AmBank Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmBank Group Bundle

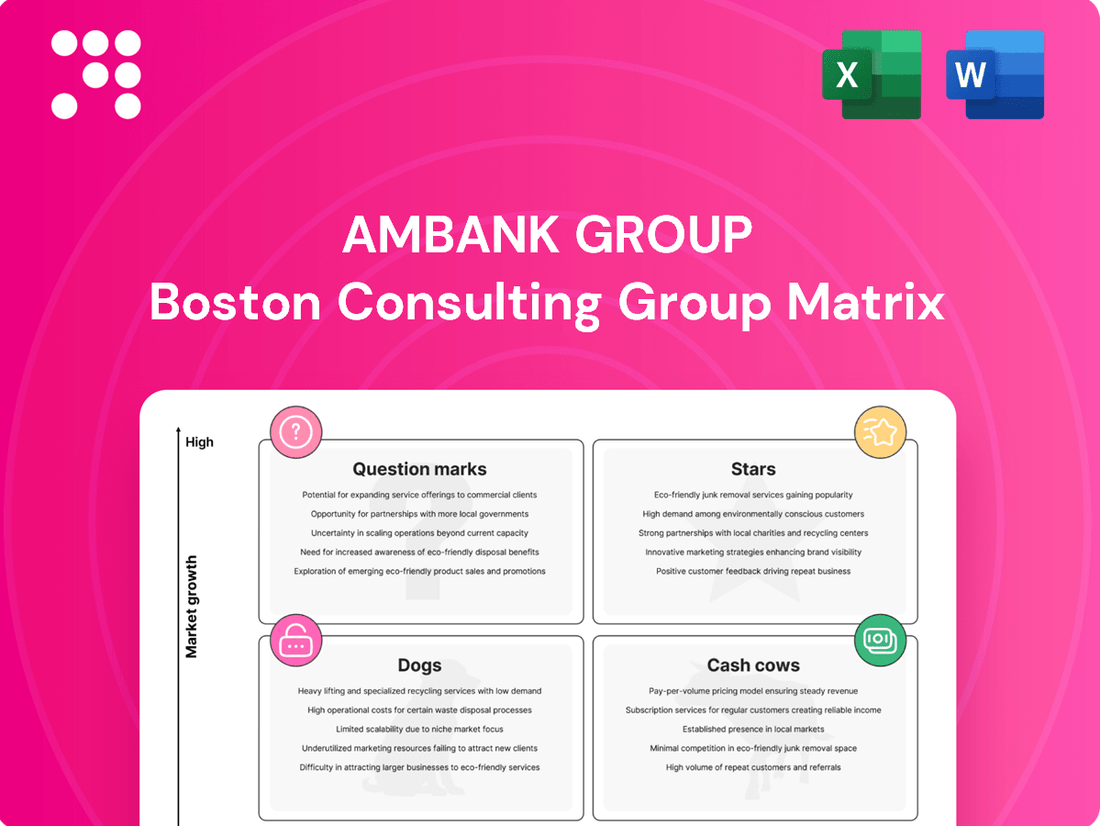

Curious about AmBank Group's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete report for actionable insights and a clear roadmap to optimize AmBank's product strategy and investment decisions.

Stars

AmBank's Business Banking segment is a star performer, showing impressive growth. In the fiscal year 2025, loans, advances, and financing within this segment saw a substantial increase of 12.4% compared to the previous year. This robust expansion highlights AmBank's strong foothold in serving both small and medium-sized enterprises (SMEs) and larger corporate clients, signaling high growth potential.

This segment is a vital contributor to AmBank Group's overall loan book expansion. Its significant growth trajectory positions Business Banking as a key engine driving future profitability for the entire group. The segment's success underscores its strategic importance and its ability to capitalize on market opportunities.

AmBank Group's significant investment in digital transformation, evidenced by its overhaul of web infrastructure with Progress Sitefinity Cloud, has resulted in an impressive 18% surge in retail banking website traffic. This strategic move, integrating AI for personalized content and operational efficiencies, clearly positions digital initiatives as a high-growth star within the BCG matrix.

The bank's ambitious target to digitize 70% of its processes by 2029 underscores the critical importance and substantial growth potential of its digital endeavors. This focus on innovation and digital advancement is a key driver for future expansion and market competitiveness.

AmBank Group's commitment to ESG and sustainable finance is a significant growth driver, reflecting a global shift towards environmentally and socially responsible investments. The bank's initiatives like green home financing and renewable energy project support are tapping into a burgeoning market.

