CALIDA Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CALIDA Group Bundle

CALIDA Group's strong brand portfolio and international presence are key strengths, but they face challenges from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for navigating the apparel market.

Want the full story behind CALIDA Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CALIDA Group boasts a robust brand portfolio, notably featuring CALIDA and AUBADE. These brands have achieved leadership positions in their respective domestic markets, particularly within the premium underwear and lingerie segments. This strong presence allows the group to effectively serve a sophisticated customer base that prioritizes quality and sophisticated design.

The group's strategic decision to divest non-core assets has further sharpened its focus on these core textile businesses. For instance, the divestment of the Millet Mountain Group in 2023 streamlined operations, allowing for greater concentration on the high-margin premium underwear sector. This focus is crucial for leveraging the established brand equity and market penetration of CALIDA and AUBADE.

In 2023, the CALIDA brand alone contributed significantly to the group's revenue, demonstrating its continued strength and customer loyalty in the premium segment. This brand power is a key differentiator, enabling CALIDA Group to command premium pricing and maintain healthy profit margins even amidst evolving market dynamics.

CALIDA Group is experiencing robust e-commerce growth, with online sales reaching 33.7% in 2024. This digital push, exemplified by the AUBADE e-commerce platform migration, bolsters operational independence and adaptability, crucial for global reach.

The group's integrated omni-channel strategy, blending physical retail, direct online sales, and wholesale partnerships, ensures broad market penetration and customer accessibility.

CALIDA Group demonstrated strong financial resilience in 2024, achieving a net profit of CHF 14.9 million. This return to profitability was significantly boosted by the strategic divestment of LAFUMA MOBILIER, allowing the company to focus on its core textile operations.

The group's balance sheet is exceptionally strong, evidenced by its debt-free status and a notable increase in net liquidity. This financial stability provides a solid foundation for future strategic initiatives and operational flexibility.

This sound financial health, combined with a clear strategic realignment towards its textile business, positions CALIDA Group favorably for sustained stability and potential growth in the evolving market landscape.

Commitment to Sustainability and Quality

CALIDA Group's dedication to sustainability is a significant strength, evidenced by certifications like OEKO-TEX® and Made in Green. This focus on resource-friendly production and innovative, durable materials appeals strongly to the growing segment of environmentally aware consumers, particularly in the premium market. For instance, in 2023, the Group continued to emphasize sustainable sourcing, with a target to increase the proportion of certified sustainable cotton used in its products.

This commitment to ethical practices and high-quality, long-lasting products not only bolsters brand reputation but also cultivates robust customer loyalty. Consumers are increasingly willing to invest in brands that align with their values. This is reflected in market trends where sustainable fashion saw continued growth through 2024, with reports indicating a double-digit percentage increase in consumer spending on eco-certified apparel.

- OEKO-TEX® and Made in Green Certifications: Demonstrates a commitment to product safety and environmentally responsible manufacturing.

- Resource-Friendly Production: Focus on minimizing environmental impact throughout the supply chain.

- Innovative Materials: Development and use of materials that are both high-quality and sustainable.

- Consumer Resonance: Strong appeal to eco-conscious consumers in the premium market segment.

Experienced New Leadership and Operational Optimization

The appointment of Thomas Stöcklin as CEO in June 2025, along with other key management shifts, highlights a strategic push towards operational efficiency and maximizing the group's brand value. This leadership transition is expected to drive significant improvements across CALIDA Group's various segments.

CALIDA Group is actively engaged in structural and operational optimization initiatives. A key element of this strategy involves the repositioning of its COSABELLA brand, a move designed to streamline operations and boost overall group efficiency. These efforts are anticipated to yield tangible benefits in the 2024-2025 fiscal year.

- New Leadership: Thomas Stöcklin appointed CEO in June 2025, signaling a fresh direction.

- Operational Focus: Ongoing optimization aims to enhance efficiency and unlock brand potential.

- Brand Repositioning: COSABELLA's strategic realignment is a core part of the efficiency drive.

CALIDA Group benefits from strong brand recognition, particularly with CALIDA and AUBADE holding leading positions in the premium underwear market. The group's strategic focus on these core textile businesses, reinforced by divestments like Millet Mountain Group in 2023, sharpens its competitive edge. This concentration allows for better leveraging of brand equity and market penetration, as seen with the CALIDA brand's significant revenue contribution in 2023.

The group's financial health is a significant strength, highlighted by its debt-free status and increased net liquidity in 2024, following a net profit of CHF 14.9 million. This stability underpins its capacity for strategic initiatives and operational flexibility. Furthermore, CALIDA Group's commitment to sustainability, demonstrated through OEKO-TEX® and Made in Green certifications, resonates with eco-conscious consumers, bolstering brand reputation and customer loyalty.

