AmBank Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmBank Group Bundle

AmBank Group operates within a dynamic financial landscape, where understanding the intensity of competition, the power of buyers and suppliers, and the ever-present threat of new entrants and substitutes is crucial. This brief overview only scratches the surface of these critical industry forces.

The complete Porter's Five Forces Analysis for AmBank Group offers a detailed, data-driven examination of each force, providing actionable insights into the bank's competitive environment and strategic positioning. Unlock the full analysis to gain a deeper understanding of the market pressures and opportunities shaping AmBank Group's future.

Suppliers Bargaining Power

AmBank Group's primary suppliers include technology providers, skilled employees, and financial market infrastructure and data providers. The banking industry's growing dependence on sophisticated technology for digital initiatives, cybersecurity, and data analysis grants specialized tech vendors moderate to high bargaining power, particularly for unique or proprietary systems.

AmBank's commitment to technological advancement is evident in its five-year capital expenditure plan, allocating RM900 million towards modernizing solutions and enhancing big data analytics capabilities. This significant investment underscores the importance of these technology suppliers and their potential leverage.

The bargaining power of suppliers for AmBank Group is notably influenced by the availability of skilled human capital, especially in critical digital and data-centric fields. The scarcity of specialized talent in areas like AI and cybersecurity within Malaysia can significantly empower these individuals, allowing them to command higher salaries and more attractive benefits.

AmBank's proactive approach to securing this talent is evident in its strategic partnerships, such as the RM3 million commitment over three years with 42 Malaysia. This investment underscores the bank's recognition of specialized tech talent as a crucial, and potentially powerful, supplier in the competitive financial landscape.

Providers of financial market data, credit rating agencies, and interbank liquidity are critical suppliers for AmBank Group. The reliance on accurate data for risk assessment and compliance means these suppliers hold a degree of influence. For instance, a significant increase in the cost of essential market data subscriptions could impact AmBank's operational expenses.

While the financial market infrastructure is heavily regulated, key data providers can still exert bargaining power. Their information is indispensable for AmBank's strategic decisions and regulatory adherence. In 2024, global spending on financial data services continued to climb, reflecting the essential nature of these inputs for major financial institutions.

Supplier Power 4

The bargaining power of suppliers for AmBank Group is significantly influenced by the cost of funds. This includes deposits from institutional investors and borrowings from the interbank market. When interest rates climb or liquidity in financial markets tightens, AmBank faces higher costs to secure these essential funds, directly impacting its net interest margin (NIM).

For instance, the Malaysian banking sector is projected to see a modest recovery in NIM in 2025. This recovery is expected to be accompanied by stable net credit costs.

- Cost of Funds: Deposits from institutional investors and interbank borrowings represent key supplier inputs for AmBank.

- Interest Rate Sensitivity: Rising interest rates directly increase the cost of acquiring these funds, squeezing profit margins.

- Liquidity Impact: Tightening liquidity in the financial markets further empowers suppliers, as AmBank competes for limited funds.

- 2025 Outlook: The Malaysian banking sector anticipates a modest NIM recovery in 2025, with stable net credit costs, suggesting a potential easing of supplier cost pressures.

Supplier Power 5

Regulatory bodies, such as Bank Negara Malaysia (BNM), exert significant influence over AmBank Group, acting as a unique 'supplier' of its operating license and the overall regulatory framework. BNM's stringent requirements, while not direct supply costs in the traditional sense, fundamentally shape AmBank's operational boundaries and impose a considerable compliance burden. BNM's ongoing commitment to fostering a resilient financial system and adapting its regulatory approach to technological advancements means AmBank must continuously invest in compliance and adapt its business model, impacting its cost structure and strategic flexibility.

BNM's role as a regulator is critical; for instance, as of late 2024, BNM continues to emphasize capital adequacy ratios and risk management frameworks, directly influencing how banks like AmBank operate and allocate resources. These regulatory stipulations, akin to supplier demands, can increase operational costs and limit certain business activities, thereby affecting profitability and competitive positioning. The dynamic nature of financial regulations, driven by global trends and domestic economic conditions, necessitates ongoing vigilance and investment from AmBank.

