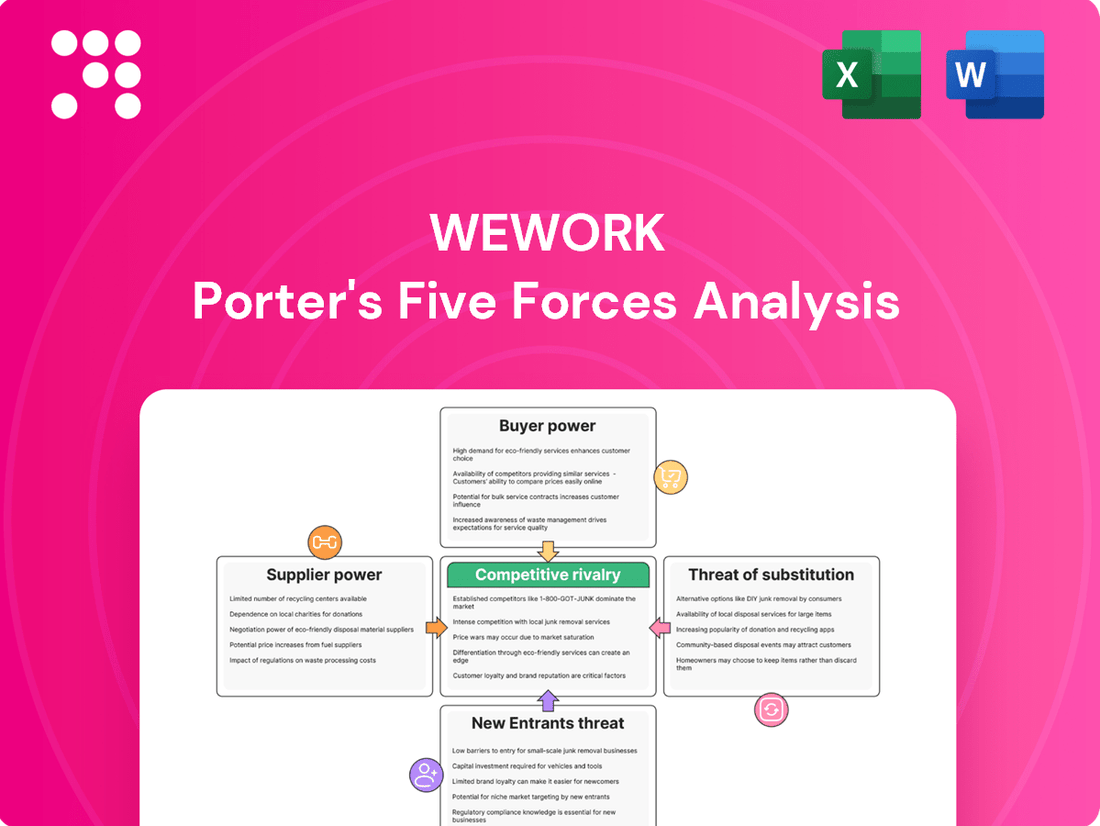

WeWork Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WeWork Bundle

WeWork's competitive landscape is shaped by intense rivalry, the looming threat of new entrants, and significant buyer power from its diverse client base. Understanding these forces is crucial for navigating the flexible workspace market.

The complete report reveals the real forces shaping WeWork’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

WeWork's primary suppliers are the landlords who own the large, often prime, office spaces that form the backbone of its operations. Historically, WeWork entered into long-term lease agreements for these properties, which locked in significant fixed costs. This reliance on long-term leases meant that landlords, particularly those with desirable urban locations, held considerable bargaining power.

Following its Chapter 11 bankruptcy filing in late 2023, WeWork demonstrated a significant shift in its bargaining power with suppliers, particularly landlords. The company successfully renegotiated terms on over 190 leases and exited 170 unprofitable locations. This aggressive restructuring significantly reduced its future rent obligations by an estimated $12 billion, a substantial win that rebalanced the scales.

