AmBank Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmBank Group Bundle

AmBank Group's strengths lie in its established brand and diverse financial services, but it faces challenges from a competitive market and evolving regulatory landscapes. Understanding these dynamics is crucial for navigating its future.

Want the full story behind AmBank Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AmBank Group's strength lies in its extensive range of financial services. This includes retail, business, wholesale, and investment banking, complemented by insurance and asset management offerings. This broad portfolio allows AmBank to serve a wide spectrum of clients, from individual consumers to major corporations, fostering opportunities for integrated financial solutions and enhanced customer loyalty.

AmBank Group has showcased impressive financial resilience, marked by consistent year-on-year net profit growth. In the fiscal year 2025, the group reported a significant 7.1% increase in net profit, reaching RM2.0 billion. This upward trajectory, coupled with robust capital adequacy ratios and an uplift in dividend payouts, underscores the effectiveness of their financial stewardship and the strength of their underlying financial health.

AmBank's strategic focus on digital transformation is a significant strength, driving improvements in both customer engagement and internal operations. By investing in platforms like Progress Sitefinity Cloud, they've seen tangible results, including an 18% surge in retail banking website traffic. This commitment to digitalization is clearly paying off.

This digital overhaul isn't just about traffic; it's also about efficiency. AmBank has achieved substantial cost savings through these initiatives. The integration of AI for content personalization and the streamlining of online services are key components of this strategy, positioning them well for continued innovation.

Commitment to ESG Practices

AmBank Group's dedication to Environmental, Social, and Governance (ESG) principles is a significant strength, embedding sustainability into its core strategies and daily operations. This commitment is demonstrated through concrete actions such as expanding green financing options and championing responsible business conduct.

This focus on ESG not only bolsters AmBank's public image but also appeals to a growing segment of investors prioritizing ethical and sustainable investments. For instance, in 2024, AmBank Group continued to grow its sustainable financing portfolio, aiming to reach RM15 billion by 2025, showcasing a tangible commitment to environmental and social impact.

- Enhanced Reputation: Strong ESG performance improves brand image and stakeholder trust.

- Investor Attraction: Appeals to a growing market of socially responsible investors.

- Risk Mitigation: Proactive ESG management can reduce regulatory and reputational risks.

- Sustainable Growth: Integrates long-term value creation with societal well-being.

Targeted Growth Segments

AmBank Group is sharpening its focus on lucrative growth areas, notably the Small and Medium Enterprise (SME) sector and the affluent customer base. This strategic alignment is designed to maximize resource deployment and capture expanding market share within these promising segments.

The group is also actively investigating new avenues for expansion, including strategic collaborations within the healthcare industry. This proactive exploration of partnerships signals a commitment to diversifying revenue streams and tapping into emerging market opportunities.

For instance, AmBank's SME banking portfolio saw a notable increase in financing for SMEs in the fiscal year ending March 31, 2024, with loan disbursements growing by 8.5% compared to the previous year. This growth outpaced the overall industry average, demonstrating the effectiveness of their targeted strategy.

Furthermore, AmBank's wealth management division reported a 12% year-on-year increase in assets under management from its affluent client segment as of Q1 2025, highlighting successful penetration and client acquisition efforts in this high-value market.

AmBank Group's diversified financial services portfolio, encompassing retail, business, wholesale, and investment banking, alongside insurance and asset management, is a core strength. This comprehensive offering allows for integrated solutions and deepens customer relationships across various segments.

The bank’s robust financial performance is evident in its consistent profit growth. For the fiscal year 2025, AmBank reported a 7.1% increase in net profit, reaching RM2.0 billion, supported by strong capital adequacy and increased dividends.

AmBank's strategic investment in digital transformation is yielding significant results, enhancing customer engagement and operational efficiency. For example, their digital initiatives led to an 18% rise in retail banking website traffic in 2024.