The bargaining power of these regulatory 'suppliers' is inherently high due to their exclusive authority. AmBank, like all financial institutions in Malaysia, must adhere to BNM directives. For example, BNM's pronouncements on digital banking licenses or cybersecurity standards directly mandate specific investments and operational changes for AmBank. This power limits AmBank's ability to negotiate terms that might deviate from compliance, effectively setting the operational playing field.

- Regulatory Authority: BNM holds the sole authority to grant and revoke operating licenses.

- Compliance Burden: Adherence to BNM's capital adequacy, risk management, and cybersecurity mandates incurs significant operational costs.

- Framework Influence: BNM's evolving regulatory stance, particularly concerning technological innovation, dictates AmBank's strategic investments and operational agility.

- Limited Negotiation: AmBank has minimal scope to negotiate the terms set by BNM, as compliance is non-negotiable.

AmBank's key suppliers, including technology providers, skilled employees, and financial market infrastructure, wield varying degrees of bargaining power. Specialized technology vendors possess moderate to high leverage due to the banking sector's increasing reliance on advanced digital solutions and cybersecurity, with AmBank investing RM900 million over five years in modernization.

The scarcity of specialized talent in areas like AI and cybersecurity in Malaysia empowers these individuals, allowing them to negotiate higher compensation, a factor AmBank addresses through partnerships like its RM3 million, three-year commitment with 42 Malaysia.

Providers of essential financial data and market infrastructure also hold influence, as accurate data is critical for AmBank's risk assessment and regulatory compliance. Global spending on financial data services continued to rise in 2024, highlighting the indispensable nature of these inputs.

The cost of funds, derived from institutional deposits and interbank borrowings, represents a significant supplier cost. Rising interest rates and tightened market liquidity directly increase these costs, impacting AmBank's net interest margin, though a modest NIM recovery is projected for the Malaysian banking sector in 2025.

| Supplier Category | Key Inputs | Bargaining Power Drivers | AmBank's Response/Investment | Impact on AmBank |

|---|---|---|---|---|

| Technology Providers | Digital platforms, cybersecurity solutions, data analytics tools | Uniqueness of technology, vendor concentration | RM900 million capital expenditure (5-year plan) | Increased operational costs, reliance on vendor roadmaps |

| Skilled Employees | AI specialists, cybersecurity experts, data scientists | Talent scarcity, specialized skills | RM3 million investment in 42 Malaysia (3-year partnership) | Higher salary and benefit costs, potential retention challenges |

| Financial Market Infrastructure & Data Providers | Market data feeds, credit ratings, interbank liquidity | Data accuracy, regulatory compliance needs | Ongoing subscription costs, adherence to data standards | Increased operational expenses, reliance on data integrity |

| Cost of Funds (Deposits & Borrowings) | Institutional deposits, interbank loans | Interest rate environment, market liquidity | Managing liquidity, optimizing deposit mix | Direct impact on Net Interest Margin (NIM) |