The bargaining power of suppliers in the commercial real estate sector, particularly for office spaces, is generally low. This is due to widespread high vacancy rates and declining property values, a trend that intensified in 2023 and continued into 2024. For instance, office vacancy rates in major U.S. cities often exceeded 15% by the end of 2023, putting pressure on landlords to secure tenants.

This market condition significantly weakens landlords' negotiating leverage. With substantial available inventory and reduced demand for traditional office layouts, property owners are more inclined to offer concessions and flexible lease terms to attract and retain tenants like WeWork. This shift means suppliers of office space have less power to dictate terms.

Diverse Service Providers

Beyond just securing office spaces from landlords, WeWork's operational efficiency hinges on a network of diverse service providers. These include companies offering essential utilities, high-speed internet, professional cleaning services, and amenities that enhance the member experience. The sheer volume of these providers, often operating in a fragmented market, generally dilutes their individual ability to exert significant bargaining power against a large customer like WeWork.

WeWork's business model allows it to consolidate these necessary services, presenting them as part of a comprehensive package to its members. This integration is a core element of what makes WeWork attractive to its user base. For instance, in 2024, the global facilities management market was valued at over $1.1 trillion, indicating a vast but often specialized supplier landscape.

- Fragmented Supplier Base: The market for utilities, internet, and cleaning services typically features numerous smaller players, limiting the leverage of any single supplier.

- WeWork's Scale: As a large enterprise, WeWork can negotiate favorable terms due to its significant purchasing volume.

- Bundled Value Proposition: WeWork's ability to package these services for its members reduces the direct negotiation power of individual providers with the end-user.

- Availability of Alternatives: The ease with which WeWork can switch between providers for non-specialized services further constrains supplier bargaining power.

New Tenant Protections

New tenant protections being implemented in various regions, especially those targeting small businesses and nonprofits, can shift the balance of power. These regulations, while directly benefiting tenants, can indirectly constrain landlords. This means landlords, including flexible workspace providers like WeWork, may have less leeway to dictate lease terms, potentially impacting their ability to extract favorable conditions from suppliers or partners.

For instance, in California, the Tenant Protection Act of 2019 (AB 1482) introduced rent caps and just cause eviction requirements, influencing lease renewals and landlord flexibility. While not directly supplier-focused, such broader tenant-friendly legislation can foster an environment where tenant rights are more robust, indirectly affecting the bargaining power dynamics within commercial real estate relationships.

- Tenant Protections Impact: New regulations in some areas strengthen tenant rights, potentially limiting landlord flexibility in lease negotiations.

- Indirect Supplier Influence: While aimed at tenants, these laws can indirectly reduce a landlord's ability to impose strict terms, affecting their overall bargaining power.

- Market Shift: This creates a more tenant-centric environment, which could translate to suppliers having a slightly stronger negotiating position in certain commercial lease-related agreements.

WeWork's bargaining power with suppliers, particularly landlords, has significantly improved following its 2023 bankruptcy. By renegotiating leases, WeWork reduced future rent obligations by an estimated $12 billion, a substantial shift in power. This is further supported by a weak commercial real estate market in 2024, with high office vacancy rates exceeding 15% in many U.S. cities, forcing landlords to offer more favorable terms.

| Supplier Type | WeWork's Bargaining Power (2024) | Key Factors |

|---|---|---|

| Landlords | Increased | Post-bankruptcy lease renegotiations, high vacancy rates, declining property values |

| Service Providers (Utilities, Internet, Cleaning) | Moderate to High | Fragmented market, WeWork's scale, bundled services, availability of alternatives |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to WeWork's flexible workspace model.

Instantly identify and address the competitive pressures impacting WeWork's business model, from supplier bargaining power to the threat of substitutes.

Customers Bargaining Power

WeWork's core strength lies in its flexible lease terms, offering options ranging from hourly to monthly. This directly empowers customers, allowing them to adjust their office space needs without the long-term commitments of traditional leases.

This adaptability means members can easily scale their operations, either expanding or contracting their workspace as business demands fluctuate. For instance, a startup might begin with a small hot desk and quickly upgrade to a private office as their team grows, a flexibility not typically found in conventional office rentals.

