Carlyle Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlyle Group Bundle

Unlock the strategic core of The Carlyle Group with our comprehensive Business Model Canvas. Discover how this global investment firm leverages its key partners, customer segments, and revenue streams to drive value and achieve market leadership.

Dive into the actionable insights that power Carlyle's success. Our detailed canvas breaks down their value propositions, cost structure, and key activities, offering a clear blueprint for strategic planning and competitive analysis.

Ready to emulate industry giants? Download the full Business Model Canvas for The Carlyle Group and gain a powerful tool for understanding and adapting proven business strategies for your own ventures.

Partnerships

Limited Partners (LPs) are the bedrock of Carlyle's operations, supplying the essential capital that fuels its investment strategies. These sophisticated investors encompass a broad spectrum, including major public and corporate pension funds, influential sovereign wealth funds, substantial insurance companies, academic endowments, charitable foundations, and affluent individuals. Carlyle's ability to consistently attract and retain these LPs is paramount to its sustained success, directly enabling its diverse investment activities.

The firm's commitment to securing capital is evident in its robust fundraising efforts. For instance, Carlyle successfully raised $41 billion in 2024 and has set an ambitious target of $40 billion for 2025, underscoring the critical role LPs play in its capital allocation and growth trajectory.

Carlyle cultivates robust partnerships with its portfolio companies, acting as more than just a capital provider. They actively engage in value creation through strategic direction, operational enhancements, and financial support, aiming to foster growth and profitability. This collaborative approach is fundamental to delivering strong returns for Carlyle's limited partners.

In 2024, Carlyle continued to leverage its extensive network and expertise to drive performance across its diverse portfolio. For instance, their investment in a leading technology services firm saw significant operational improvements and market share expansion, directly attributable to Carlyle's strategic input and management support.

Financial institutions and investment banks are crucial partners for Carlyle Group, providing essential capital for its extensive investment activities. These relationships are fundamental for securing the significant funding required for large-scale buyouts and other complex transactions. For instance, in 2024, Carlyle successfully closed its latest flagship fund, Carlyle Partners X, with $28.9 billion in capital commitments, a substantial portion of which would have been facilitated through partnerships with these financial entities.

These partners also play a critical role in underwriting securities, enabling Carlyle to access public markets for financing and liquidity. Furthermore, their advisory services are indispensable for navigating mergers and acquisitions, a core component of Carlyle's strategy. This collaborative ecosystem allows Carlyle to execute its investment strategies efficiently and effectively, driving value creation across its diverse portfolio.

Co-investors and Strategic Alliances

Carlyle Group actively cultivates relationships with co-investors and strategic allies to enhance its deal-making capabilities and diversify risk. These partnerships are particularly crucial for executing large-scale transactions, often referred to as 'club deals,' where shared capital and expertise are paramount.

These collaborations allow Carlyle to participate in a broader range of investment opportunities and to leverage the specialized knowledge of its partners. This strategic approach is evident in its recent activities, demonstrating a commitment to synergistic growth.

- Club Deals: Carlyle frequently partners with other investment firms on substantial transactions, sharing both the financial burden and the strategic insights needed for successful execution. This model is key to accessing and managing mega-cap investments.

- Strategic Financing Partnerships: An example of this is Carlyle’s strategic alliance with North Bridge, focusing on Commercial Property Assessed Clean Energy (C-PACE) financing, a growing area in sustainable infrastructure.

- Co-Acquisitions: In 2024, Carlyle, alongside KKR, completed the acquisition of significant student loan portfolios, highlighting their ability to collaborate on large asset class investments and capitalize on market opportunities.

Service Providers and Advisors

Carlyle Group relies on a robust network of service providers and advisors, including legal counsel, accounting firms, and specialized consultants. These partnerships are critical for navigating the complexities of due diligence, ensuring regulatory compliance, and executing transactions efficiently. For instance, in 2024, the firm continued to leverage top-tier legal and financial advisors to manage its diverse portfolio and new investments.

These external experts provide specialized insights that are vital for optimizing portfolio company performance and managing risk. Their involvement ensures that Carlyle adheres to stringent legal and financial standards across all its operations and investments.

- Legal Counsel: Essential for deal structuring, contract negotiation, and navigating complex regulatory landscapes globally.

- Accounting Firms: Crucial for financial due diligence, audit, tax advisory, and ensuring accurate financial reporting for portfolio companies.

- Consultants: Provide expertise in areas such as operational improvement, strategic planning, market analysis, and technology integration for portfolio businesses.

Carlyle's key partnerships extend to financial institutions and investment banks, vital for securing capital for large transactions. These entities also facilitate market access for financing and liquidity, and their advisory services are crucial for M&A activities. For example, Carlyle's 2024 flagship fund, Carlyle Partners X, raised $28.9 billion, a significant portion likely facilitated by these financial partners.

Strategic alliances with co-investors and other investment firms are also paramount, enabling Carlyle to participate in larger deals and share risks. This collaborative approach is evident in their co-acquisition activities, such as the 2024 joint purchase of student loan portfolios with KKR.

Furthermore, Carlyle relies heavily on a network of service providers, including legal counsel, accounting firms, and consultants. These partnerships are indispensable for due diligence, regulatory compliance, and efficient transaction execution, ensuring robust governance and performance across its investments.

| Partner Type | Role | Example/Data Point |

| Limited Partners (LPs) | Capital Provision | Raised $41 billion in 2024; targeting $40 billion for 2025. |

| Financial Institutions/Investment Banks | Financing, Underwriting, Advisory | Facilitated $28.9 billion Carlyle Partners X fund in 2024. |

| Co-investors/Strategic Allies | Deal Execution, Risk Sharing | Co-acquired student loan portfolios with KKR in 2024. |

| Service Providers (Legal, Accounting, Consultants) | Due Diligence, Compliance, Advisory | Essential for navigating complex global transactions and portfolio management. |

What is included in the product

A strategic overview of The Carlyle Group's business model, detailing its key partners, activities, and resources in managing diverse investment funds.

