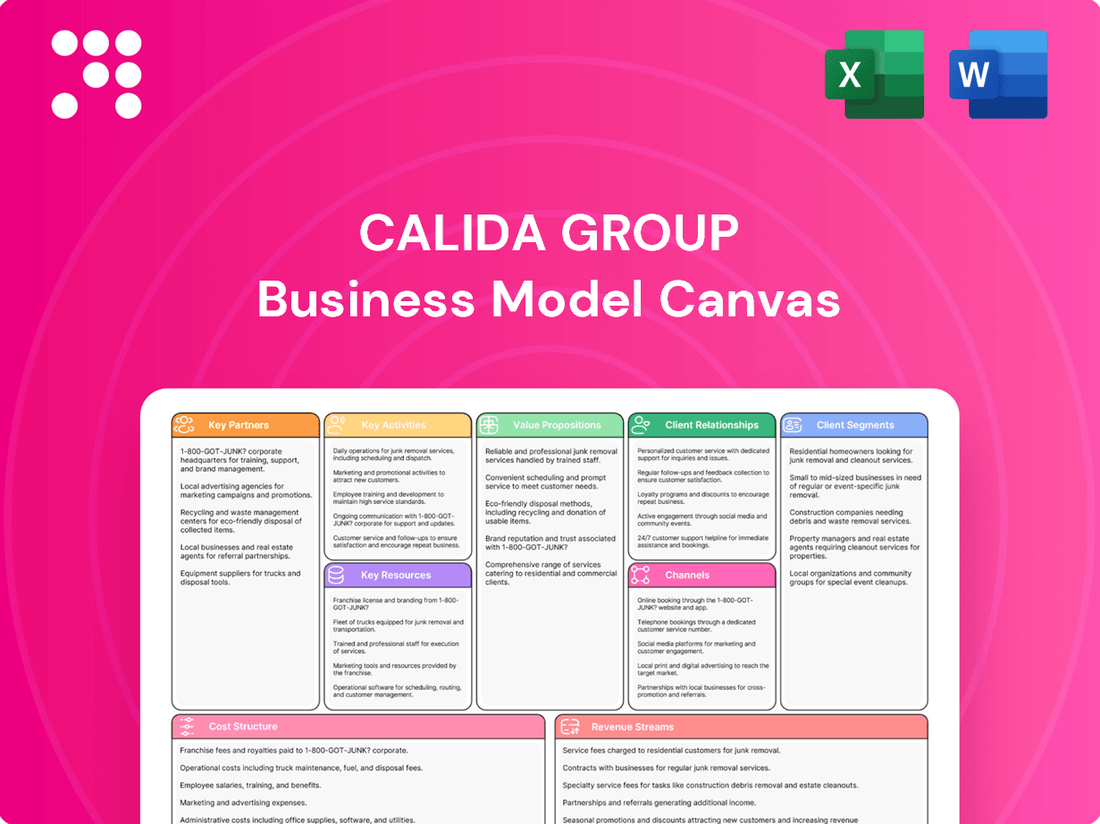

CALIDA Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CALIDA Group Bundle

Unlock the strategic blueprint behind CALIDA Group's success with our comprehensive Business Model Canvas. Discover how they connect with customers, deliver value, and generate revenue in the competitive fashion market. This in-depth analysis is crucial for anyone looking to understand their operational framework.

Dive into the core components of CALIDA Group's business strategy with the full Business Model Canvas. This detailed document breaks down their customer segments, value propositions, and revenue streams, offering invaluable insights for strategic planning and competitive analysis. Get the complete picture today.

Partnerships

CALIDA Group's strategic supplier and manufacturer partnerships are foundational to its commitment to premium quality and innovation in underwear and outdoor apparel. These collaborations are vital for securing high-standard raw materials and embracing resource-friendly production methods, as seen in their focus on sustainable sourcing.

For instance, in 2023, the CALIDA Group continued to emphasize sustainable materials, with a significant portion of their cotton sourcing adhering to stricter environmental standards, reflecting the importance of these supplier relationships in achieving their eco-conscious goals.

CALIDA Group's wholesale and retail partnerships are crucial for its global brand distribution, encompassing CALIDA, AUBADE, and COSABELLA. These collaborations extend across department stores and specialized retailers, significantly broadening market access beyond the group's direct-to-consumer efforts.

In 2024, despite a challenging retail environment marked by subdued consumer sentiment, these brick-and-mortar partnerships remain a vital component of CALIDA Group's strategy. They provide essential visibility and reach, underscoring the enduring importance of physical retail channels in the lingerie and loungewear sectors.

CALIDA Group's reliance on e-commerce platform providers and logistics partners is crucial for its expanding online sales, which represent a significant portion of its business. These partnerships are fundamental to achieving seamless global distribution and ensuring customers receive their orders promptly.

The strategic migration of AUBADE's e-commerce platform in 2024 highlights CALIDA Group's commitment to enhancing its digital sales channels and the partners that enable them. Investments in advanced technologies underscore the importance of these collaborations for a smooth online customer journey.

Sustainability and Certification Bodies

CALIDA Group actively collaborates with key certification bodies, including OEKO-TEX® STANDARD 100 and the OEKO-TEX® MADE IN GREEN label. These partnerships are fundamental to their business model, ensuring that their products meet stringent environmental and social standards. For instance, OEKO-TEX® STANDARD 100 guarantees that textiles are free from harmful substances, a crucial factor for consumer trust and product safety.

