Union Pacific Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Union Pacific Bundle

Unlock the strategic core of Union Pacific with its comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with key customer segments, leverage vital partnerships, and deliver value through their extensive network. Discover the engine driving their operational excellence and market dominance.

Ready to dissect the success of a transportation giant? Our full Union Pacific Business Model Canvas provides a clear, actionable roadmap of their revenue streams, cost structure, and key resources. Download it now to gain critical insights for your own strategic planning.

Partnerships

Union Pacific's interline railroad partnerships are crucial for creating a vast, transcontinental network, enabling seamless freight movement across North America. These collaborations, including agreements with eastern railroads and potential ties with entities like Norfolk Southern, extend Union Pacific's service reach far beyond its own 23-state operational footprint.

For instance, in 2024, Union Pacific continued to leverage these interline connections to facilitate the movement of goods, such as agricultural products and manufactured goods, connecting major production centers with key consumption markets through integrated rail services. This cooperative model allows for efficient door-to-door delivery, even for shipments originating or terminating outside Union Pacific's direct network.

Union Pacific relies heavily on trucking companies to provide essential first and last-mile services, ensuring seamless door-to-door delivery for its customers. These collaborations are critical for intermodal efficiency, bridging the gap between rail and road transport. In 2024, Union Pacific's commitment to intermodal growth, including these trucking partnerships, continued to be a cornerstone of its strategy to capture market share from over-the-road trucking.

For global reach and international shipments, Union Pacific partners with major ocean carriers. This allows for integrated supply chain solutions, moving goods across continents via sea and then connecting to the rail network. These alliances are vital for facilitating the flow of goods in and out of the country, supporting the vast network of international trade that Union Pacific serves.

Union Pacific cultivates deep partnerships with key customers, such as Chick-fil-A Supply and Agri Beef, to precisely address their unique shipping requirements. This collaborative approach extends to jointly developing rail-served facilities and fine-tuning intricate supply chain logistics.

Technology and Innovation Partners

Union Pacific actively partners with technology innovators to drive efficiency and safety. For instance, collaborations with providers of advanced locomotive energy management systems (EMS) are key to optimizing fuel consumption. In 2024, Union Pacific continued to invest in and deploy such technologies, aiming to reduce its environmental footprint and operating costs.

These partnerships extend to wayside detection systems and machine vision technology. These innovations allow for real-time monitoring of track conditions and rolling stock, proactively identifying potential issues before they impact operations. This proactive approach is vital for maintaining safety and minimizing service disruptions.

Furthermore, Union Pacific enhances its customer experience through technology partnerships focused on digital platforms. Upgrades to online customer portals in 2024 provided customers with more robust tools for shipment tracking, management, and data analytics, streamlining interactions and improving transparency.

- Energy Management Systems (EMS): Partnerships with technology providers to implement and refine EMS for locomotives, aiming for significant fuel efficiency gains.

- Wayside Detection and Machine Vision: Collaborations to deploy advanced sensors and vision systems for continuous monitoring of track and equipment health, bolstering safety protocols.

- Customer Portal Enhancements: Working with tech partners to upgrade online platforms, offering improved self-service capabilities and real-time data access for clients.

Government and Regulatory Bodies

Union Pacific's engagement with government and regulatory bodies is crucial for its operations. For instance, in 2023, the company reported significant investments in safety initiatives, directly influenced by Federal Railroad Administration (FRA) regulations. These partnerships ensure compliance and foster industry improvements.

These collaborations are essential for maintaining Union Pacific's operational licenses and advocating for policies that support rail infrastructure development. The company actively participates in discussions shaping future regulations and industry standards, aiming to enhance efficiency and safety across the network.

- Regulatory Compliance: Union Pacific works closely with agencies like the FRA to adhere to stringent safety regulations, crucial for its license to operate.

- Industry Advancement: Through dialogue, Union Pacific contributes to the development of best practices and technological advancements within the railroad sector.

- Policy Influence: The company engages in advocacy to support policies favorable to rail infrastructure investment and sustainable transportation.

- Operational Continuity: Maintaining strong relationships with regulators ensures uninterrupted service and operational stability.

Union Pacific's key partnerships are the backbone of its extensive network and service offerings. Collaborations with other railroads, trucking companies, and ocean carriers are vital for seamless intermodal and transcontinental freight movement, ensuring goods reach their destinations efficiently. These alliances are critical for Union Pacific's strategy to provide integrated, door-to-door logistics solutions, capturing market share and enhancing customer value.

In 2024, Union Pacific continued to strengthen its ties with technology providers, focusing on advancements in energy management systems and safety technologies like wayside detection. These partnerships are crucial for optimizing operations, reducing environmental impact, and improving overall network safety and reliability. Furthermore, partnerships with key customers and government bodies ensure tailored solutions and regulatory compliance, respectively.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Interline Railroads | Eastern Railroads, Norfolk Southern | Extends network reach, enables transcontinental movement | Facilitated movement of agricultural and manufactured goods |

| Trucking Companies | Various | First/last-mile delivery, intermodal efficiency | Supported intermodal growth and market share capture |

| Ocean Carriers | Major global carriers | Global reach, international trade integration | Supported cross-continental goods flow |

| Technology Providers | EMS, wayside detection, machine vision, digital platforms | Operational efficiency, safety, customer experience | Deployment of advanced systems, portal upgrades |

| Customers | Chick-fil-A Supply, Agri Beef | Tailored solutions, joint development | Fine-tuning supply chain logistics |

| Government/Regulatory Bodies | FRA | Compliance, industry advancement, policy advocacy | Investment in safety initiatives, adherence to regulations |

What is included in the product

A comprehensive overview of the Union Pacific Business Model Canvas, detailing its customer segments, key resources, and revenue streams to illustrate its freight transportation strategy.

