WeWork PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WeWork Bundle

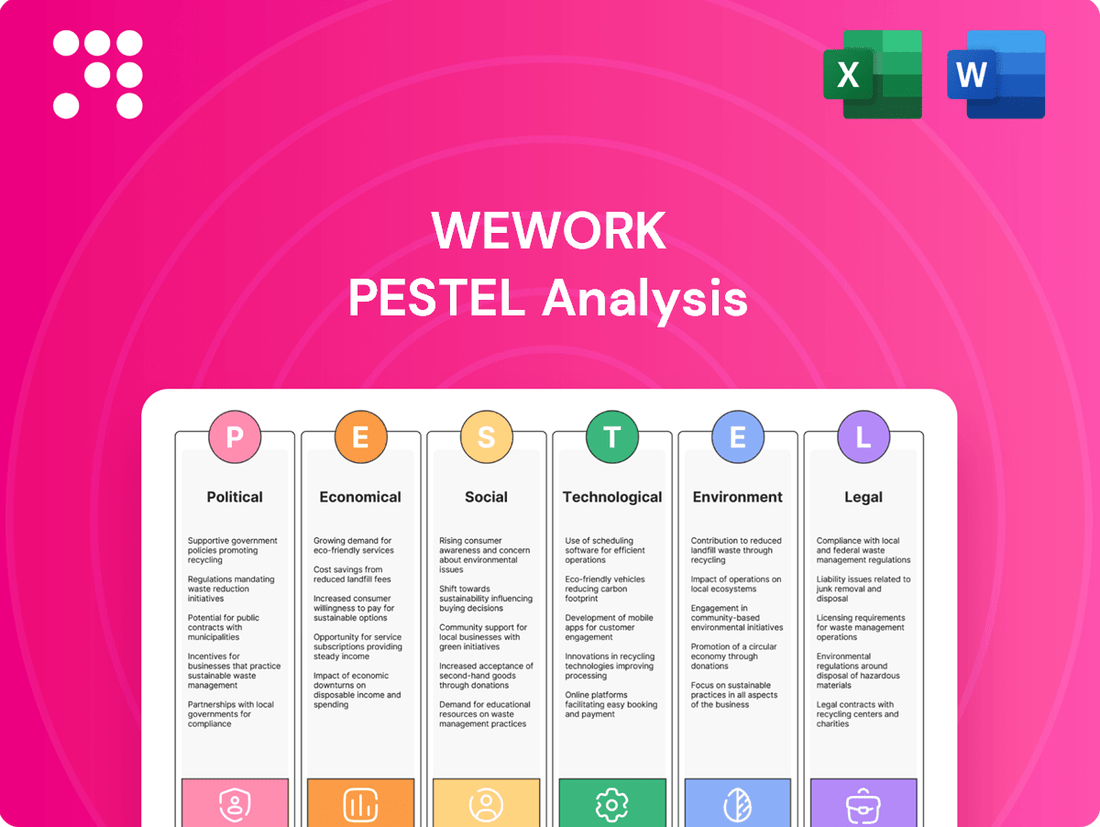

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping WeWork's trajectory. This comprehensive PESTLE analysis provides the essential context for understanding the company's challenges and opportunities. Download the full report to gain actionable insights and refine your strategic approach.

Political factors

Government policies, especially those concerning urban planning and commercial real estate, significantly shape WeWork's operating environment. For instance, in 2024, many cities are reassessing their downtown development strategies post-pandemic, which could influence the availability and cost of prime office spaces WeWork relies on.

Zoning regulations, building codes, and urban development projects directly affect WeWork's ability to open new locations or grow existing ones. Stricter building codes in major metropolitan areas, for example, could increase renovation costs for WeWork spaces, impacting their profitability.

Shifts in these governmental policies present both potential advantages and limitations for WeWork's flexible workspace model. A relaxation of certain commercial real estate regulations, perhaps to encourage business activity, could open up new markets for WeWork in 2025.

The regulatory landscape for flexible workspaces, including WeWork, is dynamic, with evolving health and safety standards and potential new classifications for co-working arrangements. For instance, in 2024, many cities are re-evaluating building codes and occupancy rules post-pandemic, directly impacting how spaces like WeWork can operate and the amenities they must provide.

WeWork's global operations mean it must constantly adapt to a patchwork of local regulations. This includes navigating varying business registration requirements and labor laws across different jurisdictions, which can affect everything from employment contracts to tax obligations.

Compliance with these diverse regulations is crucial for maintaining operational licenses and avoiding penalties. For example, in 2024, several European cities introduced stricter guidelines on data privacy for shared office environments, requiring significant adjustments to how member data is handled.