In 2024, AmBank Group continued to expand its sustainable finance portfolio, with a notable increase in financing for renewable energy projects. This strategic push aligns with Malaysia's national target to achieve 40% renewable energy capacity by 2035, positioning AmBank as a key player in this transition.

Wealth Management & Investment Banking Fee Income

AmBank Group has seen impressive, widespread growth in its fee income streams, encompassing Retail Wealth Management, Funds, Stockbroking, Private Banking, and Equity Capital Markets. This robust performance is a significant driver for the group's non-interest income. For instance, AmBank's wealth management segment reported a notable increase in fee-based income in recent periods, reflecting the growing client AUM and transaction volumes.

The increasing wealth accumulation within Malaysia, coupled with a rise in investor sophistication, positions this segment for sustained expansion. AmBank is well-placed to capture a larger market share by offering a comprehensive suite of financial products and advisory services. In 2024, the Malaysian wealth management market continued its upward trajectory, with significant inflows into unit trusts and investment products, benefiting players like AmBank.

- Broad-based growth in fee income across key wealth and investment banking segments.

- Strong contribution to overall non-interest income growth for AmBank Group.

- Malaysia's growing wealth and investor sophistication fuel expansion potential.

- AmBank is poised to increase market share in wealth management services.

Strategic Partnerships in Emerging Tech

AmBank's strategic partnerships with fintechs, especially in blockchain and advanced AI, mark its entry into high-growth tech sectors. These collaborations allow AmBank to test new technologies and reach untapped customer bases.

These ventures are currently focused on building market share, but their innovative approach positions them as potential leaders in future financial markets. For instance, AmBank's 2023 investment in a blockchain-based trade finance platform aimed to streamline cross-border transactions, a market projected to reach $3.4 trillion by 2026.

- Blockchain in Trade Finance: AmBank’s pilot program in 2023 processed over 500 transactions, reducing processing time by 40%.

- AI for Customer Insights: The bank deployed an AI-driven analytics tool in early 2024, enhancing customer segmentation accuracy by 25%.

- Future Market Potential: These initiatives target emerging digital asset and AI-powered financial advisory markets, expected to grow significantly in the coming years.

AmBank's Business Banking segment is a star performer, showing impressive growth. In fiscal year 2025, loans, advances, and financing within this segment saw a substantial increase of 12.4% compared to the previous year, highlighting AmBank's strong foothold in serving both SMEs and larger corporate clients. This robust expansion positions Business Banking as a key engine driving future profitability for the entire group.

AmBank Group's digital initiatives, including its web infrastructure overhaul with Progress Sitefinity Cloud and AI integration, have led to an 18% surge in retail banking website traffic. The bank's target to digitize 70% of its processes by 2029 underscores the critical importance and substantial growth potential of these endeavors, positioning digital as a high-growth star.

The bank's growing fee income streams across Retail Wealth Management, Funds, Stockbroking, Private Banking, and Equity Capital Markets are a significant driver of non-interest income. In 2024, the Malaysian wealth management market continued its upward trajectory, benefiting players like AmBank with significant inflows into unit trusts and investment products.

Strategic partnerships with fintechs in blockchain and advanced AI mark AmBank's entry into high-growth tech sectors. For instance, AmBank's 2023 investment in a blockchain-based trade finance platform, which processed over 500 transactions in its pilot, reducing processing time by 40%, targets a market projected to reach $3.4 trillion by 2026.

| Segment | Growth Indicator | FY2025 Performance | Strategic Importance | BCG Category |

|---|---|---|---|---|

| Business Banking | Loan growth | +12.4% | Key engine for profitability | Star |

| Digital Initiatives | Website traffic | +18% | Future expansion driver | Star |

| Fee Income Streams (Wealth Mgmt, etc.) | Fee-based income | Notable increase | Major contributor to non-interest income | Star |

| Fintech Partnerships (Blockchain/AI) | Transaction volume/Efficiency gains | Pilot success (40% time reduction) | Entry into high-growth tech sectors | Star |

What is included in the product

The AmBank Group BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis highlights which units to invest in, hold, or divest to optimize AmBank's portfolio and future growth.

The AmBank Group BCG Matrix provides a clear, one-page overview of each business unit's strategic position, relieving the pain of complex portfolio analysis.

Cash Cows

AmBank Group's Core Net Interest Income (NII) is a clear Cash Cow. In FY25, NII saw a robust 8.0% year-on-year increase, reaching RM3.57 billion. This growth was fueled by a healthy 15-basis point expansion in Net Interest Margin (NIM) to 1.94%.

This performance highlights the enduring strength and profitability of AmBank's core banking operations, specifically its lending and deposit-taking activities. The substantial and consistent cash flow generated by NII signifies a mature business segment where the bank holds a significant market share.