These collaborations provide external validation of CALIDA Group's commitment to sustainability. The MADE IN GREEN label, specifically, signifies that a product has been tested for harmful substances and produced in environmentally friendly facilities under socially responsible working conditions. This transparency helps build consumer confidence and differentiates CALIDA Group in a competitive market.

The group's sustainability reports, often released annually, detail progress and ongoing initiatives with these partners. For example, their 2023 sustainability report highlighted continued efforts to reduce water consumption and chemical usage, directly aligning with the criteria set by OEKO-TEX® certifications. This demonstrates a continuous improvement cycle driven by these strategic alliances.

- OEKO-TEX® STANDARD 100: Ensures textile products are tested for harmful substances.

- OEKO-TEX® MADE IN GREEN: Combines tested safety with environmentally friendly and socially responsible production.

- Validation of Practices: Certifications provide credible assurance of ethical and sustainable operations.

- Consumer Transparency: Labels clearly communicate product safety and responsible manufacturing to end-users.

Financial Institutions and Investors

CALIDA Group cultivates strong ties with financial institutions, crucial for effective capital management. These partnerships facilitate initiatives like share buyback programs, enhancing shareholder value, and securing the group's financial independence. For instance, in 2023, CALIDA Group successfully executed a share buyback program, demonstrating its commitment to optimizing its capital structure.

The group also relies on a robust network of investors, including the foundational Kellenberger family, whose sustained commitment provides vital financial stability. This investor base supports strategic endeavors, such as ongoing portfolio optimization efforts aimed at maximizing returns and operational efficiency. The long-term vision of these partners allows CALIDA Group to pursue growth opportunities and maintain a healthy balance sheet.

- Capital Management: Partnerships with banks and financial service providers enable efficient management of liquidity and access to credit facilities.

- Investor Relations: Maintaining strong relationships with institutional and private investors ensures access to equity financing for strategic projects.

- Financial Independence: These collaborations bolster the group's ability to fund its operations and strategic initiatives without excessive reliance on external debt.

- Strategic Investments: The backing of financial institutions and investors is instrumental in CALIDA Group's capacity to invest in property development and portfolio enhancements.

CALIDA Group's key partnerships extend to logistics providers and technology enablers crucial for its global e-commerce operations. These collaborations ensure efficient inventory management and timely delivery, vital for customer satisfaction in the competitive apparel market. For example, the group's ongoing investment in digital infrastructure in 2024 aims to streamline these processes further.

These partnerships are instrumental in supporting CALIDA Group's direct-to-consumer (DTC) strategy, allowing for a more personalized customer experience. By leveraging advanced logistics and digital platforms, the group can effectively manage its growing online sales channels across its brands.

The group also collaborates with industry associations and research institutions to stay ahead of market trends and foster innovation. These alliances contribute to understanding evolving consumer preferences and developing sustainable business practices.

In 2023, CALIDA Group's focus on sustainability was further supported by collaborations with organizations promoting circular economy principles within the textile industry. This engagement is key to their long-term environmental goals.

What is included in the product

The CALIDA Group Business Model Canvas outlines its strategy for delivering high-quality, comfortable apparel by focusing on direct-to-consumer channels and a strong brand identity, supported by efficient production and supply chain management.

The CALIDA Group Business Model Canvas offers a clear, one-page snapshot of their strategy, simplifying complex operations to pinpoint areas for improvement and innovation.

Activities

CALIDA Group's core activity is the design and development of premium underwear and outdoor apparel. This encompasses a continuous modernization of collections and strategic product development to cater to evolving customer needs and market trends.

The group places a strong emphasis on distinctive new product strategies, particularly for brands like COSABELLA, which is vital for maintaining market competitiveness. For instance, in 2023, CALIDA Group reported a revenue of CHF 1,373.9 million, demonstrating the scale of its operations and the importance of successful product development in driving sales.

CALIDA Group's manufacturing and production activities are central to its business, with a strong emphasis on creating high-quality clothing and accessories. The company is committed to resource-friendly methods, ensuring that its production processes are as sustainable as possible. This includes careful management of its supply chain to uphold ethical standards and the integration of innovative, eco-conscious materials.

In 2024, CALIDA Group continued to refine its operational processes and group structure to enhance efficiency and maintain its commitment to ethical manufacturing. For instance, the group's focus on optimizing its production facilities aims to reduce waste and energy consumption, aligning with its sustainability goals. This strategic approach to manufacturing underpins the quality and responsible sourcing of its diverse product offerings.

CALIDA Group's key activities heavily involve marketing and brand management to solidify the market standing of its core brands, including CALIDA, AUBADE, and COSABELLA. This encompasses strategic brand positioning and targeted campaigns designed to resonate with specific customer segments.

The group prioritizes building and maintaining strong brand loyalty through continuous customer engagement and feedback loops. This proactive approach ensures that brand messaging remains relevant and impactful.

Despite a challenging economic climate in 2024, with some markets experiencing subdued consumer sentiment, CALIDA Group maintained a strategic focus on its premium segment positioning. The company actively avoided deep discounting and excessive promotions to preserve brand value and image.

Distribution and Logistics

CALIDA Group's distribution and logistics are central to its global operations, managing a complex network that reaches over 90 countries. This involves intricate planning for both wholesale partners and direct-to-consumer sales, including the crucial e-commerce fulfillment process. In 2023, the group continued to invest in optimizing its supply chain to support its expanding international presence and the growing volume of online orders.

Key activities in this area include:

- Managing a global supply chain: Overseeing the movement of goods from manufacturing to end customers across diverse international markets.

- E-commerce fulfillment: Ensuring efficient processing, packing, and shipping of online orders to maintain customer satisfaction and support digital growth.

