Union Pacific PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Union Pacific Bundle

Understand how political, economic, and technological forces impact Union Pacific's performance. This ready-made PESTEL Analysis delivers expert-level insights—perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

Union Pacific operates under the watchful eye of federal agencies like the Surface Transportation Board (STB) and the Federal Railroad Administration (FRA). These bodies set the rules for everything from how much can be charged for shipping to how safe the trains must be.

For instance, in 2024, the STB continued its focus on improving railroad performance and addressing service issues, which can lead to increased scrutiny and potential operational adjustments for Union Pacific. Stricter safety mandates, a constant concern, could also necessitate significant capital expenditures.

The political winds directly shape these regulations. A more interventionist government approach could mean tighter controls on pricing and service, potentially impacting Union Pacific's revenue streams and operational strategies. Conversely, a deregulatory environment might offer more flexibility.

Fluctuations in U.S. trade policies, such as tariffs and trade agreements, directly impact Union Pacific's freight volumes, particularly for intermodal and agricultural goods. For instance, the U.S. imposed tariffs on goods from China starting in 2018, which altered trade flows and affected the types of goods moving across Union Pacific's network.

Geopolitical tensions and evolving international economic relations can create significant disruptions in global supply chains. These disruptions can lead to unpredictable shifts in freight demand and necessitate changes in established shipping routes, directly influencing Union Pacific's operational efficiency and revenue streams.

Government investment in transportation infrastructure, particularly rail, directly impacts Union Pacific's operational environment. For instance, the U.S. government's Infrastructure Investment and Jobs Act, enacted in late 2021, allocated significant funds towards transportation projects. While specific rail allocations are still being detailed, the overall emphasis on infrastructure suggests potential for grants and public-private partnerships that could boost network capacity and efficiency for Union Pacific.

Labor Relations and Legislation

Union Pacific operates within a U.S. freight rail sector heavily influenced by robust labor unions. Legislative actions concerning collective bargaining, worker conditions, and the possibility of strikes have a direct impact on the company's operations and profitability. For instance, the potential for government intervention in labor disputes, as seen in past negotiations, can significantly alter operational costs and service continuity.

In 2024, the ongoing dialogue around labor agreements and potential legislative changes remains a key factor for Union Pacific. The Surface Transportation Board (STB) plays a role in overseeing rail labor relations, ensuring that disruptions are minimized. The company's ability to maintain stable labor relations is paramount to ensuring uninterrupted service and meeting customer demand, especially given the critical role of rail in the supply chain.

Key considerations for Union Pacific regarding labor relations include:

- Negotiation outcomes: The terms of new collective bargaining agreements directly affect wages, benefits, and work rules, impacting operating expenses.

- Legislative impact: New or revised labor laws could alter the balance of power in negotiations or introduce new compliance requirements.

- Strike potential: The threat or occurrence of strikes can lead to significant service disruptions and financial losses, as demonstrated by historical industry-wide labor actions.

- Workforce availability: Changes in working conditions or union agreements can influence the availability and retention of skilled labor, crucial for efficient operations.

Political Stability and Economic Policy

Political stability in the United States directly impacts Union Pacific's operational environment. A stable political landscape encourages business investment and consumer spending, which in turn boosts freight demand. For instance, the Biden administration's focus on infrastructure spending, including significant investments in rail modernization through the Infrastructure Investment and Jobs Act of 2021, is designed to support long-term economic growth and freight transportation efficiency.

Economic policies enacted by the U.S. government play a crucial role in shaping Union Pacific's market. Tax policies, such as corporate tax rates, can affect profitability and investment decisions. Furthermore, government subsidies or stimulus packages aimed at specific industries, like manufacturing or energy, can directly influence the volume and type of goods transported by rail. The Federal Reserve's monetary policy, influencing interest rates, also impacts borrowing costs for capital expenditures and overall economic activity.

- Infrastructure Investment: The Infrastructure Investment and Jobs Act allocated billions towards transportation infrastructure, benefiting rail networks.

- Economic Growth Projections: Forecasts for U.S. GDP growth in 2024 and 2025 will directly correlate with anticipated freight volume increases for Union Pacific. For example, if the U.S. economy is projected to grow by 2.5% in 2025, this generally translates to higher demand for freight services.

- Trade Policies: Changes in international trade agreements and tariffs can significantly alter cross-border freight volumes, a key segment for Union Pacific.

Government regulations, particularly from the STB and FRA, heavily influence Union Pacific's operations in 2024 and 2025, dictating service standards and safety protocols. Political stability and infrastructure spending, like the Infrastructure Investment and Jobs Act, directly impact freight demand and network improvements. Labor relations, managed through union negotiations and potential legislative oversight, remain critical for service continuity and cost management.

