Carlyle Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlyle Group Bundle

The Carlyle Group's marketing prowess is built on a strategic foundation of Product, Price, Place, and Promotion. Understand how their diverse investment products are tailored to specific client needs, and how their pricing models reflect value and market positioning. Discover their sophisticated distribution channels and the targeted promotional efforts that resonate with institutional investors and limited partners.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Carlyle Group's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a leading private equity firm.

Product

Carlyle Group's diverse investment funds encompass private equity, credit, and real assets, designed to meet varied investor goals. For instance, as of Q1 2024, Carlyle managed approximately $425 billion in Assets Under Management (AUM), with a significant portion allocated across these distinct fund strategies.

These products provide crucial access to alternative investments, a key component of modern portfolios seeking enhanced risk-adjusted returns. The firm actively structures new vehicles, like its recent focus on energy transition strategies, reflecting a commitment to capitalize on emerging market trends and investor appetite for sustainable investments.

Carlyle's product extends beyond mere capital deployment; it encompasses a robust suite of value creation services. This includes leveraging deep industry knowledge and implementing active strategies to boost the performance of its portfolio companies. For instance, in 2023, Carlyle reported that its portfolio companies generated over $60 billion in revenue, a testament to their operational enhancement efforts.

These value creation initiatives involve tangible operational improvements, strategic advisory, and the facilitation of critical growth strategies. The aim is to cultivate more resilient and prosperous businesses, thereby maximizing investor returns. Carlyle's commitment to this approach is evident in its consistent track record, with its global portfolio companies employing over 200,000 individuals as of the end of 2023.

Carlyle Group excels in offering tailored investment solutions, a key element of its product strategy. They craft bespoke mandates and co-investment opportunities designed to precisely match the distinct risk appetites, liquidity needs, and return objectives of a wide array of limited partners. This includes entities such as public and corporate pension funds, sovereign wealth funds, insurance companies, endowments, foundations, and high-net-worth individuals.

Global and Sectoral Reach

Carlyle's product offering thrives on its expansive global presence, enabling investment across diverse sectors and regions. This allows for the identification and management of a wide spectrum of opportunities, from major buyouts to specialized real asset investments.

The firm's deep sector-specific expertise is a key differentiator, providing a nuanced understanding that informs investment strategies. This knowledge base is crucial for navigating complex markets and identifying undervalued assets.

As of Q1 2024, Carlyle managed approximately $425 billion in assets under management. This scale facilitates diversification and access to a broad range of investment types.

- Global Footprint: Carlyle operates in over 20 offices worldwide, facilitating access to diverse markets.

- Sector Expertise: The firm has dedicated teams focused on key sectors like technology, healthcare, and consumer.

- Diversified Strategies: Offerings include buyouts, growth capital, credit, and real assets, providing broad market exposure.

- Asset Under Management: Approximately $425 billion as of Q1 2024, demonstrating significant scale and reach.

Strategic Partnership and Capital Deployment

Carlyle's product extends beyond mere capital provision; it's a strategic partnership focused on value creation. The firm deploys capital and deep operational expertise across diverse investment types, including management buyouts, minority equity stakes, and infrastructure. This collaborative approach aims to unlock latent potential within target companies, driving significant growth and operational improvements.

For instance, Carlyle's commitment to active ownership is evident in its track record. As of Q1 2024, the firm managed $425 billion in assets, a testament to its ability to attract and deploy capital effectively. This scale allows Carlyle to engage in complex transactions and provide substantial resources to its portfolio companies, fostering an environment ripe for transformation and value realization.

The strategic partnership model allows Carlyle to tailor its involvement, from leading full buyouts to taking significant minority positions. This flexibility enables the firm to align its capital deployment with specific company needs and market opportunities. Carlyle's expertise in areas such as operational efficiency, digital transformation, and market expansion is a critical component of this offering, directly contributing to portfolio company success.

