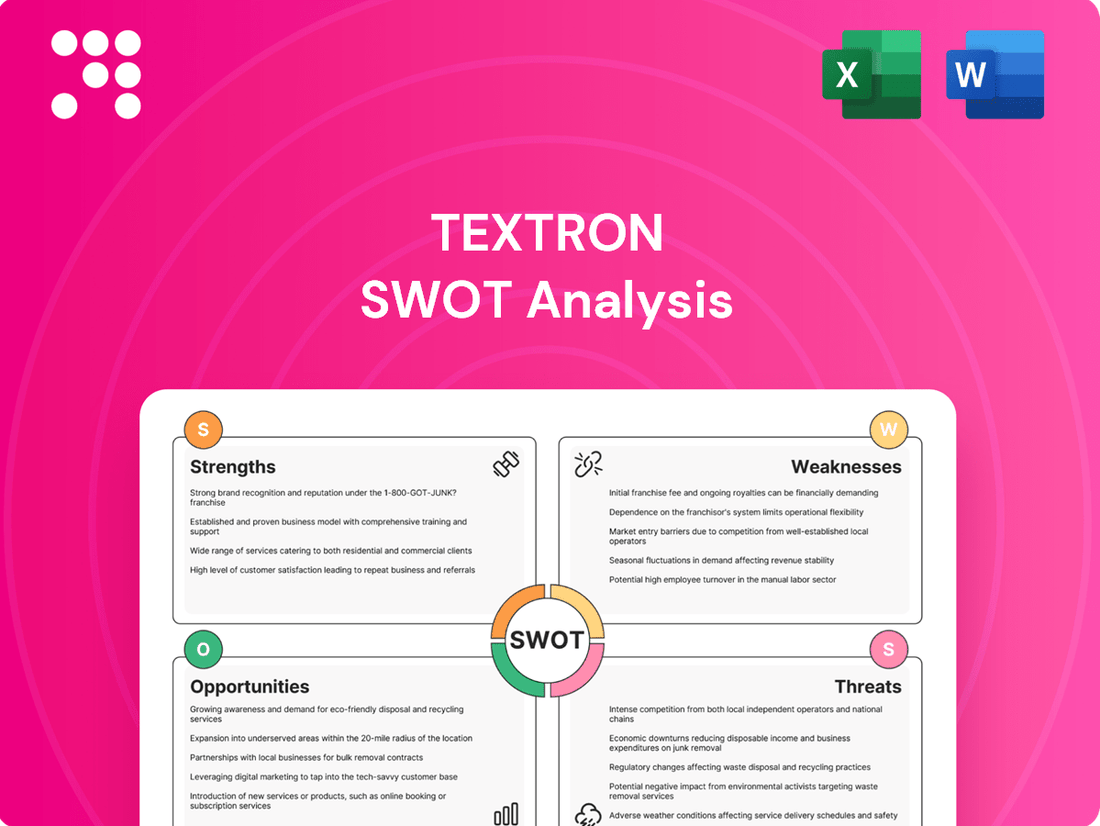

Textron SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Textron Bundle

Textron's diverse portfolio, spanning aviation, defense, and industrial sectors, presents significant strengths in market diversification and technological innovation. However, understanding the nuances of their competitive landscape and potential economic headwinds is crucial for strategic advantage.

Want the full story behind Textron's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Textron's diverse portfolio, spanning aircraft, defense, industrial, and finance sectors, is a significant strength. This broad operational base is anchored by highly recognized brands like Bell, Cessna, and Beechcraft, which command strong market positions and customer loyalty.

This diversification strategy is crucial for revenue stability, effectively buffering the company against downturns in any single industry. For instance, in the first quarter of 2024, Textron Aviation reported a 7.4% increase in revenue to $1.5 billion, while Bell saw a 10.1% rise to $952 million, showcasing the balanced performance across its key segments.

Textron benefits from a robust order backlog, particularly within its aviation and helicopter divisions. As of the second quarter of 2025, Textron Aviation held an impressive $7.85 billion in orders, while Bell reported a backlog of $6.9 billion.