What is included in the product

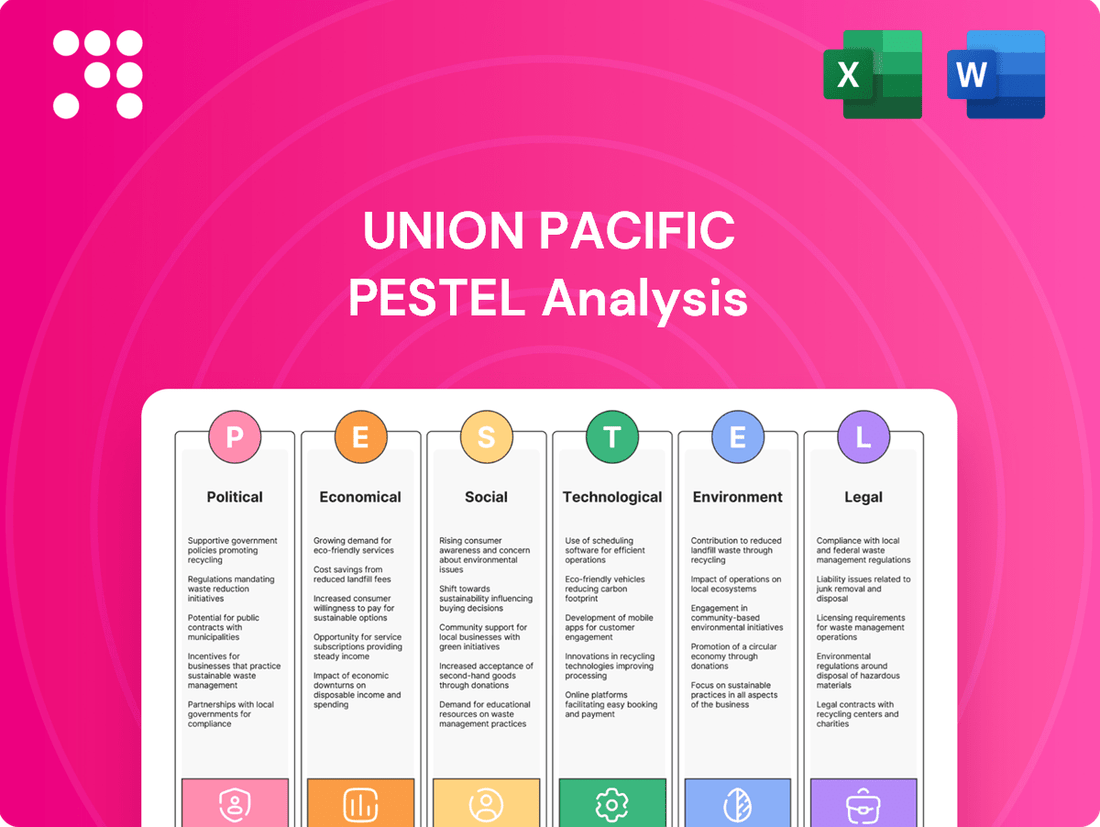

The Union Pacific PESTLE analysis dissects the critical external forces shaping its operational landscape, from government regulations and economic shifts to societal trends and technological advancements impacting the rail industry.

It provides a comprehensive framework for understanding the complex interplay of political, economic, social, technological, environmental, and legal factors that present both challenges and opportunities for Union Pacific's strategic planning.

A PESTLE analysis for Union Pacific offers a structured way to identify and address external factors that could impact operations, transforming potential disruptions into manageable challenges.

By dissecting political, economic, social, technological, environmental, and legal influences, Union Pacific can proactively mitigate risks and capitalize on emerging opportunities, thereby relieving operational pain points.

Economic factors

Union Pacific's financial performance is intrinsically linked to the overall health of the U.S. economy and the output of its industrial sectors. When the economy is robust, demand for moving goods—from raw materials to finished products—surges, directly boosting Union Pacific's freight volumes and, consequently, its revenue.

For instance, in the first quarter of 2024, Union Pacific reported a revenue of $5.9 billion. This figure directly reflects the level of economic activity and industrial production during that period. A strong industrial production index, indicating increased manufacturing and output, typically translates into higher demand for rail transportation services.

Conversely, economic slowdowns or recessions typically see a contraction in freight movement, impacting Union Pacific's top line. The company's diversified commodity portfolio, however, offers some resilience, as a downturn in one sector might be offset by relative strength in another, smoothing out the impact on overall revenue.

Union Pacific's profitability is significantly tied to diesel fuel prices, a major operating cost. For instance, in the first quarter of 2024, the company reported that fuel represented a substantial portion of its operating expenses, though specific percentages fluctuate with market prices. This sensitivity means that spikes in global oil prices can directly squeeze margins if Union Pacific can't offset them through surcharges or operational improvements.