CALIDA Group is actively enhancing its operational efficiency through structural optimization and leadership changes, including the appointment of Thomas Stöcklin as CEO in June 2025. The repositioning of brands like COSABELLA is a key part of this strategy, aiming to maximize brand value and streamline operations for anticipated benefits in the 2024-2025 fiscal year. The robust growth in e-commerce, reaching 33.7% in 2024, further strengthens the group's adaptability and global reach.

| Metric | 2023 Data | 2024 Data | Significance |

|---|---|---|---|

| CALIDA Brand Revenue Contribution | Significant | N/A | Demonstrates strong brand loyalty and market position. |

| E-commerce Sales Percentage | N/A | 33.7% | Highlights successful digital transformation and expanded reach. |

| Net Profit | N/A | CHF 14.9 million | Indicates return to profitability and financial resilience. |

| Debt Status | Debt-free | Debt-free | Provides strong financial foundation and flexibility. |

What is included in the product

Delivers a strategic overview of CALIDA Group’s internal and external business factors, highlighting its brand strength and market position while addressing potential operational challenges and evolving consumer trends.

Offers a clear, actionable framework to address CALIDA Group's specific market challenges and leverage its unique brand strengths.

Weaknesses

CALIDA Group faced a significant hurdle with a currency-adjusted sales drop of 8.5% in 2024, followed by a further 7.1% decline in the first half of 2025. This downturn was notably concentrated in its core brands, including CALIDA and AUBADE.

The primary driver behind these declining sales is a widespread subdued consumer sentiment, which has dampened purchasing power. This, combined with weak performance in physical retail stores, particularly in key markets like France for AUBADE, has directly impacted the group's overall revenue generation.

The CALIDA Group's COSABELLA brand is navigating a difficult period marked by significant sales contractions. In 2024, COSABELLA experienced a 21.5% drop in sales, which continued into the first half of 2025 with a further 23.5% decline. This substantial downturn is a direct consequence of the brand's ongoing 'necessary repositioning' and 'fundamental restructuring' efforts.

These strategic realignments are proving to be resource-intensive, demanding considerable financial investment and personnel allocation. This ongoing absorption of resources suggests that the period of instability and investment for COSABELLA is not yet concluded, impacting the group's overall performance until the restructuring yields positive results.

CALIDA Group's performance in the first half of 2025 was notably hampered by significant economic uncertainties, particularly those stemming from US trade policy and broader geopolitical tensions. These external pressures created a volatile market, directly impacting consumer confidence and, consequently, purchasing behavior across the group's diverse international markets.

Pressure on Operating Profit and Margins

CALIDA Group is experiencing significant pressure on its operating profit and margins. The adjusted operating profit (EBIT) dropped to CHF 6.4 million in 2024, down from CHF 10.9 million in 2023. This resulted in a reduced adjusted EBIT margin of just 2.8%.

The situation worsened in the first half of 2025, with the adjusted operating result turning negative at CHF -1.3 million. This decline is attributed to a combination of factors, including lower sales volumes and potentially increased sourcing costs, which are squeezing profitability.

- Declining Adjusted EBIT: From CHF 10.9 million in 2023 to CHF 6.4 million in 2024.

- Shrinking EBIT Margin: Fell to 2.8% in 2024.

- Negative H1 2025 Result: Adjusted operating result of CHF -1.3 million.

- Underlying Causes: Lower sales and potential increases in sourcing costs.

Dependence on Recovery of Consumer Sentiment

CALIDA Group's strategic ambitions are closely tied to consumer confidence, which remains a significant vulnerability. A sustained rebound in consumer sentiment is crucial for the full impact of their strategic initiatives to materialize. Until consumer spending patterns stabilize, the pace at which operational optimizations translate into tangible growth may be slower than anticipated.

The company's reliance on a positive consumer outlook means that external economic shifts can directly impede its progress. For instance, if inflation persists or interest rates remain elevated through 2025, consumers might continue to exercise caution, delaying discretionary purchases and impacting CALIDA's sales volumes. This dependence highlights a key challenge in forecasting and achieving growth targets.

- Consumer Sentiment Lag: Recovery in consumer sentiment, crucial for CALIDA's growth, may not fully materialize until late 2025 or early 2026, according to various economic forecasts.

- Impact on Discretionary Spending: Persistent inflation in 2024 and early 2025 continues to dampen discretionary spending, directly affecting demand for CALIDA's products and services.

- Strategic Realization Delay: The full benefits of CALIDA's strategic decisions, such as market expansion or product innovation, are contingent on consumers feeling financially secure enough to engage.

