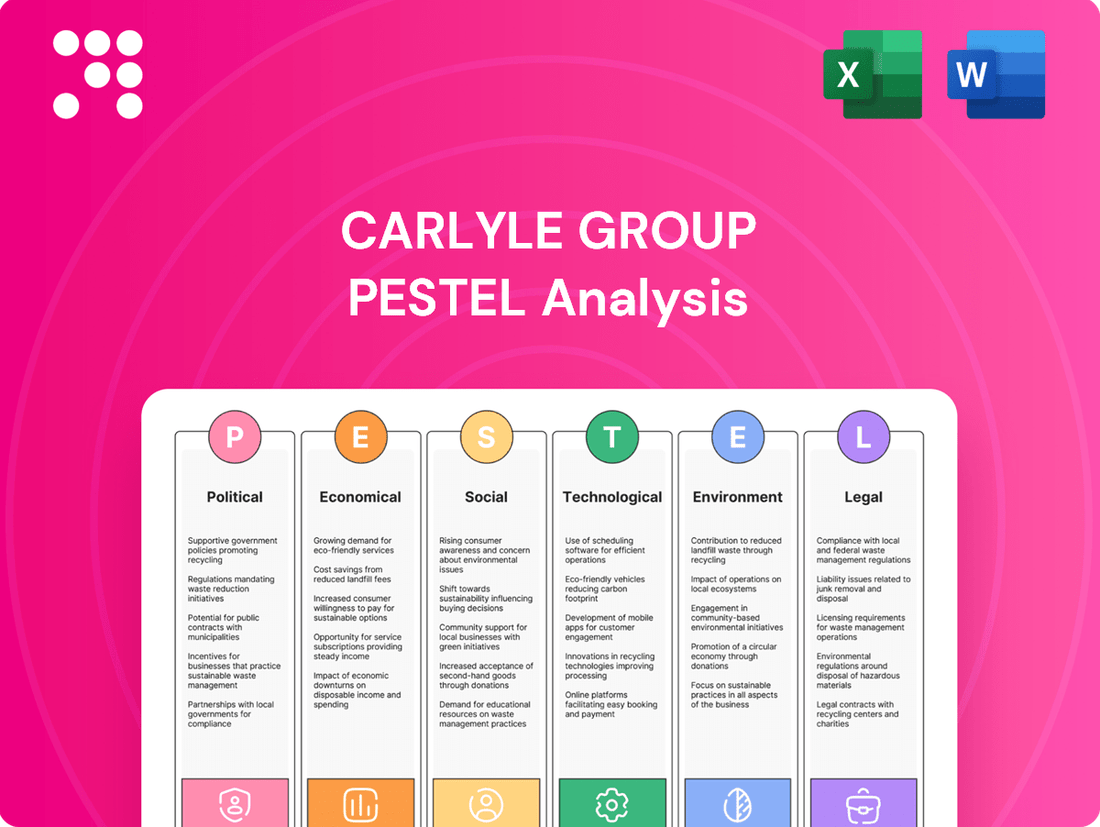

Carlyle Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlyle Group Bundle

The Carlyle Group operates within a dynamic global landscape shaped by evolving political stability, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic decision-making and identifying potential opportunities and threats. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis for The Carlyle Group. Uncover critical political, economic, social, technological, legal, and environmental insights that directly impact its operations and future trajectory. Download the full version now to equip yourself with the strategic foresight needed to navigate the complexities of the investment world.

Political factors

Government policy and industrial policy shifts significantly impact global investment firms like Carlyle. In the United States, for example, a bipartisan inclination towards bolstering domestic industries through targeted incentives is evident, regardless of election outcomes. This trend is projected to continue through 2024 and into 2025, potentially steering Carlyle's investment strategies towards sectors that align with these national priorities.

Global geopolitical stability is a critical consideration for Carlyle Group. Uncertainty in international relations, such as ongoing trade disputes or regional conflicts, can directly affect investment strategies and the flow of capital. For instance, the International Monetary Fund (IMF) projected in late 2024 that global growth would be subdued, partly due to persistent geopolitical risks.

These tensions can create headwinds for private equity firms like Carlyle by making cross-border deal-making more complex and potentially impacting the performance of portfolio companies exposed to international markets. However, the private equity model is often built to navigate such volatility, with managers actively seeking opportunities that arise from market dislocations and economic shifts, even in periods of political unpredictability.

Government oversight and evolving regulations significantly shape the private equity landscape, directly impacting firms like Carlyle Group. Changes in disclosure requirements, capital adequacy rules, and investment practices can introduce new operational costs and necessitate strategic adjustments. For instance, the ongoing discussions and potential implementation of stricter regulations on alternative asset managers in major markets like the US and EU, which were gaining momentum in 2024, could influence how Carlyle structures its funds and manages its portfolio companies.

