CALIDA Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CALIDA Group Bundle

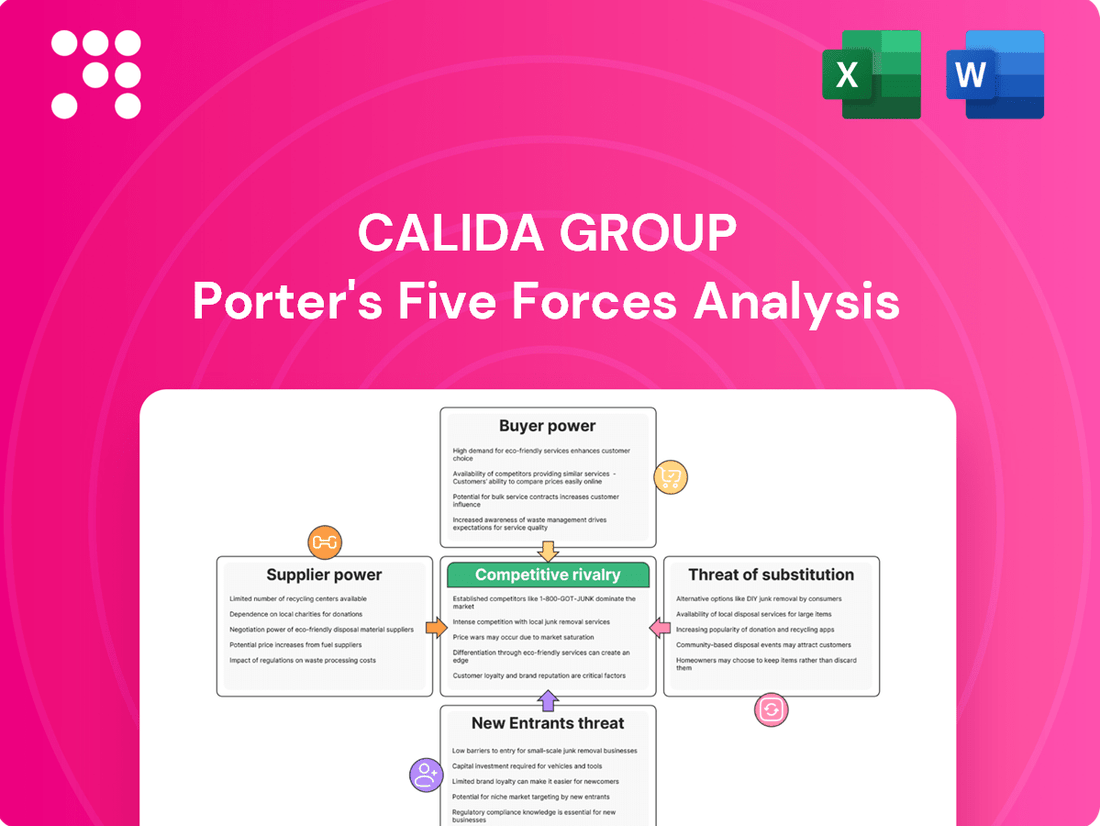

The CALIDA Group operates within a dynamic retail landscape, facing moderate threats from new entrants and the availability of substitutes for its core apparel offerings. Buyer power is significant, driven by price sensitivity and brand loyalty, while supplier power is generally low due to the fragmented nature of textile manufacturing. Intense rivalry among existing players, including fast-fashion giants and established brands, further shapes the competitive environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CALIDA Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CALIDA Group's commitment to premium underwear and outdoor apparel means they depend on specialized, high-quality materials like organic cotton and advanced performance fabrics. Suppliers of these unique or certified materials often hold more sway because there aren't many other options available. For instance, the price of cotton, a key material for many apparel companies, saw fluctuations in 2024, impacting production costs.

CALIDA Group's strong focus on sustainability, evidenced by certifications like OEKO-TEX STANDARD 100 and Made in Green, significantly impacts supplier bargaining power. This commitment means CALIDA must source from suppliers adhering to rigorous environmental and ethical standards.

The limited number of suppliers capable of meeting these stringent criteria grants them increased leverage. These certified suppliers can often negotiate higher prices or more favorable contractual terms, as CALIDA has fewer alternatives for its sustainable material needs.

