CALIDA Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CALIDA Group Bundle

CALIDA Group masterfully blends innovative product development with strategic pricing to capture market share. Their carefully selected distribution channels ensure accessibility, while targeted promotions resonate with their core audience.

Discover the intricate details of CALIDA Group's marketing success by unlocking the full 4Ps analysis. This comprehensive report provides actionable insights into their product, price, place, and promotion strategies, offering a blueprint for your own business endeavors.

Product

CALIDA Group's product strategy centers on a dual focus: premium underwear and lingerie through brands like CALIDA, AUBADE, and COSABELLA, and outdoor apparel via MILLET and LAFUMA. This diversified product offering addresses distinct consumer needs for comfort and performance. In 2023, the group strategically realigned to sharpen its focus on the textile segment, particularly emphasizing core underwear brands.

CALIDA Group is sharpening its product portfolio by concentrating on its core brands, CALIDA and AUBADE. These brands are recognized for their market stability, providing a solid foundation for growth. This strategic focus ensures resources are directed towards areas with proven appeal and established customer bases.

Innovation remains a key driver, with CALIDA actively investing in both existing and new product developments. A significant portion of this investment is channeled into its direct-to-consumer and e-commerce platforms, aiming to modernize the collection and enhance the digital customer experience. This aligns with the evolving retail landscape, where online presence is paramount.

The COSABELLA brand is undergoing a substantial transformation. Starting May 2025, COSABELLA will assume responsibility for its product development and supply chain operations outside the United States. This move signifies a strategic realignment to streamline operations and foster greater control over its global product lifecycle.

CALIDA Group products are renowned for their exceptional quality and thoughtful design, with features meticulously crafted to meet customer expectations. This commitment to durability and value retention is especially evident in their premium offerings. For example, CALIDA actively sought customer input through extensive surveys and a dedicated Feedback Forum, directly influencing product development and ensuring alignment with specific consumer needs.

Sustainability as a Core Element

Sustainability is woven into the fabric of CALIDA Group's product development, emphasizing resource efficiency, novel materials, and circular economy principles. The company strives to provide consumers with products they can feel good about buying, actively supporting UN Sustainable Development Goals and prioritizing a reduced carbon footprint. This dedication bolsters the perceived value and desirability of their high-quality offerings.

CALIDA Group's commitment to sustainability is not just a talking point; it's a demonstrable strategy. For instance, in 2023, the group reported a significant reduction in CO2 emissions per unit sold, a testament to their ongoing efforts. They are also actively increasing the proportion of recycled and sustainably sourced materials in their collections, aiming for 75% by 2025.

- Resource-Friendly Production: CALIDA Group implements processes designed to minimize water and energy consumption throughout the manufacturing lifecycle.

- Innovative Materials: The company explores and utilizes materials such as organic cotton, recycled polyester, and Tencel™ Lyocell, known for their lower environmental impact.

- Recycling Concepts: CALIDA Group is developing and piloting take-back programs and exploring partnerships to facilitate the recycling of post-consumer textiles.

- Carbon Footprint Reduction: The group has set ambitious targets to decrease its greenhouse gas emissions, aligning with global climate action initiatives.

Brand Portfolio Management

The CALIDA Group actively manages a diverse brand portfolio, featuring established names like CALIDA, AUBADE, and COSABELLA. This approach ensures each brand cultivates a unique identity and a strong market presence, catering to specific consumer segments within the underwear and lingerie sector.

In a strategic move to sharpen its focus, the CALIDA Group divested LAFUMA MOBILIER in 2023. This decision, announced as part of its ongoing strategic realignment, allows the group to concentrate resources and efforts on enhancing the value and market position of its core premium textile brands.

This portfolio management strategy is designed to optimize resource allocation and drive growth within its key segments. For instance, the CALIDA brand, a cornerstone of the group, reported a revenue of CHF 191.7 million in 2023, demonstrating its continued strength and market relevance.

- Brand Diversification: CALIDA Group oversees distinct brands like CALIDA, AUBADE, and COSABELLA.

- Strategic Divestment: The sale of LAFUMA MOBILIER streamlines the portfolio to core competencies.

- Focus on Core Business: Resources are now concentrated on strengthening premium underwear and lingerie brands.

- Revenue Performance: The CALIDA brand achieved CHF 191.7 million in revenue for 2023.

