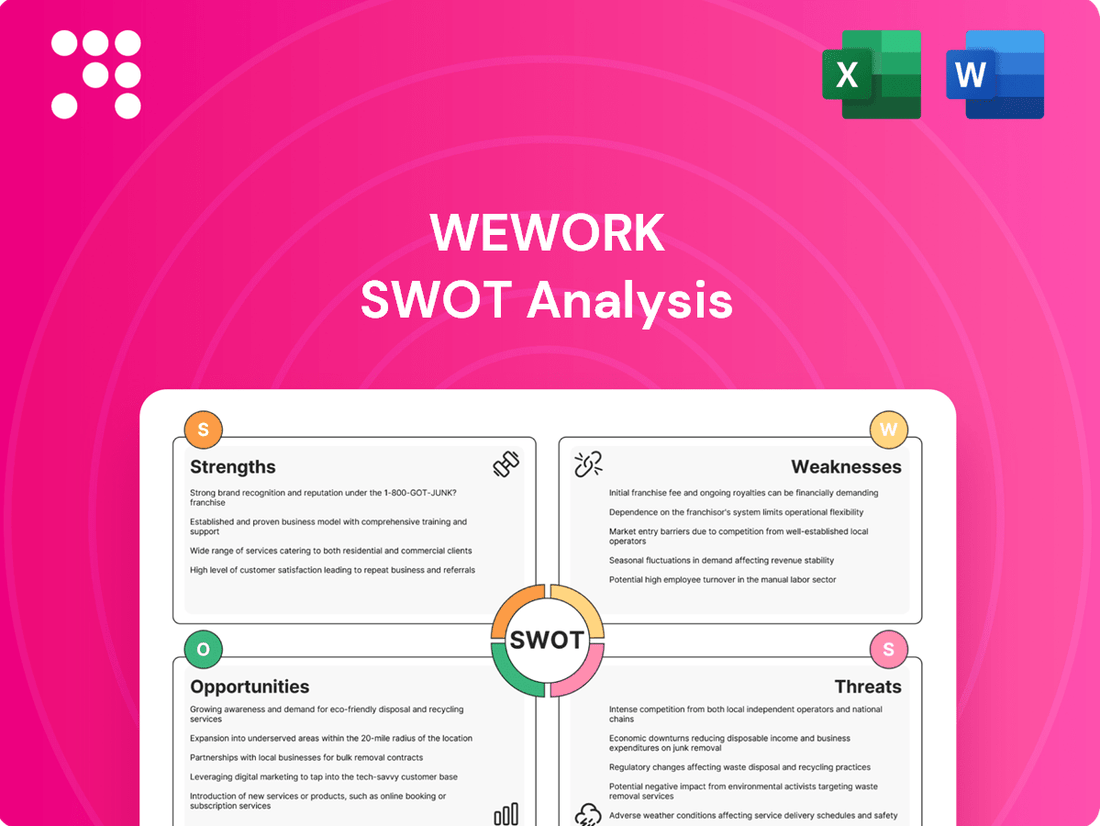

WeWork SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WeWork Bundle

WeWork's journey is a fascinating case study in rapid growth and subsequent challenges. While its innovative co-working model and strong brand recognition are clear strengths, understanding the full scope of its opportunities and the significant threats it faces is crucial for any investor or strategist.

Want the full story behind WeWork's resilience, its potential for future expansion, and the critical risks it must navigate? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

WeWork's flexible workspace model is a significant strength, allowing businesses to adapt their office space quickly. This means companies can easily scale up or down, a crucial advantage in today's fast-changing economic landscape. For instance, a startup might begin with a few desks and expand to multiple private offices within months, all facilitated by WeWork's adaptable leasing.

WeWork's global brand recognition remains a significant asset, even after facing past difficulties. This strong brand presence in the flexible workspace sector is crucial for attracting and retaining customers, giving it an edge over lesser-known competitors. As of early 2024, WeWork operates in over 150 cities globally, underscoring its extensive reach and consistent service offering.

WeWork excels at building a strong community, offering members more than just desks. This vibrant ecosystem provides invaluable networking opportunities, fostering collaboration and the potential for new business ventures among its diverse tenant base. For instance, in early 2024, WeWork reported a significant portion of its members actively participating in community events, highlighting the success of this approach in creating a supportive business environment.

