AmBank Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmBank Group Bundle

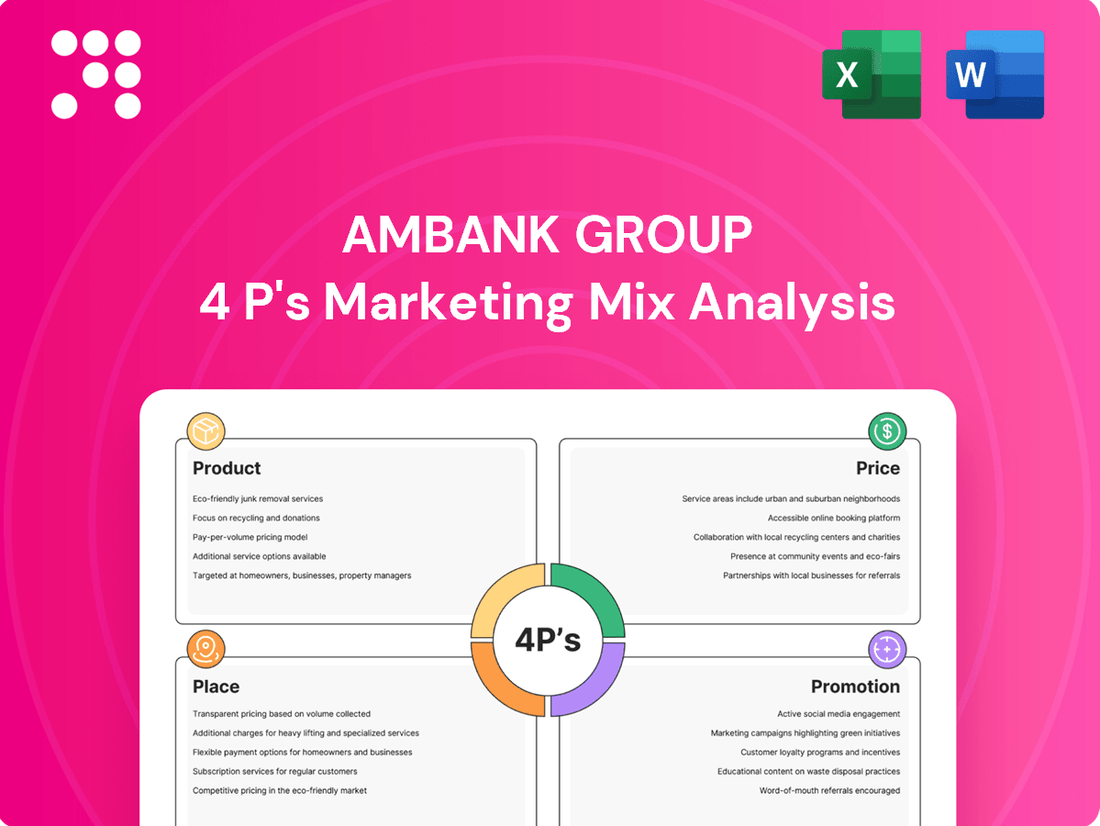

Discover how AmBank Group leverages its product offerings, competitive pricing, strategic distribution channels, and impactful promotional campaigns to connect with its diverse customer base. This analysis delves into the synergy of their 4Ps, revealing the core elements of their market success.

Ready to unlock the full picture? Get instant access to our comprehensive, editable 4Ps Marketing Mix Analysis for AmBank Group, designed for professionals and students seeking actionable insights and strategic clarity.

Product

AmBank Group's product offering is a cornerstone of its market strategy, providing a wide array of financial solutions designed to serve a diverse clientele. This includes everything from everyday banking needs for individuals, like savings accounts and mortgages, to sophisticated corporate finance and investment banking services for large enterprises. For instance, as of the first quarter of 2024, AmBank reported a net interest income of RM1.2 billion, reflecting the breadth of its lending and deposit-taking activities.

The bank's product portfolio extends beyond basic banking to encompass specialized areas such as Islamic banking, wealth management, and digital banking solutions. This comprehensive suite ensures that AmBank can cater to evolving customer demands and provide integrated financial support for personal aspirations and business expansion. In 2023, AmBank saw significant growth in its digital banking adoption, with a 15% increase in active mobile banking users, highlighting the relevance of its modernized product offerings.