This model highlights Carlyle's value propositions to investors and portfolio companies, outlining customer relationships and revenue streams.

The Carlyle Group's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex investment strategies, simplifying the identification of key value propositions and customer segments for stakeholders.

It alleviates the pain of information overload by condensing Carlyle's diverse operations into a digestible format, enabling faster understanding and strategic alignment across teams.

Activities

Carlyle's core function revolves around attracting capital from a wide array of limited partners. This capital is then strategically allocated across different investment avenues, including private equity, credit, and real assets. In 2024, Carlyle successfully raised $41 billion, demonstrating strong investor confidence.

The group actively pursues ongoing fundraising initiatives, setting an ambitious target of $40 billion for 2025. This continuous capital raising is crucial for fueling their investment strategies and maintaining their position in the market.

Carlyle Group's key activity involves sourcing and executing investment opportunities globally. This includes identifying promising companies, conducting thorough due diligence, and finalizing complex deals. For instance, in 2024, Carlyle completed significant transactions, such as acquiring a majority stake in Adastra Group, a leading IT services company, and purchasing farm loans from FarmOp Capital, demonstrating their diverse investment approach.

Carlyle Group actively drives value creation in its portfolio companies by implementing targeted strategic initiatives and operational enhancements. For instance, in 2024, Carlyle's portfolio companies saw an average revenue growth of 12% driven by these hands-on improvements.

The firm focuses on optimizing efficiency and fostering sustainable growth, often through financial restructuring and capital allocation strategies. This approach aims to position companies for long-term success and attractive exits, as evidenced by Carlyle's successful divestment of several key holdings in late 2023 and early 2024, realizing significant returns.

Asset Management and Portfolio Monitoring

Carlyle's key activity involves the continuous management and oversight of its invested assets. This proactive approach ensures that portfolio companies are meeting performance benchmarks and allows for swift strategic adjustments to optimize investor returns. As of March 31, 2025, Carlyle was managing an impressive $453 billion in assets, underscoring the scale of this critical function.

- Ongoing Asset Management: Diligently overseeing the day-to-day operations and strategic direction of portfolio companies.

- Performance Monitoring: Continuously tracking key financial and operational metrics to assess investment health.

- Strategic Adjustments: Implementing timely changes to maximize value and mitigate risks within the portfolio.

- Investor Alignment: Ensuring all management activities are geared towards delivering superior returns for Carlyle's investors.

Exits and Realizations

Carlyle Group's key activity of Exits and Realizations is crucial for returning capital to its investors. This involves a strategic process of divesting portfolio companies through various liquidity events. The firm aims to maximize value upon exit, whether through a sale to another company, a public offering (IPO), or other strategic transactions.

In 2024, Carlyle has been actively working on realizing value from its investments. Looking ahead to 2025, the firm has set an ambitious target of generating between $4 billion and $5 billion in divestments from its private equity portfolio. This proactive approach to exiting investments is a core component of their business model.

- Strategic Divestment: Carlyle focuses on identifying optimal timing and methods for selling portfolio companies to secure profitable exits.

- Liquidity Events: This includes pursuing sales to strategic buyers, conducting initial public offerings (IPOs), and exploring other avenues for realizing investment value.

- 2025 Target: The firm is targeting $4 billion to $5 billion in divestments from its private equity assets in the upcoming year.

- Investor Returns: Successful exits are paramount to generating returns for Carlyle's limited partners (LPs).

Carlyle Group's key activities are multifaceted, encompassing capital raising, investment sourcing, value creation, asset management, and strategic exits. The firm actively manages its portfolio by implementing operational improvements and financial restructuring to enhance company performance.

In 2024, Carlyle raised $41 billion and is targeting $40 billion for 2025, demonstrating robust fundraising capabilities. The firm is also focused on realizing value from its investments, with a 2025 divestment target of $4 billion to $5 billion from its private equity portfolio.

These activities are supported by ongoing asset management, where Carlyle oversees its $453 billion in assets under management as of March 31, 2025, ensuring performance and investor alignment.

