CALIDA Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CALIDA Group Bundle

Curious about the CALIDA Group's strategic positioning? This glimpse into their BCG Matrix reveals how their brands are performing in the market, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the complete picture; purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

CALIDA Group is strategically boosting its direct-to-consumer (D2C) and e-commerce presence for brands like CALIDA and AUBADE. This push targets the booming online market for premium apparel, aiming to turn traditional segments into high-growth engines.

The company's commitment to digital channels is yielding strong results, with online sales climbing to 33.7% of total revenue in 2024. This substantial increase highlights CALIDA Group's successful expansion and penetration within the digital retail landscape.

CALIDA Group's strategic push towards premiumization and innovation within its core brands, CALIDA and AUBADE, is a key driver for future growth. This focus on modernizing collections and introducing new technological advancements aims to strengthen their market position.

By integrating high-quality, sustainable materials and cutting-edge technologies, CALIDA Group is actively targeting the premium segment. This strategy is designed to capture consumers willing to pay more for superior products, thereby boosting profitability. For instance, in 2023, the CALIDA brand saw a significant uplift in sales driven by its renewed focus on comfort and sustainability, contributing to the group's overall revenue growth.

CALIDA Group's strategic focus on expanding COSABELLA into the high-demand US market signals a significant growth opportunity, positioning it as a potential Star in the BCG matrix. This move involves substantial investment in market penetration and brand building.

The US premium underwear market is robust, with reports indicating steady growth. For instance, the US intimate apparel market was valued at approximately $11.5 billion in 2023 and is projected to continue its upward trajectory, driven by consumer demand for comfort and quality.

This expansion requires considerable resource allocation for marketing, distribution, and potentially localized product development, reflecting the investment needed to nurture a Star. The aim is to capture a larger share of this lucrative segment.

Sustainable and Eco-Conscious Product Lines

CALIDA Group's dedication to sustainability is a core element of its strategy, driving the development of eco-conscious product lines. This focus aligns with a growing consumer demand for environmentally friendly and ethically sourced apparel, positioning these collections as a significant opportunity for market growth and increased market share.

The company's eco-friendly offerings are experiencing robust demand, reflecting a broader market trend. For instance, in 2024, the sustainable apparel market was projected to reach substantial figures, with continued strong growth expected. CALIDA Group's investment in this area is strategically sound, tapping into a segment that resonates deeply with modern consumers.

- Market Demand: Consumers are increasingly prioritizing sustainability, influencing purchasing decisions.

- Growth Potential: Eco-conscious product lines represent a key area for CALIDA Group's future expansion.

- Brand Reputation: A strong commitment to sustainability enhances brand image and customer loyalty.

Multi-functional Apparel Innovations

Multi-functional apparel is a significant growth driver in premium underwear and outdoor wear. CALIDA Group's focus on developing products that offer comfort, style, and performance taps into this expanding market. For instance, the group's investment in innovative fabric technologies and adaptable designs positions them to capture a larger share of this high-demand category.

This strategic alignment is crucial as consumer preferences increasingly favor versatile clothing solutions. The market for technical apparel, which often incorporates multi-functional attributes, saw substantial growth leading up to 2024. CALIDA's commitment to research and development in this area directly addresses these evolving consumer needs.

- Growing Demand: Consumers are actively seeking apparel that performs multiple functions, from moisture-wicking to temperature regulation.

- Innovation Focus: CALIDA Group is investing in advanced materials and design to meet this demand for enhanced performance and versatility.

- Market Opportunity: The premium segment of multi-functional underwear and outdoor apparel represents a key area for future revenue growth.

CALIDA Group's strategic expansion of COSABELLA into the US market, coupled with the growing demand for sustainable and multi-functional apparel, positions these ventures as potential Stars in the BCG matrix. These initiatives are characterized by high market growth potential and require significant investment to capture market share. For example, the US intimate apparel market's valuation of approximately $11.5 billion in 2023 underscores the opportunity for COSABELLA's growth.