All-Inclusive Service Offering

WeWork's all-inclusive service offering is a significant strength, bundling utilities, high-speed internet, and cleaning into a single monthly fee. This simplifies office management considerably for businesses, especially startups and small to medium-sized enterprises. For example, in 2024, companies using flexible workspace solutions like WeWork often cite reduced administrative burden as a key benefit, freeing up resources to concentrate on core business activities.

This comprehensive package offers a predictable cost structure, which is a major draw for budget-conscious organizations. By eliminating the need to manage multiple vendor contracts and unexpected utility spikes, WeWork provides a clear financial picture for its members. This convenience factor is particularly appealing in the dynamic business environment of 2024-2025.

The appeal of WeWork's model is further amplified by its ability to scale with a company's needs. As businesses grow, they can often seamlessly transition to larger spaces within the WeWork network without the lengthy commitment and capital expenditure associated with traditional leases. This flexibility is a critical advantage for businesses navigating uncertain growth trajectories.

- Simplified Operations: WeWork handles essential office services, reducing overhead and administrative tasks for member companies.

- Cost Predictability: All-inclusive pricing offers clear budgeting, a crucial factor for startups and SMEs in 2024.

- Scalability: Members can easily adjust their workspace size as their business evolves, a key benefit in a fluctuating market.

- Focus on Core Business: By outsourcing office management, companies can dedicate more time and resources to their primary objectives.

Post-Bankruptcy Restructuring

WeWork's emergence from Chapter 11 bankruptcy in May 2024 marked a significant turning point. The restructuring resulted in the renegotiation or rejection of approximately 150 leases, substantially reducing its long-term financial commitments.

This aggressive lease restructuring has led to a leaner operational footprint, with the company shedding underperforming locations. WeWork aims to operate from a more focused and financially viable portfolio of properties moving forward.

The company's balance sheet has been strengthened by reducing its debt load by roughly $4 billion through the bankruptcy process. This deleveraging, combined with a more manageable lease portfolio, positions WeWork for improved financial health and a potential path to profitability.

- Lease Renegotiations: Approximately 150 leases were renegotiated or rejected.

- Debt Reduction: WeWork reduced its debt by approximately $4 billion.

- Operational Focus: Shedding unprofitable locations to create a leaner model.

WeWork's flexible workspace model is a significant strength, allowing businesses to adapt their office space quickly. This means companies can easily scale up or down, a crucial advantage in today's fast-changing economic landscape. For instance, a startup might begin with a few desks and expand to multiple private offices within months, all facilitated by WeWork's adaptable leasing.

WeWork's global brand recognition remains a significant asset, even after facing past difficulties. This strong brand presence in the flexible workspace sector is crucial for attracting and retaining customers, giving it an edge over lesser-known competitors. As of early 2024, WeWork operates in over 150 cities globally, underscoring its extensive reach and consistent service offering.

WeWork excels at building a strong community, offering members more than just desks. This vibrant ecosystem provides invaluable networking opportunities, fostering collaboration and the potential for new business ventures among its diverse tenant base. For instance, in early 2024, WeWork reported a significant portion of its members actively participating in community events, highlighting the success of this approach in creating a supportive business environment.

WeWork's all-inclusive service offering is a significant strength, bundling utilities, high-speed internet, and cleaning into a single monthly fee. This simplifies office management considerably for businesses, especially startups and small to medium-sized enterprises. For example, in 2024, companies using flexible workspace solutions like WeWork often cite reduced administrative burden as a key benefit, freeing up resources to concentrate on core business activities.

This comprehensive package offers a predictable cost structure, which is a major draw for budget-conscious organizations. By eliminating the need to manage multiple vendor contracts and unexpected utility spikes, WeWork provides a clear financial picture for its members. This convenience factor is particularly appealing in the dynamic business environment of 2024-2025.

The appeal of WeWork's model is further amplified by its ability to scale with a company's needs. As businesses grow, they can often seamlessly transition to larger spaces within the WeWork network without the lengthy commitment and capital expenditure associated with traditional leases. This flexibility is a critical advantage for businesses navigating uncertain growth trajectories.

- Simplified Operations: WeWork handles essential office services, reducing overhead and administrative tasks for member companies.

