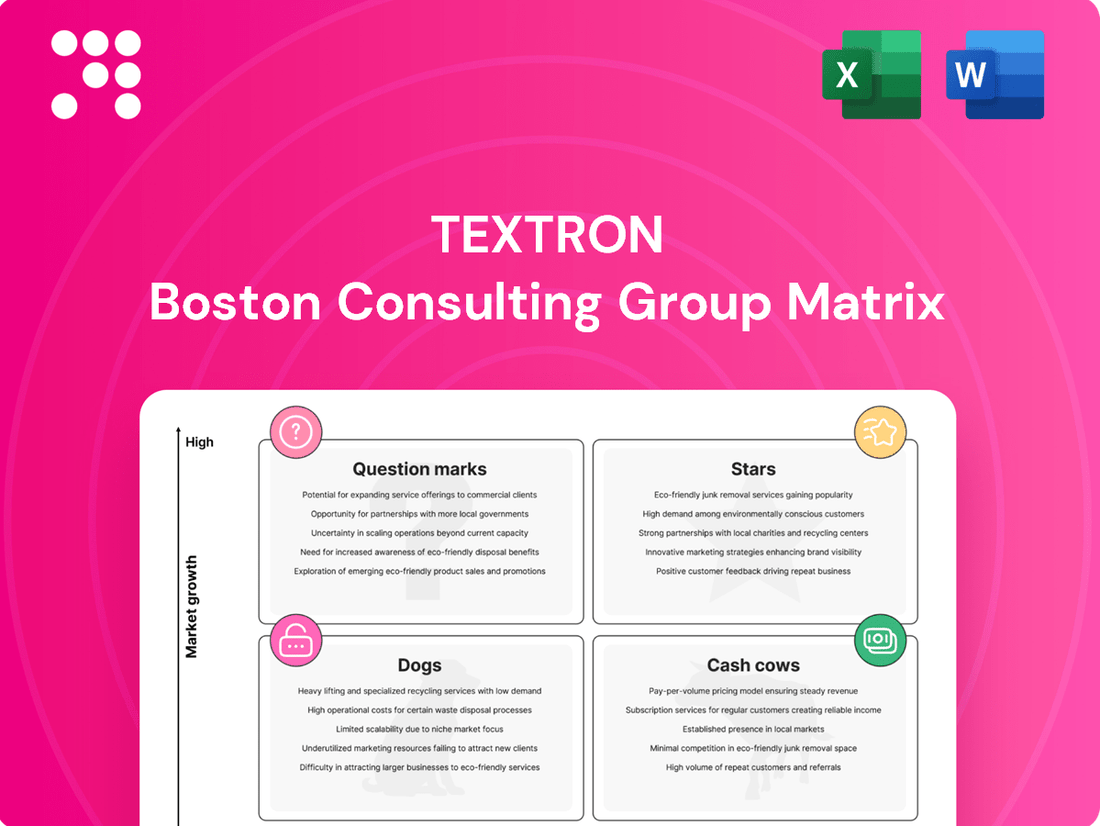

Textron Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Textron Bundle

Unlock the strategic potential of Textron's product portfolio with a clear understanding of its BCG Matrix. See which divisions are market leaders, which are generating consistent cash, and which require careful evaluation. Purchase the full report for detailed quadrant analysis and actionable insights to optimize your investment strategy.

Stars

Bell's V-280 Valor, selected for the U.S. Army's Future Long-Range Assault Aircraft (FLRAA) program, signifies a substantial growth opportunity for Textron. This initiative is set to be the Army's most significant helicopter acquisition in four decades, promising sustained revenue and a dominant position in the military tiltrotor market.

The FLRAA program is currently in its engineering and manufacturing development stage. With prototype flights anticipated in 2026 and initial deployment targeted for 2030, the V-280 Valor is positioned within a high-growth market segment, reflecting strong future potential for Textron.