This model offers insights into Union Pacific's operational structure, value propositions, and cost structure, providing a strategic blueprint for its extensive rail network.

The Union Pacific Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, simplifying the understanding of how they deliver value and manage costs.

Activities

Union Pacific's key activity is the physical movement of goods, primarily via its vast rail network spanning the western two-thirds of the United States. This core function supports the transportation of a wide array of commodities, from agricultural products and automotive components to chemicals, coal, and industrial goods.

In 2024, Union Pacific continued to focus on efficient and reliable freight transportation, a critical component of the North American supply chain. The company's extensive network is designed to handle diverse cargo types, including a significant volume of intermodal containers, which represent a growing segment of freight movement.

The company's operations in 2024 involved managing complex logistics to ensure timely delivery of essential goods. This includes optimizing train schedules, maintaining track infrastructure, and employing advanced technology to enhance operational efficiency and safety across its routes.

Union Pacific's commitment to network maintenance and infrastructure investment is crucial for its operations. In 2023, the company reported capital expenditures of approximately $3.7 billion, with a significant portion dedicated to maintaining and upgrading its extensive rail network, including tracks, bridges, and signaling systems. This ongoing investment ensures the safety, reliability, and efficiency of its freight transportation services.

These capital expenditures are not just about upkeep; they represent strategic investments in modernization. By replacing aging infrastructure and implementing new technologies, Union Pacific aims to enhance its operational capacity and reduce the likelihood of service disruptions. This proactive approach is vital for meeting the demands of its diverse customer base and maintaining a competitive edge in the logistics industry.

Union Pacific's locomotive and rolling stock management is central to its operations, focusing on keeping its vast fleet of trains and cars in top condition. This involves rigorous maintenance schedules, upgrading older equipment, and strategically purchasing new assets to meet the ever-growing demand for freight transportation. For instance, in 2024, Union Pacific continued its investment in modernizing its fleet, aiming to enhance fuel efficiency and reliability.

Optimizing the productivity of its locomotives and the length of its trains is another crucial activity. By ensuring locomotives are used efficiently and trains are as long as safely possible, Union Pacific can move more goods with fewer resources, directly impacting operational costs and service speed. This focus on efficiency is key to maintaining a competitive edge in the rail industry.

Operational Efficiency and Safety Initiatives

Union Pacific prioritizes operational efficiency and safety through continuous improvement. A key focus is the implementation of Precision Scheduled Railroading (PSR) principles, aiming to streamline operations and enhance service reliability. This involves optimizing freight car velocity and reducing time spent in terminals, directly impacting productivity.

Advanced technologies play a crucial role in these initiatives, bolstering both safety protocols and overall productivity. By leveraging these tools, Union Pacific works to improve workforce performance and ensure a safer working environment across its network.

- Precision Scheduled Railroading (PSR) implementation

- Adoption of advanced technologies for safety and productivity

- Focus on improving freight car velocity and reducing terminal dwell time

- Enhancing workforce productivity through operational improvements

Customer Relationship Management and Sales

Union Pacific's customer relationship management and sales involve actively engaging with clients to pinpoint their unique shipping needs. This means crafting personalized transportation solutions that precisely match these requirements, ensuring efficiency and cost-effectiveness. For instance, in 2024, Union Pacific continued to invest in digital platforms to give customers better control and real-time tracking of their shipments, a key factor in maintaining strong relationships.

A significant part of these activities is focused on growth, specifically attracting new businesses that can benefit from rail service. This often involves showcasing the advantages of rail transport, such as its environmental benefits and capacity for large volumes. By improving the overall customer experience, from initial contact to ongoing support, Union Pacific aims to foster long-term partnerships and secure repeat business.

- Customer Engagement: Proactively understanding client needs to offer bespoke transportation solutions.

- Digital Enhancement: Providing advanced digital tools for shipment management and enhanced visibility.

- Business Development: Actively seeking and onboarding new rail-served businesses.

- Experience Improvement: Focusing on elevating the entire customer journey for greater satisfaction and loyalty.

Union Pacific's key activities center on the efficient and safe movement of freight across its extensive rail network. This involves rigorous maintenance of its infrastructure, including tracks and bridges, to ensure reliability. The company also focuses on modernizing its locomotive and rolling stock fleet, as seen in its continued investments in new equipment throughout 2024 to improve fuel efficiency and capacity.

Operational excellence is driven by the implementation of Precision Scheduled Railroading (PSR) principles, aimed at increasing freight car velocity and reducing terminal dwell times. Furthermore, Union Pacific leverages advanced technologies to boost safety and workforce productivity across its operations. In 2023, capital expenditures reached approximately $3.7 billion, with a substantial portion allocated to network upgrades and fleet modernization.

| Key Activity | Description | 2023 Data/Focus |

|---|---|---|

| Network Operations & Maintenance | Physical movement of goods via rail; infrastructure upkeep. | Capital expenditures of ~$3.7 billion for network upgrades. |

| Fleet Management | Maintenance, upgrading, and acquisition of locomotives and rolling stock. | Continued investment in fleet modernization for efficiency in 2024. |

| Operational Efficiency | Implementing PSR, optimizing car velocity, reducing terminal times. | Focus on streamlining operations for enhanced service reliability. |

| Technology Integration | Utilizing advanced tech for safety, productivity, and customer visibility. | Digital platforms enhanced for real-time shipment tracking. |