AmBank Group's Wholesale Banking segment is a clear Cash Cow, demonstrating strong performance with a 6.8% year-on-year growth in loans, advances, and financing for FY25. This segment commands a significant market share within the stable corporate financing sector, reflecting its maturity and established position.

The consistent generation of substantial revenue and its significant contribution to AmBank's profitability highlight its Cash Cow status. It achieves this without the need for extensive marketing expenditures, underscoring its efficient and reliable income stream.

AmBank Group's existing customer deposit base is a significant Cash Cow, contributing RM141.5 billion in FY25. This substantial volume, even with a slight dip in the CASA mix, offers a stable and cost-efficient funding foundation for the bank.

The growth of time deposits by 1.0% year-on-year highlights the reliability of this segment. This mature deposit base is crucial for AmBank's liquidity management and its ability to extend credit, consistently generating predictable cash flows.

Insurance Services (AmMetLife & AmGeneral)

AmBank's insurance businesses, AmMetLife Insurance and AmGeneral Insurance, are key contributors to the Group's non-interest income, demonstrating their role as cash cows. In the financial year ended March 31, 2024, AmBank reported a net profit of RM2.2 billion, with insurance operations playing a significant part in this performance through steady fee income and profit generation.

The Malaysian insurance market is well-established, and AmBank has carved out a strong, recognized presence within it. This maturity, coupled with AmBank's established position, allows AmMetLife and AmGeneral to consistently generate reliable cash flows, reinforcing their status as stable income generators for the parent group.

- Steady Profitability: AmMetLife and AmGeneral consistently deliver profits, bolstering AmBank's overall financial health.

- Non-Interest Income Driver: These insurance entities are crucial in diversifying AmBank's revenue streams beyond traditional lending.

- Mature Market Strength: Operating in a stable, mature Malaysian insurance sector allows for predictable earnings.

- 2024 Performance: Insurance contributions were integral to AmBank's RM2.2 billion net profit for FY24.

Established SME Customer Base

AmBank's established SME customer base, numbering around 100,000, functions as a significant cash cow. This segment has demonstrated robust historical growth, with compounded annual growth rates of 7.8% for SME deposits and a substantial 12.2% for SME loans. These figures highlight the maturity and consistent revenue generation capabilities of this portfolio.

The sheer size and historical performance of the SME segment translate into a steady stream of interest income and fee-based revenue for AmBank. Even with growth initiatives like SME Amplify, the existing, broad SME portfolio represents a mature and dependable source of earnings, underpinning its classification as a cash cow within the AmBank Group BCG Matrix.

- SME Customer Base Size: Approximately 100,000 customers.

- Historical SME Deposit CAGR: 7.8%

- Historical SME Loan CAGR: 12.2%

- Revenue Generation: Consistent interest income and fees from a mature segment.

AmBank Group's Treasury and Markets division acts as a vital cash cow, consistently generating stable income through its foreign exchange and money market operations. In FY25, this segment contributed significantly to the Group's overall financial performance, leveraging its expertise in managing liquidity and currency exposures.

The division's ability to generate predictable revenue streams, even in fluctuating market conditions, underscores its maturity and established market position. This consistent contribution supports AmBank's profitability and provides a reliable source of funds for other business activities.

| Segment | FY25 Contribution (Illustrative) | Key Drivers | Cash Cow Rationale |

| Treasury & Markets | Significant non-interest income | Forex, money market operations, liquidity management | Stable, predictable income from established operations |

Full Transparency, Always

AmBank Group BCG Matrix

The AmBank Group BCG Matrix preview you're examining is the identical, fully rendered document you will receive immediately after completing your purchase. This means you'll get the complete analysis, devoid of any watermarks or demo indicators, ready for immediate strategic application. The detailed breakdown of AmBank's business units within the BCG framework, as you see it now, is precisely what you'll download and utilize for your planning. Rest assured, this preview accurately represents the professional-grade BCG Matrix report that will be yours to leverage for informed decision-making.

Dogs

AmBank's retail banking loans saw a 2.1% year-on-year decline in FY25, signaling a potential 'Dog' in its BCG matrix. This contraction reflects a strategic move by AmBank to moderate growth, aiming to de-risk its portfolio and reallocate capital towards more lucrative opportunities.

The observed low-growth environment within AmBank's retail loan segment necessitates a thorough strategic review. This could involve divesting underperforming sub-segments or exploring innovative strategies to revitalize this area of the business.

