Union Pacific Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Union Pacific Bundle

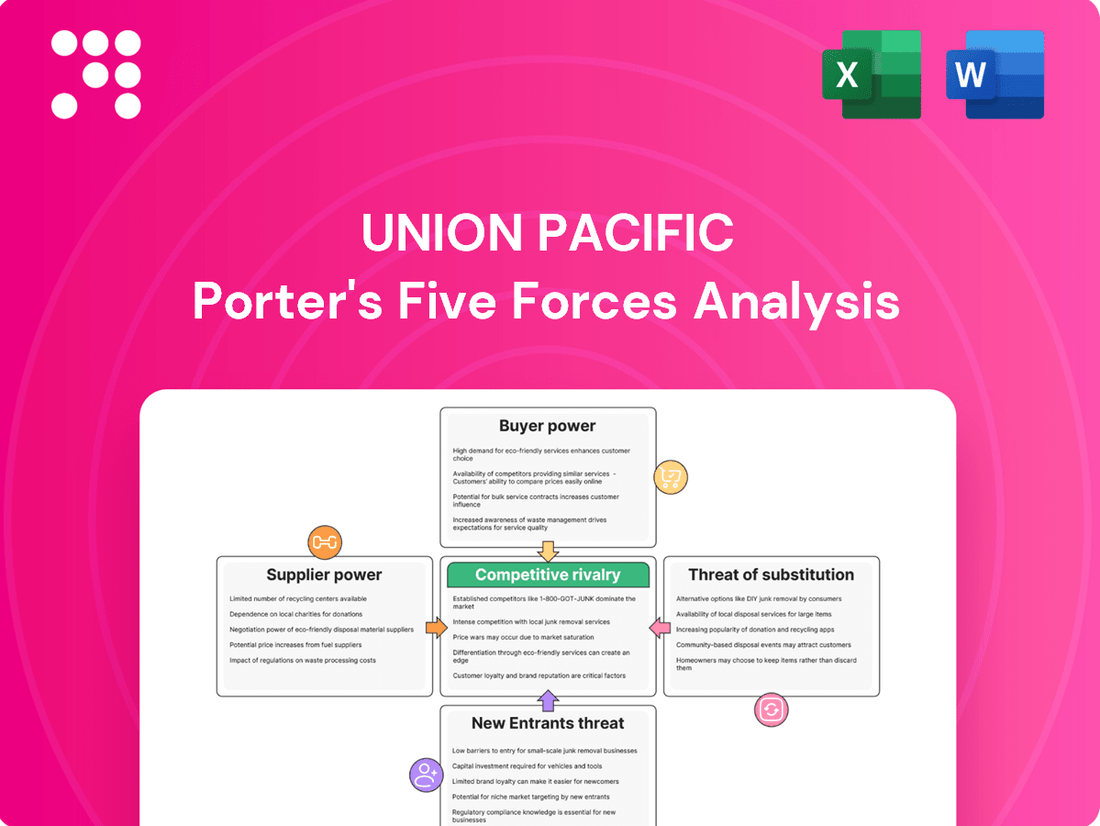

Union Pacific operates within a complex landscape, facing significant bargaining power from its major customers and the ever-present threat of new entrants disrupting established routes. Understanding these dynamics is crucial for any stakeholder looking to navigate the rail industry.

The complete report reveals the real forces shaping Union Pacific’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Union Pacific's reliance on a concentrated group of specialized suppliers for critical components like locomotives and advanced signaling systems grants these suppliers significant bargaining power. For instance, in 2024, the rail industry continues to see limited manufacturers for high-horsepower locomotives, meaning Union Pacific has few alternatives when procuring these essential assets, directly impacting pricing and contract negotiations.

Switching costs for Union Pacific to change suppliers for core assets like locomotives and signaling systems are substantial. For instance, integrating a new locomotive type into their existing fleet requires significant capital investment, extensive employee retraining, and can lead to considerable operational disruptions. This complexity makes it difficult and costly for Union Pacific to switch away from established suppliers, thereby enhancing the bargaining power of those suppliers.

The inputs from Union Pacific's key suppliers are absolutely critical for its day-to-day operations and, importantly, for maintaining safety standards. Without a consistent and high-quality supply of essential items like locomotives, track materials, and fuel, the railroad simply cannot run. This fundamental reliance means that the quality and dependable delivery from these vendors are non-negotiable aspects of Union Pacific's business.

