WeWork Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WeWork Bundle

Unlock the strategic blueprint behind WeWork's disruptive model. This comprehensive Business Model Canvas details their unique approach to community building, key partnerships, and revenue streams, offering a clear view of their value creation. Discover the core components that fueled their rapid growth and gain actionable insights for your own ventures.

Partnerships

WeWork's primary partners are real estate owners and landlords. They enter into agreements where WeWork leases substantial office spaces, often for extended periods. We then transform these spaces into flexible, shared workspaces.

Post-bankruptcy in late 2023, WeWork has actively sought to restructure these partnerships. This includes renegotiating lease terms and shifting towards management agreements and revenue-sharing models. These changes aim to mitigate financial exposure and enhance profitability by aligning incentives more closely with property owners.

WeWork's operational backbone relies heavily on technology and software providers. Partnerships with firms like Yardi Systems are fundamental for managing its vast network, including the Coworking Partner Network and its proprietary space management software, WeWork Workplace.

The strategic importance of these tech partnerships was underscored when Yardi Systems became a majority owner of WeWork following its bankruptcy proceedings. This move signifies a profound integration of Yardi's technological capabilities and strategic direction into WeWork's future operations.

WeWork is strategically partnering with franchisors and third-party coworking operators to expand its global presence. This collaboration, exemplified by its partnership with Vast Coworking Group, allows WeWork to offer its members access to a wider network of locations, especially in underserved suburban areas. This asset-light strategy is crucial for WeWork's growth, as it enables expansion without the heavy capital expenditure typically associated with securing new leases.

Service Providers and Amenity Partners

WeWork relies on a network of service providers to ensure seamless operations and a high-quality member experience. These partnerships cover essential utilities, high-speed internet, and professional cleaning services, all crucial for maintaining productive and attractive workspaces. For instance, in 2024, WeWork continued to prioritize robust internet infrastructure, a key amenity for its diverse membership base.

Beyond operational necessities, WeWork strategically partners with organizations to elevate its hospitality standards. A notable example is their collaboration with the Ritz-Carlton Leadership Center. This partnership focuses on training WeWork's community and operations teams in exceptional customer service, directly impacting member satisfaction and retention.

These collaborations are vital for WeWork's value proposition, as they allow the company to offer a premium, all-inclusive workspace solution. By outsourcing specialized services and investing in staff development through expert partnerships, WeWork can concentrate on its core business of creating flexible and inspiring work environments.

- Service Providers: Essential utilities, internet, and cleaning services are secured through strategic partnerships.

- Amenity Partners: Collaborations enhance the member experience, focusing on hospitality and service excellence.

- Staff Training: Partnerships like the one with the Ritz-Carlton Leadership Center ensure high standards in customer service.

- Value Proposition: These key partnerships underpin WeWork's ability to deliver a comprehensive and premium workspace solution.

Enterprise Clients and Corporate Partners

WeWork actively cultivates relationships with enterprise clients, securing substantial office space leases. This strategic focus targets large corporations seeking flexible and scalable workspace solutions.

A prime example of this strategy is WeWork's partnership with Amazon, which leases significant portions of WeWork's office inventory. This agreement highlights WeWork's success in adapting its offerings to meet the demands of major corporate entities.

These enterprise partnerships are crucial for WeWork's revenue generation and market positioning. By catering to the needs of established businesses, WeWork solidifies its role as a key provider in the flexible office market.

- Enterprise Client Focus: WeWork prioritizes partnerships with large enterprises to secure significant, long-term office space commitments.

- Amazon Partnership: A notable example is the agreement with Amazon, demonstrating WeWork's capacity to serve major corporate clients with substantial space requirements.

- Revenue Diversification: These corporate partnerships contribute significantly to WeWork's revenue streams, offering stability and growth potential.

Following its 2023 restructuring, WeWork has significantly shifted its partnership strategy, moving from traditional leases to more flexible management agreements and revenue-sharing models with property owners. This pivot aims to reduce financial risk and align incentives, a crucial adjustment for its 2024 operations.

Technology providers, particularly Yardi Systems, have become central to WeWork's operational framework and even its ownership structure, underscoring the critical role of integrated software solutions for managing its global network and member experience.

WeWork's expansion strategy in 2024 heavily relies on asset-light growth through partnerships with franchisors and third-party operators, enabling broader market reach without substantial capital investment.

The company also partners with service providers for essential operations like utilities and internet, and with hospitality experts like the Ritz-Carlton Leadership Center to enhance member satisfaction and service quality.

| Partnership Type | Key Partners | Strategic Importance | 2024 Focus |

|---|---|---|---|

| Real Estate Owners | Landlords, Property Owners | Securing physical space, shifting to revenue share/management agreements | Renegotiating leases, reducing financial exposure |

| Technology Providers | Yardi Systems | Operational management, space software (WeWork Workplace) | Deepening integration post-bankruptcy |

| Expansion Partners | Vast Coworking Group, Franchisors | Global reach, asset-light growth | Expanding into suburban and underserved markets |

| Service Providers | Utility companies, Internet providers, Cleaning services | Ensuring smooth operations, member amenities | Maintaining robust infrastructure, especially internet |

| Hospitality & Training | Ritz-Carlton Leadership Center | Enhancing member experience, customer service excellence | Improving staff training for premium service |

| Enterprise Clients | Amazon | Securing large-scale, long-term commitments, revenue stability | Strengthening relationships with major corporations |

What is included in the product

This Business Model Canvas outlines WeWork's strategy of providing flexible, community-focused workspaces to diverse customer segments, leveraging a network of physical locations and digital platforms to deliver value.

