Textron Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Textron Bundle

Unlock the strategic DNA of Textron with our comprehensive Business Model Canvas. This detailed breakdown reveals how Textron leverages its diverse portfolio, from aerospace to industrial products, to create and deliver value. Discover their key partners, revenue streams, and cost structures to gain a competitive edge.

Partnerships

Textron Inc. maintains crucial partnerships with government and military agencies globally, especially through its Bell and Textron Systems divisions. These collaborations are vital for developing and supplying advanced aircraft and defense systems for national security and homeland defense operations.

A prime example is Textron's involvement in the U.S. Army's Future Long Range Assault Aircraft (FLRAA) program, now designated as the Future Vertical Lift (FVL) effort, where Bell is a key participant. Such long-term contracts, often spanning years, underscore the deep integration and reliance these agencies place on Textron's technological capabilities and product offerings.

Textron relies heavily on a diverse network of aerospace and defense suppliers to source specialized components, raw materials, and cutting-edge technologies. These collaborations are fundamental to maintaining efficient production lines for its aircraft, helicopters, and defense systems, directly influencing operational costs and overall supply chain resilience.

Textron actively partners with technology firms and academic institutions to drive research and development, especially in cutting-edge fields like sustainable aviation and autonomous systems. These collaborations are crucial for staying ahead in innovation.

A prime example is Textron's involvement in developing electric aircraft, exemplified by Pipistrel's Velis Electro, showcasing a commitment to greener aviation solutions. This focus on electric propulsion is a significant trend in the aerospace industry.

Furthermore, Textron is advancing its capabilities in unmanned aircraft systems (UAS), which are increasingly vital for both defense and commercial applications. These advancements in autonomous technology are key to Textron's future product portfolio and maintaining a competitive edge in the market.

International Aviation and Defense Organizations

Textron's strategic alliances with international aviation and defense organizations are crucial for its global operations. A prime example is the recent sustainment program agreement with Thai Aviation Industries Co., Ltd., which directly supports the operational readiness of global fleets and strengthens Textron's footprint in key international markets. These partnerships are vital for providing localized support and fostering robust relationships with foreign governments and their military forces.

These collaborations enable Textron to:

- Enhance global fleet sustainment: By partnering with local entities like Thai Aviation Industries, Textron ensures that its aircraft receive timely and effective maintenance and support worldwide.

- Expand international market presence: These agreements open doors to new markets and solidify Textron's reputation as a reliable international defense partner.

- Strengthen government relations: Collaborations with foreign military and government organizations build trust and facilitate future business opportunities.

Financial Institutions and Lessors

Textron Financial Corporation (TFC) is a crucial partner, offering financing to buyers of Textron Aviation aircraft and Bell helicopters. This internal financing arm simplifies the purchasing process for customers, making high-value assets more accessible.

These relationships with financial institutions and lessors are vital for driving sales of Textron's complex and expensive products. By providing readily available financing options, Textron removes a significant barrier to entry for many potential buyers.

- Textron Financial Corporation (TFC): Offers tailored financing solutions for Textron's aviation and defense products.

- Facilitates Sales: Enables customers to acquire aircraft and helicopters by providing essential capital.

- Customer Support: Ensures a smoother acquisition process for high-value asset purchases.

- Market Access: Broadens the customer base by making products attainable through financing.

Textron's key partnerships extend to original equipment manufacturers (OEMs) and specialized technology providers, crucial for integrating advanced systems into its aircraft and defense platforms. These collaborations ensure access to state-of-the-art avionics, propulsion, and sensor technologies, vital for maintaining a competitive edge. For instance, Textron Aviation partners with Garmin for advanced cockpit avionics, enhancing pilot situational awareness and operational efficiency.

In 2024, Textron's commitment to innovation is evident in its partnerships aimed at developing next-generation aviation solutions. These include collaborations with companies focused on sustainable aviation fuels and advanced materials, positioning Textron to meet evolving environmental regulations and customer demands.

Textron's supplier network is extensive, with many long-standing relationships that are critical for production continuity and quality. For example, Textron Aviation relies on suppliers like Spirit AeroSystems for major airframe components, underscoring the interdependence within the aerospace manufacturing ecosystem.

| Partner Type | Examples | Impact on Textron |

| Government/Military Agencies | U.S. Army, U.S. Air Force, International Defense Ministries | Secures large, long-term contracts; drives R&D for advanced defense systems. |

| Aerospace & Defense Suppliers | Spirit AeroSystems, Garmin, Rolls-Royce | Ensures component availability, quality, and technological advancement; impacts production costs and efficiency. |

| Technology & Academic Institutions | Various tech firms, Universities | Drives innovation in areas like electric propulsion, autonomous systems, and sustainable aviation. |

| Financial Institutions & Lessors | Textron Financial Corporation, external finance partners | Facilitates customer purchases of high-value assets, driving sales volume. |

| International Aviation/Defense Orgs | Thai Aviation Industries Co., Ltd. | Enhances global fleet sustainment, expands international market presence, and strengthens government relations. |

What is included in the product

A detailed breakdown of Textron's diversified operations, illustrating how its various business units, from aviation to industrial products, create, deliver, and capture value across distinct customer segments.

Textron's Business Model Canvas provides a structured framework that simplifies complex strategies, alleviating the pain of information overload and enabling clearer decision-making.

Activities

Textron's core activities revolve around the intricate design, meticulous engineering, and precise manufacturing of a broad spectrum of advanced products. This includes everything from sophisticated business jets and versatile turboprop aircraft to robust military helicopters and specialized ground vehicles.

These operations span the entire product journey, from initial concept development through to final production, with a relentless emphasis on pioneering innovation and unwavering quality standards. For instance, in 2024, Textron Aviation continued to see strong demand for its Citation business jets and Beechcraft turboprops, reflecting the company's engineering prowess.

The company's engineering teams are instrumental in developing cutting-edge technologies and ensuring the performance and reliability of its diverse product lines, a commitment evident in the ongoing advancements in their Bell helicopter portfolio, which saw significant orders in 2024 for both commercial and military applications.

