Carlyle Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlyle Group Bundle

The Carlyle Group operates within a dynamic private equity landscape, facing intense rivalry among established players and emerging funds. Understanding the bargaining power of their limited partners and the threat of substitute investment vehicles is crucial for sustained success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Carlyle Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Carlyle Group's reliance on highly skilled investment professionals, deal originators, and portfolio managers is a significant factor in supplier bargaining power. The private equity industry, particularly at Carlyle's level, experiences a scarcity of top-tier talent. This scarcity means these individuals can command substantial compensation packages and carry structures, directly impacting Carlyle's operating costs.

In 2023, the average compensation for a managing director in private equity could easily exceed $1 million annually, with significant bonuses and profit-sharing. The ability of these key personnel to negotiate favorable terms stems from their proven track record in generating returns. Losing even a few critical team members can disrupt fundraising efforts and negatively affect investment performance, underscoring the importance of retaining this essential human capital.

The availability of quality deal flow significantly impacts the bargaining power of suppliers in the private equity industry, including for firms like Carlyle Group. Investment banks, brokers, and even company founders who bring attractive businesses to market are key suppliers of investment opportunities.

These suppliers can exert considerable power by controlling access to prime assets. For instance, in 2024, the global M&A market saw robust activity, with deal volumes reaching hundreds of billions of dollars, intensifying competition for desirable targets. Carlyle's ability to secure these opportunities hinges on its reputation and its relationships with these crucial intermediaries.

A strong track record and efficient deal execution are vital for Carlyle to maintain a consistent pipeline of high-quality assets. When competition for these prime assets is fierce, as it often is, acquisition multiples can be driven higher, directly impacting the cost of capital and potential returns for investors.

Carlyle Group, like many private equity firms, relies heavily on specialized external advisory and legal services. These firms are crucial for conducting thorough due diligence, structuring complex transactions, and ensuring compliance with a myriad of regulations. The quality and expertise of these advisors can significantly impact the success and profitability of Carlyle's investments.

The bargaining power of these specialized service providers is considerable. Firms with deep expertise in private equity, M&A, and specific industry sectors can command premium fees. For instance, top-tier legal firms specializing in private equity transactions often charge hourly rates that reflect their niche knowledge and the high stakes involved in these deals. The demand for such specialized skills, coupled with a limited supply of truly expert providers, elevates their negotiating position.

In 2024, the market for these advisory services remained robust, driven by continued activity in the private equity sector. While specific fee structures are often confidential, industry reports indicate that major legal and financial advisory firms involved in large-scale private equity deals can bill tens of millions of dollars for their services on a single transaction. This highlights the significant cost associated with securing top-tier advice and the inherent bargaining power of these suppliers.

Technology and Data Providers

As financial markets lean heavily on data, suppliers of advanced analytics, market data, and AI tools are gaining significant bargaining power. Carlyle Group, like many investment firms, relies on these technologies for crucial functions such as deal sourcing, portfolio monitoring, and robust risk management. This dependency means that a limited number of dominant vendors can exert considerable influence.

The increasing adoption of AI for due diligence and to fulfill Limited Partner (LP) requests further amplifies the leverage of these technology providers. For instance, the global AI market is projected to grow substantially, with some estimates suggesting it will reach over $1.8 trillion by 2030, highlighting the critical nature of these services.

- Data Dependency: Carlyle's operational efficiency is directly tied to the quality and availability of data from specialized technology and data providers.

- AI Integration: The growing use of AI in investment processes, including due diligence and LP reporting, strengthens the position of AI solution vendors.

- Market Concentration: A concentrated market for advanced financial analytics and AI tools can lead to fewer choices and higher costs for firms like Carlyle.

- Strategic Value: These technological capabilities are no longer just tools but strategic assets, enhancing the bargaining power of their suppliers.

Financing Sources for Portfolio Companies

The bargaining power of suppliers for Carlyle Group's portfolio companies primarily stems from providers of debt financing. These financial institutions, acting as suppliers of capital, can influence returns through their lending terms, interest rates, and covenants. In 2024, as interest rates remained elevated compared to the preceding years, the cost of debt for many leveraged buyouts increased, giving lenders greater leverage.