The premium apparel sector, especially for niche products such as seamless underwear, often features a constrained number of manufacturers possessing the expertise and infrastructure for superior quality output. This limited supply of highly capable production partners naturally bolsters their leverage in negotiations.

CALIDA Group, with its portfolio of distinct brands including CALIDA, AUBADE, COSABELLA, MILLET, LAFUMA, and EIVY, relies on maintaining consistent quality standards across its offerings. This dependence on a select group of proficient manufacturers grants these suppliers considerable sway in pricing and terms, potentially impacting CALIDA's cost structure and operational flexibility.

Supplier Consolidation Trends

Supplier consolidation is a growing concern for CALIDA Group. Recent trends show a significant number of smaller textile and apparel manufacturers merging with larger entities. This industry consolidation is empowering the remaining larger suppliers, giving them more leverage in price negotiations and contract terms.

This shift means CALIDA Group might face increased costs as dominant suppliers can dictate higher prices. Their negotiation flexibility is consequently reduced, impacting CALIDA Group's profitability and supply chain stability.

- Industry Consolidation: Reports from 2024 highlight an accelerating trend of mergers and acquisitions within the global textile manufacturing sector.

- Increased Supplier Leverage: As the number of independent suppliers shrinks, the remaining larger players gain substantial market power.

- Price Impact: This concentration can lead to upward pressure on raw material and manufacturing costs for brands like CALIDA Group.

Importance of Supplier Relationships for Innovation

CALIDA Group's pursuit of continuous product innovation, particularly in advanced textile technologies for premium apparel, hinges on strong ties with its key suppliers. Suppliers at the cutting edge of new fabric development, sustainable manufacturing methods, or novel production techniques are invaluable assets.

This dependence on suppliers for innovation and maintaining a competitive edge naturally amplifies their bargaining power within the relationship. For instance, in 2024, the global textile industry saw significant investment in research and development for sustainable materials, with companies like Lenzing reporting increased demand for their eco-friendly fibers, directly impacting supplier leverage.

- Supplier Innovation as a Competitive Differentiator: CALIDA Group relies on suppliers for access to advanced materials and production methods that are critical for its premium positioning.

- Increased Supplier Leverage: Suppliers who offer unique or proprietary innovations gain significant bargaining power, as CALIDA Group's ability to differentiate itself is linked to their capabilities.

- Strategic Partnerships for R&D: The need for ongoing technological advancement necessitates close collaboration, turning suppliers into strategic partners in product development rather than mere vendors.

- Impact of Sustainable Sourcing: The growing emphasis on sustainability in textiles, a key trend in 2024, empowers suppliers who can provide certified eco-friendly materials, further strengthening their position.

The bargaining power of suppliers for CALIDA Group is significant, driven by the specialized nature of their materials and the increasing consolidation within the textile industry. Suppliers of certified organic cotton and advanced performance fabrics, essential for CALIDA's premium positioning, often have limited competition, allowing them to command higher prices and more favorable terms. For example, the global organic cotton market continued its growth trajectory in 2024, with demand outstripping supply in certain segments, thereby increasing supplier leverage.

| Factor | Impact on CALIDA Group | 2024 Data/Trend |

|---|---|---|

| Specialized Materials | Limited sourcing options increase supplier sway. | Continued demand for certified organic cotton and high-performance synthetics. |

| Sustainability Certifications | Suppliers meeting stringent standards have greater negotiation power. | Increased consumer and regulatory pressure for eco-friendly materials. |

| Industry Consolidation | Fewer, larger suppliers gain market dominance. | Accelerating M&A activity in textile manufacturing. |

| Supplier Innovation | Dependence on suppliers for new technologies enhances their leverage. | Significant R&D investment in sustainable textile innovations. |

What is included in the product

This analysis of the CALIDA Group dissects the competitive landscape, evaluating the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately, CALIDA's strategic position.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Porter's Five Forces for CALIDA Group.

Customers Bargaining Power

Current economic headwinds, including persistent inflation and ongoing geopolitical instability, have significantly dampened consumer confidence across CALIDA Group's key European markets. This subdued sentiment translates directly into heightened price sensitivity among shoppers.