AmBank Group's CASA mix has seen a decline, with Current Account and Savings Account balances falling by 3.3% year-on-year to RM51.0 billion in FY25. This shift has brought the CASA mix down to 36.0%.

A decreasing CASA mix signals a challenge in attracting and retaining low-cost funding sources, especially in today's competitive banking landscape. This situation points to a potentially weak market position in a crucial area of financial operations.

Such a trend positions this aspect of AmBank Group's business as a 'Dog' within the BCG Matrix framework. It suggests that this segment is consuming resources without generating the expected growth or market share, indicating a need for strategic review or divestment.

AmBank Group's FY25 results show that while non-interest income was impacted, a key factor was the reduced trading gains from Group Treasury and Markets (GTM). This indicates that specific trading operations within GTM are not currently contributing as strongly to the bank's overall performance. For instance, if GTM's contribution to non-interest income fell by 5% in FY25 compared to FY24, this would directly pull down the total non-interest income figure.

These lower trading gains suggest that certain market segments or trading strategies are either underperforming or operating in a less favorable economic climate. When an area within a business consistently generates lower returns, it can be viewed as a 'dog' in the BCG matrix, tying up valuable capital without yielding substantial profits. This situation warrants a closer look at the efficiency and profitability of these specific GTM activities.

Legacy IT Systems/Fragmented Web Presence

AmBank's legacy IT systems and fragmented web presence prior to its digital consolidation clearly fit the 'Dog' quadrant in the BCG Matrix. These older infrastructures were resource-intensive, demanding significant capital for maintenance without yielding proportionate returns or an integrated customer experience. For instance, the cost of maintaining these disparate systems before the overhaul could be seen as a drain on resources that could have been allocated to more promising ventures.

The bank's previous setup involved four separate platforms, creating a disjointed online experience for customers. This fragmentation, coupled with the inherent inefficiencies and higher operational costs of outdated technology, characterized these assets as low-growth, low-market-share entities. The effort and expenditure involved in their eventual consolidation underscore their 'Dog' status, representing past investments that were not performing optimally.

- Fragmented Presence: Operated across four distinct web platforms, hindering a unified customer journey.

- High Maintenance Costs: Legacy systems required substantial investment for upkeep, acting as cash traps.

- Inefficiency: Outdated infrastructure limited operational efficiency and the ability to deliver a seamless digital experience.

- Low ROI: These systems consumed resources without generating significant growth or market share prior to consolidation.

Underperforming Niche Retail Products

Within AmBank Group's extensive retail banking offerings, certain niche products likely fall into the Dogs category. These are typically services with minimal customer uptake and little to no market growth. For instance, a specialized loan product for a very specific industry or an outdated savings account with unfavorable interest rates might fit this description.

These underperforming niche retail products are characterized by their low market share and low growth prospects. They often persist due to legacy systems or a historical strategic focus that is no longer relevant. While not a significant drain on resources compared to major product lines, they still represent an opportunity cost, tying up development and marketing efforts that could be better allocated elsewhere.

Consider these potential examples of AmBank's underperforming niche retail products:

- Legacy Foreign Currency Accounts: Specialized accounts for currencies with declining international trade relevance for AmBank's customer base.

- Niche Investment Funds: Funds focused on very specific, low-demand sectors that have seen little investor interest in recent years.

- Outdated Loyalty Programs: Rewards programs tied to specific, less popular retail partnerships that have failed to gain traction.

AmBank's retail banking loans experienced a 2.1% year-on-year decrease in FY25, indicating a potential 'Dog' in its BCG matrix. This contraction suggests a strategic shift towards de-risking the portfolio and reallocating capital, but it also highlights a segment with low growth and market share. The declining CASA mix, down to 36.0% in FY25, further reinforces this 'Dog' classification, as it signifies challenges in attracting low-cost funding. Certain legacy IT systems and fragmented web presences, requiring significant maintenance without proportionate returns, also fit this 'Dog' quadrant, consuming resources inefficiently.

| Business Segment | BCG Quadrant | FY25 Performance Indicator |

|---|---|---|

| Retail Banking Loans | Dog | -2.1% YoY decline |

| CASA Mix | Dog | 36.0% (down from previous) |

| Legacy IT/Web Presence | Dog | High maintenance, low ROI (prior to consolidation) |

Question Marks

AmBank's new digital payment offerings like Buy Now, Pay Later (BNPL), eWallets, and QR Pay are positioned to tap into Malaysia's rapidly expanding fintech market. These services are designed to attract younger demographics and digitally savvy consumers, representing a strategic move into high-growth segments. For instance, Malaysia's digital payment market is projected to reach $12.7 billion by 2025, with BNPL and eWallets being key drivers.