A strong commitment to ESG principles, including a growing sustainable financing portfolio aimed at RM15 billion by 2025, enhances AmBank's reputation and appeals to socially conscious investors.

| Strength | Description | Supporting Data |

|---|---|---|

| Diversified Services | Comprehensive financial offerings | Retail, business, wholesale, investment banking, insurance, asset management |

| Financial Resilience | Consistent profit growth | 7.1% net profit increase in FY2025 to RM2.0 billion |

| Digital Transformation | Improved customer engagement & efficiency | 18% surge in retail banking website traffic (2024) |

| ESG Commitment | Sustainable financing and responsible conduct | Targeting RM15 billion in sustainable financing by 2025 |

What is included in the product

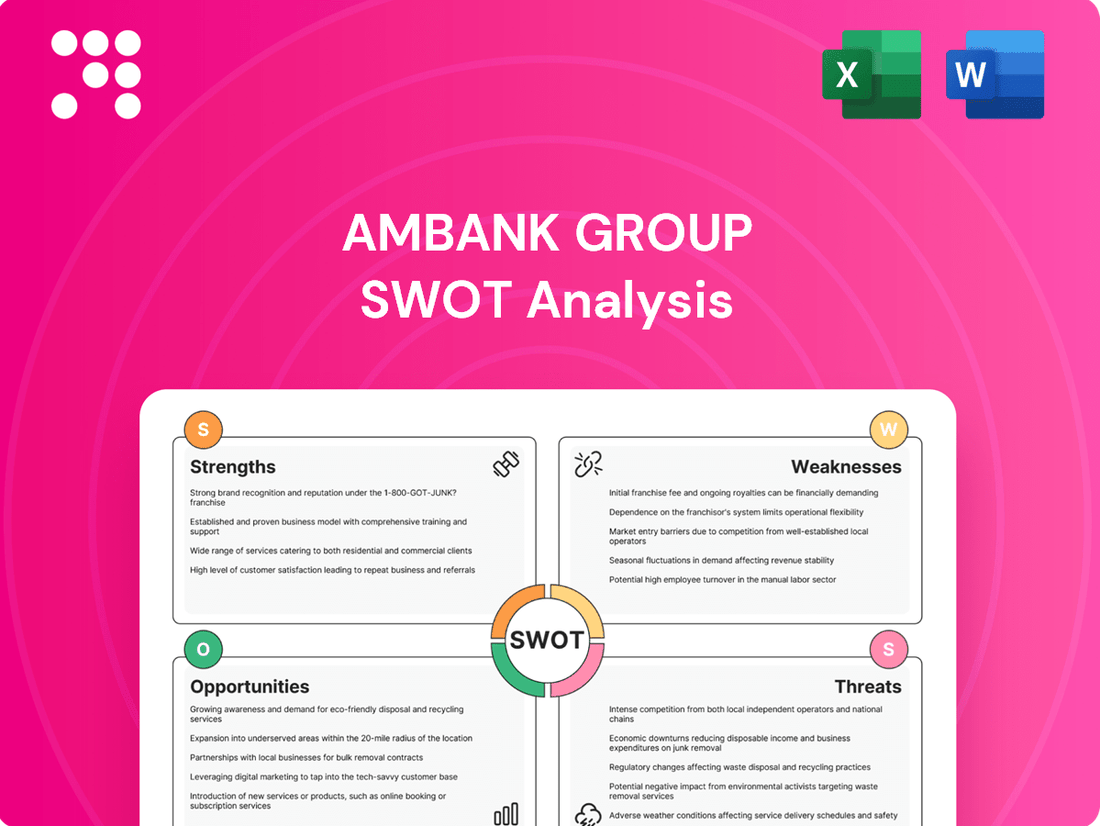

Delivers a strategic overview of AmBank Group’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Identifies key vulnerabilities and opportunities to proactively address challenges and capitalize on growth for AmBank Group.

Weaknesses

AmBank Group has seen a notable decline in its Current Account Savings Account (CASA) mix. This means that while overall deposits might be growing, a larger portion is shifting towards more expensive time deposits rather than cheaper, readily available current and savings accounts. For instance, in the fiscal year ending March 2024, AmBank's CASA ratio saw a dip, with a corresponding increase in fixed deposits.

This shift directly impacts AmBank's cost of funds. Time deposits, by their nature, require banks to pay higher interest rates compared to the typically low or zero interest paid on CASA balances. This widening gap between the cost of deposits and the interest earned on loans can put pressure on the bank's net interest margin, a key indicator of profitability in the banking sector.