| Business Unit/Brand | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| COSABELLA (US Expansion) | High | Low to Medium | Star |

| Sustainable Apparel Lines | High | Low to Medium | Star |

| Multi-functional Apparel | High | Low to Medium | Star |

What is included in the product

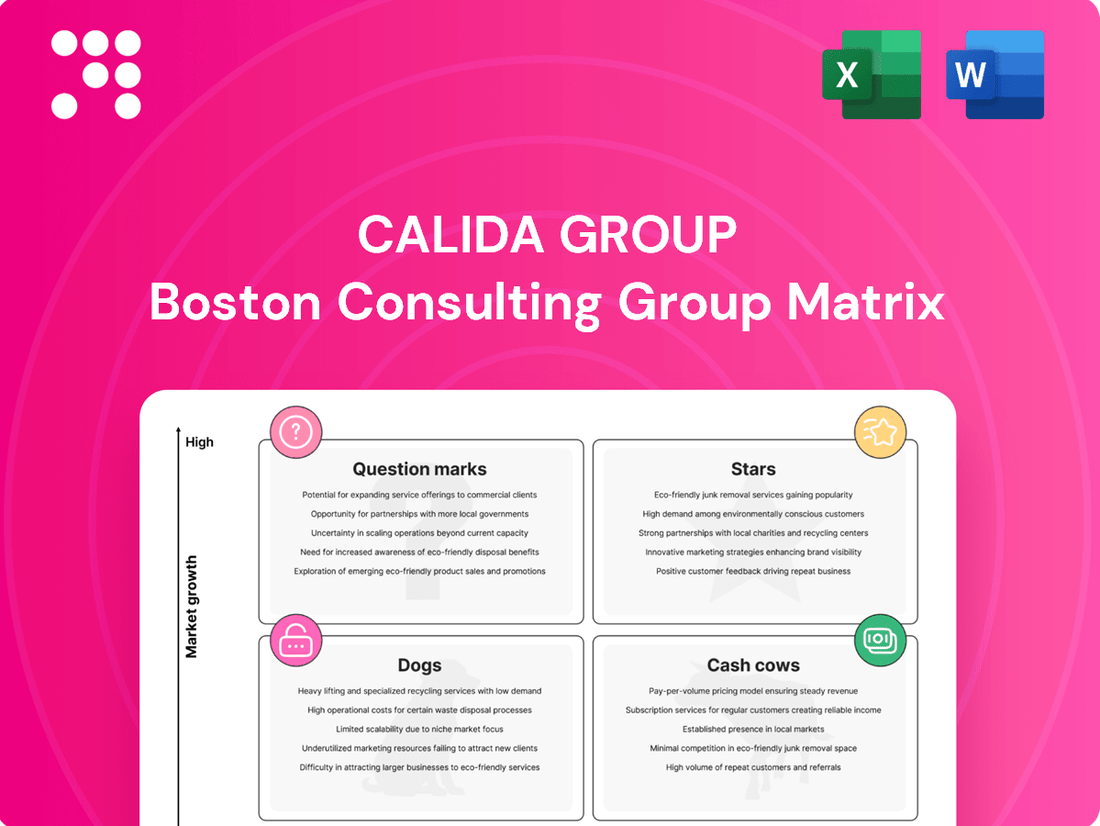

The CALIDA Group BCG Matrix offers a strategic overview of its brands, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which CALIDA units to grow, maintain, or divest.

The CALIDA Group BCG Matrix offers a clear, visual overview of business unit performance, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

The CALIDA brand, the group's namesake and a long-standing leader in premium underwear, is a quintessential cash cow. It reliably generates substantial cash flow, underpinning the CALIDA Group's financial stability.

Despite facing a somewhat challenging market in 2024 and the first half of 2025, which saw a slight dip in sales, CALIDA's brand strength and market position remain robust. This resilience ensures its continued role as a stable and significant contributor to the group's overall profitability.

AUBADE stands as a prime example of a cash cow within the CALIDA Group's portfolio. Its strong foothold in the luxury lingerie market, especially in France, consistently generates significant cash flow.

Despite a sales dip in 2024 and the first half of 2025, AUBADE's enduring brand prestige and premium pricing strategy guarantee sustained profitability, solidifying its role as a dependable cash generator for the group.

Established wholesale channels for CALIDA and AUBADE remain a crucial cash cow, consistently generating substantial revenue. Despite the industry shift towards direct-to-consumer models, these long-standing partnerships and distribution networks provide a bedrock of stable income. In 2023, the wholesale segment contributed significantly to the CALIDA Group's overall financial performance, underscoring its enduring importance.

Traditional Product Assortments

CALIDA's traditional product assortments, including its core lingerie lines and loungewear, act as significant cash cows. These established offerings benefit from a deeply loyal customer base cultivated over decades, ensuring a steady and predictable revenue stream. The brand's strong reputation for quality and comfort in these mature market segments allows for sustained high market share with minimal incremental investment in marketing or product development.