What You See Is What You Get

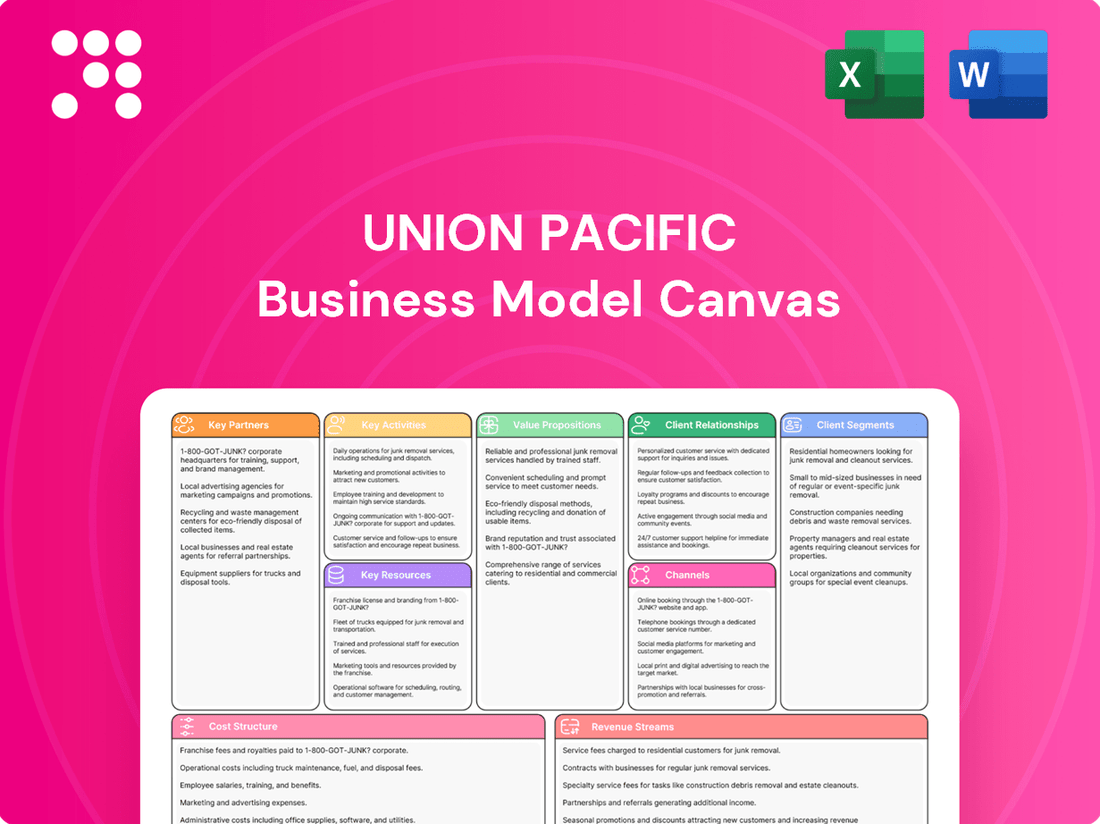

Business Model Canvas

The Union Pacific Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You'll gain full access to this professionally structured and informative document, ready for your analysis.

Resources

Union Pacific's extensive rail network, covering over 30,000 miles across 23 western U.S. states, is its core physical asset. This vast infrastructure connects vital gateways and major ports, forming the backbone of its comprehensive transportation services.

In 2024, Union Pacific continued to leverage this immense network, which is a significant competitive advantage, enabling efficient and cost-effective movement of goods. The company's ongoing investments in maintaining and upgrading this infrastructure ensure its continued reliability and capacity.

Union Pacific's extensive fleet of locomotives and diverse rolling stock, including specialized freight cars, are the backbone of its operations, facilitating the movement of everything from grain to automobiles. As of the first quarter of 2024, Union Pacific reported owning approximately 5,500 locomotives and a vast array of freight cars, numbering in the hundreds of thousands.

Maintaining and upgrading this critical asset base is paramount for operational efficiency and meeting customer demand. In 2023, Union Pacific invested roughly $3.7 billion in its capital plan, a significant portion of which was allocated to maintaining and expanding its locomotive and freight car fleet, ensuring reliability and capacity for the future.

Union Pacific's skilled workforce is a cornerstone of its operations. This includes highly trained engineers, conductors, and maintenance crews who ensure the safe and efficient movement of goods across its vast network. In 2024, the company continued to invest in training programs to maintain and enhance the expertise of these essential employees.

Logistics professionals also play a critical role, managing the complexities of rail transportation and customer service. Their knowledge is vital for optimizing routes and ensuring timely deliveries, contributing directly to Union Pacific's service reliability. The company emphasizes continuous development for these team members.

Technology and Data Systems

Union Pacific leverages advanced technology and data systems as a cornerstone of its operations. These systems are vital for optimizing efficiency, ensuring safety, and elevating the customer experience. For instance, Positive Train Control (PTC) is a significant safety enhancement, and computer-assisted dispatching streamlines train movements.

Energy Management Systems (EMS) contribute to fuel efficiency, a critical cost factor in rail operations. Furthermore, customer-facing digital platforms provide transparency and ease of interaction. Data analytics underpins many of these advancements, allowing for informed decision-making and continuous improvement across the network.

- Positive Train Control (PTC): Essential for preventing certain types of train accidents, Union Pacific reported significant progress in its PTC implementation.

- Computer-Assisted Dispatching: Enhances real-time decision-making for train movements, improving network fluidity.

- Energy Management Systems (EMS): Focuses on optimizing locomotive fuel consumption, a key operational expense.

- Customer-Facing Digital Platforms: Tools like their online shipment tracking and management systems are crucial for customer satisfaction and operational visibility.

Strategic Land Holdings and Focus Sites

Union Pacific leverages its extensive strategic land holdings, including dedicated Focus Sites, as a core resource. These are prime locations, often featuring direct rail connectivity, designed to attract large-scale industrial development. In 2024, the company continued to highlight these sites as crucial for economic development partnerships.