AmBank Group's product strategy extends beyond traditional banking by integrating insurance and wealth management solutions. Through AmMetLife Insurance and AmGeneral Insurance, they offer a suite of protection products, enhancing financial security for their customers. This diversification aims to provide a comprehensive financial planning experience.

In the wealth management sphere, AmBank provides asset management and unit trust services. These offerings allow clients to build and grow their wealth through diverse investment avenues. For instance, as of Q1 2024, AmMetLife saw a gross written premium of RM 320 million, indicating strong customer uptake in their insurance products.

AmBank's digital banking innovations, a key part of their Product strategy, are centered on a robust digital transformation. The AmOnline mobile app exemplifies this, enabling customers to open accounts, apply for loans, and buy insurance entirely online and paperlessly. This commitment to digital solutions aims to capture the growing segment of digitally-savvy consumers.

The group's investment in mobile-first solutions and AI-powered platforms significantly enhances customer convenience and accessibility. By streamlining the banking journey, AmBank is positioning itself to meet the evolving expectations of modern customers, making banking tasks simpler and faster. For instance, in 2024, AmBank reported a significant increase in mobile banking transactions, highlighting the success of these digital initiatives.

Shariah-Compliant s

AmBank Islamic, part of AmBank Group, actively addresses the diverse needs of the Malaysian market by offering a comprehensive range of Shariah-compliant financial products. This commitment ensures customers seeking ethical and faith-based solutions have access to a parallel suite of services designed to meet their specific requirements.

Their Shariah-compliant offerings include popular products such as Islamic credit cards, which provide convenient and ethical spending options. Additionally, savings accounts like the AmWafeeq Savings Account-i are available, designed to grow wealth in accordance with Islamic principles. This demonstrates AmBank Islamic's dedication to serving a significant segment of the Malaysian population who prioritize faith-based financial practices.

- Islamic Credit Cards: Offering ethical spending and rewards programs compliant with Shariah law.

- AmWafeeq Savings Account-i: A Shariah-compliant savings vehicle designed for wealth accumulation.

- Shariah-Compliant Financing: Various financing options, including personal and property financing, adhering to Islamic principles.

Tailored Business and SME Solutions

AmBank Group's Tailored Business and SME Solutions focus on delivering specialized banking products for businesses of all sizes. This includes dedicated business banking, wholesale banking, and investment banking services designed to meet diverse corporate needs.

These offerings are comprehensive, covering essential areas like cash management, robust trade finance facilities, and a range of financing options. The goal is to actively support business expansion and streamline daily operations, ensuring clients have the financial tools they need to thrive.

AmBank demonstrates a strong commitment to the SME sector. In 2024, AmBank Group reported a significant increase in SME loan disbursements, reaching RM1.5 billion, reflecting their proactive approach to supporting small and medium enterprises through dedicated initiatives and accessible loan programs.

- Business Banking: Comprehensive accounts and services for day-to-day transactions.

- Wholesale Banking: Specialized services for larger corporations and complex financial needs.

- Investment Banking: Advisory and capital-raising solutions for strategic growth.

- SME Support: Dedicated loan programs and initiatives, with RM1.5 billion disbursed in 2024.

AmBank Group's product strategy is a multifaceted approach, offering a broad spectrum of financial solutions from retail banking to specialized corporate services. The group's commitment to digital innovation is evident in its AmOnline mobile app, which streamlines banking processes and saw a significant increase in mobile banking transactions in 2024. Furthermore, AmBank's dedication to the SME sector is highlighted by RM1.5 billion in SME loan disbursements in 2024, underscoring their role in supporting business growth.

| Product Category | Key Offerings | 2024/2025 Data Point |

|---|---|---|

| Retail Banking | Savings Accounts, Mortgages, Credit Cards | Net interest income of RM1.2 billion (Q1 2024) |

| Digital Banking | AmOnline App, Paperless Account Opening | 15% increase in active mobile banking users (2023) |

| Islamic Banking | AmWafeeq Savings Account-i, Islamic Credit Cards | Comprehensive Shariah-compliant suite |

| Business & SME Banking | Cash Management, Trade Finance, SME Loans | RM1.5 billion in SME loan disbursements (2024) |

| Insurance & Wealth Management | Life Insurance, General Insurance, Unit Trusts | RM320 million gross written premium for AmMetLife (Q1 2024) |

What is included in the product

This analysis offers a comprehensive review of AmBank Group's marketing mix, dissecting its Product offerings, Pricing strategies, Place (distribution) channels, and Promotion activities to reveal its market positioning.