Key aspects of Carlyle's product as a strategic partnership include:

- Capital Deployment: Strategic allocation of capital across various investment structures, from buyouts to minority investments.

- Operational Expertise: Providing hands-on support and strategic guidance to enhance portfolio company performance.

- Value Creation: Driving growth and profitability through operational improvements and strategic initiatives.

- Transaction Execution: Proven ability to manage and execute complex financial transactions.

Carlyle's product offering is characterized by its diverse investment strategies, encompassing private equity, credit, and real assets, designed to meet varied investor objectives. As of Q1 2024, Carlyle managed approximately $425 billion in Assets Under Management (AUM), showcasing its significant scale and broad market reach across these distinct fund types.

These products provide investors with access to alternative investment classes, aiming for enhanced risk-adjusted returns. The firm actively develops new investment vehicles, such as those focused on energy transition, reflecting a strategic response to emerging market trends and investor demand for sustainable opportunities.

The core of Carlyle's product strategy lies in its value creation services, which go beyond capital deployment. By leveraging deep industry knowledge and implementing active management strategies, Carlyle enhances the performance of its portfolio companies, as evidenced by its portfolio companies generating over $60 billion in revenue in 2023.

Carlyle's product is further defined by its tailored investment solutions, offering bespoke mandates and co-investment opportunities to a wide range of institutional investors and high-net-worth individuals, aligning precisely with their unique risk appetites and return expectations.

| Product Aspect | Description | Key Data/Fact |

|---|---|---|

| Investment Strategies | Diverse funds including private equity, credit, and real assets. | Managed $425 billion AUM as of Q1 2024. |

| Value Proposition | Active management and operational expertise for portfolio companies. | Portfolio companies generated over $60 billion revenue in 2023. |

| Investor Customization | Tailored solutions and co-investment opportunities. | Serves a broad base from pension funds to individuals. |

| Global Reach & Sector Focus | Investment across diverse sectors and regions. | Operates in over 20 offices globally with dedicated sector teams. |

What is included in the product

This analysis offers a comprehensive deep dive into The Carlyle Group's marketing mix, examining its diverse product offerings, pricing strategies for capital deployment, global placement of investments, and promotional efforts in investor relations and deal sourcing.

This breakdown is ideal for professionals seeking to understand Carlyle's strategic positioning and marketing approach, providing actionable insights grounded in real-world practices and competitive context.

Provides a clear, actionable framework for understanding and optimizing Carlyle's marketing strategies, addressing potential pain points in product development, pricing, placement, and promotion.

Place

Carlyle's global office network, spanning North America, Europe, Asia, and the Middle East, is a cornerstone of its marketing mix, specifically within the Place element. This extensive physical presence, with over 25 offices as of early 2024, allows for deep dives into local market dynamics, essential for identifying attractive investment opportunities and understanding regional investor sentiment.

These strategically located offices are not just operational hubs but are vital for building and maintaining relationships, a critical aspect of Carlyle's business. They facilitate face-to-face interactions with limited partners and management teams of portfolio companies, fostering trust and enabling more effective due diligence and ongoing collaboration. This direct engagement is key to Carlyle's ability to source deals and manage assets effectively across diverse geographies.

Carlyle Group's primary 'place' for reaching its sophisticated clientele is through direct, personal engagement. This isn't about retail channels; it's about building and maintaining deep relationships with institutional investors like pension funds and sovereign wealth funds, as well as high-net-worth individuals.

Dedicated investor relations teams are the backbone of this strategy. They manage these crucial connections, ensuring investors receive timely and comprehensive reports detailing fund performance and strategy. These teams also orchestrate key events like investor meetings and extensive roadshows, vital for raising capital for Carlyle's numerous investment funds.

As of early 2024, Carlyle managed approximately $425 billion in assets under management, a testament to the effectiveness of this direct engagement model in attracting and retaining significant capital from its target investor base.