For instance, the average interest rate on broadly syndicated leveraged loans in the U.S. hovered around 9-10% in early 2024, a significant jump from much lower figures experienced in prior years. This higher cost of capital directly impacts the profitability and valuation of portfolio companies, effectively increasing the bargaining power of the banks and private credit funds providing the financing.

- Increased Cost of Debt: Higher interest rates in 2024 mean portfolio companies pay more for borrowed capital, reducing their net income and cash flow available for reinvestment or distribution.

- Tighter Covenants: Lenders may impose stricter financial covenants, limiting a portfolio company's operational flexibility and ability to pursue strategic initiatives without lender approval.

- Limited Access to Capital: In periods of market uncertainty, the availability of debt financing can become restricted, further empowering the few institutions willing to lend.

- Rise of Private Credit: The growing influence of private credit funds, which often provide bespoke financing solutions, also represents a significant supplier group whose terms can impact portfolio company performance.

The bargaining power of suppliers for Carlyle Group is notably influenced by the specialized nature of talent and data providers. Top-tier investment professionals and advanced analytics firms hold significant sway due to scarcity and critical dependencies.

In 2024, the demand for skilled private equity professionals remained high, with compensation packages reflecting their value. Similarly, providers of AI and data analytics tools saw their leverage increase as firms like Carlyle integrated these technologies more deeply into their operations.

The cost of debt also remains a key supplier influence, with lenders in 2024 commanding higher rates and potentially stricter covenants due to the prevailing interest rate environment.

| Supplier Type | Key Influence | 2024 Context |

|---|---|---|

| Human Capital (Investment Professionals) | Scarcity of top talent, compensation demands | High demand for experienced PE professionals |

| Data & AI Providers | Critical for operations, growing AI integration | Increased reliance on advanced analytics and AI tools |

| Debt Financing Providers | Interest rates, loan covenants | Elevated interest rates impacting cost of capital |