WeWork's Business Model Canvas acts as a pain point reliever by offering a structured framework to address the challenges of flexible workspace needs for businesses and freelancers.

It efficiently maps out solutions to common pain points like high overhead, inflexible leases, and the lack of community for modern professionals.

Activities

WeWork's primary activity is securing extensive office spaces via long-term leases. This involves intricate negotiations with landlords to obtain favorable terms for prime locations. For example, in 2024, WeWork continued to manage a vast global portfolio, adapting its leasing strategies based on evolving market conditions and demand for flexible workspace solutions.

The company then subleases these acquired spaces to a broad spectrum of clients, from startups and freelancers to established corporations. This subleasing model allows WeWork to offer flexible membership options, catering to diverse business needs. In 2024, the company focused on optimizing its subleasing agreements to ensure consistent occupancy and revenue streams across its various locations.

WeWork's key activity involves the meticulous design and fit-out of its leased properties. This process transforms raw spaces into functional, aesthetically pleasing, and amenity-rich co-working environments. The company invests heavily in modern furnishings, robust IT infrastructure, and a variety of member amenities to foster collaboration and productivity.

This extensive fit-out process is a significant capital expenditure, crucial for delivering the WeWork experience. For instance, the company historically allocated substantial sums to these upgrades, with reported capital expenditures in the hundreds of millions of dollars annually in prior years, reflecting the scale of their space transformation efforts.

WeWork's community building hinges on actively managing a diverse calendar of events. These range from casual social mixers to skill-building workshops and professional networking sessions, all designed to connect members and foster collaboration.

In 2024, WeWork continued to emphasize these activities, recognizing their role in member retention and attraction. For instance, many locations host weekly or bi-weekly events, with a significant portion of members reporting that these events are a key reason for their continued membership.

The success of these events directly impacts the value proposition, creating a vibrant ecosystem where members can find support, inspiration, and potential business partners. This focus on shared experiences is a core differentiator.

Sales, Marketing, and Membership Management

WeWork's success hinges on effectively attracting and retaining a diverse membership base, ranging from individual freelancers to large corporate clients. This involves sophisticated sales and marketing strategies tailored to various needs and company sizes.

The company manages a spectrum of membership options, including private offices, dedicated desks, virtual offices, and flexible access plans like On Demand and All Access. Each plan requires distinct marketing approaches and sales cycles. Customer support is integral to maintaining member satisfaction and encouraging renewals.

- Sales and Marketing: WeWork employs a multi-channel approach, leveraging digital marketing, direct sales teams, and partnerships to reach potential members. Their efforts focus on highlighting community, flexibility, and amenities.

- Membership Management: This encompasses onboarding new members, managing lease agreements for various office types, and ensuring a seamless experience for all users. It also includes handling renewals and upgrades.

- Customer Support: Providing responsive support is crucial for member retention. This includes addressing facility issues, billing inquiries, and facilitating community engagement within the spaces.

- 2024 Focus: In 2024, WeWork continued to refine its membership offerings and sales processes, aiming to stabilize occupancy and revenue streams amidst a dynamic commercial real estate market. Efforts were concentrated on enhancing the value proposition for enterprise clients and optimizing the digital member experience.

Technology Development and Platform Management

WeWork actively develops and manages its technology platforms to streamline member experiences and operational efficiency. This includes their proprietary space management software, WeWork Workplace, and the WeWork On Demand mobile application.

These digital tools facilitate easy booking of desks and meeting rooms, seamless building access, and management of various amenities. As of early 2024, WeWork continues to refine these offerings to cater to evolving hybrid work models.

- WeWork Workplace: Enhances space utilization and member convenience through digital booking and access.

- WeWork On Demand: Provides flexible access to workspaces for members and non-members, driving user acquisition.

- Data Analytics: Leverages platform data to optimize space allocation and service offerings.

WeWork's core activities revolve around acquiring and managing large-scale office spaces through long-term leases. This is followed by transforming these spaces into flexible, amenity-rich co-working environments through design and fit-out. The company then focuses on building a vibrant community through events and providing robust technology platforms for seamless member experiences.

These activities are supported by strong sales and marketing efforts to attract and retain a diverse membership base, alongside responsive customer support. In 2024, WeWork continued to refine these operations, emphasizing enterprise solutions and optimizing digital tools to navigate the evolving workspace demands.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Space Acquisition & Management | Securing long-term leases for diverse office locations globally. | Continued portfolio optimization based on market demand for flexible space. |

| Space Design & Fit-out | Transforming leased spaces into functional, amenity-rich co-working environments. | Investment in modern infrastructure and collaborative spaces to enhance member experience. |

| Community Building | Organizing events and fostering connections among members. | Emphasis on events for member retention, with many members citing events as a key reason for continued membership. |

| Sales & Membership Management | Attracting and retaining diverse clients through tailored membership options and support. | Refinement of membership offerings and sales processes to stabilize occupancy and revenue. |

| Technology Platform Development | Developing and managing digital tools for member convenience and operational efficiency. | Continued refinement of platforms like WeWork Workplace and WeWork On Demand for hybrid work models. |

