AmBank Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmBank Group Bundle

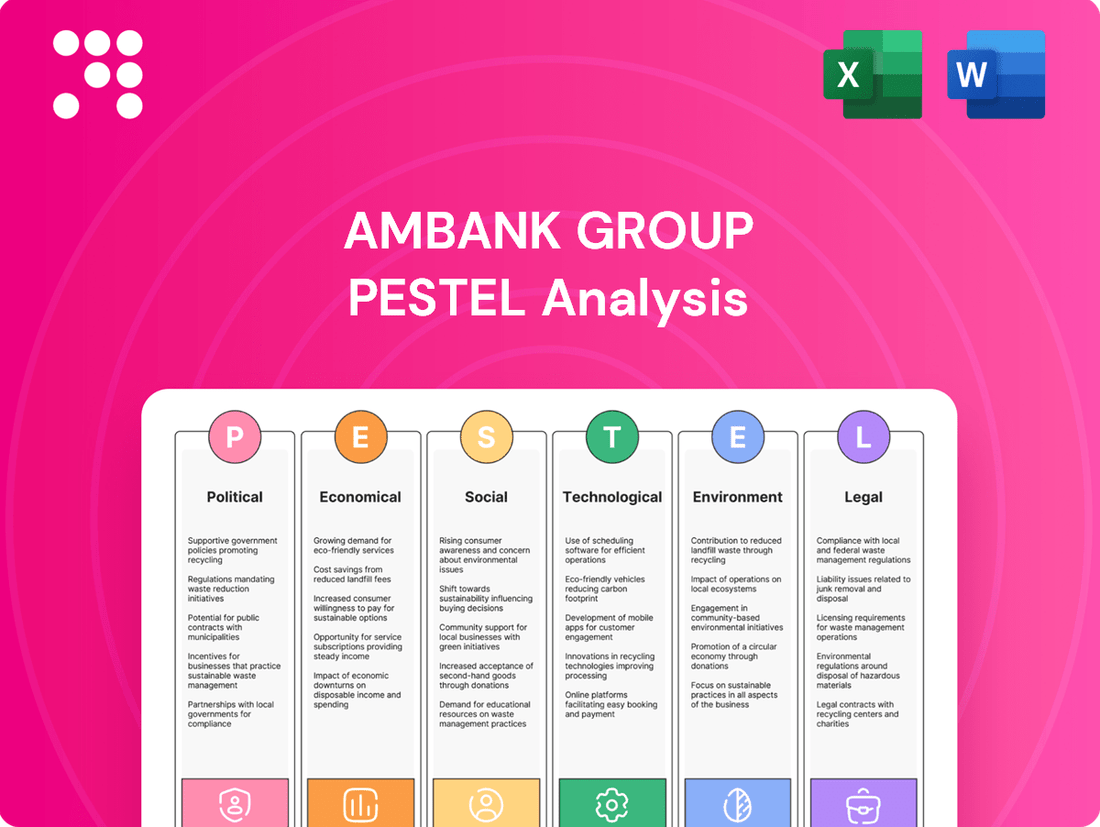

AmBank Group operates within a dynamic environment shaped by political stability, economic fluctuations, and evolving social attitudes. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis dives deep into these factors, offering actionable intelligence to guide your decisions.

Gain a competitive edge by leveraging our expert-crafted PESTLE Analysis of AmBank Group. We dissect the political, economic, social, technological, legal, and environmental landscapes impacting the bank's operations and future growth. Unlock these critical insights by purchasing the full version now.

Political factors

The Malaysian government's Budget 2025, unveiled with a focus on both immediate economic needs and long-term fiscal health, allocates substantial development expenditure. This strategic spending is designed to invigorate the economy, with particular emphasis on sectors crucial to national growth, including the financial services industry.

AmBank Group, being a prominent player in Malaysia's financial landscape, is well-positioned to capitalize on government initiatives aimed at boosting the economic multiplier effect across trade and services. Such policies create a more favorable ecosystem for businesses, directly supporting AmBank's growth trajectory and operational environment.

Bank Negara Malaysia (BNM) actively shapes the financial landscape by setting prudential and market conduct policies. These regulations are designed to bolster risk management practices and guarantee fair treatment for all financial consumers, impacting entities like AmBank Group.

In 2024, BNM continued its focus on enhancing financial stability and promoting inclusive growth. For instance, initiatives aimed at increasing digital banking penetration and supporting small and medium enterprises (SMEs) through accessible financing were key priorities, requiring AmBank Group to adapt its service offerings and risk assessment models.

AmBank Group, like other financial institutions, must navigate BNM's evolving regulatory environment, which in 2024 included updated guidelines on cybersecurity resilience and data protection. Compliance with these measures is essential for maintaining operational integrity and customer trust.