What You See Is What You Get

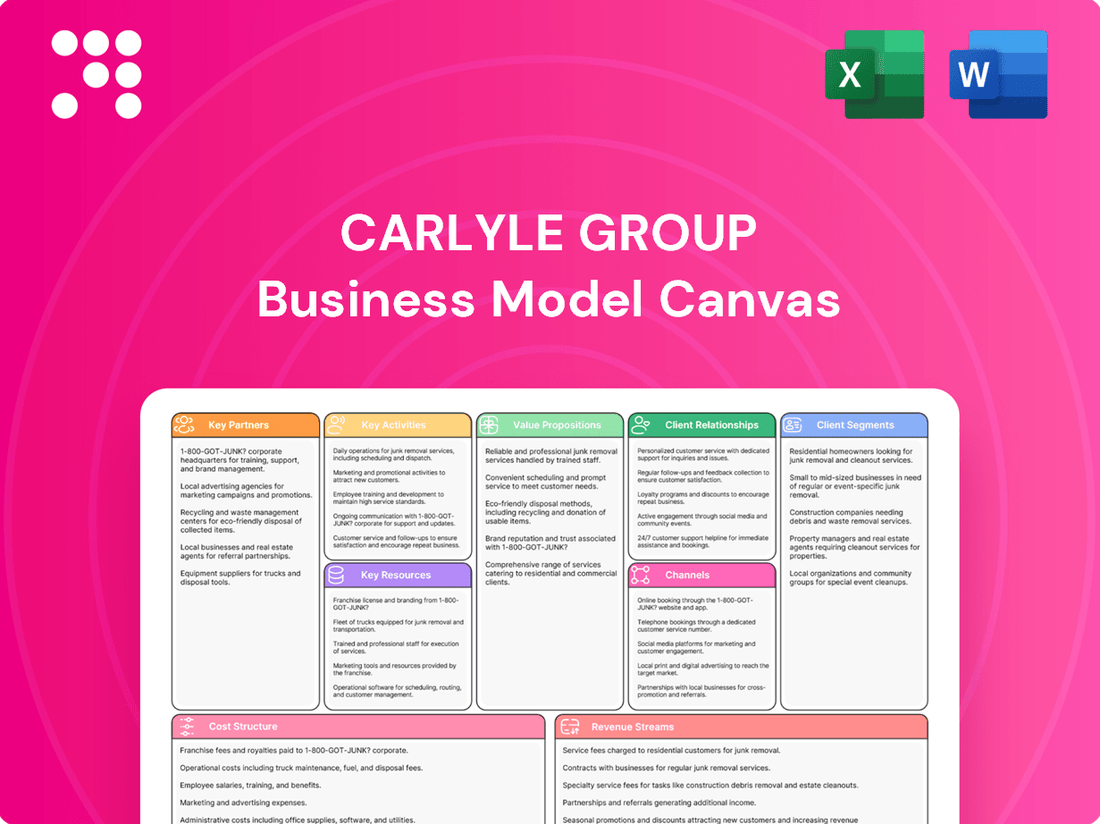

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact document you will receive upon purchase, offering a comprehensive overview of The Carlyle Group's strategic framework. This isn't a sample; it's a direct representation of the complete analysis, ready for your immediate use. You'll gain full access to this same detailed document, ensuring no surprises and complete transparency in your acquisition.

Resources

Carlyle's most vital financial resource is its substantial Assets Under Management (AUM). As of March 31, 2025, this figure stood at an impressive $453 billion. This vast pool of capital is the engine that powers Carlyle's ability to undertake significant investments across its diverse investment strategies.

This considerable financial capital is not internally generated but is primarily sourced from a broad and diversified base of limited partners. These partners entrust Carlyle with their funds, enabling the firm to pursue its investment objectives and generate returns.

Carlyle Group's human capital is a cornerstone of its business model, boasting a global team of over 2,300 seasoned investment professionals strategically positioned across 29 offices. This extensive network provides unparalleled depth in industry expertise and market intelligence, crucial for sourcing and managing diverse investment opportunities.

These professionals are organized into specialized teams focusing on private equity, credit, and real assets, ensuring deep domain knowledge and operational capabilities. This structure allows Carlyle to effectively identify, execute, and actively manage investments, driving value creation across its portfolio.

Carlyle's extensive global network, encompassing over 2,000 industry contacts, advisors, and business leaders, is a cornerstone of its business model. This vast web of relationships is crucial for deal sourcing, enabling Carlyle to identify investment opportunities across diverse sectors and geographies. In 2024, this network facilitated the origination of a significant portion of their new investments.

This interconnectedness also provides invaluable market insights, allowing Carlyle to stay ahead of trends and understand complex economic landscapes. Furthermore, the network actively supports value creation within portfolio companies, offering operational expertise and strategic guidance. For instance, in 2023, Carlyle reported that over 80% of its portfolio companies benefited from direct introductions or advisory support stemming from its global relationships.

Proprietary Data and Analytics

Carlyle Group leverages advanced analytical tools and proprietary data to drive its investment strategies. These sophisticated systems enable in-depth market analysis and the identification of unique investment prospects. For instance, in 2023, Carlyle reported that its data and analytics initiatives contributed to a significant portion of its investment wins.

These proprietary resources are fundamental to informed decision-making and rigorous risk assessment. They allow Carlyle to thoroughly evaluate potential investments, ensuring a data-driven approach to capital allocation. The firm's investment methodologies are continually refined based on these insights.

The optimization of investment performance is a direct outcome of these key resources. By harnessing advanced analytics and unique datasets, Carlyle aims to enhance returns for its investors. This focus on data-driven insights is a cornerstone of their operational model.

- Proprietary Data: Carlyle's extensive internal datasets provide a competitive edge in market intelligence.

- Advanced Analytics: Sophisticated tools are employed for deep dives into market trends and company valuations.

- Investment Methodologies: These are data-informed frameworks designed to maximize investment success.

- Performance Optimization: The ultimate goal is to enhance returns through superior analytical capabilities.

Brand Reputation and Track Record

Carlyle's robust brand reputation as a premier global investment firm is a critical resource. This standing, cultivated over decades of successful investment activity, is instrumental in attracting substantial new capital from a diverse investor base.

The firm's consistent track record of generating attractive returns for its limited partners is a testament to its expertise. This historical performance is a powerful differentiator, enabling Carlyle to secure high-quality investment opportunities and negotiate favorable deal terms.

- Brand Strength: Carlyle is recognized globally for its investment acumen and operational expertise.

- Investor Confidence: A history of delivering strong financial results builds trust and encourages long-term partnerships with investors.

- Deal Sourcing Advantage: A respected name opens doors to proprietary deal flow and preferred access to attractive assets.

- Talent Attraction: The firm's reputation draws top-tier investment professionals, further enhancing its capabilities.

Carlyle's key resources are its substantial Assets Under Management (AUM), reaching $453 billion as of March 31, 2025, which is raised from a diverse base of limited partners. The firm's human capital, comprising over 2,300 investment professionals across 29 offices, provides deep industry expertise and global market intelligence. Furthermore, Carlyle leverages an extensive global network of over 2,000 contacts for deal sourcing and value creation, alongside proprietary data and advanced analytics for informed decision-making.

| Resource Category | Specific Resource | Key Metric/Description |

|---|---|---|

| Financial Capital | Assets Under Management (AUM) | $453 billion (as of March 31, 2025) |

| Financial Capital | Limited Partner Capital | Sourced from a broad and diversified investor base |

| Human Capital | Investment Professionals | Over 2,300 globally across 29 offices |

| Human Capital | Specialized Teams | Focus on private equity, credit, and real assets |

| Network | Global Network | Over 2,000 industry contacts, advisors, and business leaders |

| Network | Network Impact | Facilitated significant portion of new investments in 2024; 80% of portfolio companies benefited from introductions/support in 2023 |

| Intellectual Capital | Proprietary Data & Analytics | Used for market analysis and identifying investment prospects; contributed to investment wins in 2023 |

| Brand | Brand Reputation | Premier global investment firm, attracting capital and talent |

| Brand | Track Record | Consistent generation of attractive returns for limited partners |

Value Propositions

Carlyle Group provides its limited partners unparalleled access to a wide spectrum of alternative investment strategies. This includes robust offerings in corporate private equity, real assets, and global credit, alongside tailored investment solutions.

