Union Pacific Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Union Pacific Bundle

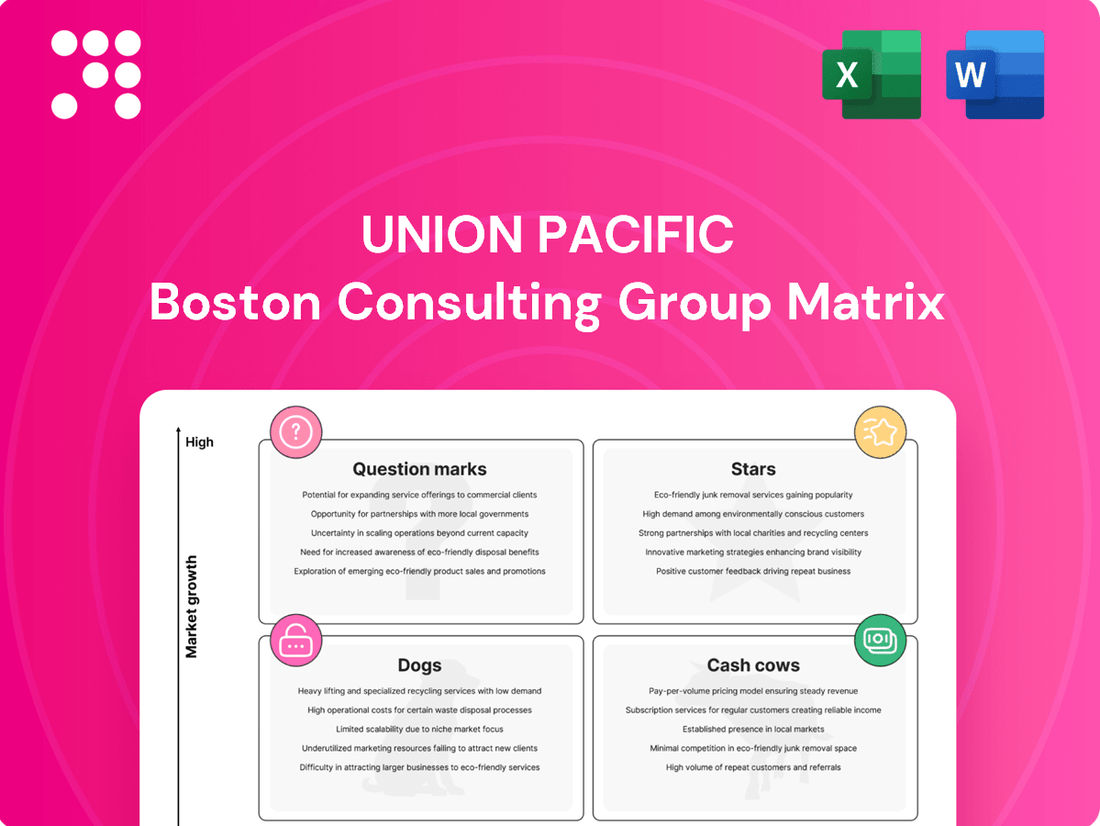

Union Pacific's BCG Matrix reveals a fascinating strategic landscape, highlighting their dominant "Cash Cows" in established rail routes and their emerging "Stars" in intermodal services. Understanding these placements is crucial for any investor looking to capitalize on the company's strengths.

This preview offers a glimpse into Union Pacific's strategic positioning, but the full BCG Matrix report unlocks a comprehensive breakdown of each business unit. Gain actionable insights into their market share and growth potential, and make informed decisions about where to invest.

Don't miss out on the complete picture; purchase the full BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Union Pacific.

Stars

Union Pacific's intermodal business, especially international, is booming. In the fourth quarter of 2024, international intermodal volumes surged by 26%, and in the first quarter of 2025, premium volumes saw a healthy 13% increase. This strong performance reflects Union Pacific's dominant position in a segment fueled by rising import activity through West Coast ports.

Union Pacific's automotive sector partnerships are a prime example of its Stars in the BCG Matrix. Collaborations with giants like Volkswagen and General Motors highlight significant growth opportunities and a strong market position within this vital industry. In 2024, Union Pacific continued to leverage these relationships, transporting millions of vehicles and components, underscoring the sector's reliance on efficient rail logistics.

Union Pacific's strategic pricing power is a key strength, allowing it to achieve consistent core pricing gains that improve its operating ratio. This ability to increase prices without significantly impacting demand is a hallmark of a strong market position.

