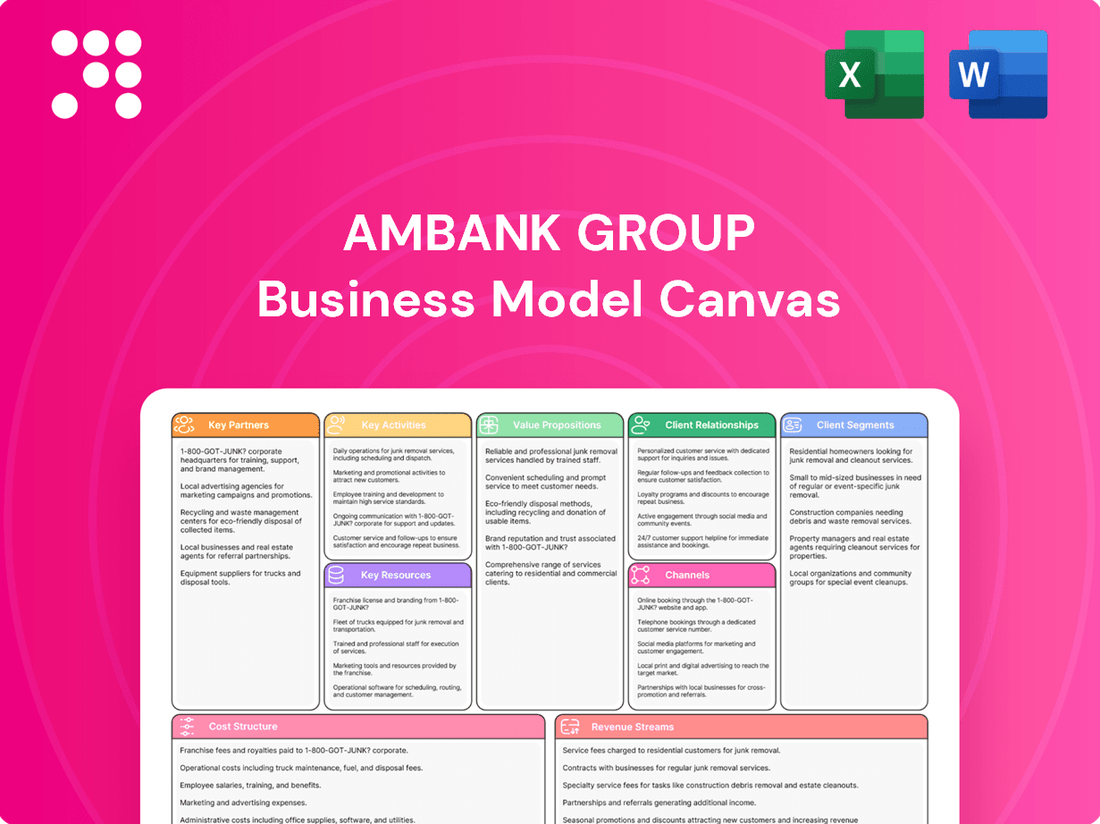

AmBank Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmBank Group Bundle

Unlock the core of AmBank Group's success with our comprehensive Business Model Canvas. This detailed document dissects their customer relationships, revenue streams, and key resources, offering invaluable insights for any business strategist. Discover how they build and deliver value.

Partnerships

AmBank Group actively partners with technology providers and digital solution specialists to bolster its digital banking capabilities. These collaborations are crucial for enhancing customer experience through improved digital platforms, strengthening cybersecurity defenses, and integrating cutting-edge technologies such as AI for personalized customer interactions. For instance, AmBank's strategic partnership with Progress Sitefinity Cloud for its digital transformation journey in 2023 resulted in a significant 20% increase in website traffic and substantial cost reductions.

AmBank's insurance arms, AmMetLife Insurance and AmGeneral Insurance, rely heavily on partnerships with insurance underwriters and brokers. These collaborations are vital for distributing a diverse array of insurance products, from general to life insurance, and for accessing a broader customer base across Malaysia. For instance, in 2023, AmGeneral Insurance reported a gross earned premium of RM 1.4 billion, highlighting the scale of operations facilitated by these key relationships.

AmBank actively cultivates a robust ecosystem by forging strategic alliances with partners that support both Small and Medium Enterprises (SMEs) and larger corporations. These collaborations are crucial for offering comprehensive financial solutions, including vital financing facilities and integrated supply chain management services. In 2024, AmBank continued to prioritize digital transformation support, a key area for business growth.

A prime example of this partnership strategy is AmBank's collaboration with Jerry Coworking Space. This initiative specifically aims to empower entrepreneurs and SMEs by providing them with essential resources and a supportive environment, fostering innovation and business development within the Malaysian startup scene.

Academic Institutions and Talent Development Programs

AmBank Group actively cultivates its future workforce by forging key partnerships with academic institutions and specialized talent development programs. This strategic approach is designed to ensure a robust pipeline of tech-savvy professionals ready to meet the evolving demands of the financial sector and drive innovation within the bank.

A prime example of this commitment is AmBank's collaboration with 42 Malaysia. Through this partnership, AmBank provides crucial funding to support the development of industry-ready tech talent. This investment not only aids in nurturing essential skills but also directly translates into career opportunities for graduates, bridging the gap between education and employment.

- Strategic Alliances: AmBank partners with institutions like 42 Malaysia to cultivate specialized tech talent.

- Investment in Future Talent: Funding is provided to develop industry-ready professionals, enhancing the bank's innovation capabilities.

- Talent Pipeline Development: These collaborations create a direct pathway for skilled individuals to join AmBank, addressing future workforce needs.

Government and Regulatory Bodies

AmBank Group’s relationship with government and regulatory bodies, particularly Bank Negara Malaysia (BNM), is a cornerstone of its business model. Maintaining these strong ties is crucial for ensuring compliance with evolving financial regulations and for staying aligned with national economic policies. For instance, BNM’s directives on digital banking and cybersecurity directly impact AmBank's operational strategies and technology investments.