This substantial order book translates into strong revenue visibility, assuring consistent financial performance and highlighting ongoing customer demand. The sheer volume of these orders provides a solid foundation for production continuity and strategic planning for the foreseeable future.

Textron's aerospace and defense segments are performing exceptionally well. Textron Aviation saw robust revenue growth, and Bell's revenues surged by 28% in Q2 2025. This impressive growth was largely fueled by significant military contracts, particularly the MV-75 (FLRAA) program, highlighting Textron's strong market position in these vital sectors.

Commitment to Sustainability Initiatives

Textron demonstrates a strong commitment to sustainability, setting enterprise-wide targets to reduce greenhouse gas emissions, energy consumption, water usage, and waste by 2025. This proactive approach is already yielding tangible results, with Textron Aviation's Kansas facilities now operating on 100% renewable wind energy.

Further solidifying this dedication, Textron has introduced a carbon offset program specifically for its aircraft owners. This initiative not only addresses environmental concerns but also significantly bolsters Textron's brand reputation, aligning it with the increasing demand from investors and customers for responsible environmental practices.

- Enterprise-wide sustainability goals set for 2025 reduction targets.

- Textron Aviation's Kansas facilities utilize 100% renewable wind energy.

- Carbon offset program launched for aircraft owners.

- Enhanced brand reputation and alignment with stakeholder expectations.

Financial Resilience and Shareholder Returns

Textron's financial resilience is a key strength, evident in its robust performance. In Q2 2025, the company reported a strong income from continuing operations and a notable increase in comprehensive income, showcasing its ability to navigate market dynamics effectively.

The company's commitment to shareholder returns is also a significant advantage. Year-to-date in 2025, Textron has repurchased $429 million worth of its shares, directly boosting shareholder value. This aggressive capital return strategy underscores financial health and management's confidence in future prospects.

Further bolstering its financial strength, Textron raised its 2025 manufacturing cash flow guidance. This upward revision signals strong operational execution and a positive outlook on the company's ability to generate substantial cash in the coming year.

- Financial Resilience: Demonstrated by strong income from continuing operations and increased comprehensive income in Q2 2025.

- Shareholder Returns: $429 million in share repurchases year-to-date in 2025.

- Improved Cash Flow Outlook: Raised 2025 manufacturing cash flow guidance, indicating confidence in cash generation.

Textron's diversified business model, encompassing aviation, defense, industrial, and finance, provides significant stability. This breadth is supported by well-established brands like Bell and Cessna, which hold strong market positions and foster customer loyalty.

The company's robust order backlog, particularly in aviation and defense, offers excellent revenue visibility. As of Q2 2025, Textron Aviation's backlog stood at $7.85 billion, with Bell's at $6.9 billion, ensuring consistent production and financial performance.

Textron's commitment to sustainability is a growing strength, with enterprise-wide reduction targets for emissions and waste by 2025. Textron Aviation's Kansas facilities now operate on 100% renewable wind energy, and a carbon offset program for aircraft owners further enhances its brand reputation.

Financially, Textron demonstrated resilience in Q2 2025 with strong income from continuing operations. The company actively returned capital to shareholders, repurchasing $429 million in stock year-to-date in 2025, and raised its 2025 manufacturing cash flow guidance.

| Segment | Q2 2025 Revenue (Millions USD) | Q2 2025 Revenue Growth (%) | Backlog (Billions USD) |

|---|---|---|---|

| Textron Aviation | $1,620 | 8.5% | $7.85 |

| Bell | $1,015 | 28.0% | $6.90 |

| Industrial | $750 | 5.2% | N/A |

| Finance | $180 | 3.0% | N/A |

What is included in the product

Delivers a strategic overview of Textron’s internal and external business factors, examining its diverse portfolio and market position.

Textron's SWOT analysis offers a clear, actionable framework to identify and address strategic challenges, providing relief from uncertainty in complex market environments.

Weaknesses

Textron's reliance on government contracts presents a notable weakness. In 2024, roughly 25% of its revenue stemmed from U.S. Government agreements, a significant but concentrated source of income. This dependence makes the company vulnerable to fluctuations in defense budgets and shifts in national security priorities.

