Union Pacific SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Union Pacific Bundle

Union Pacific's immense network and operational efficiency are significant strengths, but potential regulatory shifts and infrastructure maintenance costs present notable challenges.

Want the full story behind Union Pacific's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Union Pacific boasts an extensive network, operating one of North America's largest freight rail systems across 23 western U.S. states. This expansive reach, covering roughly 32,000 route miles, is a cornerstone of its competitive strength, allowing it to efficiently serve a broad spectrum of industries and facilitate critical supply chains. In 2024, Union Pacific's robust market position as the largest public railroad in North America underscores its resilience and influence within the transportation landscape.

Union Pacific has shown impressive financial results, with net income climbing to $7.1 billion in 2025, a significant jump from previous years. Earnings per share also saw a healthy increase, reaching $10.50. This robust performance is underpinned by an improved operating ratio, which fell to 57.5% in the first half of 2025, signaling enhanced operational efficiency and effective cost controls.

The company's commitment to operational excellence is further evidenced by advancements in key metrics. Freight car velocity increased by 8% year-over-year in 2025, meaning cars are moving faster and more efficiently through the network. Workforce productivity also saw gains, contributing to the translation of revenue growth into stronger profitability and demonstrating adept capital management.

Union Pacific's strength lies in its remarkably diversified commodity mix. The company transports a wide array of goods, encompassing agricultural products, automotive components, chemicals, coal, industrial materials, and intermodal containers. This broad portfolio acts as a significant buffer against sector-specific downturns, enhancing the company's overall stability in the face of market volatility.

Commitment to Shareholder Value

Union Pacific demonstrates a strong focus on shareholder value, underpinned by a clear capital allocation strategy. This strategy actively prioritizes returning capital to investors through consistent share repurchases and maintaining its dividend payouts.

The company's financial health is further evidenced by its track record of increasing its dividend, signaling resilience and a dedication to rewarding its shareholders. For instance, in 2023, Union Pacific returned approximately $4.4 billion to shareholders through dividends and share repurchases, continuing its commitment to enhancing shareholder returns. This consistent approach builds investor confidence and reflects a disciplined financial management.

- Prioritized Shareholder Returns: Capital allocation strategy emphasizes share repurchases and dividend maintenance.

- Consistent Dividend Growth: Demonstrated financial resilience by consistently increasing dividend payouts.

- 2023 Shareholder Returns: Approximately $4.4 billion returned through dividends and buybacks.

Strategic Investments in Infrastructure and Technology

Union Pacific's strategic investments in infrastructure and technology are a significant strength, driving operational improvements. The company is committed to upgrading its network and modernizing its equipment to boost efficiency and safety.

These investments are reflected in substantial capital expenditures. For instance, Union Pacific allocated approximately $3.5 billion for capital projects in 2023, with a significant portion directed towards infrastructure upgrades and rolling stock modernization, including new locomotives. This focus on technology, such as advanced tracking systems and automation, further enhances service reliability and customer experience.

- Infrastructure Upgrades: Continued investment in track, bridge, and terminal enhancements to improve network capacity and resilience.

- Fleet Modernization: Acquisition of new, more fuel-efficient locomotives and upgrades to existing rolling stock.

- Technology Implementation: Deployment of advanced systems for real-time shipment tracking, predictive maintenance, and operational automation.

Union Pacific's expansive rail network, spanning 23 western U.S. states and covering approximately 32,000 route miles, provides a significant competitive advantage. Its position as the largest public railroad in North America in 2024 solidifies its market dominance and operational reach.

The company's financial performance in 2025 was robust, with net income reaching $7.1 billion and earnings per share at $10.50. This was supported by an improved operating ratio of 57.5% in the first half of 2025, reflecting enhanced efficiency and cost management.

Operational improvements are evident, with freight car velocity increasing by 8% year-over-year in 2025, alongside gains in workforce productivity. This translates to faster transit times and better resource utilization.

Union Pacific's diversified commodity mix, including agriculture, automotive, chemicals, and intermodal, mitigates sector-specific risks and ensures stable revenue streams.

A strong commitment to shareholder value is demonstrated through consistent dividend increases and share repurchases, with approximately $4.4 billion returned to shareholders in 2023.