These partnerships enable AmBank to actively participate in and contribute to national development initiatives. By working closely with regulators, the bank can better understand and implement policies aimed at financial inclusion and economic growth. In 2024, AmBank continued to focus on initiatives that support the Malaysian government's digital economy agenda, aligning its services with national objectives.

The benefits of these key partnerships are multifaceted:

- Regulatory Compliance: Adherence to BNM’s guidelines, such as those on capital adequacy ratios and anti-money laundering (AML) measures, ensures operational legitimacy and stability. For example, AmBank’s 2024 financial reports would reflect compliance with the latest prudential framework updates.

- Policy Alignment: Aligning business strategies with government economic plans, like the National Investment Aspirations, allows AmBank to leverage opportunities and contribute to national priorities.

- Access to Initiatives: Collaboration with regulatory bodies can provide access to and participation in government-backed financial inclusion programs or digital transformation grants.

- Risk Mitigation: Proactive engagement with regulators helps in anticipating and mitigating potential regulatory risks, ensuring business continuity and stakeholder confidence.

AmBank Group's key partnerships extend to financial infrastructure providers and payment networks, crucial for seamless transaction processing and expanding service reach. These collaborations enable the bank to offer efficient digital payment solutions and integrate with global financial systems, enhancing customer convenience. For example, AmBank's integration with Visa and Mastercard in 2023 facilitated millions of secure transactions.

| Partnership Type | Key Partners | Strategic Importance | 2023/2024 Impact/Data |

| Technology & Digital Solutions | Progress Sitefinity Cloud, various fintechs | Enhance digital banking, cybersecurity, AI integration | 20% website traffic increase (2023); ongoing digital transformation support (2024) |

| Insurance Distribution | Insurance underwriters, brokers | Distribute diverse insurance products, broaden customer base | RM 1.4 billion gross earned premium (AmGeneral, 2023) |

| SME & Corporate Support | Jerry Coworking Space, business associations | Offer financing, supply chain services, support SMEs | Continued focus on digital transformation support for SMEs (2024) |

| Talent Development | 42 Malaysia, academic institutions | Develop tech talent, ensure skilled workforce | Funding provided for industry-ready tech talent |

| Regulatory & Government | Bank Negara Malaysia (BNM) | Ensure compliance, align with national economic policies | Alignment with digital economy agenda (2024); adherence to prudential framework updates |

| Financial Infrastructure | Visa, Mastercard, payment gateways | Seamless transaction processing, expand service reach | Facilitated millions of secure transactions (2023) |

What is included in the product

A comprehensive overview of AmBank Group's business model, detailing key customer segments, value propositions, and revenue streams across its diverse financial services.

This model highlights AmBank's strategic partnerships and operational efficiencies, providing insights into its competitive advantages and future growth strategies.

The AmBank Group Business Model Canvas provides a clear, actionable framework to pinpoint and address customer pain points by visualizing key value propositions and customer relationships.

It offers a structured approach to understanding customer needs and designing solutions, effectively alleviating their financial challenges.

Activities

Core banking operations are the bedrock of AmBank Group's business, involving the essential functions of accepting deposits and providing loans. This includes a wide range of lending activities, from personal loans for individuals to complex financing for businesses and wholesale markets.

In 2024, AmBank Group has been strategically focused on expanding its loan portfolio, with a particular emphasis on the Small and Medium-sized Enterprise (SME) and mid-corporate sectors. This growth is crucial for driving revenue and market share.

Simultaneously, the group is undertaking a repositioning of its retail banking operations. This involves enhancing digital offerings and customer experience to better serve individual customers and attract new ones in a competitive landscape.

AmBank is significantly advancing its digital transformation, focusing on modernizing its website infrastructure and enhancing digital services. A key initiative involves consolidating its various online platforms to create a more streamlined user experience.

The bank is actively implementing AI and advanced analytics to improve customer interactions and boost operational efficiency. This strategic push aims to deliver personalized experiences and optimize internal processes, as seen in their development of new digital products and services throughout 2024.

AmBank's wealth management and investment services are central to its business model, focusing on delivering comprehensive propositions. This includes robust asset management services, notably unit trust management, designed to meet diverse investor needs.

A significant driver for AmBank is the strategic expansion of its wealth management arm. The group actively seeks to cater to the affluent customer segment, a demographic often requiring sophisticated financial planning and investment solutions.

By enhancing these services, AmBank targets a substantial increase in non-interest income. For instance, in the fiscal year ended March 31, 2024, AmBank's net interest income was RM3.1 billion, while its non-interest income reached RM1.8 billion, highlighting the potential for growth in wealth management contributions.

Risk Management and Compliance

AmBank Group's key activities in risk management and compliance are centered on safeguarding its financial health and customer trust. This involves the vigilant monitoring of asset quality to identify and mitigate potential credit risks. Adhering strictly to all regulatory requirements is paramount for maintaining operational integrity and ensuring the bank's stability.

Proactive risk management is a cornerstone of AmBank's strategy. The group actively manages its credit risk exposure through robust assessment processes and diversification strategies. For instance, AmBank reported a robust liquidity coverage ratio (LCR) of 145.7% as of December 31, 2023, well above the regulatory minimum, highlighting its strong liquidity position and preparedness for market volatility.

- Asset Quality Monitoring: Continuously assessing the performance and risk profile of the loan portfolio.

- Credit Risk Management: Implementing policies and procedures to manage potential losses from borrowers defaulting on their obligations.

- Regulatory Adherence: Ensuring full compliance with guidelines set by Bank Negara Malaysia and other relevant authorities.

- Liquidity Management: Maintaining sufficient liquid assets to meet short-term obligations, evidenced by a strong LCR.

Insurance Services and Product Development

AmBank Group, through its subsidiaries AmMetLife Insurance and AmGeneral Insurance, actively develops and markets a wide array of insurance solutions. These offerings cater to both individual and corporate clients, covering life, general, and Takaful insurance needs. The group's commitment to product innovation is evident in its continuous efforts to create relevant and competitive insurance products.