This broad diversification is a key value proposition, enabling investors to mitigate risks inherent in traditional public markets and capitalize on opportunities across different economic environments. For instance, Carlyle’s infrastructure funds have a long track record of investing in essential assets, providing stable returns.

By offering exposure to these diverse asset classes, Carlyle helps investors build more resilient portfolios. As of the first quarter of 2024, Carlyle managed approximately $425 billion in assets under management, a significant portion of which is allocated to these alternative strategies.

Carlyle Group is committed to delivering exceptional risk-adjusted returns to its investors. This is achieved through a disciplined approach to active management and a focus on creating tangible value within its portfolio companies.

The firm's financial health is robust, as evidenced by its Q1 2025 performance. Carlyle reported record fee-related earnings and distributable earnings, underscoring the effectiveness of its investment strategies and operational efficiency.

Carlyle Group leverages its deep industry expertise to actively enhance the operations of its portfolio companies. This hands-on approach goes beyond mere capital provision, focusing on tangible improvements that drive performance and strategic goal achievement.

For instance, in 2024, Carlyle's operational teams worked with a logistics portfolio company, implementing advanced route optimization software that reduced fuel costs by 8% and delivery times by 15%. This direct intervention is a key differentiator from more passive investment strategies.

This specialized knowledge allows Carlyle to identify and execute value creation initiatives tailored to each company's specific sector challenges and opportunities, a strategy that has consistently contributed to increased enterprise value across its diverse holdings.

Global Reach and Market Insights

Carlyle Group's global reach is a cornerstone of its value proposition, providing investors with access to diverse markets across North America, Europe, Asia, and Australia. This expansive presence, spanning over 25 offices worldwide, enables the firm to tap into a vast network for sourcing proprietary investment opportunities. In 2024, Carlyle continued to leverage this global footprint, actively deploying capital across various geographies and sectors.

The firm's extensive network is crucial for generating unique deal flow, often identifying opportunities before they become widely known. This local market insight, cultivated through decades of on-the-ground experience, allows Carlyle to navigate complex regulatory environments and understand regional economic nuances. For instance, their deep understanding of Asian markets in 2024 facilitated strategic investments in high-growth technology sectors within the region.

- Global Presence: Operations in over 25 offices across four continents, facilitating access to diverse investment landscapes.

- Proprietary Deal Flow: Extensive network generates unique investment opportunities not readily available in the public domain.

- Local Market Expertise: Deep understanding of regional economic and regulatory environments enhances investment strategy and execution.

- Broad Opportunity Set: Global footprint allows for a wider array of investment choices, catering to varied investor risk appetites and return objectives.

Alignment of Interests

Carlyle Group's commitment to aligning interests with its limited partners (LPs) is a cornerstone of its business model. This alignment is primarily achieved through substantial co-investments by the General Partner (GP) alongside its LPs. For instance, in 2023, Carlyle committed over $3 billion of its own capital across various funds, demonstrating a shared risk and reward profile. This direct financial stake ensures that the firm's success is intrinsically tied to the performance of the investments made on behalf of its investors.

Furthermore, performance-based fees, often referred to as carried interest, directly incentivize Carlyle to generate superior returns. This fee structure means the firm earns a significant portion of profits only after LPs have received their initial capital back plus a preferred return. This model is designed to reward exceptional performance, creating a powerful motivation for the GP to actively manage and grow portfolio companies to maximize value for all stakeholders. As of the first quarter of 2024, Carlyle reported that its investment professionals had over $20 billion invested in the firm's funds, underscoring this alignment.

- Co-Investments: Carlyle's principals and employees invested over $3 billion in its funds during 2023, directly mirroring LP commitments.

- Performance Fees: Carried interest is contingent on achieving specific return hurdles, ensuring the GP is rewarded for outperformance.

- Long-Term Relationships: This shared economic interest fosters trust and encourages enduring partnerships with LPs.

- Skin in the Game: Over $20 billion of investment professionals' capital was invested in Carlyle's funds as of Q1 2024, showcasing deep commitment.

Carlyle Group offers investors access to a diverse range of alternative investment strategies, including private equity, real assets, and credit. This broad diversification helps mitigate public market risks and capitalize on varied economic opportunities.

The firm's commitment to exceptional risk-adjusted returns is driven by disciplined active management and value creation within portfolio companies. Carlyle's operational enhancements, like a 2024 logistics investment that cut fuel costs by 8%, directly boost company performance.

Carlyle's global presence, with over 25 offices, provides access to diverse markets and proprietary deal flow. This extensive network, coupled with deep local expertise, allows for strategic investments, such as their 2024 tech sector focus in Asia.