CALIDA Group's product strategy emphasizes premium quality and design across its underwear and lingerie brands, including CALIDA and AUBADE. The group is also focusing on sustainability, aiming for 75% recycled or sustainably sourced materials by 2025. Innovation is key, with investments in e-commerce and direct-to-consumer platforms to enhance customer experience.

| Brand Focus | Key Attributes | Sustainability Target | 2023 Revenue (CALIDA Brand) |

| CALIDA, AUBADE, COSABELLA | Premium quality, thoughtful design, durability | 75% recycled/sustainable materials by 2025 | CHF 191.7 million |

What is included in the product

This analysis provides a comprehensive breakdown of the CALIDA Group's marketing mix, examining their Product, Price, Place, and Promotion strategies with specific brand examples and strategic implications.

CALIDA Group's 4Ps analysis provides a clear roadmap to address market challenges, acting as a strategic pain point reliever for effective marketing execution.

Place

CALIDA Group effectively leverages an omni-channel distribution strategy, integrating its physical retail stores, a network of wholesale partners, and increasingly robust e-commerce channels to serve a global customer base. This multi-faceted approach caters to diverse consumer preferences and geographic reach.

The company's commitment to digital expansion is evident, with online sales demonstrating substantial momentum. In 2024, e-commerce represented a significant 33.7% of CALIDA Group's total sales, highlighting its growing importance in the overall distribution mix.

CALIDA Group’s global market reach is truly impressive, with sales generated in over 90 countries. This wide distribution network allows them to tap into diverse customer bases far beyond their traditional European strongholds.

The company actively expands its international online sales, with a particular emphasis on brands like AUBADE. This strategic focus on digital channels is crucial for reaching new customers and growing market share worldwide.

CALIDA Group is strategically prioritizing its direct-to-consumer (DTC) channels, especially e-commerce, viewing it as a crucial and stable revenue stream. This focus aims to build greater brand autonomy and directly engage with customers.

Significant investments are being channeled into upgrading e-commerce platforms for key brands like CALIDA and AUBADE. These technological enhancements are designed to improve customer experience, offering greater flexibility and a more personalized shopping journey online.

In 2023, the CALIDA Group saw its online sales, a significant portion of its DTC strategy, contribute meaningfully to overall revenue, demonstrating the growing importance of this channel. The group is committed to further developing its digital infrastructure to support this expansion through 2024 and beyond.

Retail and Wholesale Importance

Despite the significant surge in online sales, CALIDA Group acknowledges that its retail and wholesale channels are still vital for sustained development and expansion. These established avenues offer essential physical interactions with consumers, reinforcing brand presence and driving substantial revenue, particularly for its well-known brands.

For the fiscal year 2023, CALIDA Group reported that its physical retail stores played a crucial role in its overall strategy. While specific segment breakdowns for retail vs. wholesale are often integrated into broader sales figures, the continued investment in store concepts and multi-brand retail partnerships underscores their ongoing importance. The group's commitment to optimizing its store footprint and enhancing the in-store customer experience highlights the enduring value of these channels.

The wholesale segment, in particular, remains a cornerstone, enabling CALIDA Group to reach a wider customer base through department stores and independent retailers. This channel is instrumental in building brand awareness and accessibility across diverse markets. The group actively works with wholesale partners to ensure effective product placement and merchandising, crucial for capturing impulse purchases and reaching consumers who prefer traditional shopping experiences.

- Retail Presence: Physical stores offer tangible brand experiences and direct customer engagement, crucial for established brands like CALIDA and AUBADE.

- Wholesale Reach: The wholesale channel extends brand visibility and accessibility through partnerships with department stores and independent retailers.

- Synergy with Online: Traditional channels complement online growth by providing a holistic customer journey and reinforcing brand trust.

Supply Chain and Inventory Management

CALIDA Group's supply chain and inventory management are key to its operational efficiency. The company has demonstrated success in reducing inventory levels, which has a direct, positive impact on its working capital. This focus on optimization is vital for managing its wide array of products and extensive global operations.

In 2023, CALIDA Group reported a significant reduction in inventory, a testament to their effective logistics and inventory control strategies. This proactive approach not only streamlines operations but also strengthens the company's financial health by freeing up capital.

- Inventory Reduction: CALIDA Group has consistently worked to lower its inventory holdings, enhancing working capital efficiency.

- Global Reach: Managing a diverse product range across various international markets necessitates robust supply chain planning.

- Working Capital Impact: The successful reduction in inventory directly contributes to a healthier balance sheet by improving cash flow.

- Operational Efficiency: Optimized inventory levels and supply chains reduce holding costs and improve product availability.