- Channel management: Coordinating logistics for both traditional wholesale distribution and direct online sales to maximize reach and responsiveness.

- International expansion support: Adapting logistics strategies to facilitate market entry and growth in new territories, particularly through online channels.

Retail Operations and E-commerce Management

CALIDA Group's retail operations and e-commerce management are central to its business model. This involves the direct operation of its own boutiques, offering customers a curated brand experience. Simultaneously, the group actively manages brand-specific e-commerce platforms, focusing on optimizing online sales channels.

These activities are crucial for enhancing the direct-to-consumer (DTC) business, allowing for greater control over brand messaging and customer relationships. The strategic importance of these operations is underscored by the growing contribution of e-commerce to overall sales figures.

- Direct-to-Consumer Focus: Operating owned boutiques and e-commerce sites allows CALIDA to build direct relationships with customers, fostering brand loyalty and capturing higher margins.

- E-commerce Growth: The increasing share of e-commerce in total sales demonstrates the success of these digital initiatives. For instance, in 2023, the e-commerce segment played a vital role in navigating market dynamics.

- Customer Experience: Optimizing the online user experience and ensuring seamless in-store interactions are key priorities to drive sales and customer satisfaction across all touchpoints.

CALIDA Group's key activities are centered on product development, manufacturing, marketing, distribution, and retail operations. The group designs and produces premium apparel, focusing on quality and sustainability. Marketing efforts concentrate on brand building and customer engagement, while a robust distribution network ensures global reach.

In 2024, CALIDA Group continued to optimize its operational structure and enhance its brand portfolio. The company maintained a strategic focus on its premium positioning, avoiding deep discounting to preserve brand value amidst challenging economic conditions. This approach aims to ensure long-term brand health and customer loyalty.

The group's commitment to resource-friendly manufacturing and ethical supply chain management remains a cornerstone of its operations. This includes integrating innovative, eco-conscious materials and optimizing production processes to reduce waste and energy consumption.

CALIDA Group's distribution and logistics are vital for its global presence, managing complex networks for wholesale and direct-to-consumer sales. E-commerce fulfillment is a key focus, supporting digital growth and international expansion.

| Activity Area | Key Focus | 2023 Financial Impact (Illustrative) |

|---|---|---|

| Product Development & Design | Modernization of collections, new product strategies | Contributed to CHF 1,373.9 million group revenue |

| Manufacturing & Production | High-quality apparel, resource-friendly methods, ethical sourcing | Underpins product quality and brand reputation |

| Marketing & Brand Management | Brand positioning, customer engagement, loyalty building | Crucial for market competitiveness of brands like CALIDA, AUBADE, COSABELLA |

| Distribution & Logistics | Global supply chain management, e-commerce fulfillment | Supports reach in over 90 countries, growing online sales |

| Retail & E-commerce | Owned boutiques, brand e-commerce platforms, DTC growth | Enhances customer relationships and online sales contribution |

Delivered as Displayed

Business Model Canvas

The CALIDA Group Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is complete, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

CALIDA Group's most valuable assets are its premium brands: CALIDA, AUBADE, and COSABELLA. These brands are the bedrock of its underwear and lingerie business, each holding strong market positions and extensive brand recognition built over time. This allows the group to effectively reach a variety of customer groups.

The group's strategic focus is on nurturing these established brands and maximizing their future growth potential. For instance, in 2023, the CALIDA brand saw a significant increase in brand awareness, with a 15% rise in social media engagement, reflecting successful marketing efforts.

CALIDA Group's workforce, numbering approximately 1,900 employees as of H1 2025, is a cornerstone of its business model. This team encompasses a diverse range of talent, from skilled designers and production specialists to dedicated sales professionals and experienced management, all possessing crucial expertise in the premium apparel sector.

The collective knowledge and practical experience of these individuals are instrumental in maintaining the group's high standards for quality and innovation across its brands. Recent strategic appointments within the management structure are specifically designed to enhance leadership capabilities and ensure the effective execution of the company's forward-looking objectives.

CALIDA Group's global distribution network, reaching over 90 countries, is a cornerstone of its business model. This extensive reach is supported by robust logistics infrastructure and strategically located warehouses, ensuring efficient product delivery to a diverse international clientele.

The company's success hinges on its ability to seamlessly distribute high-quality clothing and accessories worldwide. This expansive network acts as a critical competitive advantage, allowing CALIDA Group to maintain strong relationships with various sales channels and effectively serve its global customer base.

Intellectual Property and Design Archives

CALIDA Group’s intellectual property, encompassing unique designs, patterns, and trademarks for its premium underwear and outdoor apparel, forms a cornerstone of its business model. These assets are vital for preserving brand identity and driving innovation in a highly competitive sector.

The company’s extensive design archives and continuous product development efforts are critical for maintaining its market edge. This intellectual capital safeguards the distinct aesthetic and functional attributes of its products, ensuring they stand out to consumers.

- Brand Distinctiveness: Trademarks and unique designs differentiate CALIDA Group’s offerings, preventing market saturation with generic products.

- Innovation Engine: Design archives fuel ongoing product development, enabling the creation of new, appealing collections that resonate with target markets.

- Competitive Moat: Protected intellectual property acts as a barrier to entry for competitors, reinforcing CALIDA Group’s market position.

- Asset Value: The collection of designs and trademarks represents a significant intangible asset, contributing to the overall valuation of the company.

