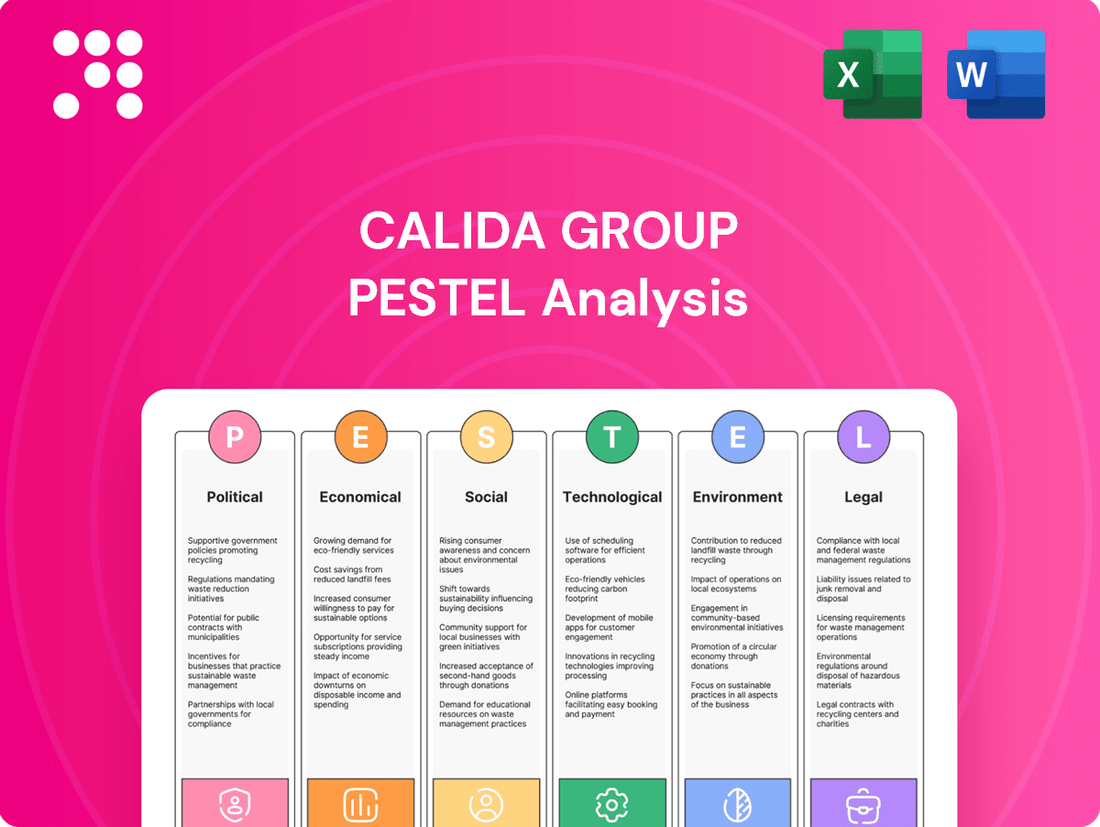

CALIDA Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CALIDA Group Bundle

Uncover the critical political, economic, and social factors shaping CALIDA Group's trajectory. Our PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence for strategic planning. Don't get left behind; download the full version to gain a competitive edge.

Political factors

CALIDA Group's global presence across more than 90 countries means it's significantly influenced by diverse government regulations and trade policies. For instance, in 2024, ongoing trade discussions between major economic blocs could introduce new tariffs or alter existing agreements, potentially affecting CALIDA's material sourcing costs and the competitiveness of its finished goods in various markets.

Changes in import/export duties or the implementation of new trade barriers are critical considerations. For example, a shift in a key market's stance on textile imports could directly impact CALIDA's supply chain efficiency and its ability to access those consumer bases.

Political stability in regions where CALIDA manufactures and sells its products is paramount. Unforeseen political shifts or instability in manufacturing hubs could disrupt production, while economic uncertainty in sales markets can dampen consumer spending, directly affecting CALIDA's revenue streams and operational continuity.

Geopolitical instability remains a significant concern, as noted in CALIDA Group's half-year results for 2025. These ongoing uncertainties directly influence consumer confidence and, consequently, market demand for the group's offerings.

Such global tensions can create considerable disruptions to supply chains, elevate operational risks, and cause volatile currency exchange rates, all of which can negatively impact CALIDA Group's profitability.

Given CALIDA Group's extensive international operations, it is crucial for the company to continuously monitor and strategically adapt to the evolving political landscapes across its various markets to mitigate potential adverse effects.