Government stimulus packages, like the U.S. Inflation Reduction Act of 2022, aim to spur economic activity, potentially increasing demand for office spaces as businesses expand. Policies fostering SME growth, such as the UK's Start Up Loans scheme, can directly benefit WeWork by creating a larger pool of potential clients needing flexible workspace solutions.

Economic recovery plans can significantly impact WeWork's revenue. For instance, if stimulus efforts lead to a stronger GDP growth forecast for major markets in 2024-2025, this could translate to higher occupancy rates for WeWork's locations.

International Relations and Trade Policies

WeWork's global presence makes it highly susceptible to shifts in international relations and trade policies. For instance, the ongoing trade disputes between major economic blocs can create uncertainty, impacting expansion plans and operational costs in affected regions. The company's ability to freely move capital and personnel across borders is directly influenced by these geopolitical dynamics.

Trade agreements, or the lack thereof, significantly shape WeWork's market access and pricing strategies. A favorable trade environment can reduce tariffs on office equipment and technology, lowering overhead. Conversely, protectionist measures could increase costs and create barriers to entry in key international markets. For example, as of early 2024, the ongoing renegotiation of trade pacts in various regions could introduce new compliance requirements for companies like WeWork.

- Geopolitical Instability: Tensions between nations can disrupt supply chains for office furnishings and technology, increasing costs and delivery times for WeWork's global fit-out projects.

- Trade Agreements: Favorable trade agreements can reduce import duties on office equipment and technology, directly benefiting WeWork's cost structure and ability to offer competitive pricing.

- Sanctions and Restrictions: International sanctions or specific country restrictions can limit WeWork's ability to operate or expand in certain markets, impacting revenue diversification.

- Foreign Investment Climate: The ease of foreign direct investment is crucial for WeWork's international growth; policies that encourage or discourage such investment directly affect its expansion capabilities.

Political Stability and Local Governance

WeWork's operational landscape is heavily influenced by political stability. For instance, in 2024, regions experiencing heightened political tensions, such as parts of Eastern Europe, could pose risks to WeWork's physical locations and member safety. This instability can lead to unpredictable regulatory changes, impacting lease agreements and the overall cost of doing business.

Local governance plays a critical role in WeWork's expansion and day-to-day operations. In 2024, cities with streamlined permitting processes and supportive local governments, like certain hubs in Asia, offer a more predictable environment for securing new locations. Conversely, cities with frequent changes in zoning laws or business regulations, as seen in some Western European municipalities, can create operational hurdles and increase compliance costs for WeWork.

The security of long-term investments in real estate, a cornerstone of WeWork's model, is directly tied to political predictability. Stable political climates, such as those observed in major North American business centers in early 2025, foster confidence for securing multi-year leases. Political unrest or sudden policy shifts in emerging markets, however, can jeopardize these commitments and create uncertainty for future capital allocation.

Key considerations for WeWork regarding political factors include:

- Assessing geopolitical risk: Monitoring political stability in key operational markets to mitigate potential disruptions.

- Navigating local regulations: Adapting to diverse and evolving local governance policies affecting real estate and business operations.

- Securing long-term leases: Prioritizing markets with stable political environments to ensure the security of substantial property commitments.

- Member confidence: Maintaining operations in politically stable areas to assure members of a secure working environment.

Government policies regarding urban planning and commercial real estate are pivotal for WeWork's operational success. As of 2024, many cities are reassessing their downtown development strategies, which directly impacts the availability and cost of prime office spaces. For instance, in 2025, new regulations concerning flexible workspaces could emerge, affecting how WeWork structures its offerings and pricing.

WeWork must navigate a complex web of local and international regulations, including zoning laws, building codes, and data privacy standards. In 2024, cities like London and New York are updating occupancy rules post-pandemic, requiring WeWork to adapt its space configurations and safety protocols. Compliance with these diverse requirements is essential for maintaining operational licenses and avoiding penalties.

Political stability and predictable governance are crucial for WeWork's long-term lease agreements and investments. In early 2025, markets with stable political environments, such as major business hubs in North America, offer greater security for WeWork's substantial property commitments. Conversely, geopolitical instability in regions like Eastern Europe presents risks to physical locations and member safety.

Trade agreements and international relations significantly influence WeWork's global expansion and operational costs. As of 2024, ongoing trade pact renegotiations could introduce new compliance requirements or affect the import of office equipment. Sanctions or country-specific restrictions can also limit market access, impacting revenue diversification for WeWork.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting WeWork's business model and global operations.

A PESTLE analysis for WeWork, presented clearly and concisely, helps relieve the pain point of navigating complex external factors by providing a digestible overview of political, economic, social, technological, environmental, and legal influences impacting the flexible workspace industry.