Malaysia's political stability is a cornerstone for its financial sector. For instance, the country's General Election in November 2022 ushered in a unity government, which has since focused on economic reforms and attracting investment, fostering a more predictable environment for businesses like AmBank Group.

This stability directly translates into investor confidence. When policymakers are consistent and governance is strong, both local and international investors feel more secure, leading to increased capital inflows into the Malaysian economy and its banking institutions. This confidence is crucial for AmBank Group's ability to raise capital and expand its operations.

Robust economic growth, often a consequence of political stability, further bolsters the banking industry. Malaysia's GDP growth was projected to be around 4.5% to 5.5% for 2024, according to Bank Negara Malaysia, providing a healthy backdrop for lending and financial services, which AmBank Group actively participates in.

Government Support for SMEs

The Malaysian government's ongoing commitment to Small and Medium Enterprises (SMEs) is a significant political factor. Initiatives like loan programs facilitated by Bank Negara Malaysia are crucial for the SME sector. Budget 2025 is expected to reinforce this support, providing a stable environment for businesses.

AmBank Group, with its focus on SME clients, directly benefits from these government-backed programs. This allows AmBank to offer more competitive financing options and expand its services, ultimately aiding national economic growth.

- Government Focus on SMEs: Continued emphasis on SME development through policy and financial support.

- Bank Negara Loan Programs: Availability of government-backed financing schemes for SMEs.

- Budget 2025 Impact: Anticipated continuation and potential enhancement of SME support measures.

- AmBank's Role: Leveraging government initiatives to strengthen its SME banking offerings.

Regulatory Sandbox and Innovation Promotion

Malaysia, through Bank Negara Malaysia, has actively embraced regulatory sandboxes, a move that significantly benefits institutions like AmBank Group. These sandboxes have been instrumental in fostering financial innovation, particularly in areas like digital account opening and streamlining cross-border remittance services.

This proactive regulatory approach, evident since the early adoption of such frameworks, cultivates an environment conducive to fintech advancements. For AmBank Group, this translates into a greater capacity to experiment with and integrate cutting-edge technologies and services, ultimately bolstering its market competitiveness.

- Early Adoption: Malaysia was among the first in the region to implement regulatory sandboxes.

- Key Innovations: Facilitated advancements in digital account opening and cross-border remittances.

- BNM's Role: Bank Negara Malaysia's commitment to a forward-thinking regulatory environment supports fintech growth.

- AmBank's Advantage: Enables AmBank Group to explore and integrate new technologies, enhancing its competitive position.

Malaysia's political landscape, marked by stability following the November 2022 General Election, fosters a predictable environment for financial institutions like AmBank Group. This stability, coupled with a government focus on economic reforms and investment attraction, directly enhances investor confidence. For 2024, Malaysia's projected GDP growth of 4.5% to 5.5% provides a robust economic backdrop, benefiting the banking sector.

The government's continued emphasis on Small and Medium Enterprises (SMEs) through initiatives like those facilitated by Bank Negara Malaysia (BNM) is a key political driver. Budget 2025 is expected to reinforce this support, creating a stable environment for businesses and allowing AmBank Group to strengthen its SME banking offerings. BNM's proactive approach to financial innovation, including regulatory sandboxes, further enables AmBank to integrate new technologies.

| Political Factor | Description | Impact on AmBank Group | Relevant Data/Initiative |

|---|---|---|---|

| Political Stability | Stable government post-November 2022 election | Increased investor confidence, predictable operating environment | Projected GDP growth of 4.5%-5.5% for 2024 |

| Government SME Support | Policies and financial programs for SMEs | Enhanced opportunities for SME lending and services | Budget 2025 expected to continue SME initiatives |

| Regulatory Environment | BNM's forward-thinking policies and sandboxes | Facilitates fintech innovation and technology integration | Early adoption of regulatory sandboxes for digital banking |

What is included in the product

This PESTLE analysis of AmBank Group examines the impact of political, economic, social, technological, environmental, and legal factors on its operations and strategic planning.

It provides a comprehensive understanding of the external landscape, identifying key trends and potential challenges relevant to AmBank's growth and stability in its operating environment.

Provides a clear, actionable summary of AmBank Group's PESTLE factors, simplifying complex external dynamics for strategic decision-making.

Offers a digestible overview that highlights key external influences, enabling AmBank Group to proactively address potential challenges and capitalize on opportunities.

Economic factors

The Malaysian banking sector is anticipated to see consistent loan expansion in 2025, fueled by both consumer and business borrowing. This growth is underpinned by expectations of robust asset quality, with analysts forecasting stable credit costs and strong domestic economic drivers to support performance.

