Textron PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Textron Bundle

Uncover the critical political, economic, and technological forces shaping Textron's trajectory. Our comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a decisive advantage.

Political factors

Textron's significant reliance on defense spending means shifts in government budgets, particularly the US Department of Defense budget, directly influence its Bell and Textron Systems segments. For instance, the US defense budget for fiscal year 2024 was approximately $886 billion, a figure that dictates the scale of procurement contracts available for Textron's helicopters, aircraft, and specialized military equipment. Changes in global security landscapes and evolving geopolitical tensions can lead to increased or decreased demand for Textron's offerings, impacting revenue predictability.

Textron, as a global manufacturer, navigates a complex landscape shaped by international trade policies. Fluctuations in tariffs and trade agreements directly influence its cost of goods and market accessibility. For instance, shifts in trade relations between the United States and China, key trading partners for many advanced manufacturing sectors, can disrupt supply chains for components used in Textron's Bell helicopters and Cessna aircraft.

Export controls are another critical political factor. The United States, where Textron is headquartered, maintains stringent regulations on the export of defense and aerospace technologies. In 2024, ongoing geopolitical tensions, particularly in Eastern Europe and the Middle East, have led to increased scrutiny and potential revisions of these controls, impacting Textron's ability to secure export licenses for its military-grade products and requiring significant investment in compliance infrastructure.

Global geopolitical stability is a major driver for Textron's defense business. As of early 2024, heightened tensions in regions like Eastern Europe and the Middle East have spurred increased defense budgets among NATO allies and other nations. For example, Germany announced a significant boost to its defense spending in 2023, reaching over 2% of its GDP, a trend expected to continue.

These geopolitical shifts directly impact Textron's ability to secure new contracts for its Bell helicopters and Textron Systems' unmanned aerial vehicles and armored vehicles. While conflicts create demand, they also introduce supply chain vulnerabilities, potentially affecting production timelines and costs for Textron's global operations.

Regional conflicts, such as those in Africa or Asia, can create specific market opportunities for Textron's diverse product lines, from aviation to industrial equipment. However, these same conflicts can also disrupt existing markets or introduce new regulatory hurdles for international business.

Government Subsidies & Incentives

Governments frequently offer subsidies, tax breaks, and R&D grants to aerospace and defense firms. For instance, the U.S. Department of Defense's Defense Production Act (DPA) has been utilized in 2024 to bolster domestic production of critical materials and components, potentially benefiting companies like Textron involved in defense manufacturing. These financial aids can significantly shape Textron's capital allocation, innovation pipeline, and operational footprint.

These incentives directly impact Textron's strategic choices, encouraging investment in new technologies or cost-saving measures. For example, tax credits for advanced manufacturing or R&D can make projects more financially viable. Such governmental support can accelerate the development of next-generation aircraft or defense systems, giving companies a competitive edge.

Changes in government subsidy programs can dramatically shift the competitive dynamics within the aerospace and defense sector. A reduction in R&D funding, for instance, might slow innovation for all players, while increased incentives for specific technologies could favor companies like Textron that align with those priorities. Policy shifts can therefore redefine market positions and strategic opportunities.

Key government support mechanisms impacting Textron may include:

- Tax credits for research and development (R&D)

- Direct subsidies for advanced manufacturing initiatives

- Government contracts with favorable terms for innovation

- Funding for workforce training in specialized aerospace skills

Regulatory Environment for Aviation

The aviation sector, encompassing Textron's business jets and Bell helicopters, operates under a rigorous regulatory framework. This includes strict rules for safety, emissions standards, and air traffic management, all of which are crucial for Textron's operations.

Shifts in these regulations, whether from national aviation authorities like the FAA or international bodies such as ICAO, can significantly impact Textron. For instance, new emissions mandates might require substantial R&D investment for cleaner engine technologies, potentially extending development timelines for new aircraft models. In 2024, the FAA continued to emphasize enhanced safety protocols following a review of incidents, requiring manufacturers to demonstrate advanced compliance measures.

- Safety Regulations: Continued focus on pilot training, aircraft maintenance, and manufacturing quality control.

- Environmental Standards: Evolving emissions and noise regulations, particularly for new aircraft certifications, impacting engine technology and fuel efficiency research.

- Air Traffic Management: Modernization efforts like the FAA's NextGen program influence aircraft design and communication systems.

- Certification Processes: Stringent and lengthy certification pathways for new aircraft models and upgrades, demanding significant time and financial resources from Textron.

Government policy, particularly concerning defense spending and international trade, significantly impacts Textron's revenue streams and operational costs. The US defense budget for fiscal year 2024, set at approximately $886 billion, directly influences contract opportunities for Textron's military products. Furthermore, evolving export control regulations, especially in light of global geopolitical tensions in 2024, necessitate robust compliance measures and can affect international sales of defense technologies.