Economic factors

WeWork's emergence from Chapter 11 bankruptcy in June 2024 marks a pivotal economic shift, shedding over $4 billion in debt and slashing future rent commitments by roughly $12 billion. This drastic financial overhaul provides a significantly cleaner balance sheet, essential for navigating the current economic climate and pursuing profitability.

The restructuring directly addresses the unsustainable operating losses that plagued WeWork's rapid expansion phase. With a leaner financial foundation, the company is better positioned to adapt to evolving market demands and investor expectations in the post-bankruptcy era.

The flexible office space market is projected to continue its robust growth through 2025. This expansion is fueled by a significant shift in how businesses approach their real estate needs, with a growing preference for agility over traditional, long-term leases. Companies are actively seeking ways to adapt quickly to changing market dynamics and workforce requirements.

Large enterprises, in particular, are leading this charge, recognizing the strategic advantage of flexible solutions. They are prioritizing the ability to scale their office footprints both up and down with ease, a direct response to economic uncertainties and evolving operational models. This adaptability allows for better cost management and operational efficiency.

This demand directly benefits companies like WeWork, whose business model is built around providing these adaptable workspace solutions. The emphasis on agility and cost-effectiveness in the current economic climate makes flexible office spaces a highly attractive option for businesses aiming to maintain financial flexibility and operational responsiveness.

Interest rate hikes in 2024 and 2025 directly impact WeWork's operational costs. Higher rates increase the cost of borrowing for expansion and can make existing variable-rate leases more expensive, squeezing profit margins.

Commercial real estate costs remain a significant factor. While WeWork has been renegotiating leases, the average asking rent for office space in major U.S. cities, which saw some stabilization in late 2024, still presents a challenge for securing cost-effective locations. For instance, in Q1 2025, average asking rents in Manhattan remained around $75 per square foot, a figure WeWork aims to mitigate through its revenue-sharing model.

WeWork's strategic shift towards revenue-sharing agreements with landlords is a direct response to these market conditions. This approach, rather than fixed leases, allows the company to better manage its exposure to fluctuating real estate costs and interest rate environments, aligning expenses more closely with occupancy and revenue generated from its spaces.

Hybrid Work Model Impact

The widespread adoption of hybrid work models significantly impacts the demand for traditional office spaces. Many companies are downsizing their physical footprints or seeking more flexible solutions, directly benefiting flexible workspace providers like WeWork. This trend reduces the need for large, fixed headquarters, making co-working spaces more attractive for their convenience, collaborative environments, and cost-effectiveness.

WeWork is strategically positioned to leverage this shift by offering adaptable workspace solutions designed for distributed workforces. For instance, in 2024, reports indicated that while some companies are reducing their office square footage, they are also increasing their utilization of flexible office spaces to accommodate fluctuating employee needs. This indicates a sustained demand for the services WeWork provides.

- Hybrid work adoption continues to reshape office space demand.

- Companies are increasingly downsizing traditional offices in favor of flexible solutions.

- Co-working spaces offer key advantages like convenience, collaboration, and cost savings.

- WeWork's business model is designed to capitalize on the trend of distributed workforces.

Path to Profitability and Revenue Growth

WeWork is on a clear path toward profitability, with projections showing a return to positive earnings before interest, tax, depreciation, and amortization (EBITDA) anticipated in early 2025. This signifies a significant milestone, representing the company's first sustained period of global profitability.

The company's financial turnaround is further evidenced by its reporting of positive EBITDA for two consecutive quarters in early 2025. During this period, revenue saw a notable increase, reaching $3.98 billion.

- EBITDA Turnaround: Projections indicate a return to positive EBITDA in early 2025.

- Sustained Profitability: This marks the first sustained period of global profitability for WeWork.

- Revenue Growth: Revenue increased to $3.98 billion in early 2025.

- Strategic Focus: The turnaround is supported by a focus on prime locations and enterprise clients.

WeWork's emergence from Chapter 11 in June 2024, shedding over $4 billion in debt, significantly improves its economic footing for 2025. The company's path to profitability is underscored by projections of positive EBITDA in early 2025, a first for sustained global operations, with revenues reaching $3.98 billion in early 2025.

Interest rate hikes in 2024-2025 directly impact WeWork's borrowing costs and lease expenses, while commercial real estate costs, with average asking rents in Manhattan around $75 per square foot in Q1 2025, remain a key consideration. The company's pivot to revenue-sharing agreements with landlords aims to mitigate these economic pressures.