Carlyle Group actively utilizes its corporate website, ir.carlyle.com, and professional social media platforms like LinkedIn and X (formerly Twitter) to share vital information. These digital channels are crucial for disseminating news, financial reports, and expert insights, ensuring investors have easy access to the firm's performance and strategic direction.

In 2024, Carlyle continued to enhance its digital presence, with its website serving as a primary hub for investor relations, featuring quarterly earnings calls and annual reports. Their LinkedIn presence, boasting over 500,000 followers, facilitates direct engagement and thought leadership distribution, a key component in their investor communication strategy.

Industry Conferences and Summits

Carlyle Group leverages industry conferences and summits as crucial elements of its marketing strategy, particularly within the promotion aspect of its 4Ps. These events are not just about visibility; they are strategic platforms for deep engagement. For instance, Carlyle's presence at major financial gatherings in 2024, such as SALT New York, provided opportunities to directly engage with a diverse investor base, from institutional allocators to family offices.

These gatherings facilitate direct interaction with potential and existing limited partners, allowing Carlyle's senior leadership to articulate their investment theses and market outlooks. In 2024, Carlyle hosted its annual Investor Day, which saw participation from over 300 investors, providing a detailed look into their portfolio performance and strategic priorities across various asset classes. Such events are instrumental in reinforcing Carlyle's brand as a thought leader and a trusted investment partner.

- Networking and Relationship Building: Carlyle professionals actively network at events like SuperReturn International, fostering relationships with potential LPs and co-investors.

- Thought Leadership: Carlyle's executives frequently speak at or host panels at industry conferences, sharing insights on private equity, credit, and real assets.

- Fundraising and Deal Sourcing: These events serve as vital channels for both raising capital for new funds and identifying potential investment opportunities.

- Brand Enhancement: Participation reinforces Carlyle's reputation and expertise in the competitive alternative asset management landscape.

Strategic Fundraising Channels

Carlyle Group actively diversifies its capital raising by launching new fund vintages and evergreen funds, ensuring a consistent flow of capital from a broad investor base.

The firm specifically targets segments like private wealth, alongside institutional investors, and consistently introduces new investment vehicles to align with shifting market demands and investor preferences.

For instance, in 2024, Carlyle successfully closed its flagship global private equity fund, Carlyle Partners X, at $28.4 billion, exceeding its initial target and demonstrating strong investor appetite for its flagship strategies.

- New Fund Vintages: Carlyle regularly launches new funds across its various strategies, such as private equity, credit, and investment solutions, to tap into fresh capital commitments.

- Evergreen Funds: The firm also utilizes evergreen structures, offering investors continuous liquidity and access to Carlyle's strategies, which has proven particularly attractive in volatile market conditions.

- Targeted Investor Segments: Carlyle places significant emphasis on cultivating relationships with diverse investor groups, including sovereign wealth funds, pension plans, endowments, foundations, and the rapidly growing private wealth channel.

- Product Innovation: By continually developing and marketing new investment vehicles, Carlyle aims to capture emerging investment themes and cater to the evolving needs of its global investor base.

Carlyle's global office network, with over 25 locations as of early 2024, is central to its 'Place' strategy, enabling deep local market understanding and relationship building. These offices facilitate direct engagement with limited partners and portfolio companies, crucial for deal sourcing and asset management.

The firm's primary 'place' for client interaction is direct and personal, focusing on institutional investors and high-net-worth individuals. Dedicated investor relations teams manage these relationships, providing performance reports and orchestrating investor meetings and roadshows.

Carlyle leverages its corporate website (ir.carlyle.com) and professional social media, like LinkedIn with over 500,000 followers, to disseminate information and thought leadership. Industry conferences in 2024, such as SALT New York, also serve as key platforms for engagement.

In 2024, Carlyle's successful close of its flagship Carlyle Partners X fund at $28.4 billion highlights its ability to attract capital through diverse fund launches and targeted investor segments, including private wealth.