CALIDA Group's core brands, including CALIDA and AUBADE, experienced a significant sales decline of 8.5% in 2024, continuing into the first half of 2025 with a further 7.1% drop. This downturn is largely attributed to subdued consumer sentiment and weak performance in physical retail, particularly impacting AUBADE in France.

The COSABELLA brand is undergoing a substantial restructuring, leading to a sharp sales contraction of 21.5% in 2024 and an additional 23.5% in the first half of 2025. These repositioning efforts are resource-intensive, diverting financial and personnel resources and delaying the brand's return to profitability.

Profitability is under severe pressure, with adjusted EBIT falling to CHF 6.4 million in 2024 from CHF 10.9 million in 2023, resulting in a reduced EBIT margin of 2.8%. The situation deteriorated further in H1 2025, with a negative adjusted operating result of CHF -1.3 million, driven by lower sales and potentially higher sourcing costs.

| Brand | 2024 Sales Change (Adj.) | H1 2025 Sales Change (Adj.) | Key Issues |

|---|---|---|---|

| CALIDA | -8.5% | -7.1% | Subdued consumer sentiment, weak retail |

| AUBADE | -8.5% | -7.1% | Weak retail in France, subdued consumer sentiment |

| COSABELLA | -21.5% | -23.5% | Restructuring, repositioning |

Full Version Awaits

CALIDA Group SWOT Analysis

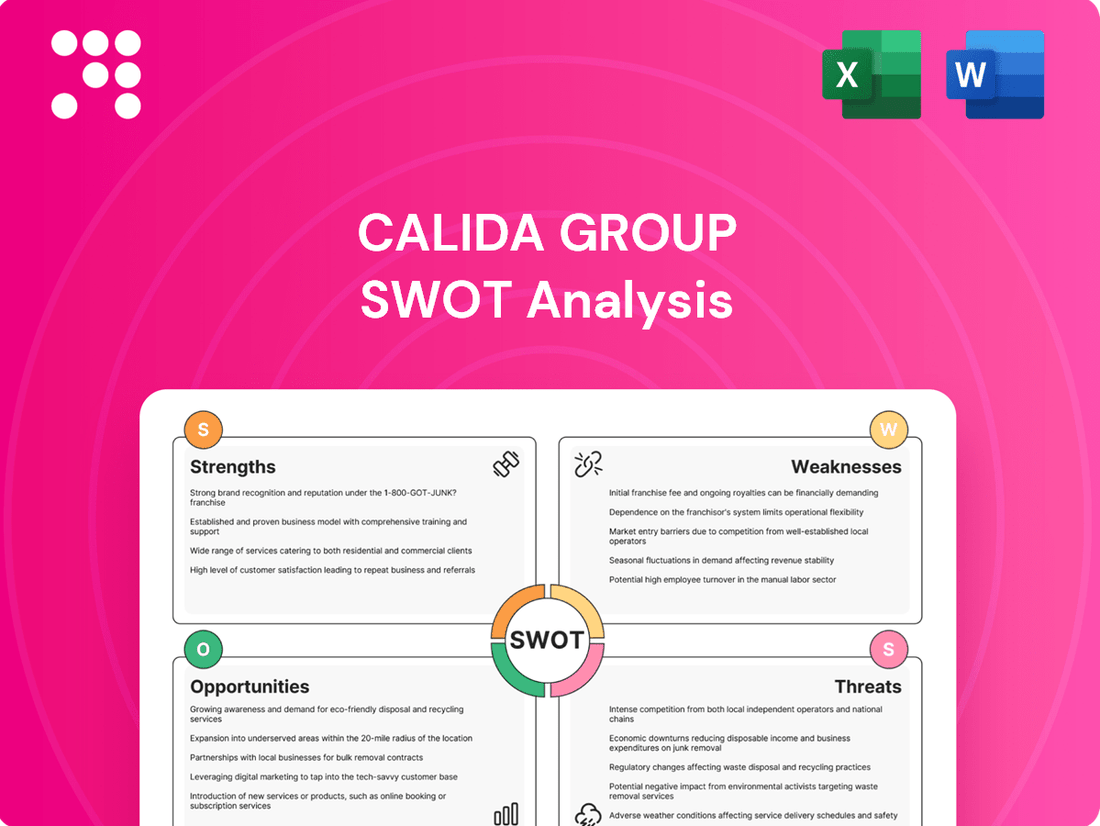

This is the actual CALIDA Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full CALIDA Group SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic insights for informed decision-making.