The flexible office space market is expected to grow through 2025, driven by businesses, particularly large enterprises, seeking agility and cost management in response to economic uncertainties. This trend benefits WeWork's adaptable workspace model, as companies increasingly prioritize flexible solutions over traditional leases.

| Economic Factor | Impact on WeWork | Data Point (2024/2025) |

| Debt Reduction | Improved financial stability post-bankruptcy | $4 billion+ debt shed (June 2024) |

| Profitability Projections | Path to sustained positive operations | Positive EBITDA projected early 2025 |

| Revenue | Demonstrates market recovery and demand | $3.98 billion (early 2025) |

| Interest Rates | Increased operating and borrowing costs | Hikes observed in 2024-2025 |

| Real Estate Costs | Ongoing challenge for location acquisition | Manhattan avg. asking rent ~$75/sq ft (Q1 2025) |

What You See Is What You Get

WeWork PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This comprehensive WeWork PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping WeWork's business environment, presented exactly as you see it now.

Sociological factors

The modern workforce is clearly shifting, with a strong emphasis on flexibility. Surveys from 2024 and early 2025 consistently show a majority of employees favoring hybrid work arrangements, valuing the ability to blend remote and in-office time. This desire for autonomy extends to schedules, with many seeking greater control over their working hours.

Commuting is a major pain point for many. Data from 2024 indicates that a significant percentage of workers would prefer to reduce their commute time, making proximity to home a key factor in job satisfaction. This trend directly benefits flexible office solutions that are located in suburban areas rather than solely in central business districts.

WeWork's strategy of offering a network of accessible, adaptable spaces aligns perfectly with these evolving work preferences. By providing co-working options closer to residential areas, they cater to the demand for reduced travel and increased work-life balance, a sentiment that has only grown stronger through 2024 and is projected to continue into 2025.

Even with more people working from home, there's a noticeable pull towards in-person interaction and building a sense of community. Many professionals actively seek out environments that foster collaboration and connection, a trend that WeWork’s model directly taps into.

WeWork’s focus on creating lively, collaborative spaces with built-in networking opportunities directly addresses this social demand. These spaces are designed to be more than just places to work; they are intended as destinations that encourage interaction and spontaneous idea generation, moving beyond the confines of individual tasks.

In 2024, surveys indicated that over 70% of hybrid workers value face-to-face interaction for team cohesion and innovation. WeWork's strategy to offer flexible office solutions that include communal areas and events directly caters to this desire for a shared workspace experience, differentiating it from purely remote setups.

Companies are placing a much greater emphasis on employee well-being, driving demand for workspaces that go beyond basic functionality. This shift means businesses are looking for environments that support physical and mental health, a trend that WeWork's flexible office solutions are well-positioned to address. For instance, a 2024 survey by Deloitte found that 70% of employees believe their employer is more focused on well-being than in previous years.

WeWork's model, which often incorporates amenities such as dedicated wellness spaces, comfortable common areas, and robust technological infrastructure, directly caters to this growing need. These features are designed to foster a more positive and productive work experience, which is crucial for attracting and keeping good employees in today's competitive job market. In 2023, companies that invested in employee well-being programs reported a 20% higher employee retention rate compared to those that did not.

Demographic Shifts and Workforce Diversity

The evolving demographic landscape, particularly the increasing influence of Millennials and Gen Z in the workforce, significantly shapes demand for flexible workspace solutions. These younger generations prioritize work-life integration and seek dynamic, collaborative environments, aligning well with WeWork's adaptable offerings. For instance, by 2025, Millennials are projected to constitute nearly 75% of the global workforce, a substantial segment actively seeking flexible work arrangements.

WeWork's success hinges on its ability to cater to a diverse membership base, ranging from agile startups to established corporations. Each of these segments possesses distinct requirements for office space, amenities, and community engagement. Understanding these varied needs is crucial for WeWork to maintain its appeal and market share in the competitive coworking sector.

- Millennial and Gen Z Workforce Dominance: These generations are increasingly driving demand for flexible and amenity-rich office spaces.

- Work-Life Integration Demand: Younger workers prioritize environments that support a balance between professional and personal lives.

- Diverse Client Needs: WeWork must accommodate a wide spectrum of businesses, from small startups to large enterprises, each with unique spatial and functional requirements.

Cultural Acceptance of Flexible Work

The cultural acceptance of flexible work has significantly evolved, transitioning from a pandemic-induced necessity to a core business strategy. This shift is evident in how companies now view adaptable work models, with many prioritizing them for talent acquisition and retention. For instance, a 2024 survey by Gartner indicated that 70% of organizations planned to offer hybrid work arrangements long-term, highlighting this enduring trend. WeWork directly benefits from this widespread societal embrace of agile and flexible working environments, as it aligns perfectly with their core offerings.

This fundamental change means flexible office solutions are no longer a niche perk but a mainstream component of modern workplace strategies. Businesses are actively seeking out spaces that can accommodate fluctuating team sizes and diverse work needs. A 2025 report from CBRE noted a substantial increase in demand for flexible office space, with companies of all sizes exploring these options to enhance operational agility and employee satisfaction. This broad cultural embrace of adaptable and agile work models provides a fertile ground for WeWork's continued growth and relevance.