Evidence of this pricing power can be seen in its financial performance. Freight revenue, excluding the fuel surcharge, experienced a healthy 4% increase in the first quarter of 2025 and a robust 6% rise in the second quarter of 2025. These figures underscore Union Pacific's capacity to secure higher rates for its services, even amidst volatile energy markets.

Operational Efficiency Improvements

Union Pacific's operational efficiency has reached new heights, solidifying its position as a star performer. The company reported record operating ratios, a testament to its streamlined processes and cost management.

Key improvements are evident in metrics like freight car velocity, which saw a notable 10% increase in the second quarter of 2025. Workforce productivity also climbed by 9% during the same period, demonstrating enhanced operational output.

- Record Operating Ratios Achieved

- Freight Car Velocity Increased by 10% (Q2 2025)

- Workforce Productivity Rose by 9% (Q2 2025)

- Continuous Technology and Process Investments

Network Expansion and Investment

Union Pacific is actively investing in its network to fuel growth and enhance efficiency. For 2025, the company plans capital investments totaling $3.4 billion, a significant portion dedicated to expanding its reach and upgrading existing infrastructure. This includes the development of new intermodal ramps and the establishment of industrial parks, directly supporting high-growth regions and solidifying its market leadership.

This strategic investment approach is crucial for Union Pacific's "Star" positioning within the BCG Matrix. By proactively expanding capacity and improving market access, the company is not only catering to current demand but also anticipating future opportunities. These efforts are designed to drive continued revenue growth and maintain a strong competitive advantage in the evolving transportation landscape.

Key aspects of Union Pacific's network expansion and investment strategy include:

- $3.4 billion planned capital investments for 2025

- Development of new intermodal ramps to enhance freight movement

- Establishment of industrial parks to attract and support business growth

- Focus on high-growth areas to maximize market penetration

Union Pacific's "Stars" in the BCG matrix are its high-growth, high-market-share segments. These include its booming intermodal business, particularly international, and its strong automotive sector partnerships. The company's ability to achieve consistent core pricing gains and record operating ratios further solidifies these segments as stars, driven by operational efficiencies and strategic investments.

| Segment | Growth Rate | Market Share | BCG Category |

|---|---|---|---|

| International Intermodal | 26% (Q4 2024) | High | Star |

| Automotive | Consistent Growth | High | Star |

| Operational Efficiency | N/A (Internal Metric) | N/A | Enabler of Star Status |

What is included in the product

The Union Pacific BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which segments to grow, maintain, or divest for optimal resource allocation.

A Union Pacific BCG Matrix provides a clear, visual overview of business unit performance, relieving the pain of uncertainty about where to focus resources.

Cash Cows

Union Pacific's agricultural products segment is a classic cash cow, consistently delivering significant revenue and holding a dominant market share. This strength is fueled by robust harvests and strong export demand, especially to Mexico, a key market for the company. For instance, in 2024, agricultural products represented a substantial portion of Union Pacific's overall freight revenue, demonstrating its reliable contribution to the company's financial stability.

Chemicals transportation is a cornerstone of Union Pacific's business, acting as a reliable Cash Cow. This sector consistently generates substantial revenue due to persistent industrial needs, with demand remaining strong.

In 2024, Union Pacific's Chemicals business unit continued to be a major contributor, reflecting the essential nature of chemical products in the broader economy. The segment benefits from long-term agreements, ensuring a steady flow of business and predictable income for the company.

Union Pacific's established industrial products segment functions as a classic Cash Cow within its BCG Matrix. This diverse category of goods, serving mature markets, generates substantial and consistent revenue due to its high market share and stable demand. For instance, in 2023, Union Pacific reported that its Industrial segment, which includes chemicals, plastics, and forest products, saw revenue growth, underscoring its reliable contribution to the company's financial stability.

Extensive Rail Network

Union Pacific's extensive rail network, a cornerstone of its operations, covers 23 states across the western two-thirds of the United States. This mature asset, boasting a dominant market share, functions as a prime cash cow.

The sheer scale of this infrastructure generates substantial cash flow. Crucially, its core operations require minimal additional growth investment, allowing Union Pacific to effectively leverage its existing routes and customer relationships.

- Dominant Market Position: Union Pacific operates one of the largest rail networks in North America, a significant competitive advantage.

- Mature Asset, High Cash Flow: The network's extensive reach and established routes generate consistent, strong cash flow with limited need for new capital expenditure on core infrastructure.