What is included in the product

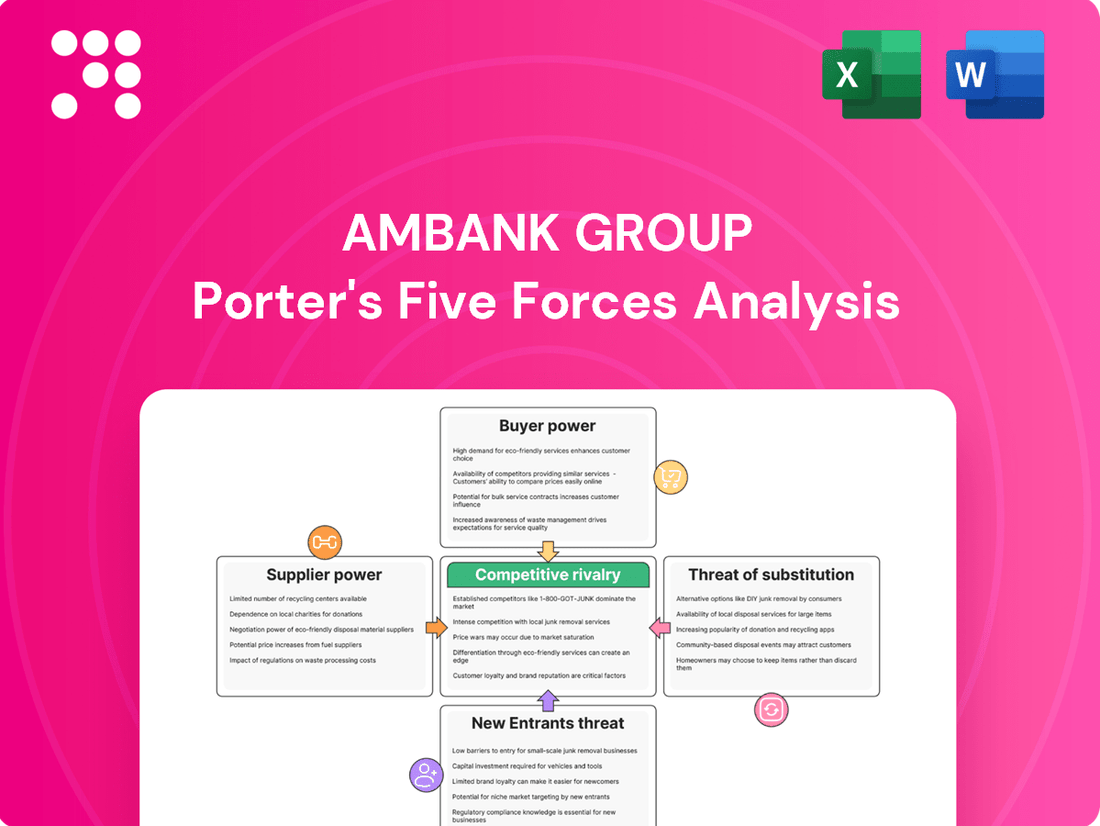

This analysis reveals the intensity of competition, the bargaining power of customers and suppliers, the threat of new entrants and substitutes, all specifically for AmBank Group's operating environment.

Instantly visualize AmBank Group's competitive landscape with a dynamic Porter's Five Forces model, highlighting key pressures to inform strategic adjustments.

Customers Bargaining Power

AmBank Group faces varying levels of customer bargaining power across its diverse clientele. Individual retail customers, particularly those with smaller balances, possess limited individual power due to the standardized offerings in banking. However, their collective ability to switch providers for better interest rates or enhanced digital services can exert pressure on AmBank.

For Small and Medium Enterprises (SMEs) and large corporations, bargaining power tends to be higher. These clients often have more complex financial needs and can leverage larger transaction volumes or the potential for significant business relationships to negotiate more favorable terms, such as preferential loan rates or tailored corporate banking solutions.

AmBank's strategic focus on deepening relationships and expanding its retail banking, especially within the affluent segment, aims to mitigate this power. By offering personalized services and value-added products, AmBank seeks to increase customer loyalty and reduce price sensitivity, thereby strengthening its position against customer-driven price competition.

Large corporations and institutional clients wield significant bargaining power with AmBank, especially when seeking substantial loan facilities or complex investment banking services. Their ability to negotiate favorable terms and customized solutions stems from the sheer volume of business they represent, directly impacting AmBank's revenue streams.

In 2024, AmBank's diverse portfolio, encompassing retail, business, wholesale, and investment banking, means that clients across these segments have varying degrees of influence. For instance, a major corporate client securing a multi-million dollar loan facility will naturally have more leverage than an individual retail depositor.

Customers wield significant bargaining power in the banking sector, amplified by readily available information and simplified switching processes, particularly with the growth of digital banking. This transparency allows consumers to easily compare interest rates, fees, and service quality, driving competition among financial institutions.