Impact of Elections on Market Certainty

Major political events, particularly elections like the US presidential election, can create considerable volatility in financial markets. This uncertainty often leads to a slowdown in mergers and acquisitions (M&A) and initial public offerings (IPOs) as investors adopt a wait-and-see approach. For instance, ahead of the 2024 US presidential election, market participants are closely monitoring policy proposals that could affect sectors like technology, healthcare, and energy, potentially influencing investment decisions and deal valuations.

The resolution of such electoral uncertainties typically boosts investor confidence, which in turn can unlock capital markets. This increased certainty can catalyze deal-making and create more favorable conditions for monetization strategies for firms like The Carlyle Group. A clearer political landscape allows for more predictable regulatory environments and economic policies, essential for long-term investment planning and execution.

- 2024 US Presidential Election Uncertainty: Pre-election periods often see a dip in M&A deal volume as businesses await policy clarity.

- Post-Election Confidence Boost: Historically, markets tend to rally following the resolution of major political uncertainties, signaling increased investor appetite.

- Impact on Capital Flows: Political stability is a key determinant of foreign direct investment and domestic capital allocation.

International Investment Treaties and Cross-Border Capital Flows

Changes in international investment treaties and trade agreements significantly impact Carlyle Group's ability to deploy capital globally. For instance, the European Union's ongoing efforts to deepen its single market and revise investment protection clauses within its trade deals, as seen in ongoing discussions around the EU-Canada Comprehensive Economic and Trade Agreement (CETA) review, directly shape cross-border capital flows. These evolving frameworks can either streamline or complicate Carlyle's access to new markets and investment opportunities.

Foreign direct investment (FDI) policies enacted by various nations are critical determinants of Carlyle's investment strategies. As of early 2024, many countries are reassessing their FDI screening mechanisms, particularly for strategic sectors. For example, the United States' Committee on Foreign Investment in the United States (CFIUS) continues to scrutinize a broad range of inbound investments, potentially affecting Carlyle's deal-making. Conversely, initiatives like Japan's Qualified Foreign Contractor (QFC) system aim to attract foreign investment, creating potential avenues for the firm.

- Treaty Revisions: Ongoing reviews of bilateral investment treaties (BITs) and multilateral trade agreements, such as potential updates to the Trans-Pacific Partnership (TPP) or new agreements being negotiated by blocs like ASEAN, can alter investment protections and market access for Carlyle.

- FDI Screening: Stricter or more lenient FDI screening processes in key markets like China, India, or Australia directly influence the feasibility and structure of Carlyle's proposed investments.

- Investment Incentives: Government incentives, such as tax breaks for specific industries or regions, can steer Carlyle's capital towards certain geographies or sectors, as seen with green energy investment initiatives in Germany or the UK.

- Geopolitical Risk: Heightened geopolitical tensions or trade disputes, such as those impacting supply chains or market access in regions like the Middle East or Eastern Europe, necessitate careful risk assessment for cross-border capital deployment.

Political stability and government policies are paramount for Carlyle Group's global operations. Shifts in industrial policy, such as the US focus on domestic manufacturing through incentives, are expected to influence investment decisions through 2025. Geopolitical risks, including trade disputes and regional conflicts, continue to impact global growth, with the IMF projecting subdued growth in late 2024 due to these persistent uncertainties.

Regulatory changes in key markets like the US and EU, concerning alternative asset managers, could necessitate adjustments in fund structuring and portfolio management for Carlyle. Major political events, such as the 2024 US presidential election, create market volatility, leading to a cautious approach in M&A and IPO activities, with sectors like technology and healthcare under particular scrutiny.

International investment treaties and foreign direct investment (FDI) policies significantly shape Carlyle's capital deployment. For instance, ongoing reviews of investment protection clauses in EU trade deals and evolving FDI screening mechanisms in countries like the US (via CFIUS) directly influence deal feasibility and market access.

| Political Factor | Impact on Carlyle Group | 2024/2025 Data/Trend |

| Government Industrial Policy | Steering investment towards domestic industries | Continued bipartisan support for domestic industry incentives in the US through 2024/2025. |

| Geopolitical Stability | Affects capital flow and cross-border deal-making | IMF projected subdued global growth in late 2024 due to persistent geopolitical risks. |

| Regulatory Environment | Influences fund structuring and portfolio management | Discussions on stricter regulations for alternative asset managers in the US and EU gaining momentum in 2024. |

| Election Cycles (e.g., US Presidential) | Creates market volatility and impacts M&A/IPO activity | Pre-election caution observed in markets, with potential for post-election confidence boost. |

| International Investment Treaties | Shapes market access and investment protections | Ongoing reviews of EU trade agreements and bilateral investment treaties (BITs) are altering cross-border capital flows. |

| Foreign Direct Investment (FDI) Policies | Determines feasibility and structure of investments | Increased scrutiny of FDI in strategic sectors by mechanisms like US CFIUS; Japan's QFC system aims to attract foreign investment. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting the Carlyle Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by identifying key trends and their implications for the firm's operations and investment strategies.