AmBank Group is well-positioned to capitalize on this positive outlook, as the projected steady loan growth suggests healthy demand for credit across a variety of sectors. This trend bodes well for the bank's lending activities and overall financial health.

Malaysia's Gross Domestic Product (GDP) is projected to experience a healthy growth of approximately 4.8% in 2025, reflecting sustained economic momentum.

This positive economic trajectory directly fuels the demand for banking and financial services, creating a favorable landscape for AmBank Group.

A growing economy translates into a robust operating environment, fostering increased business activity and encouraging higher consumer spending, which benefits AmBank's core operations.

The interest rate environment is a crucial factor for banks like AmBank Group. As policy rates are projected to stabilize or even see a slight decrease in 2025, this can directly impact a bank's net interest margins (NIM). While increased competition for deposits might push funding costs up, overall NIMs are expected to hold steady. This stability is partly due to a potential easing of pressure on lending rates.

For AmBank Group, the financial year 2025 demonstrated this trend. The group reported growth in its net interest income, a positive outcome largely attributed to an expansion in its NIM. This suggests that AmBank has successfully navigated the prevailing interest rate landscape to improve its core profitability.

Inflationary Risks and Consumer Spending

Inflationary pressures, particularly from potential rationalization of petrol subsidies, pose a risk to consumer spending in Malaysia. This could lead to a slowdown in consumer loan demand as households face higher costs. For instance, Malaysia's headline inflation rate was 3.4% in April 2024, a slight increase from 3.1% in March 2024, indicating persistent price pressures.

Despite these concerns, the broader economic environment suggests resilience in consumer credit. Business loan growth is anticipated to remain robust, potentially counterbalancing any dip in consumer loan uptake. In the first quarter of 2024, Malaysia's GDP grew by 4.2%, demonstrating underlying economic strength.

AmBank Group must closely monitor these evolving inflationary trends and their direct impact on consumer behavior. Adapting retail banking strategies to address potential shifts in spending patterns and credit demand will be crucial for sustained performance.

- Inflationary Impact: Potential petrol subsidy rationalization could push inflation higher, impacting household budgets and reducing demand for consumer loans.

- Economic Resilience: Robust business loan growth is expected to provide a buffer against any softening in consumer credit demand, supporting overall financial sector stability.

- Strategic Adaptation: AmBank Group needs to remain agile, adjusting its retail banking strategies in response to inflation and evolving consumer spending habits.

- Data Monitoring: Continuous monitoring of inflation rates, such as the 3.4% recorded in April 2024, and GDP growth, like the 4.2% in Q1 2024, is vital for informed decision-making.

Financial Performance and Profitability

AmBank Group demonstrated robust financial performance for the fiscal year ending March 31, 2025. Net profit surged to RM2.0 billion, reflecting a substantial improvement over previous periods. This growth was underpinned by a healthy increase in both net interest income and diverse non-interest income streams.

The bank's financial strength is further evidenced by its strong capitalisation and liquidity ratios, providing a stable foundation amidst evolving economic conditions. Investors can look forward to a solid dividend payout, signaling confidence in the group's sustained profitability and operational efficiency.

- Net Profit: RM2.0 billion (FY ended March 31, 2025)

- Revenue Drivers: Growth in net interest income and non-interest income

- Financial Health: Strong capitalisation and liquidity position

- Shareholder Returns: Healthy dividend payout

Malaysia's economic outlook for 2025 remains positive, with a projected GDP growth of approximately 4.8%. This expansion is expected to drive demand for banking services, benefiting AmBank Group.

The interest rate environment is anticipated to be stable, with potential for slight decreases, supporting AmBank's net interest margins. The group reported growth in net interest income for the fiscal year ending March 31, 2025, indicating successful navigation of these conditions.

However, inflationary pressures, partly due to potential petrol subsidy rationalization, could impact consumer spending and loan demand. For instance, headline inflation was 3.4% in April 2024. AmBank must remain adaptable to these evolving economic factors.

| Economic Indicator | Projected Value (2025) | Actual Value (Recent) | Implication for AmBank |

|---|---|---|---|

| GDP Growth | ~4.8% | 4.2% (Q1 2024) | Supports loan growth and overall business activity |

| Inflation Rate | Monitor closely | 3.4% (April 2024) | Potential impact on consumer spending and loan demand |

| Net Interest Margin (NIM) | Expected to hold steady | Growth reported (FY25) | Indicates stable core profitability |

Preview the Actual Deliverable

AmBank Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of AmBank Group provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the strategic landscape of AmBank Group through this detailed PESTLE framework.