Textron's commitment to Research and Development (R&D) is a cornerstone of its strategy, particularly within its aerospace and defense segments. This ongoing investment fuels the creation of next-generation aircraft and advanced defense systems, ensuring the company remains at the forefront of technological advancement. For instance, Textron Aviation consistently invests in developing new aircraft models and enhancing existing ones, aiming to meet evolving market demands for efficiency and performance.

In 2024, Textron's dedication to R&D is evident in its pursuit of sustainable aviation solutions. This includes exploring advancements in electric propulsion and alternative fuels for aircraft, aligning with global trends towards environmental responsibility. Such initiatives are crucial for maintaining a competitive edge in an industry increasingly focused on reducing its carbon footprint and developing more eco-friendly transportation options.

Textron's key activity of product servicing and aftermarket support is crucial for maintaining customer loyalty and generating recurring revenue. This includes offering a comprehensive suite of services such as maintenance, inspection, and repair for its diverse product lines, from Bell helicopters to Cessna aircraft. In 2023, Textron Aviation's aftermarket business saw continued growth, reflecting the demand for these essential services.

Furthermore, Textron provides vital flight training devices and operational support, ensuring customers can maximize the utility and safety of their Textron products. This focus on the entire product lifecycle, from sale to ongoing operation, solidifies Textron's commitment to its customers and enhances product longevity. The company's aftermarket segment is a significant contributor to its overall financial performance, demonstrating the value placed on these ongoing customer relationships.

Program Management for Government Contracts

Program Management for Government Contracts is a cornerstone of Textron’s operations, particularly in the defense sector. This involves the intricate orchestration of large-scale projects, demanding meticulous adherence to stringent government specifications and delivery schedules. For instance, Textron’s involvement in programs like the Future Long-Range Assault Aircraft (FLRAA), identified as the MV-75, exemplifies this. Successfully managing such complex endeavors is vital for securing and executing significant defense contracts.

This core activity directly impacts Textron’s ability to maintain robust relationships with government clients. It requires a deep understanding of regulatory frameworks, budget management, and technical execution across diverse platforms. Textron's commitment to program management ensures the successful delivery of advanced military capabilities, reinforcing its position as a key defense contractor.

- Complex Program Oversight: Managing programs like FLRAA (MV-75) requires coordinating numerous stakeholders, suppliers, and internal teams to meet demanding performance requirements and timelines.

- Adherence to Specifications: Strict compliance with government-defined technical, safety, and operational specifications is paramount for contract fulfillment and client satisfaction.

- Timely Delivery: Ensuring on-time delivery of defense systems and components is critical for maintaining operational readiness for government forces and securing future contracts.

- Client Relationship Management: Proactive communication and transparent execution build trust and foster long-term partnerships with government and military entities.

Global Sales and Distribution

Textron's global sales and distribution strategy relies on a dual approach: an internal sales force and a network of authorized independent sales representatives. This allows them to effectively reach a wide array of customers across different regions and industries for both their commercial and military offerings.

In 2024, Textron continued to leverage this extensive network. For instance, Bell, a Textron segment, secured significant orders for its military helicopters, underscoring the importance of direct sales channels and established relationships within defense sectors globally. Textron Aviation also reported strong delivery numbers for its business jets, highlighting the reach of its distributor and direct sales efforts in the civilian market.

- Global Reach: Textron's sales and distribution spans over 100 countries, ensuring a broad market presence for its diverse product lines.

- Sales Force Structure: The company utilizes a combination of direct sales teams for key accounts and large programs, alongside independent representatives for broader market penetration.

- Customer Segments: This approach caters to distinct customer needs, from large government defense contracts to individual business aircraft buyers.

- Distribution Network: In 2024, Textron continued to invest in its distribution infrastructure, including service centers and parts availability, to support its global customer base.

Textron's key activities encompass advanced product design, engineering, and manufacturing across aerospace and defense sectors. They also focus on comprehensive product servicing and aftermarket support, alongside expert program management for government contracts. A robust global sales and distribution network, utilizing both internal teams and independent representatives, is crucial for reaching diverse customer segments.

| Key Activity | Description | 2024 Relevance/Data Point |

|---|---|---|

| Product Design, Engineering & Manufacturing | Creating and producing aircraft, helicopters, and ground vehicles. | Strong demand for Citation jets and Beechcraft turboprops. |

| Product Servicing & Aftermarket Support | Providing maintenance, repair, and operational support. | Aftermarket business saw continued growth in 2023. |

| Government Contract Program Management | Orchestrating complex defense projects. | Involvement in programs like the Future Long-Range Assault Aircraft (FLRAA). |

| Global Sales & Distribution | Reaching customers through internal sales and independent representatives. | Bell secured significant military helicopter orders globally. |