The Malaysian banking landscape has seen a surge in digital banks, offering consumers a broader array of choices and more tailored banking experiences. For instance, by the end of 2023, Malaysia's digital banking licenses were granted to consortia including established players and tech firms, signaling a shift towards increased customer choice and competitive pricing.

Bargaining Power 4

The bargaining power of customers for AmBank Group is significantly influenced by the highly competitive Malaysian financial sector. With numerous traditional banks and emerging digital banks vying for market share, customers have a wealth of choices. This intense competition compels AmBank to focus on customer retention and acquisition through competitive pricing and innovative service offerings.

This dynamic environment means customers can readily switch providers if they find better terms or services elsewhere. For instance, the Malaysian banking sector is projected to show strong performance in 2025, with anticipated steady loan growth and enhancements in asset quality, further empowering customers with more attractive banking options.

- Increased Customer Options: The presence of multiple strong competitors, including traditional and digital banks, provides customers with a wide array of alternatives.

- Price Sensitivity: Customers can leverage the competitive landscape to seek better interest rates, lower fees, and more favorable terms.

- Demand for Innovation: The need to attract and retain customers in this environment pushes AmBank to continuously innovate its products and digital services.

- Impact of Sector Performance: A resilient Malaysian banking sector in 2025, marked by steady loan growth and improved asset quality, further strengthens the customer's position by offering more attractive alternatives.

Bargaining Power 5

Customers in AmBank Group's insurance segments, AmMetLife Insurance and AmGeneral Insurance, wield significant bargaining power. This is largely due to the increasing accessibility of online comparison sites, which allow consumers to easily evaluate and switch between different insurance providers. In 2024, the Malaysian insurance market saw continued growth in digital adoption, with many customers actively seeking the best deals online.

Furthermore, regulatory efforts in Malaysia are actively empowering consumers. Initiatives focused on boosting insurance penetration and encouraging the adoption of digital insurance products are making insurance more affordable and readily available. This increased accessibility translates directly into greater customer leverage, as they have more options and information at their fingertips to negotiate terms or switch providers if dissatisfied.

- Customer Empowerment: Access to comparison sites and the ease of switching insurers enhance customer bargaining power.

- Digitalization Impact: The rise of digital insurance platforms in Malaysia in 2024 provides consumers with more choices and transparency.

- Regulatory Influence: Government initiatives promoting insurance penetration and digital products further strengthen the customer's position by increasing affordability and accessibility.

The bargaining power of customers for AmBank Group is substantial, driven by a competitive Malaysian financial landscape featuring numerous traditional and digital banks. This intense competition, evident in the projected steady loan growth and enhanced asset quality for the Malaysian banking sector in 2025, compels AmBank to focus on customer retention through competitive pricing and innovative services. Customers can readily switch providers, leveraging readily available information and simplified switching processes, particularly with the growth of digital banking, to seek better terms and services.

| Factor | Impact on AmBank | Customer Leverage | 2024/2025 Data Point |

|---|---|---|---|

| Competition Intensity | Pressure on pricing and service offerings | High, due to numerous traditional and digital bank alternatives | Malaysian banking sector projected steady loan growth in 2025 |

| Digitalization & Transparency | Need for enhanced digital services and competitive rates | High, easy comparison of rates, fees, and services online | Growth in digital adoption in Malaysian insurance market in 2024 |

| Customer Switching Ease | Risk of customer attrition | High, ability to switch providers for better terms | Increased customer choice with new digital banking licenses in Malaysia |

Preview the Actual Deliverable

AmBank Group Porter's Five Forces Analysis

This preview showcases the comprehensive AmBank Group Porter's Five Forces Analysis, detailing the competitive landscape of the banking sector with insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering a complete and actionable strategic overview.

Rivalry Among Competitors

Competitive rivalry within the Malaysian financial services sector is intense, with AmBank Group facing strong competition from major local players such as Maybank, CIMB, Public Bank, and Hong Leong Bank. These established institutions, along with various international banks and specialized financial providers, actively compete for customer loyalty and market share across all banking and investment segments.