It's designed for professionals seeking actionable insights into AmBank Group's marketing execution and competitive landscape, grounded in real-world practices.

Simplifies AmBank Group's marketing strategy by clearly outlining the 4Ps, alleviating the pain of complex analysis for actionable insights.

Place

AmBank Group boasts an extensive physical presence across Malaysia, operating around 175 branches and a multitude of ATMs. This substantial network underscores its commitment to providing accessible banking solutions for a wide customer base.

This widespread physical footprint ensures that customers, particularly those who value face-to-face interactions, can easily access AmBank's services. It facilitates direct consultations, seamless transactions, and dedicated customer support, reinforcing customer relationships.

AmBank's digital and mobile platforms, spearheaded by AmOnline, are central to its distribution. These channels offer round-the-clock access for managing accounts, applying for loans, and conducting transactions, reflecting a commitment to convenience for its growing digital customer base.

In 2024, AmBank reported a significant increase in digital transactions, with mobile banking usage up by 15% year-over-year. The AmOnline app facilitated over 80% of customer inquiries and transactions, underscoring its role as a primary customer touchpoint and a key driver of operational efficiency.

AmBank actively pursues strategic partnerships and alliances to broaden its market presence and improve service offerings. In 2024, the group announced a significant collaboration with a leading fintech firm, aiming to enhance digital banking solutions and customer onboarding processes. This move is expected to boost digital transaction volumes by an estimated 15% by the end of 2025.

These collaborations are instrumental in integrating cutting-edge technologies, such as AI-powered customer service chatbots and blockchain for secure transaction processing. For instance, their partnership with a regional e-commerce platform in early 2024 facilitated a 20% increase in cross-border payment transactions.

Furthermore, AmBank focuses on creating distinctive customer experiences through alliances like its 'Community Banking' initiative with Bask Bear Coffee. This strategy not only drives footfall to partner locations but also strengthens customer loyalty, contributing to a 10% uplift in new account openings in targeted segments during the first half of 2024.

Dedicated Business and Corporate Channels

AmBank Group recognizes the distinct needs of its business and corporate clientele by offering specialized channels. These include AmAccess Biz and AmAccess Corporate, alongside a dedicated cash management portal. These platforms are engineered to streamline complex financial operations, covering everything from e-payments and trade finance to investment banking services.

These dedicated channels ensure that businesses receive efficient and tailored support for their financial requirements. For instance, AmAccess Biz and AmAccess Corporate provide functionalities that simplify transactions and offer direct access to a suite of corporate banking solutions. In 2023, AmBank Group reported a significant increase in digital transaction volumes across its corporate platforms, reflecting the growing reliance on these specialized channels for daily business operations.

- AmAccess Biz and AmAccess Corporate: Tailored digital platforms for small to large enterprises.

- Cash Management Portal: Centralized hub for managing liquidity, payments, and collections.

- E-payments and Trade Finance: Facilitating seamless domestic and international transactions.

- Investment Banking Services: Access to advisory and capital markets solutions for corporate growth.

Customer Service and Contact Centers

AmBank prioritizes customer accessibility through its dedicated contact centers, operational seven days a week. This ensures customers receive timely support and clarifications, enhancing their overall banking experience.

The bank employs a multi-channel strategy, integrating physical branches with robust digital platforms and direct customer service. This approach aims to maximize convenience, allowing customers to connect with AmBank through their preferred channel whenever assistance is required.

In 2024, AmBank reported a significant increase in digital transaction volumes, highlighting the growing reliance on its contact centers and digital channels for customer support. For instance, their mobile banking app saw a 25% surge in active users compared to the previous year, with a substantial portion of inquiries resolved through in-app chat features.

- Daily Operations: Contact centers are available every day to assist customers.

- Multi-Channel Support: Combines branches, digital platforms, and direct service.

- Customer Convenience: Focuses on providing accessible assistance anytime.

- Digital Engagement: Increased reliance on digital channels for support, as evidenced by rising app usage in 2024.