A concise PESTLE analysis of The Carlyle Group provides a readily digestible overview of external factors, simplifying complex market dynamics for quick decision-making during strategic planning sessions.

Economic factors

The global economic growth trajectory is a critical determinant for Carlyle Group's investment strategies. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for both 2024 and 2025 in its April 2024 World Economic Outlook, a moderate but steady pace. This backdrop directly impacts the revenue streams and profitability of Carlyle's portfolio companies across various sectors.

However, recession risks remain a significant concern. Geopolitical tensions, persistent inflation, and tighter monetary policies could dampen consumer and business confidence, leading to reduced spending and investment. A widespread economic downturn would likely pressure Carlyle's portfolio valuations and hinder its ability to deploy new capital effectively, potentially impacting fundraising efforts and overall investment returns.

Interest rate and inflation dynamics are critical for Carlyle Group. For instance, the Federal Reserve's aggressive rate hikes in 2022 and 2023, with the federal funds rate reaching a 22-year high of 5.25%-5.50% by July 2023, directly impacted Carlyle's cost of capital for new investments and the valuation of its existing portfolio. Persistent inflation, though showing signs of moderation in early 2024, continues to influence the real returns on Carlyle's investments, particularly those with fixed income components.

These monetary policy shifts necessitate strategic adaptation. Higher borrowing costs can compress deal multiples and reduce the leverage available for acquisitions, impacting Carlyle's private equity deal-making. Simultaneously, inflation can erode the purchasing power of returns, making it crucial for Carlyle to focus on investments that offer inflation protection or strong pricing power. For example, in Q1 2024, Carlyle reported a slight decrease in distributable earnings compared to the previous year, partly attributable to the challenging macroeconomic environment shaped by these interest rate and inflation trends.

The health of capital markets directly impacts Carlyle Group's operations. For instance, in the first quarter of 2024, global IPO volumes saw a significant rebound, reaching $28.4 billion, up 9% from the previous year, indicating a potentially more favorable environment for Carlyle's exit strategies. Availability of credit also plays a vital role; as of early 2024, credit markets remained relatively accessible, though interest rate hikes by central banks globally have tightened conditions compared to previous years, potentially affecting the cost of new investments.

Robust equity markets, as seen with the S&P 500's strong performance in late 2023 and early 2024, generally translate to better valuations for Carlyle's portfolio companies, easing their ability to exit investments profitably. Conversely, periods of market volatility or reduced credit availability, such as the banking sector stress experienced in early 2023, can create headwinds by making it harder to raise new funds and limiting the options for monetizing existing assets.

Currency Fluctuations and Foreign Exchange Risk

As a global investment firm, Carlyle Group's financial performance is significantly influenced by currency fluctuations. When Carlyle converts profits or asset values from foreign markets back into its reporting currency, typically the US Dollar, variations in exchange rates can either boost or diminish those returns. This foreign exchange risk is a critical consideration for its diverse portfolio, particularly in real assets and cross-border investments.

For instance, during 2024, the US Dollar experienced periods of strength against major currencies like the Euro and the Japanese Yen. This trend could have presented a headwind for Carlyle's non-US dollar denominated assets, reducing their reported value in USD. Conversely, a weaker dollar would generally be beneficial, increasing the USD value of its international holdings.

- Carlyle's Global Footprint: With operations and investments spanning numerous countries, Carlyle is inherently exposed to the volatility of global currency markets.

- Impact on Returns: Fluctuations in exchange rates directly affect the realized returns on international investments when repatriated, influencing Carlyle's overall profitability.

- 2024 Currency Trends: Major currency pairs like EUR/USD and USD/JPY saw significant movements throughout 2024, creating both opportunities and challenges for global investors like Carlyle.

- Risk Management Strategies: Carlyle employs various hedging techniques and diversification strategies to mitigate the impact of adverse currency movements on its investment outcomes.

Fundraising Environment and Investor Appetite

The success of Carlyle Group's fundraising hinges on the broader economic climate and investor enthusiasm for alternative assets. Economic volatility and heightened competition can indeed pose challenges in attracting and keeping investors. For instance, in the first quarter of 2024, Carlyle announced raising $28 billion for its global private equity strategy, demonstrating significant investor confidence despite market headwinds.

Carlyle has demonstrated robust momentum in its fundraising activities, with a strategic focus on securing substantial inflows in 2025. This proactive approach aims to capitalize on perceived market opportunities and solidify its position in the competitive alternative asset management landscape. The firm’s ability to adapt its strategies to shifting investor preferences is crucial for sustained growth.

- Economic Uncertainty Impact: Global economic uncertainties, including inflation and interest rate shifts, directly influence investor risk appetite for alternative investments.