These Focus Sites are instrumental in driving volume growth by providing shovel-ready locations for new businesses. By offering integrated logistics solutions, Union Pacific makes these sites highly attractive for industries requiring efficient transportation. This strategic asset directly supports the company's mission to connect businesses to markets.

- Strategic Land Portfolio: Union Pacific's land holdings are a significant asset for industrial development.

- Focus Sites: These are specifically designated large-scale areas with direct rail access, optimized for attracting new businesses.

- Volume Growth Driver: The availability of these sites directly contributes to increasing freight volumes by facilitating new industrial operations.

- Economic Development: Union Pacific actively uses these holdings to foster economic growth and attract investment in the regions it serves.

Union Pacific's extensive rail network, spanning over 30,000 miles across 23 western U.S. states, is its primary physical asset. This vast infrastructure connects critical gateways and major ports, forming the foundation of its comprehensive transportation services. In 2024, the company continued to leverage this immense network, a significant competitive advantage that enables efficient and cost-effective goods movement, with ongoing investments in its upkeep and expansion.

The company's fleet of locomotives and diverse rolling stock, including specialized freight cars, are vital for moving all types of cargo. As of Q1 2024, Union Pacific owned approximately 5,500 locomotives and hundreds of thousands of freight cars. Investments in 2023, totaling around $3.7 billion, were largely directed towards maintaining and expanding this fleet to ensure future reliability and capacity.

Union Pacific's skilled workforce, comprising engineers, conductors, and maintenance crews, is crucial for safe and efficient operations across its network. In 2024, the company continued to invest in training programs to enhance employee expertise. Additionally, logistics professionals manage complex rail transportation and customer service, optimizing routes and ensuring timely deliveries, with a focus on continuous development.

Advanced technology and data systems are central to Union Pacific's operations, driving efficiency, safety, and customer experience. Positive Train Control (PTC) enhances safety, while computer-assisted dispatching streamlines train movements. Energy Management Systems (EMS) improve fuel efficiency, and digital platforms offer customers transparency and ease of interaction, with data analytics underpinning many of these improvements.

Union Pacific utilizes its strategic land holdings, including dedicated Focus Sites, as a key resource for attracting large-scale industrial development. These sites, often with direct rail connectivity, are designed to foster economic growth. In 2024, the company continued to promote these shovel-ready locations, which are instrumental in driving volume growth by facilitating new industrial operations and integrated logistics solutions.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Rail Network | Over 30,000 miles across 23 western U.S. states, connecting gateways and ports. | Core competitive advantage for efficient goods movement; ongoing infrastructure investments. |

| Locomotives & Rolling Stock | Approximately 5,500 locomotives and hundreds of thousands of freight cars (as of Q1 2024). | Essential for cargo movement; $3.7 billion capital investment in 2023 focused on fleet maintenance and expansion. |

| Skilled Workforce | Engineers, conductors, maintenance crews, logistics professionals. | Ensures safe and efficient operations; continued investment in training and development in 2024. |

| Technology & Data Systems | PTC, Computer-Assisted Dispatching, EMS, Digital Customer Platforms. | Drives efficiency, safety, and customer experience; data analytics supports informed decision-making. |

| Strategic Land Holdings | Focus Sites with direct rail access for industrial development. | Attracts new businesses, drives volume growth, and fosters economic development partnerships. |

Value Propositions

Union Pacific delivers safe, reliable, and efficient rail transport, a cornerstone for businesses needing consistent supply chains. In 2024, the company continued to leverage its vast network to ensure timely deliveries, a critical factor for customer success.

Union Pacific's value proposition centers on providing highly cost-effective shipping for bulk and long-haul freight. Rail transport, by its nature, is significantly more economical than trucking for moving large quantities of goods over extended distances, especially for commodities such as agricultural products, chemicals, and coal.

This economic advantage translates directly into substantial savings for Union Pacific's customers. For instance, in 2024, the cost per ton-mile for rail freight remains considerably lower than for trucking, a key driver for shippers of bulk materials. This efficiency makes Union Pacific a critical partner for industries reliant on moving large volumes of raw materials and finished goods across the country.

Union Pacific provides a greener transportation alternative, recognizing that trains are significantly more fuel-efficient than trucks. This translates to a lower carbon footprint for businesses, a critical factor as corporate environmental, social, and governance (ESG) goals become increasingly important.

In 2024, Union Pacific continued to emphasize its commitment to sustainability. The company reported that its operations are, on average, three times more fuel-efficient than trucking. This efficiency directly supports customers aiming to meet their own emissions reduction targets.

Extensive Network Connectivity

Union Pacific's extensive network connectivity is a cornerstone of its value proposition. Spanning 23 states, it provides a massive reach across the United States. This vast infrastructure ensures efficient movement of goods, connecting key industrial centers and agricultural regions.

This broad access is crucial for diverse supply chain needs. Union Pacific's network directly links to major U.S. ports on both the West and Gulf Coasts, facilitating international trade. Furthermore, it offers vital gateways to Mexico, streamlining cross-border commerce.

- Network Reach: Operates across 23 states, covering a significant portion of the U.S.

- Port Access: Connects to major U.S. ports, enabling global logistics.

- International Gateways: Provides crucial links to Mexico for North American trade.

Tailored Solutions and Customer Support

Union Pacific excels by collaborating directly with clients to grasp their specific shipping demands, developing bespoke transportation plans and providing attentive customer service. This commitment ensures complex logistical challenges are met with precision.

They offer advanced tracking and visibility tools, allowing customers real-time insight into their shipments. This proactive approach to information sharing is crucial for managing intricate supply chains effectively.

- Customized Logistics: Union Pacific tailors transportation strategies to individual client requirements.