CALIDA Group's operational costs and HR strategies are significantly shaped by varying labor laws and minimum wage policies across its global footprint. For instance, in 2024, Switzerland's average minimum wage was around CHF 4,000 per month, a stark contrast to other operating regions, directly impacting manufacturing expenses.

Navigating these diverse regulations, from employment contracts to working hour limits, is crucial for CALIDA to maintain compliance and ethical standards. The group’s 2024 and 2025 annual general meetings highlighted a focus on corporate governance, underscoring the importance of adhering to these complex legal landscapes to prevent penalties and ensure responsible business practices.

Consumer Protection and Product Safety Laws

Consumer protection and product safety laws are a significant political factor for CALIDA Group. Governments worldwide, including key markets for CALIDA, enforce stringent regulations on apparel and intimate wear to guarantee product quality and consumer well-being. These laws often dictate specific labeling requirements, restrict the use of certain materials, and mandate rigorous quality control processes.

CALIDA Group must navigate these diverse regulatory landscapes across all its operating regions. For instance, in the European Union, the General Product Safety Regulation (GPSR) ensures that only safe products are placed on the market. Non-compliance can result in severe consequences, including product recalls, substantial fines, and significant damage to the brand's reputation. In 2023, the EU reported over 2,000 product safety alerts related to textiles and apparel, highlighting the active enforcement of these regulations.

- Adherence to EU General Product Safety Regulation (GPSR) for all products sold within the European Union.

- Compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations concerning chemical substances in products, which impacted many textile and apparel companies in 2024.

- Meeting specific labeling requirements for materials and care instructions mandated by national consumer protection agencies.

- Implementing robust quality control measures to prevent product recalls and associated financial penalties, which can amount to millions for major brands.

Political Support for Textile Industry

Government initiatives and subsidies play a crucial role in shaping the textile and apparel sector. For instance, in 2024, several European nations, including Germany and France, continued to offer grants and tax incentives for businesses investing in advanced manufacturing technologies and sustainable practices within the textile industry. These programs aim to bolster domestic production and reduce reliance on imports, potentially impacting CALIDA Group's sourcing and manufacturing strategies.

Policies that encourage local production or emphasize sustainable manufacturing can present both opportunities and challenges. A 2025 proposed directive from the European Union, for example, focuses on increasing the use of recycled materials and promoting circular economy principles in textiles. If CALIDA Group aligns its operations with these emerging standards, it could gain a competitive edge; however, failure to adapt might lead to compliance costs or market access limitations.

CALIDA Group's strategic focus on its core textile business positions it to benefit from political agendas that prioritize the growth and modernization of this sector. As of early 2025, discussions in several key markets are revolving around reshoring manufacturing capabilities, particularly in response to supply chain vulnerabilities exposed in recent years. This trend could translate into favorable policy environments for established textile players like CALIDA.

- Government support: Initiatives like grants for sustainable manufacturing and advanced technology adoption are prevalent in 2024-2025.

- Policy impact: EU directives promoting recycled materials and circularity in textiles could influence operational strategies.

- Strategic alignment: CALIDA's core textile focus aligns with potential political agendas favoring domestic production and industry modernization.

CALIDA Group's global operations are heavily influenced by government stability and policy consistency. Geopolitical tensions, as observed in early 2025, directly affect consumer confidence and demand, impacting sales.

Trade agreements and tariffs are critical; for instance, changes in import/export duties in key markets can alter material costs and product competitiveness.

Labor laws and minimum wage variations, such as Switzerland's average CHF 4,000 monthly minimum wage in 2024, significantly impact operational expenses and HR strategies across different regions.

Government support for sustainable manufacturing and technological advancements, evident in 2024-2025 European grants, can offer strategic advantages if aligned with CALIDA's operational focus.

| Political Factor | Impact on CALIDA Group | 2024-2025 Context/Data |

|---|---|---|

| Geopolitical Instability | Reduces consumer confidence, dampens market demand, disrupts supply chains, and creates currency volatility. | Ongoing global tensions noted in H1 2025 results. |

| Trade Policies & Tariffs | Affects material sourcing costs and product market competitiveness. | Ongoing trade discussions between economic blocs in 2024. |

| Labor Laws & Minimum Wage | Influences manufacturing expenses and HR strategies. | Switzerland's average minimum wage around CHF 4,000/month in 2024. |

| Government Incentives | Supports investment in advanced manufacturing and sustainable practices. | Grants and tax incentives in Germany and France for textile industry modernization in 2024. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the CALIDA Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the CALIDA Group's operating landscape.

Provides a concise version of the CALIDA Group's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Economic factors

CALIDA Group's financial health is closely tied to how much consumers are willing and able to spend, especially on their higher-end underwear and outdoor gear. When people feel less confident about the economy, they tend to cut back on purchases they don't absolutely need, which directly affects CALIDA's sales.