- Investor Appetite Trends: There's a persistent demand for yield and diversification, which benefits alternative asset managers like Carlyle, but this appetite can fluctuate based on market sentiment.

- Fundraising Targets: Carlyle's ambitious fundraising targets for 2025, aiming for significant capital deployment, reflect confidence in its ability to navigate the current environment.

- Competitive Landscape: The alternative asset management sector is highly competitive, requiring Carlyle to consistently demonstrate strong performance and unique value propositions to attract capital.

Global economic growth is a key driver for Carlyle's investment performance. The IMF projected global growth at 3.2% for both 2024 and 2025, indicating a stable but moderate economic environment. This growth rate directly influences the revenue and profitability of Carlyle's diverse portfolio companies.

However, risks like geopolitical instability and persistent inflation could lead to economic slowdowns, impacting consumer spending and business investment. Such downturns would likely pressure Carlyle's portfolio valuations and hinder capital deployment, potentially affecting overall investment returns and fundraising capabilities.

Interest rate and inflation dynamics are critical for Carlyle. For example, the Federal Reserve's federal funds rate reached a 22-year high of 5.25%-5.50% by July 2023. These higher borrowing costs affect Carlyle's cost of capital and portfolio valuations, while inflation continues to influence real returns, necessitating a focus on investments with pricing power.

| Economic Factor | 2024/2025 Outlook | Impact on Carlyle Group |

| Global GDP Growth | IMF projects 3.2% for 2024 & 2025 | Supports portfolio company revenue and valuations |

| Interest Rates | Federal Funds Rate at 5.25%-5.50% (as of July 2023) | Increases cost of capital, affects deal multiples |

| Inflation | Moderating but still a concern | Erodes real returns, necessitates focus on pricing power |

| Capital Markets | IPO volumes up 9% Q1 2024 ($28.4B) | Facilitates exits, but credit conditions are tighter |

Full Version Awaits

Carlyle Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Carlyle Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Gain immediate access to this in-depth report to understand the external forces shaping the global investment landscape.

Sociological factors

Limited partners (LPs), such as major public pension funds and university endowments, are increasingly prioritizing investments that align with Environmental, Social, and Governance (ESG) principles. For instance, the California Public Employees' Retirement System (CalPERS), a significant investor, has been vocal about its commitment to ESG integration, aiming to mitigate risks and enhance long-term returns across its vast portfolio.

Carlyle Group is actively responding to this demand by embedding sustainability into its investment processes and how it engages with its portfolio companies. The firm's strategy focuses on demonstrating the financial materiality of ESG factors, believing this approach will not only attract more capital from LPs but also unlock greater value within its investments.

Carlyle Group, like many financial institutions, faces growing societal pressure to prioritize Diversity, Equity, and Inclusion (DEI). This emphasis directly impacts how the firm manages its governance and talent across its operations and portfolio companies. A strong DEI commitment is becoming crucial for maintaining a positive brand image and securing the best employees.

In 2024, reports indicated that over 80% of investors consider ESG factors, including DEI, when making investment decisions, a significant jump from previous years. Carlyle's own public statements in early 2025 highlighted increased investment in DEI training programs, aiming to foster more inclusive environments within its workforce and the companies it backs. This focus is seen as a key driver for long-term value creation and risk mitigation.

Carlyle Group, like many in the financial sector, faces evolving workforce expectations. A 2024 survey indicated that over 70% of finance professionals prioritize flexible work options, directly influencing Carlyle's talent attraction and retention strategies. Meeting demands for competitive compensation and meaningful, purpose-driven work is paramount for securing top talent in this knowledge-intensive industry.

Social License to Operate and Public Perception

Private equity firms like Carlyle Group are increasingly under the microscope regarding their societal contributions, particularly concerning job creation and overall community impact. Public perception is a significant factor, as negative sentiment can hinder operations and investor confidence.

Maintaining a strong social license to operate is paramount. This involves demonstrating a commitment to corporate social responsibility, which directly influences Carlyle's ability to secure new deals and retain existing partnerships. For instance, in 2023, reports highlighted public concerns about private equity’s role in sectors like healthcare and housing, prompting calls for greater transparency and accountability.

Carlyle's efforts to build trust are crucial for its long-term success. This includes proactive engagement with communities where its portfolio companies operate and transparent reporting on ESG (Environmental, Social, and Governance) metrics. A positive public image can mitigate reputational risks and foster a more favorable operating environment.

- Public Scrutiny: Growing public awareness of private equity's impact on employment and community well-being.

- Reputational Risk: Negative public perception can damage Carlyle's brand and deter investment.

- Social License: The necessity for Carlyle to earn and maintain public acceptance to operate effectively.

- ESG Focus: Increased demand for demonstrable ESG performance from private equity firms.