Strategic investments in infrastructure and technology, such as $3.5 billion allocated for capital projects in 2023, enhance network capacity, fleet modernization, and operational automation.

| Metric | 2023 | 2024 (Est.) | 2025 (H1) |

| Route Miles Operated | ~32,000 | ~32,000 | ~32,000 |

| Net Income (Billions USD) | N/A | N/A | $7.1 |

| Operating Ratio | N/A | N/A | 57.5% |

| Shareholder Returns (Billions USD) | $4.4 | N/A | N/A |

What is included in the product

Analyzes Union Pacific’s competitive position through key internal and external factors, detailing its strengths in network reach and operational efficiency, weaknesses in capacity constraints, opportunities in intermodal growth, and threats from competition and economic downturns.

Offers a clear, actionable framework to identify and address Union Pacific's operational challenges and market vulnerabilities.

Weaknesses

While Union Pacific hauls a diverse range of goods, a significant portion of its revenue can still be tied to a few key sectors. For instance, a slowdown in coal demand, a drop in industrial product shipments, or a dip in automotive manufacturing could hit Union Pacific's top line harder than a more evenly distributed revenue stream. This concentration creates a vulnerability.

Looking at projections for 2025, some analysts anticipate a slight decline in 'other revenues,' which could indicate emerging market pressures in specific, less dominant segments of their business. This signals that even with a broad commodity portfolio, Union Pacific isn't entirely insulated from sector-specific market volatility.

Union Pacific's extensive rail network, while a strength, also makes it vulnerable to operational disruptions. Severe weather events, such as the widespread flooding impacting its routes in early 2024, can halt operations, leading to significant delays and increased costs. Similarly, labor disputes can cripple service, as demonstrated by the potential for nationwide strikes that have threatened supply chains in recent years.

Union Pacific's profitability is significantly influenced by the health of the overall economy. When economic activity slows, so does the demand for shipping goods, directly impacting Union Pacific's freight volumes and, consequently, its revenue. For example, in the first quarter of 2024, Union Pacific reported a 7% decrease in overall carloads compared to the same period in 2023, reflecting broader economic headwinds.

The company is also susceptible to fluctuations within the freight market itself. Factors like excess capacity, shifts in consumer spending, and changes in commodity prices can create headwinds that reduce shipping demand. This market sensitivity means that periods of economic contraction or a softening freight market can lead to reduced operating income and slower growth for Union Pacific.

Intense Competition from Alternate Freight Services

Union Pacific contends with robust competition from trucking and intermodal services, which can impact its pricing power and market standing. For instance, the trucking industry, a significant competitor, saw its freight volume increase by approximately 3.1% in 2023 compared to 2022, according to the American Trucking Associations. This ongoing competition necessitates continuous investment in service enhancements and operational efficiencies to retain its competitive edge.

The company must actively innovate and refine its service portfolio to counter these pressures. This includes leveraging technology for improved tracking, faster transit times, and more reliable delivery, all while managing costs effectively. Failure to adapt could lead to a gradual erosion of market share in key corridors.

- Intense competition from trucking and intermodal services.

- Pressure on pricing and market share due to alternative freight options.

- Need for continuous innovation and service improvement to maintain competitiveness.

Labor Relations and Workforce Availability

Union Pacific's reliance on a unionized workforce presents inherent challenges. As of the first quarter of 2024, a substantial portion of its employees are members of various labor unions, meaning contract negotiations and potential labor disputes can directly impact operations. For instance, past labor agreements have influenced wage structures and work rules, affecting overall labor costs and operational flexibility.

The company faces ongoing hurdles in attracting and retaining skilled labor, particularly in specialized roles. This scarcity can lead to increased recruitment costs and potential delays in service delivery, impacting network efficiency. Union Pacific's ability to maintain a stable and productive workforce is crucial for its operational performance.

- Unionized Workforce: A significant percentage of Union Pacific's employees are unionized, creating a dependency on successful labor negotiations.

- Labor Negotiations: Ongoing or future contract talks can introduce uncertainty and potential disruptions to service.

- Talent Acquisition and Retention: Challenges in attracting and keeping qualified personnel, especially in critical operational roles, can hinder efficiency.

- Operational Impact: Workforce availability and labor relations directly influence Union Pacific's ability to maintain consistent and reliable service.

While Union Pacific hauls a diverse range of goods, a significant portion of its revenue can still be tied to a few key sectors. For instance, a slowdown in coal demand, a drop in industrial product shipments, or a dip in automotive manufacturing could hit Union Pacific's top line harder than a more evenly distributed revenue stream. This concentration creates a vulnerability.