WeWork's business model is intrinsically linked to this cultural acceptance. The company thrives because it provides tangible solutions for businesses navigating the new landscape of work. As more organizations recognize the benefits of flexible arrangements, the demand for coworking spaces and flexible office solutions like those offered by WeWork is expected to remain robust. This cultural acceptance underpins the strategic imperative for companies to adopt more adaptable workspace strategies, directly benefiting providers like WeWork.

The increasing preference for work-life integration, particularly among younger generations like Millennials and Gen Z, is a significant sociological driver. By 2025, these demographics are expected to represent a substantial portion of the workforce, actively seeking flexible and dynamic work environments that support their lifestyle choices.

Societal acceptance of flexible work arrangements has shifted dramatically, moving from a temporary measure to a fundamental aspect of business strategy. This cultural evolution means companies are prioritizing adaptable office solutions to attract and retain talent, a trend that directly benefits WeWork's core offerings.

Employee well-being is now a paramount concern for businesses, influencing the demand for workspaces that promote both physical and mental health. WeWork's model, which often includes amenities and community-focused spaces, aligns with this growing emphasis on creating supportive and engaging work environments.

| Sociological Factor | Impact on WeWork | Supporting Data (2024-2025) |

| Work-Life Integration | Drives demand for flexible and accessible workspaces. | Millennials and Gen Z, projected to be ~75% of the workforce by 2025, prioritize flexibility. |

| Cultural Acceptance of Flexibility | Legitimizes and increases demand for coworking solutions. | 70% of organizations planned long-term hybrid work arrangements in 2024 (Gartner). |

| Employee Well-being Focus | Creates demand for amenity-rich, community-oriented spaces. | 70% of employees believe employers are more focused on well-being (Deloitte, 2024). |

Technological factors

WeWork is actively integrating smart building technologies, utilizing Internet of Things (IoT) devices to refine its operational efficiency and elevate the experience for its members. This strategic move includes deploying smart lighting that adapts to occupancy levels and smart thermostats designed for energy conservation.

Furthermore, WeWork is implementing sensors to continuously monitor crucial environmental factors like air quality, aiming to foster a more comfortable, energy-efficient, and healthier atmosphere within its spaces. The adoption of these technologies is a key component in WeWork's strategy to differentiate its offerings in the competitive coworking market.

AI is revolutionizing how WeWork manages its physical spaces. By analyzing occupancy data and predicting future needs, AI algorithms help optimize space utilization, ensuring that desks and meeting rooms are used efficiently. This is crucial for cost management in the flexible workspace industry, where underutilized space directly impacts profitability.

Beyond space, AI enhances the member experience. Personalized recommendations for services, networking opportunities, and even office setups are becoming standard. For instance, AI can analyze member behavior and preferences to suggest relevant events or connect individuals with similar professional interests, fostering a more engaged community within WeWork locations.

In 2024, WeWork continued to invest in AI-driven solutions to improve operational efficiency. While specific figures for AI's direct impact on space optimization are proprietary, the company's focus on data analytics suggests a significant push towards leveraging AI for better resource allocation and member satisfaction, aiming to solidify its market position.

WeWork's proprietary technology platform is central to its operational efficiency, integrating building systems and simplifying member bookings. This tech backbone, including WeWork Workplace, provides crucial data on space usage, enabling businesses to refine their real estate footprints. For instance, in Q1 2024, WeWork reported a 92% occupancy rate across its global portfolio, a testament to the platform's ability to manage and optimize space effectively.

High-Quality Connectivity and Virtual Collaboration

WeWork's success hinges on dependable, high-speed internet, essential for members handling large data, video calls, and joint ventures. In 2024, global mobile data traffic was projected to reach 1,500 exabytes, highlighting the demand for robust infrastructure. Ensuring seamless connectivity and strong security is paramount for safeguarding member data.

The ongoing advancements in VR/AR technology offer exciting possibilities for enhancing collaboration, particularly for distributed and hybrid teams. For instance, Meta reported in early 2025 that its Horizon Workrooms had seen a significant uptick in enterprise adoption, signaling a growing trend towards immersive virtual workspaces.

- Connectivity Reliance: WeWork members depend on stable, fast internet for core business functions like large file transfers and video conferencing.

- Security Imperative: Robust security protocols are non-negotiable to protect the sensitive data of diverse businesses operating within WeWork spaces.

- VR/AR Integration: Emerging VR/AR technologies are set to revolutionize virtual collaboration, offering more engaging and productive experiences for remote and hybrid workforces.