What is included in the product

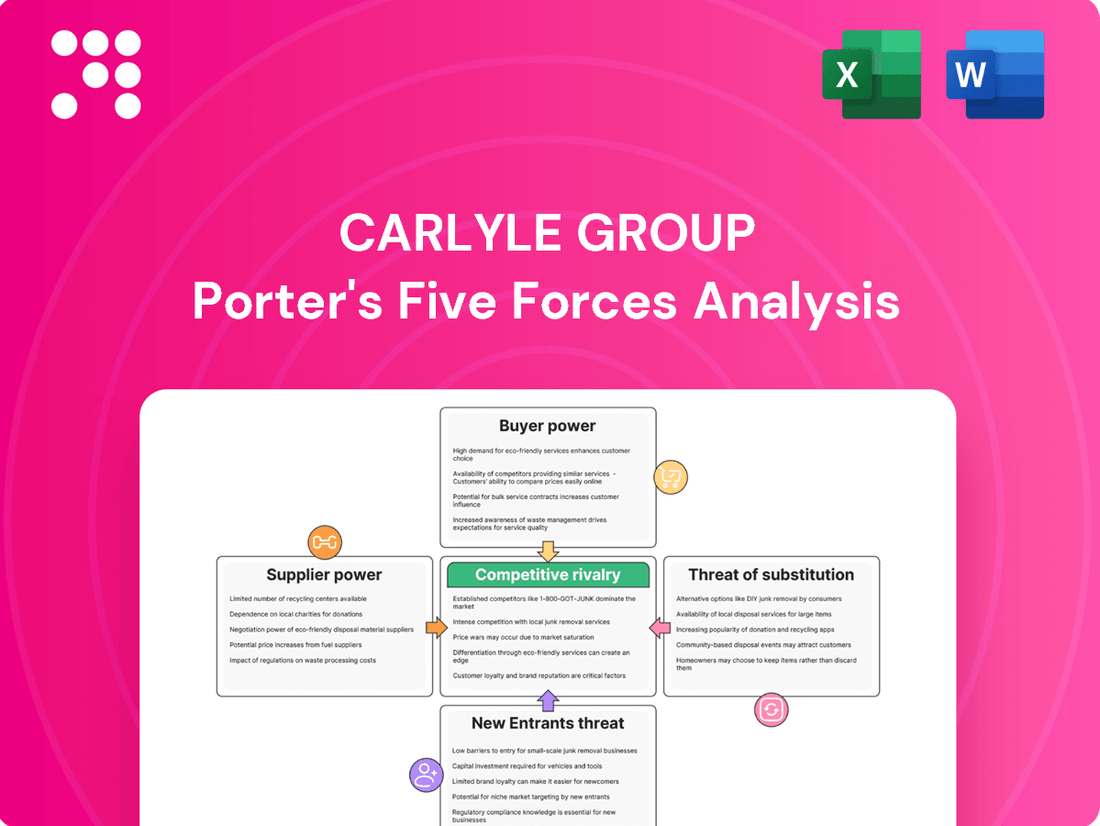

This Porter's Five Forces analysis for Carlyle Group dissects the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on private equity firms.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Carlyle Group's customers, primarily large institutional investors such as pension funds and sovereign wealth funds, are increasingly consolidating their capital with a smaller number of elite managers. This consolidation grants these Limited Partners (LPs) greater bargaining power. For instance, in 2023, the average private equity fund size continued to grow, with many LPs seeking to allocate larger checks to fewer managers, thereby amplifying their negotiation leverage on fees and terms.

This growing influence allows LPs to demand more favorable fee structures, greater transparency, and enhanced co-investment rights. Consequently, Carlyle, like other major alternative asset managers, faces pressure to demonstrate superior and consistent investment performance to retain and attract these powerful clients. The trend reflects a maturing market where LPs are becoming more sophisticated and discerning in their manager selection.

Limited Partners (LPs) are increasingly sophisticated, driving demand for niche strategies like private credit or real assets over broad private equity. This sophistication translates into greater bargaining power as they seek specialized expertise.

LPs are also demanding more transparency regarding fees, performance metrics, and crucially, environmental, social, and governance (ESG) factors. For instance, by the end of 2024, many LPs are expected to have dedicated teams reviewing ESG disclosures, giving them leverage to negotiate terms that align with their sustainability goals.

Large limited partners (LPs) increasingly want to invest directly alongside Carlyle in specific deals, a trend that intensified in 2024. This desire allows them to potentially lower fees typically associated with traditional fund structures and exert more influence over investment decisions.

This growing demand for co-investment opportunities significantly strengthens the bargaining power of these sophisticated LPs. They can leverage their capital and willingness to bypass standard fund arrangements to negotiate more favorable terms with Carlyle, effectively reducing their reliance on blind pool funds.

Performance Track Record and Consistency

Limited Partners, or LPs, scrutinize Carlyle's performance track record and consistency across various fund vintages. A history of strong returns significantly bolsters Carlyle's position, granting it greater bargaining power.

Conversely, any underperformance can swiftly tilt the scales, empowering LPs. They might respond by reducing future capital commitments or seeking out alternative investment managers with more compelling results.

In late 2024, Carlyle's investment performance presented a mixed picture. The Credit and Investment Solutions segments saw notable appreciation, outperforming the Global Private Equity division.

- Carlyle's performance in late 2024 showed Credit and Investment Solutions outperforming Global Private Equity.

- LPs assess Carlyle's historical returns and consistency across fund vintages.

- Strong track record enhances Carlyle's bargaining power with LPs.

- Underperformance can lead LPs to reduce future allocations or switch managers.

Liquidity Needs and Redemption Options

Limited Partners (LPs) are increasingly seeking ways to manage the inherent illiquidity of private equity. The growing interest in semi-liquid funds and secondary market transactions, which saw record volumes in 2024, highlights this shift. This enhanced desire for liquidity can strengthen LPs' bargaining power, allowing them to negotiate more favorable terms or explore alternative investment avenues if traditional private equity offerings don't align with their evolving liquidity needs.

- Growing Secondary Market: The global private equity secondary market reached an estimated $120 billion in transaction volume in 2024, a significant increase from previous years.

- LP Demand for Flexibility: A survey of institutional investors revealed that over 60% are actively seeking more liquid private market solutions.

- Impact on Terms: This increased LP leverage could lead to demands for shorter lock-up periods or more frequent capital distributions from private equity firms.

Carlyle's large institutional investors, like pension funds, are consolidating their capital, giving them more sway. This means they can negotiate better fees and terms. For example, by late 2024, many LPs were prioritizing niche strategies and demanding greater transparency, including on ESG factors, which strengthens their bargaining position.