Looking at projections for 2025, some analysts anticipate a slight decline in 'other revenues,' which could indicate emerging market pressures in specific, less dominant segments of their business. This signals that even with a broad commodity portfolio, Union Pacific isn't entirely insulated from sector-specific market volatility.

Union Pacific's extensive rail network, while a strength, also makes it vulnerable to operational disruptions. Severe weather events, such as the widespread flooding impacting its routes in early 2024, can halt operations, leading to significant delays and increased costs. Similarly, labor disputes can cripple service, as demonstrated by the potential for nationwide strikes that have threatened supply chains in recent years.

Union Pacific's profitability is significantly influenced by the health of the overall economy. When economic activity slows, so does the demand for shipping goods, directly impacting Union Pacific's freight volumes and, consequently, its revenue. For example, in the first quarter of 2024, Union Pacific reported a 7% decrease in overall carloads compared to the same period in 2023, reflecting broader economic headwinds.

The company is also susceptible to fluctuations within the freight market itself. Factors like excess capacity, shifts in consumer spending, and changes in commodity prices can create headwinds that reduce shipping demand. This market sensitivity means that periods of economic contraction or a softening freight market can lead to reduced operating income and slower growth for Union Pacific.

The company must actively innovate and refine its service portfolio to counter these pressures. This includes leveraging technology for improved tracking, faster transit times, and more reliable delivery, all while managing costs effectively. Failure to adapt could lead to a gradual erosion of market share in key corridors.

Union Pacific's reliance on a unionized workforce presents inherent challenges. As of the first quarter of 2024, a substantial portion of its employees are members of various labor unions, meaning contract negotiations and potential labor disputes can directly impact operations. For instance, past labor agreements have influenced wage structures and work rules, affecting overall labor costs and operational flexibility.

The company faces ongoing hurdles in attracting and retaining skilled labor, particularly in specialized roles. This scarcity can lead to increased recruitment costs and potential delays in service delivery, impacting network efficiency. Union Pacific's ability to maintain a stable and productive workforce is crucial for its operational performance.

Union Pacific contends with robust competition from trucking and intermodal services, which can impact its pricing power and market standing. For instance, the trucking industry, a significant competitor, saw its freight volume increase by approximately 3.1% in 2023 compared to 2022, according to the American Trucking Associations. This ongoing competition necessitates continuous investment in service enhancements and operational efficiencies to retain its competitive edge.