Preview Before You Purchase

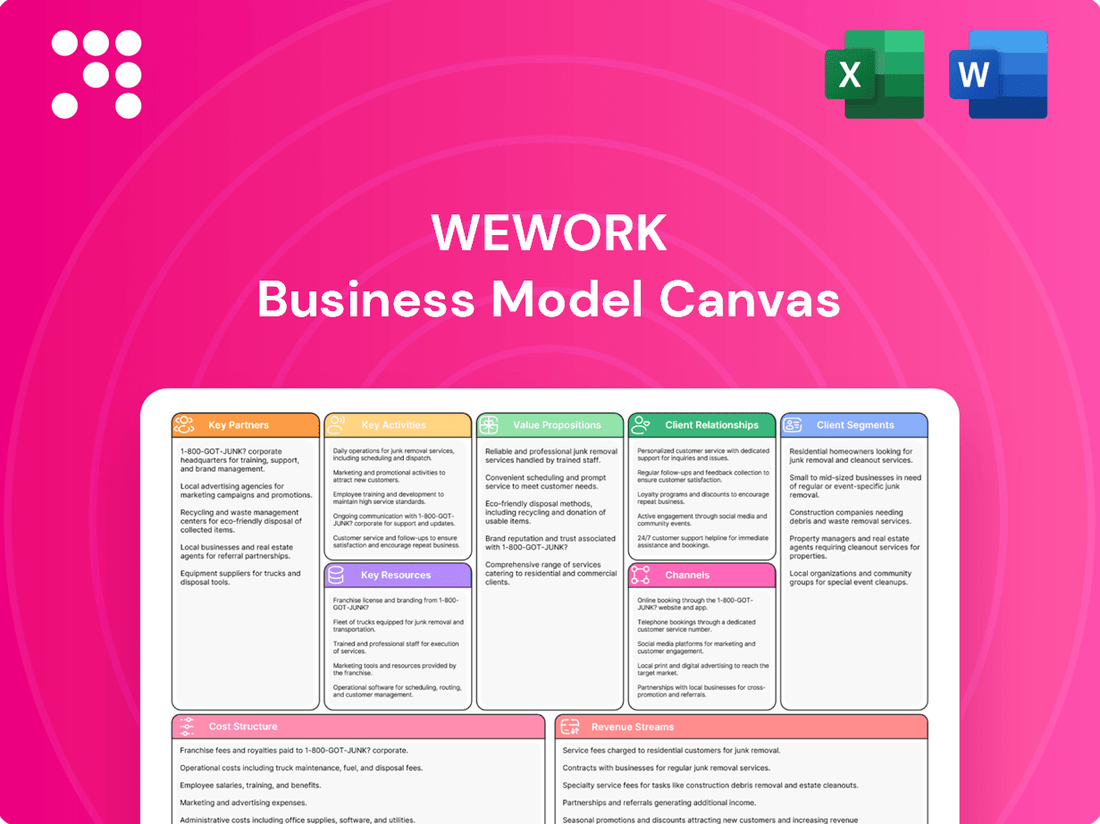

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting you see are precisely what will be delivered, ensuring no discrepancies. You can trust that the file you preview is the complete, ready-to-use business model canvas, offering full transparency and immediate value.

Resources

WeWork's global real estate portfolio represents its core physical asset, a vast network of flexible office spaces spanning numerous cities and countries. Following its Chapter 11 bankruptcy filing in late 2023, the company has been actively "right-sizing" this portfolio.

As of early 2024, WeWork has exited hundreds of locations, significantly reducing its physical footprint. This strategic pruning aims to improve profitability and align the portfolio with current market demand and the company's revised operational strategy.

Despite these reductions, the remaining portfolio still comprises hundreds of locations globally, offering a diverse range of workspace solutions. These spaces cater to various business needs, from individual desks to private offices and larger team areas, all designed for flexibility.

WeWork's brand recognition remains a cornerstone of its business model, even after navigating significant turbulence. This established name in the flexible workspace sector offers a distinct advantage in drawing in new customers and forging strategic alliances.

Despite past financial struggles, WeWork's global presence, with locations in numerous cities worldwide, continues to be a powerful draw. This extensive network is crucial for attracting both individual members and corporate clients seeking flexible office solutions.

In 2024, WeWork's brand equity, though impacted by its history, still holds considerable weight. This recognition is vital for its ongoing efforts to rebuild trust and attract the diverse clientele necessary for its operational success.

WeWork's proprietary technology, including WeWork Workplace and the WeWork On Demand app, forms the backbone of its operations. These platforms streamline everything from booking desks to managing memberships, significantly boosting efficiency.

In 2024, WeWork continued to invest in these technological assets to enhance member experience and optimize space utilization. The app allows members to easily find and book workspaces globally, a critical feature for a flexible office provider.

These internal systems are not just about convenience; they are vital for data collection and analysis, enabling WeWork to understand usage patterns and improve service delivery. This technological infrastructure is a key differentiator in the competitive flexible workspace market.

Skilled Workforce and Community Teams

The individuals managing WeWork spaces, orchestrating community events, and offering member support are absolutely essential. These teams are the face of the company, directly impacting member experience and retention. Their ability to foster a sense of community is a core component of WeWork's value proposition.

WeWork has invested in robust training to ensure these teams deliver exceptional service. A notable example is their collaboration with the Ritz-Carlton Leadership Center, aimed at instilling world-class customer service standards. This focus on training directly translates into a higher quality of service for members.

- Skilled Community Managers: These employees are crucial for member satisfaction and retention.

- Event Facilitation: Their role in organizing and running community events builds engagement.

- Member Support: Providing responsive and helpful support is key to the WeWork experience.

- Ritz-Carlton Partnership: This training initiative highlights a commitment to service excellence.