The Malaysian banking sector demonstrated significant resilience and growth throughout 2024, with projections indicating sustained momentum into 2025. This dynamic environment means AmBank must continuously innovate and offer competitive products and services to maintain and expand its position against well-entrenched rivals.

The competitive rivalry within Malaysia's banking sector has significantly escalated with the introduction of new digital banks licensed by Bank Negara Malaysia (BNM). These new entrants, including GXBank, Boost Bank, AEON Bank, KAF Digital Bank, and Ryt Bank, are actively targeting the retail and SME markets by offering innovative, digital-first banking solutions that challenge established players like AmBank Group.

These digital banks are leveraging advanced technology to provide seamless, often lower-cost, banking experiences. As of early 2024, all five of these licensed digital banks are either fully operational or in advanced alpha testing phases, meaning they are actively engaging customers and refining their offerings, thereby intensifying the pressure on traditional banks to adapt and innovate their own digital strategies.

The competitive landscape for AmBank Group is intensifying as fintech firms increasingly challenge traditional banking models. These new entrants offer specialized services, from peer-to-peer lending platforms to digital payment solutions and automated robo-advisory services, fragmenting the market and giving customers more choices for specific financial needs. This shift means banks like AmBank must innovate to retain customers who can now access niche financial services outside the traditional banking ecosystem.

Fintech adoption in Malaysia, a key market for AmBank, is on a significant upward trajectory. This growth is fueled by the widespread adoption of digital technologies and a growing consumer demand for more personalized and convenient banking experiences. For instance, by the end of 2023, Malaysia saw a substantial increase in digital banking users, with many actively engaging with non-traditional financial service providers, directly impacting AmBank's customer acquisition and retention strategies.

Competitive Rivalry 4

AmBank Group's insurance subsidiaries, AmMetLife Insurance and AmGeneral Insurance, operate within a highly competitive insurance landscape in Malaysia. Rivalry is intense from established local players and global insurance giants vying for market share.

The Malaysian general insurance industry demonstrated robust growth, expanding by 6.9% in 2024. This expansion is anticipated to continue, fueled by rising consumer demand for protection and supportive regulatory frameworks.

- Intense Competition: AmBank faces significant rivalry from numerous local and international insurance companies.

- Market Growth: The Malaysian general insurance sector grew by 6.9% in 2024, indicating a dynamic and attractive market.

- Growth Drivers: Future expansion is expected due to increasing demand and favorable regulatory initiatives.

- Strategic Importance: AmBank must continually innovate and offer competitive products to maintain its position against strong competitors.

Competitive Rivalry 5

Competitive rivalry within the Malaysian banking sector, including AmBank Group, is shaped by the broader macroeconomic climate. Interest rate trends and overall loan growth significantly influence how intensely banks compete. For instance, while the sector anticipates stable net interest margins and healthy loan expansion in 2025, the focus for many banks is on safeguarding these margins rather than pursuing aggressive lending. This strategic caution suggests a less cutthroat competitive landscape, at least in terms of pricing new loans.

This environment means that while competition exists, it's not necessarily characterized by price wars on loans. Banks are more likely to compete on service, digital offerings, and customer relationships. The Malaysian banking sector, as of early 2025, has shown resilience, with major banks reporting solid earnings. For example, Bank Negara Malaysia's policy rate has remained steady, contributing to a predictable interest rate environment, which in turn supports stable net interest margins for institutions like AmBank.

- Macroeconomic Influence: Interest rate movements and loan growth directly impact competitive intensity in Malaysian banking.

- Margin Preservation Focus: Banks are prioritizing protecting their net interest margins over aggressive loan volume growth in 2025.

- Cautious Competition: This strategic approach indicates a more measured, rather than aggressive, competitive environment among banks.

- Resilient Sector Outlook: The Malaysian banking sector is expected to maintain stable net interest margins and robust loan growth, fostering a predictable operating environment.

Competitive rivalry within Malaysia's banking sector remains a dominant force, with AmBank Group facing intense pressure from established domestic giants like Maybank and CIMB, as well as international banks and emerging digital players. The digital banking landscape, in particular, has intensified competition, with five new digital banks licensed by Bank Negara Malaysia actively targeting retail and SME segments with innovative, technology-driven solutions.