Consumers are exercising greater caution with their discretionary spending, leading to a noticeable impact on sales volumes for many of CALIDA Group's brands. For instance, in the first half of 2024, the group reported a 5.5% decrease in sales compared to the same period in 2023, reflecting this cautious consumer behavior.

This increased awareness of pricing empowers customers, making them more inclined to hunt for deals, delay non-essential purchases, or switch to more budget-friendly alternatives. Consequently, CALIDA Group faces intensified pressure to maintain competitive pricing strategies to retain market share.

CALIDA Group's diversified distribution channels, spanning owned retail, wholesale, and e-commerce, serve customers in over 90 countries. This broad reach is a strength, but the increasing importance of e-commerce, which represented 33.7% of sales in 2024, highlights a critical factor influencing customer bargaining power.

The growing reliance on online platforms empowers customers by providing easy access to price comparisons and a wider array of alternative brands. This transparency and accessibility directly enhance their ability to negotiate or switch suppliers, thereby strengthening their bargaining position against CALIDA Group.

CALIDA Group's premium segment, featuring 'love brands' like CALIDA and AUBADE, benefits from strong customer loyalty in their primary markets. These brands are recognized for quality and comfort, fostering a dedicated customer base.

This established brand loyalty in the premium segment acts as a buffer against significant customer bargaining power. Consumers attached to the heritage and perceived value of these brands are less likely to be swayed by lower-priced competitors, even during challenging economic periods.

Influence of Online Reviews and Social Media

Customers today have substantial influence thanks to online reviews and social media. CALIDA, recognizing this, has implemented a customer feedback forum to gather insights and suggestions. This direct channel allows customers to voice their opinions on product quality, fit, and overall service, directly impacting the brand's responsiveness to consumer needs.

The collective voice of customers online can swiftly shape a company's reputation and sales figures. For example, a surge of negative reviews concerning a specific product line can force a brand to re-evaluate its offerings. This digital feedback loop means companies like CALIDA must actively manage customer sentiment and address concerns promptly to maintain market standing.

- Customer Influence: Online reviews and social media empower customers, allowing them to collectively impact brand perception and sales.

- CALIDA's Response: CALIDA's introduction of a feedback forum demonstrates a proactive approach to harnessing customer input for product and service improvement.

- Reputation Management: Negative sentiment expressed online can significantly damage a brand, necessitating a strong focus on customer satisfaction and responsiveness.

- Demand Responsiveness: Companies are compelled to meet customer demands regarding product attributes like quality and fit due to the transparency and reach of digital platforms.

Availability of Alternative Brands and Products

Even with CALIDA Group's focus on premium quality, the underwear and outdoor apparel sectors are crowded. Customers can easily find comparable or more budget-friendly alternatives from a vast number of competitors. This abundance of choice significantly strengthens their ability to negotiate or switch brands if their expectations aren't met.

- Broad Market Choice: The global apparel market, valued at over $1.5 trillion in 2023, offers consumers extensive options beyond CALIDA's specific offerings.

- Competitor Landscape: Numerous brands, from high-end to mass-market, directly compete by offering similar product categories, impacting CALIDA's pricing power.

- Price Sensitivity: A significant portion of consumers, particularly in the mid-market segment, are price-sensitive, making them more likely to explore alternatives if CALIDA's pricing is perceived as too high.

- Ease of Switching: For many apparel items, the cost and effort for a customer to switch brands are minimal, further amplifying their bargaining power.

The bargaining power of customers for CALIDA Group is moderate, influenced by brand loyalty in premium segments but countered by market saturation and price sensitivity. While strong brands like CALIDA and AUBADE retain loyal customers, the broader apparel market offers abundant alternatives, especially in the mid-market. This, coupled with increased price awareness due to economic pressures and easy online price comparisons, means customers can exert significant influence.

| Factor | Impact on CALIDA | Customer Influence Level |

| Brand Loyalty (Premium Segment) | Mitigates power for specific brands | Low to Moderate |

| Market Saturation & Alternatives | Increases customer options | Moderate to High |

| Price Sensitivity & Economic Headwinds | Drives demand for value | High |

| Online Transparency & Comparison | Empowers informed choices | High |

Preview Before You Purchase

CALIDA Group Porter's Five Forces Analysis

This preview showcases the precise CALIDA Group Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of industry competition and profitability. It details the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, providing actionable insights into CALIDA's strategic positioning. The document is fully formatted and ready for immediate use, ensuring you get the exact, professionally crafted analysis without any surprises.