- Efficiency and Scale: In 2024, Union Pacific continued to focus on operational efficiency, aiming to improve train speed and reduce transit times, further enhancing the cash-generating capability of its existing assets.

- Strategic Advantage: This vast, integrated network provides a significant barrier to entry for competitors and allows Union Pacific to efficiently serve diverse industries across its service territory.

Dividend Payments and Share Repurchases

Union Pacific's robust dividend payments and significant share repurchases clearly mark it as a Cash Cow. These actions demonstrate a business that consistently generates more cash than it needs for its operations and growth initiatives.

In the first quarter of 2025, Union Pacific returned a substantial $2.5 billion to its shareholders. Looking ahead, the company has ambitious plans, intending to repurchase between $4.0 billion and $4.5 billion worth of its own shares throughout 2025. This aggressive capital allocation strategy underscores its strong free cash flow generation and a clear commitment to enhancing shareholder value.

- Consistent Dividend Growth: Union Pacific has a history of steadily increasing its dividend payouts, a hallmark of a mature, profitable business.

- Significant Share Repurchases: The company's substantial buyback programs, like the planned $4.0-$4.5 billion in 2025, directly return excess cash to investors.

- Strong Free Cash Flow: The ability to fund both dividends and large repurchases points to a business model that generates significant excess cash after all expenses and investments.

- Shareholder Value Focus: This capital return strategy signals management's confidence in the company's stability and its commitment to rewarding its owners.

Union Pacific's core rail network is a prime example of a Cash Cow. Its vast infrastructure, covering 23 states, represents a dominant market position with minimal need for new capital investment in its core operations.

This mature asset consistently generates substantial cash flow, enhanced by ongoing efficiency improvements. For instance, in 2024, Union Pacific focused on boosting operational efficiency, including increasing train speed and reducing transit times, further optimizing its cash-generating capabilities from existing routes.

The company's commitment to returning capital to shareholders, through dividends and substantial share repurchases, further solidifies its Cash Cow status. In the first quarter of 2025, Union Pacific returned $2.5 billion to shareholders, with plans for $4.0-$4.5 billion in share repurchases for the full year 2025, demonstrating strong free cash flow generation.

The agricultural products segment, driven by strong harvests and export demand, particularly to Mexico, is another key Cash Cow. In 2024, this segment contributed significantly to Union Pacific's overall freight revenue, underscoring its reliable financial contribution.

| Segment | BCG Category | Key Drivers | 2024 Data Point |

| Rail Network Infrastructure | Cash Cow | Dominant market share, operational efficiency, mature asset | Focus on increasing train speed and reducing transit times |

| Agricultural Products | Cash Cow | Strong harvests, export demand (Mexico) | Substantial portion of freight revenue |

| Chemicals Transportation | Cash Cow | Persistent industrial needs, long-term agreements | Major contributor to revenue, reflecting essential nature |

| Industrial Products | Cash Cow | Mature markets, stable demand, high market share | Revenue growth in 2023 (part of Industrial segment) |

What You See Is What You Get

Union Pacific BCG Matrix

The Union Pacific BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no altered content, and no demo versions; just the complete, professionally analyzed BCG Matrix ready for your strategic decision-making.

Rest assured, the Union Pacific BCG Matrix report you see here is precisely the file that will be delivered to you after your purchase is complete. It's a finished product, meticulously prepared to offer clear insights into Union Pacific's business units, allowing for immediate application in your strategic planning.

What you are previewing is the actual, uncompromised Union Pacific BCG Matrix document you will obtain once you complete your purchase. This means you'll have immediate access to a comprehensive analysis, formatted for professional use and ready for integration into your business strategy discussions.

Dogs

Coal transportation, despite a Q2 2025 revenue uptick from specific contracts, is firmly in the "dog" category for Union Pacific. The overarching energy transition presents significant long-term headwinds, leading to a shrinking market for this segment.

While still a revenue contributor, its low growth and declining market position mean it requires careful management to avoid becoming a cash trap. Union Pacific is actively adapting to this trend by exploring strategic pivots and diversifying its transportation services.

Union Pacific's segments dealing with construction materials, sand, and rock have seen a noticeable dip in demand. These areas, while not the company's main moneymakers, are characterized by slow growth and a small slice of the market, potentially consuming resources without generating substantial profits.