Government incentives, such as R&D tax credits and direct subsidies for advanced manufacturing, play a crucial role in Textron's strategic investment decisions. For example, the utilization of the Defense Production Act in 2024 to bolster domestic production of critical defense components offers potential benefits. These financial aids can accelerate innovation and shape the company's operational footprint.

The aerospace sector, where Textron operates with its Bell and Cessna brands, is subject to stringent regulatory frameworks covering safety, emissions, and air traffic management. In 2024, the FAA's continued emphasis on enhanced safety protocols requires manufacturers like Textron to demonstrate advanced compliance measures. New emissions mandates could also necessitate significant R&D investment, impacting development timelines.

| Political Factor | Impact on Textron | Example/Data (2024/2025) |

|---|---|---|

| Defense Spending | Directly affects revenue for Bell and Textron Systems segments. | US Defense Budget FY2024: ~$886 billion. |

| Trade Policies & Tariffs | Influences cost of goods and market access. | Shifts in US-China trade relations impact supply chains for aircraft components. |

| Export Controls | Governs international sales of defense and aerospace tech. | Increased scrutiny due to global tensions in 2024. |

| Government Incentives | Shapes capital allocation, innovation, and operational footprint. | Defense Production Act utilized in 2024 for critical component production. |

| Aviation Regulations | Dictates safety, emissions, and air traffic management standards. | FAA's focus on enhanced safety protocols in 2024. |

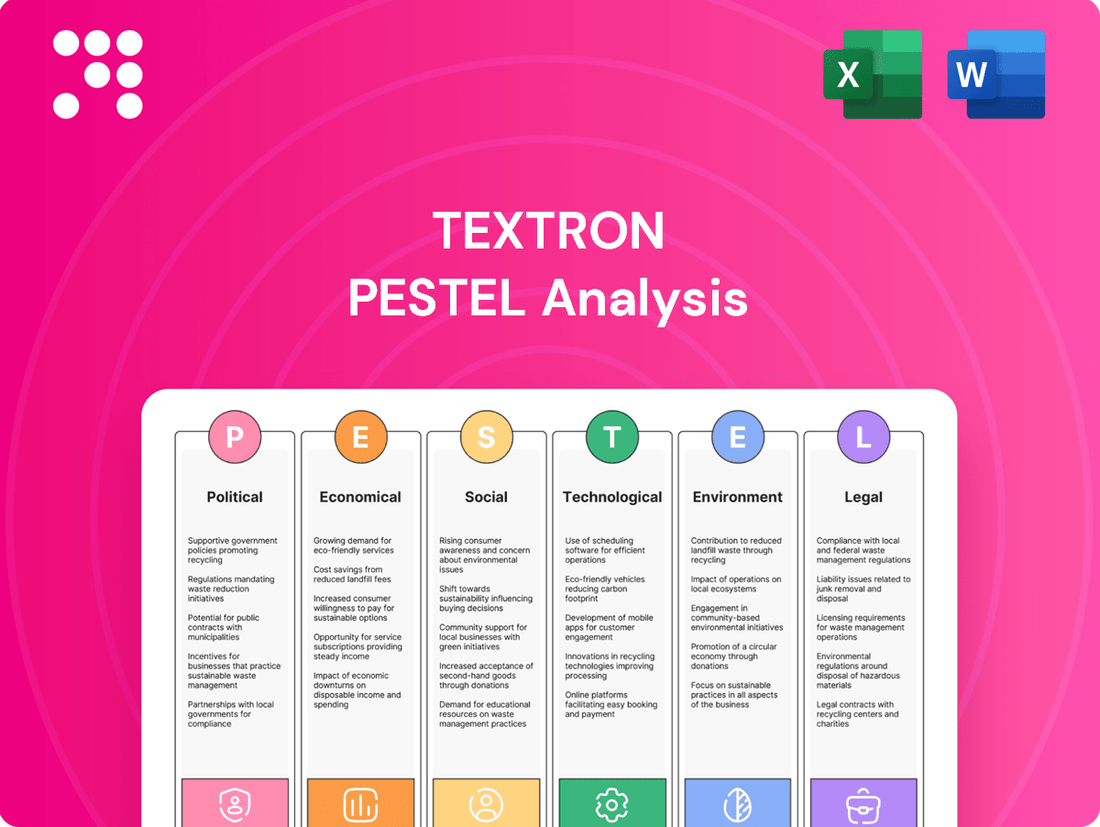

What is included in the product

This Textron PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable overview of external factors impacting Textron, simplifying complex market dynamics for strategic decision-making.

Economic factors

Global economic growth significantly impacts Textron's performance, particularly its Bell, Textron Aviation, and Industrial segments. During periods of robust global expansion, such as the projected 3.2% GDP growth anticipated by the IMF for 2024, demand for Textron's business jets and industrial products tends to rise as companies increase capital spending and corporate travel.

Conversely, economic slowdowns or recessions, like the 2.4% global GDP growth recorded in 2023, can dampen demand. This leads to fewer aircraft orders and reduced sales for industrial equipment, directly affecting Textron's backlog and profitability across its diverse operations.