Rivalry Among Competitors

The CALIDA Group faces fierce rivalry in its core markets of premium underwear, lingerie, and outdoor apparel. Established global brands and agile regional players constantly vie for consumer attention, pushing the need for differentiation and operational excellence.

In 2023, the global intimate apparel market was valued at approximately USD 110 billion, with significant growth driven by premiumization and athleisure trends. Similarly, the outdoor apparel sector continues to see robust competition from giants like Nike and Adidas, alongside specialized brands, all competing for a share of a market projected to reach over USD 200 billion by 2027.

This intense competitive landscape demands continuous investment in product innovation, marketing, and supply chain efficiency. For CALIDA, staying ahead means not only meeting but anticipating evolving consumer preferences for comfort, sustainability, and performance in both intimate wear and outdoor gear.

CALIDA Group operates in markets featuring formidable global competitors like HanesBrands, Victoria's Secret, and Fast Retailing in the apparel sector, alongside giants such as Adidas, Nike, and Columbia Sportswear in outdoor wear. These companies possess substantial financial clout, enabling them to invest heavily in marketing and leverage extensive distribution channels.

The presence of these well-established global players means CALIDA Group faces intense pressure on pricing and market share. For instance, in 2023, HanesBrands reported revenues of approximately $6.5 billion, demonstrating the scale of operations CALIDA must contend with. This rivalry necessitates continuous innovation and efficient operations to maintain a competitive edge.

CALIDA Group, even within its premium positioning, encounters significant price competition. This is exacerbated by a broader fashion industry trend of subdued consumer sentiment, leading to increased price sensitivity. For instance, in 2023, many apparel retailers reported needing to offer more frequent promotions to move inventory, a dynamic CALIDA likely navigates.

The pressure to offer discounts and promotions, even for premium brands, directly impacts profit margins. This balancing act between maintaining brand value and responding to market demand for affordability is a constant challenge. The general economic climate, with inflation impacting disposable incomes, further fuels this price-driven competition.

Differentiation Through Brand and Sustainability

CALIDA Group leverages its robust brand portfolio and a strong commitment to sustainability as primary differentiators. This approach resonates particularly well with environmentally aware consumers, fostering loyalty. However, the competitive landscape is evolving, with rivals increasingly adopting similar sustainability narratives and brand-building strategies.

The intensified focus on sustainability and authentic brand storytelling among competitors creates a dynamic environment. Brands are actively competing to capture consumer attention and trust by showcasing their eco-friendly practices and ethical sourcing. This escalating rivalry means CALIDA must continuously innovate and communicate its unique value proposition to maintain its market position.

- Brand Strength: CALIDA's established brands, such as CALIDA and AUBADE, contribute significantly to its competitive edge.

- Sustainability Leadership: The group's proactive stance on sustainability, including its ambitious climate targets, sets it apart. For instance, CALIDA aims for a 30% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 compared to 2023 levels.

- Competitive Response: Competitors are responding by highlighting their own sustainability initiatives, making it crucial for CALIDA to maintain transparency and authenticity in its communications.

- Consumer Trust: The market increasingly rewards brands perceived as genuinely committed to sustainability, driving intense competition for consumer loyalty based on these values.

Rapid Product Innovation and Evolving Trends

The apparel industry, including brands like CALIDA Group, thrives on swift shifts in fashion, material science, and what consumers want in terms of comfort, performance, and aesthetics. For example, in 2024, the athleisure trend continued its strong showing, pushing brands to innovate with breathable, moisture-wicking fabrics. This constant evolution means CALIDA Group must pour resources into developing new products and updating its offerings to stay relevant.

Competitors are frequently launching new collections and adopting cutting-edge technologies. This dynamic landscape demands that CALIDA Group maintain a high pace of innovation. Their ability to quickly adapt to these changing consumer desires is absolutely key for remaining competitive and ensuring long-term success in the market.

- Fashion Cycles: Apparel trends can shift dramatically season to season, impacting demand for specific styles and materials.

- Material Innovation: Advances in textiles, such as sustainable fabrics or performance-enhancing materials, create new product opportunities and competitive advantages.