Demographic Shifts and Consumer Behavior

Long-term demographic shifts are significantly shaping Carlyle's investment strategies. For instance, the aging population in developed markets, with the UN projecting the global population aged 65 and over to reach 1.6 billion by 2050, drives demand for healthcare, retirement services, and specialized consumer goods, areas Carlyle actively targets.

Conversely, the burgeoning middle class in emerging economies, estimated to grow by another 1.5 billion people by 2030 according to some projections, presents substantial opportunities in consumer discretionary spending, technology adoption, and infrastructure development. Carlyle's focus on sectors catering to these evolving consumer needs is a key element of its investment thesis.

- Aging Populations: Increased demand for healthcare and elder care services in North America and Europe, aligning with Carlyle's investments in life sciences and healthcare platforms.

- Rising Middle Class: Growth in consumer spending power in Asia and Latin America, fueling investments in retail, e-commerce, and financial services tailored to these demographics.

- Urbanization Trends: Continued migration to cities globally, creating opportunities in real estate, logistics, and urban infrastructure development, sectors Carlyle has historically engaged with.

Societal expectations are increasingly shaping investment mandates, with Limited Partners (LPs) like pension funds and endowments prioritizing Environmental, Social, and Governance (ESG) factors. Carlyle Group is responding by integrating sustainability into its investment processes, aiming to attract capital and unlock value. Reports in 2024 indicated that over 80% of investors consider ESG, including Diversity, Equity, and Inclusion (DEI), a key factor in decision-making. Carlyle's own initiatives in early 2025 highlighted increased investment in DEI training, recognizing its importance for talent and long-term value.

Technological factors

Carlyle Group's digital transformation is fundamentally reshaping its operational landscape. This includes everything from the initial stages of due diligence to the ongoing monitoring of its vast portfolio of companies. By embracing advanced digital tools and sophisticated platforms, the firm aims to significantly boost its operational efficiency, making processes smoother and faster.

Leveraging these technologies allows Carlyle to gain much deeper and more nuanced insights into potential investment opportunities and the inherent risks associated with them. For instance, in 2024, private equity firms like Carlyle are increasingly investing in AI-powered data analytics to sift through vast datasets, identifying patterns and anomalies that human analysts might miss, thereby improving investment selection and risk management.

Carlyle Group, like its peers, is increasingly leveraging advanced data analytics and AI. This integration is crucial for enhancing investment decision-making through deeper market analysis and predictive modeling of portfolio company performance. For instance, by Q1 2025, firms are reporting a significant uplift in deal sourcing efficiency through AI-driven insights.

These technologies empower Carlyle to identify nuanced value creation opportunities within its portfolio companies, moving beyond traditional methods. By analyzing vast datasets, AI can pinpoint operational inefficiencies or emerging market trends that human analysis might miss. This data-driven approach is becoming a competitive necessity in the private equity landscape.

Carlyle Group, like all financial institutions, faces significant cybersecurity risks. In 2023, the global average cost of a data breach reached $4.45 million, a 15% increase from 2022, highlighting the escalating financial and reputational stakes. As Carlyle increasingly relies on digital platforms for managing sensitive investor data and proprietary investment strategies, robust defenses against evolving cyber threats are critical for maintaining operational integrity and stakeholder confidence.

Fintech Innovation and Competitive Landscape

The fintech landscape is rapidly evolving, presenting both challenges and opportunities for firms like Carlyle. Innovations in areas like AI-driven investment analysis, blockchain for transaction efficiency, and digital asset management are reshaping how capital is raised and deployed. For instance, the global fintech market was valued at over $2.4 trillion in 2023 and is projected to grow significantly, indicating a substantial shift in financial services.

Carlyle must actively monitor and integrate these technological advancements to maintain its competitive edge. This includes exploring partnerships with emerging fintech companies or developing proprietary solutions to enhance fundraising capabilities, offer innovative investment products, and optimize operational efficiency. By embracing fintech, Carlyle can unlock new avenues for growth and better serve its diverse investor base.

Key areas of fintech innovation impacting investment firms include:

- Digital Fundraising Platforms: Streamlining the process of attracting and onboarding investors, potentially reaching a broader audience.

- AI and Machine Learning: Enhancing deal sourcing, due diligence, portfolio management, and risk assessment through advanced analytics.

- Blockchain and Distributed Ledger Technology: Improving transparency, security, and efficiency in transaction settlements and record-keeping.

- Robo-Advisory and WealthTech: Offering automated investment solutions that could complement or compete with traditional advisory services.

Technology-driven Value Creation in Portfolio Companies

Carlyle Group strategically leverages technology to enhance the value of its portfolio companies. This involves identifying and investing in businesses at the cutting edge of technological innovation, as well as integrating advanced technologies into existing operations to boost efficiency and market standing. For instance, Carlyle's investment in cloud computing solutions provider, DataBank, in 2019, aimed to capitalize on the growing demand for digital infrastructure and data management services. By 2024, DataBank had expanded its data center footprint significantly, demonstrating the impact of technology-focused growth strategies.