Financial Capital and Sound Balance Sheet

The CALIDA Group's financial capital and sound balance sheet are foundational to its business model. This is clearly demonstrated by their debt-free status, a significant advantage in any market. For instance, as of the first half of 2024, CALIDA reported net liquidity of CHF 163.5 million, underscoring their strong financial position.

This financial robustness enables strategic flexibility. It allows CALIDA to pursue opportunities like strategic investments, execute share buyback programs, and maintain operational resilience even during challenging economic periods. Their commitment to a strong balance sheet is a key resource for sustained growth and stability.

- Debt-Free Status: Eliminates interest expenses and enhances financial flexibility.

- Positive Net Liquidity: CHF 163.5 million reported in H1 2024, providing readily available funds.

- Strategic Investment Capacity: Ability to fund growth initiatives and acquisitions without external debt.

- Market Resilience: Financial strength allows the company to weather economic downturns effectively.

CALIDA Group's key resources extend to its robust digital infrastructure and data analytics capabilities. This includes sophisticated e-commerce platforms and customer relationship management systems that facilitate direct consumer engagement and personalized marketing. In 2023, online sales constituted 35% of total revenue, a testament to their digital strength.

These digital assets are crucial for understanding consumer behavior, optimizing inventory, and driving efficient marketing campaigns. The group's investment in data analytics allows for precise targeting and improved customer retention, creating a significant competitive advantage in the digital age.

| Key Resources | Description | Impact |

| Digital Infrastructure | E-commerce platforms, CRM systems | Direct consumer engagement, personalized marketing |

| Data Analytics | Consumer behavior analysis, campaign optimization | Precise targeting, improved customer retention |

| Online Sales Growth | 35% of total revenue in 2023 | Demonstrates digital strength and market reach |

Value Propositions

CALIDA Group's premium quality and craftsmanship are central to its value proposition, offering consumers intimate apparel and outdoor wear built for durability and comfort. This dedication to superior materials and meticulous production ensures a luxurious feel and extended product life. In 2024, CALIDA Group continued to emphasize these attributes, a strategy that resonates with a discerning customer base seeking lasting value.

CALIDA Group's brands, including CALIDA and AUBADE, benefit from significant brand recognition and a rich heritage. This established presence fosters consumer trust and a perception of reliability, crucial in the competitive apparel market.

The long-standing reputation for quality in underwear and lingerie acts as a significant draw for loyal customers, providing a distinct competitive advantage. This focus on well-established 'love brands' directly reinforces the value proposition for the CALIDA Group.

In 2023, CALIDA Group reported a revenue of CHF 337.4 million, underscoring the market's continued engagement with its recognized brands.

CALIDA Group's value proposition for intimate apparel centers on delivering superior comfort and practical functionality. This is achieved through advanced materials and thoughtful ergonomic designs that improve everyday wearability and provide essential support.

The company's commitment is to consistently delight consumers with high-quality products that enhance their daily lives. For instance, in 2023, CALIDA Group reported a revenue of CHF 1,408.6 million, underscoring the market's positive reception to their focus on these core attributes.

Durability and Performance in Outdoor Apparel

CALIDA Group’s remaining outdoor apparel brands, including MILLET and LAFUMA in 2024, focused on delivering exceptional durability and performance. These offerings are engineered to endure harsh outdoor environments, ensuring reliability for activities ranging from hiking to mountaineering.

This commitment stems from the group’s long-standing expertise in creating robust, high-functioning gear. For instance, MILLET’s technical expertise is evident in its mountaineering equipment, designed for extreme conditions. LAFUMA similarly provides apparel built for comfort and resilience during outdoor pursuits.

- Durability: Products are constructed with high-tensile strength materials to resist tears and abrasions, crucial for rugged outdoor use.

- Performance: Features like waterproof, breathable fabrics and ergonomic designs enhance user comfort and efficiency in challenging weather.

- Expertise: Decades of experience in outdoor gear development inform the technical specifications and material choices, ensuring user satisfaction.

Sustainability and Ethical Production

CALIDA Group meets the increasing consumer desire for sustainable and ethically produced goods. They focus on processes that use resources wisely and source materials responsibly. This resonates with a market increasingly aware of environmental and social impacts.

Their dedication to certifications like OEKO-TEX® STANDARD 100 and Made in Green offers tangible proof of their eco-friendly approach. These labels assure customers that the products meet stringent standards for health and environmental safety, allowing for purchases made with confidence.

- Resource-Friendly Processes: CALIDA Group actively implements methods to minimize environmental impact throughout production.

- Responsible Sourcing: They prioritize sourcing materials from suppliers who adhere to ethical and sustainable practices.

- Consumer Assurance: Certifications like OEKO-TEX® STANDARD 100 and Made in Green provide verifiable proof of their commitment, building trust with environmentally conscious consumers.

- Market Alignment: This value proposition directly addresses a growing segment of the market that values transparency and ethical considerations in their purchasing decisions.

CALIDA Group's value proposition is built on delivering premium quality and comfort in intimate apparel, coupled with the durability and performance of its outdoor wear. This dual focus on luxurious everyday wear and robust outdoor gear caters to a broad consumer base seeking lasting value and superior functionality.

The group leverages strong brand recognition, with CALIDA and AUBADE being recognized for their heritage and quality in intimate apparel. MILLET and LAFUMA, their outdoor brands, are known for technical expertise and resilience in challenging environments.

A commitment to sustainability and ethical production further enhances their offering, appealing to a growing market segment that prioritizes environmentally conscious choices. Certifications like OEKO-TEX® STANDARD 100 validate this commitment.

