policies, tariffs, or industry-specific regulations can drastically alter an investment's cost structure and market viability.

- Diminished Market Access: Sanctions, boycotts, or protectionist measures can effectively block access to key customer bases or essential supply chains.

- Profitability Erosion: Increased compliance costs, operational inefficiencies due to external factors, or reduced pricing power can severely impact profit margins.

Carlyle's "Dogs" represent portfolio segments with low market share in slow-growing or declining industries. These can include legacy private equity funds or specific credit strategies in commoditized markets. For example, Carlyle's private equity segment saw a decrease in distributable earnings in Q4 2024, potentially reflecting the impact of such underperforming assets.

These investments often require ongoing capital without generating commensurate returns, acting as capital traps. Carlyle's strategic goal to divest $4 billion to $5 billion in private equity assets in 2025 highlights efforts to move away from these less productive ventures.

Emerging market ventures that fail to gain traction or investments impacted by geopolitical risks and regulatory shifts also fall into this category. Such "Dogs" are candidates for divestiture to reallocate capital to more promising opportunities, a trend observed among private equity firms in 2024.

| Category | Characteristics | Carlyle Example/Context |

| Private Equity Funds | Low growth, lagging benchmarks | Q4 2024 distributable earnings decrease |

| Credit Strategies | Commoditized markets, intense competition | Focus on undifferentiated corporate debt |

| Emerging Ventures | Low market share, stalled growth | Unscaled ventures in less developed markets |

| Geopolitically Exposed | Regulatory headwinds, diminished market access | Semiconductor investments affected by 2024 trade tensions |

Question Marks

Carlyle Group's strategic expansion into thematic funds, such as those focused on specific biotech or space technology niches, positions them as potential question marks in the BCG Matrix. These new ventures target markets with substantial growth prospects, but Carlyle's current market share within these nascent sectors is likely minimal, necessitating significant capital infusion to build a dominant presence.

The success of these thematic funds is intrinsically linked to their ability to capture rapid market adoption and deliver robust performance. For instance, the global space economy was projected to reach $1 trillion by 2040, according to Morgan Stanley, highlighting the immense growth potential Carlyle is aiming to tap into with its space tech initiatives.

Carlyle Group is actively developing a new growth equity vehicle, aiming for up to $2 billion. This initiative is specifically designed to target mid-size private equity deals within North America. The focus is on companies exhibiting rapid expansion and innovative approaches.

These early-stage growth equity initiatives are strategically positioned to capture opportunities in sectors like technology and healthcare. These industries are known for their high growth potential, but they also carry inherent risks and require significant capital infusion to achieve scalability. Carlyle's move reflects a deliberate strategy to capitalize on these dynamic market segments.

Carlyle Group's strategic expansion into nascent geographic markets, such as Japan and India, positions them to capitalize on significant growth opportunities. In Japan, for instance, Carlyle deployed a substantial JPY430 billion buyout fund, signaling a strong commitment to this market.

While these emerging regions offer immense potential, Carlyle's current market share within specific sub-regions or nascent operational areas might be relatively low. This necessitates considerable investment and strategic effort to establish a more dominant presence, characteristic of a question mark in the BCG matrix.

Leveraged Buyouts (LBOs) in Challenging Financing Environments

Carlyle Group continues to pursue substantial leveraged buyouts, even as financing conditions prove more difficult due to elevated interest rates. These transactions, aimed at market leaders, promise considerable returns but necessitate significant capital and carry inherent execution risks in today's unpredictable markets.

For Carlyle's portfolio, these large LBOs could represent future Stars, contingent upon a revival in merger and acquisition activity and more accommodating financing terms. The firm's commitment to these deals underscores a belief in the long-term value of established industry players, even amidst current economic headwinds.

- Carlyle's LBO Strategy: Focuses on industry leaders with strong cash flows, despite higher interest rates impacting deal financing.

- Risk and Reward: These deals demand substantial capital and face execution challenges in volatile markets, but offer potential for high returns.

- Future Potential: Success as future Stars hinges on improved dealmaking environments and more favorable financing conditions.

- Market Context: As of early 2024, private equity deal volume saw a notable slowdown compared to previous years, reflecting the challenging financing landscape.

New Retail and Private Wealth Products

Carlyle Group is strategically expanding its reach into the retail investor market, a move underscored by plans for a new private equity product slated for launch in 2025. This initiative targets the burgeoning private wealth segment, a key growth area for alternative asset managers.

The introduction of these new products is designed to capture a larger share of the expanding private wealth investor base. This segment represents a significant opportunity for Carlyle to diversify its investor pool and tap into new capital flows.

- Retail Channel Expansion: Carlyle's push into retail distribution marks a significant strategic shift, aiming to broaden its investor base beyond institutional clients.

- 2025 Private Equity Product: The planned 2025 launch of a new private equity offering is specifically tailored to attract and serve the needs of private wealth investors.

- Tapping into High-Growth Market: This expansion directly addresses the substantial growth observed in the private wealth investor segment, which is increasingly seeking access to alternative investments.

- New Distribution Channel Challenges: While promising, this new channel requires substantial investment in marketing and distribution infrastructure to achieve widespread adoption and compete effectively.

Carlyle's new thematic funds and expansion into nascent geographic markets like Japan and India represent potential question marks. These ventures target high-growth areas but likely have a low current market share, requiring significant investment to build dominance.

The firm's new growth equity vehicle, aiming for $2 billion to target mid-size North American deals in sectors like technology and healthcare, also fits the question mark profile. These initiatives offer high growth potential but carry inherent risks and demand substantial capital for scaling.

Carlyle's strategic push into the retail investor market with a planned 2025 private equity product is another question mark. While this taps into a growing segment, it necessitates considerable investment in marketing and distribution to achieve widespread adoption.

| Initiative | Market Potential | Current Share | Capital Needs | BCG Classification |

|---|---|---|---|---|

| Thematic Funds (Biotech, Space Tech) | High (e.g., Space Economy $1T by 2040 projection) | Low | High | Question Mark |

| New Growth Equity Vehicle (North America) | High (Tech, Healthcare) | Low | High | Question Mark |

| Retail Investor Market Expansion | High (Growing Private Wealth Segment) | Low | High (Marketing, Distribution) | Question Mark |

| Expansion into Japan and India | High | Low (in specific sub-regions) | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.