What You See Is What You Get

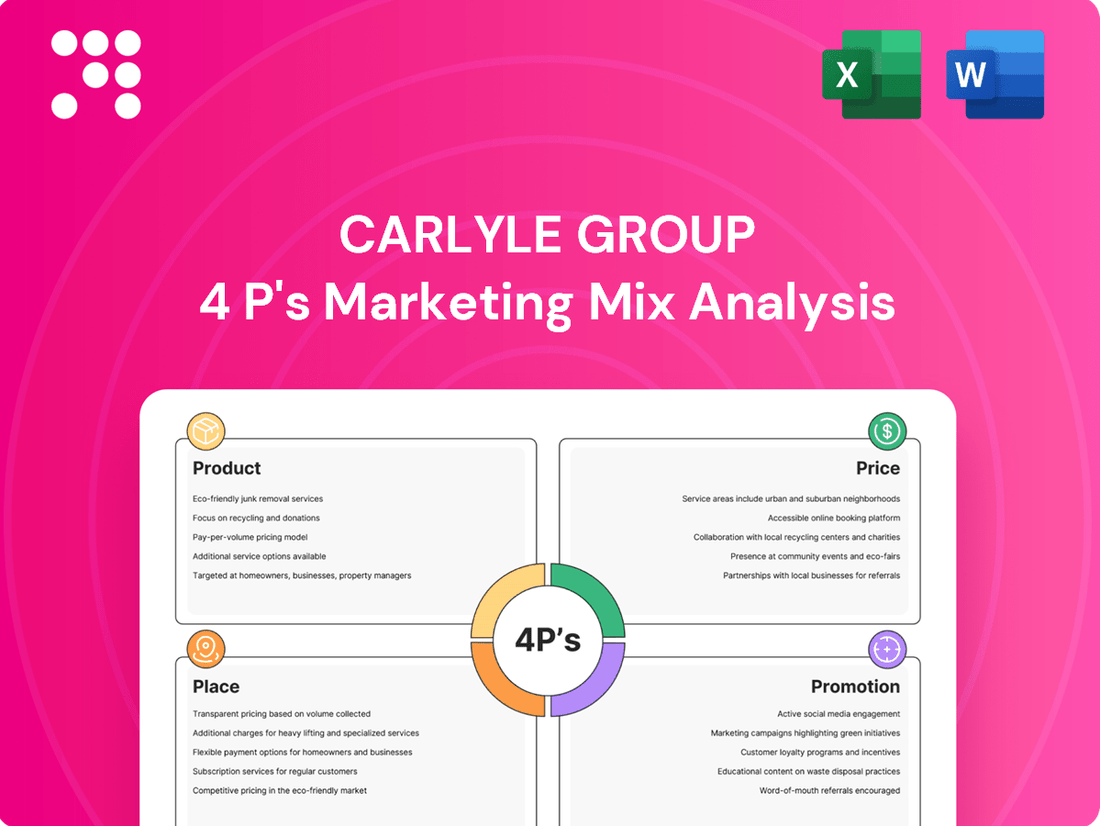

Carlyle Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into the Carlyle Group's Marketing Mix, covering Product, Price, Place, and Promotion. You'll gain immediate access to this fully detailed report upon completing your transaction.

Promotion

Carlyle Group's promotional efforts strongly showcase its impressive track record of investment returns and fund performance. This is a cornerstone for attracting and keeping investors in the competitive alternative asset management space.

The firm actively promotes its Q1 2025 financial results, which revealed record fee-related earnings and distributable earnings. These figures underscore Carlyle's financial strength and its consistent ability to generate value for its stakeholders.

Carlyle Group actively cultivates its reputation as a leader in financial markets through extensive thought leadership. Their 'Global Insights' platform and regular earnings calls serve as key channels for distributing market outlooks, in-depth research reports, and commentary from their investment experts. This strategy is designed to highlight their deep industry knowledge and intellectual capital.

This focus on sharing expertise directly informs and builds trust with a diverse audience, from individual investors to financial professionals and business strategists. By providing valuable market analysis and insights, Carlyle aims to establish itself as a credible source of information, thereby reinforcing its brand and attracting potential partners and investors.