Innovation in Virtual Office Services

WeWork's virtual office services, a key technological focus, rely on sophisticated digital infrastructure to manage mail, provide professional addresses, and support remote teams. This necessitates ongoing investment in cloud computing, secure data management, and user-friendly digital platforms. For instance, in 2024, the demand for virtual office solutions saw significant growth, with many businesses adopting hybrid work models, pushing companies like WeWork to enhance their digital toolkits for seamless remote collaboration and administration.

Innovation in these virtual offerings directly impacts WeWork's value proposition, catering to businesses seeking flexible and comprehensive support beyond physical desks. The company is continuously developing integrated digital solutions that streamline operations for its members. By 2025, the trend towards digital-first business operations is expected to accelerate, making advancements in virtual communication and administrative technology crucial for WeWork's competitive edge.

- Digital Infrastructure Investment: WeWork's virtual services depend on robust cloud and data management systems.

- Remote Team Tools: Enhancements to digital collaboration and administrative tools are vital.

- Market Demand: The growing adoption of hybrid work models in 2024 fuels demand for advanced virtual office solutions.

- Future Trends: By 2025, digital-first operations will make technological innovation in virtual services a key differentiator.

WeWork's technological strategy centers on smart building integration, leveraging IoT for enhanced operational efficiency and member experience, as seen with adaptive lighting and smart thermostats. AI is also a significant focus, optimizing space utilization and personalizing member interactions to foster community and improve resource allocation.

The company's proprietary tech platform, including WeWork Workplace, is crucial for managing space usage, with a reported 92% occupancy rate globally in Q1 2024 underscoring its effectiveness. High-speed, secure internet is a fundamental requirement for members, with global mobile data traffic projected to hit 1,500 exabytes in 2024, highlighting the demand for robust connectivity.

Emerging VR/AR technologies are poised to transform virtual collaboration, with enterprise adoption of platforms like Meta's Horizon Workrooms showing a significant uptick by early 2025. WeWork’s virtual office services also depend on advanced digital infrastructure, including cloud computing and secure data management, to support remote teams and evolving hybrid work models.

| Technology Area | WeWork's Application | Key Data/Trend (2024/2025) |

|---|---|---|

| Smart Building/IoT | Optimizing energy use, monitoring air quality, enhancing member comfort | Smart lighting and thermostats deployed for energy conservation |

| Artificial Intelligence (AI) | Space utilization optimization, predictive analytics, personalized member services | Focus on data analytics for resource allocation and member satisfaction |

| Connectivity | Ensuring high-speed, reliable internet for members | Global mobile data traffic projected at 1,500 exabytes in 2024 |

| VR/AR | Enhancing virtual collaboration for hybrid teams | Increased enterprise adoption of VR collaboration tools by early 2025 |

| Virtual Office/Digital Infrastructure | Supporting remote teams, mail management, digital platforms | Growth in virtual office solutions driven by hybrid work models |

Legal factors

WeWork's successful emergence from Chapter 11 bankruptcy in June 2024 marked a significant legal milestone. A U.S. bankruptcy judge approved its restructuring plan in May 2024, a crucial step that allowed the company to shed over $4 billion in debt.

This legal maneuver also provided substantial relief on future rent obligations, estimated to be around $12 billion. Operating as a private entity now, WeWork's restructuring was a direct response to its financial challenges, demonstrating how legal frameworks can facilitate corporate turnarounds.

WeWork's aggressive restructuring in 2023 and 2024 heavily relied on navigating complex legal frameworks to renegotiate hundreds of office leases. This process was critical for shedding its costly legacy portfolio.

The company successfully exited over 170 unprofitable locations worldwide, a direct result of these legal negotiations. This move significantly reduced its financial burden, cutting annual rent and tenancy expenses by more than $800 million.

WeWork navigates a labyrinth of commercial real estate laws. These include zoning rules, crucial fire safety codes, and essential accessibility standards, all of which differ significantly from one city or country to another. For instance, in 2024, major cities like New York and London continue to update their building codes, impacting lease agreements and renovation requirements.

Adherence to these regulations is non-negotiable for maintaining legal operations and ensuring the safety of its members and staff. Failure to comply can lead to hefty fines or even forced closures, as seen in past instances where businesses faced penalties for not meeting fire egress requirements.

The company must actively track and adjust to evolving legal landscapes. This proactive approach ensures that all its locations, from its flagship London sites to its burgeoning Tokyo spaces, remain compliant and operational in a dynamic regulatory environment.

Contractual Agreements and Member Terms

WeWork's core operations are built upon a complex web of contractual agreements, primarily with property owners for leasing spaces and with its members for providing workspace solutions. These contracts dictate crucial terms such as lease duration, rent, termination clauses, and service level agreements, directly impacting WeWork's financial stability and operational flexibility. For instance, the ability to renegotiate or exit unfavorable leases is a significant legal consideration.