This deep dependency significantly amplifies the bargaining power held by these crucial suppliers. For instance, in 2023, Union Pacific's cost of fuel, a key supplier input, fluctuated significantly, impacting operational expenses and highlighting the leverage fuel providers can exert. Similarly, the specialized nature of locomotive parts and track components means there are often limited alternative suppliers, further strengthening the position of existing ones.

Availability of Substitutes for Suppliers

The availability of substitutes for suppliers significantly impacts Union Pacific's bargaining power. While the company can procure some standard materials from various vendors, the rail industry relies on highly specialized equipment and technology. This scarcity of alternatives for critical components limits Union Pacific's ability to switch suppliers easily.

For example, the market for Class I freight locomotives is highly concentrated, with only a handful of global manufacturers. This limited supplier base grants these specialized equipment providers considerable leverage. In 2024, the capital expenditure for new locomotives remains a significant investment for Class I railroads, underscoring the importance of these few suppliers.

- Limited Substitutes for Specialized Rail Equipment: Union Pacific faces few alternatives for critical, industry-specific components.

- Concentrated Locomotive Market: The global supply of Class I freight locomotives is dominated by a small number of manufacturers.

- Supplier Leverage: This concentration of specialized suppliers grants them substantial bargaining power over Union Pacific.

- High Capital Investment in Locomotives: The substantial cost of new locomotives in 2024 highlights the dependence on these few providers.

Impact of Labor Unions as Suppliers

Labor unions are a significant force impacting Union Pacific's operational costs and efficiency. These unions, representing a substantial portion of the railroad's employees, wield considerable bargaining power through collective agreements that dictate wages, benefits, and working conditions. This makes labor a critical, albeit non-traditional, supplier to Union Pacific, directly influencing its financial performance.

The highly unionized structure of the rail industry amplifies the bargaining power of these labor groups. In 2024, for instance, discussions around new contracts often involve significant wage increase demands and adjustments to work rules, which can directly translate into higher operating expenses for Union Pacific. For example, the Brotherhood of Locomotive Engineers and Trainmen (BLET) and the SMART Transportation Division are key unions representing Union Pacific's train crews.

- Labor unions represent a significant portion of Union Pacific's workforce.

- Collective bargaining agreements directly influence wages, benefits, and working conditions.

- The rail industry's high unionization rate makes labor a powerful supplier of human capital.

- Union negotiations can lead to increased operating costs for Union Pacific.

Union Pacific's dependence on a limited number of specialized suppliers for critical components like locomotives and signaling systems significantly boosts supplier bargaining power. The rail industry's concentrated market for high-horsepower locomotives in 2024 means few alternatives for Union Pacific, directly impacting procurement costs and contract terms.

Switching costs for Union Pacific are substantial due to the specialized nature of rail equipment, requiring significant investment and operational adjustments. This difficulty in switching suppliers enhances the leverage of existing providers, particularly for essential assets like locomotives and track materials.

The critical nature of supplier inputs, from locomotives to fuel, for Union Pacific's operations and safety standards is undeniable. For instance, fuel costs, a key variable in 2023, demonstrated the leverage fuel suppliers hold over the railroad's operational expenses.

The limited availability of substitutes for specialized rail equipment, such as Class I freight locomotives, concentrates power with the few global manufacturers. This reality, evident in the significant capital expenditure for new locomotives in 2024, underscores Union Pacific's reliance on these select providers.

| Supplier Type | Key Inputs | Supplier Bargaining Power Factors | Impact on Union Pacific |

|---|---|---|---|

| Locomotive Manufacturers | High-horsepower locomotives | Concentrated market, high switching costs, critical input | Higher capital costs, limited negotiation flexibility |

| Signaling System Providers | Advanced signaling systems | Specialized technology, high integration costs | Dependence on specific vendors, potential for price increases |

| Fuel Suppliers | Diesel fuel | Commodity price volatility, essential operational input | Fluctuating operating expenses, impact on profitability |

| Track Material Suppliers | Steel rails, ties | Specialized manufacturing, cyclical demand | Potential for supply chain disruptions, cost pressures |

What is included in the product

Analyzes the competitive intensity within the railroad industry, assessing Union Pacific's bargaining power with suppliers and customers, and the threat of new entrants and substitutes.