Fintech firms are also fragmenting the market by offering specialized services, compelling traditional banks like AmBank to enhance their digital strategies and customer retention efforts. This dynamic environment necessitates continuous innovation and competitive product offerings to maintain market share.

The Malaysian general insurance sector, where AmBank's subsidiaries operate, saw robust growth of 6.9% in 2024, driven by increasing consumer demand and favorable regulatory frameworks. This expansion highlights the attractiveness of the market but also underscores the intense rivalry from both local and global insurance providers.

The competitive intensity is further influenced by macroeconomic factors, with banks in 2025 focusing on preserving net interest margins rather than aggressive loan growth, indicating a more cautious approach to competition. This environment favors competition based on service and digital offerings over price wars.

| Competitor Type | Key Players | Impact on AmBank |

| Traditional Banks | Maybank, CIMB, Public Bank, Hong Leong Bank | Strong established presence, extensive customer base, broad product offerings. |

| Digital Banks | GXBank, Boost Bank, AEON Bank, KAF Digital Bank, Ryt Bank | Disruptive innovation, focus on niche markets, potentially lower cost structures, driving digital transformation. |

| Fintech Firms | Peer-to-peer lenders, digital payment providers, robo-advisors | Market fragmentation, specialized services, customer acquisition outside traditional banking channels. |

| Insurance Companies | Local & International Insurers | Intense competition in insurance subsidiaries, requiring competitive product development and customer engagement. |

SSubstitutes Threaten

The most significant threat of substitutes for AmBank Group arises from fintech companies offering alternative financial solutions outside the traditional banking system. These include mobile payment apps, e-wallets, and online lending platforms that can bypass traditional banks for certain transactions, offering convenience and often lower fees.

The COVID-19 pandemic significantly accelerated the shift towards digital banking and the rapid uptake of digital payments and e-wallets in Malaysia. For instance, in 2023, the value of mobile payments in Malaysia was projected to reach USD 19.55 billion, indicating a strong consumer preference for these digital alternatives.

The rise of direct peer-to-peer (P2P) lending platforms and crowdfunding initiatives presents a significant threat to AmBank's traditional lending services. These platforms offer alternative avenues for capital, particularly for small and medium-sized enterprises (SMEs) and individuals who might face hurdles with conventional banking. This is especially potent in the business banking segment where faster, more accessible funding is often sought.

In 2023, the Malaysian P2P financing market saw substantial growth, with over RM1.8 billion disbursed across various platforms, indicating a growing acceptance and demand for these alternatives to traditional loans. This directly competes with AmBank’s core lending business, potentially siphoning off customers seeking quicker or more specialized financing solutions.

Investment alternatives outside of traditional banking pose a significant threat. For instance, direct investments in stocks and bonds via online brokerage platforms, or unit trusts offered by independent fund houses, provide viable substitutes for AmBank's wealth management and investment banking services. In 2024, the Malaysian Securities Commission reported a substantial increase in retail investor participation, with digital platforms playing a key role in this growth.

The burgeoning fintech sector is a major disruptor. Robo-advisors and automated investment platforms are increasingly popular, offering lower fees and accessible entry points for wealth management. These digital solutions directly compete with AmBank’s advisory services, catering to a growing segment of investors seeking convenient, tech-driven financial solutions.

Threat of Substitutes 4

The burgeoning popularity of 'buy now, pay later' (BNPL) services poses a significant threat to AmBank Group's traditional credit card and personal loan offerings, especially within the consumer spending segment. These flexible payment options are becoming increasingly attractive to a broad range of customers.

The Malaysian government's proactive stance, as evidenced by the proposed Consumer Credit Bill 2025, underscores the growing influence of BNPL. This legislation aims to bring non-bank credit and service providers, including BNPL operators, under regulatory oversight, acknowledging their substantial market presence.

- BNPL as a Direct Substitute: BNPL services directly compete with credit cards and personal loans by offering installment-based purchasing, often with zero interest, appealing to consumers seeking short-term, manageable payment plans.