For instance, in 2024, Union Pacific reported that carloads for construction materials, including aggregates and energy products, were down compared to the previous year, reflecting broader economic slowdowns impacting infrastructure projects. This trend highlights the importance of scrutinizing these lower-return segments.

The company's strategic approach may involve carefully evaluating these less profitable business lines. A potential divestment or reallocation of resources from these low-growth areas could free up capital and enhance operational efficiency, allowing Union Pacific to focus more intently on its higher-performing segments.

Legacy infrastructure, such as older track sections or inefficient yard operations, can be considered Union Pacific's dogs in the BCG matrix. These assets often require significant capital for maintenance but generate low returns, hindering overall profitability. For instance, in 2024, Union Pacific continued its substantial investments in infrastructure upgrades, with capital expenditures projected to be around $3.5 billion, aimed at modernizing the network and improving efficiency.

Underperforming Regional Routes

Underperforming regional routes within Union Pacific's network, characterized by consistently low volumes and profitability, represent the 'Dogs' in a BCG Matrix analysis. These segments often struggle with limited growth prospects and may demand significant investment relative to their returns.

Identifying these routes is crucial for strategic resource allocation. For instance, Union Pacific's 2024 operational reports might highlight specific branch lines that have seen declining carloads, such as those serving niche agricultural or industrial sectors with shrinking demand. These routes could be candidates for optimization or potential divestiture if they consistently fail to meet profitability thresholds.

- Low Volume Segments: Routes with a consistent year-over-year decline in freight volume, indicating reduced industrial activity or shifts in supply chains.

- Profitability Challenges: Segments that operate at a loss or generate minimal profit, often due to high maintenance costs or low pricing power.

- Limited Growth Potential: Areas where economic forecasts or market analysis suggest no significant future expansion of demand for rail services.

- Strategic Review: These routes necessitate a thorough evaluation to determine if operational efficiencies can be achieved or if they should be de-emphasized to focus resources on more promising network segments.

Non-Core or Divested Assets

Union Pacific's "Dogs" in the BCG matrix would encompass non-core assets or business units that have been divested or are being considered for divestiture. These are typically segments with low market share and limited growth prospects, where the company strategically chooses to reallocate resources to more promising areas.

For instance, Union Pacific has a history of divesting non-essential operations to streamline its business. In 2023, the company continued its focus on core rail operations, which implicitly means shedding assets that do not align with this primary objective.

- Divestiture Strategy: Union Pacific actively manages its portfolio by divesting underperforming or non-strategic assets to enhance overall efficiency and profitability.

- Resource Allocation: The company prioritizes investment in its core rail network and growth opportunities, moving away from businesses with low market share and growth potential.

- Historical Context: Past divestitures, such as the sale of non-core logistics businesses, exemplify this strategy of shedding "dogs" to focus on core competencies.

- Financial Impact: Divestitures can improve financial metrics by reducing associated costs and allowing capital to be redeployed to higher-return activities.

Union Pacific's "dog" segments, characterized by low growth and low market share, include certain legacy infrastructure and underperforming regional routes. These areas, such as specific branch lines with declining carloads or older track sections requiring extensive maintenance, consume resources without generating substantial profits. For example, in 2024, Union Pacific continued significant infrastructure upgrades, with capital expenditures around $3.5 billion, highlighting the ongoing need to manage older, less efficient assets.

Coal transportation, despite recent revenue upticks from specific contracts, is firmly in the dog category due to long-term headwinds from the energy transition, leading to a shrinking market. Similarly, segments dealing with construction materials like sand and rock have seen demand dips in 2024, reflecting broader economic slowdowns impacting infrastructure projects. These lower-return segments require careful evaluation, potentially leading to divestment or resource reallocation to more profitable areas.

| Segment | BCG Category | Key Characteristics | 2024 Data/Context |

| Coal Transportation | Dog | Low growth, shrinking market due to energy transition | Revenue saw Q2 2025 uptick from contracts, but long-term outlook is weak. |

| Construction Materials (Sand, Rock) | Dog | Slow growth, small market share, impacted by economic slowdowns | Carloads down in 2024 compared to previous year. |

| Underperforming Regional Routes | Dog | Consistently low volumes and profitability, limited growth prospects | Specific branch lines serving niche sectors with shrinking demand may be candidates for optimization or divestiture. |

| Legacy Infrastructure | Dog | High maintenance costs, low returns | Requires ongoing capital investment for modernization, e.g., $3.5 billion projected CAPEX in 2024 for network upgrades. |

Question Marks

Union Pacific is actively exploring emerging technologies like hybrid switch locomotives, with a target of achieving 5-7% utilization by 2025. This positions them within the high-growth decarbonization market, a sector ripe for transformation.