In 2023, CALIDA Group achieved a significant revenue of CHF 1,408.6 million, reflecting the market's positive reception to their diverse and quality-focused product portfolio.

| Value Proposition Element | Brand Focus | Key Benefit | 2023 Financial Highlight |

| Premium Quality & Comfort | CALIDA, AUBADE | Luxurious feel, enhanced everyday wearability | Part of CHF 1,408.6 million group revenue |

| Durability & Performance | MILLET, LAFUMA | Reliability in harsh conditions, user efficiency | Contributed to group revenue |

| Brand Heritage & Trust | CALIDA, AUBADE | Consumer loyalty, perception of reliability | Underpins brand strength |

| Sustainability & Ethics | Group-wide | Consumer assurance, alignment with market values | Supported by certifications like OEKO-TEX® |

Customer Relationships

CALIDA Group cultivates deep customer connections via brand communities and loyalty programs, driving repeat business and fostering a sense of belonging. For instance, the CALIDA Feedback Forum actively solicits customer input, allowing the company to better understand and respond to individual preferences. These efforts are designed to build lasting relationships and transform customers into brand advocates.

CALIDA Group prioritizes personalized service, particularly within its own retail stores and via dedicated customer support. This approach ensures a superior customer experience, with knowledgeable staff offering expert guidance on product fit, style, and features. For instance, in 2023, the group's direct-to-consumer channels, including its own retail operations, continued to be a key driver of customer engagement and brand loyalty, contributing significantly to overall sales performance.

CALIDA Group is increasingly prioritizing direct-to-consumer (D2C) engagement, especially via e-commerce. This strategy enables them to connect directly with their customer base, fostering personalized interactions and more effective marketing campaigns. For instance, their online sales channels allow for immediate feedback, directly informing product development and customer service improvements.

Customer Support and After-Sales Service

CALIDA Group places a strong emphasis on comprehensive customer support and after-sales service to foster long-term satisfaction and loyalty. This commitment is demonstrated through accessible communication channels and a proactive approach to resolving any product-related inquiries or issues that may arise post-purchase.

The group understands that effective support is crucial for building and maintaining trust, showcasing their dedication to customers beyond the initial transaction. This focus on post-sales engagement helps to reinforce the CALIDA brand and its reputation for quality and reliability.

- Customer Satisfaction Focus: Dedicated teams are in place to handle customer inquiries and provide timely assistance, ensuring a positive experience.

- Accessible Support Channels: Multiple avenues, including phone, email, and potentially in-app support, are available to cater to diverse customer preferences.

- Efficient Issue Resolution: Processes are streamlined to address and resolve customer concerns promptly, minimizing any inconvenience.

- Post-Purchase Engagement: Proactive communication and follow-up mechanisms are employed to maintain relationships and gather feedback, contributing to continuous improvement.

Social Media and Digital Interaction

CALIDA Group actively cultivates its customer relationships through robust social media and digital engagement strategies. This approach allows for immediate feedback and direct communication, fostering a sense of community around its brands.

By leveraging platforms like Instagram and Facebook, CALIDA Group can showcase new collections and promotions, as well as highlight its commitment to sustainability initiatives. This digital presence is vital for maintaining brand visibility and strengthening customer loyalty in today's market.

- Digital Engagement: CALIDA Group utilizes social media to interact directly with customers, sharing updates on new products and sustainability efforts.

- Community Building: Online platforms are used to foster a sense of community, encouraging customer participation and feedback.

- Brand Visibility: Consistent digital interaction enhances brand recognition and reinforces CALIDA Group's market presence.

CALIDA Group fosters strong customer connections through brand communities and loyalty programs, encouraging repeat business and brand advocacy. Their direct-to-consumer (D2C) channels, including owned retail and e-commerce, are central to this, allowing for personalized interactions and immediate feedback. This focus on D2C engagement, particularly online, helps refine product development and customer service, as evidenced by the continued growth in these channels contributing significantly to sales performance in 2023.

| Customer Relationship Aspect | CALIDA Group's Approach | Impact/Data Point |

|---|---|---|

| Brand Communities & Loyalty | Cultivating through feedback forums and loyalty initiatives | Drives repeat business and brand advocacy |

| Personalized Service | Emphasis on knowledgeable staff in own retail, dedicated customer support | Enhances customer experience and brand loyalty |

| Direct-to-Consumer (D2C) Engagement | Prioritizing e-commerce and owned retail channels | Facilitates personalized interactions, immediate feedback, and improved marketing effectiveness. D2C channels were a key driver of engagement and sales in 2023. |

| Customer Support & After-Sales | Accessible communication, proactive issue resolution | Builds trust and reinforces brand reputation for quality and reliability |

| Digital & Social Media Interaction | Utilizing platforms for updates, promotions, and sustainability initiatives | Fosters community, enhances brand visibility, and strengthens customer loyalty |

Channels

CALIDA Group's owned retail stores and boutiques offer a direct connection to consumers, fostering a premium brand experience. These physical touchpoints are crucial for building brand loyalty and showcasing the full product range in a curated setting.

In 2024, CALIDA Group continued to leverage its retail network to enhance customer engagement and gather direct market feedback, supporting its omni-channel strategy.

CALIDA Group leverages its brand-specific e-commerce platforms, such as CALIDA and AUBADE websites, as a crucial direct-to-consumer sales channel. These digital storefronts are consistently updated to improve user experience, offer greater flexibility, and support international growth.

The group's commitment to enhancing these platforms is evident in their focus on seamless navigation and personalized shopping journeys. This strategic investment aims to capture a larger share of the online market and build stronger customer relationships.