The growing demand for co-investment opportunities in 2024 allows sophisticated LPs to bypass standard fund structures, potentially lowering fees and increasing their influence over deals. This trend significantly boosts their bargaining power against managers like Carlyle.

Carlyle's performance in late 2024 showed that while Credit and Investment Solutions were strong, Global Private Equity lagged. This performance disparity matters; LPs scrutinize track records, and underperformance can lead them to reduce future allocations, directly impacting Carlyle's bargaining leverage.

The increasing LP focus on liquidity, evident in the booming secondary market in 2024, further empowers them. With over 60% of institutional investors seeking more liquid private market solutions, firms like Carlyle face pressure to offer more flexible terms.

| Factor | Impact on Carlyle | 2024 Data/Trend |

|---|---|---|

| Capital Consolidation | Increased LP bargaining power on fees and terms. | LPs allocating larger checks to fewer managers. |

| Demand for Transparency (incl. ESG) | Pressure for more detailed disclosures and aligned terms. | Many LPs expected dedicated ESG review teams by end of 2024. |

| Co-Investment Demand | LPs seeking direct deal participation to lower fees and gain influence. | Trend intensified in 2024, allowing LPs to bypass blind pool funds. |

| Performance Scrutiny | Strong track record enhances Carlyle's power; underperformance weakens it. | Credit/Investment Solutions outperformed Global Private Equity in late 2024. |

| Liquidity Needs | LPs seeking more liquid solutions strengthens their negotiation leverage. | Secondary market transaction volume estimated at $120 billion in 2024. |

Preview the Actual Deliverable

Carlyle Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the Carlyle Group's competitive landscape through a detailed Porter's Five Forces analysis, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This professionally formatted analysis is ready for your immediate use.

Rivalry Among Competitors

The alternative asset management sector is fiercely competitive, with giants like Blackstone, KKR, and Apollo Global Management holding significant sway. These established firms directly challenge Carlyle across private equity, credit, and real assets, creating a highly competitive landscape for both investor capital and attractive investment opportunities.

While Carlyle Group demonstrated robust fundraising success, securing $41 billion in 2024, the broader private equity landscape faced a challenging year with overall fundraising declining. This environment forces firms to compete fiercely for Limited Partner (LP) capital, as LPs increasingly concentrate their investments with a select group of managers.

This trend of LP consolidation means that even strong performers like Carlyle must work harder to attract and retain commitments. The pressure is on to clearly articulate unique value propositions and consistently deliver top-tier returns to stand out in a crowded market.

The competition among private equity firms for attractive investment opportunities is incredibly intense, especially when it comes to securing high-quality assets. Firms are constantly vying for the best deals, and this rivalry plays out across several key areas. Success hinges on offering superior valuations, demonstrating exceptional speed in executing transactions, showcasing deep industry expertise, and presenting compelling value creation strategies that can truly move the needle for a target company.

This fierce competition is clearly reflected in the market. For instance, in 2024, the average entry multiples in the private equity sector continued to climb, a direct indicator of how aggressively firms are bidding for promising businesses. This trend underscores the pressure on firms like Carlyle Group to not only identify but also win these coveted deals amidst a crowded field of sophisticated investors.

Talent Wars Among Firms

The competition for highly skilled investment professionals is a significant driver of rivalry within the private equity sector, impacting firms like Carlyle Group. This intense demand means that attracting and retaining top talent often involves substantial financial incentives and a focus on cultivating a desirable workplace environment.

Firms frequently engage in aggressive recruitment tactics, essentially poaching experienced professionals from competitors by presenting superior compensation structures, performance-based bonuses, and equity opportunities. For instance, in 2024, compensation packages for senior private equity professionals continued to climb, with some managing directors at top-tier firms potentially earning millions annually through base salary, carried interest, and other performance-related payouts.

- Talent Acquisition Costs: The need to offer highly competitive compensation packages directly increases operational expenses for firms, potentially impacting profitability and investment capacity.

- Retention Challenges: High turnover due to poaching can disrupt deal execution, portfolio management, and the overall strategic direction of a firm.

- Impact on Strategy: A constant drain or influx of talent can influence a firm's ability to maintain consistent strategic execution and cultivate long-term institutional knowledge.