- Enhanced Visibility: Providing advanced tools for shipment tracking and monitoring.

- Responsive Support: Dedicated customer service to address complex logistical needs.

Union Pacific's value proposition is built on delivering safe, reliable, and cost-effective rail transport for businesses. They offer significant savings for bulk and long-haul freight compared to trucking, a critical advantage for industries moving large volumes. Furthermore, their operations are substantially more fuel-efficient, providing a greener shipping option that aids customers in meeting their ESG goals.

| Value Proposition Element | Description | Key Benefit | Supporting Data/Fact (2024 Focus) |

|---|---|---|---|

| Cost-Effective Freight Transport | Economical for bulk and long-haul shipments. | Reduced logistics costs for customers. | Rail remains significantly more cost-efficient per ton-mile than trucking for bulk commodities. |

| Environmental Sustainability | More fuel-efficient than trucking. | Lower carbon footprint for shippers. | Union Pacific's operations are approximately three times more fuel-efficient than trucking. |

| Extensive Network and Connectivity | Vast network across 23 states with port and international access. | Efficient movement of goods, enabling broad supply chain integration. | Network connects to major U.S. ports and provides gateways to Mexico. |

| Customer-Centric Solutions | Tailored logistics plans and advanced tracking. | Optimized supply chains and enhanced visibility. | Focus on customized solutions and real-time shipment monitoring. |

Customer Relationships

Union Pacific leverages dedicated account managers to cultivate robust, enduring partnerships with its most significant business clients. This personalized strategy ensures a deep understanding and effective fulfillment of customer requirements, fostering loyalty and repeat business.

Union Pacific enhances customer relationships through robust digital self-service platforms. These online portals empower customers to manage shipments, track freight in real-time, and access billing information with unparalleled efficiency.

Recent enhancements to these digital tools, as of early 2024, prioritize a more intuitive and seamless user experience. This focus aims to reduce friction and provide customers with greater control and transparency over their logistics operations.

Union Pacific prioritizes proactive communication, keeping customers informed about shipment status and potential disruptions. In 2024, they continued to invest in digital tools to enhance transparency, aiming to reduce the need for reactive customer service by providing real-time updates. This focus on informed decision-making for their clients is a cornerstone of their customer relationship strategy.

Customer Feedback and Advisory Programs

Union Pacific prioritizes customer relationships by actively soliciting feedback through various channels. This includes regular customer surveys, in-depth interviews, and the establishment of customer advisory boards. These initiatives are designed to pinpoint areas of friction and guide service enhancements, reflecting a dedication to ongoing improvement driven by client insights.

In 2024, Union Pacific continued to leverage these programs to refine its digital platforms and operational efficiency. For instance, feedback from its advisory boards directly influenced the development of new tracking features within their online portal, aiming to provide greater transparency for shippers.

- Customer Feedback Channels: Surveys, interviews, and advisory boards are key to understanding customer needs.

- Focus on Improvement: Feedback directly informs enhancements to services and digital tools.

- Data-Driven Decisions: Union Pacific uses customer input to prioritize operational and technological upgrades.

Strategic Partnerships and Collaborations

Union Pacific cultivates strategic partnerships with key customers, moving beyond simple service provision. This involves deep integration of customer supply chains with Union Pacific’s rail network, fostering mutual growth and efficiency.

A prime example is collaborating on the development of new rail-served facilities, directly enhancing customer distribution capabilities and Union Pacific's freight volume. For instance, in 2024, Union Pacific continued its focus on intermodal growth, a sector heavily reliant on such integrated partnerships.

- Customer Integration: Deepening supply chain ties with shippers to create more efficient logistics.

- Facility Development: Jointly investing in and developing new rail-served industrial sites.

- Mutual Growth: Aligning business objectives to ensure shared success and increased freight volumes.

Union Pacific's customer relationship strategy centers on personalized service, digital empowerment, and collaborative growth. By employing dedicated account managers and sophisticated online platforms, they ensure a seamless and transparent experience for their clients.

In 2024, Union Pacific continued to refine its customer engagement through proactive communication and feedback mechanisms, directly influencing service improvements and digital tool development. This data-driven approach, incorporating insights from surveys and advisory boards, underpins their commitment to client satisfaction and operational excellence.

Their focus on strategic partnerships, including joint facility development, exemplifies a commitment to integrating customer supply chains, fostering mutual benefits and increased freight volumes, particularly evident in their intermodal growth initiatives throughout 2024.

| Customer Relationship Aspect | Key Initiatives (2024 Focus) | Impact/Data Point |

|---|---|---|

| Personalized Service | Dedicated Account Managers | Cultivates loyalty among top-tier clients. |

| Digital Self-Service | Enhanced Online Portals & Real-time Tracking | Improved customer efficiency and transparency. |

| Customer Feedback | Surveys, Interviews, Advisory Boards | Informed enhancements to digital tools and operations. |

| Strategic Partnerships | Facility Development & Supply Chain Integration | Supported intermodal growth and increased freight volumes. |

Channels

Union Pacific's direct sales force is crucial for securing freight contracts with major clients like industrial manufacturers and agricultural producers. This team builds relationships and tailors logistics solutions, directly impacting revenue generation.

In 2024, Union Pacific continued to leverage its dedicated sales force to manage intricate supply chains for key sectors. Their efforts are vital in securing long-term commitments for bulk commodities and finished goods, reflecting the importance of personalized client engagement in the rail industry.

Union Pacific’s website and dedicated online portals are crucial digital channels, enabling customers to efficiently manage shipments, access real-time tracking, and find essential information. These platforms are continuously being enhanced to offer a more intuitive and data-rich experience for users. For instance, in 2024, Union Pacific continued to invest in its digital infrastructure, aiming to streamline customer interactions and provide greater transparency throughout the supply chain.