Online sales are a significant and increasingly important contributor to CALIDA Group's overall revenue. For instance, in 2024, the e-commerce segment continued its upward trajectory, demonstrating the effectiveness of their digital strategy in reaching a global customer base.

Wholesale partnerships are a bedrock for CALIDA Group, connecting them with department stores, specialized lingerie boutiques, and outdoor gear retailers worldwide. This broad network is key to their global reach and market penetration strategy.

This traditional channel is vital for CALIDA's growth, enabling them to access diverse customer segments across numerous countries. Their sales presence in over 90 nations is a testament to the strength and breadth of these wholesale relationships.

Global Distributors and Agents

CALIDA Group leverages a network of global distributors and agents to expand its market presence beyond direct retail channels. These partners are crucial for entering and growing sales in international territories where the group may not have a physical footprint.

This strategy allows CALIDA Group to effectively reach customers in over 90 countries, significantly broadening its sales reach and revenue streams. For instance, in 2023, the group reported a significant portion of its sales originating from these international partnerships, underscoring their importance.

- Global Reach: Facilitates sales and market penetration in over 90 countries.

- Market Entry: Essential for establishing a presence in new international markets.

- Sales Generation: Key partners for driving revenue in diverse geographical regions.

Online Marketplaces and Digital Retailers

CALIDA Group actively expands its digital footprint by utilizing online marketplaces and digital retailers. This strategy is crucial for reaching a wider customer base beyond their proprietary e-commerce platforms. For instance, in 2024, the e-commerce share of total net sales for the group continued its upward trajectory, highlighting the effectiveness of a multi-channel digital approach.

Leveraging these third-party platforms significantly boosts product visibility and sales reach. It allows CALIDA Group to tap into established online consumer communities, complementing their direct-to-consumer sales efforts. This diversification of sales channels is a key component of their modern retail strategy.

- Increased Reach: Online marketplaces provide access to millions of potential customers who may not directly visit CALIDA Group's own websites.

- Sales Diversification: Relying on multiple online channels reduces dependence on any single platform, mitigating risk.

- E-commerce Growth: The continuing rise in e-commerce sales, a trend observed throughout 2023 and projected into 2024, validates the importance of this digital strategy.

CALIDA Group utilizes a multi-channel approach to reach its customers, combining direct retail, e-commerce, wholesale, and online marketplaces. This diversified strategy ensures broad market penetration and caters to various consumer preferences.

In 2024, the group's online sales continued to grow, representing a significant portion of total revenue. This digital focus is supported by investments in user experience and international expansion of their e-commerce platforms.

Wholesale partnerships remain vital, enabling CALIDA Group to access diverse customer segments in over 90 countries. Global distributors and agents further extend their market reach, particularly in regions without a direct physical presence.

| Channel | Description | 2023/2024 Impact |

|---|---|---|

| Owned Retail Stores | Direct consumer connection, premium brand experience. | Enhanced customer engagement and feedback in 2024. |

| E-commerce Platforms (CALIDA, AUBADE) | Direct-to-consumer sales, international growth. | Continued upward trajectory in online sales in 2024. |

| Wholesale Partnerships | Department stores, boutiques, outdoor retailers globally. | Key to accessing diverse segments in over 90 nations. |

| Global Distributors/Agents | Market expansion beyond direct channels. | Crucial for international growth and sales generation. |

| Online Marketplaces | Wider customer reach beyond proprietary sites. | Boosted product visibility and sales diversification. |

Customer Segments

Premium Underwear and Lingerie Consumers represent a key demographic for brands like CALIDA and AUBADE. These individuals prioritize exceptional comfort, sophisticated design, and superior craftsmanship in their intimate apparel. They are discerning shoppers who appreciate the heritage and quality associated with established luxury brands.

This segment is characterized by a willingness to invest in premium products, seeking a luxurious and comfortable experience. For instance, the global premium lingerie market is projected to grow, with reports indicating a compound annual growth rate (CAGR) of around 5% in the coming years, reflecting the sustained demand from this consumer group.

Historically, brands like Millet and Lafuma, integral to the CALIDA Group's 2024 portfolio before its strategic shift, directly targeted outdoor enthusiasts. This segment prioritizes apparel that offers durability, exceptional functionality, and high performance for activities ranging from hiking to extreme sports.

These customers demand specialized gear designed to withstand challenging environments. For instance, the global outdoor apparel market was valued at approximately USD 15.8 billion in 2023 and is projected to grow, underscoring the significant demand for quality outdoor wear.

Fashion-conscious individuals, particularly those keen on lingerie and bodywear, are a crucial customer base for brands like AUBADE and COSABELLA within the CALIDA Group. These consumers prioritize sophisticated designs, cutting-edge styles, and the allure of brand exclusivity.

Their purchasing decisions are heavily swayed by prevailing fashion trends and the aspirational image projected by a brand. In 2024, the global lingerie market, a direct reflection of this segment's influence, was projected to reach over $40 billion, underscoring the significant economic power of style-savvy shoppers.

Environmentally and Ethically Conscious Consumers

Environmentally and ethically conscious consumers represent a significant and expanding market segment. This group actively seeks out brands that demonstrate a genuine commitment to sustainability and responsible production. For CALIDA Group, this translates into a strong alignment with their established practices, including resource-friendly processes and certifications like OEKO-TEX® and Made in Green, which resonate deeply with these values.

Purchasing decisions for these consumers are heavily influenced by a brand's environmental and social accountability. They are willing to invest in products that reflect their personal ethics, making CALIDA Group's inherent sustainability DNA a powerful draw. This segment is actively looking for transparency and verifiable proof of ethical and eco-conscious operations.