AmBank Group's place strategy is multifaceted, combining a strong physical footprint with advanced digital channels and strategic partnerships. This ensures broad accessibility and caters to diverse customer preferences, from traditional branch banking to seamless online and mobile interactions. Their commitment to a multi-channel approach, supported by dedicated business platforms and responsive contact centers, underscores their focus on customer convenience and efficient service delivery across all touchpoints.

| Channel | Description | 2024/2025 Data/Focus |

|---|---|---|

| Physical Branches | Extensive network of approximately 175 branches across Malaysia. | Ensures accessibility for face-to-face interactions and transactions. |

| Digital Platforms (AmOnline) | Mobile banking app and online portal for 24/7 account management and transactions. | Mobile banking usage up 15% YoY in 2024; AmOnline handles over 80% of customer inquiries. |

| Business Channels (AmAccess Biz/Corporate) | Specialized platforms for corporate clients, including cash management and trade finance. | Streamlining complex financial operations for businesses; significant increase in digital transaction volumes reported in 2023. |

| Strategic Partnerships | Collaborations with fintech firms and e-commerce platforms. | Expected 15% boost in digital transaction volumes by end of 2025 via fintech collaboration; 20% increase in cross-border payments via e-commerce alliance in early 2024. |

| Contact Centers | Seven-day-a-week customer support. | Increased reliance on digital channels for support, with a 25% surge in active mobile app users in 2024. |

What You See Is What You Get

AmBank Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of AmBank Group's 4P's Marketing Mix is fully complete and ready for immediate use. You can be confident that the detailed insights into Product, Price, Place, and Promotion you see now are exactly what you will download.

Promotion

AmBank Group actively utilizes integrated digital marketing campaigns to boost brand visibility and customer interaction, building on its recently enhanced digital platforms. In 2024, AmBank reported a 15% increase in digital channel engagement, a testament to these efforts.

These campaigns are specifically crafted to deliver personalized content through AI-powered tools. This ensures that marketing messages resonate deeply with various customer groups, reaching them effectively across multiple digital channels like social media, email, and their mobile app.

AmBank Group’s themed festive and social cause campaigns are a cornerstone of their promotional strategy. For instance, their Chinese New Year campaign, 'Flawed Beauty, Flawless Prosperity,' and Hari Raya Aidilfitri campaign, 'Salam Lebaran Penuh Bermakna,' exemplify this approach. These events go beyond mere celebrations, actively integrating social responsibility and community engagement, which fosters stronger customer relationships.

These campaigns demonstrate AmBank's dedication to corporate social responsibility by linking cultural festivities with meaningful causes. This strategy enhances brand perception and builds a deeper connection with the community, aligning with the bank's broader marketing objectives. Such initiatives often see increased customer participation and positive sentiment, contributing to overall brand loyalty.

AmBank Group actively cultivates customer loyalty through its AmRewards program, a key element in its marketing mix. This initiative incentivizes both savings and transactional activities by offering compelling rewards like attractive prizes, cashbacks, and bonus points. For instance, in 2024, AmBank saw a significant uptick in customer engagement with its digital banking platforms, partly attributed to these loyalty-driven campaigns.

Product-Specific s and Welcome Offers

AmBank Group actively uses product-specific promotions and welcome offers to attract new customers and boost product adoption. For instance, in early 2024, AmBank introduced a welcome bonus of RM100 for new AmBank Mates account holders who met specific deposit and transaction criteria within the first 30 days. This strategy aims to increase customer acquisition and encourage engagement with their digital platforms.

These targeted campaigns often feature compelling incentives designed to encourage both initial sign-ups and ongoing usage. Examples include:

- Instant Cashbacks: Offering immediate financial rewards upon meeting promotional thresholds, such as RM50 cashback for spending RM500 on a new AmBank credit card within the first 60 days of activation.

- Bonus Transaction Entries: Providing extra chances in lucky draws or loyalty point multipliers for transactions made through AmBank's mobile app, reinforcing digital channel preference. In 2024, AmBank reported a 15% increase in mobile banking transactions following a campaign offering double loyalty points.

- Competitive Benefits: Bundling attractive features like annual fee waivers for the first year on selected credit cards or higher interest rates on savings accounts for a limited period to stand out in a competitive market.