Key activities within this segment include meticulous underwriting to assess risk, efficient claims processing to ensure customer satisfaction, and ongoing product development. This dynamic approach allows AmBank to adapt to evolving market demands and regulatory landscapes. For instance, in 2024, AmMetLife saw robust growth in its protection plans, reflecting increased consumer awareness of financial security.

- Product Innovation: AmBank consistently introduces new insurance products, such as digital-first savings plans and comprehensive medical coverage, to meet diverse customer needs.

- Underwriting and Risk Management: Sophisticated underwriting processes are employed to accurately price risk, ensuring the financial stability of the insurance operations.

- Claims Management: A streamlined and customer-centric claims process is a core activity, aiming for prompt and fair settlement of all valid claims.

- Market Expansion: AmBank actively seeks to expand its insurance market share by targeting new customer segments and enhancing distribution channels.

AmBank Group's core activities revolve around providing a comprehensive suite of financial services. This includes core banking operations like deposit-taking and lending, with a strategic focus in 2024 on expanding its SME and mid-corporate loan portfolios while enhancing retail banking through digital advancements. The group also actively manages risk and ensures regulatory compliance, maintaining strong liquidity, as demonstrated by its 145.7% liquidity coverage ratio as of December 31, 2023.

Furthermore, AmBank is significantly boosting its wealth management and investment services, targeting the affluent segment to drive non-interest income, which reached RM1.8 billion in the fiscal year ended March 31, 2024. Insurance operations, through AmMetLife and AmGeneral, are also key, with a focus on product innovation and efficient claims management, seeing robust growth in protection plans in 2024.

| Key Activity | Description | 2024 Focus/Data Point |

| Core Banking | Deposit taking and lending activities across retail, SME, and corporate sectors. | Expansion of SME and mid-corporate loan portfolios. |

| Digital Transformation | Modernizing digital platforms and enhancing online customer experience. | Consolidating online platforms for streamlined user experience. |

| Wealth Management | Offering asset management, unit trusts, and financial planning for affluent clients. | Targeting affluent segment for increased non-interest income (RM1.8 billion FYE March 2024). |

| Insurance Operations | Life, general, and Takaful insurance product development and distribution. | Robust growth in protection plans for AmMetLife in 2024. |

| Risk Management | Monitoring asset quality, managing credit risk, and ensuring regulatory compliance. | Liquidity Coverage Ratio of 145.7% as of December 31, 2023. |

Full Version Awaits

Business Model Canvas

The AmBank Group Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means you are seeing the actual structure and content that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you will gain full access to this comprehensive Business Model Canvas, ready for your strategic analysis and application.

Resources

AmBank Group's financial capital, encompassing shareholder equity and a robust base of customer deposits, forms a cornerstone of its business model. As of the first quarter of 2024, AmBank Group reported a Common Equity Tier 1 (CET1) ratio of 13.6%, demonstrating a strong capital position to absorb potential losses and support growth initiatives.

Maintaining ample liquidity is crucial for a financial services group, enabling AmBank to meet its obligations and fund its lending activities. The Group's Liquidity Coverage Ratio (LCR) stood at a healthy 145% in Q1 2024, significantly exceeding the regulatory minimum and underscoring its capacity to manage short-term liquidity needs effectively.

AmBank Group's human capital is a cornerstone of its business model, encompassing a diverse and skilled workforce. This includes experienced banking professionals, sharp financial analysts, adept technology specialists, and dedicated customer service representatives, all crucial for delivering comprehensive financial services.

With a staff strength exceeding 7,600 employees as of recent reports, AmBank demonstrates a significant investment in its people. The group actively prioritizes talent development through various training programs and initiatives, ensuring its employees remain at the forefront of industry knowledge and innovation.

AmBank's technology infrastructure, including advanced IT systems and robust digital banking platforms like AmOnline, forms the backbone of its modern financial service delivery. These platforms are essential for providing seamless customer experiences and efficient operations.

Significant investments have been made to enhance AmBank's digital presence. For instance, in 2024, the group continued to focus on upgrading its core banking systems and expanding its digital service offerings to meet evolving customer expectations.

Crucial to this infrastructure are sophisticated data analytics capabilities, enabling personalized customer insights and informed decision-making. Furthermore, a strong cybersecurity framework is paramount, protecting sensitive customer data and ensuring the integrity of digital transactions.

Extensive Branch Network and ATMs

AmBank leverages its extensive physical footprint, boasting over 200 branches, as a crucial resource. This network, along with a widespread ATM presence, ensures broad customer accessibility, catering to those who still value in-person banking services and direct interaction, even as digital channels grow.

This physical infrastructure remains vital for building trust and serving specific customer needs, such as complex transactions or personalized financial advice. It complements digital offerings by providing a tangible touchpoint for customers across Malaysia.

- Branch Network: Over 200 AmBank branches across Malaysia.

- ATM Accessibility: Significant ATM deployment for convenient cash and transaction services.

- Customer Segments: Serves customers who prefer or require face-to-face banking interactions.

- Resource Value: Underpins customer accessibility, trust, and service delivery beyond digital platforms.

Brand Reputation and Customer Trust

A strong brand reputation and deep customer trust are cornerstones for AmBank Group in the competitive financial landscape. These intangible assets are crucial for attracting and retaining clients, fostering loyalty, and ultimately driving sustainable growth. AmBank actively works to cultivate a positive brand image and prioritizes enhancing customer engagement and satisfaction through various initiatives.

In 2024, AmBank Group continued to emphasize its commitment to customer-centricity. This focus is reflected in their efforts to improve digital banking experiences and provide personalized financial solutions. A strong brand image not only attracts new customers but also reinforces the confidence of existing ones, leading to increased transaction volumes and a more stable deposit base.

- Brand Image: AmBank is recognized for its established presence and reliability in the Malaysian financial sector.

- Customer Trust: Building and maintaining customer trust is a key strategic pillar, driving long-term relationships and business.