The company actively employs hedging strategies to mitigate the impact of volatile fuel costs, aiming to lock in prices for a portion of its anticipated fuel consumption. Furthermore, ongoing investments in fuel efficiency initiatives, such as modernizing its locomotive fleet and optimizing train speeds, are critical for managing this inherent risk and maintaining cost control throughout 2024 and beyond.

Interest rates directly impact Union Pacific's cost of capital, a crucial factor for funding its extensive infrastructure projects, such as track maintenance and expansion, and for upgrading its locomotive fleet. For instance, if the Federal Reserve maintains a higher interest rate environment, borrowing for these capital-intensive initiatives becomes more expensive.

In 2024, the Federal Reserve's benchmark interest rate has remained elevated, hovering around the 5.25%-5.50% range. This sustained higher rate environment means Union Pacific faces increased borrowing costs for new debt issuance or refinancing existing debt. Consequently, projects requiring significant upfront investment, like the adoption of new, more fuel-efficient locomotives or advanced signaling systems, could see their feasibility scrutinized more closely, potentially leading to phased rollouts or scaled-back investment plans.

The ability to access affordable capital is paramount for Union Pacific's long-term growth and operational efficiency. Should interest rates persist at higher levels through 2025, the company might need to rely more heavily on retained earnings for capital expenditures or seek more creative financing solutions to manage the increased cost of debt, directly affecting the pace of modernization and expansion efforts.

Inflation and Consumer Spending

Inflation presents a direct challenge for Union Pacific, as rising costs for fuel, materials, and labor can squeeze profit margins. For instance, the Producer Price Index (PPI) for transportation and warehousing services saw a notable increase in early 2024, indicating higher operational expenses. Union Pacific must carefully manage these costs, potentially through efficiency improvements or by passing on increases to customers, which can impact freight volumes.

Consumer spending is a critical driver for Union Pacific's freight volumes, especially for intermodal shipments carrying finished goods. As of early 2024, retail sales data indicated a resilient consumer, supporting demand for goods that move by rail. A strong consumer economy translates to more goods needing transportation, directly benefiting Union Pacific's top line.

- Inflationary Pressures: Union Pacific faces increased operating costs due to inflation, impacting everything from diesel fuel to wages.

- Consumer Demand Link: Higher consumer spending generally leads to increased demand for manufactured goods, boosting rail freight volumes.

- Intermodal Importance: A significant portion of Union Pacific's business involves intermodal freight, directly tied to the movement of consumer products.

- Economic Sensitivity: The company's performance is sensitive to shifts in consumer confidence and spending habits, which influence freight demand.

Supply Chain Dynamics and Global Trade Flows

Union Pacific's business is significantly shaped by how global supply chains are evolving. Trends like reshoring and nearshoring, where companies bring production closer to home, directly influence where freight originates and where it needs to go. This can alter long-haul routes that are Union Pacific's specialty.

Disruptions within these global flows, such as persistent port congestion or shortages of shipping containers, can create bottlenecks that impact intermodal volumes. Conversely, periods of strong global trade generally translate into higher demand for long-distance rail transport, benefiting Union Pacific. For instance, in the first quarter of 2024, Union Pacific reported a 1.7% decrease in overall carloads compared to the previous year, reflecting some of these ongoing supply chain adjustments, though intermodal volumes saw a slight increase.

- Reshoring/Nearshoring: Companies shifting production closer to end markets can reduce reliance on traditional long-haul international shipping, potentially impacting freight volumes for railroads.

- Port Congestion & Container Shortages: These disruptions in maritime shipping can delay goods, affecting the efficiency and volume of intermodal rail services.

- Global Trade Growth: Robust international trade typically drives demand for long-distance freight movement, which is a core component of Union Pacific's business model.

- Intermodal Volume Fluctuations: Changes in the balance between domestic and international supply chains directly influence the demand for Union Pacific's intermodal services.

Union Pacific's performance is closely tied to the economic cycle, with robust industrial activity boosting freight volumes. For example, in Q1 2024, the company generated $5.9 billion in revenue, a direct reflection of economic output.

Higher interest rates, like the Federal Reserve's benchmark rate around 5.25%-5.50% in 2024, increase Union Pacific's cost of capital for infrastructure investments. Inflation also pressures margins by raising operating expenses, as seen in rising producer prices for transportation services in early 2024.

Consumer spending directly impacts intermodal freight, with resilient retail sales in early 2024 supporting demand for goods moved by rail.

Supply chain shifts like reshoring can alter freight patterns, while disruptions such as port congestion affect intermodal volumes. In Q1 2024, Union Pacific saw a 1.7% decrease in carloads, indicating ongoing supply chain adjustments.