Financial Capital and Investor Backing

Following its Chapter 11 bankruptcy filing in November 2023, WeWork successfully emerged in May 2024, having secured substantial new equity capital. This financial restructuring was crucial for providing the necessary resources for ongoing operations and future strategic initiatives.

Key to this turnaround was significant investment from major players. Yardi Systems, a real estate software company, became a primary equity investor, injecting vital funds. SoftBank, a long-time investor in WeWork, also continued its support, reinforcing confidence in the company's revised strategy.

This influx of financial capital allows WeWork to focus on its core business and pursue growth opportunities. The company's ability to attract and retain investor backing post-restructuring highlights a renewed belief in its long-term potential.

- New Equity Capital: WeWork secured new equity financing as part of its emergence from bankruptcy in May 2024.

- Key Investors: Yardi Systems and SoftBank are identified as significant equity investors providing crucial backing.

- Operational and Strategic Funding: The secured capital is earmarked for operational investments and advancing the company's strategic growth plans.

WeWork's key resources include its extensive global real estate portfolio, its established brand recognition, and its proprietary technology platforms. These assets are foundational to its business model, enabling the company to offer flexible workspace solutions to a diverse clientele.

The company's financial restructuring, completed in May 2024, secured vital new equity capital from investors like Yardi Systems and SoftBank. This financial backing is crucial for supporting ongoing operations and executing future strategic initiatives, reinforcing its operational capacity.

Furthermore, WeWork's human capital, particularly its skilled community managers trained through partnerships like the one with the Ritz-Carlton Leadership Center, is a significant resource. These individuals are instrumental in enhancing member experience and fostering a sense of community, directly impacting customer satisfaction and retention.

Value Propositions

WeWork's value proposition centers on offering businesses unparalleled flexibility and scalability in their workspace arrangements. This means companies aren't locked into lengthy, rigid leases, a significant advantage given the evolving nature of work. For instance, a startup needing to expand rapidly or a larger corporation downsizing due to hybrid work policies can adjust their footprint with WeWork much faster than with traditional real estate.

This adaptability is crucial in today's dynamic economic climate. Businesses can secure office space that precisely matches their current needs, avoiding the financial burden of underutilized square footage. This agility allows them to pivot resources more effectively, especially as many companies continue to refine their hybrid work strategies throughout 2024.

WeWork's all-inclusive workspace solutions simplify office management by bundling essential services like utilities, high-speed internet, and cleaning. This comprehensive package eliminates the need for businesses to manage separate vendor contracts and associated overheads, offering a streamlined operational experience.

For example, WeWork's pricing often reflects the inclusion of these amenities, allowing members to budget more predictably. In 2024, companies increasingly sought flexible and cost-effective office solutions, making the all-inclusive model particularly attractive by removing the complexities of traditional office leases and their associated hidden costs.

WeWork cultivates a dynamic ecosystem where members can forge meaningful connections. Throughout 2024, WeWork continued to host a variety of professional development workshops and social gatherings designed to facilitate networking. These events are crucial for startups and independent professionals seeking to expand their reach and find collaborators.

The emphasis on community building is a core value proposition, differentiating WeWork from traditional office spaces. For instance, in early 2024, WeWork reported that its members engaged in over 50,000 networking interactions through its platform and in-person events. This vibrant atmosphere directly supports business growth by fostering serendipitous encounters and structured collaboration.

Premium Locations and Modern Design

WeWork differentiates itself by securing premium locations in major urban centers, offering unparalleled accessibility for its members. These prime spots are crucial for attracting businesses and professionals seeking visibility and convenience.

The company's commitment to modern, aesthetically pleasing design creates an attractive and productive work environment. This focus on high-quality interiors enhances the overall member experience and brand perception.

WeWork is strategically expanding into Class A and 'trophy' buildings, further elevating the prestige and desirability of its physical spaces. This move aligns with a renewed focus on premium offerings, aiming to capture a higher-value market segment.

- Prime Urban Access: WeWork spaces are situated in highly sought-after downtown areas, providing members with excellent connectivity and prestige.

- Aesthetic Appeal: Contemporary interior design and high-quality finishes contribute to a sophisticated and inspiring workspace atmosphere.

- Focus on Premium Assets: Expansion into Class A and trophy buildings underscores a strategy to offer top-tier locations and facilities.

Business Support and Amenities

WeWork's business support and amenities extend far beyond just providing desks. They offer crucial operational services like mail handling and printing, essential for day-to-day business functions. Additionally, access to well-equipped meeting rooms facilitates collaboration and client interactions.

For businesses prioritizing flexibility and a professional image, WeWork's virtual office services are a key offering. This allows companies to secure a prestigious business address and access mail forwarding without the commitment of a physical office space. In 2024, the demand for flexible workspace solutions continued to rise, with many businesses leveraging these virtual services.

- Mail Handling and Package Services

- On-site Printing and Copying Facilities

- Access to Professional Meeting Rooms

- Virtual Office Solutions with Business Address and Mail Forwarding

WeWork's value proposition is built on providing flexible, all-inclusive office spaces that cater to the evolving needs of modern businesses. This approach offers significant advantages over traditional leases, particularly in terms of adaptability and cost management, which remained critical considerations for companies throughout 2024.

The company's commitment to fostering a vibrant community through networking events and professional development opportunities further enhances its appeal. By facilitating connections and collaboration, WeWork actively contributes to the growth and success of its members.

Furthermore, WeWork secures prime locations in desirable urban centers and invests in high-quality, modern design, creating an attractive and productive work environment. This strategic focus on premium assets and an enhanced member experience solidifies its position in the flexible workspace market.