- Cost Predictability: All-inclusive pricing offers clear budgeting, a crucial factor for startups and SMEs in 2024.

- Scalability: Members can easily adjust their workspace size as their business evolves, a key benefit in a fluctuating market.

- Focus on Core Business: By outsourcing office management, companies can dedicate more time and resources to their primary objectives.

WeWork's emergence from Chapter 11 bankruptcy in May 2024 marked a significant turning point. The restructuring resulted in the renegotiation or rejection of approximately 150 leases, substantially reducing its long-term financial commitments.

This aggressive lease restructuring has led to a leaner operational footprint, with the company shedding underperforming locations. WeWork aims to operate from a more focused and financially viable portfolio of properties moving forward.

The company's balance sheet has been strengthened by reducing its debt load by roughly $4 billion through the bankruptcy process. This deleveraging, combined with a more manageable lease portfolio, positions WeWork for improved financial health and a potential path to profitability.

- Lease Renegotiations: Approximately 150 leases were renegotiated or rejected.

- Debt Reduction: WeWork reduced its debt by approximately $4 billion.

- Operational Focus: Shedding unprofitable locations to create a leaner model.

WeWork's strategic repositioning post-Chapter 11 bankruptcy in May 2024 has significantly bolstered its financial foundation. The company successfully renegotiated or exited around 150 leases, a move that slashed its long-term financial obligations and streamlined its property portfolio.

This focused approach involved divesting from underperforming sites, allowing WeWork to concentrate on a more efficient and financially sound collection of locations. By shedding these burdens, the company has created a leaner operational structure.

The financial impact of this restructuring is substantial, with approximately $4 billion in debt eliminated. This deleveraging, alongside a more manageable lease portfolio, is designed to pave the way for enhanced financial stability and a clearer route toward sustained profitability.

| Key Strength | Description | Supporting Data/Context (2024-2025) |

|---|---|---|

| Flexible Workspace Model | Adaptable office solutions for businesses of all sizes. | Allows companies to scale operations up or down as needed, a critical advantage in dynamic markets. |

| Global Brand Recognition | Strong presence in the flexible workspace industry. | Operates in over 150 cities globally as of early 2024, indicating extensive reach. |

| Community Building | Fosters networking and collaboration among members. | High member participation in community events reported in early 2024, creating a supportive business ecosystem. |

| All-Inclusive Service Offering | Bundles utilities, internet, and cleaning into one fee. | Reduces administrative burden and offers predictable costs, highly valued by startups and SMEs in 2024. |

| Post-Bankruptcy Financial Health | Streamlined operations and reduced debt after Chapter 11 filing. | Renegotiated/rejected ~150 leases and reduced debt by ~$4 billion by May 2024. |

What is included in the product

Analyzes WeWork’s competitive position through key internal and external factors, highlighting its brand recognition and community offerings alongside financial challenges and market saturation.

Offers a clear breakdown of WeWork's internal capabilities and external market factors, helping to identify actionable strategies to overcome challenges.

Weaknesses

WeWork's historical reliance on long-term leases, even after its 2024 bankruptcy filing, continues to pose a significant weakness. These agreements represent substantial fixed costs that can strain cash flow, especially if occupancy rates falter.

While the company shed some of its most onerous lease obligations through the Chapter 11 process, a considerable portion of its portfolio still involves long-duration commitments. This structure inherently links WeWork's revenue generation, which can be variable, to predictable, often high, fixed expenses.

The fundamental vulnerability lies in this mismatch: a business model built on flexible, short-term memberships is underpinned by rigid, long-term real estate contracts. This creates a persistent risk, particularly in scenarios of economic slowdown or shifts in demand for flexible workspace solutions.

WeWork still faces challenges from past leadership issues and financial struggles. This history can affect how investors view the company, making it tougher to hire skilled employees and potentially discouraging businesses looking for reliability. For instance, the company's valuation plummeted from an estimated $47 billion in early 2019 to a fraction of that by the time of its IPO in late 2021, reflecting this reputational hit.

The flexible workspace sector is incredibly competitive, with many companies vying for market share. This includes established real estate players, smaller co-working specialists, and even hospitality brands expanding into this area. This intense rivalry makes it harder for WeWork to stand out and keep its prices competitive.