AmBank Group has experienced a rise in its operating expenses, notably due to increased personnel costs and significant investments in computerization and technology. For instance, in the third quarter of fiscal year 2024, the bank reported a notable increase in operating expenses compared to the previous year, impacting its cost-to-income ratio.

AmBank Group operates within a highly competitive Malaysian banking landscape, particularly concerning the acquisition of deposits. This intense rivalry for customer funds puts upward pressure on the interest rates banks must offer, directly impacting their cost of funding. For instance, in early 2024, several major Malaysian banks were observed increasing their fixed deposit rates to attract and retain customers, a trend that AmBank must also navigate.

This aggressive competition for deposits can significantly squeeze AmBank's net interest margins (NIMs). When the cost of borrowing (through deposits) rises faster than the rates at which the bank can lend, profitability is eroded. As of the first quarter of 2024, the average NIM for Malaysian banks hovered around 2.2%, a figure that could be further compressed for institutions facing substantial deposit-gathering challenges.

Sensitivity to Economic Slowdown

AmBank Group, like many financial institutions, faces a significant weakness in its sensitivity to economic slowdowns. Even with a generally positive outlook for the Malaysian banking sector, factors like slower-than-anticipated economic growth and persistent inflationary pressures could dampen loan expansion and potentially affect the quality of existing assets. For instance, if Malaysia's GDP growth, projected by the World Bank to be around 4.2% for 2024 and 4.5% for 2025, falters, it would directly impact borrowing demand and the ability of customers to repay loans.

Furthermore, the broader global economic climate presents considerable risks. Heightened geopolitical tensions and ongoing uncertainties in international trade can erode both business and consumer confidence. This erosion of confidence often translates into reduced spending and investment, directly impacting AmBank's revenue streams and increasing the likelihood of non-performing loans. For example, a downturn in key export markets for Malaysia could lead to reduced corporate profitability, indirectly affecting the banking sector's performance.

- Economic Growth Concerns: Slower-than-expected GDP growth in Malaysia, potentially below the 4.2% forecast for 2024, could curb loan demand.

- Inflationary Pressures: Rising inflation might lead to higher interest rates, impacting borrowers' repayment capacity and potentially increasing non-performing loans.

- Global Uncertainty Impact: Geopolitical risks and trade disputes can dampen consumer and business sentiment, affecting AmBank's operational environment.

Reliance on Traditional Loan Segments

While AmBank Group has seen expansion in its business and wholesale banking sectors, a notable weakness lies in the slower loan growth experienced within its retail banking segments. This concentration can present challenges.

A significant reliance on specific loan categories, without adequate diversification, inherently exposes AmBank to sector-specific risks. Should these particular segments face downturns or slower expansion, the bank's overall performance could be disproportionately affected. For instance, data from AmBank's financial reports in late 2024 indicated that while corporate lending showed robust gains, mortgage and personal loan portfolios experienced more modest increases, highlighting this potential imbalance.

- Slower Retail Loan Growth: AmBank's retail banking loan segments have not kept pace with the growth seen in corporate and wholesale banking.

- Sector-Specific Risk Exposure: Over-reliance on particular loan types, like commercial property or automotive financing, can make the bank vulnerable to downturns in those specific industries.

- Diversification Gap: A lack of broad diversification across various retail lending products could limit AmBank's ability to capture growth opportunities in diverse consumer markets.

AmBank's declining CASA ratio, with a shift towards more expensive time deposits, directly impacts its cost of funds and can squeeze net interest margins. For instance, the CASA ratio saw a dip in FY2024, increasing the bank's funding costs and potentially reducing profitability.

Increased operating expenses, driven by higher personnel costs and technology investments, are also a concern. In Q3 FY2024, AmBank reported a notable rise in operating expenses, affecting its cost-to-income ratio.

The bank faces intense competition for deposits in Malaysia, forcing it to offer higher interest rates, which further pressures its net interest margins. This competition is evident as other Malaysian banks also adjusted their deposit rates in early 2024.

AmBank's growth is susceptible to economic slowdowns, with potential impacts on loan expansion and asset quality. Slower-than-expected GDP growth in Malaysia, perhaps below the 4.2% forecast for 2024, could curb loan demand.