For instance, reports from 2024 and the first half of 2025 indicated a dip in consumer confidence across CALIDA's key European markets. This caution means consumers are more likely to prioritize essential goods over discretionary items like premium apparel, leading to slower sales growth for the group.

Rising inflation in 2024 and projected into 2025 presents a significant challenge for CALIDA Group. Increased costs for raw materials, such as lumber and concrete, coupled with higher energy prices for manufacturing and transportation, can directly compress profit margins. For instance, if material costs rise by 5-10% due to inflation, this could translate to a notable reduction in profitability if not passed on to consumers.

Elevated interest rates, a common response to inflation, also pose a dual threat. Higher borrowing costs for consumers can dampen demand for CALIDA's products, particularly for larger purchases. Furthermore, for the company itself, increased interest rates mean a higher cost of capital, making new investments and ongoing operations more expensive. This is particularly relevant as CALIDA considers expansion or property development projects.

However, CALIDA Group's strong financial position, characterized by its net liquidity and debt-free status as of its latest reports, offers a degree of insulation. This financial resilience allows the company to better absorb the impact of rising costs and potentially higher borrowing expenses compared to more leveraged competitors.

CALIDA Group's global footprint, spanning over 90 countries, inherently exposes it to the volatility of currency exchange rates. A strengthening Swiss Franc (CHF) against other major currencies can significantly diminish the reported value of foreign earnings when translated back into its reporting currency.

For instance, during 2023, CALIDA Group's financial reports often included currency-adjusted sales figures to provide a clearer picture of underlying operational performance, separate from the impact of currency movements. This adjustment is crucial for understanding the true growth trajectory amidst fluctuating forex markets.

The weakening of key market currencies, such as the Euro or US Dollar, directly translates to lower CHF-denominated revenues and profits for CALIDA Group. This financial pressure necessitates careful hedging strategies and robust financial planning to mitigate potential negative impacts on the company's overall financial health.

Supply Chain Costs and Raw Material Prices

The cost of essential raw materials like cotton and synthetic fibers, alongside global supply chain logistics, directly impacts CALIDA Group's production expenses. For instance, cotton prices saw significant fluctuations in late 2023 and early 2024, influenced by weather patterns and demand. This volatility can squeeze the company's gross margins.

Global events, rising energy prices, and geopolitical tensions contribute to this cost instability. For example, disruptions in shipping routes in 2024 have led to increased freight costs for many apparel companies. CALIDA Group's strategic realignment, focusing on operational optimization, aims to buffer against these pressures and mitigate rising expenses.

- Raw Material Price Volatility: Cotton prices, a key input for CALIDA Group, experienced notable upward pressure in early 2024, with futures contracts indicating a 7% increase in the first quarter compared to the previous year.

- Supply Chain Logistics Costs: Global shipping rates, particularly for container transport, remained elevated in 2024, with average spot rates for Asia-Europe routes up by approximately 15% year-over-year.

- Impact on Gross Margins: Increased raw material and logistics costs directly challenge CALIDA's ability to maintain historical gross margin levels, potentially impacting profitability if not effectively managed.

- Mitigation Strategies: CALIDA's focus on supply chain efficiency and exploring alternative sourcing options are crucial for navigating these cost pressures and improving operational resilience.

E-commerce Growth and Retail Landscape

The ongoing expansion of e-commerce remains a significant and consistent growth engine for CALIDA Group. In 2024, online sales represented a substantial 33.7% of the group's total revenue. This digital shift is a key factor in the company's strategy.

Despite the e-commerce surge, traditional retail and wholesale channels are still vital for CALIDA Group's performance. A slowdown in brick-and-mortar sales within key European markets, for instance, could potentially counteract the positive impact of online sales growth.

CALIDA Group is making strategic investments to bolster its direct-to-consumer (DTC) capabilities. This includes the active migration and enhancement of e-commerce platforms for its premium brands, such as AUBADE and COSABELLA, to improve online customer experience and sales efficiency.

- E-commerce as a Stable Driver: Online sales constituted 33.7% of CALIDA Group's revenue in 2024, highlighting its consistent contribution to business growth.

- Importance of Traditional Channels: Brick-and-mortar retail and wholesale remain critical, with potential weaknesses in these areas able to offset online gains.

- DTC Investment: CALIDA Group is actively upgrading e-commerce platforms for brands like AUBADE and COSABELLA to strengthen their direct-to-consumer operations.

Economic factors significantly influence CALIDA Group's performance, particularly consumer spending power and confidence. In 2024, a noticeable dip in consumer confidence across key European markets led to a more cautious spending approach, impacting sales of discretionary items like premium apparel.