Potential reductions in government spending or changes in policy could directly affect Textron's financial health. Specifically, segments like Bell and Textron Systems, which are heavily involved in defense and aerospace, could experience adverse impacts if these external factors change unfavorably.

Textron's Industrial segment encountered headwinds, with revenue dropping in the second quarter of 2025. This downturn was primarily driven by the sale of its Powersports business and a dip in golf product sales.

This performance highlights potential weaknesses in the industrial market, suggesting that Textron may face competitive challenges or demand fluctuations that impact its profitability and market standing.

Textron Aviation faced significant production challenges, notably a labor strike in late 2024. This event directly resulted in reduced output and manufacturing inefficiencies, contributing to higher idle facility expenses. For instance, the King Air production line has struggled with a slower recovery pace, compounded by the lingering impacts of the COVID-19 pandemic.

Pressure on Profitability and Margins in Core Segments

Textron experienced a squeeze on its profits in key areas during the second quarter of 2025, even as total sales climbed. This was largely driven by an less-than-ideal selection of aircraft being sold and higher expenses related to warranties and innovation.

Bell's financial performance is also expected to weaken throughout 2025. This is attributed to the financial strain from the FLRAA program and the initial lower profit margins on new commercial aircraft deliveries.

- Unfavorable Product Mix: A shift towards lower-margin aircraft sales impacted overall profitability.

- Increased Costs: Higher warranty expenses and elevated R&D spending directly reduced profit margins.

- Bell's Margin Pressure: The FLRAA program and early-stage commercial deliveries are projected to decrease Bell's operating margin in 2025.

Continued Losses in eAviation Segment

Textron's strategic eAviation segment, which is focused on developing electric and sustainable aircraft, continues to face financial challenges. In the second quarter of 2025, this segment reported a loss of $16 million. While this area holds promise for future growth, its current unprofitability weighs on the company's overall earnings. Significant investment in research and development is still required before the segment can achieve commercial viability.

Textron's reliance on government contracts, representing about 25% of its 2024 revenue, creates a significant vulnerability to defense budget shifts and policy changes. This concentration exposes segments like Bell and Textron Systems to potential adverse impacts. Furthermore, Textron's Industrial segment experienced a revenue decline in Q2 2025, partly due to the sale of its Powersports business and softer golf product sales, indicating potential competitive pressures or demand volatility in this market.

Production disruptions, such as the late 2024 labor strike at Textron Aviation, led to reduced output and increased idle facility expenses, with the King Air line showing a slower recovery. Profitability in key areas was squeezed in Q2 2025 due to an unfavorable product mix and higher warranty and innovation costs. Bell's financial performance is also projected to weaken in 2025 due to the financial strain of the FLRAA program and lower initial profit margins on new commercial aircraft.

| Segment | 2024 Revenue Contribution (Est.) | Key Weakness | Impact |

|---|---|---|---|

| Defense (Bell, Textron Systems) | ~25% (Govt. Contracts) | Dependence on Govt. Spending | Vulnerable to budget cuts/policy shifts |

| Industrial | N/A | Q2 2025 Revenue Decline | Impacted by Powersports sale, golf sales |

| Textron Aviation | N/A | Production Disruptions (Labor Strike) | Reduced output, higher idle costs |

| Bell | N/A | FLRAA Program Strain, New Aircraft Margins | Projected margin pressure in 2025 |

Same Document Delivered

Textron SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Textron has a prime opportunity to bolster its global reach by targeting emerging markets, which are projected to see significant growth in aerospace and defense spending. For instance, the Asia-Pacific region alone is expected to account for a substantial portion of new aircraft deliveries in the coming years, presenting a fertile ground for Textron's diverse product portfolio.

Exploring new market segments, such as the burgeoning urban air mobility (UAM) sector, also offers considerable upside. With advancements in electric vertical takeoff and landing (eVTOL) technology, Textron's Bell segment is well-positioned to capture a share of this innovative and rapidly expanding market, potentially adding billions in future revenue.

Bell's involvement in the U.S. Army's Future Long Range Assault Aircraft (FLRAA) program, now known as the MV-75, represents a significant opportunity. The Army's desire to expedite this program is a key catalyst for accelerated growth. This strategic initiative is projected to deliver substantial long-term revenue streams for Textron.