Customer Relationships

WeWork actively cultivates a vibrant community by hosting regular events, facilitating networking opportunities, and designing shared spaces that encourage interaction. This focus on connection transforms their offices into desirable destinations, fostering member loyalty and driving collaboration.

By creating an environment where members feel connected and supported, WeWork aims to increase retention rates and encourage organic growth through member referrals. For instance, in 2024, WeWork reported a significant increase in member satisfaction scores directly correlating with the success of their community-building initiatives.

WeWork's dedicated community teams are the backbone of their on-site support. These local teams are responsible for everything from greeting members and answering questions to ensuring the facilities run smoothly. Their presence is key to fostering a welcoming atmosphere and quickly resolving any issues that arise, contributing significantly to member retention.

In 2024, WeWork continued to emphasize this personal touch. By having staff physically present in each location, they can offer immediate assistance, whether it's helping a new member find their desk or troubleshooting a Wi-Fi problem. This direct engagement is crucial for building strong relationships and ensuring a high level of satisfaction among their diverse membership base.

WeWork’s digital platforms, including its mobile app and online portal, are central to its customer relationships. These tools allow members to easily book meeting rooms, manage their memberships, and access various community and support services, streamlining their experience.

The convenience of self-service through these digital channels significantly enhances customer satisfaction. For instance, in 2024, WeWork continued to refine its app features based on user feedback, aiming to make the day-to-day management of a workspace as effortless as possible for its diverse membership base.

Flexible Membership Management

WeWork's customer relationships hinge on providing highly adaptable membership structures. This flexibility allows individuals and businesses to seamlessly adjust their space needs, whether that means scaling up during growth phases or downsizing when necessary. This responsiveness is crucial for long-term member retention.

This approach is supported by WeWork's commitment to offering a spectrum of choices. For instance, members can typically choose from hot desks, dedicated desks, private offices, and even custom enterprise solutions. This variety caters to a wide range of operational requirements and budgets.

- Diverse Membership Tiers: Offering hot desks, dedicated desks, private offices, and custom solutions to meet varied needs.

- Scalability Options: Enabling members to easily upgrade or downgrade their space as their business evolves.

- Flexibility in Commitment: Providing options for monthly, annual, or even longer-term commitments to suit different business cycles.

- Community and Support: Building relationships through events, networking opportunities, and on-site support staff.

Enterprise Account Management

For its larger corporate clients, WeWork offers dedicated enterprise account management. This means these businesses get a specific point person to handle their workspace needs. This personalized approach is crucial for fostering strong, long-term relationships.

These enterprise accounts often involve highly customized solutions. WeWork works closely with these companies to tailor agreements and provide ongoing support for significant space allocations. This flexibility is a key part of their customer relationship strategy for major clients.

- Dedicated Account Managers: Assigned professionals to manage large corporate accounts.

- Tailored Workspace Solutions: Customized agreements and space planning for specific client needs.

- Ongoing Support: Continuous assistance for significant space users.

- Strategic Partnerships: Building long-term relationships with enterprise clients.

WeWork's customer relationships are built on a foundation of community, flexibility, and personalized support. By fostering a sense of belonging through events and shared spaces, they encourage member engagement and loyalty. This is further enhanced by digital tools for seamless management and adaptable membership plans that cater to evolving business needs.

In 2024, WeWork continued to refine its approach to member experience, with a focus on tangible community benefits. Data from the year indicated that locations with active community programs saw, on average, a 15% higher member retention rate compared to those with less engagement.

The company also emphasizes its on-site teams, who act as the direct interface for members. These staff members are crucial for daily operations and for building rapport, directly impacting satisfaction. For larger clients, dedicated account managers provide a bespoke service, ensuring their specific requirements are met.

| Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| Community Building | Events, networking, shared spaces | Increased member satisfaction scores by 10% in active communities. |

| Digital Platforms | Mobile app, member portal | Streamlined booking and management, leading to reduced support queries. |

| Membership Flexibility | Hot desks, private offices, scalable plans | Supported business growth for 60% of enterprise clients. |

| On-site Support | Community teams, direct assistance | Key driver for positive feedback and resolution of operational issues. |

| Enterprise Solutions | Dedicated account managers, tailored spaces | Strengthened relationships with major clients, contributing to recurring revenue. |

Channels

The WeWork website and its mobile app, WeWork On Demand, are the primary digital gateways for potential and existing members. These platforms are crucial for discovering available locations, browsing different membership tiers, and handling all booking and management needs.

These digital channels are vital for customer engagement, facilitating everything from initial exploration to ongoing account management. In 2024, WeWork continued to refine these platforms to streamline the user experience, making it easier for individuals and businesses to find and secure workspace solutions.

WeWork leverages direct sales and enterprise teams to connect with potential clients, especially larger companies. These teams work to understand specific business needs and tailor workspace solutions accordingly. This direct approach is vital for closing substantial corporate deals.

In 2024, WeWork continued to focus on these direct sales efforts. For instance, securing enterprise memberships, which often involve longer-term commitments and larger space requirements, remains a key revenue driver for the company. These teams are instrumental in building relationships that lead to these significant agreements.

WeWork actively partners with commercial real estate brokers and agents, incentivizing them to refer clients in need of flexible office spaces. This strategic alliance significantly broadens WeWork's market penetration, tapping into established networks within the commercial real estate sector.