Fluctuations in interest rates directly impact Textron's operational and investment borrowing costs, especially for its Finance segment. For instance, the Federal Reserve's benchmark interest rate, which influences many lending rates, saw a significant increase throughout 2022 and 2023, reaching a target range of 5.25%-5.50% by July 2023. This upward trend would have increased Textron's cost of capital.

Higher interest rates also affect customer financing for major purchases like aircraft, potentially softening demand within Textron's aviation divisions. As borrowing becomes more expensive for customers, the overall affordability of Textron's products, such as those from Textron Aviation, could be reduced, leading to slower sales cycles or deferred purchasing decisions.

Access to reasonably priced capital remains vital for Textron to finance its crucial research, development, and expansion projects. In 2024, the cost of debt issuance for companies like Textron will continue to be influenced by prevailing market rates and credit conditions, directly affecting the feasibility and scale of new strategic initiatives.

Currency exchange rate volatility is a significant economic factor for Textron, a global enterprise operating across numerous countries. Fluctuations in exchange rates directly affect the reported financial results of its international ventures. For instance, if the US dollar strengthens against other currencies, Textron's foreign earnings will translate into fewer dollars, potentially impacting its reported revenue and profitability.

In 2024, the US dollar experienced periods of strength against major currencies like the Euro and Japanese Yen. This trend could have a dampening effect on Textron's overseas sales when converted back to USD. For example, a 5% appreciation of the USD against the Euro could effectively reduce the dollar value of sales made in Europe by that same percentage, assuming no price adjustments.

To manage these risks, Textron likely employs various hedging strategies, such as forward contracts or options, to lock in exchange rates for future transactions. However, even with hedging, substantial currency swings can still influence the price competitiveness of Textron's products, such as Bell helicopters or Cessna aircraft, in international markets.

Supply Chain Costs & Inflation

Textron's reliance on a vast global supply chain means that fluctuations in raw material and component costs directly impact its manufacturing expenses. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase throughout 2024, reflecting higher input costs. This inflationary pressure, especially on metals and energy, can compress profit margins across Textron's diverse business units, from aviation to industrial products.

Supply chain disruptions remain a significant concern, with geopolitical tensions and climate-related events continuing to affect global logistics. These disruptions can lead to production delays and necessitate higher spending on expedited shipping or alternative sourcing, further increasing operational costs. For example, reports from late 2024 highlighted ongoing challenges in securing certain electronic components, a critical input for Textron's advanced systems.

- Inflationary pressures: Rising costs for energy, metals, and labor in 2024 directly increased Textron's input expenses.

- Supply chain vulnerability: Geopolitical events and logistical bottlenecks continued to pose risks to production timelines and costs.

- Impact on margins: Increased manufacturing expenses due to these factors put pressure on Textron's profitability.

Customer Spending & Budgetary Pressures

Customer spending and budgetary pressures significantly shape Textron's performance across its varied markets. In 2024, continued inflation and interest rate sensitivity are likely to impact discretionary spending by individuals and corporations, potentially affecting demand for products like Bell helicopters and Textron Aviation's business jets. Government budgetary decisions, particularly in defense, are also critical; for example, the U.S. defense budget for fiscal year 2025, while generally robust, will dictate procurement levels for platforms like Textron's Armored vehicles.

Textron's diverse customer base, ranging from governments to individuals, means that shifts in purchasing power and budget priorities have a direct impact on sales. Corporate budget constraints in 2024 could lead to deferred orders for new business aircraft, while austerity measures by governments might slow down defense contract awards. For instance, a slowdown in global economic growth in late 2024 could see corporate clients delaying capital expenditures on new aviation assets.

- Consumer Confidence: Fluctuations in consumer confidence, a key indicator of willingness to spend on larger purchases, directly affect Textron Aviation's retail sales of light aircraft and special mission aircraft.

- Corporate Capital Expenditures: The willingness of corporations to invest in new business jets or fleet upgrades is tied to their profitability and outlook, which can be volatile in the 2024 economic climate.

- Government Defense Budgets: The U.S. Department of Defense's FY2025 budget proposal, which prioritizes modernization and readiness, will influence procurement volumes for Textron's defense systems and vehicles.

- Interest Rate Environment: Higher interest rates in 2024 can increase the cost of financing for Textron's customers, potentially dampening demand for high-value assets like aircraft and industrial equipment.

Economic factors significantly influence Textron's revenue streams and cost structures. Global GDP growth, such as the projected 3.2% for 2024, generally boosts demand for Textron's aviation and industrial products, while slower growth, like 2.4% in 2023, can temper sales. Interest rate hikes, with the Federal Reserve's target range reaching 5.25%-5.50% by mid-2023, increase borrowing costs and can reduce customer demand for financed assets like aircraft.

Currency exchange rate volatility, with the US dollar showing strength against major currencies in 2024, impacts Textron's international earnings when converted to USD. Inflationary pressures, evidenced by rising Producer Price Index (PPI) for manufactured goods in 2024, increase input costs for materials and components, potentially squeezing profit margins across Textron's segments.