Global uncertainties, including geopolitical tensions and trade disputes, can negatively affect business and consumer confidence, impacting AmBank's revenue and increasing the risk of non-performing loans.

While corporate lending shows strength, AmBank's retail banking loan growth is slower, leading to sector-specific risk exposure. For example, in late 2024, corporate lending saw robust gains, but mortgage and personal loan portfolios experienced more modest increases.

| Weakness | Description | Impact | Example Data/Trend |

|---|---|---|---|

| Declining CASA Ratio | Shift from low-cost current and savings accounts to higher-cost time deposits. | Increased cost of funds, pressure on Net Interest Margins (NIMs). | FY2024 saw a dip in CASA ratio; time deposits increased. |

| Rising Operating Expenses | Higher personnel costs and investments in technology. | Impact on cost-to-income ratio, potentially reduced profitability. | Q3 FY2024 reported a notable increase in operating expenses year-on-year. |

| Intense Deposit Competition | Rivalry for customer funds in the Malaysian banking sector. | Upward pressure on deposit rates, squeezing NIMs. | Early 2024 saw increased fixed deposit rates offered by competitors. |

| Economic Sensitivity | Vulnerability to economic slowdowns and inflation. | Reduced loan expansion, potential increase in non-performing loans. | Malaysia's 2024 GDP growth forecast of 4.2% could be impacted. |

| Slower Retail Loan Growth | Lagging growth in retail segments compared to wholesale banking. | Concentration risk, missed opportunities in consumer markets. | Late 2024 data showed modest growth in mortgages and personal loans vs. corporate lending. |

Same Document Delivered

AmBank Group SWOT Analysis

This preview reflects the real AmBank Group SWOT analysis document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of AmBank's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This is the actual document, offering actionable insights for strategic planning.

Opportunities

The Malaysian banking sector is poised for continued expansion, with projections indicating steady loan growth and robust performance throughout 2025. This positive outlook is underpinned by a stable macroeconomic environment and an ongoing improvement in asset quality, creating a fertile ground for AmBank to broaden its lending activities and enhance its profitability.

AmBank can capitalize on the banking sector's digital evolution by expanding its AI and data analytics capabilities, aiming to personalize customer experiences and optimize internal processes. For instance, as of Q1 2024, Malaysian banks saw a 15% year-on-year increase in digital transaction volumes, highlighting a strong customer preference for online channels.

The rise of digital-only banks and growing customer comfort with digital solutions present a clear opportunity for AmBank to innovate its product suite and strengthen customer relationships. By developing new digital-first products and services, AmBank can tap into this expanding market segment, potentially increasing its customer acquisition by an estimated 10-12% in the next 18-24 months based on industry trends.

The Malaysian banking sector is seeing a significant push towards ESG practices and green financing. This trend presents a prime opportunity for AmBank to broaden its sustainable finance products and services. By aligning with these growing global demands, AmBank can attract investors and businesses that prioritize environmental and social responsibility, building stronger, enduring partnerships.

As of early 2024, Bank Negara Malaysia's Sustainable Banking Framework continues to guide financial institutions in integrating ESG considerations. This framework encourages the development of green financial products, and AmBank is well-positioned to capitalize on this by expanding its green loan portfolios and sustainability-linked bonds, tapping into a market segment increasingly seeking ethical investment avenues.

Targeting Underserved Market Segments

AmBank is strategically targeting market segments traditionally overlooked by conventional banking. By offering tailored digital solutions like Buy Now, Pay Later (BNPL) and expanding its e-wallet capabilities, the group aims to attract a broader customer base and unlock new avenues for revenue growth.

This focus on underserved demographics is crucial in Malaysia's evolving financial landscape. For instance, the digital banking sector in Malaysia saw significant growth, with e-wallets becoming increasingly popular among younger consumers and SMEs. AmBank’s initiative aligns with this trend, potentially capturing a substantial share of this expanding market.

- Expanding BNPL Reach: AmBank's BNPL offerings are designed to cater to a growing demand for flexible payment options, particularly among millennials and Gen Z, who are increasingly adopting digital financial services.