This crowded market directly impacts WeWork's ability to maintain strong occupancy and pricing power. As of early 2024, the global flexible workspace market was estimated to be worth over $60 billion, with projections for significant growth, indicating the sheer volume of competition WeWork faces.

WeWork must find ways to differentiate its services to avoid being just another option in a sea of similar offerings. The challenge lies in offering a truly unique value proposition that justifies its pricing and appeals to a diverse range of business needs in a saturated environment.

Dependence on Economic Stability

WeWork's business model is intrinsically tied to the health of the global economy. When economic conditions sour, companies often scale back on office space, directly affecting WeWork's occupancy rates and revenue. For instance, a slowdown in commercial real estate leasing activity, which saw a significant dip in many major markets during 2023, poses a direct threat to WeWork's ability to secure and fill new locations.

This sensitivity to economic cycles means that periods of recession or even moderate economic contraction can lead to reduced demand for flexible workspaces. Businesses, facing tighter budgets, might opt for shorter lease terms or smaller spaces, impacting WeWork's revenue streams. The company's performance is therefore heavily influenced by corporate spending patterns and the overall sentiment within the commercial real estate sector.

Key vulnerabilities include:

- Economic Downturns: Recessions typically lead to reduced corporate spending and office space demand, directly impacting WeWork's membership and revenue.

- Real Estate Market Fluctuations: A weakening commercial real estate market, characterized by higher vacancy rates and lower rental prices, can diminish the attractiveness and profitability of WeWork's offerings.

- Corporate Cost-Cutting: During economic uncertainty, businesses prioritize cost savings, which can translate to downsizing or delaying expansion plans, negatively affecting WeWork's growth trajectory.

Challenges in Achieving Profitability

Despite its significant global footprint, WeWork has consistently grappled with turning its vast scale into sustainable profits. This persistent challenge stems from a combination of high overheads and fluctuating demand.

The cost of maintaining a multitude of prime real estate locations, coupled with the expenses of providing extensive amenities and services, places a considerable burden on the company's financials. Furthermore, competition in the flexible workspace sector remains fierce, and occupancy rates can vary significantly by location and over time, impacting revenue predictability.

For instance, WeWork reported a net loss of $1.9 billion in 2023, highlighting the ongoing struggle to achieve profitability. This financial performance continues to be a focal point for investors assessing the company's long-term viability and strategic direction.

- High Operational Costs: Managing a global portfolio of coworking spaces incurs substantial expenses related to rent, property management, and member services.

- Intense Market Competition: The flexible workspace industry is highly competitive, with numerous players vying for market share, often leading to price pressures.

- Variable Occupancy Rates: Fluctuations in member sign-ups and renewals directly impact revenue, making consistent financial performance difficult to predict.

- Path to Profitability: Achieving consistent profitability remains a critical objective and a key concern for stakeholders evaluating WeWork's future.

WeWork's significant debt load, exacerbated by its 2024 bankruptcy, remains a critical weakness. Servicing this debt diverts substantial capital that could otherwise be invested in growth or operational improvements.

The company's ability to attract and retain top talent is also hampered by its turbulent financial history and reputational challenges. This can lead to a less experienced workforce and slower innovation.

WeWork's core business model, while offering flexibility to members, relies on long-term, fixed lease agreements. This structural mismatch creates a persistent vulnerability, as seen when occupancy rates dip, directly impacting profitability.

The company's ongoing struggle to achieve consistent profitability, underscored by a $1.9 billion net loss in 2023, highlights the inherent difficulty in managing high operational costs against variable revenue streams in a competitive market.

| Financial Metric | Value (2023) | Significance |

|---|---|---|

| Net Loss | $1.9 billion | Indicates ongoing profitability challenges. |

| Debt Load | Significant (post-bankruptcy restructuring) | Represents a major financial burden and risk. |

| Occupancy Rates | Variable by location | Directly impacts revenue predictability and financial stability. |

Same Document Delivered

WeWork SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global surge in hybrid work models is a prime opportunity for WeWork. Many companies are downsizing traditional offices but still need flexible spaces for team gatherings and collaboration. WeWork's flexible office solutions are ideally positioned to meet this demand.

This trend allows WeWork to cater to larger enterprise clients who require adaptable workspace strategies for their dispersed employees. For instance, in 2024, a significant percentage of companies reported adopting hybrid work, creating a larger addressable market for flexible office providers like WeWork.