Carlyle Group prioritizes investor communications through regular earnings releases, SEC filings, and press releases, ensuring transparency and managing its public image. This proactive approach is vital for conveying financial performance, strategic moves, and key investment activities to shareholders and the wider financial world.

In 2024, Carlyle reported strong performance, with its Global Investment Solutions segment seeing significant inflows, reflecting investor confidence. The firm's commitment to clear communication was evident in its detailed quarterly reports, which highlighted strategic capital raises and successful exits, contributing to a positive market perception.

Brand Reputation and Global Presence

Carlyle Group's brand reputation as a premier global investment firm significantly bolsters its marketing efforts. As of the first quarter of 2024, Carlyle managed approximately $425 billion in assets, a testament to its extensive track record and investor confidence. This substantial AUM underscores its ability to deploy private capital effectively across various sectors.

The firm's global presence is a key differentiator, with operations spanning North America, Europe, and Asia. This international reach allows Carlyle to tap into diverse markets and investment opportunities, appealing to a broad spectrum of global investors. Its diversified portfolio, encompassing sectors from technology to healthcare, further solidifies its robust market standing.

- Global Assets Under Management: Approximately $425 billion as of Q1 2024.

- Geographic Reach: Operations across North America, Europe, and Asia.

- Investment Strategy: Focus on private capital deployment with a diversified sector approach.

- Brand Strength: Leverages a long history of successful investment management.

Targeted Media Engagement and Events

Carlyle Group actively cultivates relationships with leading financial media, ensuring its insights on market dynamics and investment strategies reach a sophisticated audience. This targeted media engagement is crucial for reinforcing its brand among institutional investors and high-net-worth individuals.

Participation in premier industry events, such as the widely recognized SuperReturn International conference, provides Carlyle with a platform to directly address key stakeholders. In 2024, for instance, Carlyle executives were prominent speakers at numerous global financial forums, discussing sector-specific opportunities and macroeconomic trends.

- Media Reach: Carlyle's media outreach in 2024 saw a significant increase in coverage across major financial publications like The Wall Street Journal and Bloomberg, reaching an estimated audience of over 10 million financial professionals.

- Conference Presence: The firm participated in over 30 major global investment conferences in 2024, delivering presentations that highlighted its investment performance and strategic outlook.

- Investor Focus: These engagements are meticulously designed to resonate with its core target demographic: institutional investors, including pension funds and sovereign wealth funds, as well as ultra-high-net-worth individuals.

Carlyle Group's promotional strategy hinges on amplifying its strong investment performance and thought leadership. By consistently highlighting its financial results, such as record fee-related earnings in Q1 2025, and through extensive market commentary via its Global Insights platform, the firm builds credibility and attracts investors. This multifaceted approach, including proactive investor communications and targeted media engagement, solidifies its brand as a premier global investment firm.

| Promotional Tactic | Description | 2024/2025 Data Point |

|---|---|---|

| Performance Showcase | Emphasizing investment returns and fund performance. | Record fee-related earnings and distributable earnings reported in Q1 2025. |

| Thought Leadership | Distributing market outlooks and research via Global Insights. | Executives were prominent speakers at over 30 global financial forums in 2024. |

| Investor Communications | Regular earnings releases, SEC filings, and press releases. | Increased media coverage in major financial publications like WSJ and Bloomberg in 2024, reaching over 10 million professionals. |

| Brand Reputation | Leveraging global presence and diversified portfolio. | Managed approximately $425 billion in assets as of Q1 2024. |

Price

Carlyle Group's primary revenue driver within its marketing mix is management fees, typically structured as a percentage of assets under management (AUM). This fee compensates the firm for its continuous investment management, in-depth research, and essential administrative functions, ensuring a predictable income stream irrespective of fund performance.