Quickly identify and address competitive threats by visualizing the intensity of each Porter's Five Forces on a dynamic, interactive dashboard.

Customers Bargaining Power

Union Pacific serves a wide range of customers, from big industrial companies to farmers and those involved in intermodal transport. While no single customer makes up a huge chunk of their income, some very large clients do move a lot of goods. This volume gives them a bit of negotiating power, particularly if they can choose different rail companies or switch to other transportation methods.

However, the essential nature of rail transport for moving vast quantities of goods means that even these high-volume shippers often find rail indispensable. In 2024, Union Pacific's total revenue was approximately $24.4 billion, showcasing the scale of operations where individual customer impact, while present, is managed within this larger framework.

Customers' switching costs for Union Pacific vary significantly. For businesses with specialized rail infrastructure, like dedicated sidings or unique loading equipment, the cost to switch to trucking or another carrier involves substantial logistical overhauls and new capital expenditure. This can easily run into hundreds of thousands or even millions of dollars, making them less likely to switch.

Conversely, customers shipping more standardized goods, such as intermodal containers or bulk commodities that require less specialized handling, face lower switching costs. For these clients, the decision might hinge more on price and transit times, as the effort and expense to change providers are considerably less. This flexibility means Union Pacific must remain competitive on service and cost for these segments.

While rail transportation is inherently cost-effective for bulk and long-haul shipments, the fundamental service of moving goods by rail is largely undifferentiated. Union Pacific strives to stand out through its extensive network, consistent service reliability, and specialized equipment tailored for specific commodity needs.

However, for many clients, the critical decision-making elements remain transit speed, dependability, and cost. This focus on core performance metrics can weaken customer loyalty if other rail carriers or alternative transportation modes offer comparable or superior value propositions. For instance, in 2024, the freight rail industry continued to grapple with service challenges that impacted reliability, potentially increasing customer sensitivity to price and transit times.

Threat of Backward Integration by Customers

The threat of customers backward integrating, meaning they'd build their own rail infrastructure, is extremely low for Union Pacific. The sheer cost to acquire and operate a railroad is astronomical. For instance, Union Pacific's 2024 capital expenditures were projected to be around $3.7 billion, highlighting the massive investment needed just for maintenance and upgrades, let alone building new lines.

This immense capital requirement, coupled with the complex regulatory landscape and the specialized operational expertise needed to run a railroad safely and efficiently, makes backward integration an unrealistic option for most customers. They simply cannot replicate the scale and capabilities of a company like Union Pacific.

- Immense Capital Outlay: Building and maintaining a railroad requires billions in investment, far beyond the reach of most shippers.

- Regulatory Barriers: Navigating federal and state regulations for rail operation is a significant hurdle.

- Operational Complexity: Railroads demand specialized knowledge in logistics, safety, and maintenance.

- Lack of Viable Alternatives: Customers lack the ability to realistically become their own transportation providers.

Importance of Rail Service to Customer Operations

For many of Union Pacific's customers, especially those transporting bulk commodities such as coal, chemicals, and grains over long distances, rail service is an absolutely essential component of their supply chains. The sheer cost-effectiveness and immense carrying capacity of rail for these types of goods make it incredibly challenging for customers to maintain efficient operations without it, thereby inherently limiting their overall bargaining power.

In 2024, Union Pacific's freight revenue was significantly driven by these bulk commodity movements. For instance, coal and related products, along with agricultural products like grain, consistently represent substantial portions of their total carloads. This reliance on rail for these specific, high-volume, long-haul shipments means that alternative transportation methods often cannot compete on price or volume for these customers.

- Dependence on Rail for Bulk: Customers moving commodities like coal and grain often have limited viable alternatives to rail for long-distance, high-volume transport.

- Cost and Capacity Advantages: Rail's inherent efficiency in moving large quantities of goods over long distances provides a significant cost advantage that is difficult for customers to replicate.

- Supply Chain Integration: Rail is often deeply integrated into customer operations, making switching to other modes disruptive and costly.

- Limited Customer Leverage: This deep integration and lack of readily available alternatives reduce the bargaining power of these key customer segments.