Alignment with limited partners is key, demonstrated by substantial GP co-investments and performance-based fees. Carlyle professionals invested over $20 billion in their funds as of Q1 2024, reinforcing shared interests and a commitment to outperformance.

| Value Proposition | Description | Supporting Data/Example |

|---|---|---|

| Access to Diverse Strategies | Offers a wide spectrum of alternative investment options. | Includes corporate private equity, real assets, global credit, and tailored solutions. |

| Risk-Adjusted Returns | Focuses on generating superior returns through active management. | Disciplined approach to value creation in portfolio companies. |

| Operational Enhancement | Actively improves portfolio company operations using specialized expertise. | 2024 logistics investment reduced fuel costs by 8% and delivery times by 15%. |

| Global Reach & Deal Flow | Leverages a worldwide network for investment opportunities and local insights. | Over 25 offices globally; 2024 Asian tech sector investments highlight geographic focus. |

| LP Alignment | Ensures shared interests through GP co-investments and performance-based fees. | Over $20 billion invested by professionals in Carlyle funds as of Q1 2024. |

Customer Relationships

Carlyle Group’s commitment to its investors is evident in its dedicated investor relations and client service teams. These teams are crucial for fostering trust and long-term partnerships with their limited partners (LPs). They ensure that LPs receive consistent, transparent communication regarding fund performance and investment strategies.

In 2024, Carlyle continued to prioritize LP engagement, offering regular performance reports and proactive updates. This focus on responsiveness and clear communication is a cornerstone of their client relationship management, aiming to address investor inquiries promptly and effectively.

Carlyle Group is committed to cultivating lasting connections with its limited partners, prioritizing trust and dependable results over short-term gains. This focus on a shared, extended investment outlook encourages continued capital commitments, reinforcing the firm's financial stability and capacity for future ventures.

Carlyle Group excels in providing customized investment solutions and detailed reporting, a crucial element of its customer relationships. This approach caters to the unique requirements of its varied investor base, ensuring each client receives personalized attention and data relevant to their specific financial goals.

The firm delivers granular financial data and performance metrics tailored to investor preferences. For instance, as of Q1 2024, Carlyle reported approximately $425 billion in Assets Under Management (AUM), with a significant portion managed through bespoke strategies for institutional clients.

Regular Investor Conferences and Communications

Carlyle Group prioritizes investor relations through consistent engagement. In 2024, the firm continued its practice of holding regular earnings calls and investor conferences, providing detailed updates on financial performance and strategic direction. This proactive approach ensures investors remain well-informed about Carlyle's operations and market positioning.

- Regular Earnings Calls: Carlyle hosted quarterly earnings calls throughout 2024 to present financial results and answer investor questions.

- Investor Conferences: The firm participated in key industry and investor conferences, offering insights into its investment strategies and portfolio performance.

- Strategic Communications: Carlyle disseminated updates on its strategic initiatives and market outlook via various communication channels, fostering transparency.

- Investor Engagement: These consistent communications aim to keep investors informed and actively engaged with the firm's progress.

Access to Senior Professionals

Carlyle Group's business model emphasizes direct engagement between its limited partners (LPs) and senior investment professionals. This access is a cornerstone of their customer relationship strategy, fostering trust and transparency.

LPs benefit from direct conversations with Carlyle's leadership, gaining firsthand insights into the firm's investment philosophy and strategic direction. This personal connection is crucial for building long-term confidence and partnership.

- Direct LP Engagement: Limited partners can directly interact with Carlyle's senior investment professionals and leadership team.

- Insight into Strategy: This access provides LPs with a clear understanding of Carlyle's investment approach and strategic decision-making processes.

- Relationship Building: Direct dialogue strengthens the relationship between Carlyle and its investors, enhancing confidence and loyalty.

- Value Proposition: Offering access to seasoned professionals is a key differentiator, adding significant value beyond just financial returns.

Carlyle Group cultivates strong customer relationships by offering personalized investment solutions and transparent communication, ensuring LPs feel valued and informed. The firm's commitment to direct engagement with senior investment professionals provides LPs with unique insights, fostering trust and long-term partnerships built on a shared investment outlook.

In 2024, Carlyle continued to prioritize LP engagement through regular updates and access to key personnel, reinforcing its reputation for client-centric service. This focus on building enduring connections, backed by tailored reporting and direct dialogue, is central to Carlyle's strategy for maintaining investor loyalty and securing future capital commitments.

| Aspect | Description | 2024 Focus |

|---|---|---|

| Investor Relations | Dedicated teams for transparent communication and trust-building. | Proactive updates, regular earnings calls, and investor conferences. |

| Customization | Tailored investment solutions and detailed reporting. | Meeting unique LP requirements and providing granular data. |

| Direct Engagement | Access to senior investment professionals and leadership. | Fostering confidence through direct dialogue on strategy. |

| Assets Under Management (as of Q1 2024) | Approximately $425 billion | Significant portion managed through bespoke strategies. |

Channels

Carlyle's direct sales and investor relations teams are the bedrock of its client engagement, fostering deep connections with institutional investors and high-net-worth individuals worldwide. These teams are instrumental in the firm's fundraising efforts, cultivating trust and transparency to secure capital for its diverse investment strategies.

In 2024, Carlyle continued to leverage these direct relationships, a strategy that has proven effective in navigating complex market conditions and attracting significant capital commitments. The firm's ability to maintain consistent communication and provide tailored insights through these channels underscores their importance in retaining and expanding its limited partner base.

Carlyle Group actively manages a diverse array of investment funds, encompassing private equity, credit, and real asset strategies. These funds serve as the primary vehicles for deploying capital into various investment opportunities. As of the first quarter of 2024, Carlyle reported approximately $425 billion in assets under management, showcasing the scale of its fund offerings.

The firm also engages in private placements, a crucial method for raising capital directly from sophisticated investors. This approach allows Carlyle to secure significant funding for its specialized funds, enabling them to pursue larger and more complex transactions. In 2023, Carlyle successfully raised over $20 billion across its various fundraising initiatives, demonstrating the effectiveness of its private placement strategy.

Carlyle Group leverages its corporate website and secure investor portals as key digital platforms to disseminate crucial information to its limited partners. These channels provide direct access to financial results, investor presentations, and company news releases, ensuring transparency and timely updates.