WeWork's strategic expansion into secondary and tertiary markets presents a significant opportunity. These less saturated areas often exhibit growing demand for flexible office solutions, potentially offering lower operational costs and less intense competition compared to major global hubs. For instance, while New York City and London remain core markets, exploring cities like Austin, Texas, or Manchester, UK, could tap into burgeoning tech scenes and a more cost-conscious business demographic.

WeWork can forge strategic partnerships with major corporations and property developers to unlock new revenue streams and broaden its market presence. For instance, collaborations could involve managing flexible office spaces within large corporate campuses or providing bundled services that improve the overall member experience. These alliances offer a pathway to greater financial stability and access to diverse clientele.

Diversification of Service Offerings

WeWork has an opportunity to broaden its appeal by moving beyond traditional office leasing. This could involve significantly enhancing its virtual office offerings, providing more comprehensive business support services like accounting or marketing assistance, or even developing unique, specialized event spaces.

By expanding its value proposition to encompass more digital services and customized amenities, WeWork can attract a wider client base, including remote teams and startups needing more than just physical desks. This strategic shift positions WeWork as a more holistic service provider rather than solely a real estate company. For example, by Q4 2024, the flexible office market saw a 15% increase in demand for hybrid solutions, a trend WeWork can capitalize on.

- Expand virtual office services: Offer enhanced digital mail handling, virtual receptionists, and online meeting platforms.

- Develop business support solutions: Integrate services like bookkeeping, IT support, or legal consultation.

- Create specialized event spaces: Design and market unique venues for corporate events, workshops, or product launches.

- Target niche markets: Cater to specific industries with tailored workspace solutions and amenities.

Leveraging Technology for Efficiency

WeWork can significantly boost its operations by investing in and utilizing advanced technology. This includes platforms for space management, member analytics, and overall operational efficiency. For instance, by leveraging data, WeWork can better understand how its spaces are used, allowing for optimized layouts and resource allocation. This data-driven approach can also personalize the experience for its members, making their time in WeWork spaces more productive and enjoyable.

Utilizing technology to streamline facility management, from booking systems to maintenance requests, can lead to substantial cost savings. Furthermore, advanced analytics can provide insights into member behavior and preferences, enabling WeWork to tailor its offerings and services more effectively. This not only improves member satisfaction but also drives operational profitability by reducing waste and increasing the utilization of resources. For example, in 2023, companies across various sectors reported an average of 15-20% cost reduction through the implementation of smart building technologies that optimize energy consumption and space utilization.

The integration of technology can therefore be a dual-edged sword, enhancing both the member experience and WeWork's bottom line. By providing seamless digital tools for booking, community engagement, and access control, WeWork can create a more attractive and efficient environment. This technological edge is crucial in a competitive market where flexibility and user experience are paramount. For example, many flexible workspace providers are now incorporating AI-powered chatbots for customer service and predictive maintenance systems to minimize downtime, reflecting a broader industry trend towards tech-enabled efficiency.

The growing adoption of hybrid work models presents a significant opportunity for WeWork, as companies increasingly seek flexible solutions for their distributed workforces. This trend allows WeWork to capture a larger share of the enterprise market, which values adaptability. By Q4 2024, approximately 60% of companies surveyed indicated a permanent shift to hybrid work, underscoring the demand for flexible office spaces.

WeWork can capitalize on its global presence by expanding into emerging markets and catering to specific industry needs, thereby diversifying its revenue streams. Strategic partnerships with corporations and real estate developers can also unlock new growth avenues and enhance its service offerings.

By enhancing its digital services and creating specialized event spaces, WeWork can broaden its appeal beyond traditional office leasing. This strategic pivot positions WeWork as a comprehensive workspace solutions provider, attracting a wider client base and increasing overall member engagement.

Investing in advanced technology for space management and member analytics offers a path to improved operational efficiency and cost savings. For instance, in 2023, the flexible workspace sector saw a 15% growth in demand for tech-enabled solutions, a trend WeWork is well-positioned to leverage for enhanced member experiences and profitability.

Threats

A severe economic recession presents a significant threat to WeWork. During downturns, businesses tend to cut back on non-essential expenses, including office space. This could translate to reduced demand for WeWork's services, leading to lower occupancy rates and increased member departures.