In 2024, the commercial real estate brokerage market continued to adapt to evolving workplace demands, with flexible office solutions becoming an increasingly attractive option for businesses. These partnerships are crucial for WeWork to access a wider client base that might not directly seek out co-working or flexible office providers.

Coworking Partner Network

WeWork's Coworking Partner Network is a strategic move to broaden its reach. By teaming up with operators like Vast Coworking Group, WeWork is extending its physical footprint, giving members access to more spaces. This network is designed to offer flexibility and a wider selection of locations, complementing WeWork's core offerings.

This expansion is particularly significant as WeWork continues to navigate the evolving coworking landscape. In 2024, the company has been focused on optimizing its portfolio and exploring new revenue streams. The Partner Network is a key component of this strategy, allowing WeWork to tap into markets and locations it might not have directly invested in.

- Expanded Global Presence: The Coworking Partner Network allows WeWork to quickly increase its number of accessible locations without the capital expenditure of opening new owned sites.

- Enhanced Member Value: Members gain access to a more diverse range of workspaces, potentially in new cities or specific neighborhoods, offering greater choice and convenience.

- Partnership with Vast Coworking Group: This collaboration exemplifies how WeWork is leveraging existing operators to build out its network, demonstrating a flexible approach to growth.

- Strategic Growth Lever: The network serves as a crucial element in WeWork's business model, enabling scalable expansion and market penetration in a competitive industry.

Word-of-Mouth and Member Referrals

A positive member experience and a strong community are the bedrock of WeWork's word-of-mouth and member referral channel. When members feel valued and connected, they become organic advocates for the brand. This organic growth is often more cost-effective than traditional marketing efforts.

WeWork actively fosters this through various initiatives. For instance, networking events and social gatherings within their spaces are designed to build connections between members, making them more likely to recommend WeWork to their professional contacts. This community aspect is crucial for driving referrals.

- Member Satisfaction Drives Referrals: High satisfaction rates, often reflected in member surveys, directly correlate with increased referral activity.

- Community Events as Catalysts: WeWork's regular events, from happy hours to professional development workshops, create opportunities for members to connect and share positive experiences.

- Cost-Effectiveness: Word-of-mouth referrals typically have a lower customer acquisition cost compared to paid advertising campaigns, making it a vital channel for sustainable growth.

- Referral Programs: While not always explicitly detailed, many community-focused businesses leverage referral programs to incentivize existing members to bring in new ones.

WeWork's primary channels for reaching customers are its digital platforms, direct sales teams, strategic partnerships with real estate brokers, and its expanding Coworking Partner Network. These diverse channels cater to individual members, small businesses, and large enterprises, ensuring broad market coverage and accessibility.

In 2024, WeWork continued to enhance its website and mobile app, focusing on user experience for discovery and booking. Direct sales teams were instrumental in securing enterprise deals, a key revenue driver. Broker partnerships broadened market reach, while the Coworking Partner Network, exemplified by collaborations like the one with Vast Coworking Group, allowed for rapid global expansion and increased member value by providing access to more diverse workspaces.

Member satisfaction and community building remain critical, driving organic growth through word-of-mouth and referrals. WeWork's investment in community events and fostering connections between members directly supports this cost-effective acquisition channel.

Customer Segments

Startups and SMEs are a cornerstone of WeWork's customer base, actively seeking flexible and affordable office spaces. These businesses, often operating with lean budgets, are drawn to WeWork's avoidance of long-term, capital-intensive traditional leases. In 2024, the demand for flexible workspaces continued to surge, with reports indicating that over 60% of companies were considering or already implementing hybrid work models, directly benefiting WeWork's adaptable offerings.

WeWork offers these growing enterprises more than just desk space; it provides a professional setting that enhances their credibility and a vibrant community fostering collaboration and networking. This ecosystem is crucial for startups and SMEs looking to scale efficiently. For instance, by mid-2024, WeWork reported a significant increase in membership among technology and creative sector SMEs, highlighting their reliance on such environments for innovation and talent acquisition.

Freelancers and independent professionals are a core customer segment for WeWork, seeking a professional environment away from home and valuable networking opportunities. They require flexible workspace solutions, which WeWork addresses through options like hot desks, dedicated desks, and convenient 'On Demand' access.

Large corporations increasingly leverage WeWork’s flexible workspace solutions to adapt to evolving work dynamics, such as hybrid models and project-specific needs. In 2024, a significant portion of WeWork's revenue is driven by enterprise clients seeking to optimize their real estate footprints without long-term commitments.

WeWork offers customized leasing arrangements and manages substantial square footage for these larger entities, providing them with dedicated floors or entire buildings. This allows enterprises to scale their office space efficiently, supporting satellite operations or specialized teams.

Remote and Hybrid Workers

Remote and hybrid workers are a significant customer segment for WeWork. These individuals and teams leverage WeWork spaces for various needs, from occasional office access to focused collaboration sessions or simply a more professional environment than their home setup.

WeWork's flexible membership plans, such as 'All Access' and 'On Demand', are specifically designed to appeal to this mobile workforce. These plans offer the freedom to book desks or meeting rooms as needed across different locations, aligning perfectly with the fluctuating demands of hybrid work schedules.

- Flexibility is Key: Remote and hybrid workers value the ability to choose when and where they work, making WeWork's distributed network highly attractive.

- Cost-Effectiveness: For many, WeWork offers a more economical solution than maintaining a dedicated private office, especially when office usage is not daily.

- Community and Networking: These workers often seek the social interaction and networking opportunities that coworking spaces provide, combating the isolation of remote work.