Textron Aviation's Citation series is a strong contender in the booming global business jet market, which is expected to grow at a 4.8% CAGR between 2025 and 2034. This segment benefits from sustained demand, evident in Textron Aviation's impressive $7.85 billion backlog as of Q2 2025. The consistent delivery of these aircraft underscores their market relevance and Textron's ability to meet customer needs in this dynamic sector.

Bell's military helicopter programs are a significant contributor to its overall performance, benefiting from a robust global defense market. The military helicopter sector is projected to grow at a compound annual growth rate of 5.9% between 2024 and 2025, fueled by rising defense spending worldwide.

Bell's military segment demonstrated this strength with a notable $154 million revenue increase in the first quarter of 2025. This growth was primarily bolstered by the company's sustainment programs, which ensure the continued operational readiness of existing fleets for allied nations.

The sustained demand for advanced rotorcraft, coupled with increasing defense budgets across many countries, positions Bell's military helicopter offerings as a strong performer within the current market landscape. This segment is a key driver of Bell's financial results and strategic positioning in the aerospace and defense industry.

Textron Systems (Defense Solutions)

Textron Systems, a key player in the defense sector, is navigating a dynamic market. While its revenue experienced a minor dip in Q2 2025, the broader defense industry is experiencing robust growth, fueled by increased global military spending and ongoing modernization programs. This trend is expected to continue, presenting a favorable environment for Textron Systems.

The company's strong performance is underpinned by a substantial backlog of $2.2 billion. This significant order book demonstrates sustained demand for Textron Systems' specialized defense offerings, ranging from advanced unmanned systems to precision weapons. The company's ability to secure such a backlog highlights its competitive edge and the critical nature of its products.

Furthermore, Textron Systems has seen an improvement in its profitability. This gain is a testament to the company's operational efficiencies and its strategic positioning within the high-growth defense market. The positive profit trend, despite minor revenue fluctuations, suggests effective cost management and a focus on high-margin products and services.

Key financial and operational highlights for Textron Systems include:

- Revenue: Experienced a slight decrease in Q2 2025, but the overall defense market is expanding.

- Backlog: Stands at a robust $2.2 billion, indicating strong future revenue potential.

- Profitability: Showed improvement, reflecting enhanced operational efficiency and strategic market placement.

- Market Context: Benefiting from increased global military expenditure and modernization efforts driving defense sector growth.

Innovation in Aviation (New Aircraft Development)

Textron is demonstrating a strong commitment to innovation in aviation, particularly with the development of new aircraft. The Citation Ascend and Beechcraft Denali are prime examples, with both slated for certification and entry into service in 2025. These aircraft are strategically positioned to gain traction in dynamic and expanding segments of the business aviation market. This focus on new product development underscores Textron's ambition to lead in future aviation landscapes.

- Citation Ascend: Targeting the light to mid-size business jet market, aiming to offer enhanced performance and cabin comfort.

- Beechcraft Denali: A single-engine turboprop designed for versatility, intended for both passenger and cargo missions with advanced avionics and a new engine.

- Market Focus: These developments reflect Textron's strategy to address evolving customer needs and capture growth opportunities in key business aviation sectors.

Textron's Bell V-280 Valor, chosen for the U.S. Army's FLRAA program, is a significant growth driver. This program, representing the Army's largest helicopter acquisition in decades, promises substantial, long-term revenue and a leading position in the military tiltrotor market.

The Citation Ascend and Beechcraft Denali are slated for 2025 certification and entry into service. These new aircraft are strategically positioned to capture market share in expanding business aviation segments, reflecting Textron's commitment to innovation and future growth.

Textron Aviation's Citation series is a strong performer in the growing business jet market, evidenced by a $7.85 billion backlog as of Q2 2025. Bell's military helicopter programs also benefit from a robust defense market, with projected sector growth of 5.9% between 2024 and 2025, further bolstered by $154 million in Q1 2025 revenue growth from sustainment programs.