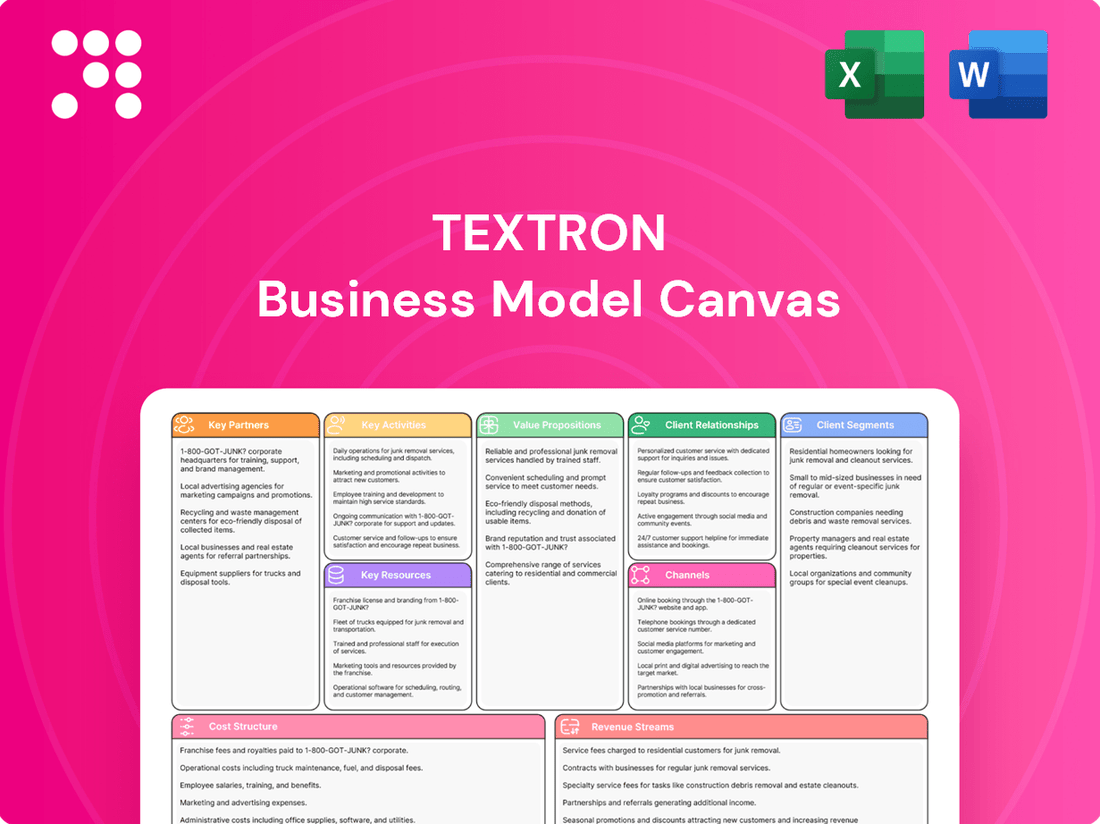

Preview Before You Purchase

Business Model Canvas

The Textron Business Model Canvas preview you're seeing is the actual document you will receive upon purchase. This isn't a mockup; it's a direct representation of the complete, ready-to-use file. You'll get the full Business Model Canvas, structured and formatted precisely as displayed, ensuring you have exactly what you need to analyze and strategize.

Resources

Textron's approximately 34,000 employees are a cornerstone of its operations, bringing essential skills to the forefront. This diverse team includes highly skilled engineers, meticulous technicians, and experienced manufacturing specialists.

The collective expertise within Textron, particularly in the demanding aerospace, defense, and industrial sectors, is directly responsible for driving product innovation. This deep knowledge base ensures the high quality of manufacturing and the reliable delivery of services across all business units.

Textron operates a robust global network of manufacturing facilities, crucial for producing its diverse portfolio of aircraft, defense systems, and industrial products. These sites are outfitted with cutting-edge technology, enabling the intricate production processes required for their complex offerings.

The company consistently invests in optimizing its manufacturing capabilities. For instance, Textron Aviation's Wichita facilities are known for their advanced assembly lines and lean manufacturing principles, contributing to efficient production of aircraft like the Cessna Citation series. This focus on technological advancement and efficiency is key to maintaining a competitive edge in its various markets.

Textron's intellectual property portfolio is a cornerstone of its business, featuring numerous patents and proprietary technologies, especially within its aerospace and defense divisions. These innovations drive product development and competitive advantage.

The company's robust brand recognition, exemplified by names like Bell, Cessna, Beechcraft, and Pipistrel, translates directly into customer trust and market preference. For instance, Textron Aviation, which includes Cessna and Beechcraft, delivered 185 aircraft in the first quarter of 2024, highlighting the ongoing demand for its established brands.

Financial Capital and Backlog

Textron's business model relies heavily on its substantial financial capital. This includes significant cash reserves and access to credit, enabling the company to fund its extensive operations, research and development efforts, and strategic investments across its diverse business segments. This financial muscle is crucial for maintaining a competitive edge and pursuing long-term growth opportunities.

A key indicator of Textron's financial strength is its robust backlog of orders. As of early 2025, the total company backlog stood at an impressive $17.9 billion. This substantial backlog provides a predictable revenue stream and demonstrates strong customer demand for Textron's products and services, underpinning its operational stability and future financial performance.

- Financial Capital: Textron possesses considerable financial resources, including cash, investments, and borrowing capacity, essential for funding its global operations and strategic initiatives.

- Order Backlog: The company maintained a significant total company backlog of $17.9 billion in early 2025, reflecting strong demand and providing visibility into future revenues.

- Investment Capacity: This financial strength allows Textron to invest in innovation, new product development, and potential acquisitions to drive long-term growth and market share.

- Operational Funding: The financial capital directly supports day-to-day operations, manufacturing processes, and the execution of large-scale projects across its business units.

Global Supply Chain Network

Textron's global supply chain network is a foundational asset, enabling the procurement of diverse materials, components, and specialized services from international markets. This extensive network is crucial for maintaining operational continuity and building resilience against potential supply chain disruptions.

Managing this intricate web of suppliers effectively is paramount to Textron's ability to ensure uninterrupted production cycles and mitigate risks. In 2024, companies across industries faced significant supply chain challenges, with reports indicating that over 60% of businesses experienced some form of disruption, highlighting the critical nature of robust supply chain management.

- Global Sourcing Capabilities: Access to a wide array of global suppliers for specialized aerospace, defense, industrial, and finance components.

- Risk Mitigation: Diversified supplier base to reduce reliance on single sources and buffer against geopolitical or economic instability.

- Efficiency and Cost Management: Optimized logistics and supplier relationships to control costs and ensure timely delivery of essential inputs.

- Supplier Collaboration: Strategic partnerships with key suppliers to foster innovation and ensure quality standards are met across the network.

Textron's key resources are its skilled workforce, robust manufacturing infrastructure, valuable intellectual property, strong brand recognition, substantial financial capital, and a well-managed global supply chain.