The ability to switch providers or modify their footprint with minimal penalty significantly shifts bargaining power towards the customer. In 2024, the demand for flexible workspaces continued to rise, with many companies prioritizing agility in their real estate strategies, further amplifying this customer leverage.

The shift towards hybrid and remote work significantly amplifies customer bargaining power in the office space market. Businesses now have a wider array of choices, from fully remote setups to flexible co-working spaces, reducing their dependence on traditional, long-term leases. This flexibility allows them to negotiate better terms and demand more adaptable solutions from providers like WeWork.

WeWork caters to a wide array of customers, including freelancers, startups, and large corporations. This broad customer base presents varied demands and price sensitivities, with major enterprise clients often wielding greater bargaining power due to the significant volume of space they can potentially occupy.

Availability of Alternatives

Customers in the flexible workspace sector face a wealth of options, significantly boosting their bargaining power. Major competitors like Regus, operating under the IWG umbrella, and Spaces, alongside a burgeoning landscape of smaller, specialized coworking providers, offer diverse choices. This intense competition means customers can readily switch providers or negotiate better terms, as alternatives are plentiful and easily accessible.

The abundance of alternatives directly translates to increased customer leverage. For instance, a company seeking flexible office solutions can compare pricing, amenities, and contract flexibility across numerous providers. This readily available comparison empowers them to demand better value, driving down prices and forcing providers to differentiate on more than just cost.

- Abundant Alternatives: The flexible workspace market is populated by major players like IWG (Regus, Spaces) and a growing number of niche operators.

- Increased Customer Choice: This competitive environment provides customers with a wide array of providers to choose from.

- Enhanced Bargaining Power: Customers can leverage the availability of alternatives to negotiate better pricing and terms.

- Provider Differentiation: Companies must offer competitive advantages beyond just price to retain and attract clients.

Focus on Value and Amenities

While price remains a significant consideration for WeWork's customers, the company's focus on fostering a strong sense of community, facilitating valuable networking opportunities, and providing comprehensive, all-inclusive amenities plays a crucial role in shaping their decisions. These value-added services can differentiate WeWork, potentially shifting customer focus away from a purely price-driven comparison.

This emphasis on experience and connection can mitigate the bargaining power of customers who might otherwise solely leverage price. For instance, a startup seeking collaboration might prioritize WeWork's curated events and member introductions over a slightly cheaper, less community-focused workspace. In 2023, WeWork reported that its members valued networking and community events as key drivers for choosing and remaining with the company, indicating a willingness to pay a premium for these benefits.

- Community and Networking Value: WeWork's success hinges on its ability to deliver more than just physical space, with members actively seeking connections and collaborative opportunities.

- Amenity Appeal: All-inclusive services like high-speed internet, printing, and stocked kitchens contribute to a perceived value that can offset price sensitivity.

- Differentiation Strategy: By highlighting these non-price factors, WeWork aims to reduce the direct price comparison customers might make with competitors.

- Member Retention: The perceived value of these additional benefits can contribute to higher member retention rates, even in a competitive market.

The bargaining power of WeWork's customers is significantly high due to the abundant alternatives available in the flexible workspace market. This intense competition, featuring major players like IWG (Regus, Spaces) and numerous niche operators, allows customers to easily compare offerings and negotiate favorable terms. In 2024, the continued demand for agile real estate strategies further amplified this customer leverage, as businesses prioritized flexibility over long-term commitments.

Customers can readily switch providers or demand better value, forcing companies like WeWork to differentiate beyond just price. While WeWork attempts to mitigate this by fostering community and offering comprehensive amenities, the fundamental ease of access to alternatives remains a powerful customer advantage.

| Provider | Key Offerings | Customer Leverage Factor |

|---|---|---|

| WeWork | Flexible leases, community, amenities | High (due to competition) |

| IWG (Regus, Spaces) | Global network, diverse office solutions | High (established brand, wide reach) |

| Niche Co-working Spaces | Specialized industries, unique environments | High (specific appeal, tailored services) |

Preview Before You Purchase

WeWork Porter's Five Forces Analysis

This preview offers a comprehensive Porter's Five Forces analysis of WeWork, detailing the competitive landscape and strategic positioning of the flexible workspace provider. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, ensuring you receive an accurate and complete assessment of WeWork's market dynamics.