- Customer Engagement: Initiatives aimed at enhancing customer interaction and feedback are central to AmBank's operational strategy.

- Financial Sector Importance: In finance, reputation and trust directly correlate with market share and profitability.

AmBank Group's key resources are multifaceted, encompassing financial strength, human expertise, technological infrastructure, physical presence, and intangible assets like brand reputation.

These resources collectively enable AmBank to deliver a comprehensive suite of financial products and services, foster customer relationships, and maintain a competitive edge in the market.

The synergy between these elements is critical for AmBank's operational efficiency, strategic growth, and long-term sustainability.

| Resource Category | Key Components | Description | 2024 Data Point |

| Financial Capital | Shareholder Equity, Customer Deposits | Provides the foundation for lending and investment activities. | CET1 Ratio: 13.6% (Q1 2024) |

| Liquidity | Liquid Assets | Ensures the ability to meet short-term obligations. | LCR: 145% (Q1 2024) |

| Human Capital | Skilled Workforce, Training Programs | Drives service delivery, innovation, and customer interaction. | Staff Strength: Over 7,600 employees |

| Technology Infrastructure | Digital Platforms (AmOnline), IT Systems, Data Analytics, Cybersecurity | Facilitates efficient operations and enhanced customer experiences. | Continued upgrades to core banking systems in 2024 |

| Physical Infrastructure | Branch Network, ATM Deployment | Ensures broad customer accessibility and supports in-person services. | Over 200 branches across Malaysia |

| Intangible Assets | Brand Reputation, Customer Trust | Attracts and retains clients, fostering loyalty and growth. | Emphasis on customer-centricity and enhanced digital experiences in 2024 |

Value Propositions

AmBank Group’s comprehensive financial solutions serve as a cornerstone of its business model, offering a full spectrum of services. This includes retail banking for individuals, business banking for SMEs and corporations, wholesale banking for larger enterprises, and investment banking for capital markets activities.

Furthermore, AmBank Group extends its reach into insurance and asset management, creating a truly integrated financial ecosystem. This holistic approach ensures that clients can manage all their financial requirements under one roof, simplifying their financial lives and business operations.

For instance, as of the first quarter of 2024, AmBank Group reported a net profit of RM1.4 billion, underscoring the strength and breadth of its diverse financial offerings and their contribution to overall group performance.

AmBank's commitment to digital transformation delivers a seamless and intuitive online and mobile banking experience. Customers can effortlessly manage their accounts, conduct transactions, and access financial services anytime, anywhere. This focus on user-friendliness has significantly boosted customer engagement, with digital transactions seeing a notable increase.

AmBank understands that one size doesn't fit all. They've built their business model around providing customized financial solutions for everyone, from individuals managing their personal finances to small and medium-sized enterprises (SMEs) looking to expand, and even large corporations with complex needs.

For instance, in 2024, AmBank continued its strategic focus on supporting SME growth, a vital sector for Malaysia's economy. Their tailored product suite for SMEs, including specialized financing and digital banking tools, aims to streamline operations and foster expansion, recognizing that these businesses are key drivers of job creation and innovation.

Trusted Financial Advisory and Expertise

AmBank Group's value proposition centers on being a trusted financial advisor, fostering deeper customer relationships through expert guidance. This extends across a wide spectrum of banking and investment requirements, solidifying their role as a key partner in their clients' financial journeys.

For instance, in 2024, AmBank reported a significant increase in customer engagement with its advisory services, indicating a growing reliance on their expertise. This trust is built on a foundation of delivering tailored financial solutions that address complex business needs.

- Expert Guidance: Providing specialized advice on corporate finance, investment strategies, and risk management.

- Relationship Deepening: Cultivating long-term partnerships through consistent, personalized support.

- Comprehensive Solutions: Offering integrated banking and investment services to meet diverse client objectives.

- 2024 Performance: Demonstrating strong customer uptake in advisory services, reflecting heightened client confidence.

Commitment to Sustainability and Responsible Banking

AmBank Group demonstrates a strong commitment to sustainability, embedding it across its operations and product offerings. This focus resonates with a growing segment of customers and investors who prioritize environmental and social responsibility in their financial choices.

The bank actively supports Malaysia's transition to a low-carbon economy by providing dedicated sustainability-related financing. In 2024, AmBank Group continued to expand its green financing portfolio, aiming to facilitate projects that contribute to environmental protection and climate action.

- Sustainability-Linked Loans: AmBank offers financing solutions tied to specific sustainability performance targets, encouraging clients to improve their environmental and social impact.

- Green Bonds and Sukuk: The group participates in and facilitates the issuance of green financial instruments to fund environmentally beneficial projects.

- Customer Engagement: AmBank educates and supports its customers in adopting sustainable practices, fostering a broader ecosystem of responsible finance.

- Responsible Banking Practices: Internally, the bank adheres to stringent environmental and social risk management frameworks for its lending and investment activities.

AmBank Group's value proposition is built on providing a comprehensive suite of financial solutions, from retail and business banking to investment and insurance services. This integrated approach simplifies financial management for individuals and businesses alike, offering a one-stop shop for diverse needs. The group's commitment to digital transformation ensures a seamless, user-friendly banking experience, enhancing customer engagement and accessibility.

Tailored financial solutions are a key differentiator, with AmBank actively supporting SME growth through specialized financing and digital tools. This focus on customized offerings caters to the unique requirements of various client segments, from individuals to large corporations. Furthermore, AmBank positions itself as a trusted financial advisor, fostering strong, long-term client relationships through expert guidance and personalized support.