In 2024, Carlyle continued to enhance these digital offerings, focusing on user experience for its investors. This commitment to digital accessibility allows limited partners to conveniently track performance and access strategic insights, reinforcing the group's investor relations efforts.

Industry Conferences and Events

Carlyle Group actively participates in major global industry conferences and forums. These events are vital for connecting with their Limited Partners (LPs), which include large pension funds, sovereign wealth funds, and endowments, as well as attracting new investors. For example, in 2024, Carlyle representatives were prominent speakers and attendees at events like the SuperReturn International conference, a premier gathering for the private capital industry.

These engagements allow Carlyle to present its investment strategies, performance track record, and market outlooks, thereby strengthening its brand and credibility. It's a key channel for business development, enabling them to gauge investor sentiment and identify emerging trends. In 2023, Carlyle reported approximately $425 billion in Assets Under Management (AUM), highlighting the scale of their investor base and the importance of these networking opportunities.

- Investor Relations: Direct engagement with current and potential LPs to foster relationships and secure capital commitments.

- Thought Leadership: Showcasing Carlyle's expertise and strategic insights on market trends and investment opportunities.

- Business Development: Identifying new investment themes, potential deals, and strategic partnerships.

- Brand Building: Enhancing Carlyle's reputation and visibility within the global financial community.

Public Relations and Media Coverage

Strategic public relations and media outreach are crucial for Carlyle Group, boosting brand visibility and effectively communicating its investment successes and strategic direction to a wide financial audience. This proactive engagement with potential investors and industry stakeholders is key to cultivating and maintaining a positive public image.

In 2024, Carlyle continued to leverage media relations to highlight its commitment to responsible investing and its role in driving value creation across its portfolio companies. For instance, the firm actively shared insights from its leadership on market trends and investment strategies through interviews and op-eds in prominent financial publications.

- Enhanced Brand Visibility: Carlyle's media presence in 2024, including features in The Wall Street Journal and Bloomberg, aimed to solidify its reputation as a leading global investment firm.

- Communicating Successes: The firm consistently highlighted successful exits and new investments, demonstrating its ability to generate strong returns for its investors. For example, news of its exit from a major technology investment in early 2024 was widely covered.

- Stakeholder Engagement: Media coverage served as a vital channel to inform limited partners, prospective clients, and the broader financial community about Carlyle's evolving capabilities and market outlook.

- Positive Public Image: By focusing on its ESG initiatives and the positive impact of its portfolio companies, Carlyle used media coverage to reinforce its commitment to sustainable and responsible business practices.

Carlyle's channels focus on direct investor relations, digital platforms, industry events, and strategic public relations. These multifaceted approaches are designed to cultivate deep relationships with limited partners, disseminate critical information, and enhance brand visibility. The firm's commitment to transparency and consistent communication across these channels is fundamental to its capital-raising success and investor retention efforts.

In 2024, Carlyle continued to refine its digital investor portals and actively participate in key industry conferences, reinforcing its commitment to accessible and transparent communication. This strategic use of channels ensures that both existing and potential investors remain informed about the firm's performance, strategies, and market outlook.

The firm's media outreach in 2024 emphasized its investment successes and ESG commitments, further solidifying its reputation. By leveraging these diverse channels, Carlyle effectively engages with its stakeholders, driving business development and strengthening its position in the global investment landscape.

| Channel | Purpose | 2023/2024 Highlight | Key Investor Segment |

|---|---|---|---|

| Direct Sales & Investor Relations | Capital raising, relationship building | Secured over $20 billion in capital commitments in 2023; maintained consistent communication in 2024. | Institutional Investors, High-Net-Worth Individuals |

| Corporate Website & Investor Portals | Information dissemination, transparency | Enhanced user experience in 2024 for easier performance tracking. | All Limited Partners |

| Industry Conferences & Forums | Networking, brand building, thought leadership | Prominent participation at SuperReturn International in 2024. | Pension Funds, Sovereign Wealth Funds, Endowments |

| Public Relations & Media Outreach | Brand visibility, communicating successes | Highlighted ESG initiatives and successful exits in 2024 through financial publications. | Broad Financial Audience, Potential Investors |

Customer Segments

Public and corporate pension funds are crucial for Carlyle Group, acting as substantial, long-term investors. These institutions prioritize steady capital appreciation and broad diversification to secure retirement benefits for their beneficiaries. In 2024, the global pension fund market continued its growth trajectory, with assets under management reaching trillions of dollars, making them a cornerstone for private equity fundraising.

Sovereign Wealth Funds (SWFs) are significant players in the global investment landscape, managing trillions of dollars. These government-owned entities, often driven by objectives like economic diversification and intergenerational wealth preservation, seek stable, long-term returns and strategic partnerships. Carlyle’s extensive global network and diversified investment strategies, spanning private equity, credit, and real assets, align well with the broad mandates and substantial capital deployment capabilities of SWFs.

In 2024, SWFs continued to be a crucial source of capital for alternative asset managers like Carlyle. For instance, the Norway Government Pension Fund Global, one of the world's largest SWFs, reported managing approximately $1.4 trillion as of early 2024, demonstrating the scale of capital available. Carlyle's ability to offer access to niche markets and specialized investment themes, such as infrastructure and technology, makes it an attractive partner for SWFs looking to enhance portfolio diversification and achieve specific economic or strategic goals.

Insurance companies represent a significant customer segment for Carlyle Group, primarily due to their need to invest substantial assets to cover long-term liabilities. They are actively seeking investment strategies that offer both consistent income generation and capital appreciation. Carlyle's expertise in credit and real assets aligns well with these objectives, providing solutions designed to meet these specific financial requirements.

In 2024, Carlyle reported a notable increase in assets under management within its insurance solutions business, reflecting growing confidence from these institutional investors. This segment has been a key driver of growth, with Carlyle actively developing tailored investment products to cater to the evolving needs of insurers seeking yield and stability in their portfolios.