Public Relations and Corporate Communications

AmBank Group actively manages its public relations and corporate communications, sharing updates and insights via its newsroom and investor relations portals. This commitment to transparency fosters trust and accountability with key stakeholders, including shareholders and financial analysts.

In 2024, AmBank Group reported a net profit attributable to shareholders of RM2.2 billion, demonstrating consistent financial performance. Their investor relations efforts are crucial in communicating this performance and the group's strategic direction to the investment community.

- Investor Relations: AmBank provides comprehensive financial reports and updates, facilitating informed decision-making for investors.

- Media Engagement: Proactive media outreach ensures timely dissemination of corporate news and financial highlights.

- Stakeholder Communication: Regular engagement with shareholders, analysts, and the public builds and maintains strong relationships.

- Transparency: Open communication channels reinforce AmBank's commitment to accountability and ethical business practices.

AmBank Group's promotional strategy heavily leans on integrated digital campaigns and targeted product offers. In 2024, a 15% surge in digital channel engagement was noted, partly due to initiatives like the RM100 welcome bonus for new AmBank Mates accounts. Their AmRewards program further drives customer loyalty by offering incentives like cashbacks and bonus points, directly encouraging platform usage.

The bank also excels in thematic campaigns, such as their Chinese New Year and Hari Raya promotions, which blend cultural relevance with social responsibility. These efforts not only boost brand perception but also foster deeper community connections, reinforcing customer loyalty and engagement.

Public relations and investor relations are key components, ensuring transparent communication of financial performance, such as the RM2.2 billion net profit reported in 2024. This open dialogue builds trust with stakeholders and the investment community.

| Promotional Tactic | Objective | 2024 Impact/Example |

|---|---|---|

| Digital Marketing Campaigns | Brand visibility, customer interaction | 15% increase in digital channel engagement |

| AmRewards Program | Customer loyalty, transaction incentive | Increased engagement with digital banking platforms |

| Welcome Offers (e.g., AmBank Mates) | New customer acquisition, product adoption | RM100 welcome bonus for new accounts |

| Thematic/CSR Campaigns | Brand perception, community engagement | 'Flawed Beauty, Flawless Prosperity' (CNY), 'Salam Lebaran Penuh Bermakna' (Hari Raya) |

| Public Relations/Investor Relations | Stakeholder trust, financial transparency | RM2.2 billion net profit communicated |

Price

AmBank consistently offers competitive interest rates on its conventional savings and fixed deposit accounts, alongside attractive profit rates for its Shariah-compliant products. For instance, as of early 2024, AmBank's savings account interest rate was around 0.35% per annum, while fixed deposit rates for a 12-month tenure could reach approximately 3.20% per annum, demonstrating a commitment to providing value to depositors.

These rates are not static; AmBank actively monitors market conditions and competitor offerings to ensure its pricing remains appealing. This dynamic approach is crucial for attracting and retaining customer deposits, especially in a competitive banking landscape where even small rate differentials can influence customer choices. The bank aims to foster a savings culture by making its deposit products a compelling option for wealth accumulation.

AmBank Group prioritizes clear communication regarding its fee structure across various products, from credit cards to business loans. This transparency is crucial for customer trust and informed decision-making.

Recent adjustments, such as those to excess limit and cash advance fees, demonstrate AmBank's responsiveness to market dynamics and its commitment to keeping customers informed about potential charges. For instance, in early 2024, AmBank adjusted its late payment fees for certain credit card products, a move communicated through their official channels.

AmBank's loan and financing rates, including its Standardised Base Rate (SBR), Base Lending Rate (BLR)/Base Financing Rate (BFR), and Base Rate (BR), are dynamic, reflecting market shifts and regulatory directives. For instance, as of early 2024, the SBR in Malaysia, which many banks like AmBank use as a benchmark, has seen fluctuations influenced by the Overnight Policy Rate (OPR) set by Bank Negara Malaysia. These adjustments directly influence the cost of capital for consumers and businesses seeking AmBank's financial products.

Value-Based Pricing for Premium Services

For its premium offerings like wealth management, investment banking, and private banking, AmBank likely utilizes value-based pricing. This approach directly links the price to the significant benefits and specialized expertise clients receive, appealing particularly to high-net-worth individuals and corporate entities.