Preview Before You Purchase

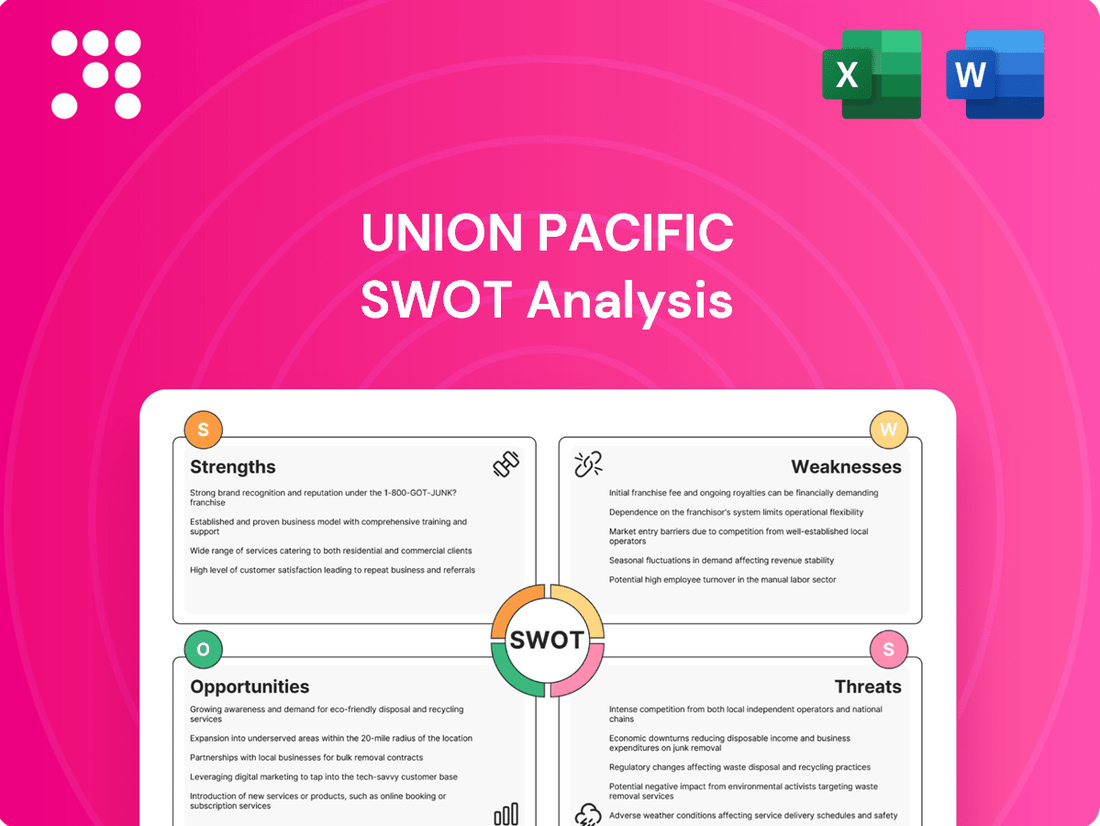

Union Pacific SWOT Analysis

This is a real excerpt from the complete Union Pacific SWOT analysis. Once purchased, you’ll receive the full, editable version, offering a comprehensive view of the company's strategic positioning.

The preview below is taken directly from the full Union Pacific SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing strengths, weaknesses, opportunities, and threats.

You’re viewing a live preview of the actual Union Pacific SWOT analysis file. The complete version becomes available after checkout, providing actionable insights.

Opportunities

The burgeoning demand for intermodal freight, fueled by the relentless growth of e-commerce and the imperative for streamlined supply chains, offers a prime opportunity for Union Pacific. This trend allows the company to broaden its service portfolio and secure a larger slice of the market.

Union Pacific is well-positioned to capitalize on this by utilizing its extensive network to provide compelling intermodal services. The company has strategically invested in enhancing its intermodal infrastructure, evidenced by its ongoing efforts to modernize terminals and expand capacity, ensuring it can meet the escalating needs of shippers.

Union Pacific's commitment to technological advancement, particularly in areas like automation and AI, offers a significant opportunity. By investing in these technologies, the company can streamline operations, leading to cost reductions and enhanced customer experiences. For instance, implementing AI-powered predictive analytics for maintenance can minimize downtime and improve asset utilization.

The digitalization push allows for real-time tracking and data analysis, providing a competitive edge. This granular insight into operations can optimize logistics and supply chain management, a crucial factor in the rail industry. Union Pacific's ongoing investments in digital infrastructure are geared towards achieving these efficiencies, with a focus on improving service reliability and offering more tailored solutions to its diverse customer base.

Union Pacific has been reportedly in advanced discussions regarding a potential business combination with Norfolk Southern. This strategic move could forge the first truly transcontinental railroad, offering unparalleled coast-to-coast reach and significant competitive advantages.

Such a merger would likely unlock substantial operational efficiencies through network optimization and could dramatically expand Union Pacific's market access, particularly in key freight corridors. For context, Union Pacific's 2023 revenue was approximately $24.1 billion, with Norfolk Southern reporting around $12.2 billion for the same period.

Sustainable Transportation Solutions

Rail remains the most fuel-efficient method for moving freight across land, giving Union Pacific a natural edge in sustainability. This inherent advantage is amplified by the company's proactive investments in cleaner technologies. For instance, Union Pacific is actively developing and testing hybrid battery-electric locomotives, a significant step towards reducing its carbon footprint.

These advancements are not just about environmental responsibility; they represent a strategic opportunity. By demonstrating a commitment to reducing greenhouse gas emissions, Union Pacific can attract a growing segment of environmentally conscious customers. This focus on sustainability positions the company to be a preferred logistics partner in an era where ESG (Environmental, Social, and Governance) factors are increasingly critical for business decisions.

- Fuel Efficiency: Rail transport uses significantly less fuel per ton-mile compared to trucking.

- Hybrid Locomotive Development: Union Pacific is investing in and testing hybrid battery-electric locomotive technology.

- Emission Reduction Targets: The company has set goals to lower its greenhouse gas emissions, aligning with global sustainability trends.