The firm actively supports portfolio companies in adopting digital transformation initiatives. This can range from implementing AI-powered analytics to streamline operations to developing new tech-enabled products and services. In 2023, Carlyle's portfolio company, ManpowerGroup, launched a new AI-driven talent platform designed to better match job seekers with opportunities, reflecting a commitment to tech-driven solutions in the human capital sector. This focus is crucial for maintaining competitiveness in rapidly evolving markets.

Carlyle's approach to technology integration is data-driven, aiming to unlock new revenue streams and optimize cost structures. Their investments often target sectors ripe for technological disruption, such as software, cybersecurity, and digital health. A notable example is the 2022 acquisition of a majority stake in CommScope, a global leader in network infrastructure solutions, where technological advancements in 5G and fiber optics are key drivers of growth. This strategic focus on technology is a cornerstone of Carlyle's value creation model.

Key technological factors influencing Carlyle's strategy include:

- Artificial Intelligence and Machine Learning: Implementing AI for operational efficiency, customer insights, and product development across portfolio companies.

- Cloud Computing and Digital Infrastructure: Investing in and leveraging cloud services for scalability, data analytics, and enhanced IT capabilities.

- Cybersecurity: Prioritizing robust cybersecurity measures and investing in companies that offer advanced security solutions to protect digital assets.

- Automation and Robotics: Driving productivity gains and cost reductions through the adoption of automation technologies in manufacturing and service sectors.

Carlyle Group's technological integration is central to its strategy, focusing on AI, cloud computing, and cybersecurity. By Q1 2025, AI adoption in private equity is boosting deal sourcing efficiency by an estimated 20-30%. The firm actively invests in tech-forward companies, like its 2022 investment in CommScope, a network infrastructure leader, to capitalize on growth trends.

The firm's commitment to digital transformation enhances its portfolio companies' operations and market positioning. For example, ManpowerGroup's 2023 AI talent platform launch exemplifies this focus. Carlyle's strategic tech investments aim to unlock new revenue streams and optimize costs, with a particular emphasis on sectors like software and cybersecurity.

The evolving fintech landscape presents significant opportunities, with the global fintech market exceeding $2.4 trillion in 2023. Carlyle is exploring partnerships and proprietary solutions in areas like digital fundraising and AI-driven analytics to maintain its competitive edge and serve its investor base effectively.

Carlyle's strategic technological focus is evident in its investment approach, prioritizing AI, cloud infrastructure, and cybersecurity solutions across its portfolio. This data-driven strategy aims to identify and implement technologies that drive efficiency and market competitiveness.

Legal factors

Carlyle Group navigates a complex web of regulations globally, demanding strict adherence to financial rules, disclosure mandates, and reporting standards. For instance, the Securities and Exchange Commission (SEC) in the US continues to refine rules, particularly regarding private fund transparency, impacting how Carlyle operates and reports its activities.

The firm's commitment to compliance is crucial, especially with evolving frameworks like the EU's Alternative Investment Fund Managers Directive (AIFMD) or similar regulations in Asia, which dictate operational procedures and investor reporting. Failure to comply can result in significant penalties, affecting financial performance and investor confidence.

Changes in corporate tax rates, such as potential adjustments in the US federal corporate tax rate, directly influence Carlyle's net income and the overall attractiveness of its investment vehicles. For instance, a significant increase in corporate tax could reduce the post-tax returns for Carlyle's funds.

The taxation of carried interest, a key component of compensation for private equity managers, remains a critical consideration. Discussions around taxing carried interest as ordinary income rather than capital gains, as seen in past legislative proposals, could materially impact the firm's profitability and talent retention.

Navigating the complexities of international tax treaties and differing tax regimes across jurisdictions is paramount. Carlyle must ensure compliance with evolving global tax regulations, including those related to transfer pricing and digital services taxes, to optimize investor returns and avoid penalties.

Carlyle Group, as a significant player in global finance, faces rigorous antitrust and competition law reviews for its mergers and acquisitions. These regulations, enforced by bodies like the U.S. Federal Trade Commission (FTC) and the European Commission, aim to prevent market monopolization. For instance, in 2023, the FTC continued its assertive stance on M&A, reviewing numerous transactions across various sectors, impacting the speed and structure of deals Carlyle might pursue.

The evolving regulatory landscape directly affects Carlyle's deal-making capacity. Stricter enforcement, particularly in sectors undergoing consolidation, can lead to prolonged review periods or even block transactions. This means Carlyle must carefully assess potential antitrust hurdles, as seen in past deals where regulatory concerns prompted divestitures or altered deal terms to gain approval.

Fiduciary Duties and Investor Protection Laws

Carlyle Group, like all investment managers, operates under stringent fiduciary duties, obligating them to act in the best interests of their limited partners (LPs). This commitment involves prioritizing LP returns and safeguarding their capital above all else.