Union Pacific's customers, particularly those shipping bulk commodities over long distances, possess limited bargaining power due to their heavy reliance on rail. The cost-effectiveness and capacity of rail for these goods make alternatives impractical, as evidenced by Union Pacific's substantial revenue from segments like coal and agriculture in 2024, totaling around $24.4 billion.

Switching costs for customers vary; those with specialized infrastructure face high expenses, while others shipping standardized goods have more flexibility. Union Pacific's extensive network and service reliability are key differentiators, but price and transit times remain critical for price-sensitive clients, especially given industry-wide service challenges in 2024.

The threat of customers backward integrating to operate their own rail infrastructure is negligible due to the immense capital outlay, estimated by Union Pacific's 2024 capital expenditure of approximately $3.7 billion, and significant regulatory and operational complexities.

| Customer Segment | Reliance on Rail | Bargaining Power Factors | Union Pacific's 2024 Revenue (Approx.) |

|---|---|---|---|

| Bulk Commodity Shippers (Coal, Grain) | Very High | Low switching costs for alternatives, essential service | Significant portion of $24.4 billion |

| Industrial Companies | High | Moderate switching costs based on infrastructure | Substantial |

| Intermodal Transport | Moderate | Lower switching costs, price/transit time sensitive | Growing segment |

Same Document Delivered

Union Pacific Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Union Pacific Porter's Five Forces Analysis you see here details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the railroad industry. Understand the strategic positioning of Union Pacific through this in-depth analysis.

Rivalry Among Competitors

The North American freight rail sector is a classic oligopoly, with a handful of Class I railroads holding significant sway. Union Pacific and BNSF are the dominant forces in the Western United States, while CSX and Norfolk Southern lead the pack in the East. This limited number of major players means competition is fierce, with each company keenly observing the others' moves regarding pricing, service quality, and infrastructure investments.

This concentrated market structure fosters a dynamic of strategic interdependence. For instance, in 2024, Union Pacific reported operating revenues of $24.1 billion, and BNSF, a subsidiary of Berkshire Hathaway, also posted substantial figures, though specific annual revenue breakdowns for BNSF are not always publicly disclosed separately. The intense rivalry compels each railroad to react to the others' strategic decisions, shaping the overall competitive landscape.

The freight rail industry's growth is closely linked to the overall economy and specific commodity markets, influencing competitive intensity. In 2023, Union Pacific reported a revenue of $24.9 billion, reflecting the demand for its services.

When the economy slows or capacity exceeds demand, railroads often engage in more aggressive competition for market share, potentially impacting pricing. Conversely, robust economic expansion and high demand can shift the focus of rivalry towards service reliability and efficient capacity utilization rather than price wars.

Union Pacific operates in an industry with exceptionally high fixed costs. Building and maintaining its vast network of tracks, bridges, and tunnels, along with a substantial fleet of locomotives and railcars, represents a massive capital investment. For instance, in 2023, Union Pacific reported capital expenditures of approximately $3.7 billion, a significant portion of which is dedicated to maintaining and upgrading this extensive infrastructure.

These substantial fixed costs, coupled with the specialized nature of rail assets, create formidable barriers to exiting the market. Once a company has invested heavily in its rail network, it is difficult and costly to divest or repurpose these assets. This economic reality compels existing players to maximize the utilization of their existing capacity, fostering intense competition to secure freight volume, even at reduced profitability levels.

Product and Service Differentiation

While the fundamental service of rail freight transport is largely standardized, Union Pacific distinguishes itself through its emphasis on service reliability, efficient transit times, extensive network coverage, and the provision of specialized equipment tailored to diverse commodity needs. This focus allows them to capture value beyond just hauling goods.

Union Pacific leverages its expansive network, robust intermodal operations, and dedicated customer service programs as key differentiators. For instance, in 2024, Union Pacific continued to invest in network enhancements aimed at improving service performance and reducing transit times for key lanes, directly impacting customer satisfaction and operational efficiency.

However, achieving significant product and service differentiation in the rail industry remains a challenge. This often results in competitive pressure on pricing, particularly for less specialized routes and commodities, where the core offering is perceived as more similar across carriers.

- Service Reliability: Union Pacific's investments in infrastructure and technology aim to improve on-time performance, a critical factor for shippers.

- Network Reach: The company's vast network across the western two-thirds of the United States provides a significant competitive advantage in terms of connectivity and reach.