The terms within these agreements, particularly concerning flexibility and termination, became increasingly critical for WeWork, especially following the COVID-19 pandemic. Members sought more adaptable arrangements, and landlords faced pressure to offer concessions, highlighting the importance of well-drafted and legally sound contracts. In 2023, WeWork continued to navigate lease restructurings, impacting its financial performance and legal standing.

Clear and enforceable contracts are paramount for mitigating legal risks and managing disputes effectively. Ambiguities in membership terms or landlord agreements can lead to costly litigation and reputational damage. WeWork's legal team plays a vital role in ensuring these agreements align with evolving regulations and protect the company's interests.

Key legal factors within these agreements include:

- Lease Flexibility: Clauses allowing for adjustments in space or lease terms in response to changing market conditions or membership needs.

- Termination Conditions: Specific provisions outlining the circumstances and procedures under which either WeWork or its members can terminate agreements, impacting occupancy and revenue predictability.

- Liability and Indemnification: Defining responsibilities and potential liabilities for both WeWork and its members in case of accidents, property damage, or other incidents within the workspace.

- Compliance with Local Regulations: Ensuring all contractual terms adhere to local zoning laws, business licensing requirements, and tenant protection ordinances.

Data Privacy and Security Laws

WeWork, as a tech-enabled service provider handling significant member data, faces increasing scrutiny under global data privacy regulations. The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States are prime examples of legislation dictating how companies must manage personal information. Failure to comply can result in substantial fines; for instance, GDPR violations can reach up to 4% of annual global turnover or €20 million, whichever is higher. This necessitates robust data security measures, transparent data handling policies, and secure storage across WeWork's international operations to maintain member trust and avoid legal repercussions.

Navigating these evolving legal landscapes is critical for WeWork's operational integrity. In 2024, the focus on data breach notification and consumer rights continues to intensify, requiring companies to be proactive in their security protocols. WeWork's commitment to secure data storage, ethical usage, and controlled sharing practices across its diverse network of locations directly impacts its ability to operate legally and maintain a positive brand reputation. The cost of non-compliance, including potential lawsuits and reputational damage, far outweighs the investment in comprehensive data protection strategies.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- CCPA Enforcement: Significant penalties for data breaches and non-compliance.

- WeWork's Obligation: Secure data storage, transparent usage, and controlled sharing.

WeWork's successful emergence from Chapter 11 bankruptcy in June 2024, following a judge's approval of its restructuring plan in May 2024, demonstrates the critical role of legal frameworks in corporate turnarounds. This legal process allowed the company to shed over $4 billion in debt and significantly reduce future rent obligations, estimated at around $12 billion.

The company's aggressive lease renegotiations in 2023 and 2024 were vital for exiting over 170 unprofitable locations, cutting annual rent expenses by more than $800 million. WeWork also operates under a complex web of commercial real estate laws, including zoning, fire safety, and accessibility standards, which vary globally and require constant adaptation to avoid penalties.

Data privacy regulations like GDPR and CCPA impose strict requirements on handling member data, with potential fines reaching up to 4% of global annual turnover for GDPR violations. WeWork's commitment to secure data storage and transparent usage is essential for legal compliance and maintaining member trust.

Environmental factors

Sustainability is no longer a niche concern; it's a major driver for businesses and individuals alike, fueling a strong demand for environmentally conscious office spaces. This shift directly impacts companies like WeWork, pushing them to adopt greener practices.

WeWork is responding by integrating sustainable design features across its portfolio. Think energy-saving LED lighting, smart thermostats that optimize temperature control, and furniture made from recycled or responsibly sourced materials. These aren't just aesthetic choices; they're functional elements aimed at reducing environmental impact.

This focus on green building aligns with a larger corporate movement. Many companies are actively seeking LEED or BREEAM certified spaces, recognizing that eco-friendly offices not only benefit the planet but also enhance employee well-being and can lead to operational cost savings. For instance, the global green building market is projected to reach $3.02 trillion by 2027, highlighting the significant economic impetus behind these trends.

WeWork is focusing on enhancing energy efficiency across its global portfolio, a key environmental consideration. This includes implementing smart building technologies, such as advanced HVAC systems, to optimize climate control and minimize energy waste. For instance, by 2024, many of their locations are expected to feature upgraded systems aimed at reducing consumption by up to 15% compared to older installations.

The company is also exploring the integration of renewable energy sources where practical. While widespread solar panel installation might be challenging in all urban office spaces, WeWork is actively seeking to source a greater percentage of its electricity from renewable providers. In 2023, WeWork reported that approximately 25% of its energy consumption was derived from renewable sources, with a target to increase this to 40% by the end of 2025.

WeWork is focusing on robust waste management and recycling programs as a significant environmental strategy. By implementing comprehensive recycling, proper waste segregation, and exploring composting for organic materials, they aim to significantly lessen their ecological footprint. This commitment not only aligns with growing environmental awareness but also attracts members who prioritize sustainability in their workspace choices.