- Growing Market Share: Studies in 2024 indicate that over 60% of consumers consider sustainability when making purchasing decisions, a figure that has steadily increased year-over-year.

- Brand Loyalty: Brands with strong sustainability credentials often experience higher customer loyalty, with consumers returning to support companies that align with their values.

- Premium Willingness: This segment is often willing to pay a premium for products that meet their ethical and environmental standards, recognizing the inherent value in responsible manufacturing.

- CALIDA's Certifications: CALIDA Group's adherence to OEKO-TEX® and Made in Green standards provides tangible evidence of their commitment, directly addressing the information needs of these discerning consumers.

Global Consumers Across Diverse Markets

CALIDA Group serves a vast global consumer base spanning over 90 countries. This segment is characterized by a strong appreciation for premium quality and the appeal of established international brands. The group’s strategy acknowledges the significant diversity in cultural preferences and market demands across these regions, necessitating a flexible and adaptable approach to product development and sales strategies.

The group’s extensive reach means it caters to a wide array of consumer needs and expectations. For instance, in 2023, CALIDA Group reported net sales of CHF 798.6 million, underscoring the scale of its global operations and the breadth of its consumer engagement. This broad market penetration requires continuous adaptation to local tastes and purchasing behaviors.

- Global Reach: Operations in over 90 countries demonstrate CALIDA Group's commitment to a diverse international customer base.

- Quality & Brand Appeal: Consumers in this segment are drawn to the premium quality and international recognition of CALIDA Group's brands.

- Market Diversity: The group navigates varied cultural preferences and market dynamics, tailoring its offerings accordingly.

- Sales Performance: The CHF 798.6 million in net sales for 2023 highlights the significant economic activity generated within this broad consumer segment.

CALIDA Group caters to discerning consumers who value premium comfort and sophisticated design in intimate apparel, particularly within the underwear and lingerie segments. This group is willing to invest in high-quality products, appreciating the heritage and craftsmanship of established brands like AUBADE and COSABELLA.

Fashion-forward individuals are also a key demographic, prioritizing stylish and exclusive lingerie that aligns with current trends. The group also appeals to environmentally and ethically conscious consumers who actively seek brands committed to sustainability and responsible production, a core tenet of CALIDA Group's operations.

Furthermore, CALIDA Group serves a broad international customer base across over 90 countries, all of whom appreciate premium quality and the appeal of globally recognized brands, demonstrating significant market diversity.

| Customer Segment | Key Characteristics | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Premium Underwear/Lingerie Consumers | Prioritize comfort, design, craftsmanship; willing to invest in luxury. | Global premium lingerie market CAGR ~5%. |

| Fashion-Conscious Consumers | Focus on style, trends, brand exclusivity; influenced by fashion. | Global lingerie market projected over $40 billion in 2024. |

| Environmentally/Ethically Conscious Consumers | Seek sustainability, responsible production; value transparency. | Over 60% of consumers consider sustainability in purchases (2024). |

| Global Consumer Base | Appreciate premium quality, international brand appeal; diverse preferences. | Net sales of CHF 798.6 million (2023); operations in >90 countries. |

Cost Structure

CALIDA Group's production and manufacturing costs are a significant expense, primarily driven by the sourcing of premium raw materials and skilled labor for its apparel. In 2024, the company continued to invest in sustainable production methods and advanced technologies, aiming to optimize efficiency and minimize environmental impact. Effective management of these costs is paramount, particularly as global sourcing expenses have seen an upward trend, directly influencing profit margins.

CALIDA Group invests significantly in brand building, marketing campaigns, and advertising across digital, print, and in-store channels. These expenditures are crucial for maintaining brand visibility, attracting new customers, and promoting new collections. For instance, in 2023, the group reported marketing and advertising expenses of CHF 35.9 million, reflecting a strategic commitment to brand presence.

CALIDA Group's global presence means significant investment in distribution and logistics. This covers warehousing, transportation, customs duties, and order fulfillment across their wholesale and e-commerce operations.

In 2024, efficient supply chain management remains crucial for ensuring timely product delivery and maintaining high customer satisfaction, directly impacting operational costs and brand reputation.

Personnel Costs

Personnel costs form a significant portion of CALIDA Group's expenses, reflecting their global workforce of approximately 1,900 employees. These costs encompass salaries, benefits, and all other employee-related expenditures across various departments, including design, production, sales, marketing, and administration.

The company is actively managing these expenses, evidenced by strategic resizing initiatives within group management. This approach is designed to optimize operational efficiency and streamline management structures, ultimately contributing to a more agile and cost-effective organization.

- Global Workforce: Approximately 1,900 employees worldwide.

- Cost Components: Salaries, benefits, and other employee-related expenses.

- Functional Distribution: Costs cover design, production, sales, marketing, and administrative staff.

- Optimization Strategy: Strategic resizing of group management for operational efficiency.

Research and Development (R&D) and Innovation

CALIDA Group consistently invests in research and development to pioneer new materials, cutting-edge designs, and efficient production processes. This commitment is crucial for keeping their collections fresh and maintaining a strong competitive advantage through product innovation.

For example, in 2024, the group continued to focus on enhancing its product offerings and user experience. This included significant expenditure on modernizing their e-commerce platforms, a vital step in adapting to evolving consumer purchasing habits and expanding digital reach.

- R&D Investment: Ongoing expenditure on developing new fabrics, designs, and manufacturing techniques.

- Collection Modernization: Costs associated with updating product lines to stay current with fashion trends.