- Intermodal Capabilities: Strong intermodal offerings, connecting rail with trucking and other modes, allow for flexible and efficient supply chain solutions.

- Specialized Equipment: Providing specific types of railcars for commodities like chemicals, grain, and automobiles enhances service for targeted industries.

Switching Costs for Shippers Between Railroads

For shippers dependent on a single railroad's network, the process of switching to a competitor is often complex and costly. This typically involves transloading freight, moving goods from one railcar to another, or utilizing intermodal services, both of which add significant expenses and lead times. For instance, in 2024, the average cost for transloading a container can range from $300 to $1,000, depending on the commodity and location.

However, the competitive landscape shifts dramatically for shippers with access to multiple Class I railroads or those strategically located near intermodal hubs. In these scenarios, the barriers to switching are considerably lower, which directly fuels more intense rivalry among the major rail carriers. This increased competition can lead to more favorable pricing and service agreements for these shippers.

- Shipper Dependency: Shippers reliant on a single rail line face higher switching costs due to the need for transloading or intermodal transfers.

- Intermodal Access: Proximity to intermodal hubs and access to multiple Class I railroads significantly reduces switching costs for shippers.

- Rivalry Impact: Lower switching costs in competitive environments intensify rivalry among railroads, potentially benefiting shippers.

- Cost Factors: Transloading costs in 2024 can add an estimated $300 to $1,000 per container, influencing shipper decisions.

Competitive rivalry within the freight rail sector, dominated by a few Class I railroads like Union Pacific and BNSF, is intense due to the industry's oligopolistic nature. This rivalry is further fueled by high fixed costs and specialized assets, which create barriers to entry and exit, compelling existing players to fight for market share. Union Pacific's 2023 revenues of $24.9 billion and capital expenditures of $3.7 billion highlight the scale of operations and investment required, intensifying the competition to maximize asset utilization.

While differentiation exists through service reliability and network reach, the core service can be perceived as similar, leading to price competition, especially on less specialized routes. Shippers with multiple rail access points face lower switching costs, which in turn amplifies the rivalry among carriers as they vie for these more mobile customers. This dynamic can result in more aggressive pricing and service offerings to retain or gain business.

| Key Metric | Union Pacific (2023/2024 Data) | BNSF (Subsidiary of Berkshire Hathaway) |

| Operating Revenue | $24.9 billion (2023) | Significant, specific annual figures not always publicly separated |

| Capital Expenditures | ~$3.7 billion (2023) | Substantial, focused on network and fleet upgrades |

| Competitive Focus | Service reliability, network efficiency, intermodal capabilities | Similar focus on operational efficiency and customer service |

SSubstitutes Threaten

The availability of long-haul trucking presents a significant threat to Union Pacific's rail freight business. Trucking offers a compelling alternative, especially for businesses prioritizing speed and direct, door-to-door delivery. This flexibility makes it a strong substitute for certain types of freight, particularly those that are time-sensitive or of higher value.

While rail often holds a cost advantage for bulk and long-distance shipments, trucking's ability to handle smaller volumes and deliver directly to the customer's doorstep can outweigh the per-ton-mile cost difference. For instance, in 2024, the trucking industry continued to see strong demand, with freight volumes remaining robust, underscoring its competitive position.

Furthermore, ongoing advancements in trucking technology, including the potential integration of autonomous vehicles, could further bolster its competitive edge. Such innovations might reduce operating costs and improve transit times, making trucking an even more attractive substitute for a wider range of Union Pacific's potential customers.

For bulk commodities such as coal, grain, and construction materials, barges and inland waterways present a highly cost-effective substitute for rail transport, particularly in regions with established water routes. While considerably slower than rail, their substantial carrying capacity and reduced operating expenses make them a compelling choice for freight that is not time-sensitive. This competitive pressure directly affects Union Pacific's segments dealing with bulk commodities.

Air freight poses a threat to Union Pacific, particularly for high-value, time-sensitive, or perishable goods where speed is the primary driver and cost is less of a factor. This includes sectors like electronics, pharmaceuticals, and expedited shipping. For instance, in 2024, the global air cargo market saw continued growth, with demand for express freight remaining robust, driven by e-commerce expansion.