Green Building Certifications

The growing emphasis on sustainability in commercial real estate means green building certifications like LEED (Leadership in Energy and Environmental Design) and IGBC (Indian Green Building Council) are gaining traction. For co-working spaces, aligning with these standards is becoming a key differentiator.

WeWork's dedication to achieving these certifications can significantly boost its brand image. It appeals to a growing segment of the market, particularly younger professionals and businesses, who actively seek out partners and environments that reflect their commitment to environmental responsibility. For instance, a 2024 survey indicated that 65% of office workers prefer workplaces with sustainability credentials.

Beyond reputation, these certifications often translate into tangible benefits for occupants and operators. Buildings with LEED certification, for example, can see energy savings of up to 30% and water savings of up to 18% compared to conventional buildings. This improved efficiency can lead to lower operating costs for WeWork and a more comfortable, healthier environment for its members.

- LEED Certification: A widely recognized global standard for sustainable building design and operation.

- IGBC Certification: A prominent green building rating system in India, promoting sustainable practices in the construction industry.

- Member Preference: Data suggests a significant portion of the workforce prioritizes environmentally conscious workplaces.

- Operational Benefits: Green certifications often correlate with reduced energy consumption and improved indoor environmental quality.

Promotion of Sustainable Commuting

WeWork can significantly contribute to environmental sustainability by actively promoting and facilitating sustainable commuting options for its members. This involves strategic site selection, prioritizing locations with robust public transportation networks. For instance, in 2024, many urban centers saw continued investment in public transit infrastructure, with cities like London and New York reporting increased ridership and expansion projects.

Beyond location, WeWork can enhance member commuting by providing essential amenities. This includes secure and ample bike storage facilities, encouraging cycling as a viable alternative to driving. Furthermore, the installation of electric vehicle (EV) charging stations directly supports members who opt for electric mobility, a sector that experienced substantial growth in new registrations globally throughout 2024, with projections indicating further acceleration into 2025.

These initiatives directly address the carbon footprint associated with daily commutes. By making sustainable options more accessible and convenient, WeWork aligns itself with broader environmental goals and corporate social responsibility mandates. This focus on reducing emissions from member travel is becoming increasingly critical as businesses worldwide aim to meet net-zero targets by 2050, with interim goals often set for 2030.

- Location Strategy: Prioritizing WeWork sites near major public transport hubs, such as metro stations or bus interchanges, to reduce reliance on private vehicles.

- On-site Amenities: Offering secure bicycle parking and repair stations, alongside EV charging points, to support eco-friendly travel choices.

- Carbon Footprint Reduction: Facilitating sustainable commuting directly lowers the Scope 3 emissions associated with member travel to and from WeWork locations.

- Member Engagement: Promoting these facilities through internal communications can foster a culture of environmental awareness among the WeWork community.

WeWork's commitment to environmental sustainability is evident in its operational choices and strategic goals. The company is actively upgrading its global portfolio with energy-efficient technologies, aiming for significant reductions in energy consumption. For example, by 2024, many locations are expected to see up to a 15% decrease in energy use compared to older installations.

The company is also increasing its reliance on renewable energy sources, targeting 40% of its energy consumption from renewables by the end of 2025, up from 25% in 2023. This focus on green practices, including robust waste management and recycling programs, appeals to a growing market segment that prioritizes eco-friendly workspaces, with 65% of office workers in a 2024 survey preferring workplaces with sustainability credentials.

WeWork is also facilitating sustainable commuting by selecting locations near public transport and providing amenities like bike storage and EV charging stations. This strategy not only reduces its members' carbon footprints but also aligns with broader corporate social responsibility goals and the global push towards net-zero emissions by 2050.

| Environmental Focus Area | WeWork Initiatives | Data/Target |

|---|---|---|

| Energy Efficiency | Smart thermostats, LED lighting, upgraded HVAC | Up to 15% reduction in energy consumption by 2024 |

| Renewable Energy | Sourcing electricity from renewable providers | Target of 40% renewable energy by end of 2025 (from 25% in 2023) |

| Waste Management | Comprehensive recycling, waste segregation, composting | Reducing ecological footprint |

| Green Building Certifications | Pursuing LEED and IGBC certifications | Enhances brand image; LEED buildings can save up to 30% on energy |

| Sustainable Commuting | Prioritizing transit-accessible locations, bike storage, EV charging | Supports member eco-friendly travel choices |

PESTLE Analysis Data Sources

Our WeWork PESTLE Analysis is built on a comprehensive review of data from reputable sources including global economic reports from institutions like the IMF and World Bank, government policy updates, and industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing WeWork's operations and strategy.