Opportunities

The robust growth of e-commerce, now representing over a third of CALIDA Group's total sales, is a prime avenue for expanding its global reach. This digital shift allows for efficient penetration into new international markets and customer bases, particularly beneficial for brands like AUBADE.

By strategically investing in cutting-edge e-commerce technologies and refining its digital platforms, CALIDA Group can enhance its ability to connect with a broader audience worldwide. This focus on digital optimization is key to capturing a larger share of the international online apparel market.

The strategic repositioning of COSABELLA presents a significant growth opportunity for the CALIDA Group. By taking over product development and supply chain management for non-US markets from May 2025, COSABELLA is poised to streamline operations and enhance its global reach. This move is expected to unlock the brand's full potential, particularly in the crucial US market, where it aims to become a more substantial contributor to overall group sales.

The global demand for premium, high-quality, and sustainable apparel is on the rise. Consumers are increasingly willing to invest in products that offer durability and ethical production, a trend particularly evident in the underwear and outdoor wear sectors. For instance, the global sustainable apparel market was valued at approximately USD 6.3 billion in 2022 and is projected to grow significantly.

CALIDA Group is strategically positioned to leverage this shift. Their established focus on premium product lines, coupled with a demonstrable commitment to sustainability, aligns perfectly with evolving consumer preferences. This allows them to attract a discerning customer base that prioritizes both quality and eco-consciousness, often reflected in higher average selling prices.

Product Innovation and Diversification within Core Segments

CALIDA Group has a significant opportunity to boost growth by continuously innovating its product offerings. This includes developing fresh designs, utilizing advanced materials, and incorporating new functionalities across its core segments like bodywear, sleepwear, and lingerie.

By exploring cutting-edge technical features, smart textiles, and adaptable designs, the group can better cater to changing consumer demands for enhanced comfort, superior performance, and contemporary style. For instance, the 2024 financial year saw a focus on expanding the product range, with specific initiatives aimed at integrating sustainable materials and digital enhancements into their collections.

- Product Innovation: Developing new designs, materials, and functionalities in bodywear, sleepwear, and lingerie.

- Technical Features: Exploring smart textiles and performance-enhancing elements.

- Consumer Appeal: Meeting evolving preferences for comfort, performance, and style.

- Market Growth: Driving expansion through differentiated and high-value product offerings.

Targeting Emerging Markets and Niche Segments

CALIDA Group can strategically target emerging markets demonstrating increasing disposable incomes and a growing appreciation for fashion. For instance, the Asia-Pacific region presents a significant opportunity for expansion in the men's underwear segment, a market projected to see robust growth.

Furthermore, CALIDA can cultivate new revenue streams by identifying and serving niche segments within its premium underwear and outdoor apparel categories. This approach allows for focused marketing efforts and product development tailored to specific consumer needs and preferences.

- Asia-Pacific Underwear Market Growth: The global men's underwear market, with significant potential in Asia-Pacific, is expected to grow, driven by increasing disposable incomes and evolving fashion trends.

- Niche Segment Potential: Identifying and catering to specific consumer groups within premium segments can lead to higher margins and brand loyalty.

- Diversification Strategy: Expanding into new geographic and demographic markets reduces reliance on established, potentially saturated core markets.

CALIDA Group can capitalize on the growing demand for sustainable and premium apparel by aligning its product development with these consumer preferences. The global sustainable apparel market's projected growth, coupled with the group's existing focus on quality and eco-consciousness, positions them well to attract a discerning customer base and achieve higher average selling prices.

Product innovation presents a key opportunity for CALIDA Group to drive growth across its segments, including bodywear, sleepwear, and lingerie. By integrating advanced materials, new functionalities, and smart textiles, the group can enhance consumer appeal and cater to evolving demands for comfort and performance, as evidenced by their 2024 focus on expanding product ranges with sustainable materials and digital enhancements.

Expansion into emerging markets, particularly in the Asia-Pacific region for men's underwear, offers significant growth potential driven by rising disposable incomes and fashion trends. Additionally, identifying and serving niche segments within their premium offerings can foster brand loyalty and open new revenue streams, diversifying their market presence.

Threats

Persistent subdued consumer sentiment and economic uncertainty remain a significant threat for CALIDA Group. Geopolitical tensions and ongoing trade uncertainties continue to dampen consumer demand, impacting sales across all its brands. For instance, in 2023, consumer confidence in key European markets, where CALIDA has a strong presence, remained below pre-pandemic levels, reflecting cautious spending habits.

This weak consumer demand directly pressures CALIDA Group's sales performance. If consumer confidence does not rebound as expected, the company could face continued downward pressure on revenue and profitability. This is particularly concerning for its brick-and-mortar retail operations, which are more sensitive to shifts in consumer foot traffic and discretionary spending.