Diversification and Product Innovation

Competitors are actively diversifying their product suites and pioneering novel fund structures, such as semi-liquid vehicles and private wealth offerings, to capture a wider array of investors. This necessitates that Carlyle Group consistently pushes for innovation and broadens its solution portfolio.

Carlyle's strategic emphasis on areas like Global Wealth and Global Credit is a direct response to this competitive pressure. For instance, in 2024, the firm continued to expand its private credit offerings, aiming to capture a larger share of the growing alternative credit market, which saw significant inflows across the industry.

- Diversification: Competitors are broadening their investment strategies and product types.

- Innovation: New fund structures like semi-liquid and private wealth products are emerging.

- Carlyle's Response: Focus on Global Wealth and Global Credit to stay competitive.

- Market Trend: The alternative credit market experienced substantial investor interest in 2024.

The competitive rivalry within alternative asset management remains intense, with firms like Blackstone, KKR, and Apollo Global Management posing significant challenges to Carlyle Group across various investment strategies. This rivalry extends to securing investor capital, as evidenced by Carlyle's $41 billion fundraising in 2024 amidst an overall decline in private equity fundraising, forcing a greater focus on demonstrating unique value propositions.

The competition for attractive investment opportunities is fierce, with firms like Carlyle vying for deals by offering superior valuations and demonstrating rapid execution. This is reflected in the rising average entry multiples observed in the private equity sector during 2024, indicating aggressive bidding for quality assets.

| Key Competitors | Key Strategies | Competitive Pressures |

| Blackstone, KKR, Apollo | Diversification, Innovation in Fund Structures | Talent Acquisition & Retention Costs |

| Carlyle's Focus | Global Wealth, Global Credit Expansion | Securing LP Capital, Winning Deals |

| Market Trend (2024) | Rising Entry Multiples, Alternative Credit Growth | Need for Superior Value Creation |

SSubstitutes Threaten

For investors, public equity markets represent a significant substitute for private equity, offering both growth potential and readily available liquidity. When public markets are performing robustly, capital can easily shift from private equity funds, particularly if private market returns are less compelling or the ability to exit investments is constrained.

In 2024, the S&P 500 experienced substantial gains, with many individual stocks outperforming broader market averages, making public equities an attractive alternative for investors. For instance, the technology sector, a traditional stronghold for private equity, saw many of its publicly traded companies deliver impressive year-over-year revenue growth, further increasing the appeal of public markets.

Sophisticated institutional limited partners (LPs) are increasingly opting for direct investments in companies or co-investments alongside private equity firms. This bypasses typical fund management fees, offering a direct alternative to traditional commingled funds. For example, in 2024, many large pension funds and sovereign wealth funds have allocated significant capital directly to private companies, reducing their dependence on PE fund managers like Carlyle.

Investors can easily shift capital to other alternative asset classes, such as hedge funds, real estate, and infrastructure, presenting a significant threat of substitution. Private credit, specifically, has experienced robust growth, offering a compelling alternative for investors focused on debt. For instance, the global private credit market was estimated to be around $1.5 trillion in 2024, a figure projected to grow substantially.

Carlyle Group itself boasts a strong Global Credit segment, managing over $160 billion in credit assets as of the first quarter of 2024. This internal capability highlights the direct competition Carlyle faces from these alternative avenues, as investors can choose to allocate funds to private credit strategies managed by other firms or even directly through specialized vehicles.

Fixed Income and Traditional Assets

The threat of substitutes for Carlyle Group's private equity offerings is significant, particularly from traditional fixed income and public market assets. In periods of higher interest rates, these traditional assets become more appealing.

For instance, as of early 2024, the yield on U.S. Treasury bonds has offered competitive returns, making them a viable alternative for investors seeking stable, liquid income. This directly challenges the illiquidity premium typically demanded by private equity investors.

- Fixed Income Attractiveness: With interest rates rising, traditional bonds offer compelling yields, often exceeding 4-5% for investment-grade corporate debt in 2024, providing a less risky alternative to private equity.

- Liquidity Advantage: Publicly traded equities and bonds provide immediate liquidity, a stark contrast to the lock-up periods common in private equity funds, which can range from 5 to 10 years.

- Diversification: Limited Partners (LPs) can diversify their portfolios with these more liquid and less volatile assets, reducing overall portfolio risk without sacrificing potential returns in certain market environments.