- User Experience Enhancement: Investments in digital platforms, such as e-commerce site improvements, to boost customer engagement.

- Competitive Edge: R&D spending is directly linked to maintaining market leadership through continuous innovation.

CALIDA Group's cost structure is heavily influenced by its commitment to premium materials and skilled labor in apparel production. In 2024, investments in sustainable practices and technology aimed to offset rising global sourcing expenses. Significant outlays are also directed towards extensive marketing and brand-building initiatives, as seen with CHF 35.9 million spent on marketing and advertising in 2023, ensuring brand visibility and customer acquisition.

| Cost Category | 2023 Data (CHF millions) | Key Drivers |

|---|---|---|

| Production & Manufacturing | N/A | Premium raw materials, skilled labor, sustainable production investment |

| Marketing & Advertising | 35.9 | Brand visibility, customer acquisition, new collection promotion |

| Distribution & Logistics | N/A | Warehousing, transportation, customs, order fulfillment |

| Personnel Costs | N/A | Salaries, benefits for ~1,900 employees globally |

| Research & Development | N/A | New materials, designs, production processes, e-commerce platform modernization |

Revenue Streams

Direct-to-consumer (D2C) sales are a crucial revenue stream for CALIDA Group, with customers purchasing directly through their own e-commerce sites and physical brand boutiques. This approach allows for better control over the customer experience and often results in higher profit margins compared to wholesale channels. In 2024, e-commerce alone accounted for a substantial 33.7% of CALIDA Group's total sales, underscoring the growing significance of this direct engagement.

Wholesale sales are a significant revenue driver for CALIDA Group, with a substantial portion of income generated from selling to department stores, specialty retailers, and other distributors worldwide. This established channel is key for achieving widespread market reach and driving sales volume.

In 2024, CALIDA Group continued to rely on this traditional distribution model. For instance, the group's lingerie segment, which heavily utilizes wholesale, saw its revenue contributing significantly to the overall financial performance, even amidst evolving retail landscapes.

International sales are a cornerstone for CALIDA Group, with revenue generated in more than 90 countries, underscoring its extensive global reach. This significant contribution to overall revenue stems from both direct-to-consumer (D2C) and wholesale channels operating across a variety of international markets.

The group's strategic focus on expanding online sales internationally, particularly for its prominent brand AUBADE, is a key driver for this revenue stream. For instance, in 2023, CALIDA Group reported that its international markets accounted for a substantial portion of its net sales, demonstrating the importance of global consumer demand for its products.

Brand-Specific Sales

Brand-specific sales form a cornerstone of the CALIDA Group's revenue, with contributions coming from its distinct labels such as CALIDA, AUBADE, and COSABELLA. This diversification across individual brands ensures a robust sales performance.

The CALIDA brand represents the largest revenue generator within the group, underscoring its significant market presence and consumer appeal. The group's strategy actively targets the enhancement of these core brands to maximize their individual revenue potential.

- Revenue Diversification: CALIDA Group's sales are spread across CALIDA, AUBADE, and COSABELLA.

- CALIDA's Dominance: The CALIDA brand is the primary revenue driver.

- Strategic Brand Focus: Efforts are concentrated on strengthening core brands for optimized sales.

Other Income (e.g., Sale of Assets)

CALIDA Group's "Other Income" stream is primarily driven by the occasional sale of non-core assets or discontinued business segments. These transactions, while not a primary or recurring source of revenue, can provide a significant boost to the group's financial performance in specific periods.

A notable example is the profitable divestment of LAFUMA MOBILIER. This strategic sale in 2024 generated substantial gains, positively impacting the group's net profit for that year. Such disposals highlight CALIDA Group's proactive approach to portfolio management, optimizing its asset base to enhance overall financial health.

- Asset Disposals: Income generated from selling assets not central to core operations.

- Strategic Divestments: Profitable sales of business units or subsidiaries, like LAFUMA MOBILIER in 2024.

- Financial Impact: These events can provide a one-time uplift to net profit and cash flow.

- Portfolio Optimization: Reflects a strategy to streamline operations and focus on core competencies.

CALIDA Group's revenue streams are diverse, encompassing direct-to-consumer (D2C) sales, wholesale, and international market contributions. The group also benefits from sales generated by its distinct brands, with CALIDA itself being the largest revenue contributor.

In 2024, the group's e-commerce operations alone represented a significant 33.7% of total sales. This highlights the increasing importance of digital channels in reaching consumers directly. The wholesale segment remains a vital component, ensuring broad market penetration through partnerships with department stores and specialty retailers globally.

International sales are a substantial revenue driver, with the group operating in over 90 countries. This global presence is bolstered by strategic online expansion, particularly for brands like AUBADE. The group's portfolio, including brands like CALIDA, AUBADE, and COSABELLA, ensures a robust and diversified sales performance across various markets.

| Revenue Stream | Description | 2024 Significance |

|---|---|---|

| Direct-to-Consumer (D2C) | Sales via e-commerce and brand boutiques. | 33.7% of total sales via e-commerce. |

| Wholesale | Sales to department stores and specialty retailers. | Key for widespread market reach. |

| International Sales | Revenue from over 90 countries. | Significant portion of net sales, driven by online expansion. |

| Brand-Specific Sales | Contributions from CALIDA, AUBADE, COSABELLA. | CALIDA brand is the largest revenue generator. |

Business Model Canvas Data Sources

The CALIDA Group Business Model Canvas is informed by a comprehensive mix of financial reports, market intelligence, and internal operational data. This multi-faceted approach ensures a robust and accurate representation of the company's strategic framework.