What You See Is What You Get

Union Pacific PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the Union Pacific railroad company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Union Pacific.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Union Pacific.

Sociological factors

The rail industry, including Union Pacific, faces an aging workforce, with a significant portion of its skilled engineers and conductors nearing retirement age. This demographic trend, coupled with intense competition for specialized talent like mechanics, creates a critical challenge for labor availability. For instance, the Bureau of Labor Statistics projected a 1.6% decline in the overall transportation and material moving occupations between 2022 and 2032, highlighting the broader scarcity of available workers.

Attracting and retaining qualified personnel is paramount for Union Pacific's operational continuity and safety. This necessitates substantial investments in comprehensive training programs, offering competitive wages and benefits packages, and fostering a positive and supportive workplace culture. Failure to do so can lead to labor shortages that directly impact service reliability and efficiency, a concern echoed by industry reports indicating potential disruptions due to staffing issues.

Public perception of Union Pacific's operations, especially regarding safety and environmental impact, is crucial for its social license to operate. In 2024, Union Pacific reported a 12% decrease in reportable derailments compared to 2023, a key metric for community trust. Effective community engagement and transparent communication are vital to mitigate concerns about noise and environmental effects, directly impacting operational continuity.

Societal expectations for worker and public safety are increasingly stringent, pushing Union Pacific to continually enhance its safety protocols and invest in cutting-edge safety technologies. This focus is vital for preventing accidents, safeguarding employees, and maintaining public confidence.

In 2023, Union Pacific reported a total of 1,166 reportable incidents, a decrease from 1,287 in 2022, demonstrating ongoing efforts in safety improvement. Maintaining a robust safety culture is not just a regulatory requirement but a core operational imperative.

A strong safety record directly influences operational efficiency by minimizing disruptions and reducing the likelihood of costly accidents. Furthermore, it significantly impacts regulatory scrutiny, with a history of safety lapses potentially leading to increased oversight and penalties.

Demand for Sustainable Transportation

Societal awareness regarding environmental impact is significantly shaping transportation choices. Growing demand for sustainable logistics favors rail, which boasts superior fuel efficiency and lower carbon emissions per ton-mile compared to trucking. For instance, in 2024, the rail industry continued to be recognized for its environmental advantages, with studies highlighting that railroads are, on average, three to four times more fuel-efficient than highways. This presents a clear opportunity for Union Pacific to position its services as an eco-friendly option, appealing to businesses committed to corporate social responsibility and attracting customers prioritizing green supply chains.

Public pressure for greener transportation solutions is a mounting force influencing business decisions. This trend directly benefits rail providers like Union Pacific, as their operations inherently align with environmental stewardship goals. By emphasizing their lower carbon footprint, Union Pacific can capture market share from less sustainable alternatives, meeting the evolving expectations of consumers and regulators alike. The push for decarbonization across industries is a significant driver, and Union Pacific is well-positioned to capitalize on this shift.

- Growing consumer and business demand for environmentally friendly logistics.

- Rail's inherent fuel efficiency and lower carbon emissions per ton-mile compared to trucking.

- Opportunity for Union Pacific to market its services as a sustainable transportation solution.

- Alignment with corporate social responsibility goals and attraction of environmentally conscious customers.

Shifting Consumer Preferences and E-commerce Growth

The relentless growth of e-commerce, projected to reach $8.1 trillion globally by 2024, is fundamentally altering consumer expectations for rapid delivery. This surge in online shopping directly translates to increased demand for efficient, intermodal transportation solutions, a core strength of Union Pacific. However, it also places immense pressure on supply chains to become more agile and responsive.

Meeting these evolving demands requires Union Pacific to invest in infrastructure and services that support faster transit times and enhanced reliability, particularly in the complex final-mile delivery segment. For instance, the company's 2024 investments are focused on improving network fluidity, which is critical for accommodating the growing volume of goods destined for direct-to-consumer fulfillment centers.

- E-commerce Growth: Global e-commerce sales are anticipated to hit $8.1 trillion in 2024, up from $6.3 trillion in 2023.

- Consumer Demand: A significant percentage of consumers now expect same-day or next-day delivery for online purchases.

- Intermodal Shift: The rise in e-commerce has driven a 5% year-over-year increase in intermodal freight volume for major North American railroads.

- Supply Chain Agility: Railroads must adapt to facilitate quicker handoffs and reduce overall transit times to remain competitive.

Societal expectations for worker safety are paramount, driving Union Pacific to continuously enhance its safety protocols and invest in advanced technologies. The company's commitment is reflected in its 2023 report of 1,166 reportable incidents, a decrease from 1,287 in 2022, underscoring the importance of a robust safety culture for operational integrity and public trust.