These resources collectively enable Textron to design, manufacture, and deliver complex products across its diverse business segments, ensuring operational efficiency and market competitiveness.

The company's financial strength, evidenced by a significant order backlog, and its investment capacity further solidify its ability to pursue innovation and long-term growth.

Textron's global supply chain network is vital for sourcing materials and managing risks, with strategic supplier collaborations enhancing quality and efficiency.

| Resource Category | Key Assets/Capabilities | Supporting Data/Examples |

|---|---|---|

| Human Capital | Skilled engineers, technicians, manufacturing specialists | Approx. 34,000 employees globally |

| Physical Capital | Global manufacturing facilities, advanced technology | Wichita facilities known for advanced assembly lines |

| Intellectual Property | Patents, proprietary technologies | Drives product development and competitive advantage |

| Brand Equity | Established brand names | Bell, Cessna, Beechcraft, Pipistrel; 185 aircraft delivered by Textron Aviation in Q1 2024 |

| Financial Capital | Cash reserves, credit access, order backlog | $17.9 billion total company backlog (early 2025) |

| Supply Chain | Global sourcing network, supplier partnerships | Mitigates disruptions, ensures timely delivery |

Value Propositions

Textron's commitment to innovation is a core value proposition, particularly evident in its advanced technological solutions for the aviation and defense sectors. This focus translates into groundbreaking designs and cutting-edge avionics that deliver superior performance for its customers.

The company is actively investing in future technologies, such as advancements in electric aviation, aiming to provide customers with enhanced capabilities and more sustainable options. For instance, Textron Aviation's efforts in sustainable aviation fuels and exploring electric propulsion systems underscore this technological drive.

Textron's value proposition of reliability and proven performance is deeply rooted in its long history. For instance, its Bell segment, a cornerstone of its aviation business, has consistently delivered aircraft with exceptional durability and safety records, crucial for demanding military and commercial operations. This track record assures customers of consistent operational effectiveness, a key differentiator in sectors where failure is not an option.

Customers choose Textron's products, like those from its Textron Aviation segment, because of their demonstrated longevity and performance in challenging conditions. In 2023, Textron Aviation delivered over 200 new aircraft, underscoring the ongoing demand for its reliable platforms. This consistent delivery reinforces the company's reputation for building robust and dependable machinery that stands the test of time.

Textron offers robust aftermarket support, encompassing maintenance, repair, and parts availability, crucial for keeping customer assets operational. This commitment ensures extended product lifecycles and sustained customer value.

In 2024, Textron Aviation, for example, continued to emphasize its global service network, with over 60 authorized service facilities. This extensive reach is vital for providing timely support and parts to a diverse customer base, reinforcing the value proposition of reliable long-term operation.

Diverse Product Portfolio and Customization

Textron's diverse product portfolio, encompassing business jets like the Cessna Citation series, Bell helicopters, and Textron Systems' specialized defense vehicles, allows it to cater to a broad spectrum of customer requirements across civilian and military sectors.

This extensive range is a key value proposition, enabling Textron to serve multiple markets with tailored solutions. For instance, in 2024, Textron Aviation continued to see strong demand for its light and mid-size business jets, contributing significantly to the company's overall revenue.

- Broad Market Reach: Textron's offerings span aviation (business jets, helicopters), defense, and industrial sectors, providing a wide array of solutions.

- Customization Capabilities: Products are often tailored to meet specific client needs, enhancing their utility and value.

- Synergistic Offerings: The company's diverse segments can offer integrated solutions, such as combining aviation and defense technologies.

Financial Solutions for Acquisition

Textron Financial Corporation offers tailored financing solutions that significantly ease the acquisition of Textron's premium aircraft and helicopters. This strategic offering broadens customer access by providing flexible payment structures.

For instance, Textron Financial's programs can reduce the upfront capital required for a new Bell helicopter or a Textron Aviation business jet. This approach directly addresses a key barrier to entry for many potential buyers, making substantial investments more manageable.

- Facilitates High-Value Asset Acquisition: Textron Financial Corporation provides crucial financing for Textron's expensive aircraft and helicopter products.

- Enhances Product Accessibility: Flexible payment options made available through Textron Financial open up these high-value assets to a wider customer base.

- Supports Fleet Modernization: By offering financing, Textron enables businesses and individuals to upgrade their aviation fleets more readily.

- Drives Sales Volume: The availability of financing directly contributes to increased sales of Textron's aviation segment products.

Textron's value proposition is built on a foundation of innovation, delivering advanced technological solutions, particularly in aviation and defense. This focus is evident in their pursuit of cutting-edge designs and avionics, ensuring superior performance for their clientele. The company's commitment extends to future technologies, such as advancements in electric aviation, aiming to provide customers with enhanced capabilities and more sustainable options. For example, Textron Aviation's exploration of electric propulsion systems highlights this forward-thinking approach.

Customer Relationships

Textron’s dedicated sales and service teams are crucial for building and maintaining strong customer relationships across its varied business segments. These teams offer personalized support, ensuring clients receive expert guidance tailored to their specific needs, from initial purchase through ongoing maintenance and upgrades.

This direct engagement is a cornerstone of Textron's customer relationship strategy, fostering loyalty and understanding customer requirements deeply. For instance, Textron Aviation reported strong aftermarket services revenue in 2024, underscoring the value customers place on this dedicated support throughout the product lifecycle.

For Textron's military and government segments, customer relationships are deeply rooted in long-term contracts and strategic partnerships. These aren't just transactional; they involve continuous support, essential upgrades, and the co-development of new defense programs, fostering a high degree of collaboration and trust.

In 2024, Textron Aviation, for instance, continued to deliver robust support for its existing aircraft fleets, a key component of maintaining these long-term relationships. Similarly, Textron Systems secured significant contract awards for its unmanned systems and integrated solutions, underscoring the ongoing commitment from government clients for sustained program development and operational support.