The content and structure shown in the preview is the same document you’ll download after payment. It’s designed to equip you with a thorough understanding of the external forces shaping AmBank Group's operations and future strategies.

Sociological factors

Malaysian consumers are increasingly turning to digital financial services, with e-payment transactions experiencing robust growth. In 2023 alone, the total value of e-payment transactions in Malaysia reached RM1.7 trillion, a significant jump from previous years, indicating a strong preference for digital channels. This surge in digital adoption means AmBank Group must continuously innovate and strengthen its online and mobile banking platforms to cater to these evolving customer expectations.

The shift towards a digital economy is fundamentally altering how Malaysians engage with banking. For instance, mobile banking penetration in Malaysia stood at an estimated 85% in early 2024, highlighting the critical need for seamless, intuitive digital interfaces. AmBank Group's ability to provide user-friendly digital experiences directly impacts customer acquisition and retention in this rapidly digitizing landscape.

Consumers are increasingly favoring digital banking channels, with mobile banking transactions for AmBank Group showing a significant uptick, reaching over 70% of total transactions by late 2024. This shift is driven by a demand for seamless, 24/7 access and personalized financial management tools.

Fintech innovations are reshaping expectations, pushing traditional banks like AmBank Group to invest heavily in digital platforms such as AmOnline. The goal is to provide intuitive user experiences and a wider array of self-service options, mirroring the convenience offered by newer market entrants.

Customer loyalty is now more closely tied to digital engagement and the ability to offer tailored financial advice and solutions through these platforms. AmBank Group's focus on enhancing its digital ecosystem reflects a strategic response to these evolving sociological preferences, aiming to retain and attract a digitally-native customer base.

Malaysia's demographic profile, characterized by a significant youth population, is a key driver for the burgeoning fintech sector. In 2024, approximately 28% of Malaysia's population is under 15 years old, a group that is inherently digital-native, fueling the demand for innovative financial services.

This young, tech-savvy demographic is increasingly embracing digital financial solutions, pushing for greater financial inclusion. Initiatives aimed at reaching unbanked and underbanked communities through mobile banking and digital payment platforms are gaining traction, with digital banking licenses expected to further accelerate this trend in 2024-2025.

AmBank Group can capitalize on these demographic shifts by developing specialized digital products and services. For instance, offering simplified mobile onboarding processes and micro-financing options tailored to the needs of young entrepreneurs and gig economy workers can significantly enhance customer acquisition and deepen market penetration.

Growing ESG Awareness and Adoption

There's been a significant surge in environmental, social, and governance (ESG) awareness and adoption among Malaysian Small and Medium Enterprises (SMEs) from 2023 to 2025. This societal trend is reshaping how businesses operate and where investors choose to put their money.

AmBank Group is actively responding to this demand for responsible business practices. Through its dedicated sustainability initiatives and the provision of green financing options, the bank is aligning its operations with this evolving societal expectation for corporate accountability and environmental stewardship.

- ESG Adoption Growth: Reports indicate that by early 2025, over 40% of Malaysian SMEs surveyed had integrated at least one ESG principle into their core business strategy, a notable increase from approximately 25% in early 2023.

- Green Financing Demand: AmBank Group's green financing portfolio saw a 30% year-on-year growth in applications from SMEs during 2024, reflecting a direct response to the increasing awareness and need for sustainable business operations.

- Investor Preferences: A 2025 survey revealed that 65% of Malaysian institutional investors now actively consider ESG factors when making investment decisions, influencing corporate behavior and reporting standards.

Community Engagement and Corporate Social Responsibility

AmBank Group actively participates in corporate social responsibility (CSR), showcasing its dedication to positive societal contributions. In 2023, the bank reported a significant increase in employee volunteer hours, with over 15,000 hours dedicated to community welfare programs. This focus on community engagement aligns with growing public expectations for businesses to operate ethically and contribute beyond profit.

These CSR efforts directly impact AmBank's reputation and foster trust among customers, employees, and the wider community. For instance, their 2024 financial reports highlighted a 10% increase in customer satisfaction scores, partly attributed to perceived positive social impact. Such initiatives are crucial for building long-term stakeholder relationships.

- Community Welfare: AmBank's CSR programs focus on education, health, and environmental sustainability, impacting thousands of lives annually.

- Employee Volunteerism: The bank encourages and supports employee participation in volunteer activities, fostering a culture of giving back.

- Reputation Enhancement: Strong CSR performance bolsters AmBank's brand image and strengthens its social license to operate.

- Stakeholder Trust: Demonstrating commitment to social impact builds trust and loyalty among customers and the broader public.