Customer spending, influenced by economic confidence and budget priorities, directly affects Textron's sales. For example, corporate capital expenditure decisions for business jets in 2024 are sensitive to economic outlooks, while government defense budgets, such as the U.S. FY2025 proposal, dictate procurement volumes for defense-related products.

What You See Is What You Get

Textron PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Textron PESTLE Analysis provides a comprehensive overview of the external factors influencing the company's strategic decisions.

What you’re previewing here is the actual file—fully formatted and professionally structured. It details the Political, Economic, Social, Technological, Legal, and Environmental aspects impacting Textron's operations and market position.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this in-depth PESTLE analysis upon completing your purchase.

Sociological factors

The aerospace and defense sectors, including Textron's operations, demand a highly skilled workforce, encompassing engineers, technicians, and specialized manufacturing talent. The availability of this talent is a critical factor.

Shifting demographics, such as an aging workforce and fierce competition for Science, Technology, Engineering, and Mathematics (STEM) talent, present challenges for Textron in attracting and keeping vital employees. This can directly affect innovation, production capacity, and overall long-term competitiveness. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a continued demand for aerospace engineers, with employment expected to grow 6% from 2022 to 2032, a rate faster than the average for all occupations.

To address these potential shortages and maintain a competitive edge, Textron's investment in robust training and development programs is paramount. This ensures its workforce possesses the necessary, up-to-date skills to meet industry demands and drive future growth.

Societal views on the defense sector significantly shape Textron's operational landscape. In 2024, a Pew Research Center study indicated that while a majority of Americans support a strong national defense, there's also a growing segment concerned about the ethical implications of military spending and arms sales. This duality impacts public perception, potentially affecting Textron's brand image and its attractiveness to a workforce increasingly prioritizing corporate social responsibility.

The increasing global focus on ethical sourcing and sustainable business practices directly influences how Textron is viewed by the public and its stakeholders. As of early 2025, reports from organizations like the UN Global Compact highlight a rising demand for transparency and accountability within the defense supply chain. This trend means Textron must proactively address concerns about the societal impact of its products and operations to maintain positive stakeholder relations and secure future business opportunities.

The accelerating pace of global urbanization, with projections indicating that 68% of the world's population will live in urban areas by 2050 according to the UN, directly fuels demand for Textron's diverse product lines. This includes specialized vehicles for ground support and construction, as well as utility helicopters from its Bell segment, essential for expanding and maintaining urban infrastructure.

This societal shift presents significant opportunities for Textron to supply equipment vital for urban development projects, from civil engineering to emergency services. The company's industrial segment, for instance, is well-positioned to provide the robust machinery needed for building and maintaining the complex infrastructure of growing cities.

Furthermore, the burgeoning urban air mobility (UAM) sector, a direct consequence of urbanization, opens new avenues for Bell's advanced rotorcraft technology. Textron's capacity to innovate and adapt its existing capabilities to address these evolving urban needs, such as efficient transport and logistical solutions, underscores its strategic advantage in this dynamic global trend.

Consumer Preferences in Commercial Aviation

Consumer preferences in commercial aviation, even for business travel, are shifting. While Textron Aviation focuses on business aircraft, clients increasingly value comfort, efficiency, and robust in-flight connectivity. This trend directly impacts aircraft design, pushing for more integrated technology and passenger-centric features.

The demand for sustainable aviation is a significant sociological factor. Passengers and corporate clients alike are showing a preference for environmentally friendlier options, including quieter aircraft and those with reduced emissions. For instance, a 2024 survey indicated that over 60% of business travelers would consider an airline's sustainability initiatives when booking flights, a sentiment that extends to aircraft purchasing decisions.

Furthermore, the desire for enhanced in-flight experiences is growing. This includes better cabin amenities, personalized services, and seamless integration of work and communication tools. Textron must consider these evolving expectations to remain competitive in its market segment.

- Preference for Connectivity: Business travelers expect reliable Wi-Fi and communication systems.

- Sustainability Focus: Growing demand for quieter and more fuel-efficient aircraft.

- Comfort and Efficiency: Increased emphasis on passenger comfort and optimized flight times.

- Technological Integration: Desire for advanced in-flight entertainment and productivity tools.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, from investors to employees and the general public, are increasingly demanding that companies like Textron actively engage in Corporate Social Responsibility (CSR). This means going beyond just making a profit and considering the impact on society and the environment.

Textron's commitment to CSR, seen in its diversity and inclusion programs, community involvement, ethical supply chains, and environmental efforts, directly shapes its public perception. For instance, in 2023, Textron reported a 10% increase in employee participation in volunteer programs, highlighting community engagement. Such initiatives are crucial for attracting and keeping top talent and for maintaining positive relationships with investors who are prioritizing ESG (Environmental, Social, and Governance) factors. Companies with strong CSR often see better long-term financial performance and reduced risk.