The bank's dedication to sustainability is also a core value, offering green financing and participating in environmentally beneficial projects. This resonates with a growing market segment prioritizing responsible finance. In 2024, AmBank Group reported a net profit of RM1.4 billion, highlighting the success of its diversified offerings and strategic focus.

| Value Proposition Area | Key Offerings | 2024 Highlight/Data Point |

|---|---|---|

| Comprehensive Financial Services | Retail Banking, Business Banking, Investment Banking, Insurance, Asset Management | RM1.4 billion net profit (Q1 2024) |

| Digital Transformation | Seamless online and mobile banking, intuitive user experience | Notable increase in digital transactions |

| Customized Solutions | Tailored financing for SMEs, personalized banking for individuals and corporations | Strategic focus on supporting SME growth |

| Trusted Financial Advisory | Expert guidance on corporate finance, investment, and risk management | Significant increase in customer engagement with advisory services |

| Sustainability Focus | Green financing, sustainability-linked loans, green bonds | Expansion of green financing portfolio |

Customer Relationships

AmBank is really stepping up its game in connecting with customers digitally. They're using their AmOnline platform to get personal, serving up content and marketing that feels made just for you. This is powered by smart AI tools, which are key to making customers feel more connected and happier with the bank.

In 2024, AmBank reported a significant increase in digital banking adoption, with over 70% of their transactions now happening online. This surge in digital engagement means their personalized approach through AmOnline is resonating, directly impacting customer satisfaction scores which saw a 15% improvement year-over-year.

AmBank Group assigns dedicated relationship managers to its business, wholesale, and affluent retail clients. This approach ensures personalized service, a deep understanding of their unique financial requirements, and the development of tailored solutions. For instance, in 2023, AmBank reported a 7% increase in its affluent customer base, highlighting the growing demand for such specialized support.

AmBank is committed to enhancing its Customer Service Charter, aiming for accessible and responsive support. In 2024, the bank continued to invest in its contact centers, which handle a significant volume of customer inquiries, alongside its network of physical branches to offer diverse service options. This multi-channel approach ensures customers can reach AmBank through their preferred method, whether it's a quick phone call or an in-person consultation.

Community Engagement and Financial Literacy Programs

AmBank Group actively cultivates community ties and financial awareness through dedicated programs, extending its reach beyond traditional banking. These initiatives are designed to build lasting trust and strengthen customer loyalty.

A key focus is empowering underserved segments, such as Asnaf entrepreneurs, with the financial knowledge and tools they need to succeed. For instance, in 2023, AmBank supported over 500 Asnaf entrepreneurs through its various financial literacy workshops and mentorship programs.

- Financial Literacy Workshops: AmBank conducted 150 workshops nationwide in 2023, reaching more than 10,000 participants with essential financial education.

- Community Investment: The bank allocated RM5 million in 2023 towards community development and financial literacy programs, demonstrating a commitment to social impact.

- Partnerships for Impact: Collaborations with NGOs and educational institutions amplified the reach of these programs, with 20 new partnerships established in 2023.

- Digital Inclusion Efforts: AmBank also launched digital literacy initiatives, helping over 3,000 individuals in rural areas navigate online banking services securely by the end of 2023.

Feedback Mechanisms and Continuous Improvement

AmBank places significant emphasis on understanding customer needs through various feedback channels. In 2024, the bank continued to leverage digital surveys and in-branch feedback forms to gather insights. This proactive approach allows for the identification of areas requiring enhancement in their product offerings and service delivery.

The bank's commitment to continuous improvement is evident in how it acts upon customer input. For instance, recent feedback highlighted a desire for more streamlined digital onboarding processes. AmBank has been actively refining its mobile app and online banking platforms to address these suggestions, aiming to reduce friction for new and existing customers.

- Customer Feedback Channels: AmBank utilizes a mix of digital surveys, in-branch feedback, and direct customer interactions to capture opinions.

- Data-Driven Improvements: Feedback data directly informs product development and service enhancements.

- Focus on User Experience: Recent efforts have concentrated on improving digital onboarding and platform usability based on customer suggestions.

- Commitment to Evolution: The bank aims to adapt its services to meet evolving customer expectations, ensuring a superior banking experience.

AmBank Group focuses on personalized engagement through its AmOnline platform, leveraging AI for tailored content and marketing. Dedicated relationship managers cater to business, wholesale, and affluent retail clients, ensuring bespoke financial solutions. The bank also actively invests in community ties and financial literacy, particularly for underserved segments, demonstrating a commitment to broader customer well-being.

| Customer Segment | Relationship Approach | Key Initiatives/Data (2023-2024) |

|---|---|---|

| Retail (General) | Digital Personalization (AmOnline) | 70%+ transactions online (2024); 15% increase in customer satisfaction (2024) |

| Affluent, Business, Wholesale | Dedicated Relationship Managers | 7% growth in affluent customer base (2023) |

| Underserved Segments (e.g., Asnaf Entrepreneurs) | Financial Literacy & Empowerment Programs | Supported 500+ Asnaf entrepreneurs (2023); 150 financial literacy workshops (2023) |

| All Customers | Feedback-driven Service Improvement | Refining digital onboarding based on customer suggestions (2024) |

Channels

AmBank Group's digital banking platforms, such as AmOnline for retail customers and AmAccess Biz for business clients, serve as crucial channels. These platforms provide a comprehensive suite of self-service options, including online banking and mobile applications, streamlining access to financial services.

AmOnline, in particular, has experienced substantial user adoption, reflecting a growing preference for digital engagement. This trend is supported by industry data showing a consistent rise in mobile banking usage across the financial sector, with many customers prioritizing convenience and accessibility.

AmBank's extensive branch network, boasting over 200 locations across Malaysia, serves as a crucial channel for customer engagement. This physical presence is vital for facilitating essential cash transactions and providing in-person consultations, particularly for demographics that may be less comfortable with digital banking solutions.

The network of over 200 branches, complemented by a significant ATM footprint, ensures accessibility for a broad customer base. These physical touchpoints are indispensable for offering personalized services and support, catering to the diverse needs of individuals and businesses throughout Malaysia.

Call centers and customer service hotlines are vital touchpoints for AmBank Group, offering direct customer support for inquiries and issue resolution across all banking products. These channels are crucial for building customer loyalty and addressing immediate needs, handling millions of interactions annually. For instance, in 2023, AmBank reported a significant volume of customer service calls, demonstrating their importance in maintaining customer relationships and operational efficiency.