Rivalry Among Competitors

The flexible workspace sector is notably fragmented, featuring a large number of providers. This market is also expanding rapidly, particularly in North America and the Asia Pacific regions, with projections indicating continued robust growth through 2024 and beyond.

This expansion acts as a magnet for new entrants, thereby heightening competitive pressures. Companies are actively competing to capture market share, especially as opportunities emerge in suburban areas and smaller, tertiary cities, diversifying beyond traditional urban centers.

WeWork contends with formidable competition from seasoned global entities such as IWG, the parent company of Regus. IWG operates an even more extensive portfolio of flexible workspaces worldwide, presenting a direct challenge to WeWork's market share. This intense rivalry means both companies are actively vying for the same customer base, from individual freelancers to large corporations seeking adaptable office environments.

The coworking market isn't just about the big names. We're seeing a significant rise in smaller, regional, and even hyper-local coworking spaces. These often target specific industries, like tech startups or creative professionals, or cater to unique community needs.

This proliferation of specialized spaces intensifies competition for WeWork. For instance, in 2024, many cities saw a surge in independent coworking hubs offering tailored amenities or community events, directly challenging WeWork's more standardized model and capturing market share from specific user segments.

WeWork's Post-Bankruptcy Re-positioning

WeWork's emergence from Chapter 11 bankruptcy in June 2024 signals a determined effort to redefine its market position. The company is now prioritizing profitability by focusing on prime real estate and securing larger contracts with enterprise clients, a move that intensifies its rivalry with established players and other flexible workspace providers. This strategic pivot means WeWork is actively vying for market share in a sector characterized by rapid evolution and persistent competition.

The competitive landscape WeWork re-enters is robust, with numerous companies offering similar flexible office solutions. Key rivals include:

- Industrious: Known for its premium offering and strong enterprise focus, Industrious has been expanding its footprint and is a direct competitor for high-value clients.

- Regus (part of IWG plc): A long-standing global leader, Regus offers a vast network of business centers and caters to a broad range of business needs, presenting significant scale-based competition.

- Local and Niche Providers: Numerous smaller, regional co-working spaces and specialized providers also compete for market share, often by offering unique community aspects or specialized amenities.

WeWork's renewed strategy, emphasizing quality locations and enterprise partnerships, directly challenges these competitors for the same lucrative customer base. The success of this re-positioning will hinge on its ability to differentiate itself and demonstrate a more stable, value-driven offering compared to its rivals.

Differentiation Beyond Price

Competitive rivalry in the flexible workspace sector extends well beyond simple pricing strategies. Providers actively differentiate themselves through a rich tapestry of offerings, including premium amenities, dedicated community-building initiatives, distinctive interior design, and the seamless integration of cutting-edge technology. This multifaceted approach allows companies to carve out unique market positions.

WeWork's enduring legacy lies in its historical commitment to fostering vibrant, community-centric environments. This focus on creating engaging and collaborative spaces remains a significant differentiator in a market that is increasingly saturated. As competitors strive to offer more hospitality-like experiences, WeWork's established brand identity in this area continues to resonate.

- Amenities: Offering services like premium coffee, fitness centers, and event spaces.

- Community Building: Facilitating networking events, workshops, and social gatherings to foster a sense of belonging.

- Design & Aesthetics: Creating inspiring and functional workspaces that reflect a company's brand identity.

- Technology Integration: Providing high-speed internet, smart building features, and user-friendly booking systems.

The flexible workspace market is highly competitive, with numerous providers vying for market share. WeWork faces intense rivalry from global players like IWG, which operates a vast network of centers, and premium providers such as Industrious, focusing on enterprise clients. The sector's fragmentation means smaller, niche providers also contribute to competitive pressure by offering specialized services or catering to specific communities.