- Regulatory Scrutiny: The impending Consumer Credit Bill 2025 in Malaysia signals a move to regulate entities like BNPL providers, reflecting their increasing market penetration and potential impact on the financial landscape.

- Customer Preference Shift: A growing segment of consumers, particularly younger demographics, are showing a preference for BNPL due to its perceived simplicity and immediate gratification, potentially diverting market share from conventional banking products.

- Market Growth: While specific 2024 figures for BNPL adoption in Malaysia are still emerging, global trends indicate rapid expansion, with projections suggesting continued strong growth in the coming years, further amplifying this competitive threat.

Threat of Substitutes 5

The threat of substitutes for AmBank Group's insurance arms, AmMetLife Insurance and AmGeneral Insurance, is a significant consideration. Large corporations increasingly explore self-insurance strategies, retaining risk internally rather than purchasing traditional policies. This can reduce the demand for conventional insurance products.

Furthermore, the rise of specialized insurtech platforms presents a potent substitute. These platforms often offer highly customized insurance solutions or facilitate peer-to-peer insurance models, directly challenging the standardized offerings of established insurers. For instance, in Malaysia, the DITO (Digital Insurer and Takaful Operator) licensing framework actively encourages digital innovation, potentially leading to more agile and niche substitute products emerging.

- Self-insurance by large corporations: Reduces demand for traditional policies.

- Insurtech platforms: Offer customized or peer-to-peer models.

- DITO framework in Malaysia: Fosters digital transformation, enabling new substitutes.

The threat of substitutes for AmBank Group is substantial, driven by fintech innovations and evolving consumer preferences. Digital payment platforms and P2P lending services offer faster, often cheaper alternatives to traditional banking products. Furthermore, investment platforms and 'buy now, pay later' schemes directly challenge AmBank's core offerings in wealth management and consumer credit.

The Malaysian digital payment market is booming, with the value of mobile payments projected to reach USD 19.55 billion in 2023. Similarly, the P2P financing market disbursed over RM1.8 billion in 2023, highlighting a clear shift towards alternative financial solutions.

These substitutes, particularly those leveraging technology for convenience and lower costs, directly compete with AmBank's established services, potentially eroding market share and impacting revenue streams across various segments.

Entrants Threaten

The Malaysian financial services landscape is experiencing a significant shift with the emergence of new digital banks. Bank Negara Malaysia (BNM) has issued five digital bank licenses, with all of them either operational or in advanced testing phases. These include GXBank, Boost Bank, AEON Bank, KAF Digital Bank, and Ryt Bank.

These digitally native institutions are built with agility and a strong focus on customer experience, directly challenging incumbents like AmBank Group. Their lean operating models and innovative technology allow them to potentially offer more competitive pricing and tailored services, thereby increasing the threat of new entrants.

The Malaysian financial sector, while welcoming innovation, presents significant hurdles for new entrants. Bank Negara Malaysia (BNM) enforces strict licensing, capital adequacy, and compliance requirements, acting as a substantial barrier. For instance, as of late 2024, the minimum capital requirement for digital banks remains a key consideration for aspiring players.

However, BNM's forward-looking initiatives, such as the Digital Bank framework and the anticipated Consumer Credit Bill 2025, signal an intent to foster competition. These measures aim to streamline processes and create a more conducive environment for new, particularly digital-first, financial service providers, potentially lowering entry barriers for agile and innovative firms.

The threat of new entrants for AmBank Group is moderate, primarily due to high capital requirements and the need for extensive infrastructure. Traditional banking demands significant investment in technology and branch networks, acting as substantial barriers. For instance, establishing a fully compliant banking operation often requires hundreds of millions of ringgit in initial capital, making it a daunting prospect for newcomers.

While digital banks have a lower physical footprint, they still require substantial investment in robust digital platforms and advanced cybersecurity measures to build trust and ensure operational integrity. AmBank itself has demonstrated this commitment by investing heavily in its digital transformation, including upgrading its core banking systems and enhancing its mobile banking app, which underscores the ongoing need for technological advancement to compete effectively.