Textron cultivates lasting customer bonds through comprehensive aftermarket service agreements. These agreements offer vital ongoing maintenance, readily available spare parts, and expert technical support, ensuring customers' Textron products remain operational and efficient.

These service contracts are crucial for maintaining high levels of customer satisfaction and operational readiness. For instance, in 2024, Textron Aviation reported that its service centers handled a significant volume of aircraft, underscoring the demand for such support services.

Beyond customer satisfaction, these agreements create a predictable and recurring revenue stream for Textron. This consistent income helps to stabilize financial performance and allows for continued investment in product development and service enhancements, fostering long-term loyalty.

Customer Training and Education

Textron invests significantly in customer training and education, especially for operators and maintenance teams of its aircraft. These programs are crucial for maximizing product performance and ensuring operational safety.

For instance, Textron Aviation's King Air training center offers extensive simulator and classroom instruction, a vital component for building customer proficiency. In 2024, Textron continued to expand its digital learning platforms, providing accessible resources to a global customer base.

- Enhanced Product Utilization: Well-trained customers can leverage Textron's products more effectively, leading to greater satisfaction and repeat business.

- Improved Safety Standards: Comprehensive education directly contributes to safer operations, a key differentiator in the aviation industry.

- Strengthened Brand Loyalty: By empowering customers with knowledge, Textron fosters a deeper, more trusting relationship.

- Reduced Support Costs: Educated customers often require less direct support, optimizing Textron's service resources.

Online Portals and Digital Engagement

Textron utilizes online portals and digital platforms to enhance customer relationships by offering accessible support and information. These digital channels facilitate communication, providing customers with convenient self-service options.

While direct sales remain crucial, Textron's digital engagement strategies, including online portals, complement traditional customer relationship management. This approach boosts accessibility and convenience for a wider customer base.

- Digital Support Channels: Textron's online portals provide customers with 24/7 access to FAQs, product manuals, and troubleshooting guides, reducing reliance on direct support for common queries.

- Information Hub: These platforms serve as a central repository for product updates, service bulletins, and company news, ensuring customers are well-informed.

- Facilitating Communication: Digital engagement tools allow for streamlined communication, enabling customers to submit service requests or inquiries efficiently.

- Complementary Strategy: In 2024, Textron reported a significant increase in digital customer interactions across its business segments, highlighting the growing importance of these channels in customer relationship management.

Textron's customer relationships are built on a foundation of direct engagement through dedicated sales and service teams, ensuring personalized support across its diverse segments. This approach, evident in Textron Aviation's strong 2024 aftermarket services revenue, prioritizes understanding and meeting client needs throughout the product lifecycle.

For government and military clients, relationships are cemented through long-term contracts and collaborative program development, fostering deep trust and ongoing support. Textron Systems' significant contract awards in 2024 for unmanned systems reflect this sustained commitment from key partners.

Comprehensive aftermarket service agreements, including maintenance and spare parts, are vital for customer satisfaction and operational readiness, as demonstrated by Textron Aviation's busy service centers in 2024. These agreements also provide Textron with predictable, recurring revenue, supporting continued investment in product and service enhancements.

Textron further strengthens customer bonds through extensive training programs, like those at Textron Aviation's King Air training center, enhancing product utilization and safety. The expansion of digital learning platforms in 2024 made these resources more accessible globally.

Channels

Textron leverages a dedicated direct sales force to cultivate relationships with major commercial clients, government entities, and military branches. This approach facilitates direct negotiation and the development of customized solutions. In 2024, Textron's direct sales efforts were crucial in securing significant contracts, contributing to its robust revenue streams across its diverse business segments.

Textron leverages an authorized dealer and distributor network to expand its market reach for specific product lines like specialized vehicles and certain general aviation aircraft. This strategy is crucial for providing localized sales and after-sales service, effectively reaching a wider customer base. For instance, Textron Aviation's network includes over 150 authorized service facilities globally, ensuring customers have access to maintenance and support.

Textron’s global network of service centers and maintenance facilities forms a critical component of its customer support infrastructure. These strategically located sites ensure that Textron’s diverse customer base, from aviation to industrial sectors, receives prompt and reliable aftermarket services, including repairs, overhauls, and parts management.

In 2024, Textron Aviation continued to expand its service capabilities, with its wholly owned service centers and authorized service facilities offering comprehensive maintenance, repair, and overhaul (MRO) services for its Citation, King Air, and Hawker aircraft families. This extensive reach is vital for maintaining customer satisfaction and aircraft operational readiness across the globe.

Trade Shows and Industry Events

Textron leverages major aerospace, defense, and industrial trade shows and industry events as crucial channels. These platforms are essential for unveiling new products, fostering connections with prospective clients, and building relationships across the sector. For instance, participation in events like the Paris Air Show or Farnborough Airshow allows Textron to directly demonstrate its capabilities and innovations to a global audience, driving significant lead generation and enhancing brand recognition.

These events are more than just showcases; they are vital for market intelligence and competitive analysis. By observing competitor offerings and engaging in direct dialogue with industry stakeholders, Textron gains invaluable insights that inform product development and strategic planning. In 2024, the aerospace and defense sector continued to see robust engagement at these events, with many companies reporting strong interest in advanced technologies and sustainable aviation solutions.

- Product Demonstration: Trade shows offer a tangible way to showcase the performance and features of Textron's diverse product portfolio, from Bell helicopters to Textron Aviation aircraft and Textron Systems' defense solutions.

- Customer Engagement: Direct interaction at events facilitates understanding customer needs, gathering feedback, and nurturing potential sales pipelines.

- Networking Opportunities: These gatherings are critical for building and maintaining relationships with suppliers, partners, government officials, and potential investors.

- Brand Visibility: Prominent presence at key industry events reinforces Textron's brand as a leader in its respective markets.

Digital Platforms and Online Presence

Textron utilizes its corporate website, www.textron.com, as a central hub for information dissemination, investor relations, and brand building. This platform provides detailed product information, company news, and financial reports, crucial for stakeholders seeking to understand Textron's diverse portfolio.