Inflationary pressures in 2024 and extending into 2025 have increased CALIDA's operational costs, from raw materials to energy. For example, a 5-10% rise in material costs can directly affect profit margins if not fully passed on to consumers. Additionally, higher interest rates, a response to inflation, increase borrowing costs for both consumers and the company, potentially dampening demand and investment.

CALIDA Group's financial resilience, evidenced by its debt-free status and strong net liquidity in recent reports, provides a buffer against these economic headwinds. This financial strength allows the company to better navigate cost increases and higher borrowing expenses compared to competitors.

Currency fluctuations also play a crucial role, with a strong Swiss Franc potentially reducing the value of foreign earnings. For instance, in 2023, currency-adjusted sales figures were often highlighted to show underlying performance, underscoring the impact of forex movements on reported results.

| Economic Factor | Impact on CALIDA Group | Data/Observation (2023-2025) |

|---|---|---|

| Consumer Confidence | Reduced discretionary spending, slower sales growth | Dip observed in key European markets in 2024 |

| Inflation | Increased raw material and energy costs, pressure on margins | Potential 5-10% increase in material costs impacting profitability |

| Interest Rates | Higher borrowing costs for consumers and company, dampened demand | Increased cost of capital for new investments |

| Currency Exchange Rates | Reduced value of foreign earnings when converted to CHF | Use of currency-adjusted sales figures to reflect underlying performance |

Preview Before You Purchase

CALIDA Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the CALIDA Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. It provides a strategic overview essential for understanding the external forces shaping their operations and future growth.

Sociological factors

Consumer tastes are always shifting, with a rising desire for clothing that is not only comfortable and adaptable but also produced responsibly. For instance, the global athleisure market was valued at approximately USD 333.5 billion in 2023 and is projected to grow significantly, highlighting this trend.

CALIDA Group, specializing in high-quality underwear and outdoor wear, needs to adjust its products to meet demands for athleisure, loungewear, and eco-friendly fashion to stay competitive. The strategic repositioning of brands such as COSABELLA, which has seen a renewed focus on modern designs and sustainable materials, demonstrates a clear move to align with these evolving market expectations.

Societal awareness around sustainability and ethical consumption is on the rise, influencing purchasing decisions. Consumers are increasingly gravitating towards brands that showcase genuine commitment to environmental stewardship and social responsibility. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's sustainability practices when making a purchase.

CALIDA Group actively embeds sustainability into its operations, evidenced by certifications such as OEKO-TEX® STANDARD 100 and Made in Green. This commitment is not just a marketing point but a core strategic pillar, reflecting a growing consumer preference for ethically produced goods. This sociological shift creates a favorable market environment for companies like CALIDA that prioritize responsible production.

The increasing emphasis on health and well-being globally is significantly shaping consumer purchasing habits, driving demand for apparel that offers comfort, breathability, and practical functionality, particularly in categories like underwear and activewear. CALIDA Group's portfolio, with its reputation for high-quality and comfortable premium offerings, is strategically aligned to capitalize on this widespread consumer preference.

Furthermore, the rising popularity of outdoor pursuits directly benefits CALIDA Group's specialized brands, such as MILLET and LAFUMA, which are recognized for their performance-oriented outdoor apparel. For instance, the global wellness market was valued at over $4.5 trillion in 2022 and is projected to continue its upward trajectory, indicating a robust and growing consumer base for health-conscious products.

Demographic Shifts and Lifestyle Changes

Demographic shifts, such as aging populations in key European markets like Germany and Switzerland, directly influence CALIDA Group's product demand. For instance, the increasing proportion of individuals over 65, who represented approximately 22% of the German population in 2023, often seek comfort and ease of wear, impacting sales of specific apparel lines. Evolving family structures, with a rise in single-person households and smaller family units, also reshape purchasing patterns, favoring versatile and practical clothing options.

Urbanization trends continue to drive lifestyle changes, with a significant portion of the global population now residing in cities. This trend, coupled with a growing emphasis on work-life balance, leads consumers to prioritize comfort and convenience in their clothing choices. For CALIDA Group, this means a heightened demand for loungewear and adaptable pieces suitable for both home and casual outings, reflecting a market shift observed across many developed economies.

- Aging Population: In 2023, the proportion of individuals aged 65 and over in CALIDA Group's core European markets continued to rise, influencing demand for comfortable and easy-to-wear apparel.

- Urbanization Impact: The ongoing shift towards urban living encourages a preference for practical, comfortable, and versatile clothing items that cater to busy lifestyles.

- Lifestyle Evolution: Changing work-life dynamics and an increased focus on well-being are driving consumer interest in casual wear and loungewear, a trend CALIDA Group is positioned to address.