Public perception significantly influences Union Pacific's social license to operate, particularly concerning safety and environmental impact. In 2024, Union Pacific saw a 12% reduction in reportable derailments compared to the previous year, a positive indicator for community relations and operational reliability. Transparent communication and community engagement are key to addressing concerns about noise and environmental effects.

The growing demand for sustainable logistics favors rail transport due to its inherent fuel efficiency and lower carbon emissions per ton-mile compared to trucking. Studies in 2024 continued to highlight that railroads are, on average, three to four times more fuel-efficient than highways, positioning Union Pacific to attract environmentally conscious customers and align with corporate social responsibility goals.

Technological factors

Advancements in automation, such as Positive Train Control (PTC), are transforming Union Pacific's operations. PTC, which aims to prevent certain types of train accidents, has seen significant rollout across the industry, with Union Pacific investing heavily in its implementation. For instance, by the end of 2023, Union Pacific had completed its PTC system, ensuring compliance with federal mandates and enhancing safety.

Looking ahead, the prospect of fully autonomous train operations presents even greater opportunities for Union Pacific to boost safety, efficiency, and network capacity. While the initial capital outlay and securing regulatory approvals are substantial hurdles, these technologies promise substantial long-term reductions in operational costs and significant improvements in reliability. The potential for autonomous technology to reshape rail logistics is immense.

Union Pacific is increasingly using big data analytics and artificial intelligence (AI) to streamline its operations. These technologies help optimize train scheduling, anticipate equipment malfunctions, and manage inventory with greater precision, ultimately boosting network efficiency. For instance, AI-powered predictive maintenance is a significant focus, aiming to reduce downtime and maintenance costs.

Digital platforms and real-time tracking are revolutionizing freight management. Union Pacific's integration with customer logistics platforms is crucial for seamless visibility and improved communication, offering value-added services. This digital transformation enhances customer experience and operational transparency, a key driver of competitive advantage in the current market.

The adoption of Internet of Things (IoT) sensors and advanced communication systems is central to this digitalization. These technologies enable unprecedented levels of data collection and analysis within the supply chain. For instance, in 2024, many leading logistics firms reported significant improvements in delivery times and reduced operational costs through such IoT implementations, with some seeing up to a 15% efficiency gain.

Advanced Safety Systems and Signaling Technology

Union Pacific is heavily invested in advanced safety systems and signaling technology, recognizing their critical role in rail operations. The company continuously develops and deploys innovations like advanced sensor systems for track integrity and drone inspections for hard-to-reach areas. These advancements directly contribute to reducing accidents and ensuring the safety of their workforce and the public.

The ongoing investment in these technologies is crucial for Union Pacific to maintain compliance with increasingly stringent safety regulations. For instance, the Federal Railroad Administration (FRA) continues to emphasize advancements in Positive Train Control (PTC) systems, which Union Pacific has been actively implementing. By staying at the forefront of safety tech, Union Pacific not only mitigates risks but also solidifies its commitment to operational excellence and public trust.

- Enhanced Safety: Deployment of advanced sensor systems and drone inspections to proactively identify and address potential track and equipment issues.

- Regulatory Compliance: Adherence to evolving safety standards, including the continued implementation and refinement of Positive Train Control (PTC) systems, which saw significant progress across the industry in 2024.

- Workforce Protection: Investing in technologies that minimize human exposure to hazardous conditions and improve overall worker safety.

- Public Trust: Demonstrating a commitment to safe operations through technological innovation, bolstering confidence among communities and stakeholders.

Alternative Fuels and Locomotive Technology

Union Pacific is actively exploring alternative fuels and advanced locomotive technologies to enhance sustainability and efficiency. The company has been a pioneer in testing hydrogen fuel cell technology, with a prototype locomotive demonstrating significant potential for emissions reduction. This aligns with broader industry trends, as the Association of American Railroads (AAR) reported in 2024 that the rail industry continues to invest in cleaner technologies, aiming to reduce greenhouse gas emissions by 30% by 2030 compared to 2000 levels.

Research and development into battery-electric locomotives and more fuel-efficient diesel-electric designs are paramount for Union Pacific. These advancements are critical not only for reducing the company's substantial carbon footprint, which was reported to be around 20 million metric tons of CO2e in 2023, but also for lowering operating costs through improved fuel economy. While widespread adoption of these technologies is still in its early stages, strategic investments in emerging solutions are essential for long-term environmental compliance and competitive positioning.

The electrification of rail lines represents a more significant, long-term technological consideration. While not an immediate focus for the entirety of Union Pacific's vast network, it remains a vital aspect of future planning as the company navigates evolving environmental regulations and seeks to further decarbonize its operations.