Social media channels, particularly LinkedIn and YouTube, are actively employed for marketing, talent acquisition, and showcasing company innovations. For instance, Textron Aviation frequently uses these platforms to highlight new aircraft models and operational advancements, reaching a broad audience of industry professionals and potential customers.

- Corporate Website: Textron.com serves as the primary digital storefront for company information and investor relations.

- Social Media Engagement: LinkedIn and YouTube are key platforms for marketing, showcasing products, and engaging with the professional community.

- Information Hub: Digital platforms are vital for communicating company strategy, financial performance, and technological achievements to a global audience.

Textron's channels are multifaceted, encompassing direct sales, dealer networks, and extensive service infrastructure. These are further amplified by strategic participation in industry events and robust digital platforms. This integrated approach ensures broad market penetration and strong customer support across its diverse business segments.

In 2024, Textron continued to emphasize direct sales for large-scale contracts, particularly within the defense and aerospace sectors, securing key agreements that bolstered its revenue. Simultaneously, its authorized dealer network facilitated wider accessibility for products like general aviation aircraft, with Textron Aviation maintaining over 150 global service facilities to support these sales and ensure customer satisfaction.

Digital channels, including the corporate website and social media platforms like LinkedIn and YouTube, are instrumental in brand building and information dissemination. These platforms not only showcase innovations and financial performance but also serve as vital tools for engaging with customers and industry professionals, driving lead generation and market awareness.

| Channel Type | Key Function | 2024 Focus/Example |

|---|---|---|

| Direct Sales Force | Cultivating relationships with major clients, government, and military. | Securing significant contracts in aerospace and defense. |

| Dealer/Distributor Network | Expanding market reach for specific product lines. | Providing localized sales and after-sales service for general aviation. |

| Service Centers/MRO Facilities | Ensuring prompt aftermarket services and customer support. | Comprehensive maintenance for Citation, King Air, and Hawker aircraft. |

| Trade Shows/Industry Events | Product unveiling, client engagement, and networking. | Showcasing advanced technologies at major aerospace and defense exhibitions. |

| Digital Platforms (Website, Social Media) | Information dissemination, brand building, marketing. | Highlighting innovations and engaging with professionals on LinkedIn and YouTube. |

Customer Segments

The U.S. Government and Military represent a cornerstone customer segment for Textron, with significant revenue generated by its Bell and Textron Systems divisions. This segment includes major branches like the U.S. Army, Navy, Air Force, and Marine Corps, as well as other defense-related agencies.

These entities procure a wide array of Textron's products, from advanced military helicopters and tiltrotor aircraft like the V-22 Osprey, to sophisticated unmanned aerial systems and various defense solutions. These acquisitions are critical for national security, global military operations, and maintaining technological superiority.

In 2023, Textron reported that its Bell segment's revenue was $4.1 billion, with a significant portion attributed to military programs. Textron Systems also plays a vital role, contributing to defense contracts for platforms such as the Shadow and Aerosonde unmanned aircraft systems, which are widely deployed by the U.S. military.

Textron actively engages with international governments and military forces, supplying specialized defense and training aircraft. These sales often occur through direct government contracts or intergovernmental agreements, facilitating global reach and fostering strategic partnerships.

In 2024, Textron's Bell segment, a key provider of military rotorcraft, secured significant orders. For instance, the U.S. Army's Future Long-Range Assault Aircraft (FLRAA) program, where Textron's V-280 Valor is a contender, represents a substantial potential future revenue stream, with initial procurements expected to ramp up in the coming years.

Textron's commitment to international defense extends to its Cessna and Beechcraft divisions, offering turboprop and jet aircraft for surveillance, training, and light transport roles to allied nations. This diversification strengthens its position in the global aerospace market, contributing to approximately 30% of Textron's total revenue from its defense segments coming from international customers.

Commercial Aviation Operators, a key customer segment for Textron, encompass a broad range of entities including fractional aircraft businesses, charter and fleet operators, and corporate aviation departments. These businesses, along with individual high-net-worth buyers, are significant purchasers of Textron's business jets, turboprop aircraft, and commercial helicopters, utilizing them for both essential business travel and private transportation needs.

In 2024, the business aviation market continued to show resilience, with demand for new aircraft remaining robust. For instance, Textron Aviation reported strong order activity for its Cessna Citation and Beechcraft King Air product lines, reflecting the ongoing need for efficient and flexible travel solutions among these operators.

Industrial and Commercial Businesses

Textron's Industrial segment caters to a broad spectrum of commercial and industrial clients. A key area is supplying automotive manufacturers with essential components, such as plastic fuel systems. In 2024, the automotive sector continued to be a significant driver for industrial suppliers.

Beyond automotive, Textron provides specialized vehicles crucial for various operations. This includes golf cars, widely used in resorts and recreational facilities, and utility vehicles essential for logistics and maintenance across different industries. Furthermore, their ground support equipment plays a vital role in airport operations.

- Automotive Components: Supplying plastic fuel systems to major car manufacturers.

- Specialized Vehicles: Offering golf cars and utility vehicles for diverse commercial needs.

- Ground Support Equipment: Providing essential machinery for airport operations.

Law Enforcement, Public Safety, and Emergency Services

This segment encompasses government agencies and private organizations that deploy Bell helicopters for crucial operations like policing, emergency response, and public safety. These entities depend on Textron's aircraft for their ability to quickly and effectively reach critical situations, often in challenging environments.

Bell's helicopters are vital tools for these sectors, offering speed and maneuverability essential for missions such as search and rescue, medical evacuations, and border patrol. In 2024, the demand for advanced rotorcraft in public safety continued to grow, with many agencies seeking to upgrade aging fleets for enhanced capabilities.

- Law Enforcement: Police departments globally utilize Bell helicopters for aerial surveillance, pursuit, and tactical support, contributing to efficient crime prevention and response.

- Public Safety: Fire departments and emergency management agencies rely on these aircraft for disaster assessment, aerial firefighting support, and personnel transport during critical events.