- Brand Strategy Adaptation: CALIDA Group's success hinges on its ability to tailor brand messaging and product offerings to meet the specific needs and preferences of diverse, evolving demographic segments.

Brand Perception and Loyalty

Brand perception and loyalty are critical sociological factors for CALIDA Group, heavily influencing its market standing. A brand's image, particularly concerning quality, trustworthiness, and its resonance with consumer values like sustainability and social responsibility, is paramount in today's market. For instance, CALIDA and AUBADE are recognized as well-established, internationally positioned brands, benefiting from strong market positions that suggest a foundation of existing consumer loyalty that requires ongoing cultivation and reinforcement.

CALIDA Group's commitment to sustainability, a key value for many consumers, is a significant driver of its brand perception. In 2023, the Group reported that 95% of its materials were sourced sustainably, a figure that directly appeals to environmentally conscious shoppers and bolsters loyalty. This focus on ethical practices and high-quality products, exemplified by brands like AUBADE, helps maintain their appeal and fosters repeat purchases.

- Brand Image: CALIDA and AUBADE are perceived as established, quality brands.

- Consumer Values: Alignment with sustainability and social responsibility enhances loyalty.

- Market Position: Strong positions indicate pre-existing brand loyalty.

- Sustainability Focus: 95% of CALIDA Group's materials were sustainably sourced in 2023.

Societal awareness regarding health and well-being is a significant driver for CALIDA Group, boosting demand for comfortable and functional apparel. The global wellness market exceeded $4.5 trillion in 2022, a figure expected to continue its growth, underscoring the consumer shift towards health-conscious purchasing.

Demographic shifts, such as the aging population in Europe, with individuals over 65 representing about 22% of Germany's population in 2023, directly impact CALIDA Group's product demand, favoring comfort and ease of wear.

CALIDA Group's brand perception is strongly tied to its commitment to sustainability, with 95% of its materials sourced sustainably in 2023, appealing to environmentally conscious consumers and fostering loyalty.

The evolving consumer preference for athleisure and loungewear, driven by changing work-life dynamics and urbanization, presents a market opportunity for CALIDA Group's comfortable and versatile offerings.

Technological factors

Technology is a cornerstone of CALIDA Group's sales approach, with e-commerce proving to be a consistent and expanding revenue source. In 2024, digital channels contributed a significant 33.7% to the group's overall sales.

Strategic investments in and the ongoing migration of e-commerce platforms, exemplified by the work done for AUBADE, are vital for strengthening the direct-to-consumer (DTC) business. These upgrades provide CALIDA Group with enhanced operational autonomy, greater flexibility in its offerings, and ultimately, a more refined customer experience.

This ongoing digital evolution is indispensable for effectively engaging and serving a worldwide customer base, ensuring CALIDA Group remains competitive in the global marketplace.

CALIDA Group is poised to leverage significant advancements in textile technology, including the rise of sustainable fabrics like recycled polyester and organic cotton, as well as the integration of smart textiles with embedded sensors for enhanced functionality. These innovations offer a clear pathway for the group to differentiate its product offerings and capture market share in an increasingly discerning consumer landscape.

The company's commitment to resource-friendly production and novel materials directly aligns with these technological shifts. For instance, the development of biodegradable synthetics and water-saving dyeing techniques are becoming increasingly feasible, supporting CALIDA's strategic focus on eco-conscious operations. This proactive approach ensures the group remains at the forefront of industry trends, meeting consumer demand for both high-quality apparel and environmental responsibility.

CALIDA Group is increasingly integrating digitalization and automation into its supply chain to boost efficiency and cut costs. This involves adopting advanced logistics, automated warehousing solutions, and real-time tracking systems. For instance, the group's 2024 operational optimization plans specifically target the enhancement of inventory management through these technological advancements, aiming for a projected 15% reduction in warehousing overhead by year-end.

Data Analytics and Personalization

CALIDA Group's strategic advantage is increasingly shaped by its ability to leverage data analytics. By closely examining consumer behavior, preferences, and purchasing trends, the company can tailor its offerings and marketing efforts. This focus on customer-centricity, driven by data, is crucial for optimizing product development and managing inventory efficiently.

The company's commitment to data-driven decision-making is evident in its pursuit of personalized marketing campaigns and targeted promotions. For example, in 2024, the retail sector saw a significant increase in personalized offers, with companies reporting higher engagement rates. CALIDA Group aims to replicate this success by understanding individual customer needs.

Key technological factors enabling this include:

- Advanced Data Mining: Utilizing sophisticated algorithms to extract actionable insights from vast datasets.

- Customer Relationship Management (CRM) Systems: Implementing robust CRM platforms to track customer interactions and preferences.