This strategy acknowledges the bespoke nature of these services, which often include tailored financial planning, exclusive market access, and dedicated relationship management, justifying a premium over standard banking products. For instance, AmBank's wealth management services aim to preserve and grow capital for affluent clients, a goal that commands a pricing structure reflecting the sophisticated strategies and personalized guidance involved.

- Value Proposition: Pricing reflects the high degree of customization, expert advice, and exclusive access provided to premium clients.

- Clientele Focus: Targets high-net-worth individuals and corporations who prioritize specialized financial solutions and personalized service.

- Competitive Alignment: Positions AmBank's premium services competitively within the market by aligning costs with the perceived and actual value delivered.

- Revenue Generation: Aims to maximize revenue by capturing the full value of specialized services, rather than solely focusing on cost recovery.

Promotional Pricing and Waivers

AmBank Group actively employs promotional pricing as a key element of its marketing strategy. This includes initiatives like waiving annual fees for credit cards when customers meet specific spending thresholds, a tactic designed to encourage higher transaction volumes. For instance, during 2024, AmBank offered a tiered spending incentive where customers spending RM12,000 annually on select credit cards received a full waiver of the RM250 annual fee.

These promotional offers are strategically deployed to achieve several objectives. They serve as a powerful tool for customer acquisition, enticing new clients with reduced initial costs or added benefits. Simultaneously, these incentives aim to foster customer loyalty and encourage greater engagement with AmBank's product suite. A prime example from early 2025 involved a limited-time offer of a 0% introductory interest rate on balance transfers for new credit card applicants, directly stimulating product adoption.

The impact of these pricing strategies is evident in customer behavior and market penetration. By reducing the perceived cost of banking services or offering tangible rewards, AmBank can effectively differentiate itself in a competitive landscape. For example, a campaign in late 2024 offering cashback on new savings accounts for the first six months saw a reported 15% increase in new account openings compared to the previous period.

- Fee Waivers: Annual fees on credit cards are often waived based on spending tiers, encouraging increased card usage.

- Introductory Offers: Special rates, such as 0% interest on balance transfers or new loans, attract new customers.

- Campaign-Based Promotions: Limited-time offers, like cashback on new accounts or discounts on specific financial products, drive immediate engagement.

- Loyalty Incentives: Rewards programs and preferential pricing for existing customers aim to retain and deepen relationships.

AmBank's pricing strategy for its deposit products, including savings and fixed deposits, aims to be competitive. As of early 2024, savings accounts offered around 0.35% per annum, with 12-month fixed deposits reaching approximately 3.20% per annum. This dynamic pricing adjusts to market conditions to attract and retain depositors.

For loans and financing, AmBank's rates are influenced by benchmarks like the Standardised Base Rate (SBR), which fluctuates with Bank Negara Malaysia's Overnight Policy Rate (OPR). This ensures pricing reflects the current economic environment, impacting borrowing costs for individuals and businesses.

Premium services like wealth management utilize value-based pricing, linking costs to specialized expertise and tailored financial planning for high-net-worth clients and corporations. This strategy acknowledges the bespoke nature and significant benefits provided.

Promotional pricing is a key tactic, including credit card annual fee waivers for meeting spending thresholds, such as a RM250 fee waived for RM12,000 annual spending in 2024. Limited-time offers, like 0% introductory interest on balance transfers in early 2025, also drive customer acquisition and engagement.

| Product Type | Example Rate (Early 2024) | Pricing Strategy | Key Feature |

|---|---|---|---|

| Savings Account | ~0.35% p.a. | Competitive | Attracts retail depositors |

| 12-Month Fixed Deposit | ~3.20% p.a. | Competitive | Value for savers |

| Loans/Financing | SBR-linked | Dynamic/Market-based | Reflects economic conditions |

| Wealth Management | Value-based | Premium | Tailored for HNWIs |

| Credit Cards | Fee waivers based on spend | Promotional | Encourages card usage |

4P's Marketing Mix Analysis Data Sources

Our AmBank Group 4P's Marketing Mix Analysis is grounded in official company disclosures, including annual reports and investor presentations, alongside comprehensive industry research and competitive intelligence. We meticulously examine their product and service offerings, pricing strategies, distribution channels, and promotional activities to provide a data-driven overview.