Union Pacific's extensive network of intermodal facilities and terminals serves as the backbone for efficient freight transfer between rail and other transportation modes, particularly trucking and ocean shipping. These hubs are essential for enabling seamless multimodal logistics solutions, connecting global supply chains.

In 2024, Union Pacific continued to invest in its intermodal infrastructure, enhancing capacity and efficiency at key terminals. This focus supports the growing demand for integrated supply chain services, allowing for faster transit times and reduced handling costs for customers.

Rail Network and Track Access

The physical rail network is a core channel, directly connecting Union Pacific to customers with rail-served facilities. This extensive infrastructure, spanning approximately 32,000 route miles across 23 western U.S. states as of 2024, offers a crucial logistical advantage.

Track access agreements also function as a vital channel, enabling other railroads to utilize Union Pacific's network for a fee. This interline traffic contributes to network efficiency and broader market reach.

- Physical Network: Union Pacific's 32,000 route miles serve as the primary channel for direct rail transportation.

- Track Access: Agreements allow other carriers to use Union Pacific's tracks, expanding service reach and generating revenue.

- Customer Connectivity: Direct rail service to customer sidings is a key value proposition, streamlining supply chains.

Industry Associations and Events

Union Pacific actively engages with industry associations and participates in key events. This involvement is crucial for building relationships and staying abreast of industry trends. For instance, in 2024, the company continued its participation in organizations like the Association of American Railroads (AAR), a vital forum for policy advocacy and operational standards.

These engagements allow Union Pacific to network with peers, potential customers, and suppliers, fostering collaboration and identifying new business opportunities. It's a platform to share best practices in areas like safety and efficiency, which are paramount in the rail industry.

Events provide a stage to showcase Union Pacific's technological advancements and service offerings, reinforcing its position as a leading transportation provider. In 2024, participation in events like the annual Railway Interchange showcase demonstrated their commitment to innovation and customer engagement.

Key benefits include:

- Networking Opportunities: Connecting with industry leaders and potential clients.

- Best Practice Sharing: Learning from and contributing to industry advancements.

- Capability Showcase: Demonstrating services and innovations to a targeted audience.

- Market Intelligence: Gaining insights into competitive landscapes and emerging trends.

Union Pacific's direct sales force is pivotal for securing freight contracts with major clients, building relationships, and tailoring logistics solutions. In 2024, this team remained essential for managing complex supply chains and securing long-term commitments for bulk commodities and finished goods, highlighting the value of personalized client engagement.

Customer Segments

Agricultural Businesses are a cornerstone for Union Pacific, encompassing a wide array of producers and distributors. This includes those handling grain and its products, essential fertilizers, and the critical refrigerated goods that keep our food supply chain moving. Union Pacific's role is to bridge these vital agricultural markets with processing centers and international export terminals, ensuring the efficient flow of goods.

In 2024, the agricultural sector continued to rely heavily on robust transportation networks. For instance, Union Pacific moved approximately 1.1 million carloads of agricultural products, including grains, soybeans, and fertilizers, demonstrating its significant contribution to this segment's operations and the broader food economy.

Union Pacific plays a crucial role in the automotive industry, transporting both finished vehicles and essential parts for major manufacturers. In 2024, the company continued to be a vital link in the supply chain, moving millions of vehicles and tons of automotive components across its extensive rail network. This segment demands high efficiency and dependability to meet the stringent just-in-time inventory and delivery schedules that define modern automotive production.

The chemical and petroleum industries represent a crucial customer segment for Union Pacific, involving the transportation of a wide array of products including plastics, chemicals, and refined petroleum. These shipments frequently demand specialized equipment and rigorous adherence to safety protocols, areas where Union Pacific excels.

In 2024, Union Pacific's network facilitated the movement of significant volumes for these sectors. For instance, the company reported moving millions of carloads of chemicals and energy products, underscoring its vital role in the supply chain for these industries.

Coal and Renewable Energy Producers

Union Pacific serves both traditional coal producers and emerging renewable energy companies, recognizing the evolving energy landscape. While coal volumes have experienced a downward trend, the company remains a critical logistics partner for power generation needs. In 2023, Union Pacific's coal revenue was approximately $3.1 billion, reflecting its continued, albeit reduced, role in this sector.

The company's strategy within this segment centers on providing efficient, high-volume bulk transportation solutions. This includes moving materials for renewable fuels, such as ethanol and biodiesel, which are gaining traction. Union Pacific's commitment to this diverse energy portfolio underscores its adaptability to market shifts.

- Serving Diverse Energy Needs: Union Pacific transports both coal for power generation and materials for renewable fuels.

- Adapting to Market Trends: The company continues to support the coal sector while expanding its services for renewable energy producers.

- Focus on Efficiency: This customer segment relies on Union Pacific for high-volume, cost-effective bulk transportation.

- Financial Contribution: Coal revenue represented a significant portion of Union Pacific's freight revenue in recent years.

Industrial Product Manufacturers

Industrial Product Manufacturers represent a core customer segment for Union Pacific, encompassing businesses that transport diverse materials like metals, minerals, lumber, and construction supplies. These companies rely on efficient, large-scale logistics for both their raw material inputs and finished products.

The demand for these industrial goods directly impacts shipping volumes. For instance, in the first quarter of 2024, Union Pacific reported a 3% increase in carload traffic for industrial products compared to the same period in 2023, highlighting the segment's continued importance. This growth is driven by ongoing infrastructure projects and manufacturing activity.

- Bulk and Carload Services: This segment primarily utilizes Union Pacific's bulk and carload services, which are designed for high-volume, often single-commodity shipments.

- Supply Chain Reliability: Manufacturers depend on Union Pacific for consistent and reliable delivery of materials to keep their production lines running smoothly.