- Personalization Engines: Employing AI-driven tools to deliver customized content and product recommendations.

- Predictive Analytics: Forecasting consumer demand and market trends to inform inventory and product strategy.

Digital Marketing and Social Media

Digital marketing and social media platforms are essential for CALIDA Group to enhance its brand visibility and connect with customers across its portfolio, including CALIDA, AUBADE, MILLET, LAFUMA, and EIVY. The group's success in leveraging these channels directly influences its market reach and sales performance in the competitive global fashion and lifestyle sector. For instance, by Q1 2024, the CALIDA Group reported a revenue increase, partly attributable to improved marketing efforts, including a stronger digital presence.

The effectiveness of digital advertising campaigns and social media engagement is paramount for driving brand awareness and fostering customer loyalty. CALIDA Group's strategic investments in online marketing are designed to resonate with diverse consumer segments for each of its brands.

- Brand Reach: Social media platforms allow CALIDA Group to directly engage with millions of potential customers worldwide, significantly expanding its market reach beyond traditional advertising.

- Customer Engagement: Interactive content and targeted campaigns on digital channels foster deeper customer relationships and provide valuable feedback for product development.

- Sales Performance: Effective digital marketing strategies, including e-commerce integration and online promotions, directly contribute to sales figures, as seen in the group's revenue growth in early 2024.

- Competitive Edge: In a crowded market, a strong digital footprint is crucial for differentiating CALIDA Group's brands and capturing market share from competitors.

CALIDA Group's technological focus centers on enhancing its e-commerce presence, which accounted for 33.7% of sales in 2024, and optimizing its supply chain through digitalization and automation. Investments in e-commerce platforms, like those for AUBADE, bolster direct-to-consumer (DTC) capabilities, offering greater operational autonomy and improved customer experiences. The group is also embracing advancements in sustainable textiles and smart fabrics to differentiate its product lines.

Leveraging data analytics is key for CALIDA Group to understand consumer behavior and personalize marketing efforts, aiming for increased engagement and efficient inventory management. This data-driven approach supports tailored promotions and product development, mirroring successful trends in the retail sector observed in 2024.

Digital marketing and social media are critical for expanding brand visibility across CALIDA Group's portfolio, including brands like MILLET and LAFUMA. This digital engagement directly influences market reach and sales performance, contributing to revenue growth as seen in early 2024 figures.

| Technology Area | 2024 Data/Impact | Strategic Focus |

|---|---|---|

| E-commerce Sales Contribution | 33.7% of Group Sales | Strengthening DTC, platform migration |

| Supply Chain Automation | Targeted 15% reduction in warehousing overhead by year-end 2024 | Adopting advanced logistics, automated warehousing |

| Data Analytics in Marketing | Increased personalized offers in retail sector | Customer-centricity, optimized product development |

Legal factors

CALIDA Group navigates a complex web of product safety and labeling regulations across its 90+ markets. These rules dictate everything from the materials used in garments to clear care instructions and allergen information, vital for consumer trust and safety. For instance, in the European Union, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations impose strict controls on chemical substances, impacting textile sourcing and production.

Failure to adhere to these diverse international standards, such as those set by the Consumer Product Safety Commission (CPSC) in the United States or similar bodies globally, can result in severe consequences. These include costly product recalls, which in 2024 continued to be a significant risk for apparel brands, leading to substantial financial losses and, critically, reputational damage that can erode consumer confidence built over years.

CALIDA Group, with its workforce of around 2,000 employees, navigates a complex web of national and international labor laws. These regulations cover crucial aspects like working conditions, minimum wages, employee benefits, and the right to unionize, impacting operations across its various segments.

Strict adherence to these labor laws is paramount for CALIDA Group to prevent costly legal disputes, foster a positive and productive work environment, and uphold ethical labor practices throughout its entire operational footprint and supply chain.

CALIDA Group places significant emphasis on safeguarding its prominent brands, including CALIDA, AUBADE, MILLET, LAFUMA, and EIVY, against counterfeiting and unauthorized commercial use. This legal imperative necessitates comprehensive trademark registrations across key markets and diligent enforcement of copyright protections to maintain brand integrity and market share.

The group actively monitors for and combats intellectual property infringement worldwide, a crucial strategy to preserve its brand equity and competitive standing. For instance, in 2023, the fashion industry globally saw continued challenges with counterfeit goods, with reports indicating significant revenue losses for legitimate brands, underscoring the importance of CALIDA Group's proactive legal measures.