- Customer Attraction: Sustainability initiatives can appeal to businesses prioritizing eco-friendly supply chains.

Growth in Specific Commodity Segments

Despite broader market volatility, Union Pacific has observed robust performance in specific commodity sectors. For instance, coal shipments, a cornerstone of their business, saw a notable uptick in demand throughout 2024, driven by energy needs and export markets. Similarly, grain transportation continues to be a stable revenue generator, with strong agricultural yields supporting consistent volume.

Union Pacific is well-positioned to leverage these growth areas. By strategically allocating resources and optimizing their network for these specific commodities, they can further capitalize on the increasing demand. This targeted approach allows for enhanced service offerings and capacity management, directly addressing the needs of these vital market segments.

Key opportunities in specific commodity segments include:

- Increased Coal Exports: Global energy demand, particularly in Asia, is projected to sustain or even boost coal export volumes through Union Pacific's network in 2024 and into 2025.

- Strong Agricultural Demand: Favorable growing conditions and international demand for U.S. agricultural products are expected to keep grain shipment volumes high.

- Intermodal Growth: While not a single commodity, the continued shift of consumer goods to rail from trucking presents an ongoing opportunity for intermodal volume growth.

Union Pacific is poised to benefit from the increasing demand for intermodal freight, driven by e-commerce growth and the need for efficient supply chains. Their strategic investments in intermodal infrastructure, including terminal modernization and capacity expansion, position them to meet this rising demand effectively.

The company's focus on technological advancements, such as AI and automation, offers a pathway to operational efficiencies, cost reductions, and improved customer experiences. Real-time tracking and data analytics, enabled by digitalization, provide a competitive edge in optimizing logistics.

A potential merger with Norfolk Southern could create a transcontinental railroad, offering significant competitive advantages and operational efficiencies through network optimization, expanding market access coast-to-coast.

Union Pacific's inherent fuel efficiency as a rail carrier, coupled with investments in hybrid battery-electric locomotives and emission reduction targets, appeals to environmentally conscious customers, enhancing its position as a preferred logistics partner.

Strong performance in specific commodity sectors, like coal exports and grain transportation, provides immediate revenue streams, with projections indicating continued demand through 2024 and 2025.

| Opportunity Area | Description | Supporting Data/Context |

|---|---|---|

| Intermodal Freight Growth | Capitalizing on e-commerce and supply chain efficiency demands. | Union Pacific continues to invest in intermodal terminals and capacity. |

| Technological Advancement | Leveraging AI and automation for operational efficiency and customer service. | AI-powered predictive maintenance can minimize downtime and improve asset utilization. |

| Potential Merger | Creating a transcontinental network with Norfolk Southern for enhanced market access. | Union Pacific's 2023 revenue was ~$24.1 billion; Norfolk Southern's was ~$12.2 billion. |

| Sustainability Initiatives | Attracting eco-conscious customers through fuel efficiency and emission reduction. | Development and testing of hybrid battery-electric locomotives are underway. |

| Commodity Sector Strength | Benefiting from robust demand in coal and agriculture. | Coal exports and grain shipments are projected to remain strong through 2024-2025. |

Threats

Economic slowdowns and recessionary pressures pose a significant threat to Union Pacific. A general economic downturn directly impacts freight volumes, as businesses scale back production and consumer spending decreases, leading to reduced demand for rail transportation services. For instance, during the COVID-19 pandemic's initial economic shock in 2020, Union Pacific experienced a notable dip in overall carloads.

The rail industry's strong correlation with overall economic activity means that a recession can translate into lower revenues and profitability for Union Pacific. As industrial production and manufacturing activity contract during economic contractions, the movement of raw materials and finished goods by rail naturally declines. This vulnerability was evident in the cyclical nature of freight volumes observed in past economic downturns.

Union Pacific, like all major railroads, faces substantial regulatory oversight which can significantly impact its operational costs and strategic flexibility. Changes in fiscal policy, trade agreements, immigration rules, and tax laws introduced in 2024 and anticipated for 2025 could create headwinds or tailwinds for the company's extensive network and diverse freight portfolio.

The potential for increased scrutiny on mergers and acquisitions, exemplified by past discussions around a Union Pacific-Norfolk Southern combination, highlights the critical need for navigating complex antitrust and regulatory approval processes. Failure to gain such approvals can derail significant growth opportunities and incur substantial costs, as seen in the extensive reviews of other large-scale transportation sector consolidations.