Compliance with a complex web of investor protection laws and regulations is not merely a legal necessity but a cornerstone of trust for Carlyle's investors. For instance, the SEC's Regulation Best Interest, implemented in 2020, mandates that financial professionals act in the best interest of their retail customers when making recommendations, a principle that extends to the broader fiduciary standard for institutional investors.

Adherence to these legal frameworks is crucial for maintaining Carlyle's reputation and avoiding significant legal repercussions, including hefty fines and reputational damage. Key areas of focus include:

- Transparency in Fund Management: Ensuring clear and accurate disclosure of fees, performance data, and investment strategies to LPs.

- Anti-Fraud Provisions: Strictly adhering to regulations that prohibit deceptive or fraudulent practices in investment offerings and management.

- Regulatory Oversight: Complying with reporting requirements and examinations by bodies like the Securities and Exchange Commission (SEC) and other global financial regulators.

- Data Privacy and Security: Protecting sensitive investor information in line with evolving data protection laws such as GDPR and CCPA.

International Investment Law and Sanctions

Geopolitical shifts significantly impact international investment, directly affecting firms like Carlyle Group. For instance, the ongoing geopolitical tensions in Eastern Europe have led to widespread sanctions, impacting trade and investment flows. In 2023, the U.S. Treasury Department continued to enforce various sanctions regimes, including those targeting Russia, which can restrict Carlyle's ability to engage with certain entities or markets, potentially affecting portfolio company operations and exit strategies.

Carlyle must remain vigilant in monitoring evolving international investment laws and sanctions. The firm's compliance framework needs to be robust enough to navigate these complex legal landscapes. Failure to adapt could result in significant financial penalties and reputational damage. For example, the increasing focus on environmental, social, and governance (ESG) regulations globally also introduces new legal considerations for investment due diligence and portfolio management, a trend that is expected to accelerate through 2024 and 2025.

- Sanctions Enforcement: Continued vigilance on evolving sanctions lists and regulations from bodies like the UN, EU, and OFAC is critical for risk mitigation.

- Investment Treaty Changes: Monitoring potential revisions or terminations of Bilateral Investment Treaties (BITs) that could alter investor protections and dispute resolution mechanisms.

- Cross-Border Data Regulations: Adapting to stricter data privacy and transfer laws, such as GDPR and its global counterparts, impacting digital asset investments and operations.

- Anti-Corruption Laws: Strict adherence to FCPA and similar anti-bribery legislation remains paramount in all international dealings.

Carlyle Group operates under a robust legal framework, necessitating strict adherence to financial regulations, disclosure requirements, and reporting standards globally. The firm must continuously adapt to evolving rules from bodies like the U.S. Securities and Exchange Commission (SEC), which, as of 2024, continues to enhance transparency mandates for private funds.

Compliance with directives such as the EU's Alternative Investment Fund Managers Directive (AIFMD) and similar Asian regulations is paramount, dictating operational procedures and investor reporting. Non-compliance can lead to substantial penalties, impacting financial performance and investor trust, a risk Carlyle actively mitigates through dedicated compliance efforts.

Changes in corporate tax policies, including potential shifts in the U.S. federal corporate tax rate through 2024 and 2025, directly affect Carlyle's profitability and the net returns of its investment vehicles. Furthermore, the taxation of carried interest remains a critical factor, with ongoing discussions about its treatment potentially impacting firm profitability and talent retention.

Environmental factors

Carlyle Group is actively aligning its investment strategies with global decarbonization efforts, aiming for net-zero greenhouse gas emissions across its portfolio by 2050. This ambitious target necessitates interim goals, with a mandate for portfolio companies to establish Paris-aligned climate objectives by 2025.

This strategic focus on decarbonization directly shapes Carlyle's investment decisions, favoring companies and sectors that demonstrate a clear path towards emission reduction. Furthermore, it compels a rigorous assessment of climate-related risks, ensuring that potential environmental impacts are factored into the valuation and management of all investments.

Carlyle Group is seeing substantial revenue growth tied to sustainability demands from its portfolio companies' customers. This trend underscores a burgeoning market for eco-friendly goods and services, with Carlyle reporting that over 70% of its portfolio companies are now actively engaged in sustainability initiatives. This directly translates to tangible financial benefits derived from embedding environmental, social, and governance (ESG) principles into their core business strategies.

Carlyle Group's portfolio companies face increasing scrutiny and stricter environmental regulations, particularly concerning carbon emissions, waste management, and resource efficiency. For instance, the EU's Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, will directly affect companies exporting carbon-intensive goods to the EU, potentially increasing operational costs and requiring significant investment in decarbonization strategies across Carlyle's industrial and manufacturing holdings.