- E-wallet Adoption Drive: By integrating user-friendly e-wallet services, AmBank seeks to become a primary digital financial hub for unbanked or underbanked populations, thereby increasing transaction volumes and customer loyalty.

- Digital Product Innovation: The group's commitment to needs-based digital product development allows it to stay competitive and relevant in a market where digital-first financial solutions are becoming the norm.

- Market Share Growth: Capturing these new segments is projected to contribute to AmBank's overall market share and profitability, diversifying its revenue streams beyond traditional banking products.

Strategic Partnerships and Collaborations

Strategic partnerships, like AmBank's reinforced collaboration with Maxis, are pivotal for accelerating digital transformation, particularly within Malaysia's healthcare sector. This synergy allows AmBank to integrate its robust financial solutions with Maxis's technological expertise, fostering innovative service delivery and expanding market reach. Such alliances are crucial for tapping into new growth avenues and co-creating value in emerging digital ecosystems.

These collaborations can unlock significant opportunities:

- Enhanced Digital Offerings: By combining financial services with digital platforms, AmBank can introduce more sophisticated and user-friendly digital banking solutions for businesses and consumers.

- Market Expansion: Partnerships enable AmBank to access new customer segments and industries, such as the healthcare sector, where digital integration is rapidly advancing.

- Innovation Acceleration: Collaborating with technology-focused partners allows for faster development and deployment of cutting-edge financial products and services, keeping AmBank competitive.

- Synergistic Growth: These alliances create a win-win scenario, where AmBank leverages its financial strength and partners leverage their industry-specific capabilities to achieve mutual growth objectives.

AmBank is well-positioned to capitalize on the Malaysian banking sector's digital transformation, with digital transaction volumes increasing by 15% year-on-year in Q1 2024. The group can further leverage AI and data analytics to personalize customer experiences and optimize operations, potentially boosting customer acquisition by 10-12% through innovative digital-first products.

The growing demand for ESG practices and green financing presents a significant opportunity for AmBank to expand its sustainable finance offerings, aligning with Bank Negara Malaysia's Sustainable Banking Framework. By developing more green loan portfolios and sustainability-linked bonds, AmBank can attract environmentally conscious investors and businesses.

AmBank's strategic focus on underserved market segments, through initiatives like Buy Now, Pay Later (BNPL) and enhanced e-wallet capabilities, aims to capture a larger share of a growing digital financial market. These tailored digital solutions are crucial for increasing transaction volumes and customer loyalty among younger demographics and SMEs.

Strategic partnerships, such as the one with Maxis, are key to accelerating AmBank's digital integration, particularly in sectors like healthcare. These collaborations enable the co-creation of value and expansion into new digital ecosystems, fostering innovative service delivery and market reach.

Threats

The Malaysian banking landscape is seeing a surge of digital banks, directly challenging established players like AmBank Group. These new entrants, often unburdened by legacy systems, can operate with leaner cost structures. For instance, by mid-2024, digital banks in Malaysia were reporting significant growth in customer acquisition, with some already reaching hundreds of thousands of users, indicating a clear shift in consumer preference towards digital-first financial solutions.

This intensified competition means AmBank faces pressure to innovate rapidly and enhance its digital offerings to retain its customer base. Digital banks frequently leverage advanced technology to provide seamless user experiences and competitive pricing, which can be particularly attractive to younger, tech-savvy demographics. The increasing adoption of these digital platforms suggests a growing segment of the market may bypass traditional banking channels altogether.

The banking sector in Asia-Pacific, including Malaysia, is heavily impacted by a surge in scams and money mule accounts, leading to substantial financial losses for individuals and institutions. For instance, in 2023 alone, Malaysian banks reported billions of ringgit in losses due to various fraudulent activities, highlighting the pervasive nature of these threats.

AmBank Group, like its peers, must continuously invest in advanced cybersecurity infrastructure and sophisticated fraud detection systems. This proactive approach is crucial not only to safeguard customer assets and data but also to preserve the bank's reputation and maintain the vital trust placed in it by its clientele.

Rising inflation, potentially fueled by fuel subsidy rationalization in Malaysia, could increase operating costs and affect consumer spending power, impacting loan demand and repayment capabilities for AmBank Group. For instance, Malaysia's inflation rate stood at 1.5% in April 2024, a slight increase from previous months, highlighting ongoing price pressures.