As these are relatively new ventures for AmBank, their current market share in these specific digital payment categories is likely modest. This places them in a position that requires substantial investment in marketing, technology, and customer acquisition to compete effectively against established players and new fintech disruptors. The goal is to build a strong foundation that can evolve into future market leaders.

AmBank is strategically positioning itself to become a key facilitator of supply chain financing, connecting buyers and sellers within the ecosystem. This initiative directly addresses a significant market demand for streamlined and effective trade finance solutions.

Currently, this segment represents a nascent but high-potential area for AmBank, characterized by a low market share but substantial growth prospects. The bank recognizes the need for significant investment to capture a leading position in this emerging market.

For context, the global supply chain finance market was valued at approximately $12.9 trillion in 2023 and is projected to grow significantly in the coming years, indicating the substantial opportunity AmBank is targeting.

AmBank Group's strategy to target unserved and underserved markets, particularly through digital channels, represents a classic 'Question Mark' in the BCG Matrix. This approach involves significant upfront investment in technology and marketing to penetrate segments like gig economy workers or rural communities, which have historically lacked access to tailored financial products. For instance, in 2024, AmBank launched its digital-first AmOnline platform, aiming to onboard a substantial number of new customers from these demographics, with an initial target of 1 million new users by year-end.

The success of these initiatives hinges on AmBank's ability to effectively build market share from a low base in these new territories. If these digital ventures gain traction and achieve rapid customer acquisition and revenue growth, they have the potential to transition into 'Stars' within the portfolio. Conversely, if adoption rates remain sluggish or competitive pressures intensify, they could become 'Dogs' or require further strategic re-evaluation.

Advanced AI & Automation Implementations

AmBank Group's strategic investments in advanced AI and automation, targeting 70% process digitization by 2029, position these initiatives as Stars within the BCG Matrix. These are high-growth, high-investment areas, crucial for future competitiveness and operational efficiency.

The current phase involves significant capital expenditure for implementation and scaling, reflecting the high cash consumption typical of Star businesses. AmBank is actively deploying AI for tasks like fraud detection and personalized customer service, aiming to improve customer experience significantly.

- High Investment: Significant capital is being allocated to develop and integrate AI and automation technologies across AmBank's operations.

- High Growth Potential: These technologies are expected to drive substantial improvements in efficiency, customer satisfaction, and new revenue streams.

- Operational Streamlining: AmBank aims to digitize a majority of its processes, enhancing speed and reducing manual intervention.

- Competitive Edge: Early adoption and effective implementation of advanced AI are critical for maintaining a competitive advantage in the evolving financial landscape.

Innovative Sustainable Investment Solutions

Within AmBank Group's BCG Matrix, innovative sustainable investment solutions are positioned as Stars. These offerings, designed for emerging investor demographics and specialized eco-projects, capitalize on a robust and expanding market for ethical and environmentally conscious financial products. For instance, the global sustainable investment market reached an estimated $35.3 trillion in 2024, according to the Global Sustainable Investment Alliance.

- High Growth Potential: Tapping into the significant increase in demand for ESG-aligned investments.

- Significant Investment Required: necessitating substantial resources for product development and market penetration strategies.

- Competitive Landscape: Facing competition from established and emerging players in the green finance sector.

- Brand Enhancement: Reinforcing AmBank Group's commitment to sustainability and forward-thinking financial services.

AmBank's focus on unserved and underserved markets, particularly through its digital initiatives, aligns with the 'Question Mark' category in the BCG Matrix. These ventures, such as expanding digital banking to rural areas or the gig economy, require substantial investment to build market share from a low base. For example, AmBank's 2024 digital onboarding campaign aimed to attract 1 million new users, many from these target segments.

The success of these 'Question Marks' depends on AmBank's ability to convert initial investments into significant customer adoption and revenue growth. If these digital platforms gain traction and expand their user base rapidly, they have the potential to evolve into 'Stars.' However, without sufficient market penetration or facing intense competition, they risk becoming 'Dogs' if they fail to gain momentum.

The bank's strategic push into new digital payment solutions and supply chain financing also falls into this category. These areas represent high-growth potential but currently have a relatively low market share for AmBank, necessitating significant capital outlay for technology, marketing, and customer acquisition to compete effectively.

Malaysia's digital payment market is a prime example of this growth potential, projected to reach $12.7 billion by 2025, with AmBank seeking to capture a portion of this expansion through its new offerings.

BCG Matrix Data Sources

Our AmBank Group BCG Matrix is built upon a robust foundation of financial disclosures, industry growth rates, and competitive market analysis to provide strategic clarity.