- Economic Indicators: The shipping activity within this segment often serves as a leading indicator for broader economic trends in construction and manufacturing.

Union Pacific's customer base is broad, encompassing key sectors critical to the economy. These include agriculture, automotive, chemicals and energy, diversified industrials, and intermodal freight. Each segment relies on Union Pacific for efficient, large-scale transportation solutions.

In 2024, Union Pacific continued to move vast quantities of goods across these segments. For example, agricultural shipments remained robust, while the automotive sector's demand for parts and finished vehicles underscored the need for reliable logistics. The company's performance in these areas directly reflects its integral role in national supply chains.

The company's diversified customer portfolio highlights its adaptability. In 2024, Union Pacific reported significant carloads across various commodities, demonstrating its capacity to serve a wide range of industrial and consumer needs. This broad reach ensures resilience and continued relevance in the transportation landscape.

| Customer Segment | Key Products/Services | 2024 Relevance |

|---|---|---|

| Agriculture | Grains, fertilizers, refrigerated goods | Moved ~1.1 million carloads of agricultural products. |

| Automotive | Finished vehicles, auto parts | Transported millions of vehicles and tons of components. |

| Chemicals & Energy | Plastics, chemicals, refined petroleum | Moved millions of carloads of chemicals and energy products. |

| Industrial Products | Metals, minerals, lumber, construction supplies | 3% increase in carload traffic for industrial products in Q1 2024. |

| Intermodal | Containers, trailers | Key for efficient movement of consumer goods and e-commerce. |

Cost Structure

Union Pacific's operating expenses are heavily influenced by fuel, which is a variable cost tied to transportation volumes and market prices. In 2024, fuel costs remain a significant factor, though efficiency gains and alternative fuels are being explored.

Compensation and benefits for its extensive workforce, comprising engineers, conductors, and support staff, represent another substantial operating expense. Union Pacific's commitment to safety and employee well-being impacts these costs, with ongoing investments in training and health programs.

Purchased services and materials, including track maintenance, equipment repair, and supplies, also form a considerable part of the cost structure. Managing these expenditures effectively through strategic sourcing and operational improvements is vital for maintaining profitability in 2024.

Union Pacific's infrastructure maintenance and capital expenditures are a cornerstone of its operations. In 2024, the company projected capital expenditures of approximately $3.5 billion. This significant investment is crucial for maintaining and upgrading its extensive rail network, encompassing track, ties, and ballast, ensuring safety and operational efficiency.

Union Pacific's cost structure heavily features the acquisition, upkeep, and modernization of its vast fleet of locomotives and freight cars. These capital expenditures are substantial, reflecting the need for advanced, efficient rolling stock.

In 2024, Union Pacific continued its significant investment in its fleet. For instance, the company planned to invest billions in infrastructure and equipment, with a notable portion allocated to modernizing its locomotive fleet and maintaining its extensive network of freight cars to ensure operational efficiency and capacity.

Ongoing maintenance and repair expenses are a critical part of these equipment costs. This includes everything from routine servicing to major overhauls, ensuring the reliability and safety of its assets, which directly impacts operational uptime and service delivery.

Technology and Safety Investments

Union Pacific's commitment to technological advancement and safety significantly impacts its cost structure. Ongoing investments are channeled into sophisticated systems designed to boost operational efficiency and enhance safety across its vast network. These expenditures are crucial for maintaining a competitive edge and minimizing potential disruptions.

Key areas of investment include advanced monitoring technologies like wayside detectors, which provide real-time data on track and equipment conditions, and the implementation of Positive Train Control (PTC) systems. Furthermore, robust cybersecurity measures are a growing expense, essential for protecting sensitive operational data and preventing cyber threats.

- Technology Investments: Union Pacific invested approximately $3.7 billion in capital projects in 2023, a portion of which directly supports technology for efficiency and safety.

- Safety Systems: The rollout and maintenance of Positive Train Control (PTC) represent a substantial ongoing cost, with industry-wide investments in the billions.

- Cybersecurity: As digital threats evolve, Union Pacific allocates resources to safeguard its critical infrastructure and data, a cost that is expected to grow.

Fixed Costs and Depreciation

Union Pacific's fixed costs are considerable due to its vast network of tracks, bridges, and tunnels, along with a large fleet of locomotives and freight cars. These are essential for its operations and represent a significant upfront investment.

Depreciation is a major component of these fixed costs. For instance, in 2023, Union Pacific reported depreciation and amortization expenses of approximately $3.7 billion. This reflects the wear and tear on their extensive physical assets over time.

- Infrastructure Maintenance: Costs associated with maintaining the rail network, including track repairs and signal systems, are ongoing fixed expenses.

- Equipment Depreciation: The significant capital investment in locomotives and rolling stock leads to substantial annual depreciation charges.

- Property Taxes: Taxes on the land and facilities owned by Union Pacific contribute to its fixed cost base.

- Depreciation Expense (2023): Approximately $3.7 billion, highlighting the impact of long-lived assets on the cost structure.

Union Pacific's cost structure is dominated by operating expenses such as fuel, compensation, and purchased services, alongside significant capital expenditures for infrastructure and fleet modernization. These costs are managed through efficiency initiatives and strategic sourcing to ensure profitability.

The company's fixed costs are substantial, primarily driven by the depreciation of its extensive rail network and rolling stock, as well as ongoing infrastructure maintenance and property taxes. These long-term investments are critical for operational continuity.

In 2023, Union Pacific's depreciation and amortization expenses alone amounted to approximately $3.7 billion, underscoring the significant impact of its physical assets on its cost base. The company projected capital expenditures of around $3.5 billion for 2024, with a focus on network upgrades and fleet enhancements.