- Hydrogen Fuel Cell Testing: Union Pacific has successfully tested a prototype hydrogen fuel cell locomotive, showcasing a path towards zero-emission freight transport.

- Industry Emission Reduction Goals: The rail sector, including Union Pacific, is committed to achieving a 30% reduction in greenhouse gas emissions by 2030 (vs. 2000 levels).

- Fuel Efficiency Improvements: Ongoing development of more fuel-efficient locomotive designs aims to cut operating expenses and environmental impact.

- Electrification as a Long-Term Strategy: While not immediate, the electrification of rail lines is a key consideration for future sustainability initiatives.

Technological advancements are reshaping Union Pacific's operational landscape, driving efficiency and safety. The company has made substantial investments in automation, including the full implementation of Positive Train Control (PTC) by the end of 2023, a critical step for accident prevention. Furthermore, Union Pacific is leveraging big data and AI for optimized scheduling and predictive maintenance, aiming to reduce downtime. The integration of IoT sensors and digital platforms enhances freight management and customer visibility, with firms reporting up to a 15% efficiency gain in 2024 from such implementations.

| Technology Area | Key Developments/Investments | Impact/Goals |

|---|---|---|

| Automation & Safety | Positive Train Control (PTC) implementation completed (2023); exploring autonomous operations. | Enhanced safety, reduced accidents, potential for increased network capacity and lower operational costs. |

| Data Analytics & AI | Utilizing AI for predictive maintenance and optimizing train schedules. | Improved efficiency, reduced maintenance costs, better resource allocation. |

| Digitalization & Connectivity | IoT sensors, real-time tracking, integration with customer platforms. | Seamless visibility, improved customer experience, enhanced operational transparency. |

| Alternative Fuels & Locomotives | Testing hydrogen fuel cell technology; developing battery-electric and fuel-efficient diesel-electric designs. | Reduced carbon footprint (aiming for 30% GHG reduction by 2030 industry-wide); lower operating costs. |

Legal factors

Union Pacific navigates a dense regulatory landscape, primarily shaped by the Federal Railroad Administration (FRA) and the Surface Transportation Board (STB). These agencies dictate stringent safety protocols, operational standards, and economic regulations critical for the company's functioning. For instance, the FRA mandates specific safety measures, and as of early 2024, the push for enhanced Positive Train Control (PTC) systems continues to be a significant compliance area, with railroads investing billions to meet these requirements.

Adherence to these rules, especially concerning the safe transport of hazardous materials and the aforementioned PTC implementation, is paramount and demands continuous capital expenditure and operational diligence. Failure to comply can result in substantial fines and operational disruptions. For example, in 2023, Union Pacific reported significant investments in safety and infrastructure upgrades, partly driven by regulatory compliance needs.

Furthermore, evolving transportation regulations can introduce considerable compliance costs. Changes in environmental standards or new safety mandates, such as those related to track maintenance or crew fatigue, necessitate adaptive strategies and financial planning. The railroad industry, including Union Pacific, consistently monitors legislative proposals and agency rulemakings that could impact operating expenses and strategic investments throughout 2024 and into 2025.

Union Pacific, as a dominant force in North American freight rail, faces significant antitrust scrutiny concerning its market share, pricing strategies, and any proposed mergers or acquisitions. These regulations ensure a level playing field and prevent monopolistic practices.

Compliance with antitrust laws is paramount to prevent costly litigation, hefty fines, and potentially disruptive operational adjustments. The Surface Transportation Board (STB) actively monitors and enforces these regulations, ensuring fair competition within the rail industry.

Union Pacific navigates a complex web of environmental regulations, including those governing air emissions, water discharge, and waste management, as mandated by agencies like the EPA and state environmental bodies. These rules necessitate substantial investments in pollution control technology and robust environmental management systems to ensure compliance.

Failure to adhere to these stringent environmental laws can lead to significant financial penalties, with fines potentially reaching millions of dollars, and can also inflict considerable damage to the company's reputation. For instance, in 2023, the transportation sector faced increased scrutiny over emissions, with ongoing discussions about stricter standards for diesel-powered locomotives.

Labor Laws and Collective Bargaining Agreements

Union Pacific's operations are heavily influenced by federal labor laws, notably the Railway Labor Act, which governs its relationships with a unionized workforce. These relationships are further shaped by numerous collective bargaining agreements that set terms for wages, benefits, and working conditions.

Changes in labor legislation or the results of ongoing contract negotiations can directly impact Union Pacific's financial performance and operational efficiency. For instance, in 2024, ongoing discussions around potential changes to work rules and compensation could lead to increased labor costs if not managed effectively.

- Railway Labor Act: The foundational federal law governing labor relations in the railroad industry.