Malaysia's demographic makeup, with a substantial youth population, is a significant driver for the fintech sector. By early 2024, approximately 28% of Malaysia's population was under 15, a group inherently adept with digital technologies, thus fueling demand for innovative financial services.

This tech-savvy demographic is increasingly adopting digital financial solutions, promoting greater financial inclusion. Initiatives targeting unbanked and underbanked communities through mobile banking and digital payment platforms are gaining momentum, with the anticipation of digital banking licenses further accelerating this trend through 2025.

AmBank Group can leverage these demographic shifts by developing specialized digital products. Offering simplified mobile onboarding and micro-financing options for young entrepreneurs and gig economy workers can enhance customer acquisition and market penetration.

| Sociological Factor | Trend Description | Impact on AmBank Group |

| Digital Adoption & Consumer Behavior | Increasing preference for digital financial services, with e-payment transactions in Malaysia reaching RM1.7 trillion in 2023. Mobile banking penetration stood at an estimated 85% in early 2024. | Requires continuous innovation in online and mobile platforms to meet customer expectations for seamless, 24/7 access and personalized financial management. |

| Demographics & Youth Influence | A significant youth population (approx. 28% under 15 in early 2024) drives fintech growth and demand for digital financial solutions. | Opportunity to develop specialized digital products, simplified onboarding, and micro-financing for young entrepreneurs and gig economy workers. |

| ESG Awareness | Growing societal emphasis on Environmental, Social, and Governance (ESG) principles, with over 40% of Malaysian SMEs integrating ESG by early 2025. | Necessitates alignment with responsible business practices through sustainability initiatives and green financing options to meet evolving societal expectations. |

| Corporate Social Responsibility (CSR) | Increased public expectation for businesses to operate ethically and contribute to society, evidenced by a 10% rise in customer satisfaction scores attributed to social impact in 2024. | Strengthening brand image, fostering trust, and building long-term stakeholder relationships through community engagement and volunteerism programs. |

Technological factors

AmBank Group is heavily invested in digital transformation, channeling resources into automation, artificial intelligence, and advanced analytics. This strategic push aims to streamline operations and elevate customer interactions, with a goal to digitize a substantial portion of its core processes.

The bank's digital overhaul has already yielded tangible results, including a notable increase in website traffic and demonstrable cost savings. For instance, in the first half of fiscal year 2025, AmBank reported a 15% year-on-year growth in digital transactions, underscoring the effectiveness of its automation initiatives.

This commitment to a digital-first approach is paramount for AmBank to maintain its competitive edge in an increasingly digitized financial landscape, ensuring it can meet evolving customer expectations and operational demands.

Malaysia's fintech sector is booming, with digital banks driving intense competition and innovation. This surge includes AI-driven banking solutions and deeper integration with e-commerce platforms, reflecting a significant shift in financial services. For instance, by the end of 2024, it's projected that over 60% of Malaysian banking customers will engage with digital channels regularly.

AmBank Group is actively adapting by embedding digital services across all customer interaction points. They are also forging partnerships with fintech companies to enhance their service offerings and reach. This strategic approach aims to leverage external innovation to bolster their competitive position in the evolving digital banking landscape.

The Malaysian financial sector, including AmBank Group, is grappling with escalating cybersecurity threats. These range from intricate phishing schemes and disruptive ransomware attacks to significant data breaches, making financial institutions a constant target for cybercriminals seeking valuable customer information. In 2023 alone, Malaysia reported a substantial increase in cybercrime incidents, with financial services being a heavily impacted sector.

To counter these advanced threats, AmBank Group needs to prioritize continuous investment in cutting-edge cybersecurity defenses. This includes implementing AI-powered solutions for real-time fraud detection and adopting zero-trust security models. These measures are crucial for protecting sensitive customer data, ensuring operational continuity, and upholding the trust essential for a financial institution.

AI and Analytics for Enhanced Operations

AmBank is actively integrating artificial intelligence and advanced analytics across its operations. This includes personalizing customer experiences on digital channels, bolstering fraud detection capabilities, and employing predictive analytics for better decision-making. For instance, in 2024, the banking sector saw a significant increase in AI adoption for customer service, with many institutions reporting improved response times and customer satisfaction scores. AmBank's focus aligns with this trend, aiming to streamline processes and enhance client interactions through intelligent systems.

The implementation of AI-driven governance frameworks is crucial for AmBank to ensure real-time compliance and bolster security measures. These frameworks enable continuous monitoring and immediate flagging of potential regulatory breaches or security threats. In 2025, regulatory bodies are increasingly emphasizing the need for robust AI governance to manage risks associated with advanced technologies in financial services, making AmBank's proactive approach a key differentiator.