- Consumer Preferences: Growing demand for comfort, durability, and eco-friendly options forces brands to re-evaluate their product lines and sourcing.

CALIDA Group faces intense competition from global powerhouses and nimble regional players in its underwear, lingerie, and outdoor apparel segments. This rivalry necessitates continuous innovation and efficient operations to maintain market share and profitability.

In 2023, the global intimate apparel market was valued around USD 110 billion, while the outdoor apparel market is projected to exceed USD 200 billion by 2027, highlighting the significant scale of competition CALIDA navigates.

Established brands like HanesBrands, with 2023 revenues near $6.5 billion, and sportswear giants such as Nike and Adidas, exert considerable pressure on pricing and market positioning.

CALIDA’s premium strategy is challenged by a broader industry trend of price sensitivity, exacerbated by economic factors like inflation, leading to increased promotional activity across the sector in 2023.

| Competitor | 2023 Revenue (Approx.) | Key Market Segment |

| HanesBrands | $6.5 Billion | Underwear, Activewear |

| Victoria's Secret | $9.5 Billion | Lingerie, Beauty |

| Adidas | $24.5 Billion | Sportswear, Outdoor |

| Nike | $51 Billion | Sportswear, Outdoor |

SSubstitutes Threaten

The availability of lower-cost apparel presents a significant threat of substitutes for CALIDA Group. Consumers can readily choose significantly cheaper general apparel or fast fashion brands that offer basic underwear and casual wear. These alternatives, while not matching CALIDA's premium quality or specialized features, satisfy fundamental needs at a fraction of the cost. This is particularly impactful during economic downturns when price sensitivity rises, potentially diverting sales from CALIDA's offerings.

The expanding secondhand and re-commerce markets present a significant threat of substitutes for CALIDA Group's brands like MILLET and LAFUMA. These platforms offer consumers sustainable and budget-friendly alternatives to new outdoor apparel. For instance, the global secondhand apparel market was projected to reach $77 billion by 2025, demonstrating strong consumer adoption of pre-owned goods.

For CALIDA Group's intimate apparel segment, the threat of DIY and custom-made options is a growing concern. Consumers increasingly value personalization, with some opting for bespoke or self-created garments as alternatives to mass-produced premium underwear. This trend, while currently niche, reflects a broader shift towards tailored fashion solutions.

Functional Alternatives from Other Industries

CALIDA Group faces threats from functional alternatives originating outside the traditional outdoor apparel sector. For instance, robust industrial workwear, designed for extreme conditions, can offer comparable durability and protection to high-end outdoor gear, potentially at a lower cost. Similarly, specialized sports equipment, like advanced cycling apparel or mountaineering suits from niche brands, might provide superior performance in specific activities, drawing customers away from broader outdoor brands.

These substitutes can appeal to consumers seeking specific functionalities or value propositions not always met by mainstream outdoor apparel. For example, a construction worker might opt for heavy-duty work pants that also suffice for casual outdoor activities, bypassing dedicated outdoor brands. This diversification of functional alternatives means CALIDA Group must not only compete with direct rivals but also with products from entirely different market segments that fulfill similar needs.

As of 2024, the market for technical workwear and specialized sports apparel continues to grow, with some segments experiencing double-digit growth rates, indicating a strong demand for high-performance, functionally specific clothing. This trend highlights the increasing relevance of these cross-industry substitutes for brands like CALIDA Group.

Key functional alternatives include:

- Industrial Workwear: Offering enhanced durability and protection for demanding physical tasks.

- Specialized Sports Gear: Providing optimized performance for niche athletic activities like extreme cycling or climbing.

- Technical Military Apparel: Often featuring advanced materials and rugged construction suitable for harsh environments.

- High-Performance Athleisure: Blurring lines between athletic wear and casual wear, offering comfort and some functional benefits.

Shifting Lifestyles and Activities

Changes in consumer lifestyles, such as a growing preference for indoor activities or a move away from strenuous outdoor pursuits, can significantly impact demand for specialized premium outdoor apparel. For instance, if consumers increasingly favor athleisure wear for everyday use over technical gear for specific outdoor adventures, this presents a substitution threat. This shift could reduce the perceived need for high-performance, segment-specific items, making more versatile activewear a viable alternative.