Endowments and Foundations

Endowments and foundations are vital clients for Carlyle Group, representing non-profit entities with long-term, perpetual investment goals. Their primary objective is to preserve and grow capital to fund their ongoing charitable missions. These organizations often seek robust, consistent returns from a diversified array of alternative investments, aligning with Carlyle's expertise in private equity, credit, and real assets.

In 2024, endowments and foundations continued to be significant allocators to private markets, with many increasing their exposure to alternative asset classes to enhance yield and diversification. For instance, the average endowment allocation to private equity reached approximately 15% by the end of 2023, a trend expected to persist into 2024 as these institutions seek alpha generation beyond traditional public markets.

- Long-Term Capital Preservation: Focus on strategies that balance growth with capital preservation for indefinite mission support.

- Diversified Alternative Allocations: Seeking exposure across private equity, credit, real estate, and infrastructure to mitigate risk and enhance returns.

- Mission Alignment: Partnering with managers like Carlyle whose investment strategies can support their specific philanthropic objectives.

- Yield Enhancement: Utilizing Carlyle's capabilities to generate consistent income streams and capital appreciation in various market conditions.

High-Net-Worth Individuals and Family Offices

Carlyle Group caters to high-net-worth individuals and family offices by offering exclusive access to private markets, a segment often out of reach for everyday investors. These clients are looking for sophisticated investment strategies and opportunities that can generate significant returns.

The firm's focus on private wealth management is yielding strong results, reflecting a growing demand for alternative investments among affluent demographics. Carlyle has reported substantial growth in its private capital solutions, which directly serve these discerning clients.

- Sophisticated Investment Access: Provides entry to private equity, credit, and real assets, typically reserved for institutional investors.

- Tailored Wealth Solutions: Offers customized portfolio management and advisory services to meet the unique financial goals of affluent clients.

- Growing Private Wealth Momentum: Carlyle has experienced significant inflows and positive performance in its private wealth divisions, underscoring client trust and market demand.

Carlyle Group serves a diverse clientele, ranging from large institutional investors like pension funds and sovereign wealth funds to high-net-worth individuals and family offices. These clients are united by a desire for sophisticated investment strategies and access to alternative asset classes such as private equity, credit, and real assets, aiming for capital appreciation and diversification.

In 2024, the demand for alternative investments remained robust across these segments. For instance, institutional investors continued to allocate significant capital to private markets, with Carlyle's global fundraising efforts reflecting this trend. High-net-worth individuals are increasingly seeking specialized wealth management solutions that provide exposure to these less liquid, potentially higher-return opportunities.

| Customer Segment | Key Motivations | Carlyle's Offering |

|---|---|---|

| Public and Corporate Pension Funds | Long-term growth, diversification, retirement security | Access to private equity, credit, real assets; steady capital appreciation |

| Sovereign Wealth Funds (SWFs) | Economic diversification, intergenerational wealth, stable returns | Global network, specialized investment themes, strategic partnerships |

| Insurance Companies | Yield enhancement, capital appreciation to meet liabilities | Credit and real asset expertise, tailored investment products |

| Endowments and Foundations | Capital preservation, mission funding, consistent returns | Diversified alternative allocations, mission-aligned strategies |

| High-Net-Worth Individuals & Family Offices | Sophisticated access, wealth growth, tailored solutions | Exclusive private market opportunities, customized portfolio management |

Cost Structure

Carlyle Group's employee compensation and benefits represent a significant cost, reflecting the highly skilled nature of its workforce. In 2024, with over 2,300 employees globally, the firm invests heavily in attracting and retaining top investment professionals, management, and support staff. This compensation often includes substantial performance-based incentives and equity plans, aligning employee success with the firm's overall financial performance and demonstrating a commitment to rewarding talent.

Carlyle Group incurs significant fund operating expenses, encompassing administrative fees, legal and compliance costs, and audit fees essential for managing its diverse investment vehicles. These are inherent costs of operating a global investment firm.

For instance, in the first quarter of 2024, Carlyle reported total operating expenses of $696 million, reflecting the scale of its global operations and the complexities of managing multiple funds across different asset classes.

Carlyle Group dedicates significant resources to deal sourcing and due diligence, a crucial part of its investment process. These expenses cover external advisors, market research, and the extensive travel required to evaluate potential opportunities globally. For instance, in 2023, the firm's operating expenses, which include these costs, totaled $2.3 billion.

These upfront investments are essential for identifying high-quality deals and mitigating risks before committing capital. The thoroughness of their due diligence is a key factor in Carlyle's long-term success, ensuring they make informed investment decisions. The firm's ability to attract and retain top talent in deal origination and analysis directly impacts the effectiveness of these expenditures.

Office and Infrastructure Costs

Carlyle Group incurs significant expenses to maintain its global presence, which includes 29 offices strategically located across North America, Europe, Asia, and Australia. These costs encompass everything from prime real estate leases and essential utilities to the robust technology infrastructure needed to support a worldwide investment platform. In 2023, the company reported total operating expenses of $2.3 billion, a portion of which directly relates to these office and infrastructure requirements.

These operational overheads are crucial for facilitating Carlyle's diverse investment strategies and client services. The company’s commitment to a strong physical presence in key financial hubs enables efficient deal sourcing, due diligence, and portfolio management across its various funds.

- Global Office Network: Maintaining 29 offices across four continents.

- Operational Expenses: Covering rent, utilities, and technology infrastructure.

- Support for Investment Platform: Essential for global deal sourcing and management.

- 2023 Operating Expenses: Totaling $2.3 billion, with a significant allocation to infrastructure.

Marketing and Investor Relations Expenses

Carlyle Group dedicates significant resources to marketing and investor relations. These costs are crucial for their fundraising success and maintaining strong relationships with their limited partners (LPs). In 2024, these expenses would encompass everything from creating compelling marketing materials to actively engaging with potential and existing investors.