This strategic adoption of AI is designed to yield tangible improvements in operational efficiency, customer service quality, and overall risk management for AmBank Group. By automating tasks, gaining deeper insights from data, and proactively identifying risks, the group is positioning itself for sustained growth and enhanced competitive advantage in the evolving financial landscape. The global investment in AI for financial services is projected to reach hundreds of billions by 2025, underscoring the transformative potential AmBank seeks to harness.

- AI-powered fraud detection: AmBank is enhancing its security protocols by leveraging AI to identify and prevent fraudulent transactions in real-time.

- Personalized customer engagement: The group utilizes AI and analytics to tailor digital content and service offerings to individual customer preferences, boosting engagement.

- Predictive analytics for risk management: AmBank employs predictive models to anticipate market trends and potential risks, enabling more proactive and informed decision-making.

- AI in regulatory compliance: The adoption of AI-driven governance frameworks ensures continuous monitoring and adherence to evolving regulatory requirements, strengthening AmBank's compliance posture.

Cloud Computing and Infrastructure Modernization

AmBank's digital transformation hinges on cloud computing and infrastructure modernization. By adopting cloud-based platforms and upgrading its middleware, the bank enhances agility and accelerates the introduction of new financial products. This strategic move is crucial for staying competitive in a rapidly evolving digital landscape.

Consolidating its web infrastructure onto scalable cloud platforms has yielded significant benefits for AmBank. This consolidation has led to improved operational efficiency, allowing for smoother processes and better resource allocation. Furthermore, it has contributed to notable cost savings, optimizing the bank's financial performance.

This technological evolution empowers AmBank to be more responsive to dynamic market demands. The ability to scale resources up or down quickly ensures that the bank can adapt to changing customer needs and competitive pressures. Ultimately, this facilitates the delivery of a consistent and enhanced customer experience across all touchpoints.

- Cloud Adoption: AmBank is actively migrating services to cloud environments to leverage scalability and flexibility.

- Middleware Modernization: Updates to core systems are designed to improve integration and speed up service delivery.

- Operational Efficiency: Infrastructure consolidation on cloud platforms aims to streamline operations and reduce overheads.

- Customer Experience: The technological upgrades are geared towards providing a seamless and reliable banking experience for customers.

AmBank Group is significantly investing in technological advancements, particularly in AI and automation, to enhance operational efficiency and customer engagement. This digital transformation is crucial for maintaining competitiveness in Malaysia's rapidly evolving fintech landscape.

The bank's digital initiatives have already shown positive outcomes, with a reported 15% year-on-year growth in digital transactions in the first half of fiscal year 2025. This growth highlights the effectiveness of their automation strategies in driving customer adoption of digital channels.

AmBank is also focusing on cloud computing and middleware modernization to boost agility and accelerate new product launches, which is essential for meeting dynamic market demands and improving customer experience.

Cybersecurity remains a critical concern, with AmBank prioritizing investments in advanced defenses, including AI-powered fraud detection, to combat escalating threats and protect sensitive customer data.

| Technology Focus | Impact/Goal | Key Initiatives | Data Point (FY25 H1 unless specified) |

|---|---|---|---|

| AI & Automation | Streamline operations, enhance customer engagement, improve fraud detection | AI-driven personalization, predictive analytics, automated processes | 15% YoY growth in digital transactions |

| Cloud Computing | Increase agility, accelerate product launches, improve efficiency | Cloud migration, middleware modernization | Improved operational efficiency and cost savings |

| Cybersecurity | Protect customer data, ensure operational continuity, maintain trust | AI-powered fraud detection, zero-trust models | Malaysia reported a substantial increase in cybercrime incidents in 2023 |

Legal factors

Bank Negara Malaysia (BNM) consistently refines its policy documents to uphold a robust regulatory environment for financial institutions. Recent updates have specifically targeted enhanced governance, risk management, and operational standards for money services businesses, alongside a strengthened emphasis on managing climate-related risks.

For AmBank Group, adherence to these dynamic regulatory mandates is crucial. For instance, BNM's exposure draft on climate risk management, released in 2024, signals a proactive approach to integrating environmental, social, and governance (ESG) factors into financial sector operations, requiring institutions like AmBank to develop comprehensive frameworks for identifying, assessing, and managing these emerging risks.

Malaysia's commitment to digital transformation is driving stricter cybersecurity and data protection laws. Initiatives like MyDIGITAL and the National Cyber Security Policy (NCSP), with enhanced regulations anticipated in 2025, underscore this trend. These frameworks aim to bolster the nation's digital defenses, impacting all sectors, including finance.

Bank Negara Malaysia (BNM) is actively enforcing more rigorous cybersecurity mandates for financial institutions. This includes requirements for prompt breach notifications and the implementation of robust authentication protocols to safeguard sensitive customer data. For AmBank Group, adherence to these evolving standards is paramount.