WeWork's post-Chapter 11 strategy, emphasizing prime locations and enterprise deals, directly intensifies competition for lucrative clients. This renewed focus means WeWork must effectively differentiate its offerings, which include community building and unique design, against a backdrop of providers enhancing amenities and technology integration. For example, in 2024, the market saw a rise in specialized hubs challenging WeWork's broader approach.

| Competitor | Market Position | Key Differentiators |

|---|---|---|

| IWG (Regus) | Global Leader | Extensive network, broad client base |

| Industrious | Premium Provider | High-end amenities, strong enterprise focus |

| Niche Providers | Regional/Specialized | Tailored communities, industry-specific services |

SSubstitutes Threaten

Traditional long-term office leases remain a significant substitute for WeWork's flexible workspace model, especially for larger enterprises that prioritize dedicated and stable office environments. These corporations often value the control and customization that come with owning or leasing a traditional space, even if it means longer commitments.

However, the appeal of traditional leasing has waned considerably. In 2024, the demand for traditional office spaces continued its downward trend, influenced by the persistent shift towards hybrid and remote work models. This evolving work landscape makes long-term leases a less compelling substitute for many businesses compared to the agility offered by flexible workspace providers like WeWork.

The most significant substitute for WeWork's offerings is the widespread adoption of fully remote work models. This trend, significantly amplified by global events in recent years, has seen many companies and individuals opt out of physical office spaces altogether.

Consequently, numerous organizations have responded by reducing their office footprints or eliminating them entirely, directly diminishing the demand for flexible workspace solutions like those provided by WeWork. For instance, by the end of 2023, many major tech companies continued to maintain hybrid or fully remote policies, with some reporting substantial reductions in their leased office square footage compared to pre-pandemic levels.

For freelancers and small businesses, the threat of substitutes is significant. Setting up a home office or utilizing readily available, low-cost alternatives like coffee shops and libraries directly competes with coworking spaces. These options provide immediate accessibility and substantial cost savings, making them attractive substitutes for those prioritizing budget and convenience over a dedicated professional environment.

The proliferation of coworking spaces, now found in suburban and even tertiary markets across the US, also intensifies this threat. This expansion means more individuals can find convenient, closer-to-home coworking solutions, potentially reducing the need to travel to larger, more established urban centers where WeWork often focuses. For example, by mid-2024, the number of flexible office spaces, including coworking, had grown substantially, offering diverse price points and locations.

In-house Flexible Spaces

Large enterprises are increasingly exploring in-house flexible workspace solutions as a direct substitute for services like WeWork. This trend allows companies to customize their environments and retain greater control over operational aspects, potentially leading to cost efficiencies. For example, many businesses are adopting 'hoteling' or 'hot-desking' models within their existing office footprints, eliminating the need for external flexible space providers.

This internal approach offers significant advantages for companies seeking to manage their real estate strategies more directly. By investing in their own flexible office setups, businesses can tailor the space to their specific brand identity and operational needs, fostering a more integrated employee experience. This can also translate into cost savings, as companies avoid the premium often associated with third-party flexible workspace memberships.

- Reduced Reliance: Companies can decrease their dependence on external providers, gaining more autonomy over their workspace design and management.

- Cost Control: Developing in-house solutions can offer better cost predictability and potentially lower overall expenses compared to external leases.

- Customization: Businesses can tailor the flexible spaces to their unique brand, culture, and operational requirements, enhancing employee experience.

- Strategic Alignment: Internal flexible spaces can be more closely aligned with a company's long-term real estate and business strategy.

Virtual Office Services

Virtual office services represent a significant threat of substitutes for WeWork's core offering of physical office spaces. These services cater to businesses that need a professional image and operational support without the commitment of a leased physical location. For instance, companies requiring only a registered business address, mail forwarding, and access to meeting rooms on demand can opt for virtual office packages, bypassing the need for WeWork's coworking or private office solutions.