- Collective Bargaining Agreements: Contracts negotiated between Union Pacific and its various labor unions, covering critical aspects of employment.

- Potential Cost Impacts: Wage increases or enhanced benefits negotiated in 2024-2025 could add tens of millions to annual operating expenses.

- Operational Flexibility: Agreements often dictate crew consist and scheduling, impacting the company's ability to optimize train operations.

Land Use, Property Rights, and Eminent Domain

Union Pacific's vast rail infrastructure, spanning thousands of miles, is intrinsically tied to land use and property rights. The company must navigate a complex web of federal, state, and local regulations governing how it uses its land and rights-of-way. This includes managing easements, approving new crossings, and addressing any disputes that arise with property owners or local governments.

The potential for eminent domain actions, where governmental bodies can acquire private property for public use, presents another significant legal consideration. While Union Pacific is a private entity, its operations are often considered vital public infrastructure, which can influence how these legal frameworks are applied. For instance, in 2023, Union Pacific reported ongoing efforts to resolve various property-related matters, impacting operational efficiency and capital allocation.

Legal challenges concerning property rights can lead to substantial financial and temporal costs. These can range from lengthy negotiations for land acquisition to protracted court battles over access or usage.

- Land Use Regulations: Compliance with zoning laws and environmental impact assessments for new track or facility construction is paramount.

- Property Rights: Securing and maintaining clear title to its extensive network of land and easements is a continuous legal undertaking.

- Eminent Domain: While often used by government, the principles can affect Union Pacific's ability to expand or maintain its network if private land is essential.

- Dispute Resolution: Managing claims from landowners regarding noise, vibration, or property value impact requires dedicated legal and operational resources.

Union Pacific's operations are heavily influenced by federal labor laws, particularly the Railway Labor Act, which governs its relationships with a unionized workforce. Collective bargaining agreements set terms for wages, benefits, and working conditions, with potential cost impacts from wage increases or enhanced benefits negotiated in 2024-2025 possibly adding tens of millions to annual operating expenses. These agreements also dictate crew consist and scheduling, affecting the company's ability to optimize train operations.

The company's vast rail infrastructure necessitates navigating complex land use and property rights regulations at all government levels, including managing easements and resolving disputes with property owners or local governments. Legal challenges concerning property rights can result in substantial financial and temporal costs, impacting operational efficiency and capital allocation, as seen in ongoing efforts to resolve various property-related matters in 2023.

Antitrust scrutiny is a significant legal factor for Union Pacific due to its market dominance, impacting pricing strategies and potential mergers or acquisitions, with the Surface Transportation Board (STB) actively enforcing regulations to ensure fair competition and prevent monopolistic practices.

Environmental factors

Governments worldwide are intensifying efforts to combat climate change, leading to more stringent regulations on greenhouse gas emissions. This directly impacts transportation companies like Union Pacific, which must adapt to these evolving environmental standards.

Union Pacific is subject to increasing pressure to meet carbon reduction targets. For instance, in 2024, many rail operators are exploring or implementing strategies to lower their carbon footprint, which could involve significant capital expenditures on advanced locomotive technology and alternative fuels. The company's commitment to sustainability is increasingly scrutinized by investors and the public.

Reporting on emissions, including Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased electricity), and Scope 3 (all other indirect emissions), is becoming a critical aspect of corporate environmental responsibility. Union Pacific's transparency in these disclosures will be vital for maintaining stakeholder trust and navigating future regulatory landscapes.

Union Pacific's rail operations, particularly in arid Western states, depend on substantial water volumes for locomotive cooling, dust suppression, and facility maintenance. For instance, in 2024, the company continued to assess its water footprint across its extensive network, recognizing that drought conditions, prevalent in areas like California and Arizona, can directly impact operational efficiency and increase water acquisition costs.

Stricter water usage regulations and the growing concern over water scarcity in many of its operating regions present significant environmental challenges. Union Pacific is actively implementing water conservation strategies, such as optimizing water use in its yards and maintenance facilities, to mitigate these risks and ensure long-term sustainable operations. This proactive approach is crucial for managing costs and maintaining business continuity in water-stressed environments.

Union Pacific's extensive rail network, spanning over 32,000 route miles, traverses a variety of landscapes, raising concerns about land use and biodiversity. The company's operations can lead to habitat fragmentation, impacting wildlife corridors and sensitive ecosystems across its service territory.

In 2023, Union Pacific reported managing vegetation along its extensive rights-of-way, a critical aspect of maintaining safe operations but also a point of focus for ecological impact. Efforts to mitigate habitat disruption and promote sustainable land management are crucial for addressing environmental stewardship and meeting evolving regulatory demands.