Data Privacy and Cybersecurity Laws

CALIDA Group, like all businesses handling customer data, faces stringent legal requirements regarding data privacy and cybersecurity. With the ongoing expansion of e-commerce and the increasing volume of personal information collected, adherence to regulations such as the General Data Protection Regulation (GDPR) in Europe and similar national laws is critical. These regulations mandate how customer data is collected, stored, processed, and protected.

Failure to comply can result in significant financial penalties and reputational damage. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher. In 2023, the EU saw a notable increase in data breach notifications, underscoring the persistent challenges in cybersecurity. For CALIDA Group, maintaining robust cybersecurity measures is not just a legal obligation but a fundamental aspect of building and retaining customer trust.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- Evolving Regulations: Continuous need to monitor and adapt to new data protection laws worldwide.

- Cybersecurity Investment: Essential for preventing data breaches, which can cost millions in recovery and lost business.

- Customer Trust: Data protection is directly linked to brand reputation and customer loyalty.

Corporate Governance and Shareholder Rights

As a publicly traded entity on the SIX Swiss Exchange, CALIDA Holding AG operates under rigorous corporate governance mandates. These regulations ensure transparency in financial reporting and safeguard shareholder rights, crucial for investor confidence. The company’s adherence to these legal frameworks is paramount for its continued market participation and reputation.

Recent shareholder meetings in 2024 and 2025 underscore CALIDA's commitment to evolving governance. Key approvals included non-financial and compensation reports, alongside amendments to its articles of association. These changes aim to modernize corporate practices, reflecting ongoing legal compliance and a dedication to accountability.

- Transparency Mandates: CALIDA Holding AG must adhere to strict disclosure requirements for financial performance and operational activities.

- Shareholder Protections: Legal frameworks ensure shareholders have rights regarding voting, information access, and fair treatment.

- Governance Modernization: Approvals in 2024 and 2025 for report adoption and articles of association amendments highlight proactive legal adaptation.

CALIDA Group must comply with product safety and labeling laws across its global markets, covering everything from material composition to care instructions. Failure to meet standards like the EU's REACH regulations can lead to costly recalls and reputational damage, as seen with persistent risks for apparel brands in 2024.

The company also faces extensive labor laws worldwide, dictating working conditions, wages, and benefits for its approximately 2,000 employees. Strict adherence prevents legal disputes and fosters ethical practices throughout its supply chain.

Protecting its brands like CALIDA and LAFUMA from counterfeiting is a legal priority, requiring robust trademark enforcement. The fashion industry's ongoing battle with fakes in 2023 highlights the financial threat and the necessity of CALIDA's proactive IP strategies.

Data privacy laws like GDPR, with potential fines up to 4% of global annual revenue, are critical for CALIDA's e-commerce operations. The increasing volume of data breaches reported in the EU in 2023 emphasizes the need for strong cybersecurity to maintain customer trust.

Environmental factors

Growing environmental concerns are significantly shaping the textile industry, pushing for more sustainable practices and the adoption of circular economy principles. This shift is creating a market that increasingly favors companies demonstrating genuine commitment to eco-friendly operations.

CALIDA Group has embedded sustainability into its core strategy, emphasizing resource-efficient production, the creation of long-lasting products, and the development of recycling initiatives. This commitment is evident in their efforts to reduce the use of synthetic fibers, a move aimed at mitigating microplastic pollution and improving wastewater quality, directly supporting UN Sustainable Development Goals.

For instance, in 2023, CALIDA Group reported a further reduction in its reliance on virgin polyester, aiming for 50% recycled polyester in its main brand by 2025. This aligns with broader industry trends where consumers are increasingly willing to pay a premium for sustainably sourced apparel, with market research from 2024 indicating a 15% year-over-year increase in demand for certified eco-friendly textiles.

Climate change poses significant risks to CALIDA Group's supply chain. Extreme weather events, such as floods and droughts, can disrupt production and logistics, impacting the availability of raw materials. For instance, changes in agricultural yields for natural fibers, a key component in many apparel items, could lead to price volatility and supply shortages. These disruptions can directly affect operational efficiency and profitability.

CALIDA Group acknowledges these environmental challenges. The group's reported calculation of its Corporate Carbon Footprint demonstrates a commitment to understanding its environmental impact. This awareness is crucial for developing strategies to mitigate risks associated with climate change, ensuring greater resilience in their global operations.

The textile industry, a core sector for CALIDA Group, faces significant challenges due to resource scarcity, especially concerning water. In 2023, global textile production consumed an estimated 79 billion cubic meters of water, highlighting the immense pressure on freshwater resources. CALIDA Group's commitment to resource-friendly production and responsible consumption directly addresses this critical issue.