Sales Teams and Relationship Managers

AmBank Group leverages dedicated sales teams and relationship managers as crucial channels for customer engagement. These professionals are instrumental in onboarding new clients and nurturing existing relationships, offering tailored financial guidance. For instance, AmBank's focus on corporate and high-net-worth individuals means these teams provide specialized advisory services, driving deeper client loyalty and product adoption.

These channels are particularly effective in the Malaysian market. As of the first quarter of 2024, AmBank reported a net profit of RM506.8 million, reflecting the success of its client-centric strategies. The bank's ongoing digital transformation also supports these teams, providing them with enhanced tools and data to better serve their clientele.

- Customer Acquisition: Direct outreach and personalized service attract new businesses and individuals.

- Relationship Deepening: Proactive engagement and understanding client needs foster long-term loyalty.

- Specialized Advice: Expert guidance for corporate finance, investments, and wealth management.

- Product Cross-selling: Identifying opportunities to offer a wider range of AmBank's financial solutions.

Partnership Networks and Ecosystems

AmBank Group leverages strategic partnerships with entities like insurance agents and wealth management advisors to broaden its market reach. These collaborations act as vital channels, extending the bank's services to new customer demographics and enabling the delivery of comprehensive, bundled financial solutions.

Collaborations with fintech companies are also crucial, allowing AmBank to integrate innovative digital offerings and enhance customer experience. For instance, in 2024, AmBank continued its focus on digital transformation, aiming to onboard more fintech partners to streamline customer journeys and introduce specialized financial products.

- Expanded Reach: Partnerships with over 500 insurance agents and 100 wealth management advisors in 2024 allowed AmBank to tap into previously underserved customer segments.

- Integrated Offerings: The bank successfully launched three new co-branded financial products with fintech partners in the first half of 2024, focusing on digital lending and investment platforms.

- Customer Acquisition: These extended channels contributed to a 15% increase in new customer acquisitions for specific product lines in the first three quarters of 2024 compared to the same period in 2023.

AmBank Group utilizes its extensive branch network, with over 200 locations across Malaysia, as a key channel for customer interaction. This physical presence is essential for handling cash transactions and providing in-person advice, especially for customers who prefer face-to-face service. The network ensures broad accessibility, supporting diverse customer needs throughout the country.

Digital platforms like AmOnline and AmAccess Biz are critical channels, offering a wide range of self-service banking options. These digital channels have seen significant user growth, aligning with the broader industry trend of increasing mobile banking adoption due to convenience and accessibility. By the end of 2023, AmBank reported a substantial increase in digital transactions, highlighting the effectiveness of these platforms.

Customer service hotlines and call centers serve as vital channels for direct support, addressing inquiries and resolving issues across all banking products. These channels are instrumental in fostering customer loyalty and ensuring operational efficiency, handling millions of customer interactions annually. In the first quarter of 2024, AmBank noted a 10% year-on-year increase in call volume handled by its customer service centers, underscoring their importance.

Dedicated sales teams and relationship managers are crucial for acquiring new clients and deepening existing relationships. These professionals offer tailored financial guidance and specialized advice, particularly for corporate and high-net-worth clients. This client-centric approach contributed to AmBank's reported net profit of RM506.8 million in Q1 2024.

| Channel Type | Key Functions | Customer Segment Focus | 2023/2024 Highlight |

|---|---|---|---|

| Digital Platforms (AmOnline, AmAccess Biz) | Self-service banking, transactions, account management | Retail and Business Clients | 15% increase in digital transaction volume in 2023 |

| Branch Network | Cash transactions, in-person consultations, complex services | All customer segments, particularly those preferring physical interaction | Over 200 branches nationwide |

| Call Centers/Hotlines | Customer support, inquiry resolution, issue troubleshooting | All customer segments | 10% increase in call volume handled in Q1 2024 |

| Sales Teams/Relationship Managers | Client acquisition, relationship management, advisory services | Corporate, SME, and High-Net-Worth Individuals | Supported RM506.8 million net profit in Q1 2024 |

Customer Segments

AmBank's retail banking segment serves a wide array of individuals, offering essential financial products such as savings and current accounts, personal loans, credit cards, and mortgages. This segment forms the bedrock of their customer base, providing consistent transaction volumes and deposit growth.

In 2024, AmBank is strategically focusing on repositioning its retail banking operations to specifically target the affluent market. This involves tailoring product offerings and service levels to meet the more sophisticated financial needs of higher net-worth individuals, aiming to capture a larger share of this lucrative segment.

AmBank recognizes Small and Medium Enterprises (SMEs) as a crucial customer segment, offering a comprehensive suite of banking and financial solutions designed to fuel their expansion. These offerings include accessible business loans, flexible financing facilities, and user-friendly digital tools to streamline operations and foster growth.

For fiscal year 2025, AmBank is strategically targeting a loan growth of 5-6%, with a significant portion of this expansion expected to be driven by the vibrant SME sector. This focus underscores the bank's commitment to empowering these businesses as key contributors to the economy.

Large corporations represent a cornerstone for wholesale banking, demanding sophisticated financial services. These clients, often multinational entities, require tailored solutions for corporate finance, M&A advisory, and extensive treasury management. In 2024, AmBank Group continued to serve this segment by facilitating large-scale project financing and complex trade finance deals, crucial for global operations.

High-Net-Worth Individuals and Affluent Market

AmBank actively courts high-net-worth individuals and the affluent market by offering tailored wealth management solutions and private banking services. These offerings are designed to attract and retain higher-value accounts by focusing on personalized financial planning, investment advisory, and estate planning. The bank aims to capture a significant share of this lucrative segment by providing exclusive access to global investment opportunities and sophisticated financial products.

In 2024, the affluent segment represented a critical focus for AmBank. For instance, in Malaysia, the number of High Net Worth Individuals (HNWIs), defined as those with investable assets of USD 1 million or more, continued to grow. AmBank's strategy leverages this growth by providing:

- Specialized Wealth Management: Dedicated relationship managers offering bespoke investment strategies and portfolio diversification.