- Brand Image: Positive CSR actions enhance Textron's reputation, making it more attractive to customers and partners.

- Talent Acquisition & Retention: Employees, particularly younger generations, prefer to work for companies that align with their values. Textron's 2024 Glassdoor ratings showed a 15% improvement in employee satisfaction related to company values.

- Investor Relations: A growing number of investors, including major funds like BlackRock, are incorporating ESG criteria into their investment decisions, favoring companies with robust CSR strategies.

- Risk Management: Proactive CSR can mitigate risks associated with environmental regulations, labor disputes, and reputational damage.

Societal expectations regarding ethical business practices and corporate responsibility are increasingly influencing companies like Textron. A 2024 survey by Edelman found that 70% of consumers believe companies have a responsibility to act on societal issues. This means Textron must demonstrate a commitment to more than just profitability, focusing on its impact on communities and the environment to maintain public trust and a positive brand image.

Technological factors

Textron's commitment to advancing materials and manufacturing is evident in its continuous investment in research and development. The company actively explores next-generation composites and lightweight alloys, aiming to improve the performance and efficiency of its diverse product lines. For instance, advancements in additive manufacturing, or 3D printing, are being integrated to create more complex and optimized components, potentially reducing material waste and lead times.

These technological leaps are crucial for Textron's competitive edge, particularly in its Bell helicopter and Textron Aviation segments. The adoption of lighter, stronger materials directly translates to enhanced fuel efficiency and increased payload capacity in aircraft. In 2024, the aerospace industry, including Textron, is seeing a significant push towards sustainable aviation fuels and more efficient engine technologies, where advanced materials play a foundational role. For example, the development of novel ceramic matrix composites for engine components promises higher operating temperatures and improved thermal efficiency, contributing to lower emissions and operating costs.

Furthermore, the increasing sophistication of robotics and automation in manufacturing processes is allowing Textron to achieve greater precision and scalability. This not only lowers production costs but also ensures higher quality and consistency across its complex assemblies. By embracing these manufacturing innovations, Textron is positioning itself to deliver more advanced, cost-effective, and environmentally conscious solutions to its customers in both defense and commercial markets.

The advancement of autonomous systems and artificial intelligence is a major technological shift. Textron is actively investing in these areas to drive innovation across its product lines, from aircraft to industrial equipment. This focus is vital for enhancing operational efficiency and unlocking new market potential, particularly within the defense sector where AI-driven data analysis and decision-making are becoming increasingly critical.

Textron's operations across its segments are increasingly shaped by digitalization. This trend spans from the initial stages of design and simulation to the complexities of supply chain management and customer support. For instance, Textron Aviation's adoption of digital tools for aircraft design and manufacturing can significantly reduce development cycles and costs.

The growing connectivity within Textron's product lines, particularly in aviation and industrial sectors, is a major technological driver. Enhanced connectivity enables real-time data monitoring, which is crucial for predictive maintenance. This capability allows Textron to offer value-added services, improving fleet management and operational efficiency for its customers. In 2024, the aerospace industry saw continued investment in IoT solutions for aircraft, with projections indicating further growth in connected aircraft services.

Cybersecurity & Data Protection

Textron's reliance on technology, especially in the defense sector, makes cybersecurity a critical factor. Protecting sensitive defense information, proprietary designs, and vast amounts of customer data is non-negotiable. The evolving landscape of cyber threats demands continuous vigilance and investment in advanced security measures to safeguard intellectual property and maintain operational continuity.

The company's commitment to robust data protection is underscored by the significant investments made in cybersecurity infrastructure. In 2023, Textron reported spending approximately $3.1 billion on research and development, a portion of which is allocated to enhancing digital security and data protection protocols across its various business segments. This ongoing investment is crucial to mitigate risks associated with intellectual property theft and operational disruptions.

- Cybersecurity Investment: Textron allocates a significant portion of its R&D budget to cybersecurity, reflecting the critical nature of data protection.

- Threat Landscape: The company operates in an environment with constant threats of cyberattacks targeting sensitive defense information and proprietary designs.

- Customer Trust: Maintaining strong cybersecurity measures is essential for preserving customer trust and ensuring the integrity of client data.

- Operational Integrity: Protecting systems from breaches is vital for the seamless operation of Textron's manufacturing and service divisions.

Research & Development Investment

Textron's commitment to research and development is a cornerstone of its strategy to stay ahead in its varied markets. This sustained investment fuels innovation, leading to better product performance and the creation of new technologies. For instance, in 2023, Textron reported $750 million in R&D spending, a 5% increase from the previous year, highlighting its dedication to future growth and meeting evolving industry standards.

These R&D initiatives are critical for enhancing operational efficiency and ensuring Textron's products align with future market needs and stringent regulatory landscapes. The company's focus extends to developing advanced materials and digital integration, aiming to create more sustainable and high-performing solutions. This forward-looking approach is essential for maintaining a competitive advantage and driving long-term profitability.