Global economic uncertainties, including persistent geopolitical tensions, contribute to significant financial market volatility. This volatility can lead to slower economic growth projections, such as the World Bank's forecast of 4.3% for the ASEAN-5 region in 2024, which could dampen business investment and consumer confidence, indirectly affecting AmBank's loan growth and asset quality.

Changes in Regulatory Landscape

AmBank Group, like all financial institutions in Malaysia, faces an increasingly intricate regulatory environment. New frameworks introduced by Bank Negara Malaysia, the Securities Commission, and Bursa Malaysia are designed to enhance financial stability and consumer protection, but they also demand substantial investment in compliance infrastructure and expertise. For instance, the ongoing implementation of Basel III finalization requirements, aimed at strengthening capital and liquidity standards, continues to shape operational strategies and risk management practices throughout 2024 and into 2025.

Navigating these evolving regulations presents a significant operational challenge. The need for robust systems to monitor, report, and adapt to new directives requires continuous resource allocation, potentially impacting profitability and agility. AmBank's commitment to adhering to these standards is crucial for maintaining market trust and operational integrity. The group's 2024 financial reports indicate a consistent increase in expenditure related to compliance and risk management, reflecting the proactive measures taken to address these regulatory shifts.

Key areas of regulatory focus impacting AmBank Group include:

- Digital Banking Regulations: Increased scrutiny on cybersecurity, data privacy, and consumer protection in digital channels.

- Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF): Stricter enforcement and reporting requirements, with enhanced penalties for non-compliance.

- Environmental, Social, and Governance (ESG) Reporting: Growing expectations for transparent reporting on sustainability initiatives and climate-related risks.

- Consumer Protection Measures: New guidelines on fair lending practices, transparent fee structures, and dispute resolution mechanisms.

Talent Acquisition and Retention Challenges

AmBank Group faces significant threats from the escalating 'war for talent' within Malaysia's banking and financial services industry. This competition is particularly fierce for roles requiring expertise in crucial areas like risk management, digital product development, and sustainable finance. For instance, a 2024 report indicated a 15% year-on-year increase in demand for cybersecurity professionals in Malaysian financial institutions, a key digital talent area.

This intense hiring environment directly impacts AmBank Group by potentially driving up personnel costs as salaries and benefits must become more competitive to attract and retain skilled individuals. Furthermore, the group may struggle to secure top-tier talent who are increasingly prioritizing flexible work arrangements and comprehensive benefits packages, impacting operational efficiency and innovation capacity. Indeed, a recent survey of Malaysian banking professionals revealed that over 60% would consider changing employers for better work-life balance and enhanced benefits, even if it meant a marginal salary difference.

- Intensified Competition: The Malaysian financial sector is experiencing a heightened 'war for talent'.

- Specialized Skill Gaps: Demand is particularly high for specialists in risk management, digital products, and sustainable finance.

- Increased Personnel Costs: The competitive landscape is likely to drive up recruitment and retention expenses.

- Attraction and Retention Challenges: Meeting candidate expectations for flexibility and enhanced benefits is a growing hurdle.

The rise of digital banks presents a significant threat, as they offer agile, cost-effective alternatives that can attract customers seeking seamless online experiences. Furthermore, the pervasive issue of financial scams and fraudulent activities, which cost Malaysian banks billions in 2023 alone, necessitates continuous investment in robust security measures, impacting profitability and operational focus.

Global economic volatility, influenced by geopolitical tensions, could slow regional growth, potentially affecting loan demand and asset quality for AmBank. Additionally, an increasingly complex regulatory landscape, including new digital banking and ESG reporting requirements, demands substantial compliance investments, potentially limiting strategic flexibility.

The intense competition for specialized talent, particularly in digital and risk management roles, is driving up personnel costs and creating retention challenges for AmBank. For instance, demand for cybersecurity professionals in Malaysian finance rose 15% year-on-year in 2024, highlighting this talent war.

SWOT Analysis Data Sources

This AmBank Group SWOT analysis is built upon a robust foundation of data, drawing from the bank's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and insightful assessment.