Key cost drivers include fuel, which fluctuates with market prices, and employee compensation and benefits for its large workforce. Investments in technology and safety systems, like Positive Train Control (PTC), also represent substantial ongoing expenditures, with cybersecurity costs emerging as an increasingly important factor.

| Cost Category | 2023 Data (Approx.) | 2024 Outlook | Key Drivers |

| Depreciation & Amortization | $3.7 billion | Continued significant expense | Wear and tear on rail network and rolling stock |

| Capital Expenditures | $3.7 billion (2023 projects) | $3.5 billion projected | Infrastructure upgrades, locomotive modernization, fleet maintenance |

| Fuel | Variable | Variable | Transportation volumes, market prices |

| Compensation & Benefits | Significant | Ongoing | Workforce size, safety and training investments |

| Purchased Services & Materials | Considerable | Managed through sourcing | Track maintenance, equipment repair, supplies |

| Technology & Safety Investments | Ongoing | Increasing | PTC implementation, wayside detectors, cybersecurity |

Revenue Streams

Union Pacific generates substantial revenue from transporting bulk commodities. This includes vital sectors like agriculture, with grain and grain products forming a core component. Fertilizers, essential for crop yields, and food and refrigerated products also contribute significantly to this revenue stream.

The company also sees considerable income from the movement of coal and, increasingly, renewables. In 2024, bulk commodities represented a foundational element of Union Pacific's freight revenue, underscoring the ongoing demand for efficient, large-scale transportation of these essential goods.

Union Pacific's freight revenue from industrial products is a cornerstone of its business, generating substantial income from transporting essential materials like chemicals, plastics, metals, and minerals. This segment frequently represents the largest portion of their overall revenue. For instance, in 2024, industrial product shipments continued to be a dominant force, contributing significantly to the company's financial performance.

Freight revenue from premium shipments, encompassing high-value and time-sensitive cargo like intermodal containers and automotive products, represents a significant income source. This segment is a strategic focus for growth, capitalizing on the railroad's extensive network to ensure swift and dependable delivery. For instance, in 2023, Union Pacific's intermodal revenue saw a notable contribution, reflecting the demand for expedited logistics.

Fuel Surcharge Revenue

Union Pacific generates revenue through a fuel surcharge, a mechanism designed to offset the unpredictable costs associated with energy price swings. This surcharge is passed on to customers, helping the company manage the financial impact of volatile fuel markets on its operational expenses.

For instance, in the first quarter of 2024, Union Pacific reported that its revenue per revenue-generating carload was positively impacted by the fuel surcharge. This revenue stream is crucial for maintaining profitability in an industry heavily reliant on diesel fuel. The surcharge's effectiveness is directly tied to the fluctuations in diesel prices, which can significantly alter transportation costs.

- Fuel Surcharge: A direct pass-through to customers to cover fluctuating fuel expenses.

- Impact on Operating Expenses: Helps mitigate the financial strain of volatile energy prices.

- Revenue Driver: Contributes to overall revenue by adjusting for market conditions.

- 2024 Performance: Benefited revenue per carload in early 2024, demonstrating its importance.

Accessorial and Other Revenues

Union Pacific generates additional revenue through various accessorial charges. These fees are levied for services beyond basic transportation, including demurrage (charges for exceeding free time for loading or unloading rail cars), storage of goods, and switching services. In 2024, these ancillary revenues play a crucial role in optimizing asset utilization and capturing value from specialized services.

Beyond these service-based fees, Union Pacific also benefits from revenues generated by its other subsidiary operations. These can encompass a range of activities that complement the core rail business. For instance, in 2023, Union Pacific's other income, which includes these subsidiary revenues, contributed a notable portion to its overall financial performance.

Key components of these accessorial and other revenues include:

- Demurrage and Storage Fees: Charges for exceeding allotted times for rail car usage at customer facilities.

- Switching Charges: Fees for moving rail cars between different tracks or yards.

- Other Miscellaneous Fees: Revenue from services like re-weighing, inspection, and specialized handling.

- Subsidiary Operations: Income derived from businesses that support or are related to the primary rail network.

Union Pacific's revenue streams are diverse, built upon its extensive rail network. The company transports a wide array of goods, from bulk commodities like agriculture and coal to industrial products such as chemicals and metals. Premium shipments, including intermodal and automotive products, also contribute significantly, highlighting the demand for efficient, high-value logistics.

A notable revenue component is the fuel surcharge, which adjusts for energy price volatility and directly impacts revenue per carload. Additionally, accessorial charges for services like demurrage and switching, along with income from subsidiary operations, further diversify Union Pacific's financial base.

| Revenue Stream | Description | 2024 Data/Impact |

|---|---|---|

| Bulk Commodities | Transport of agriculture, coal, fertilizers, food, and refrigerated products. | Foundation of freight revenue; ongoing demand. |

| Industrial Products | Movement of chemicals, plastics, metals, and minerals. | Dominant force in revenue; significant financial contribution. |

| Premium Shipments | High-value, time-sensitive cargo like intermodal and automotive. | Strategic growth area; notable intermodal revenue in 2023. |

| Fuel Surcharge | Pass-through to customers to cover fuel cost fluctuations. | Positively impacted revenue per carload in Q1 2024. |

| Accessorial Charges | Fees for demurrage, storage, and switching services. | Optimize asset utilization and capture value from specialized services in 2024. |

| Other Subsidiary Operations | Income from complementary business activities. | Contributed a notable portion to overall performance in 2023. |

Business Model Canvas Data Sources

The Union Pacific Business Model Canvas is built upon a foundation of comprehensive financial disclosures, detailed operational data, and extensive market research. These sources ensure each block is filled with accurate, up-to-date information reflecting the company's strategic direction.