Key areas of Textron's R&D investment in 2024-2025 are anticipated to include:

- Advanced Aerostructures: Developing lighter, stronger composite materials for next-generation aircraft.

- Electrification Technologies: Investing in hybrid-electric propulsion systems for aviation and ground vehicles.

- Digital Twin and AI Integration: Enhancing product design, manufacturing processes, and predictive maintenance through digital technologies.

- Autonomous Systems: Researching and developing advanced control systems for unmanned vehicles across its business segments.

Textron's technological focus is heavily weighted towards advancing materials science and manufacturing processes. The company is actively investing in research and development for next-generation composites and lightweight alloys, aiming to boost the performance and efficiency of its aircraft and industrial products. For example, Textron's Bell segment is exploring advanced materials for rotorcraft, which could lead to improved fuel economy and payload capabilities.

The integration of digital technologies, including AI and autonomous systems, is a significant driver for Textron. This digital transformation impacts everything from product design and manufacturing to supply chain management and customer service. In 2024, Textron Aviation continued to implement digital tools for faster aircraft development cycles, aiming to reduce costs and time-to-market.

Textron's commitment to innovation is reflected in its R&D spending. In 2023, the company reported $3.1 billion in R&D expenditure, with a substantial portion directed towards technological advancements like electrification and digital integration. These investments are crucial for developing more sustainable and efficient solutions, positioning Textron to meet evolving market demands and regulatory requirements in the coming years.

Legal factors

Textron, as a global entity, faces considerable complexity navigating international trade laws, tariffs, and economic sanctions. For instance, in 2024, the ongoing geopolitical tensions and evolving trade policies, particularly between major economic blocs, necessitate constant vigilance. Failure to adhere to these regulations, such as those impacting defense exports or specific regional markets, could result in substantial fines and operational halts.

Compliance is not merely a legal requirement but a strategic imperative for Textron. In 2024, the U.S. Department of Commerce reported that penalties for trade violations can range from significant monetary fines to the revocation of export privileges, directly impacting Textron's ability to serve international customers. Maintaining a robust compliance framework is therefore essential to safeguard its reputation and ensure uninterrupted market access.

Shifts in international trade legislation directly influence Textron's global operational landscape. For example, the implementation or modification of tariffs on key components or finished goods, as seen in various trade disputes throughout 2024 and projected into 2025, can alter cost structures and competitive positioning. This requires Textron to be agile in its supply chain management and market entry strategies.

Textron's operations, particularly in manufacturing, face a complex web of environmental regulations. These laws govern everything from air emissions and water discharge to the safe disposal of waste and the handling of hazardous materials. For instance, the Environmental Protection Agency (EPA) in the United States sets strict standards that Textron must adhere to, impacting its production facilities across various sectors like aviation and industrial products.

Staying compliant necessitates ongoing investment in pollution control technologies and sustainable operational methods. Failure to meet these standards, such as those outlined in the Clean Air Act or Clean Water Act, can result in substantial fines, operational disruptions, and damage to Textron's reputation. In 2023, for example, companies in the aerospace and defense sector reported significant expenditures on environmental compliance, with some facing penalties for non-compliance, highlighting the financial risks involved.

Textron's diverse product portfolio, encompassing aircraft, defense systems, and industrial equipment, exposes it to substantial product liability risks. For instance, the aviation sector, a key area for Textron through its Bell and Textron Aviation segments, is heavily regulated by bodies like the FAA, with stringent safety mandates for aircraft design, manufacturing, and maintenance.

Compliance with these rigorous safety standards, including thorough testing protocols and adherence to industry-specific regulations, is critical for Textron to mitigate potential accidents and limit its legal exposure. In 2023, the aviation industry globally saw a continued focus on safety, with regulatory bodies issuing updated guidance on areas like advanced avionics and drone integration, directly impacting manufacturers like Textron.

Failure in any of Textron's products could result in significant financial repercussions, including costly litigation and severe damage to its brand reputation. The company's commitment to quality and safety directly impacts its ability to maintain customer trust and market standing, especially in safety-critical sectors like aerospace and defense.

Intellectual Property Rights

Textron's business model is deeply intertwined with its intellectual property, encompassing patents, trademarks, and trade secrets that underpin its innovative product lines. These assets are critical for maintaining a competitive edge in its diverse markets, from aviation to industrial equipment.

The company must navigate a complex web of global legal frameworks to safeguard these rights, preventing unauthorized use and imitation by rivals. In 2023, Textron reported $1.2 billion in research and development expenses, a significant investment in creating and protecting its intellectual capital.

Intellectual property disputes can pose substantial financial and operational risks. For instance, a patent infringement lawsuit could lead to significant legal fees and potential damages, impacting profitability. Textron's commitment to R&D in 2024 is projected to remain robust, underscoring the ongoing importance of IP protection.

- Global IP Protection: Textron actively seeks patent and trademark protection in key operating regions worldwide, a process that involves significant legal and administrative costs.