The firm's spending in this area supports activities like roadshows, investor conferences, and the development of sophisticated investor portals. These efforts are directly tied to attracting and retaining the substantial Assets Under Management (AUM) that fuel their business. For instance, a portion of these costs would be allocated to producing detailed quarterly reports and hosting investor calls to provide transparency and build confidence.

- Fundraising Efforts: Costs associated with marketing campaigns, roadshows, and investor presentations aimed at attracting new capital.

- Investor Communications: Expenses for maintaining investor relations, including regular reporting, investor portals, and dedicated support staff.

- Marketing Materials: Investment in high-quality brochures, digital content, and website development to showcase Carlyle's expertise and performance.

- Industry Conferences: Participation fees and travel expenses for key personnel to attend and present at prominent financial industry events.

Technology and data infrastructure represent a significant investment for Carlyle Group, underpinning its global operations and analytical capabilities. This includes substantial spending on software, hardware, cybersecurity, and data management systems to support investment analysis, portfolio management, and client reporting.

| Cost Category | Description | 2023/2024 Relevance |

| Technology Infrastructure | Software licenses, cloud services, hardware, cybersecurity | Essential for data analysis, trading, and risk management. |

| Data Acquisition | Subscriptions to financial data providers, market intelligence | Crucial for deal sourcing and due diligence. |

| Platform Development | Investment in proprietary analytical tools and systems | Enhances investment decision-making and operational efficiency. |

Revenue Streams

Management fees represent a cornerstone of Carlyle Group's revenue, calculated as a percentage of their substantial Assets Under Management (AUM). This structure ensures a predictable and consistent income stream, largely independent of the fluctuating performance of their investments. In the first quarter of 2025, Carlyle Group reported a record $311 million in fee-related earnings, underscoring the significance of this revenue source.

Performance fees, often called carried interest, represent a significant revenue source for Carlyle. This income is generated when the firm's investments perform well, exceeding a predetermined hurdle rate. It's a way to ensure Carlyle's interests are directly tied to the success of its investors, the limited partners.

In late 2024, Carlyle reported that its net accrued performance fees saw a healthy increase, rising by 15% year-over-year to reach $2.74 billion. This figure underscores the importance of successful investment management in driving the firm's profitability.

Carlyle Group generates substantial revenue through transaction and advisory fees. These fees stem from their expertise in guiding portfolio companies through complex financial maneuvers like mergers, acquisitions, and strategic restructurings.

In the first quarter of 2025, Carlyle reported robust growth in these fee-related earnings, a testament to their active deal-making and advisory capabilities. This segment plays a crucial role in their overall business model, showcasing their value-add beyond mere capital provision.

Capital Markets Income

Carlyle Group generates significant revenue from its capital markets activities. This includes fees earned from underwriting and arranging various forms of financing, such as debt and equity, for both its own portfolio companies and external clients. This segment plays a crucial role in diversifying the firm's overall income streams.

In 2023, Carlyle's Capital Markets segment demonstrated robust performance. The firm reported substantial fee-related earnings, a key component of its capital markets income. For instance, Carlyle's total fee-related earnings were approximately $1.5 billion in 2023, with capital markets activities contributing a notable portion through arrangement and underwriting fees.

- Underwriting Fees: Revenue generated from assisting companies in issuing new securities, like stocks or bonds.

- Arrangement Fees: Income earned from structuring and facilitating debt financing for portfolio companies and clients.

- Advisory Services: Fees for providing strategic financial advice related to capital raising and transactions.

- Diversified Income: This segment complements other revenue sources, contributing to the stability and breadth of Carlyle's earnings.

Real Estate and Infrastructure Income

Carlyle Group's real assets segment, encompassing real estate and infrastructure, is a significant contributor to its diversified revenue. This segment primarily generates income through rental payments from its extensive property portfolio and operational infrastructure assets. In 2024, the firm continued to leverage its expertise in managing these physical assets, aiming for stable income generation.

Beyond recurring rental income, Carlyle also realizes gains from the strategic disposition of properties and infrastructure projects. These capital events, when market conditions are favorable, provide substantial boosts to its revenue streams. This approach allows for active management and value creation within the real assets portfolio.

The income derived from real estate and infrastructure offers a valuable counterpoint to the more cyclical nature of traditional private equity investments. This diversification helps to smooth out overall firm performance and provides additional avenues for capital deployment and return generation. For example, in the first half of 2024, Carlyle reported strong performance in its infrastructure funds, driven by investments in renewable energy and digital infrastructure.

- Rental Income: Carlyle collects rent from a wide array of commercial, residential, and industrial properties.

- Property Sales: Profits are realized through the sale of developed or improved real estate assets.

- Infrastructure Revenues: Income is generated from operational infrastructure assets like toll roads, utilities, and communication networks.

Carlyle Group's revenue streams are diverse, built upon management fees, performance fees, transaction and advisory services, capital markets activities, and real assets. These pillars ensure a robust and multifaceted income generation model.

| Revenue Stream | Description | 2024/2025 Data Point |

|---|---|---|

| Management Fees | Percentage of Assets Under Management (AUM) | Fee-related earnings reached $311 million in Q1 2025. |

| Performance Fees (Carried Interest) | Share of profits from successful investments | Net accrued performance fees increased 15% YoY to $2.74 billion in late 2024. |

| Transaction & Advisory Fees | Fees for M&A, restructuring, and strategic advice | Robust growth reported in Q1 2025 fee-related earnings. |

| Capital Markets | Underwriting, arrangement, and advisory on financing | Significant fee-related earnings in 2023, contributing to total of ~$1.5 billion. |

| Real Assets | Rental income and gains from property/infrastructure sales | Strong performance in infrastructure funds in H1 2024. |

Business Model Canvas Data Sources

The Carlyle Group's Business Model Canvas is informed by a robust combination of proprietary financial data, extensive market research, and deep industry expertise. These sources enable a comprehensive understanding of investment strategies, portfolio performance, and market opportunities.