Pipelines for Liquid and Gaseous Commodities

Pipelines represent a formidable substitute for Union Pacific, particularly for liquid and gaseous commodities like crude oil, natural gas, and refined petroleum products. Their efficiency and cost-effectiveness in continuous transport present a significant challenge.

For these specific product categories, pipelines offer compelling advantages over rail, including lower operating costs and a reduced environmental footprint. This directly affects Union Pacific's revenue streams in its energy and chemical sectors.

- Cost Efficiency: Pipeline transport can be significantly cheaper per ton-mile than rail for bulk liquids and gases.

- Volume and Continuity: Pipelines provide uninterrupted, high-volume transport, ideal for continuous industrial processes.

- Environmental Impact: Generally, pipelines have a lower greenhouse gas emission profile per unit transported compared to rail.

- Market Share Impact: In 2024, the demand for efficient energy transport continues to grow, making pipeline investments attractive, potentially diverting volume from rail.

Shipper Relocation or Supply Chain Reconfiguration

The threat of substitutes for Union Pacific's rail services is fundamentally tied to customers altering their supply chain strategies. This can involve relocating production closer to raw materials or end consumers, or embracing more localized manufacturing models. Such shifts aim to minimize transportation expenses and reduce dependence on any single logistics provider, including rail.

While these are significant, long-term strategic decisions for shippers, they represent a substantial indirect threat to rail demand. For instance, in 2024, the ongoing trend of nearshoring and reshoring, driven by geopolitical considerations and a desire for supply chain resilience, could lead some businesses to re-evaluate their manufacturing footprints. Companies that previously relied on long-haul rail for intermodal transport might find it more economical to establish regional distribution centers or even offshore production closer to their primary markets, thereby reducing the volume of goods moved by rail.

- Supply Chain Reconfiguration: Customers may relocate production facilities to reduce transportation costs and reliance on specific modes like rail.

- Nearshoring/Reshoring Trends: In 2024, these trends are influencing decisions to establish production closer to end markets, potentially decreasing long-haul rail demand.

- Localized Production: A shift towards smaller, distributed manufacturing sites can diminish the need for large-scale, long-distance freight movement by rail.

The threat of substitutes for Union Pacific is multifaceted, encompassing trucking, pipelines, barges, and even shifts in supply chain strategy. Trucking offers flexibility and speed for certain goods, while pipelines are highly efficient for liquids and gases. Barges provide cost-effectiveness for bulk commodities where speed isn't critical.

In 2024, the robust demand in the trucking sector and continued investment in pipeline infrastructure highlight the persistent competitive pressures. These alternatives directly impact Union Pacific's ability to capture and retain freight volume, particularly for specific commodity types and delivery requirements.

Furthermore, evolving customer strategies, such as nearshoring and localized production, aim to minimize long-distance transportation needs. This trend, evident in 2024, can reduce the overall demand for rail services by altering manufacturing and distribution footprints.

| Substitute Mode | Key Advantages | Impact on Union Pacific |

|---|---|---|

| Trucking | Speed, door-to-door delivery, flexibility for smaller volumes | Competition for time-sensitive and less-than-carload shipments |

| Pipelines | Cost-efficiency for liquids/gases, continuous transport, lower emissions per unit | Direct threat to energy and chemical commodity transport |

| Barges/Waterways | High capacity, low cost for bulk, non-time-sensitive goods | Competition for bulk commodities like grain and coal in relevant regions |

| Supply Chain Shifts (Nearshoring) | Reduced transportation costs, increased supply chain resilience | Potential decrease in long-haul freight volumes |

Entrants Threaten

The freight rail industry, including giants like Union Pacific, demands staggering upfront investments, effectively deterring potential new competitors. Building a functional rail network requires purchasing vast tracts of land, laying thousands of miles of track, installing complex signaling, and acquiring a fleet of locomotives and railcars, a financial hurdle that few can overcome.

New entrants into the railroad industry, like Union Pacific, encounter a formidable barrier in the extensive regulatory landscape. Navigating a complex web of federal and state regulations, including those from the Surface Transportation Board (STB) and the Federal Railroad Administration (FRA), is a significant hurdle. These regulations cover everything from safety standards and environmental compliance to operational guidelines, making the entry process both time-consuming and capital-intensive, thereby deterring many potential competitors.