CALIDA Group is actively implementing strategies to mitigate the impact of water scarcity. For instance, the installation of advanced wastewater management systems at their production facilities, such as those in Asia, is a tangible step. These systems not only treat wastewater but also facilitate water recycling, thereby reducing the demand on local freshwater supplies. This aligns with their sustainability targets, aiming to decrease water consumption per garment produced.

Waste Management and Pollution Control

CALIDA Group places significant emphasis on minimizing waste generation and effectively managing chemical effluents, crucial aspects of pollution control. The company’s dedication to environmental stewardship is evident in its pursuit of certifications like OEKO-TEX® and Made in Green. These certifications underscore a commitment to environmentally sound production, aiming to reduce the use and discharge of harmful substances throughout their operations.

These efforts are not just about compliance but also about building consumer trust and ensuring long-term sustainability. For instance, in 2023, the textile industry globally faced increasing scrutiny regarding its environmental footprint, with reports highlighting the significant water usage and chemical pollution associated with dyeing and finishing processes. CALIDA Group's proactive approach through these certifications positions them favorably in a market increasingly driven by conscious consumerism and stricter environmental regulations.

Key environmental considerations and CALIDA Group's responses include:

- Waste Minimization: Implementing strategies to reduce waste at every stage of the production cycle, from raw material sourcing to finished product packaging.

- Chemical Effluent Management: Strict protocols for treating and managing wastewater to prevent the release of harmful chemicals into the environment, aligning with standards set by OEKO-TEX®.

- Pollution Control: Adhering to and exceeding regulations concerning air and water pollution, with a focus on sustainable manufacturing practices.

- Certification Alignment: Utilizing OEKO-TEX® and Made in Green certifications as frameworks to ensure and demonstrate environmentally responsible production processes.

Consumer Demand for Eco-friendly Products

Consumers are increasingly prioritizing products that are both eco-friendly and produced responsibly. This trend is particularly strong in the premium apparel market, where CALIDA Group operates.

CALIDA Group's commitment to sustainability, evidenced by its transparent ESG reporting and various certifications, directly addresses this growing consumer demand. This focus not only resonates with environmentally conscious shoppers but also strengthens the brand's appeal and competitive edge.

For instance, the 2023 ESG report highlighted a 15% increase in the use of certified organic cotton across its brands. Furthermore, consumer surveys conducted in early 2024 indicated that over 60% of premium apparel buyers consider sustainability a key purchasing factor.

- Growing Consumer Preference: A significant and expanding portion of the consumer base actively seeks out apparel made with eco-friendly materials and ethical manufacturing processes.

- CALIDA Group's Response: The company's strategic emphasis on sustainability, including detailed ESG reporting and obtaining relevant certifications, aligns directly with this market shift.

- Brand Enhancement: This alignment boosts CALIDA Group's brand image and provides a distinct competitive advantage within the premium apparel sector.

- Market Data: In 2023, CALIDA Group reported a 15% year-over-year increase in the utilization of certified organic cotton, reflecting a tangible response to market demand.

Environmental regulations are becoming more stringent globally, pushing companies like CALIDA Group to adopt greener manufacturing processes and reduce their ecological footprint. The increasing focus on climate change mitigation and resource conservation directly impacts operational costs and supply chain management.

CALIDA Group's proactive approach to environmental stewardship, including significant investments in water-saving technologies and waste reduction programs, positions them favorably against competitors facing stricter compliance demands. Their commitment to using recycled materials, such as achieving 50% recycled polyester in their main brand by 2025, demonstrates adaptability to evolving environmental standards.

The company's 2023 ESG report highlights a 15% increase in the use of certified organic cotton, a direct response to consumer demand for sustainable products. This aligns with market trends where 2024 data shows over 60% of premium apparel buyers prioritize sustainability.

| Environmental Factor | CALIDA Group's Action/Status | Impact/Data Point (2023-2025) |

|---|---|---|

| Climate Change & Resource Scarcity | Focus on resource-efficient production, reducing reliance on virgin polyester. | Aiming for 50% recycled polyester by 2025; calculated Corporate Carbon Footprint. |

| Water Consumption | Implementing advanced wastewater management and recycling systems. | Targeting reduced water consumption per garment; 2023 global textile water use: 79 billion cubic meters. |

| Pollution Control & Waste Management | Minimizing waste, managing chemical effluents, pursuing OEKO-TEX® and Made in Green certifications. | Increased use of certified organic cotton by 15% in 2023. |

| Consumer Demand for Sustainability | Transparent ESG reporting and sustainable product development. | Over 60% of premium apparel buyers consider sustainability a key factor (early 2024). |

PESTLE Analysis Data Sources

Our CALIDA Group PESTLE Analysis is meticulously constructed using data from reputable sources including international financial institutions, government statistical offices, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the group.