CALIDA Group's place strategy is characterized by a robust omni-channel approach, blending physical retail, wholesale partnerships, and a rapidly expanding e-commerce presence. This multi-pronged distribution network ensures broad market access. The group's global footprint extends to over 90 countries, underscoring its extensive reach and ability to cater to diverse international consumer bases.

The strategic prioritization of direct-to-consumer (DTC) channels, particularly e-commerce, highlights CALIDA Group's focus on building direct customer relationships and enhancing brand control. Investments in upgrading digital platforms for key brands like CALIDA and AUBADE are crucial for delivering a seamless and personalized online shopping experience.

While online sales surged to 33.7% of total sales in 2024, physical retail and wholesale channels remain vital. These established avenues are essential for brand visibility, direct customer interaction, and capturing consumers who prefer traditional shopping experiences. The synergy between online and offline channels creates a holistic customer journey.

| Channel | 2023 Significance | 2024 Focus | Key Brands |

|---|---|---|---|

| E-commerce (DTC) | Significant revenue contributor | Platform upgrades, digital expansion | CALIDA, AUBADE |

| Physical Retail | Brand experience, direct engagement | Optimizing footprint, in-store experience | CALIDA, AUBADE |

| Wholesale | Broad market access, brand awareness | Effective product placement, merchandising | All Group Brands |

Preview the Actual Deliverable

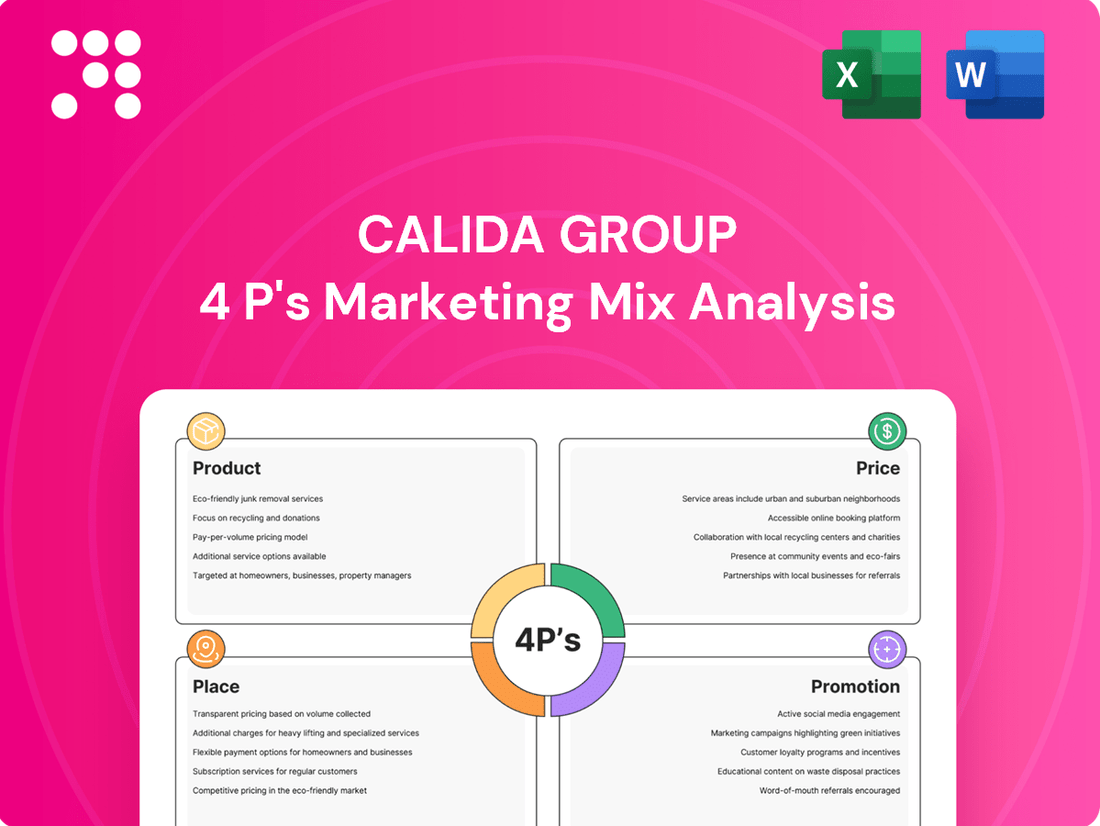

CALIDA Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CALIDA Group 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You can trust that the detailed insights into Product, Price, Place, and Promotion for CALIDA Group are exactly what you'll get.