Established players like Union Pacific possess extensive, decades-old infrastructure networks, granting them substantial economies of scale in operations, maintenance, and procurement. For instance, in 2024, Union Pacific reported capital expenditures of $3.4 billion, a significant investment in maintaining and enhancing its vast rail network, which spans over 32,000 route miles.

A new entrant would face immense difficulty and cost in replicating such a comprehensive network and achieving similar cost efficiencies. This inherent advantage makes it incredibly challenging for new competitors to enter the market and compete on price or service quality from day one, creating a substantial barrier.

Difficulty in Acquiring Right-of-Way and Permits

The acquisition of right-of-way and necessary permits poses a significant barrier for new rail entrants. This process involves intricate land negotiations, potential eminent domain proceedings, and rigorous environmental impact studies, all of which are time-consuming and costly. For instance, Union Pacific itself has faced lengthy permitting processes for its existing infrastructure, highlighting the inherent complexities.

The sheer difficulty and expense involved in securing these essential land assets create a formidable obstacle for any potential competitor, particularly in established or ecologically sensitive regions. This challenge is amplified by the fact that available land suitable for new rail construction is increasingly scarce and expensive.

- Land Acquisition Costs: The price of acquiring suitable land for new rail lines has steadily increased, making initial capital outlays substantial.

- Permitting Delays: Federal, state, and local permitting processes can take years, delaying project timelines and increasing uncertainty.

- Environmental Regulations: Stringent environmental reviews and mitigation requirements add significant complexity and cost to new rail development.

Brand Loyalty and Customer Relationships

Existing Class I railroads like Union Pacific have cultivated deeply entrenched brand loyalty and robust customer relationships over decades. These established players offer comprehensive, integrated logistics solutions, a critical factor for shippers who rely on consistent and dependable freight transportation. For instance, in 2024, Union Pacific continued to emphasize its customer-centric approach, highlighting long-term partnerships that underpin its service reliability.

New entrants would face a formidable challenge in replicating the trust and reputation that incumbent railroads have painstakingly built. The mission-critical nature of freight movement means businesses are hesitant to switch to unproven providers, even with potentially attractive pricing. This makes it exceptionally difficult for new companies to gain the necessary traction and secure significant freight volumes against such strong, established relationships.

- Established Relationships: Decades-long partnerships with major shippers are a significant barrier.

- Integrated Solutions: Incumbents offer more than just transport; they provide complex logistics.

- Trust and Reputation: Building credibility in a mission-critical industry takes considerable time and proven performance.

- Switching Costs: Shippers face operational and reputational risks when considering new carriers.

The threat of new entrants for Union Pacific is exceptionally low due to the immense capital requirements for infrastructure development and the extensive regulatory hurdles. New companies would need billions to replicate even a fraction of the existing rail network, a financial barrier that is practically insurmountable. Furthermore, the time and expertise needed to navigate the complex web of federal and state regulations, from safety to environmental compliance, deter many potential competitors.

Established players like Union Pacific benefit from massive economies of scale, with significant investments in 2024, such as Union Pacific's $3.4 billion in capital expenditures, reinforcing their cost advantages. This scale makes it difficult for newcomers to compete on price or service from the outset. The difficulty in acquiring rights-of-way and the lengthy permitting processes, which can take years and involve substantial costs, further solidify the position of incumbents.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building rail infrastructure requires billions in investment for land, track, signaling, and rolling stock. | Extremely high; deters most potential entrants. |

| Regulatory Landscape | Complex federal and state regulations (STB, FRA) cover safety, environment, and operations. | Significant time, cost, and expertise needed, increasing entry difficulty. |

| Economies of Scale | Incumbents like Union Pacific leverage vast networks for cost efficiencies. Union Pacific's 2024 capital expenditures of $3.4 billion highlight ongoing investment. | New entrants struggle to match cost structures and operational efficiencies. |

| Right-of-Way Acquisition | Securing land and permits is time-consuming, costly, and involves complex negotiations and environmental reviews. | Major obstacle, especially in established or sensitive areas. |

| Customer Relationships | Decades-long relationships and trust with shippers are difficult to replicate. | New entrants face challenges in securing freight volumes against established, reliable providers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Union Pacific leverages data from its annual reports, SEC filings, and industry-specific publications. We also incorporate insights from market research firms and economic databases to provide a comprehensive view of the competitive landscape.