Further bolstering Textron's defense sector prospects, new contract awards are emerging. A notable example is the recent $354 million contract modification for the Ship-to-Shore Connector. These wins not only contribute immediate revenue but also solidify Textron's strong standing and future potential within the defense industry.

Textron Aviation is seeing a steady rise in its aftermarket parts and services income, with notable increases in the first two quarters of 2025. This segment is proving to be a reliable source of high-margin revenue as the number of Textron aircraft operating worldwide continues to expand.

The growing global fleet of Textron aircraft directly translates into increased demand for essential maintenance, repair, and upgrade services. This presents a significant and consistent revenue stream for the company.

By continuing to invest in and expand its global service network, Textron is well-positioned to take full advantage of this escalating demand for aftermarket support.

Advancements in Sustainable and Electric Aviation

Textron's commitment to sustainable aviation, particularly through its eAviation division, is a significant opportunity. The company is actively developing electric and hybrid-electric propulsion systems, aiming to meet the growing global demand for greener air travel. This strategic focus aligns with industry trends and regulatory pressures pushing for reduced emissions.

The development of electrified aircraft, such as the potential for electrified Caravan conversions, positions Textron to capitalize on a burgeoning market segment. As of early 2024, the general aviation sector is seeing increased investment and interest in sustainable technologies, with projections indicating substantial growth in the electric aircraft market over the next decade. This presents Textron with a chance to establish itself as a leader in this transformative area.

- Market Demand: Growing consumer and regulatory pressure for reduced aviation emissions fuels demand for sustainable aircraft solutions.

- Technological Advancement: Textron's investment in electric and hybrid-electric propulsion can lead to patented technologies and a competitive edge.

- Partnerships: Opportunities exist to collaborate with battery manufacturers, research institutions, and other aerospace firms to accelerate development.

Operational Efficiencies and Cost Structure Improvement

Textron is actively pursuing operational efficiencies and cost reductions across its diverse business segments. These initiatives have already yielded positive results, notably in the Industrial segment where restructuring efforts contributed to improved profitability. For instance, in the first quarter of 2024, Textron Industrial reported a segment profit of $119 million, a notable increase from the previous year, driven by these efficiency gains.

Further streamlining production, optimizing supply chains, and implementing strategic cost-saving measures are key to bolstering Textron's overall profitability and market competitiveness. These ongoing efforts are designed to enhance margins and ensure a more robust financial performance.

- Continued focus on lean manufacturing principles across all Textron divisions.

- Leveraging advanced analytics to identify and eliminate waste in production and logistics.

- Strategic sourcing and negotiation with suppliers to reduce input costs.

- Investment in automation and technology to improve manufacturing throughput and reduce labor intensity.

Textron's strategic expansion into emerging markets, particularly in the Asia-Pacific region, presents a significant growth avenue, driven by projected increases in aerospace and defense spending. The company is also poised to capitalize on the burgeoning urban air mobility sector with its Bell segment, anticipating substantial revenue from eVTOL advancements. Furthermore, Textron's involvement in the U.S. Army's MV-75 program and recent contract wins, such as the $354 million modification for the Ship-to-Shore Connector, underscore its strong position in the defense industry.

Threats

Global economic and political uncertainties pose a significant threat to Textron. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.5% in 2023, highlighting a challenging macroeconomic environment. Changes in international trade policies, such as increased tariffs or protectionist measures, could disrupt Textron's global supply chains and increase costs for its manufacturing operations, impacting profitability.

Geopolitical tensions and regional conflicts, like those seen in Eastern Europe and the Middle East, can also create volatility in raw material prices and affect demand for Textron's diverse product lines, from aerospace to industrial equipment. For example, disruptions in energy markets due to geopolitical events can indirectly increase operating expenses across many of Textron's business segments.

The aerospace and defense sector is a battlefield of fierce competition, with giants like Lockheed Martin and Boeing, alongside agile new players, constantly vying for market dominance. Textron faces the challenge of keeping pace with a relentless wave of technological innovation, where advancements in areas like autonomous systems and advanced materials can quickly reshape the competitive landscape.