Threat of New Entrants 4

Customer loyalty and the deep trust built by established banks like AmBank Group present a significant hurdle for new entrants. This ingrained trust, cultivated over years of reliable service, makes it challenging for newcomers to attract and retain customers.

However, the landscape is evolving with the rise of digital banks. These new players are actively working to dismantle traditional barriers by offering compelling incentives. For example, they often provide attractive interest rates on savings, such as GXBank's offering of 2% per annum daily interest, and focus on delivering seamless, user-friendly digital experiences.

Furthermore, new entrants are leveraging strategic partnerships to integrate into existing digital ecosystems, thereby gaining immediate access to a broad customer base. The integration of GXBank within the Grab ecosystem is a prime illustration of this strategy, allowing it to tap into a vast network of users already accustomed to digital transactions and services.

Key strategies employed by new entrants to overcome entry barriers include:

- Offering superior digital user experience: Focusing on intuitive and efficient mobile banking platforms.

- Competitive pricing: Providing higher interest rates on deposits and lower fees on services.

- Ecosystem integration: Partnering with popular digital platforms to reach a wider audience.

- Targeted marketing: Focusing on specific customer segments with tailored digital offerings.

Threat of New Entrants 5

The threat of new entrants for AmBank Group is moderately high, particularly as emerging technologies lower barriers to entry in the financial services sector. New players can leverage advanced technologies like AI, big data, and blockchain to offer innovative and potentially more cost-effective banking solutions, directly challenging incumbents.

These new entrants, often fintech companies, can bypass the legacy infrastructure and regulatory hurdles that traditional banks face. For instance, digital-only banks have shown significant growth by focusing on streamlined customer experiences and lower operational costs. AmBank itself is investing in big data analytics capabilities to enhance its competitive edge and adapt to these technological shifts.

The ability of new entrants to attract customers with specialized digital offerings and competitive pricing presents a significant challenge. This is further amplified by the increasing digital savviness of consumers, who are more open to exploring alternative financial providers. AmBank's strategic investments in technology are crucial for mitigating this threat.

Key considerations regarding new entrants include:

- Technological Disruption: Fintechs can utilize AI for personalized financial advice and blockchain for secure, efficient transactions, potentially undercutting traditional banking fees.

- Lower Overhead: Digital-native companies often have significantly lower operating costs compared to banks with extensive physical branch networks.

- Agility and Innovation: Startups can pivot quickly to adopt new technologies and market trends, whereas established banks may face slower internal processes.

- Customer Acquisition: New entrants can attract customers through user-friendly interfaces, niche product offerings, and aggressive digital marketing campaigns.

The threat of new entrants for AmBank Group is considered moderate to high, primarily driven by the emergence of digital banks and fintech companies. While regulatory requirements and capital demands remain significant barriers, innovative business models and technological advancements are lowering these hurdles. For instance, as of late 2024, digital banks are operational or in advanced testing, including GXBank and Boost Bank, introducing agile competitors.

These new players often leverage lower operational costs and superior digital user experiences to attract customers, exemplified by GXBank offering 2% daily interest on savings. Strategic partnerships, such as GXBank's integration with the Grab ecosystem, further enhance their reach and customer acquisition capabilities, directly challenging traditional players like AmBank.

AmBank must continue investing in its digital transformation, including big data analytics and enhanced mobile platforms, to counter the technological disruption and competitive pricing strategies of these newcomers. The agility of fintechs to adopt new technologies and their focus on niche markets present ongoing challenges that require proactive adaptation from established institutions.

Porter's Five Forces Analysis Data Sources

Our AmBank Group Porter's Five Forces analysis is built upon a foundation of verified data, including AmBank's annual reports, industry-specific research from reputable firms like Fitch Ratings, and regulatory filings from Bank Negara Malaysia.

We leverage a comprehensive mix of primary and secondary data, drawing from market research reports on the Malaysian banking sector, competitor financial statements, and economic indicators from sources like the World Bank to accurately assess competitive dynamics.