- Investor Preference Shift: In 2024, some institutional investors have reallocated capital from private markets to public markets due to better visibility and more attractive yields on fixed income.

In-house Asset Management Capabilities

Large institutional investors, like sovereign wealth funds and major pension funds, are increasingly developing or enhancing their internal investment teams. This allows them to manage alternative assets directly, bypassing external asset managers. For instance, the California Public Employees Retirement System (CalPERS) has been actively expanding its in-house capabilities, aiming to manage a larger portion of its $460 billion portfolio internally. This trend directly substitutes for the services Carlyle Group and similar firms provide.

These in-house teams can offer a cost-effective alternative, especially for sophisticated investors who can absorb the operational overhead. By managing assets internally, these institutions can potentially achieve lower management fees and gain greater control over their investment strategies. This presents a significant threat as it directly reduces the pool of assets available for external management.

The growing complexity and accessibility of alternative investment strategies also empower these institutions to build the necessary expertise in-house. This reduces their reliance on external managers for specialized knowledge and execution, further solidifying the threat of substitutes.

- Growing trend of institutional investors building in-house asset management teams.

- Focus on alternative assets by large investors like sovereign wealth funds and pension funds.

- Cost savings and greater control as key drivers for internal management.

- Increased accessibility of alternative investment expertise reduces reliance on external managers.

The threat of substitutes for Carlyle Group's private equity business is substantial, primarily stemming from the increasing attractiveness and accessibility of public markets and other alternative asset classes. As investors seek diversification and competitive returns, these substitutes offer compelling alternatives that can divert capital away from traditional private equity allocations.

In 2024, robust performance in public equities, particularly within growth sectors like technology, presented a strong case for direct investment. For example, many publicly traded tech firms demonstrated significant year-over-year revenue growth, making them competitive with private equity opportunities. Furthermore, rising interest rates have boosted the appeal of fixed-income instruments, offering stable yields that challenge the illiquidity premium associated with private equity.

Institutional investors are also increasingly building internal capabilities to manage alternative assets directly, bypassing external managers like Carlyle. This trend, exemplified by large pension funds expanding their in-house teams, offers cost efficiencies and greater control, directly substituting the services provided by private equity firms.

| Substitute Asset Class | Key Attractiveness Factors (2024) | Example Data/Trend |

|---|---|---|

| Public Equities | Liquidity, Growth Potential, Sector Performance | S&P 500 experienced substantial gains; tech sector outperformance |

| Fixed Income | Yield Competitiveness, Stability, Lower Risk | U.S. Treasury yields offered competitive returns; investment-grade corporate debt yields exceeded 4-5% |

| Direct/Co-Investments | Fee Avoidance, Direct Control, Customization | Large pension funds and sovereign wealth funds allocated significant capital directly to private companies |

| Other Alternatives (e.g., Private Credit) | Specialized Returns, Diversification | Global private credit market estimated around $1.5 trillion, showing robust growth |

Entrants Threaten

Establishing a global investment firm like Carlyle Group demands immense capital, not just for initial fund commitments but also for building robust operational infrastructure and attracting seasoned professionals. For instance, raising a new flagship private equity fund in 2024 could easily require billions of dollars in commitments from limited partners, a daunting task for newcomers.

New entrants face significant hurdles in securing these initial funds and, crucially, in cultivating a credible track record that institutional investors, such as pension funds and endowments, deem reliable enough for substantial allocations. Without a proven history of successful investments and strong returns, attracting the necessary capital to compete with established players like Carlyle becomes exceptionally difficult.

A long and successful track record is paramount in private equity, directly impacting fundraising capabilities and the ability to source attractive deals. New entrants typically lack this established reputation, creating a significant barrier when attempting to compete with established firms like Carlyle Group, which boasts decades of proven performance and a strong market presence.

For instance, Carlyle Group, a prominent player in the private equity landscape, has demonstrated consistent success over many years, building trust with limited partners and deal counterparties. This deep-seated reputation, cultivated through numerous successful transactions and consistent returns, makes it inherently challenging for newcomers to attract capital and gain access to the same caliber of investment opportunities.

The private equity landscape is heavily regulated, with entities like Carlyle Group facing ongoing scrutiny from bodies such as the U.S. Securities and Exchange Commission (SEC) regarding disclosures and operational practices. New firms entering this arena must contend with a complex web of evolving rules, including those related to investor protection and market conduct.