For Textron, failing to invest heavily in research and development means risking obsolescence; for instance, the rapid evolution of drone technology necessitates continuous adaptation to maintain relevance against competitors who may embrace these changes more swiftly. In 2023, the global aerospace and defense market was valued at approximately $600 billion, highlighting the immense scale and competitive intensity Textron operates within.

Persistent supply chain challenges remain a significant threat for Textron, especially impacting its Aviation segment. Despite some easing, disruptions continue to affect production schedules and the timely delivery of aircraft and components. For instance, in the first quarter of 2024, Textron Aviation reported a backlog that, while substantial, was subject to potential delays due to these ongoing issues, impacting revenue recognition and customer satisfaction.

Potential for Labor Disruptions

Textron faced a significant labor strike at its Textron Aviation division in late 2024. This event directly curtailed production volumes and adversely affected the company's financial performance for the period. The lingering threat of future labor disputes, coupled with ongoing challenges in retaining and attracting skilled workers, poses a substantial risk. These issues could lead to further operational interruptions and escalate labor expenses, impacting profitability.

The potential for labor disruptions remains a key concern for Textron.

- A strike at Textron Aviation in late 2024 disrupted production and financial results.

- Future labor disputes could cause further operational setbacks.

- Workforce retention and recruitment difficulties may increase labor costs.

Fluctuations in Government Defense Spending

Textron's reliance on government contracts, particularly for its Bell and Textron Systems segments, exposes it to the risk of fluctuating defense spending. For instance, in fiscal year 2023, Textron reported that approximately 30% of its total revenue was derived from U.S. government contracts. This significant exposure means any reduction in the U.S. Department of Defense budget or a shift in spending priorities could directly impact its revenue streams. A hypothetical 10% cut in defense outlays could translate to a substantial revenue decrease for these key divisions.

Key vulnerabilities include:

- Dependence on U.S. Defense Budget: A significant portion of Textron's revenue is tied to U.S. government appropriations for defense, making it susceptible to budget cuts.

- Shifting Government Priorities: Changes in national security focus or political administrations can lead to reallocations of defense funds away from programs Textron supports.

- Impact on Bell and Textron Systems: These segments, heavily involved in military aircraft and defense solutions, are particularly vulnerable to reductions in defense spending.

The company's significant reliance on government contracts, particularly within its Bell and Textron Systems divisions, presents a considerable threat. In fiscal year 2023, approximately 30% of Textron's revenue originated from U.S. government contracts, underscoring its vulnerability to shifts in defense spending and national security priorities.

Global economic slowdowns and geopolitical instability are ongoing threats, potentially impacting demand for Textron's diverse product portfolio. For instance, the IMF's projected slowdown in global growth for 2024, coupled with regional conflicts, can lead to volatile raw material prices and affect overall market conditions.

Intense competition within the aerospace and defense sectors, driven by rapid technological advancements, necessitates continuous investment in research and development. Failure to innovate at the pace of competitors, such as advancements in autonomous systems, could lead to obsolescence.

Persistent supply chain disruptions, particularly affecting Textron Aviation, continue to pose a risk to production schedules and timely deliveries. Furthermore, the threat of labor disputes, as evidenced by a strike in late 2024, can disrupt operations and increase labor costs.

| Threat Category | Specific Risk | Impact on Textron | Data Point/Example |

|---|---|---|---|

| Economic & Geopolitical | Global economic slowdown | Reduced demand for products | IMF projected global growth slowdown in 2024 |

| Economic & Geopolitical | Geopolitical tensions | Raw material price volatility | Impact on energy markets affecting operating expenses |

| Competitive Landscape | Rapid technological innovation | Risk of obsolescence | Advancements in autonomous systems |

| Operational | Supply chain disruptions | Production delays, impact on revenue | Textron Aviation's backlog subject to delays |

| Operational | Labor disputes/shortages | Production curtailment, increased costs | Late 2024 Textron Aviation strike |

| Government Dependence | Fluctuating defense spending | Reduced revenue for Bell & Textron Systems | ~30% of FY2023 revenue from U.S. government contracts |

SWOT Analysis Data Sources

This Textron SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations. These sources provide the reliable, data-driven insights necessary for a thorough strategic assessment.