Despite the promising market, these innovative solutions currently represent a small fraction of Union Pacific's overall operational fleet. Significant investment is necessary to scale these technologies and assess their potential to become future revenue drivers.

Union Pacific is channeling significant resources into digital transformation, particularly AI-powered systems for real-time tracking and predictive analytics. These initiatives are positioned as high-growth avenues, aiming to boost operational efficiency and enhance customer service. For instance, in 2024, the company has emphasized advancements in its digital freight management capabilities, expecting these to streamline logistics and provide greater visibility for shippers.

While these digital and AI endeavors represent promising areas for future competitive advantage, their direct impact on current market share is still in its nascent stages of development. The company acknowledges that substantial investment is required to fully integrate and scale these advanced technologies across its vast network to realize their full potential as a differentiating factor.

Union Pacific's strategic expansion into new intermodal ramps and industrial parks, such as the significant investment in a new intermodal facility in Kansas City slated for a 2025 opening, positions these ventures as question marks within the BCG framework. While the broader intermodal market is a star, these nascent operations are in a growth phase, demanding substantial capital to establish market presence and customer traction.

These new sites are in a burgeoning market, but their current market share is minimal, requiring significant upfront investment to attract volume and customers. Their trajectory towards becoming stars hinges on achieving rapid utilization and demonstrating a clear path to profitability in the coming years.

Potential Norfolk Southern Merger

Union Pacific is reportedly in advanced talks for a potential merger with Norfolk Southern, a move that could forge a significant transcontinental railroad network. This strategic initiative is viewed as a high-growth opportunity, promising substantial network expansion and operational efficiencies if successful. For context, in 2023, Union Pacific reported operating revenues of $24.1 billion, while Norfolk Southern's revenues reached $12.2 billion for the same year. A combined entity would possess a formidable market presence.

However, this potential merger presents a high-risk, high-reward scenario. The integration of two massive rail networks is fraught with complexity, and the path to regulatory approval is expected to be challenging, given antitrust considerations and potential impacts on competition. The success of such a transformative deal hinges on navigating these significant hurdles effectively.

- Network Expansion: A merger would create a more comprehensive transcontinental route, potentially improving service and reach.

- Efficiency Gains: Consolidation could lead to cost savings through optimized operations and asset utilization.

- Regulatory Scrutiny: Significant antitrust reviews and potential conditions from regulators are anticipated.

- Integration Challenges: Merging complex operational systems, labor forces, and cultures presents substantial execution risk.

Expansion into New or Underserved Markets

Union Pacific's strategic push into new industrial development projects, especially along the Gulf Coast, aligns with the question mark category in the BCG Matrix. These regions present significant growth opportunities, evidenced by the projected expansion of chemical and manufacturing facilities in the area. For instance, the Gulf Coast region is a hub for petrochemicals, a sector Union Pacific actively serves.

While these markets offer substantial potential for increased carload volumes, Union Pacific's current market share within them is relatively low. This necessitates considerable investment in infrastructure and a patient approach to development. The company's 2024 capital expenditure plans likely include allocations for these nascent growth areas, aiming to capture future demand.

The success of these expansion initiatives will be pivotal in determining their future classification within the BCG Matrix. Key performance indicators to monitor will include:

- New customer acquisition and carload growth in targeted Gulf Coast industrial zones.

- Return on investment for infrastructure development projects in these emerging markets.

- Market share gains against competitors in these specific industrial sectors.

- Overall contribution of these new ventures to Union Pacific's total revenue and operating income.

Union Pacific's investments in new intermodal ramps and industrial parks, alongside its strategic push into Gulf Coast industrial development, represent classic question marks. These ventures are in high-growth markets but currently hold low market share, requiring substantial capital to gain traction.

Their success hinges on rapid customer acquisition and increased carload volumes to justify the significant upfront investment and demonstrate a clear path to profitability.

The potential merger with Norfolk Southern also falls into the question mark category due to its high-risk, high-reward nature and the significant regulatory and integration hurdles that must be overcome.

The company's 2024 capital expenditure plans are crucial for tracking the development of these nascent growth areas.

BCG Matrix Data Sources

Our Union Pacific BCG Matrix is built on a foundation of robust data, integrating financial reports, operational metrics, and industry growth forecasts for comprehensive strategic insights.