The premium underwear and outdoor apparel sectors are exceptionally crowded, featuring a host of well-known luxury names alongside dynamic new entrants. CALIDA Group must continually strive to set its brands apart and defend its market position against aggressive pricing tactics.

In 2023, the global premium apparel market was valued at approximately $200 billion, with significant growth projected. CALIDA Group’s brands, such as Calida and Aubade, operate within this fiercely competitive landscape, where maintaining brand loyalty and premium pricing is a constant battle against competitors like LVMH Moët Hennessy Louis Vuitton SE and Kering S.A. in the broader luxury segment.

The fashion industry, including CALIDA Group, is navigating increased production expenses. For instance, COSABELLA's H1 2025 collection faced potential delays due to ongoing supply chain challenges, directly impacting product availability and anticipated sales figures.

Geopolitical instability remains a significant threat, potentially amplifying these disruptions. Such events can drive up operational costs and diminish overall efficiency, creating further headwinds for the group's manufacturing and distribution processes.

Shifting Consumer Preferences and Fast Fashion Trends

CALIDA Group's commitment to premium quality and sustainability faces a challenge from the accelerating consumer demand for fast fashion and highly specialized technical apparel. This rapid evolution in tastes means the company must be agile in updating its collections and product lines. Failure to keep pace with changing styles, comfort expectations, and new material technologies risks market irrelevance.

For instance, the global apparel market saw a significant shift in 2024, with reports indicating a 15% increase in demand for athleisure and performance wear, potentially diverting consumers from traditional premium segments. This trend highlights the pressure on brands like CALIDA to innovate continually. The company needs to balance its core values with the necessity of offering relevant, trend-driven options to remain competitive in the dynamic fashion landscape.

- Consumer preference volatility: Rapid shifts towards fast fashion and technical gear create uncertainty for premium brands.

- Adaptation imperative: Continuous updates to collections are necessary to meet evolving styles and comfort demands.

- Technological advancements: Staying current with new materials and performance features is crucial for product relevance.

- Market obsolescence risk: A failure to adapt to these trends could lead to a decline in market share and brand appeal.

Brand Reputation Risk and Dependency on Key Markets

CALIDA Group faces brand reputation risks, as evidenced by a recent claim for damages from a LAFUMA MOBILIER purchaser, suggesting potential legal or reputational fallout from past dealings. This incident underscores the importance of meticulous transaction management and customer relations.

Furthermore, the group's significant dependence on specific geographical markets presents a substantial threat. For instance, AUBADE's heavy reliance on the French market and COSABELLA's on the US market expose CALIDA to considerable vulnerability. Should economic conditions deteriorate or specific market dynamics shift unfavorably in France or the United States, the impact on these brands and, consequently, the group's overall performance could be severe. This concentration risk requires careful monitoring and potential diversification strategies.

- Brand Reputation Vulnerability: A claim for damages from a LAFUMA MOBILIER buyer highlights potential legal and reputational challenges.

- Market Dependency: AUBADE's reliance on France and COSABELLA's on the US market creates exposure to regional economic downturns.

- Geographic Concentration: Over-reliance on key markets can amplify the impact of localized market disruptions.

CALIDA Group faces significant threats from volatile consumer preferences, particularly the increasing demand for fast fashion and specialized technical apparel. This trend puts pressure on premium brands to constantly innovate and adapt their offerings. Failure to keep pace with evolving styles and material technologies risks market irrelevance, as seen in the 2024 surge in athleisure demand, which grew by an estimated 15% globally.

Brand reputation is also a vulnerability, with a recent damages claim against LAFUMA MOBILIER highlighting potential legal and reputational risks. Furthermore, CALIDA's concentrated reliance on specific markets, such as AUBADE's dependence on France and COSABELLA's on the US, exposes the group to significant regional economic downturns and market-specific disruptions.

| Threat Category | Specific Threat | Impact on CALIDA Group | Data Point/Example |

|---|---|---|---|

| Market Trends | Shift to Fast Fashion & Technical Apparel | Decreased demand for traditional premium wear, risk of obsolescence | 15% global growth in athleisure demand (2024) |

| Brand Reputation | Legal/Customer Claims | Potential financial penalties and reputational damage | Damages claim against LAFUMA MOBILIER purchaser |

| Geographic Concentration | Over-reliance on Key Markets | Vulnerability to regional economic downturns | AUBADE dependent on France; COSABELLA dependent on US |

SWOT Analysis Data Sources

This CALIDA Group SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence reports, and expert industry commentary to ensure a data-driven and insightful assessment.