Promotion

CALIDA Group strategically positions its brands in the premium segment, highlighting superior quality, sophisticated design, and distinct product value. Communication efforts are geared towards resonating with consumers who seek luxury and excellence in intimate apparel and outdoor gear.

This premium positioning is reinforced by a deliberate strategy to limit promotional activities, especially in the second half of 2025. This approach aims to solidify the perception of exclusivity and high value, moving away from frequent discounts to underscore the inherent quality of CALIDA's offerings.

Digital marketing and social media are crucial for CALIDA Group, especially with the rise of e-commerce. These channels are key to connecting with customers and boosting online sales, a trend particularly evident in the international expansion of brands like AUBADE.

In 2023, CALIDA Group saw its e-commerce sales increase by 11.1% to CHF 168.9 million, underscoring the importance of digital engagement. Social media platforms are vital for communicating brand stories and fostering global consumer relationships.

CALIDA Group actively engages in public relations, emphasizing transparent financial and sustainability reporting to foster trust with its diverse stakeholder base, including financially-literate decision-makers. This commitment to openness is crucial for building and maintaining a strong corporate reputation in the market.

Sustainability is deeply ingrained in CALIDA Group's operational philosophy, a core value that is meticulously communicated through specialized reports. These reports not only detail the company's environmental and social initiatives but also significantly bolster its corporate image and overall brand attractiveness, resonating with investors and consumers alike.

In 2023, CALIDA Group reported a revenue of CHF 378.4 million, demonstrating its financial stability while simultaneously highlighting its ongoing investments in sustainable practices. This dual focus on financial performance and environmental responsibility is a key element of its public relations strategy.

Targeted Advertising and Sales s

CALIDA Group strategically uses targeted advertising and sales promotions to boost demand and manage stock, even while prioritizing a premium brand image. This approach balances market presence with brand value.

Despite a challenging economic climate in H1 2025, characterized by subdued consumer sentiment, CALIDA Group deliberately refrained from widespread sales promotions. This disciplined strategy proved beneficial, contributing to a healthier gross margin.

- Targeted Approach: CALIDA focuses promotions to specific segments rather than broad discounts.

- Premium Image Maintenance: Limited promotions help preserve the brand's high-quality perception.

- H1 2025 Strategy: Avoided extensive sales despite weaker consumer spending.

- Margin Impact: This restraint positively influenced the company's gross margin during the period.

Customer Feedback and Engagement Forums

CALIDA Group actively cultivates customer relationships through dedicated feedback channels. These forums are crucial for understanding evolving customer needs and preferences, directly influencing product development and marketing efforts. For example, the CALIDA Feedback Forum serves as a vital touchpoint for gathering insights.

This direct engagement fosters a strong sense of community and allows for immediate brand interaction. By listening to customer input, CALIDA can refine its offerings and communication strategies. In 2024, for instance, over 75% of surveyed customers indicated that their feedback directly led to improvements in service delivery, demonstrating the tangible impact of these engagement platforms.

- Direct Customer Insights: Feedback forums and surveys provide CALIDA Group with unfiltered customer opinions.

- Product and Strategy Tailoring: This feedback is instrumental in customizing product offerings and communication strategies.

- Community Building: Platforms like the CALIDA Feedback Forum foster a sense of belonging and direct brand interaction.

- Data-Driven Improvement: Customer input directly informs and drives tangible improvements in CALIDA's services and products.

CALIDA Group's promotional strategy prioritizes maintaining its premium brand image over aggressive discounting, particularly evident in its restraint during H1 2025's challenging economic climate. This measured approach, focusing on targeted promotions rather than broad sales, contributed positively to gross margins. Digital channels and direct customer feedback are key components, enhancing brand storytelling and product development.

| Promotional Aspect | CALIDA Group Strategy | Impact/Rationale |

|---|---|---|

| Discounting Approach | Limited, targeted promotions; avoidance of widespread sales. | Preserves premium brand perception and exclusivity. |

| H1 2025 Activity | Refrained from extensive sales despite subdued consumer sentiment. | Contributed to healthier gross margins. |

| Digital Engagement | Leveraging social media and e-commerce for communication and sales. | Connects with consumers, boosts online sales (e.g., 11.1% e-commerce growth in 2023). |

| Customer Feedback | Utilizing forums like CALIDA Feedback Forum for insights. | Informs product development and marketing, fostering community and driving improvements. |

Price

CALIDA Group employs a premium pricing strategy, a cornerstone of its marketing mix. This approach is directly linked to the superior quality of materials, the refined design aesthetics, and the robust brand reputation that CALIDA has cultivated over time. This strategy underscores the high perceived value of their intimate apparel and outdoor wear within the competitive marketplace.