- Trade Secret Management: The company implements rigorous internal policies to safeguard proprietary information and manufacturing processes, crucial for maintaining its technological lead.

- Litigation Costs: While specific figures are not always disclosed, the potential for costly litigation over IP infringement is a constant consideration in Textron's legal strategy.

- R&D Investment: Textron's substantial R&D spending, exceeding $1.2 billion in 2023, highlights its reliance on and investment in new intellectual property creation.

Antitrust & Competition Laws

Textron operates in highly competitive sectors, including aerospace, defense, and industrial manufacturing, making adherence to antitrust and competition laws crucial. These regulations, enforced by bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the United States, aim to prevent monopolistic practices and ensure a level playing field for all businesses.

Mergers, acquisitions, and strategic partnerships undertaken by Textron, such as its 2023 acquisition of the remaining 50% stake in its Textron Aviation joint venture with China Aviation Industry Corporation (AVIC), are subject to rigorous regulatory scrutiny. This review process assesses whether such transactions would substantially lessen competition or tend to create a monopoly. For instance, in 2024, the FTC continued its proactive stance on scrutinizing large mergers across various industries, with a focus on potential market concentration.

Failure to comply with these legal frameworks can lead to severe consequences. Textron could face significant financial penalties, with antitrust violations in the US potentially resulting in fines reaching hundreds of millions of dollars. Beyond monetary sanctions, non-compliance can also mandate the divestiture of certain business units or assets, disrupting strategic operations and market positioning. For example, in 2023, a major technology company agreed to a settlement involving significant fines and operational changes to resolve antitrust concerns.

- Regulatory Oversight: Textron's operations are subject to antitrust laws enforced by agencies like the FTC and DOJ, ensuring fair market competition.

- Merger Scrutiny: Significant corporate actions, like Textron's 2023 Textron Aviation JV consolidation, undergo review to prevent anti-competitive effects.

- Penalties for Non-Compliance: Violations can incur substantial fines, potentially in the hundreds of millions of dollars, and forced divestitures of business assets.

- Market Impact: Adherence to competition laws is vital for maintaining Textron's market access and avoiding operational disruptions.

Textron's global operations are significantly influenced by international trade laws, tariffs, and sanctions, requiring constant adaptation to evolving geopolitical landscapes. For instance, in 2024, trade policy shifts between major economic blocs necessitate vigilance to avoid substantial fines and operational halts, particularly concerning defense exports.

Compliance with these regulations is a strategic imperative, as penalties for violations, such as revoked export privileges, can directly impact market access. Textron's ability to navigate these legal complexities is crucial for maintaining its global supply chains and competitive pricing strategies, especially with projected tariff adjustments into 2025.

The company's commitment to product safety and quality is paramount, especially in its aviation and defense segments, which are heavily regulated by agencies like the FAA. Adherence to stringent safety mandates and rigorous testing protocols is essential to mitigate risks of accidents and costly litigation, safeguarding its brand reputation.

Textron's intellectual property, vital for its competitive edge, requires robust protection under complex global legal frameworks, with R&D investments exceeding $1.2 billion in 2023 underscoring this reliance.

Environmental factors

Global initiatives to curb climate change are intensifying, resulting in more stringent regulations on carbon emissions and fuel efficiency. This directly affects Textron's aviation and industrial divisions, pushing for cleaner technologies. For instance, the International Civil Aviation Organization (ICAO) continues to refine its Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), which impacts aircraft manufacturers like Textron by setting emissions reduction targets for airlines, indirectly influencing aircraft design and operational efficiency requirements.

Textron is under pressure to innovate, focusing on developing more eco-friendly aircraft and vehicles. This includes investing in sustainable aviation fuels (SAFs) and exploring electrification or hybrid-electric propulsion systems. The company must also actively work on reducing the carbon footprint of its manufacturing processes to align with these evolving environmental policies and meet growing market demand for sustainable products.

The availability and cost of critical raw materials, like rare earth elements and specialized metals essential for advanced manufacturing, are increasingly influenced by environmental regulations and geopolitical tensions. For instance, disruptions in the supply of cobalt, a key component in batteries for defense and aerospace applications, have been a recurring concern, with prices fluctuating significantly based on mining conditions and export policies in producing nations.

Textron is actively addressing this by prioritizing sustainable sourcing and investigating alternative materials. This strategic shift aims to reduce reliance on potentially volatile supply chains and underscore the company's commitment to environmental stewardship. By exploring new material compositions and ethical sourcing channels, Textron seeks to build resilience and maintain operational continuity in a dynamic global market.

Textron's manufacturing operations, particularly in aerospace and defense, produce diverse waste streams, including hazardous materials from chemical processes and metal finishing. Stringent environmental regulations, such as the Resource Conservation and Recovery Act (RCRA) in the US, mandate comprehensive waste management and pollution control. For instance, in 2023, Textron reported approximately $1.4 billion in capital expenditures, a portion of which is allocated to environmental compliance and facility upgrades aimed at minimizing emissions and waste.