The CALIDA Group, known for its premium loungewear and underwear, could see its outdoor-focused brands face substitution if consumer behavior trends away from intense outdoor recreation. For example, a rise in popularity of home-based fitness or virtual reality experiences over hiking or skiing could diminish the market for specialized outdoor clothing. This trend is supported by market data showing a steady growth in the global activewear market, which often overlaps with casual lifestyle wear, potentially drawing consumers away from niche outdoor apparel. In 2024, the global activewear market was valued at approximately $345 billion, with projections indicating continued expansion, suggesting a broad appeal of versatile apparel.

- Lifestyle Shift: Consumers increasingly opt for comfort and versatility, leading to a greater demand for athleisure and casual wear over highly specialized outdoor gear.

- Substitution by Activewear: General activewear brands offering multi-purpose clothing can substitute for premium outdoor apparel, particularly if outdoor activities decline in popularity.

- Market Trends: The expanding global activewear market, valued at over $345 billion in 2024, highlights a consumer preference for adaptable clothing, posing a threat to niche outdoor apparel segments.

The threat of substitutes for CALIDA Group is multifaceted, encompassing lower-cost apparel, the growing secondhand market, DIY options, and functional alternatives from other industries. These substitutes can appeal to consumers seeking value, sustainability, personalization, or specific performance features, potentially diverting sales from CALIDA's premium offerings.

The availability of significantly cheaper general apparel and fast fashion brands poses a direct substitution threat, as these alternatives can meet basic needs at a lower price point. Furthermore, the expanding secondhand market, projected to reach $77 billion by 2025, offers a sustainable and budget-friendly alternative for consumers. Even niche markets like DIY or custom-made garments can chip away at CALIDA's market share by catering to a desire for personalization.

Beyond direct apparel substitutes, CALIDA's outdoor brands, such as MILLET and LAFUMA, face competition from industrial workwear and specialized sports gear. As of 2024, the technical workwear and specialized sports apparel markets are experiencing robust growth, with some segments seeing double-digit increases. This indicates a strong consumer demand for functionally specific clothing that can sometimes serve as a substitute for broader outdoor apparel.

Consumer lifestyle shifts also play a role, with a growing preference for athleisure and versatile activewear. The global activewear market, valued at over $345 billion in 2024, demonstrates this trend, potentially drawing consumers away from highly specialized outdoor gear. This broad appeal of adaptable clothing presents a significant substitution threat to CALIDA's more niche product lines.

| Substitute Category | Key Characteristics | Impact on CALIDA Group | Market Data/Trend (2024) |

| Lower-Cost Apparel | Price, Basic Functionality | Direct competition for underwear/loungewear | Fast fashion market size significant |

| Secondhand Market | Sustainability, Affordability | Threat to new outdoor/apparel sales | Projected $77B by 2025 |

| DIY/Custom-Made | Personalization, Uniqueness | Niche threat to intimate apparel | Growing consumer interest in bespoke |

| Industrial Workwear | Durability, Protection | Alternative for outdoor functionality | Growing market segment |

| Specialized Sports Gear | Niche Performance | Alternative for specific outdoor activities | Segments experiencing double-digit growth |

| Athleisure/Activewear | Comfort, Versatility | Broad substitution for casual/outdoor use | Global market >$345B in 2024 |

Entrants Threaten

Entering the premium underwear and outdoor apparel market demands significant upfront capital. Newcomers must allocate substantial funds for sophisticated product design, establishing high-quality manufacturing capabilities, and building robust global distribution channels. For instance, setting up a single, state-of-the-art apparel production facility can easily cost tens of millions of dollars.

Furthermore, building brand recognition in a competitive landscape like CALIDA Group's requires immense investment. Established players benefit from decades of brand equity and extensive marketing campaigns. A new entrant would need to spend heavily on advertising, endorsements, and creating compelling brand narratives to even begin to rival the market presence of companies like CALIDA, which reported a revenue of CHF 352.2 million in 2023.

CALIDA Group's established brands, such as CALIDA and AUBADE, benefit from significant brand loyalty and a reputation built on quality and sustainability. This makes it difficult for new companies to attract customers away from these trusted names. For instance, in 2023, CALIDA Group reported a revenue of CHF 339.5 million, demonstrating the continued strength of its established market presence.