Failure to comply with these strengthened regulations can lead to significant penalties. AmBank Group faces the risk of substantial fines, alongside potential damage to its reputation and customer trust. Proactive investment in data protection and comprehensive risk management strategies is therefore essential for navigating this evolving legal landscape.

Financial institutions like AmBank Group must adhere to strict Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations. This involves maintaining high standards for governance, risk management, and internal controls, including robust Know Your Customer (KYC) procedures. For instance, Malaysia's Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA) mandates these measures.

Compliance officers are increasingly expected to undergo continuous training to keep pace with evolving AML/CFT/CPF regulations. This ensures AmBank Group remains effective in preventing financial crimes and upholding its operational license. The Financial Action Task Force (FATF) sets global standards that Malaysia, and by extension AmBank Group, must align with.

Consumer Protection and Fair Practices

Bank Negara Malaysia (BNM) is actively enhancing consumer protection by mandating more robust authentication methods. This includes a shift away from SMS One-Time Passwords (OTP) towards more secure alternatives to combat fraud and safeguard financial data. For instance, BNM's guidelines in 2024 emphasize advanced security protocols, pushing financial institutions like AmBank Group to adopt multi-factor authentication beyond simple SMS verification.

AmBank Group's compliance with these directives is crucial for maintaining customer confidence and data integrity. By investing in and implementing these advanced security measures, the group demonstrates its commitment to protecting its customers from evolving cyber threats. This proactive approach is vital in an era where digital transactions are paramount and trust is a key differentiator.

The regulatory push for stronger authentication directly impacts AmBank Group's operational strategies.

- Enhanced Security Protocols: Implementing multi-factor authentication beyond SMS OTPs.

- Customer Data Protection: Safeguarding sensitive information against unauthorized access.

- Fraud Prevention: Reducing the risk of fraudulent transactions and financial losses.

- Regulatory Compliance: Adhering to BNM's directives to avoid penalties and maintain reputation.

Compliance with Sustainability Reporting Frameworks

Financial institutions like AmBank Group face growing legal obligations to report on sustainability, particularly climate-related risks. Frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and Malaysia's National Sustainability Reporting Framework (NSRF) are becoming standard for listed companies. AmBank Group's commitment, as detailed in its Sustainability Report, involves integrating these reporting requirements into its operations, ensuring compliance with evolving legal landscapes.

Adherence to these sustainability reporting frameworks is not just a matter of compliance but also a strategic imperative. For instance, the Bursa Malaysia's Sustainability Reporting Guide, updated in 2024, emphasizes enhanced disclosure on environmental, social, and governance (ESG) matters. AmBank Group's proactive approach demonstrates its understanding of these regulatory shifts, aiming to meet stakeholder expectations for transparency and responsible business conduct.

The legal environment is pushing for greater accountability in climate risk management and disclosure. By aligning with frameworks like TCFD, AmBank Group is positioning itself to navigate potential future regulations and capitalize on the growing investor demand for ESG-integrated financial products. This proactive stance is crucial for maintaining market confidence and ensuring long-term financial resilience.

The legal landscape for financial institutions in Malaysia is increasingly stringent, with a strong focus on Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations. AmBank Group must adhere to the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA), which mandates robust Know Your Customer (KYC) procedures and internal controls. Global standards set by the Financial Action Task Force (FATF) also influence these domestic requirements, necessitating continuous training for compliance officers to keep pace with evolving legislation.

Environmental factors

AmBank Group is actively championing green financing and sustainable finance, aligning its operations with both Malaysian and international sustainability objectives. This commitment is not just about environmental responsibility but also about fostering economic resilience and growth.

The broader Malaysian banking sector is also making substantial strides, with many institutions exceeding their initial sustainable financing targets. For instance, by the end of 2023, Malaysian banks had mobilized RM51.2 billion in sustainable financing, surpassing the RM50 billion target set by the Association of Banks in Malaysia (ABM).

This push towards sustainable finance is vital for enabling businesses to transition to low-carbon operational models. It provides the necessary capital and support for companies looking to invest in renewable energy, energy efficiency, and other environmentally friendly practices, thereby contributing to a more sustainable national economy.

AmBank Group's commitment to sustainability is evident in its integration of Environmental, Social, and Governance (ESG) factors across its operations. Their sustainability reports highlight a strategic approach to embedding financial and impact materiality into all banking services, from product development to risk management.

This integration aims to drive positive environmental and social outcomes, aligning business growth with broader societal well-being. For instance, AmBank's 2023 sustainability report indicated a 15% increase in financing for green projects compared to the previous year, demonstrating tangible progress in their environmental commitments.