Navigating these stringent compliance requirements demands substantial investment in legal counsel, robust internal controls, and specialized compliance personnel. For instance, the Dodd-Frank Act and subsequent regulations have increased reporting burdens and capital requirements, directly impacting the cost of entry and ongoing operations for private equity firms.

These significant upfront and recurring compliance costs act as a formidable barrier to entry. New entrants, lacking the established infrastructure and economies of scale of seasoned players like Carlyle, find it particularly challenging to absorb these expenses, thereby limiting the threat of new competition.

Access to Proprietary Deal Flow and Networks

Established private equity firms like Carlyle Group benefit significantly from proprietary deal flow, often stemming from decades of cultivated relationships within specific industries. This access is a substantial barrier for new entrants, who lack the established networks needed to identify and secure attractive investment opportunities. For example, in 2024, the private equity industry continued to see a concentration of deals flowing through established channels, making it challenging for newcomers to break in without prior connections.

New firms face an uphill battle in replicating the deep industry insights and trusted relationships that provide access to off-market deals. Carlyle’s ability to source deals through its global network, which includes CEOs, investment bankers, and other dealmakers, gives it a distinct advantage. This network access is crucial, as a significant portion of private equity deals are not publicly advertised.

The threat of new entrants is therefore mitigated by the difficulty in replicating these entrenched networks.

- Proprietary Deal Flow Advantage: Established firms like Carlyle leverage extensive networks to access deals not available on the open market.

- Network Replication Challenge: New entrants struggle to build the deep industry connections necessary to identify and secure quality investment opportunities.

- 2024 Deal Landscape: The concentration of deals through established channels in 2024 underscored the importance of existing relationships for market access.

Talent Acquisition and Retention

New entrants face significant hurdles in attracting and retaining seasoned investment professionals. These individuals are crucial as they often bring established networks and specialized expertise, giving them a competitive edge. The high demand for such talent means new firms struggle to assemble a team that can truly challenge established players.

The competition for top-tier talent is fierce, impacting new entrants' ability to build a high-caliber team. For instance, in 2024, the average compensation package for a private equity associate in major financial hubs like New York or London remained exceptionally competitive, often exceeding $200,000 annually, including base salary, bonus, and carried interest potential. This makes it challenging for less-established firms to match the financial incentives offered by larger, more reputable institutions.

- Talent Scarcity: Experienced investment professionals are a limited resource.

- Network Value: Professionals with strong deal-sourcing networks are highly sought after.

- Compensation Wars: New entrants must compete with lucrative packages from established firms.

- Expertise Gap: Building a team with deep sector knowledge takes time and significant investment.

The threat of new entrants into the global investment firm sector, particularly for a firm like Carlyle Group, is significantly dampened by the immense capital requirements and the need for a proven track record. Newcomers must raise billions, a feat made harder without a history of successful investments that institutional investors trust.

The regulatory environment also presents a substantial barrier, with compliance costs for firms like Carlyle demanding significant investment in legal and operational infrastructure. Navigating complex rules, such as those stemming from the Dodd-Frank Act, adds to the cost of entry and ongoing operations.

Furthermore, established firms possess proprietary deal flow through long-cultivated networks, making it difficult for new entrants to access attractive investment opportunities. The intense competition for top-tier investment talent, with compensation packages in 2024 often exceeding $200,000 annually for associates, further solidifies the advantage of established players.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Raising billions for fund commitments and operations. | Extremely high; difficult for unproven entities. |

| Track Record & Reputation | Demonstrating successful investment history to institutional investors. | Crucial for fundraising; new firms lack this credibility. |

| Regulatory Compliance | Adhering to complex financial regulations and reporting. | Costly; requires specialized expertise and infrastructure. |

| Network Access & Deal Flow | Leveraging established relationships for proprietary deal sourcing. | New entrants struggle to replicate this access to off-market deals. |

| Talent Acquisition | Attracting and retaining experienced investment professionals. | Challenging due to high demand and competitive compensation. |

Porter's Five Forces Analysis Data Sources

Our Carlyle Group Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, investor presentations, and industry-specific market research reports.

We also incorporate insights from reputable financial news outlets, regulatory filings, and economic indicators to provide a comprehensive understanding of the competitive landscape.