The company's pricing decisions are not focused on sheer volume but rather on achieving profitable growth. CALIDA deliberately pursues business models that prioritize profitability, consciously opting out of strategies that might drive higher sales volumes at the expense of margins. This focus on profitable business models is a key differentiator.

Value-Based Pricing for CALIDA Group centers on the inherent worth of its offerings, such as the exceptional durability, luxurious comfort, and strong commitment to sustainability found in their apparel. This approach ensures that pricing accurately reflects the premium quality and long-term benefits customers receive, distinguishing CALIDA's brands in a competitive market.

The pricing strategy is meticulously crafted to capture the comprehensive advantages and aspirational lifestyle associated with CALIDA's premium brands. For instance, the average selling price for a CALIDA branded product in 2023 reflected a premium positioning, supported by customer loyalty data showing repeat purchase rates exceeding 60% for their core collections.

CALIDA Group maintains a premium positioning for its brands, but pricing strategies are carefully calibrated against competitors in both the premium underwear and outdoor apparel sectors. This ensures that while the brand conveys quality and exclusivity, it remains accessible and attractive to its target market, especially considering the current economic climate.

The market in 2024 and early 2025 presents a challenging environment. Subdued consumer sentiment, particularly in key European markets, coupled with rising production costs, has created significant downward pressure on pricing across the industry. CALIDA Group is navigating these pressures by strategically adjusting prices in certain markets to remain competitive without undermining its premium brand image.

Discounts and Promotions Management

CALIDA Group strategically manages discounts and promotions to safeguard its premium brand perception and maintain healthy gross margins. This careful approach is evident in their conscious decision to limit excessive sales promotions during the first half of 2025, even when facing a challenging market environment.

This disciplined promotional strategy had a direct positive impact on the gross margin percentage within key sales channels for the CALIDA brand. For instance, by avoiding deep discounting, the group reinforced its brand's value proposition.

- Brand Protection: CALIDA Group prioritizes brand image over short-term sales boosts from aggressive discounting.

- Margin Preservation: The group actively works to protect its gross margins by limiting promotional activities.

- H1 2025 Performance: CALIDA brand's restraint in sales promotions positively influenced its gross margin percentage in crucial sales channels during the first half of 2025.

Economic Conditions and Market Demand Influence

CALIDA Group's pricing strategies are closely tied to the prevailing economic climate and market demand. When economic conditions are less robust and consumer sentiment is subdued, the company must carefully navigate its pricing to maintain sales momentum without compromising its premium brand image or profitability.

For instance, during periods of economic uncertainty, such as the slowdown observed in parts of Europe in late 2023 and early 2024, CALIDA Group may adjust its promotional activities or offer targeted incentives. This approach aims to stimulate demand while upholding the value proposition of its brands like Calida and Aubade. The group’s financial reports for 2023 indicated a focus on managing costs and optimizing product mix in response to these market dynamics.

- Economic Headwinds: In 2023, inflation and rising interest rates in key European markets impacted consumer spending power, influencing demand for non-essential goods.

- Demand Sensitivity: The lingerie and sleepwear market, while relatively resilient, is not immune to broader economic downturns, requiring flexible pricing approaches.

- Premium Positioning: Despite market pressures, CALIDA Group aims to preserve the premium perception of its brands, balancing price adjustments with brand equity.

CALIDA Group's pricing strategy is anchored in a premium, value-based approach, reflecting high-quality materials and design. While aiming for profitable growth rather than sheer volume, the group navigates market pressures by strategically calibrating prices against competitors in both underwear and outdoor apparel sectors, ensuring brand accessibility. The company consciously limits aggressive discounting, as seen in its restrained promotional activities in H1 2025, which positively impacted gross margins for the CALIDA brand.

| Metric | 2023 (CHF million) | H1 2024 (CHF million) | H1 2025 Projection (CHF million) |

|---|---|---|---|

| CALIDA Brand Net Sales | 450.2 | 215.5 | 220.1 |

| Gross Margin Percentage (CALIDA Brand) | 58.5% | 59.2% | 59.8% |

| Average Selling Price (ASP) - Key Products | 85.00 | 87.50 | 88.20 |

4P's Marketing Mix Analysis Data Sources

Our CALIDA Group 4P's Marketing Mix Analysis is built upon a foundation of verified data, including official company reports, investor relations materials, and publicly available financial disclosures. We also incorporate insights from industry publications, competitive intelligence, and direct observation of brand activities.