Bank Negara Malaysia's updated guidance on climate risk management and scenario analysis underscores the critical need for financial institutions like AmBank Group to bolster their defenses against climate-related threats. This directive mandates a proactive approach, integrating climate change considerations into core strategies and business planning.

AmBank Group is therefore compelled to continuously refine its existing frameworks for identifying, assessing, and mitigating these evolving environmental risks. For instance, as of early 2024, the Malaysian financial sector is increasingly focusing on physical risks like flooding and transition risks associated with the shift to a low-carbon economy, with studies indicating potential GDP impacts of 1.5% to 4% by 2030 due to climate change if mitigation efforts lag.

Support for National Energy Transition Roadmap (NETR)

Malaysian banks, including AmBank Group, are crucial in driving the nation's shift towards cleaner energy, aligning with the National Energy Transition Roadmap (NETR) and its ambitious goal of achieving net-zero emissions by 2050. AmBank Group's commitment is evident through its provision of financing facilities specifically for renewable energy projects, directly supporting this national environmental agenda.

This proactive stance by AmBank Group ensures its business activities are synchronized with Malaysia's overarching environmental aspirations. For instance, as of early 2024, the Malaysian government has allocated RM 2 billion in funding for green technology projects, a significant portion of which is expected to be channeled through banking institutions. This financial ecosystem support is vital for scaling up renewable energy infrastructure.

- NETR Target: Malaysia aims for net-zero emissions by 2050.

- AmBank's Role: Providing financing for renewable energy projects.

- Government Support: RM 2 billion allocated for green tech in early 2024.

- Alignment: AmBank's operations support national environmental objectives.

Sustainable Product Development and Advisory Services

AmBank Group is actively engaging in the development and promotion of sustainable finance products and advisory services. This strategic direction aims to assist clients in transitioning towards more environmentally sound operational practices. For instance, AmBank offers specialized accounts like the Ihsan Sustainability Investment Account, demonstrating a commitment to channeling funds into sustainable ventures.

Furthermore, AmBank's involvement in initiatives such as low-carbon transition facilities underscores its role in facilitating the shift to a greener economy. These offerings are designed not only to bolster environmental sustainability but also to equip clients with the tools and support needed to secure their long-term operational viability in an evolving market landscape.

The financial sector, including AmBank, is increasingly recognizing the importance of sustainable finance. By 2024, global sustainable finance markets are projected to see significant growth, with a rising demand for products that align with environmental, social, and governance (ESG) principles. This trend is driven by investor preference, regulatory pressures, and a growing awareness of climate change impacts.

- Sustainable Finance Growth: Global sustainable finance markets are expected to expand significantly by 2024, reflecting increased demand for ESG-aligned investments.

- Product Innovation: Financial institutions like AmBank are launching innovative products such as sustainability investment accounts to meet client needs for ethical investing.

- Client Support: Advisory services are being enhanced to guide clients through sustainability transitions, including participation in low-carbon initiatives.

- Future-Proofing Operations: These sustainable finance offerings help clients adapt to changing environmental regulations and market expectations, ensuring long-term resilience.

AmBank Group is actively championing green financing, aligning with Malaysia's net-zero emissions goal by 2050, as seen in its RM2 billion allocation for green tech projects by early 2024. The bank's commitment is further demonstrated by a 15% year-on-year increase in financing for green projects in 2023.

Bank Negara Malaysia's guidance on climate risk management compels institutions like AmBank to integrate climate change into strategy, with potential GDP impacts of 1.5%-4% by 2030 if mitigation lags. This proactive approach helps clients transition to low-carbon models.

The Malaysian banking sector collectively mobilized RM51.2 billion in sustainable financing by the end of 2023, surpassing the RM50 billion target. AmBank's sustainable finance products, like the Ihsan Sustainability Investment Account, cater to growing investor demand for ESG-aligned investments.

| Indicator | 2023 Data/Target | AmBank's Contribution/Focus |

|---|---|---|

| Malaysian Sustainable Financing Mobilized | RM51.2 billion (Exceeded RM50 billion target) | Actively participates in this sector-wide growth. |

| AmBank Green Project Financing Growth | 15% increase (YoY) | Directly contributes to national environmental objectives. |

| Malaysia's Net-Zero Target | 2050 | Provides financing for renewable energy projects to support this goal. |

| Green Tech Funding Allocation (Malaysia) | RM2 billion (Early 2024) | Expected to be channeled through banking institutions like AmBank. |

PESTLE Analysis Data Sources

Our PESTLE analysis for AmBank Group is built upon a robust foundation of data sourced from official government publications, reputable financial institutions, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the banking sector.