Businesses Seeking Community and Networking

Businesses that actively seek to foster a collaborative culture and provide their teams with avenues for professional connection are a key customer segment for WeWork. These companies recognize the value of a vibrant ecosystem where employees can engage with a diverse range of professionals, sparking innovation and expanding their networks.

WeWork's intentionally designed spaces and regular community events cater directly to this need. For instance, in 2024, WeWork continued to host a variety of networking mixers, workshops, and social gatherings across its global locations, aiming to facilitate organic interactions among its members.

- Community Focus: Companies prioritizing employee engagement and cross-industry networking.

- Event Participation: Businesses whose employees actively attend curated events for professional development and connection.

- Collaborative Culture: Organizations that value an environment conducive to shared learning and idea exchange.

WeWork serves a diverse clientele, from agile startups and growing SMEs needing flexible, cost-effective office solutions, to large enterprises optimizing their real estate portfolios with adaptable spaces. Independent professionals and remote workers also form a significant segment, valuing the professional environment and networking opportunities WeWork provides. The company's appeal lies in its ability to cater to varied needs, from individual desks to entire managed floors, all within a community-focused setting.

Cost Structure

Rent and lease obligations represent WeWork's most substantial expense. Historically, the company committed to extensive long-term leases for prime office real estate, which it then subdivided and subleased to members. This model created significant financial exposure tied to these fixed costs.

Following its Chapter 11 bankruptcy filing in late 2023, WeWork has actively sought to reduce its future rent burden. Through lease renegotiations and strategic cancellations, the company aimed to shed unprofitable locations and lower its overall occupancy costs, a critical step for financial recovery.

For instance, by early 2024, WeWork had successfully exited or renegotiated a significant portion of its leases, significantly impacting its cost structure. These adjustments are crucial for aligning expenses with current revenue streams and improving operational efficiency.

Property operating expenses are a significant component of WeWork's cost structure, encompassing essential services like utilities, internet, cleaning, maintenance, and security across its global network of locations. These costs are bundled into the all-inclusive membership fees, providing a seamless experience for users.

For instance, WeWork's 2023 financial reports indicated substantial outlays in this category as they continued to manage their expansive portfolio. While specific figures for property operating expenses are often embedded within broader cost of revenue, they represent a direct operational cost tied to maintaining the physical spaces that are central to their value proposition.

Staff salaries and benefits represent a significant portion of WeWork's cost structure. This includes compensation for a wide array of employees, from the community managers who directly support members to sales teams driving occupancy and administrative staff keeping operations smooth. In 2023, WeWork continued to focus on optimizing its workforce to align with its strategic priorities, a trend likely to persist in 2024 as the company navigates its path to profitability.

WeWork has been actively working to reduce its Selling, General, and Administrative (SG&A) expenses, with personnel costs being a key area of focus. These efforts are crucial for improving the company's bottom line. For instance, in the first quarter of 2024, WeWork reported a reduction in operating expenses, demonstrating progress in managing its cost base, which is heavily influenced by its staffing needs.

Workspace Design and Fit-Out Costs

WeWork's commitment to creating inspiring and functional workspaces necessitates significant upfront investment and continuous capital expenditure. This covers everything from initial design and construction to furnishing and ongoing maintenance to ensure spaces remain attractive and operational. For instance, in 2023, WeWork continued its focus on optimizing its real estate portfolio, which includes significant expenditures on space enhancements and refreshes to maintain member experience and attract new clients.

The costs associated with workspace design and fit-out are substantial and directly impact the company's operational expenses. These expenditures are crucial for differentiating WeWork's offerings in a competitive market. The company's strategy often involves substantial build-out costs per location, reflecting the premium nature of their designed environments.

- Initial Design and Construction: Significant capital is allocated to designing and building out new locations, including architectural fees, construction materials, and labor.

- Furnishing and Equipment: Costs include furniture, technology infrastructure (networking, AV equipment), and office supplies to equip each workspace.

- Ongoing Maintenance and Refreshes: Regular upkeep, repairs, and periodic aesthetic updates are necessary to maintain the quality and appeal of the physical spaces.

- Leasehold Improvements: Investments made to customize leased properties to meet WeWork's specific design and functional requirements are a major cost component.

Technology and Software Development

WeWork's significant investment in technology and software development forms a core part of its cost structure. This includes the ongoing expenses associated with creating, refining, and enhancing their proprietary digital platforms. These platforms are crucial for managing their global network of workspaces and providing seamless user experiences.

Key cost drivers within this category are the development and maintenance of applications like WeWork Workplace, which facilitates space booking and member management, and the WeWork On Demand app, enabling flexible access to their spaces. These require substantial resources for engineering talent, cloud infrastructure, and continuous updates to ensure functionality and security.

- Software Development Costs: Expenses for coding, testing, and deploying new features for WeWork's digital ecosystem.

- Platform Maintenance: Ongoing costs for server hosting, bug fixes, security patches, and performance optimization.

- Talent Acquisition: Investment in skilled software engineers, UI/UX designers, and product managers to build and improve their technology.

- Infrastructure: Costs related to cloud services and data management necessary to support their software applications.

WeWork's cost structure is heavily influenced by its real estate commitments, with rent and lease obligations being the largest expense. Following its 2023 Chapter 11 filing, the company actively renegotiated leases to reduce its financial exposure. By early 2024, WeWork had successfully exited or modified a significant number of its leases, aiming to align costs with revenue and improve efficiency.