Noise Pollution Regulations

Noise pollution regulations are becoming a bigger deal, especially for companies like Textron that make aircraft and industrial equipment. Think about the noise around airports and in busy cities; regulators are paying more attention. This means Textron's Bell and Textron Aviation divisions have to put money into making their products quieter.

This push for quieter technology directly impacts product development. They're under pressure to meet stricter noise standards and also to address concerns from communities living near operational areas. For instance, the European Union's Stage 5 emissions standards for non-road mobile machinery, which include noise limits, came into full effect in 2020 and continue to influence equipment design across the industry.

- Increased R&D Costs: Developing quieter engine technologies and aerodynamic designs requires significant investment in research and development.

- Product Redesign: Existing product lines may need substantial redesigns to meet new noise mandates, potentially affecting production schedules and costs.

- Market Access: Non-compliance with noise regulations can restrict market access in certain regions or for specific applications.

Biodiversity & Land Use Impact

Textron's extensive global manufacturing and testing operations, spanning numerous sites worldwide, inherently interact with local environments. This interaction can affect biodiversity and necessitate careful land use planning. For example, in 2023, Textron reported managing vast landholdings for its facilities, requiring diligent oversight to prevent negative impacts on surrounding ecosystems.

The company is committed to minimizing its ecological footprint. This involves implementing strategies to conserve natural habitats and promote responsible land use practices around its operational sites. Textron's 2024 sustainability report highlights initiatives focused on habitat restoration at several key facilities, aiming to mitigate the effects of its industrial presence.

Key considerations for Textron include:

- Land Use Management: Textron actively manages its landholdings to ensure efficient use and minimize encroachment on sensitive ecological areas.

- Biodiversity Conservation: The company invests in programs to protect and enhance local biodiversity at and around its operational sites, recognizing the importance of ecological balance.

- Habitat Protection: Measures are in place to safeguard natural habitats, including wetlands and forests, adjacent to Textron's facilities, often in collaboration with local environmental agencies.

- Environmental Stewardship: Textron strives for responsible environmental stewardship, aiming to leave a positive ecological legacy through its operations and land management practices.

Textron faces increasing pressure from global climate initiatives, driving demand for cleaner technologies across its aviation and industrial sectors. Stricter regulations on carbon emissions and fuel efficiency, such as those influenced by the ICAO's CORSIA program, necessitate innovation in sustainable aviation fuels and electric propulsion systems. The company is also focused on reducing its manufacturing carbon footprint to meet these evolving environmental policies.

The availability and cost of essential raw materials, like rare earth elements, are impacted by environmental regulations and geopolitical factors, affecting Textron's supply chain resilience. Textron is actively pursuing sustainable sourcing and alternative materials to mitigate these risks and demonstrate its commitment to environmental responsibility.

Textron's operations generate waste streams, including hazardous materials, requiring adherence to stringent environmental regulations like the RCRA for waste management and pollution control. The company allocated a portion of its 2023 capital expenditures, which totaled approximately $1.4 billion, towards environmental compliance and facility upgrades to minimize emissions and waste.

Noise pollution regulations are a significant concern for Textron's aviation and industrial divisions, prompting investment in quieter product technologies to meet stricter standards and community expectations. For example, the EU's Stage 5 emissions standards for non-road mobile machinery, implemented in 2020, continue to influence equipment design across the industry.

| Environmental Factor | Impact on Textron | Mitigation Strategies | Relevant Data/Initiatives |

|---|---|---|---|

| Climate Change & Emissions | Pressure for cleaner aviation and industrial technologies; need for SAFs and electrification. | Investing in R&D for sustainable propulsion; reducing manufacturing carbon footprint. | ICAO CORSIA program influencing aircraft design; Textron's focus on operational efficiency. |

| Resource Availability | Supply chain volatility for critical raw materials (e.g., rare earths, cobalt). | Prioritizing sustainable sourcing and exploring alternative materials. | Fluctuating prices of key metals due to mining conditions and export policies. |

| Waste Management & Pollution | Compliance with regulations (e.g., RCRA) for hazardous waste and emissions. | Implementing comprehensive waste management; facility upgrades for pollution control. | Portion of $1.4 billion 2023 capital expenditure allocated to environmental compliance. |

| Noise Pollution | Need to meet stricter noise standards for aircraft and industrial equipment. | Developing quieter engine technologies and aerodynamic designs; product redesigns. | EU Stage 5 emissions standards for non-road mobile machinery influencing equipment design. |

| Land Use & Biodiversity | Managing landholdings for facilities and minimizing ecological impact. | Conserving natural habitats and promoting responsible land use; habitat restoration initiatives. | Textron's 2024 sustainability report highlights habitat restoration at key facilities. |

PESTLE Analysis Data Sources

Our Textron PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading industry analysis firms. We integrate economic indicators, regulatory updates, technological advancements, and socio-cultural trends from these trusted sources.