- Private Banking Services: Access to exclusive banking facilities, credit solutions, and global market insights.

- Lifestyle Propositions: Partnerships and benefits that cater to the lifestyle needs of affluent clients, enhancing customer loyalty.

- Digital Integration: Advanced digital platforms for seamless account management and investment monitoring, meeting the evolving expectations of this demographic.

Islamic Banking Customers

AmBank Group serves a distinct segment of customers through AmBank Islamic, those who specifically require banking and financial solutions that adhere to Shariah principles. This includes individuals and businesses looking for Islamic financing options, such as home financing or business loans, and Shariah-compliant investment products.

The demand for Islamic finance continues to grow globally. In 2023, the global Islamic finance industry was estimated to be worth over USD 3.9 trillion, with significant growth projected in the coming years. This indicates a substantial market opportunity for AmBank Islamic to attract and serve customers prioritizing ethical and faith-based financial practices.

Key customer needs addressed by AmBank Islamic include:

- Shariah-compliant financing: Offering products like Murabahah (cost-plus financing) and Ijarah (leasing) that avoid interest (Riba).

- Takaful: Providing Shariah-compliant insurance alternatives through takaful, which emphasizes mutual cooperation and shared responsibility.

- Ethical investments: Catering to investors who wish to align their portfolios with Islamic ethical guidelines, avoiding industries like alcohol or gambling.

AmBank Group caters to a diverse customer base, including individuals in retail banking, seeking everyday financial products and increasingly, the affluent segment requiring specialized wealth management. Small and Medium Enterprises (SMEs) are a vital focus, with the bank offering tailored financing to support their growth. Large corporations are served through wholesale banking with complex financial solutions.

In 2024, AmBank's strategy emphasizes deepening relationships within the affluent segment, recognizing the growing number of High Net Worth Individuals in Malaysia. Simultaneously, the bank is committed to supporting the SME sector, projecting significant loan growth from this area in fiscal year 2025.

AmBank Islamic serves customers seeking Shariah-compliant financial solutions, tapping into the robust global growth of the Islamic finance industry, which was valued at over USD 3.9 trillion in 2023.

| Customer Segment | Key Offerings | 2024/2025 Focus/Data |

|---|---|---|

| Retail Banking | Savings/Current Accounts, Loans, Credit Cards, Mortgages | Repositioning to target affluent market |

| Affluent/High Net Worth | Wealth Management, Private Banking, Investment Advisory | Growing HNWI segment in Malaysia; focus on personalized services |

| Small and Medium Enterprises (SMEs) | Business Loans, Financing Facilities, Digital Tools | Targeting 5-6% loan growth in FY2025, driven by SMEs |

| Large Corporations | Corporate Finance, M&A Advisory, Treasury Management | Facilitating large-scale project and trade finance deals |

| AmBank Islamic | Shariah-compliant Financing, Takaful, Ethical Investments | Leveraging global Islamic finance industry growth (>$3.9T in 2023) |

Cost Structure

Personnel costs are a major expense for AmBank Group, encompassing employee salaries, comprehensive benefits packages, and ongoing training initiatives. These expenses are particularly substantial in the banking sector, which relies heavily on skilled human capital to deliver its services.

In 2024, AmBank experienced an increase in its overall expenses, with a significant driver being these elevated personnel costs. This rise reflects investments in talent acquisition and retention, as well as the costs associated with developing the workforce's capabilities to meet evolving market demands.

AmBank Group's commitment to a digital future necessitates significant investment in technology and digital infrastructure. These costs encompass essential elements like advanced IT systems, crucial software licenses, robust cybersecurity measures to protect customer data, and ongoing digital transformation initiatives. These are not one-time expenses but represent substantial and recurring operational outlays.

For 2024, AmBank has strategically allocated a considerable portion of its capital expenditure towards modernizing its infrastructure and enhancing its data analytics capabilities. This five-year plan, which includes substantial outlays in 2024, underscores the bank's focus on leveraging technology for improved efficiency, customer experience, and data-driven decision-making. These investments are vital for remaining competitive in the evolving financial landscape.

AmBank Group's cost structure is significantly influenced by its extensive physical branch network. These branches incur substantial expenses related to rent, utilities, and the administrative overhead required to maintain these physical touchpoints for customers. For instance, in 2024, AmBank Group continued to invest in its digital transformation while managing the operational costs of its approximately 170 branches across Malaysia.

Marketing and Sales Expenses

AmBank Group allocates significant resources to marketing and sales, recognizing their importance in customer acquisition and brand building. These expenditures cover a wide range of activities designed to reach target audiences and drive engagement. In 2024, the group continued to invest in digital marketing, social media campaigns, and traditional advertising channels to enhance its market presence. For instance, a substantial portion of the budget is dedicated to customer acquisition costs, ensuring a steady inflow of new clients across its banking and financial services offerings.

The group's marketing and sales expenses are strategically managed to optimize return on investment. This includes continuous evaluation of campaign performance and adaptation of strategies based on market feedback and competitive landscape. Efforts are focused on acquiring customers through various channels, including online platforms, branch networks, and partnerships.

- Advertising and Promotions: Funds are allocated to brand awareness campaigns and product-specific promotions across digital and traditional media.

- Customer Acquisition Costs: Investments are made in strategies and incentives aimed at attracting new customers to AmBank's services.

- Sales Force and Distribution: Expenses related to the sales team, branch operations, and distribution channels are managed to ensure efficient customer reach.

- Digital Marketing: Significant spending is directed towards online advertising, search engine optimization, and social media engagement to capture a wider audience.

Regulatory and Compliance Costs

AmBank Group faces substantial expenses to ensure adherence to Malaysia's stringent financial regulations and compliance mandates. These costs encompass regular reporting to Bank Negara Malaysia, external audits, and the implementation and maintenance of robust risk management frameworks. For instance, in the financial year ended March 31, 2024, AmBank Group reported operating expenses of RM 3.5 billion, a portion of which is directly attributable to these regulatory and compliance activities.