- Emergency Medical Services (EMS): Air ambulance services, a key component of this segment, use Bell helicopters to rapidly transport patients to specialized medical facilities, saving valuable time in life-or-death situations.

Textron's customer base is diverse, spanning critical sectors like government, commercial aviation, and industrial markets. The company's ability to serve these distinct segments with tailored solutions, from advanced defense systems to business aircraft and industrial components, underpins its broad market reach and revenue generation strategies.

In 2024, Textron Aviation observed continued strong demand for its Cessna and Beechcraft lines, particularly from corporate flight departments and fractional ownership programs. These customers prioritize efficiency and flexibility in their travel, driving sales of light to super-midsize business jets and versatile turboprops.

The industrial segment, including its Kautex business, serves the automotive industry by providing plastic fuel systems and other components. This segment also supplies specialized vehicles like golf cars and utility vehicles, alongside ground support equipment for airports, catering to a wide array of commercial and recreational needs.

| Customer Segment | Key Offerings | 2023/2024 Relevance |

|---|---|---|

| U.S. Government & Military | Military aircraft (helicopters, tiltrotors, UAVs), defense solutions | Bell segment revenue $4.1B in 2023; V-280 Valor program significant for 2024 outlook. |

| International Governments & Military | Defense and training aircraft | Approximately 30% of defense segment revenue from international customers. |

| Commercial Aviation Operators | Business jets, turboprops, commercial helicopters | Robust demand for Cessna Citation and Beechcraft King Air in 2024. |

| Industrial (Automotive, Specialized Vehicles, GSE) | Plastic fuel systems, golf cars, utility vehicles, ground support equipment | Automotive sector remained a significant driver in 2024; continued need for specialized vehicles. |

| Public Safety & Government Agencies | Bell helicopters for law enforcement, EMS, fire services | Growing demand for fleet upgrades in 2024 for enhanced capabilities. |

Cost Structure

Manufacturing and production costs represent a substantial component of Textron's expenses. These include the direct costs associated with raw materials, such as aluminum and composites for aircraft, as well as the various components and sub-assemblies needed for their defense and industrial product lines. For instance, in 2023, Textron's cost of sales was $13.7 billion, reflecting these significant material and component outlays.

Labor costs are also a critical factor within this category. This encompasses wages and benefits for the skilled workforce involved in assembly, machining, and quality control across all their business segments. Textron's focus on optimizing production line efficiency is directly aimed at controlling and reducing these labor-intensive expenses, thereby impacting overall profitability.

Textron's significant investment in Research and Development (R&D) is a critical component of its cost structure, directly fueling its innovation pipeline and commitment to developing advanced solutions across its diverse business segments.

For the fiscal year 2023, Textron reported R&D expenses totaling $660 million, representing approximately 3.5% of its total revenue. This substantial outlay underscores the company's strategy to maintain a competitive edge and introduce next-generation products in sectors like aviation, defense, and industrial equipment.

These R&D expenditures are essential for developing cutting-edge technologies, improving existing product lines, and exploring new market opportunities, ensuring Textron remains at the forefront of technological advancements and delivers high-value solutions to its customers.

Selling, General, and Administrative (SG&A) expenses are a significant component of Textron's cost structure. These operating expenses encompass costs related to sales and marketing efforts, the salaries and benefits of administrative staff, and the overhead associated with corporate functions. For instance, in 2023, Textron reported SG&A expenses of $2.7 billion, reflecting the substantial investment in these areas to support its diverse business segments.

To enhance profitability, Textron actively pursues strategies to reduce these operating costs. Restructuring activities, such as streamlining operations or consolidating functions, are often implemented to achieve greater efficiency. These initiatives aim to optimize the allocation of resources and minimize non-essential spending within SG&A, ultimately contributing to a healthier bottom line.

Supply Chain and Logistics Costs

Textron's extensive global supply chain necessitates significant investment in procurement, warehousing, and the transportation of components and finished aircraft. Managing these intricate networks involves substantial costs, particularly in light of ongoing global supply chain volatility. For instance, in 2024, the aerospace and defense sector, where Textron primarily operates, continued to grapple with increased shipping rates and material costs, impacting overall logistics expenses.

Supply chain disruptions, a persistent challenge throughout 2024, directly translate into higher operational costs for Textron. These disruptions can arise from geopolitical events, natural disasters, or labor shortages, all of which can inflate expenses related to expedited shipping, alternative sourcing, and increased inventory holding. The company's ability to mitigate these costs is crucial for maintaining profitability.

- Procurement Expenses: Costs associated with sourcing raw materials and components from a global network of suppliers.

- Logistics and Transportation: Expenditures on freight, shipping, customs duties, and warehousing for materials and finished goods.

- Inventory Management: Costs related to holding, tracking, and insuring inventory throughout the supply chain.

- Impact of Disruptions: Increased operational costs due to expedited shipping, alternative sourcing, and potential production delays stemming from supply chain interruptions.

Aftermarket Service and Warranty Costs

Aftermarket service and warranty costs are a significant component of Textron's cost structure. The company incurs substantial expenses related to supporting its installed base of aircraft, industrial equipment, and defense products. This includes the cost of providing spare parts, technical support, and the fulfillment of warranty claims. For instance, in 2023, Textron's total cost of sales was $13.5 billion, which encompasses these service and warranty expenses.

These ongoing costs are essential for maintaining customer satisfaction and the long-term value of Textron's products. The company operates a network of service centers and invests in training to ensure efficient and effective support. Fulfilling warranty obligations, while a commitment to customers, directly impacts profitability.

- Ongoing expenses for spare parts and technical support.

- Costs associated with maintaining a global service center network.

- Financial impact of warranty claims and repairs.

- Investment in training and development for service personnel.

Textron's cost structure is heavily influenced by its manufacturing operations, with significant outlays for raw materials like aluminum and composites, as well as various components for its diverse product lines. In 2023, the company's cost of sales reached $13.7 billion, directly reflecting these substantial material and component expenses.