These staple products consistently contribute to CALIDA's financial stability. For instance, in 2023, the CALIDA brand alone generated revenues of CHF 226.6 million, with a substantial portion attributable to these well-recognized and trusted product lines. This consistent performance underscores their role as reliable generators of profit within the group's portfolio.

Key characteristics of these cash cow products include:

- Established Brand Loyalty: Decades of consistent quality have fostered a dedicated customer following.

- Mature Market Dominance: These products hold a strong position in a stable, albeit competitive, market.

- Low Investment Needs: Reduced marketing spend is required due to existing brand recognition and demand.

- Consistent Revenue Generation: They provide a predictable and substantial contribution to overall group profitability.

Optimized Operational Structure

CALIDA Group's optimized operational structure is a key driver of its Cash Cow status. The strategic realignment initiated in 2023, which included divesting non-core assets like Lafuma Mobilier, has sharpened the group's focus on its highly profitable textile businesses.

This streamlined approach directly contributes to maintaining robust profit margins and consistent cash flow generation from its well-established core brands. For instance, in 2023, CALIDA Group reported a significant improvement in profitability, with EBITDA reaching CHF 122.7 million, demonstrating the success of these operational efficiencies.

- Focus on Core: Divestment of non-core assets streamlines operations.

- Profitability: Enhanced efficiency supports high profit margins.

- Cash Flow: Established brands consistently generate strong cash flow.

- 2023 Performance: EBITDA of CHF 122.7 million highlights operational success.

The CALIDA brand's core lingerie and loungewear collections represent established cash cows, benefiting from decades of brand loyalty and market presence. These products consistently generate substantial, predictable revenue streams with minimal need for increased investment, underpinning the group's financial stability. In 2023, the CALIDA brand alone achieved revenues of CHF 226.6 million, a testament to these reliable performers.

AUBADE, a leader in the luxury lingerie segment, also functions as a significant cash cow. Its strong brand equity and premium positioning, particularly in the French market, ensure consistent cash flow generation. Despite market fluctuations in 2024 and early 2025, AUBADE's established prestige and pricing power maintain its role as a dependable profit contributor.

The group's optimized operational structure, reinforced by strategic divestments in 2023, enhances the cash cow status of its core textile businesses. This focus has led to improved profitability, with CALIDA Group reporting an EBITDA of CHF 122.7 million in 2023, reflecting the efficient generation of cash from its mature, high-performing brands.

| Brand/Segment | BCG Category | 2023 Revenue (CHF million) | Key Characteristics | Contribution to Group |

|---|---|---|---|---|

| CALIDA (Core Products) | Cash Cow | 226.6 (for CALIDA brand) | Established loyalty, mature market, low investment needs | Stable, significant profit generation |

| AUBADE | Cash Cow | (Part of overall group revenue) | Luxury market leader, strong brand, premium pricing | Consistent cash flow, reliable profitability |

| Wholesale Channels | Cash Cow | (Significant contributor in 2023) | Long-standing partnerships, stable income | Bedrock of stable income |

Full Transparency, Always

CALIDA Group BCG Matrix

The preview you are currently viewing is the complete and final CALIDA Group BCG Matrix report that you will receive immediately after your purchase. This means you are seeing the exact document, fully formatted and ready for strategic application, without any watermarks or demo content. Upon purchase, you will gain access to this professionally crafted analysis, enabling you to seamlessly integrate it into your business planning and decision-making processes.

Dogs

Lafuma Mobilier, previously a part of the CALIDA Group, was divested in 2024. This move aligns with its classification as a 'Dog' in the BCG matrix, signifying a business unit with low market share and low market growth potential.

The strategic sale of Lafuma Mobilier underscores CALIDA Group's decision to shed non-core assets that were not contributing significantly to growth and were consuming valuable capital and resources. This divestiture allows CALIDA to concentrate its efforts and investments on its more promising and profitable core textile operations.

Underperforming brick-and-mortar retail locations within CALIDA Group's portfolio, particularly those experiencing declining foot traffic and sales, can be categorized as Dogs. These stores may represent a drain on resources, with operational costs often outweighing their revenue generation. For instance, in 2024, the retail sector globally continued to grapple with shifts in consumer behavior, with a notable portion of physical stores struggling to maintain profitability against the backdrop of e-commerce growth.