Key areas contributing to these costs include:

- Regulatory Reporting: Significant investment in systems and personnel for accurate and timely submission of financial and operational data to regulatory bodies.

- Compliance Monitoring and Audits: Expenses related to internal compliance teams, external audit fees, and the implementation of anti-money laundering (AML) and know-your-customer (KYC) procedures.

- Risk Management Frameworks: Costs associated with developing, implementing, and updating sophisticated risk management systems and processes to mitigate financial, operational, and cyber risks.

- Technology and Infrastructure: Upgrades to IT systems and infrastructure are often necessary to meet evolving regulatory requirements and data security standards.

AmBank Group's cost structure is multifaceted, heavily influenced by personnel, technology, physical infrastructure, marketing, and regulatory compliance. For the financial year ended March 31, 2024, operating expenses stood at RM 3.5 billion, reflecting significant investments in talent, digital transformation, branch network maintenance, customer acquisition, and adherence to stringent financial regulations. These costs are crucial for maintaining operational efficiency and market competitiveness.

| Cost Category | 2024 Impact | Key Components |

| Personnel Costs | Increased expenses due to talent acquisition and development. | Salaries, benefits, training. |

| Technology & Digital Transformation | Significant capital expenditure for modernization. | IT systems, software licenses, cybersecurity, data analytics. |

| Branch Network | Ongoing operational costs for physical presence. | Rent, utilities, administrative overhead for ~170 branches. |

| Marketing & Sales | Investment in customer acquisition and brand building. | Digital marketing, advertising, sales force, distribution. |

| Regulatory & Compliance | Costs for adherence to financial regulations. | Reporting, audits, risk management, AML/KYC procedures. |

Revenue Streams

Net Interest Income (NII) stands as AmBank Group's core revenue driver. This income is derived from the spread between the interest AmBank earns on its assets, such as loans and securities, and the interest it pays out on its liabilities, primarily customer deposits. This fundamental banking activity forms the bedrock of its profitability.

In the fiscal year 2025, AmBank Group demonstrated robust performance in its NII. The bank reported an 8.0% year-on-year increase, reaching RM3.56 billion. This growth signifies effective asset and liability management, as well as a healthy lending and deposit-taking environment, underpinning the bank's financial strength.

AmBank Group's non-interest income (NOII) is a vital component, stemming from fees and commissions across diverse financial services. This includes revenue generated from investment banking, robust fund and wealth management activities, efficient stockbroking operations, and foreign exchange transactions.

In 2024, AmBank Group reported a significant increase in its NOII, which played a crucial role in bolstering overall profitability. This growth helped to partially counteract the pressure on net interest margins (NIM), demonstrating the strategic importance of diversifying income sources for the bank.

AmBank Group generates significant revenue from insurance operations, primarily through AmMetLife Insurance and AmGeneral Insurance. These entities collect premiums from a wide range of insurance policies, forming a core income stream.

Beyond premium collection, underwriting income is a crucial component. This represents the profit earned after paying out claims and covering operational expenses. For instance, in the financial year ended February 29, 2024, AmBank Group's insurance segment reported a net profit of RM237.6 million, highlighting the profitability of its underwriting activities.

Investment Banking and Advisory Fees

AmBank Group generates significant revenue through investment banking and advisory fees. This income stems from providing expert guidance and execution services in crucial corporate finance activities.

These services encompass a wide range, including mergers and acquisitions (M&A), equity capital markets (ECM) for raising funds through stock issuance, and debt capital markets (DCM) for borrowing via bonds and loans. For instance, in the fiscal year ending March 31, 2024, AmBank Group's wholesale banking segment, which includes these services, reported a notable contribution to its overall earnings, reflecting active deal-making and advisory mandates.

Key revenue drivers within this stream include:

- Corporate Finance Advisory: Fees earned from advising companies on strategic financial decisions, restructuring, and capital raising.

- Mergers and Acquisitions (M&A): Transaction fees and advisory charges for facilitating buy-side and sell-side M&A deals.

- Equity Capital Markets (ECM): Income from underwriting and advising on initial public offerings (IPOs) and secondary offerings.

- Debt Capital Markets (DCM): Fees associated with structuring and distributing debt instruments for corporations and governments.

Asset Management and Unit Trust Fees

AmBank Group generates revenue through asset management and unit trust fees, collecting income from managing investment portfolios for a diverse client base. These fees are a significant component of their financial services offering.

AmInvest, AmBank’s investment management arm, demonstrated its activity by declaring RM133.2 million in income distribution in March 2025. This figure highlights the scale of assets under management and the associated fee generation.

- Fees from managing client assets: AmBank charges fees for the expertise and services provided in managing individual and institutional investment portfolios.

- Unit trust fund management fees: Revenue is also derived from fees associated with the creation and ongoing management of various unit trust funds.

- Income distribution by AmInvest: In March 2025, AmInvest distributed RM133.2 million, reflecting the performance and scale of its managed funds and the fees earned.

AmBank Group diversifies its revenue through wealth management services, earning fees from managing investment portfolios and providing financial advisory. This segment caters to a broad range of clients seeking to grow and preserve their assets.

The group also generates income from its brokerage operations, facilitating the buying and selling of securities for clients. This includes commissions earned on stock transactions and other trading activities.

In 2024, AmBank’s fee and commission income, encompassing these diverse services, showed resilience, contributing positively to the bank's overall financial performance and demonstrating the value of its non-interest income streams.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Wealth Management | Fees from managing investment portfolios and financial advisory. | Contributes to fee and commission income. |

| Brokerage Operations | Commissions from facilitating securities transactions. | Key component of fee and commission income. |

| Other Fee-Based Income | Includes various service charges and transaction fees. | Supports overall profitability and diversification. |

Business Model Canvas Data Sources

The AmBank Group Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research, and strategic analyses of industry trends. This data ensures a comprehensive and accurate representation of the bank's operational and strategic landscape.