The market for virtual office providers is diverse and growing, with numerous companies offering competitive pricing and flexible packages. This accessibility means businesses can easily switch to or start with virtual solutions if they perceive them as more cost-effective or suitable for their evolving needs. The threat is amplified by the low switching costs for customers; moving from a physical space to a virtual one, or vice versa, is generally straightforward.

In 2024, the demand for flexible and remote work solutions continued to shape the commercial real estate landscape. While specific data on the direct substitution of WeWork physical spaces by virtual offices isn't readily available, the broader trend of distributed workforces suggests a sustained interest in virtual solutions. Industry reports from late 2023 and early 2024 indicated that the virtual office market was projected to grow, with some analysts estimating a compound annual growth rate of over 10% in the coming years, highlighting the persistent competitive pressure.

- High Availability: Numerous providers offer virtual office services, increasing accessibility.

- Cost-Effectiveness: Virtual solutions are often cheaper than physical office leases.

- Flexibility: Businesses can scale their virtual office needs easily.

- Growing Market: The virtual office sector is expanding, posing a continuous threat.

The threat of substitutes for WeWork is substantial, stemming from both traditional office leases and the growing trend of fully remote work. While traditional leases offer stability, their appeal has diminished due to the rise of hybrid and remote models, making long-term commitments less attractive. Fully remote work, in particular, represents a direct substitute as many companies are reducing or eliminating physical office spaces altogether.

For smaller businesses and individuals, home offices and public spaces like coffee shops are cost-effective substitutes. Furthermore, the expansion of coworking spaces into suburban areas increases competition by offering more localized and convenient alternatives. Large enterprises are also developing in-house flexible workspace solutions, allowing for greater customization and control, thereby reducing reliance on external providers like WeWork.

Virtual office services pose another significant threat, offering a professional image and operational support without the need for a physical location. The accessibility and cost-effectiveness of these services, coupled with low switching costs, make them an attractive alternative. The virtual office market is projected for continued growth, indicating sustained competitive pressure on physical workspace providers.

| Substitute Type | Key Characteristics | Impact on WeWork | 2024 Trend Indicator |

|---|---|---|---|

| Traditional Leases | Stability, control, customization | Less appealing due to remote work; still relevant for large enterprises | Continued decline in demand for traditional office space |

| Fully Remote Work | No physical office required | Directly reduces demand for all office solutions | Persistent hybrid/remote policies by major companies |

| Home/Public Offices | Low cost, high convenience | Significant for freelancers and small businesses | Continued use for budget-conscious entities |

| In-house Flexible Solutions | Customization, cost control, strategic alignment | Reduces need for third-party providers | Increasing adoption by enterprises |

| Virtual Offices | Professional image, mail services, meeting room access | Cost-effective alternative for businesses needing minimal physical presence | Projected growth of over 10% CAGR |

Entrants Threaten

Entering the flexible office market, particularly at a scale comparable to WeWork, demands immense capital. This includes securing leases for prime real estate, undertaking significant renovations, and furnishing vast spaces. For instance, WeWork's expansion often involved multi-year leases on entire buildings, requiring millions in upfront costs and ongoing capital for fit-outs and amenities.

Established players like WeWork leverage significant brand recognition and vast global networks, drawing in members who value consistency and access to diverse locations. For instance, WeWork reported having 757 locations across 150 cities as of the end of 2023, a testament to its established presence.

Newcomers must overcome the considerable hurdle of cultivating a similar reputation and physical footprint to compete effectively. This requires substantial investment in marketing and infrastructure, making it difficult to attract a critical mass of users away from trusted brands.

Securing prime urban locations, essential for attracting WeWork's target clientele, presents a significant hurdle for new entrants. High real estate costs and limited availability in sought-after markets mean newcomers may struggle to acquire desirable properties, impacting their ability to compete effectively.

Growing Market Demand

The flexible office market is booming, with projections indicating significant growth that makes it a prime target for new players. This increasing demand, despite existing barriers to entry, means more companies, including traditional property owners, are likely to pivot towards offering flexible workspace solutions.