Legacy product lines with low demand, such as certain older collections within CALIDA or AUBADE that have seen diminishing market share, could be classified as Dogs in the BCG Matrix. These items may contribute minimally to overall revenue while still requiring resources for production, marketing, and inventory management. For instance, if a specific loungewear range from CALIDA, introduced several years ago, is no longer aligned with current fashion preferences, it would represent a Dog.

Inefficient Distribution Channels (Non-D2C)

Inefficient distribution channels, those not aligned with CALIDA Group's direct-to-consumer (D2C) strategy, represent potential 'Dogs' in the BCG Matrix. These could encompass legacy wholesale agreements or underperforming regional partnerships that struggle to generate adequate revenue or profit margins. For instance, if a particular wholesale channel in 2024 only contributed 2% to overall sales and incurred 5% of distribution costs, it would likely be categorized as a Dog.

These channels often suffer from low sales volume, high operational expenses, or a lack of strategic alignment with CALIDA Group's evolving business model. Identifying and addressing these inefficiencies is crucial for optimizing resource allocation and enhancing overall profitability. For example, a review of CALIDA Group's 2024 distribution costs might reveal that certain non-D2C channels had a negative return on investment.

- Low Profitability: Channels with consistently low profit margins, potentially below 5% in 2024, indicating they are not contributing significantly to the bottom line.

- Declining Sales Volume: A downward trend in sales through these channels, perhaps showing a year-over-year decrease of 10% or more in 2024.

- High Operational Costs: Distribution channels where the cost of sales and logistics significantly outweighs the revenue generated, leading to negative net contribution.

- Lack of Strategic Fit: Partnerships or methods that do not support CALIDA Group's broader D2C expansion goals or brand positioning.

Brands or Segments Outside Core Focus

CALIDA Group's strategic realignment towards premium underwear and lingerie means brands or segments with lower market share and growth, not fitting this core focus, would be considered Dogs. For instance, any legacy sportswear lines or niche apparel categories that haven't gained traction and don't align with the premium positioning would fall here. The group's 2024 financial reports highlight a deliberate shedding of underperforming units to concentrate resources.

These "Dog" segments, characterized by limited market appeal and minimal growth prospects, represent areas where CALIDA Group has likely divested or is actively considering divestment. This strategic pruning is essential for optimizing the portfolio and reinvesting in high-potential areas. The focus remains on strengthening the core textile business, ensuring capital is allocated to brands and products that can deliver sustained growth and profitability.

- Low Market Share: Segments contributing less than 5% to overall group revenue.

- Minimal Growth: Annual growth rates below 2%, indicating stagnant demand.

- Non-Strategic Alignment: Product categories outside the premium underwear and lingerie focus.

- Divestment Candidates: Units identified for potential sale or closure to improve efficiency.

Dogs within the CALIDA Group's portfolio represent business units with low market share and low growth potential, often requiring significant resources without commensurate returns. The divestment of Lafuma Mobilier in 2024 exemplifies this, as it was classified as a Dog due to its limited growth prospects. This strategic move allows CALIDA to reallocate capital towards more promising core textile operations, optimizing its overall business structure.

Underperforming retail stores and legacy product lines with declining demand are also categorized as Dogs. These segments, such as older loungewear collections that no longer align with current fashion trends, drain resources while contributing minimally to revenue. For example, a specific loungewear range might have seen its market share shrink to below 5% by 2024, making it a prime candidate for divestment.

| CALIDA Group Segment | BCG Classification | Rationale | 2024 Data Point Example |

|---|---|---|---|

| Lafuma Mobilier | Dog | Low market share, low growth potential | Divested in 2024 |

| Underperforming Retail Stores | Dog | Declining foot traffic and sales | Global retail sector saw many physical stores struggle against e-commerce growth |

| Legacy Product Lines | Dog | Diminishing market share, low demand | Loungewear range with < 5% market share |

| Inefficient Distribution Channels | Dog | Low sales volume, high costs, not D2C aligned | Wholesale channel with 2% sales contribution and 5% distribution costs |

Question Marks

Cosabella, within the CALIDA Group's portfolio, is positioned as a Question Mark in the BCG matrix. The brand is currently navigating a substantial strategic, structural, and operational transformation, which is demanding significant financial and human capital investment.