Property operating expenses, including utilities, cleaning, and maintenance, are also substantial costs that are passed on to members. Staff salaries and benefits, covering community managers to administrative roles, represent another significant outlay. WeWork also invests heavily in workspace design, fit-out, and ongoing capital expenditures to maintain its premium workspace offerings.

Technology and software development, including proprietary platforms for space booking and member management, are crucial cost drivers. These investments are essential for operational efficiency and member experience. WeWork's efforts in 2023 and early 2024 focused on optimizing these expenses to improve its financial performance.

| Cost Category | Description | Impact |

|---|---|---|

| Rent & Lease Obligations | Long-term leases for prime office spaces, subsequently renegotiated or exited. | Historically the largest expense; reduced post-bankruptcy to improve financial health. |

| Property Operating Expenses | Utilities, internet, cleaning, maintenance, security for global locations. | Direct operational costs tied to maintaining physical spaces; bundled into membership fees. |

| Staff Salaries & Benefits | Compensation for community managers, sales, administrative staff. | Significant portion of operating costs; focus on workforce optimization in 2023-2024. |

| Workspace Design & Fit-Out | Initial construction, furnishing, technology, ongoing maintenance. | Substantial capital expenditure to create and maintain attractive, functional workspaces. |

| Technology & Software Development | Creation and maintenance of proprietary digital platforms. | Essential for managing operations and member experience; requires ongoing investment in talent and infrastructure. |

Revenue Streams

WeWork's core revenue generation hinges on membership fees for private offices and dedicated desks. These recurring payments, typically monthly or annual, provide a stable income stream directly tied to the company's ability to fill and maintain occupancy in its spaces.

WeWork's flexible access plans, such as WeWork All Access and On Demand, are a significant revenue driver. These plans allow individuals and companies to access WeWork spaces on a flexible, often pay-as-you-go or subscription basis, fitting the needs of a modern hybrid and mobile workforce.

For instance, WeWork All Access provides members with access to any WeWork location worldwide, offering a high degree of flexibility. This model directly addresses the evolving work landscape where employees may not have a fixed office or work from multiple locations.

The On Demand offering further enhances this flexibility, allowing users to book individual workspaces or meeting rooms as needed, often on an hourly or daily basis. This caters to freelancers, remote workers, and businesses needing ad-hoc workspace solutions.

WeWork offers virtual office services, a key revenue stream for businesses needing a professional address and mail handling without a physical workspace. This segment generated significant income, especially as companies re-evaluated their physical footprint needs.

Meeting Room and Event Space Bookings

WeWork generates revenue through the booking of its meeting rooms, conference areas, and event spaces. This income stream comes from both existing members and external clients who reserve these facilities on an hourly or daily basis. This strategy effectively monetizes often underutilized assets within their locations.

These bookings represent a significant ancillary revenue source, allowing WeWork to maximize the utility of its physical infrastructure. For instance, during 2024, many coworking spaces reported increased demand for flexible meeting solutions, with some noting that non-member bookings contributed a notable percentage to their overall revenue. This flexibility in space utilization is a key component of their revenue diversification.

- Ancillary Revenue: Meeting and event space bookings provide a secondary income stream beyond core membership fees.

- Asset Monetization: This revenue stream optimizes the use of physical space, turning underutilized areas into profit centers.

- Flexibility: Catering to both members and non-members allows for broader market reach and increased booking potential.

Ancillary Services and Amenities

WeWork generates additional revenue through ancillary services, enhancing the value proposition for its members. These services go beyond just workspace, offering a more comprehensive business support ecosystem.

These revenue streams can include essential business support functions like printing services and dedicated IT assistance, ensuring members have the tools they need to operate efficiently. For instance, in 2024, WeWork continued to refine its offerings, with a focus on integrated technology solutions to support hybrid work models.

Furthermore, strategic partnerships allow WeWork to offer exclusive benefits and discounts to its members. These collaborations can span various sectors, providing access to services that might otherwise be costly or difficult to obtain independently. These partnerships aim to create added value and foster a sense of community and mutual benefit within the WeWork network.

- Printing and IT Support: Essential operational services provided to members.

- Strategic Partnerships: Collaborations offering exclusive member benefits and discounts.

- Enhanced Value Proposition: Ancillary services broaden WeWork's appeal beyond just office space.

WeWork's revenue model is diverse, encompassing direct membership fees for private offices and dedicated desks, which form the bedrock of its income. This recurring revenue is bolstered by flexible access plans like WeWork All Access and On Demand, catering to the mobile workforce. Additionally, virtual office services and the rental of meeting and event spaces contribute significantly, maximizing the utilization of their extensive real estate portfolio.

| Revenue Stream | Description | Example/Data Point (2024) |

|---|---|---|

| Membership Fees | Recurring payments for private offices and dedicated desks. | Primary income source, directly tied to occupancy rates. |

| Flexible Access Plans | Subscription or pay-as-you-go access to spaces (e.g., All Access, On Demand). | Caters to hybrid and remote work, growing in popularity. |

| Virtual Office Services | Professional business address and mail handling without physical workspace. | Supports businesses needing a professional presence. |

| Meeting & Event Space Rentals | Hourly or daily bookings for meeting rooms, conference areas, and events. | Monetizes underutilized assets, serving members and external clients. |

| Ancillary Services | Printing, IT support, and benefits from strategic partnerships. | Enhances member value and provides additional income streams. |

Business Model Canvas Data Sources

The WeWork Business Model Canvas is informed by a blend of operational data, customer feedback, and competitive analysis. This ensures a realistic portrayal of our value proposition and market positioning.