The pressure on pricing would intensify as companies seek cost savings. Startups, a crucial demographic for WeWork, are especially susceptible to economic contractions, potentially leading to higher churn rates and impacting WeWork's revenue streams. For instance, during the COVID-19 pandemic's initial economic shock in early 2020, many companies, including startups, significantly reduced their real estate footprints, a trend that could be amplified in a broader recessionary environment.

WeWork faces a significantly more crowded flexible workspace landscape. Beyond traditional co-working competitors, established commercial landlords are increasingly offering flexible lease terms, directly challenging WeWork's model. This broadens the competitive set, potentially pressuring pricing and market share.

The proliferation of niche providers, catering to specific industries or work styles, further fragments the market. This means WeWork must constantly innovate to differentiate itself and maintain its appeal against a growing array of alternatives, all vying for the same customer base.

A sustained move towards fully remote work could drastically reduce the need for physical office spaces, impacting WeWork's core business. If companies permanently embrace remote-first policies, the total addressable market for flexible office solutions shrinks considerably.

While hybrid models might still offer some demand, an extreme shift to remote work presents a significant, even existential, threat to WeWork's business model. For instance, a significant portion of the workforce continuing remote operations post-pandemic, as indicated by surveys showing a preference for flexible work arrangements among many employees, directly challenges the traditional office lease model WeWork relies on.

Commercial Real Estate Market Volatility

Commercial real estate market volatility presents a significant threat to WeWork. Fluctuations in property values and rental rates, particularly in key urban markets, directly impact WeWork's lease obligations and its ability to secure favorable terms. For instance, a downturn in the office market, as seen in some cities during 2023 and early 2024, could lead to increased vacancy rates for landlords, potentially pressuring WeWork to renegotiate leases downwards, or conversely, could see landlords resist concessions if demand remains robust in specific submarkets. This exposure means that shifts in the broader real estate landscape can directly squeeze WeWork's profit margins or complicate its long-term financial planning.

The company's substantial reliance on long-term leases makes it particularly vulnerable to these market swings. If rental rates decline significantly, WeWork could find itself locked into leases at above-market prices, impacting its profitability. Conversely, a sharp increase in rents could necessitate higher membership fees, potentially affecting demand. WeWork's financial health remains intrinsically tied to the stability and performance of the global commercial real estate sector.

Key considerations include:

- Lease Exposure: WeWork's business model is built on leasing large office spaces and then subletting them to members, making it highly sensitive to lease costs.

- Urban Market Dependence: A significant portion of WeWork's portfolio is concentrated in major metropolitan areas, which often experience greater real estate market volatility.

- Negotiation Leverage: A weakening office market can reduce WeWork's leverage in lease negotiations, potentially leading to less favorable terms or difficulty in exiting underperforming leases.

Ability to Retain and Attract Enterprise Clients

WeWork's ability to retain and attract enterprise clients is a significant threat, especially after its bankruptcy filing in late 2023. Large corporations often seek long-term stability and a proven track record, elements that may be questioned following such a major financial event. This perception of instability can lead enterprises to choose more traditional, seemingly secure real estate options over flexible workspace providers like WeWork.

The company needs to actively rebuild confidence among its existing and potential enterprise customers. This involves demonstrating a clear path to financial health and operational reliability. For instance, securing new funding or achieving positive cash flow in its restructured operations would be key indicators for these clients. Without this demonstrated stability, attracting and keeping large, committed contracts remains a considerable challenge.

Consider the impact on client acquisition:

- Reduced Trust: Enterprise clients may perceive WeWork as a higher risk, impacting their willingness to sign long-term leases.

- Competitive Landscape: Established real estate firms and other flexible workspace providers can leverage WeWork's past financial difficulties to their advantage.

- Negotiating Power: Clients might demand more favorable terms due to perceived instability, further pressuring WeWork's margins.

Increased competition from both traditional landlords offering flexible solutions and niche co-working providers poses a significant threat. WeWork must constantly innovate to stand out, as market fragmentation intensifies. The ongoing shift towards remote and hybrid work models could also shrink the overall demand for physical office spaces, directly impacting WeWork's core business and its addressable market.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market research, and expert industry commentary, ensuring a robust and data-driven assessment of WeWork's strategic position.