By 2028, the global flexible office space market is anticipated to reach approximately $108.6 billion, a substantial increase from its 2023 valuation. This upward trend is a strong signal to potential entrants. For instance, in 2024, many commercial real estate firms are actively exploring conversion strategies for underutilized office buildings to tap into this expanding market.

- Market Growth: The flexible office market is expected to grow considerably, reaching an estimated $108.6 billion by 2028.

- Attractiveness to Entrants: This robust growth makes the industry appealing, potentially drawing in new competitors.

- Conversion Opportunities: Property owners are increasingly converting traditional office spaces into flexible offerings, indicating a direct pathway for new entrants.

- 2024 Trends: A notable trend in 2024 is the strategic shift by real estate companies to leverage flexible workspace models.

Asset-Light Models and Technology Platforms

The threat of new entrants in the flexible workspace sector, particularly concerning asset-light models and technology platforms, remains a significant factor. These models drastically reduce the capital required to enter the market, as companies can partner with existing property owners or manage spaces without the burden of long-term leases. This approach lowers the traditional barriers to entry, making it easier for new players to emerge and compete.

Technology platforms further amplify this threat by aggregating a wide range of flexible workspace options. This allows smaller, niche providers to gain visibility and access to a broader customer base without needing to build out their own substantial physical portfolios. For instance, platforms like Deskpass or Breather, which connect users to various coworking spaces, demonstrate how technology can democratize market access. The ease of scaling these platforms, often with minimal upfront investment in physical assets, presents a continuous challenge to established players.

- Lowered Capital Requirements: Asset-light strategies, such as revenue-sharing agreements with landlords, eliminate the need for large upfront capital expenditures on property acquisition or long-term leases, reducing financial barriers for new entrants.

- Technology Platform Enablement: Digital platforms that curate and offer access to a network of flexible workspaces allow new companies to enter the market by focusing on software and service rather than extensive physical infrastructure.

- Increased Market Accessibility: The combination of asset-light models and technology significantly broadens the pool of potential competitors, enabling smaller, agile firms to challenge incumbents with innovative service offerings.

- Scalability of Digital Models: Technology-driven aggregators can scale rapidly, reaching a national or global audience with relatively low marginal costs, thereby increasing competitive pressure on traditional workspace providers.

The threat of new entrants remains moderate but is increasing, particularly due to asset-light business models and technology platforms that significantly lower capital requirements. These strategies allow new players to enter the market by partnering with existing property owners or aggregating various spaces, bypassing the need for substantial upfront investment in physical real estate, which was a major barrier previously.

The growing market size, projected to reach $108.6 billion by 2028, continues to attract new competitors. In 2024, many commercial real estate firms are actively exploring flexible workspace conversions, directly entering the market with existing assets. This trend indicates a growing accessibility for new entrants, even those with substantial capital, who can leverage existing infrastructure.

While established players like WeWork benefit from brand recognition and scale, the ease with which technology platforms can aggregate offerings and asset-light models can be deployed means that niche providers and aggregators pose a growing challenge. This dynamic is reshaping the competitive landscape, making it easier for agile, digitally-focused companies to gain traction.

| Factor | Impact on New Entrants | Example/Data Point |

|---|---|---|

| Capital Intensity | High for traditional models, Lower for asset-light | WeWork's expansion required millions in upfront costs for leases and renovations. |

| Brand Recognition & Network | Challenging to replicate | WeWork's 757 locations across 150 cities by end of 2023. |

| Market Growth Potential | Attracts new players | Global flexible office market projected to reach $108.6 billion by 2028. |

| Technology & Aggregation | Lowers barriers, increases accessibility | Platforms like Deskpass connect users to multiple coworking spaces. |

| Real Estate Acquisition | Significant hurdle in prime locations | High costs and limited availability in sought-after urban markets. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for WeWork leverages data from company SEC filings, industry-specific market research reports, and news articles detailing competitor strategies to provide a comprehensive view of the competitive landscape.