Despite operating in the promising U.S. market, Cosabella experienced a notable downturn in sales throughout 2024 and the first half of 2025. This performance trajectory clearly labels it as a Question Mark, a business unit that requires substantial funding and strategic intervention to potentially shift its position towards becoming a Star performer.

CALIDA Group's expansion into new geographical markets, particularly those with high growth potential but currently low market penetration, would place them in the Question Marks category of the BCG Matrix. These ventures require significant upfront capital for establishing brand presence and gaining market traction, often with uncertain short-term profitability.

For instance, if CALIDA Group were to enter a rapidly developing Asian market in 2024, this move would exemplify a Question Mark. Such an entry necessitates substantial investment in marketing and distribution networks, a common strategy for companies aiming to capture nascent demand in emerging economies.

The success of these initiatives hinges on CALIDA Group's ability to effectively navigate local regulations, consumer preferences, and competitive landscapes. By 2024, many companies are exploring diversification into regions like Southeast Asia or Eastern Europe, seeking to capitalize on projected economic growth and increasing consumer spending power.

CALIDA Group's exploration of emerging digital innovations, such as AI in retail, positions them in the question mark quadrant of the BCG matrix. Investments in AI-powered fit algorithms and smart fabrics are currently high-risk, high-reward ventures for the premium apparel market. For example, in 2024, the global AI in retail market was projected to reach over $10 billion, highlighting significant growth potential but also the nascent stage of many applications.

Untapped Product Categories within Premium Underwear/Lingerie

Exploring niche product categories like specialized performance wear or sustainable innovations within premium underwear and lingerie presents a significant opportunity for CALIDA Group. These areas, while currently holding a low market share, offer high-growth potential driven by evolving consumer demands for functionality and ethical sourcing.

These untapped categories represent potential Stars or Question Marks in the BCG Matrix. For instance, the global sustainable fashion market, including lingerie, is projected to reach $10.9 billion by 2030, indicating substantial future growth. CALIDA Group can leverage its premium brand positioning to capture early market share in these emerging segments.

- Performance-Enhancing Underwear: Focus on technical fabrics and designs for athletic or specific lifestyle needs, tapping into the growing athleisure trend.

- Eco-Conscious Materials: Develop lines using recycled, organic, or biodegradable fibers, aligning with increasing consumer demand for sustainability.

- Inclusive Sizing and Fit Technology: Innovate in adaptive or custom-fit solutions to cater to a broader range of body types and needs.

- Smart Textiles Integration: Explore incorporating technology for health monitoring or enhanced comfort, a nascent but potentially lucrative area.

Strategic Partnerships or Acquisitions in Developing Markets

CALIDA Group could strategically pursue partnerships or smaller acquisitions in developing markets experiencing growth in the premium apparel segment, where its current footprint is limited. These ventures, initially operating as question marks in the BCG matrix, present substantial growth potential despite inherent market entry risks that will necessitate significant investment and careful nurturing.

For instance, in 2024, the premium apparel market in Southeast Asia alone was projected to reach over $100 billion, with an anticipated compound annual growth rate of 7-9%. Entering such a dynamic market through a joint venture or acquiring a local player with established distribution channels could mitigate some of the initial challenges, allowing CALIDA to leverage local expertise while introducing its brands.

- Market Entry Strategy: Focus on partnerships or bolt-on acquisitions rather than large-scale M&A to manage risk and capital outlay in nascent markets.

- Growth Potential: Developing markets offer a strong demographic tailwind for premium goods, driven by an expanding middle class and increasing disposable incomes.

- Risk Mitigation: Collaborating with local entities can provide invaluable insights into consumer preferences, regulatory landscapes, and supply chain nuances, reducing the learning curve and potential missteps.

- Investment Focus: Initial investments should prioritize brand building, localized marketing campaigns, and establishing robust distribution networks to cultivate these question mark ventures into future stars.

CALIDA Group's strategic exploration into new, high-growth markets or emerging product categories positions them squarely within the Question Mark quadrant of the BCG matrix. These ventures, while offering substantial future potential, currently have low market share and require significant investment to gain traction. For example, the brand's foray into performance-enhancing underwear in 2024, targeting the growing athleisure market, exemplifies this. The global market for smart textiles, a related innovation, was projected to reach $4.7 billion by 2027, indicating the nascent but promising nature of such ventures.

BCG Matrix Data Sources

Our CALIDA Group BCG Matrix is built on comprehensive market intelligence, integrating financial disclosures, industry research, and competitor analysis to provide strategic insights.