Waste Management and Recycling Practices

Union Pacific's waste management and recycling practices are crucial for its environmental footprint. The company must effectively manage waste from its extensive maintenance, operations, and office activities. This includes adhering to strict disposal regulations and actively promoting recycling to cut down on landfill waste and reduce pollution.

A significant aspect is the proper handling of hazardous materials. This includes lubricants, chemicals, and other substances used in rail operations. By implementing rigorous procedures for hazardous waste, Union Pacific mitigates environmental risks and ensures compliance.

- Waste Reduction Initiatives: Union Pacific reported a 10% reduction in total waste generated across its operations in 2023 compared to 2022, driven by enhanced sorting and recycling protocols.

- Recycling Rates: In 2024, the company aims to increase its recycling rate for non-hazardous materials, such as metals and paper, to 75% from the current 68%.

- Hazardous Waste Management: Union Pacific maintains a comprehensive hazardous waste management program, with over 95% of regulated hazardous waste being transported and disposed of by licensed and approved facilities.

Stakeholder Pressure for Sustainable Practices

Stakeholder pressure for sustainable practices is a significant environmental factor for Union Pacific. Investors, customers, and the public are increasingly demanding that companies, including railroads, demonstrate robust environmental stewardship. This translates into a need for transparent reporting on environmental performance and the setting of ambitious sustainability goals.

Meeting these expectations is not just about compliance; it's a strategic imperative. For instance, in 2023, Union Pacific reported a 15% reduction in its absolute Scope 1 and Scope 2 greenhouse gas emissions compared to a 2019 baseline, a figure driven partly by stakeholder engagement and a commitment to cleaner operations. Integrating environmental considerations into core business decisions, such as fleet modernization and route planning, can enhance brand reputation and attract environmentally conscious investors and customers.

Key areas of stakeholder focus include:

- Greenhouse Gas Emissions Reduction: Investors are scrutinizing Scope 1, 2, and 3 emissions, pushing for clear targets and progress. Union Pacific's 2023 ESG report highlighted efforts to reduce emissions intensity, a metric closely watched by many financial institutions.

- Water Management: Responsible water usage, particularly in water-scarce regions where rail operations are prevalent, is another critical concern for stakeholders.

- Biodiversity and Land Use: The impact of rail infrastructure on ecosystems and biodiversity is under increasing examination, requiring proactive management and mitigation strategies.

- Supply Chain Sustainability: Stakeholders expect Union Pacific to influence and ensure sustainability throughout its own supply chain, from fuel providers to equipment manufacturers.

Environmental regulations are becoming more stringent globally, pushing companies like Union Pacific to reduce greenhouse gas emissions and manage their carbon footprint. This trend is evident in the increasing focus on Scope 1, 2, and 3 emissions, with many rail operators in 2024 exploring advanced technologies and alternative fuels to meet these evolving standards and investor expectations.

Water scarcity, particularly in the Western United States, poses a significant operational challenge for Union Pacific, impacting its ability to maintain operations and manage costs. The company is actively implementing water conservation strategies across its network to address drought conditions and stricter usage regulations, ensuring business continuity.

Union Pacific's extensive rail network necessitates careful land management to mitigate impacts on biodiversity and ecosystems, with ongoing efforts in vegetation management along its rights-of-way. Waste reduction and responsible hazardous materials handling are also critical components of its environmental strategy, with initiatives in place to improve recycling rates and ensure compliance with disposal regulations.

Stakeholder pressure for robust environmental stewardship is a key driver for Union Pacific, influencing its sustainability goals and transparent reporting on performance. This includes a focus on reducing greenhouse gas emissions intensity, as seen in their reported 15% reduction from a 2019 baseline by 2023, and ensuring sustainability throughout their supply chain.

| Environmental Factor | Union Pacific's Response/Impact | Relevant Data (2023-2024) |

| Climate Change & Emissions | Adherence to stricter emission regulations, investment in cleaner technologies. | 15% reduction in absolute Scope 1 & 2 GHG emissions (vs. 2019 baseline) by 2023. Aiming for 75% recycling rate for non-hazardous materials in 2024. |

| Water Scarcity | Implementing water conservation strategies in arid regions. | Ongoing assessment of water footprint across network, particularly in California and Arizona. |

| Land Use & Biodiversity | Managing vegetation along rights-of-way, mitigating habitat disruption. | Continued vegetation management practices in 2023 for operational safety and ecological consideration. |

| Waste Management | Focus on waste reduction and responsible hazardous material disposal. | 10% reduction in total waste generated in 2023 vs. 2022. Over 95% of regulated hazardous waste handled by licensed facilities. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Union Pacific is built on a comprehensive review of data from government transportation agencies, economic forecasting firms, and industry-specific publications. We incorporate regulatory updates, infrastructure investment reports, and economic indicators to provide a robust understanding of the external environment.