Labor costs, including wages and benefits for skilled assembly and quality control personnel, are also a critical expense. Furthermore, Textron invests heavily in Research and Development (R&D), with $660 million allocated in 2023, underscoring its commitment to innovation and maintaining a competitive edge in its markets.

Selling, General, and Administrative (SG&A) expenses, amounting to $2.7 billion in 2023, cover sales, marketing, and corporate overhead. The company also faces significant costs related to its global supply chain, including procurement, logistics, and inventory management, with disruptions in 2024 impacting shipping rates and material costs.

| Cost Category | 2023 Expense (USD Billions) | Key Components |

|---|---|---|

| Cost of Sales | 13.7 | Raw materials, components, direct labor |

| Research & Development (R&D) | 0.66 | New product development, technological advancements |

| Selling, General & Administrative (SG&A) | 2.7 | Sales, marketing, administrative salaries, corporate overhead |

Revenue Streams

A primary revenue driver for Textron Aviation is the sale of new aircraft. This segment encompasses a diverse range of products, including the popular Cessna Citation line of business jets, known for their efficiency and performance.

The Beechcraft brand contributes significantly with its robust turboprop offerings, such as the King Air series, a staple in corporate and special mission aviation, and the versatile Caravan, widely used for cargo and passenger transport.

Furthermore, Textron’s defense segment, particularly its military trainer aircraft, also represents a substantial revenue stream. For instance, Textron Aviation delivered 187 new aircraft in the first quarter of 2024, showcasing the ongoing demand for its product portfolio.

Bell, Textron's aviation segment, drives significant revenue through the sale of both commercial helicopters and military tiltrotor aircraft. This includes lucrative contracts with the U.S. Government and international defense organizations.

In 2024, Textron's Bell segment reported robust sales, with new aircraft deliveries and continued program revenue contributing to its financial performance. For instance, the Bell V-280 Valor tiltrotor program continues to garner interest and potential orders, underscoring the demand for advanced military rotorcraft.

Textron consistently generates revenue from its installed base of aircraft and helicopters through the sale of aftermarket parts, maintenance, inspection, and repair services. This segment also includes advanced flight training devices, contributing to a stable and recurring income stream. For instance, Textron Aviation reported a significant portion of its 2023 revenue derived from aftermarket services, underscoring its importance.

Defense Systems and Solutions Sales

Textron Systems generates significant revenue by developing, manufacturing, and integrating advanced products and services tailored for defense, homeland security, and aerospace applications. This segment is a core contributor to Textron's overall financial performance.

Key revenue drivers within Defense Systems and Solutions include:

- Unmanned Aircraft Systems (UAS): Sales of platforms like the Shadow and Aerosonde provide recurring revenue through system sales and operational support.

- Marine Craft: The production and sale of high-performance patrol boats and specialized marine vessels for military and security forces contribute to this revenue stream.

- Electronic Systems: Development and delivery of advanced communication, intelligence, surveillance, and reconnaissance (ISR) systems and components for various defense platforms.

In 2024, Textron Systems' performance is bolstered by ongoing defense spending and the demand for its specialized capabilities. For instance, Textron secured a notable contract in early 2024 for continued support of its UAS programs, underscoring the sustained demand for these critical assets.

Finance Income from Customer Financing

Textron Financial Corporation (TFC) is a key revenue generator for Textron by offering financing to customers acquiring Textron Aviation aircraft and Bell helicopters. This captive finance arm not only facilitates sales but also earns significant interest income.

In 2023, Textron's finance segment, primarily driven by TFC, reported substantial earnings. For instance, Textron Financial's net income attributable to Textron Inc. was approximately $210 million in 2023, reflecting the robust income generated from its financing activities.

- Customer Financing: Textron Financial Corporation provides loans and leases to buyers of Textron's aviation and defense products.

- Interest Income: The primary revenue stream is the interest earned on these financing agreements.

- Sales Support: This financing capability acts as a crucial enabler for product sales across Textron's business units.

- 2023 Performance: Textron Financial contributed significantly to the company's overall financial results, with its operations demonstrating strong profitability in the past year.

Textron's revenue streams are diverse, spanning aircraft sales, aftermarket services, and financing. The company's aviation segment, Textron Aviation, generates substantial income from new aircraft sales, including popular business jets and turboprops. Bell, another key division, profits from both commercial and military helicopter sales, with significant contributions from defense contracts.

Beyond new product sales, Textron capitalizes on its installed base through aftermarket services like parts, maintenance, and training devices, providing a recurring revenue stream. Textron Systems adds to this with specialized defense products and integrated solutions, including unmanned aircraft systems and marine craft.

Textron Financial Corporation plays a crucial role by offering customer financing for aircraft and helicopter purchases, generating interest income and facilitating sales across the group. In 2023, Textron Financial reported approximately $210 million in net income, highlighting the profitability of its financing operations.

| Revenue Stream | Key Products/Services | 2023/2024 Relevance |

| New Aircraft Sales | Cessna Citations, Beechcraft King Air, Bell Helicopters | 187 new aircraft deliveries by Textron Aviation in Q1 2024. Bell V-280 Valor program ongoing. |

| Aftermarket Services | Parts, Maintenance, Repair, Training Devices | Significant portion of Textron Aviation's 2023 revenue derived from these services. |

| Defense Systems & Solutions | UAS (Shadow, Aerosonde), Marine Craft, Electronic Systems | Ongoing defense spending supports demand; notable UAS support contract secured in early 2024. |

| Customer Financing | Loans and Leases via Textron Financial Corp. | Textron Financial's net income was approx. $210 million in 2023. |

Business Model Canvas Data Sources

The Textron Business Model Canvas is informed by a comprehensive blend of internal financial data, extensive market research reports, and strategic analyses of industry trends. These diverse data sources ensure that each component of the canvas accurately reflects Textron's operational realities and strategic positioning.