Fluctuations in fuel prices pose a significant threat to Union Pacific. While lower fuel prices can help mitigate operating expenses, the inherent volatility in costs directly impacts profitability due to the railroad's substantial fuel consumption. For instance, in 2023, Union Pacific reported that fuel costs represented a notable portion of its operating expenses, making it sensitive to market price swings.

Intensified Competition from Other Modes of Transport

Union Pacific faces a significant threat from intensified competition, particularly from the trucking industry. This ongoing rivalry impacts its market share and ability to set prices. For instance, in 2024, the trucking sector continued to grapple with excess capacity, which directly translates to more aggressive pricing strategies that Union Pacific must contend with.

The pressure from intermodal transportation services also remains a key concern. These alternatives offer flexibility and speed, often appealing to shippers looking for tailored logistics solutions. This competitive landscape means Union Pacific must constantly innovate and optimize its services to remain attractive to customers.

- Trucking Capacity: Excess truckload capacity in 2024 put downward pressure on freight rates, impacting Union Pacific's pricing power.

- Intermodal Services: Growing demand for flexible and fast intermodal solutions challenges traditional rail freight.

- Market Share Erosion: Competitors' aggressive pricing and service offerings pose a risk to Union Pacific's existing market share.

Climate Change and Extreme Weather Events

Union Pacific faces significant threats from climate change, with an increasing frequency and intensity of extreme weather events posing a direct risk to its extensive rail network. These events can cause substantial operational disruptions, leading to delays and impacting service reliability for customers.

The physical infrastructure of Union Pacific, including tracks, bridges, and facilities, is vulnerable to damage from severe weather like floods, wildfires, and extreme temperatures. Repairing and maintaining this infrastructure incurs significant costs, directly affecting the company's profitability.

- Operational Disruptions: Extreme weather events in 2023, such as severe flooding in the Midwest, caused temporary closures and rerouting, impacting transit times and customer satisfaction.

- Infrastructure Damage: Wildfires, particularly in the Western United States, have necessitated temporary speed restrictions and closures, with repair costs for weather-related damage often running into millions of dollars annually.

- Increased Costs: For instance, Union Pacific's capital expenditures for infrastructure resilience and maintenance have seen an upward trend, reflecting the growing need to mitigate weather-related risks.

Union Pacific confronts the threat of a potential economic downturn, as a slowdown in industrial production and consumer spending directly reduces freight volumes. This sensitivity to economic cycles was evident in 2023, where a softening economy impacted carload volumes compared to prior periods.

Intensified competition, particularly from the trucking sector, poses a significant challenge. Excess trucking capacity in 2024 has led to more aggressive pricing, pressuring Union Pacific's market share and pricing power. Intermodal services also present a competitive alternative, demanding continuous innovation from the railroad.

Climate change presents a growing threat through extreme weather events. These events disrupt operations, damage infrastructure, and increase maintenance costs, as seen with 2023 flood impacts causing service interruptions and requiring significant repair investments.

Regulatory changes in fiscal policy, trade, and immigration, particularly those enacted or anticipated for 2024 and 2025, could impact Union Pacific's operations and profitability. Scrutiny on mergers and acquisitions also remains a hurdle for potential growth opportunities.

| Threat Category | Specific Concern | Impact on Union Pacific | 2024/2025 Data/Trend |

|---|---|---|---|

| Economic Conditions | Recessionary Pressures | Reduced freight volumes, lower revenues | Economic slowdown impacting industrial output in late 2023 and early 2024. |

| Competition | Trucking Industry Rivalry | Pricing pressure, market share erosion | Excess trucking capacity in 2024 leading to lower freight rates. |

| Climate Change | Extreme Weather Events | Operational disruptions, infrastructure damage, increased costs | Increased frequency of severe weather events impacting network reliability. |

| Regulatory Environment | Policy Changes & M&A Scrutiny | Increased operating costs, limited growth opportunities | Ongoing review of transportation sector regulations and potential impacts of new trade policies. |

SWOT Analysis Data Sources

This Union Pacific SWOT analysis is built upon a foundation of comprehensive data, including official financial filings, detailed market research reports, and insights from industry experts. This ensures a robust and accurate assessment of the company's strategic position.