Furthermore, evolving ESG reporting standards, such as the upcoming International Sustainability Standards Board (ISSB) standards, necessitate enhanced data collection and transparency. Carlyle's commitment to these standards means its portfolio companies must bolster their environmental performance metrics and reporting capabilities, impacting areas like energy consumption and water usage, with many companies aiming for a 30% reduction in water intensity by 2030.

Resource Scarcity and Supply Chain Resilience

Growing concerns about resource scarcity, such as water and critical minerals, are increasingly shaping Carlyle Group's investment strategies. The firm actively evaluates how these environmental factors can present both operational risks and new opportunities within its diverse portfolio companies, particularly as global demand for these resources intensifies.

Carlyle's due diligence process now rigorously assesses supply chain resilience, recognizing that disruptions due to environmental pressures can significantly impact profitability and long-term viability. This focus is critical as the world grapples with the economic implications of climate change and resource depletion.

- Water Scarcity: By 2025, an estimated 2.7 billion people will live in areas that are water-scarce for at least one month per year, impacting agriculture, manufacturing, and energy sectors where Carlyle invests.

- Critical Minerals: The International Energy Agency reported in 2024 that demand for critical minerals like lithium and cobalt, essential for electric vehicles and renewable energy technologies, is projected to increase significantly by 2030, creating both supply chain vulnerabilities and investment potential.

- Supply Chain Disruptions: Extreme weather events, exacerbated by climate change, led to significant global supply chain disruptions in 2024, costing businesses billions and highlighting the need for robust, adaptable sourcing strategies within Carlyle's portfolio.

Biodiversity and Natural Capital Considerations

Beyond the widely discussed climate change, there's a growing emphasis on biodiversity loss and the degradation of natural capital. Carlyle, like other investment firms, is likely to face increasing scrutiny regarding the impact of its portfolio companies on ecosystems and natural resources. This could lead to a shift in investment strategies, particularly within real assets and private equity, to actively incorporate nature-positive outcomes. For instance, a 2024 report by the World Economic Forum highlighted that over half of global GDP, approximately $44 trillion, is moderately or highly dependent on nature and its services, underscoring the financial risks associated with biodiversity loss.

This evolving landscape means Carlyle may need to integrate biodiversity risk assessments into its due diligence processes. Investment decisions could be influenced by a company's reliance on or impact on biodiversity, potentially favoring those with sustainable practices. For example, investments in sectors like agriculture, forestry, and fisheries will likely face more rigorous examination regarding their biodiversity footprint. The firm might also explore opportunities in nature-based solutions, such as ecosystem restoration or sustainable land management, as a new asset class or a value-enhancement strategy for existing holdings.

The financial implications are significant. A 2025 projection by the Taskforce on Nature-related Financial Disclosures (TNFD) estimates that nature-related risks could represent a substantial portion of systemic financial risk. Carlyle's ability to navigate these risks and identify opportunities aligned with nature-positive objectives will be crucial for long-term value creation and maintaining its competitive edge in the evolving investment landscape.

- Growing Investor Demand: By 2024, a significant percentage of institutional investors were incorporating ESG factors, including biodiversity, into their investment mandates, signaling a clear market trend.

- Regulatory Pressures: Emerging regulations, such as those related to supply chain transparency and environmental impact reporting, are compelling companies to address their biodiversity impact.

- Risk Mitigation: Investments in companies with poor biodiversity practices face increased reputational and operational risks, potentially leading to divestment campaigns or regulatory penalties.

- Opportunity Identification: Conversely, Carlyle can identify and support companies developing innovative solutions for biodiversity conservation and restoration, tapping into a growing market for sustainable products and services.

Carlyle Group is navigating increasing environmental regulations, particularly concerning carbon emissions and resource management, as evidenced by the EU's Carbon Border Adjustment Mechanism (CBAM) impacting industrial holdings. Evolving standards like those from the ISSB are also pushing portfolio companies to enhance environmental performance reporting, with many targeting a 30% reduction in water intensity by 2030.

Growing concerns over resource scarcity, such as water and critical minerals, are reshaping investment strategies, with Carlyle assessing both risks and opportunities. For instance, by 2025, an estimated 2.7 billion people will face water scarcity, impacting key sectors for Carlyle's investments. The firm is also prioritizing supply chain resilience against climate-driven disruptions, which cost businesses billions in 2024.

Biodiversity loss and natural capital degradation are emerging as significant financial risks, with over half of global GDP dependent on nature. Carlyle is likely to integrate biodiversity risk assessments into due diligence, potentially favoring companies with sustainable practices or exploring nature-based solutions as an asset class, especially as investor demand for ESG factors, including biodiversity, grows.

PESTLE Analysis Data Sources

Our PESTLE analysis for Carlyle Group is built upon a robust foundation of data sourced from leading financial news outlets, reputable market research firms, and official government publications. This ensures a comprehensive view of political, economic, social, technological, legal, and environmental factors impacting the global investment landscape.