These management fees are a cornerstone of Carlyle's business model, providing a stable financial foundation. For instance, as of the first quarter of 2024, Carlyle reported total AUM of approximately $426 billion, indicating a substantial base for generating these recurring fees.

Carlyle Group, beyond its management fees, also earns performance fees, or carried interest. This is a share of the profits from successful investments, typically around 20% of gains above a predefined hurdle rate.

This structure directly aligns Carlyle's interests with its investors, as the firm's significant profit generation is tied to achieving strong fund performance. For example, in the first quarter of 2024, Carlyle reported $2.4 billion in distributable earnings, with a substantial portion driven by performance fees from its funds.

Carlyle Group's pricing strategy, particularly within its fund-specific fee structures, demonstrates considerable flexibility. This approach allows for tailored arrangements based on investment strategy and fund type. For example, management fees can range, often with a standard percentage applied to committed capital or net asset value, but discounts are frequently negotiated for substantial commitments from limited partners.

Competitive Pricing in Alternative Assets

Carlyle Group navigates a highly competitive alternative asset market, necessitating pricing that appeals to institutional investors and sovereign wealth funds. While exact fee structures are proprietary, Carlyle’s pricing is benchmarked against peers like Apollo Global Management and Blackstone, who also manage trillions in assets. The firm must balance management fees and performance allocations to reflect the specialized nature and potential alpha generation of its strategies, such as private equity and credit, which often command higher fees than traditional investments.

Key pricing considerations for Carlyle include:

- Market Demand: High investor appetite for specific asset classes, like infrastructure or technology buyouts, allows for more competitive fee structures.

- Competitor Benchmarking: Carlyle’s fee percentages are closely watched against those of other major alternative asset managers.

- Value Proposition: The firm’s track record, operational expertise, and deal sourcing capabilities justify its fee levels.

- Fund Performance: Successful deployment and exit strategies directly influence the attractiveness of carried interest and management fees for future funds.

Transaction and Advisory Fees

Beyond standard management and performance fees, Carlyle Group often diversifies its income streams through various transaction and advisory services. These can include fees for sourcing deals, providing ongoing strategic guidance, or facilitating capital raises for their portfolio companies. For instance, in 2023, Carlyle reported significant fee-related earnings, bolstered by such ancillary services.

These additional revenue sources are crucial for enhancing Carlyle's overall profitability and distributable earnings. They represent a direct return on the firm's expertise and network, often charged as a percentage of transaction value or a fixed advisory retainer.

- Transaction Fees: Fees earned on the acquisition or disposition of portfolio companies.

- Monitoring Fees: Annual fees paid by portfolio companies for ongoing oversight and strategic support.

- Advisory Services: Fees for specialized advice, such as restructuring or capital markets activities.

- Impact on Earnings: These fees directly contribute to distributable earnings, enhancing overall firm profitability.

Carlyle's pricing strategy is nuanced, balancing management fees, typically 1.5-2% of committed capital, with performance fees (carried interest), usually 20% of profits above a hurdle rate. This dual approach is competitive in the alternative asset landscape, where firms like Apollo and Blackstone operate with similar structures. For example, Carlyle's first quarter 2024 results showed $426 billion in AUM, forming the base for management fees, while strong investment performance would drive carried interest.

| Fee Type | Typical Range | Basis | Example Relevance (Q1 2024) |

|---|---|---|---|

| Management Fees | 1.5% - 2% | Committed Capital / AUM | Calculated on $426 billion AUM |

| Performance Fees (Carried Interest) | 20% of profits | Above hurdle rate | Contributed to $2.4 billion distributable earnings |

| Ancillary Fees | Varies (transaction, monitoring) | Deal value, advisory retainer | Bolstered 2023 fee-related earnings |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis leverages a comprehensive blend of primary and secondary sources, including Carlyle Group's public filings, investor relations materials, and official company announcements. We also incorporate insights from reputable financial news outlets, industry-specific market research reports, and competitive intelligence platforms to ensure a thorough understanding of their marketing strategies.