New entrants must invest heavily in marketing and product development to even begin to challenge the deep-rooted consumer trust that CALIDA Group's brands enjoy. Building a comparable reputation for quality and ethical practices, which CALIDA emphasizes, can take many years and substantial financial resources, acting as a significant barrier.

The apparel industry, particularly in the premium segment where CALIDA Group operates, necessitates a highly intricate and often globally distributed supply chain. This complexity, involving sourcing raw materials, manufacturing, and logistics, presents a substantial hurdle for newcomers.

CALIDA Group's strong emphasis on sustainability further elevates this barrier. New entrants must not only build a functional supply chain but also establish robust ethical sourcing and certified production processes from day one. For instance, in 2023, the global apparel market valued at over $1.5 trillion, with a significant portion driven by brands with strong sustainability credentials, highlighting the investment required to meet these standards.

Extensive Distribution and E-commerce Infrastructure

The CALIDA Group's extensive omni-channel distribution network, encompassing physical stores, wholesale relationships, and a strong e-commerce presence, presents a significant barrier to new entrants. Establishing a comparable reach requires substantial investment in logistics, retail space, and digital infrastructure, making it difficult for newcomers to compete effectively. For instance, in 2024, the CALIDA Group continued to optimize its retail footprint, with a focus on enhancing the in-store experience alongside digital integration.

Newcomers face the daunting task of replicating CALIDA's established distribution channels and building a robust e-commerce platform capable of serving a wide customer base. This involves not only the initial setup but also ongoing investment in inventory management, supply chain efficiency, and customer service across multiple touchpoints.

- Significant capital investment is required to build a comparable distribution network.

- Developing a competitive e-commerce infrastructure demands expertise in digital marketing and logistics.

- Securing favorable terms with wholesale partners can be challenging for new players.

- The cost and complexity of managing an omni-channel strategy deter many potential entrants.

Regulatory and Compliance Hurdles

The textile and apparel sector faces significant regulatory and compliance challenges globally. New companies must invest heavily to understand and adhere to diverse rules regarding labor conditions, environmental impact, and product safety, which can be a substantial barrier to entry, especially for those operating internationally. For instance, in 2024, the European Union continued to strengthen its regulations on sustainable textiles, including measures like the Ecodesign for Sustainable Products Regulation, demanding greater transparency and circularity from manufacturers.

CALIDA Group, with its long-standing presence, has already developed robust compliance frameworks and certifications. This established infrastructure allows the company to navigate these complex requirements more efficiently than a new entrant, providing a distinct competitive advantage. Their commitment to responsible sourcing and production, often highlighted in their annual reports, demonstrates an ongoing effort to meet and exceed these evolving standards.

- Regulatory Complexity: Navigating diverse international labor, environmental, and safety laws requires significant upfront investment and expertise.

- Compliance Costs: Meeting these standards, such as those related to chemical usage and waste management, adds substantial operational costs for new players.

- CALIDA's Advantage: Established compliance systems and certifications provide CALIDA Group with a smoother operational pathway and enhanced market credibility.

The threat of new entrants for CALIDA Group is moderate, primarily due to high capital requirements for manufacturing, product development, and marketing. Building brand loyalty and navigating complex global supply chains also pose significant challenges.

New companies need substantial investment to establish quality production and distribution, with a single modern apparel facility costing tens of millions. Competing with CALIDA's established brand equity, which reported CHF 352.2 million in revenue in 2023, requires extensive marketing and brand building efforts.

CALIDA's strong brand loyalty, exemplified by its CHF 339.5 million revenue in 2023, makes it difficult for newcomers to attract customers. Furthermore, the complexity of global supply chains and increasing regulatory demands, such as the EU's sustainable textile regulations in 2024, necessitate significant expertise and investment for new players.

Porter's Five Forces Analysis Data Sources

Our CALIDA Group Porter's Five Forces analysis is built upon a foundation of robust data, including the company's annual reports, investor presentations, and filings with regulatory bodies like the Swiss Financial Market Supervisory Authority (FINMA). We also leverage industry-specific market research reports and reputable financial news outlets to capture current competitive dynamics and strategic trends.