Textron Systems, despite a minor Q2 2025 revenue dip, is well-positioned within the expanding defense sector, supported by a $2.2 billion backlog and improved profitability due to operational efficiencies.

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

Provides a clear visual of Textron's business units, simplifying complex portfolio analysis.

Cash Cows

Bell Commercial Helicopters operates within a market projected to grow at a compound annual growth rate of approximately 3.1% to 3.8% through 2029. This steady, though not explosive, expansion reflects a mature segment where established players like Bell can leverage their strong market presence.

Bell's Q1 2025 performance highlighted robust commercial helicopter deliveries, underscoring its significant market share. This strong sales momentum directly contributes to its classification as a Cash Cow within Textron's portfolio, benefiting from consistent demand for its reliable product lines.

These established commercial models are key cash generators for Textron, as they command a substantial portion of the market and require minimal capital for aggressive innovation or expansion. Their consistent profitability allows them to fund other areas of Textron's business, embodying the classic Cash Cow characteristics.

Textron Aviation's aftermarket parts and services business is a prime example of a cash cow within the company's portfolio. This segment benefits from a substantial installed base of Cessna and Beechcraft aircraft, ensuring a consistent and predictable demand for maintenance, repairs, and spare parts. This mature market generates high-margin revenue, acting as a reliable cash generator for Textron.

In the first quarter of 2025, this crucial segment experienced a notable revenue increase, underscoring its ongoing strength and contribution to Textron Aviation's overall financial performance. The consistent demand in this sector highlights its status as a stable and profitable business unit.

Textron Finance acts as a classic cash cow within Textron's portfolio. Its primary role is to facilitate sales of Textron's diverse product lines, thereby generating a steady and reliable income. This segment is characterized by its established market position and consistent profitability.

In the second quarter of 2025, Textron Finance reported a profit of $8 million. This contribution, while not indicative of rapid expansion, underscores the segment's ability to generate substantial returns with minimal investment, a hallmark of a mature cash cow.

The segment's strength lies in its high market share within its specific financing niche, coupled with low growth prospects. This allows it to operate efficiently and profitably, providing crucial financial support and stability to Textron's other business units, particularly those in higher-growth, more capital-intensive phases.

Cessna Caravan Turboprops

The Cessna Caravan turboprops represent a classic Cash Cow for Textron Aviation. This aircraft is renowned for its versatility and reliability, serving a wide array of roles from cargo transport to passenger service in diverse environments. The market for these utility turboprops is mature, meaning growth is modest, but demand remains consistently strong due to their proven track record and operational efficiency.

Textron Aviation's commitment to the Caravan line is evident in its continued production and sales. In the first quarter of 2025, the company reported the delivery of 30 commercial turboprops, a segment where the Caravan is a significant contributor. This consistent demand underscores the aircraft's established market position and its ability to generate reliable revenue streams.

The inherent strengths of the Cessna Caravan contribute to its Cash Cow status. Its long-standing market acceptance means that marketing and sales efforts require less investment compared to newer or more innovative products. This translates into lower promotional costs and higher profit margins, allowing the Caravan to efficiently generate substantial and predictable cash flow for Textron Aviation.

- Product: Cessna Caravan Turboprops

- Market Position: Mature, Stable Utility & Regional Transport

- Q1 2025 Deliveries: 30 Commercial Turboprops

- Financial Characteristic: Consistent Cash Flow Generation, Lower Promotional Costs

Bell's Legacy Military Support Programs

Bell's legacy military support programs, particularly for the V-22 Osprey, are significant cash cows for Textron. These programs are characterized by high market share and consistent demand, driven by the extended operational life of military aircraft and the continuous need for maintenance and upgrades.

These sustainment and support contracts provide a stable and predictable revenue stream. For instance, in 2023, Textron's Bell segment reported approximately $4.1 billion in revenue, with a substantial portion attributed to these ongoing support services for its established military platforms.

- Stable Revenue: Bell's support programs for existing fleets like the V-22 Osprey generate consistent cash flow.

- High Market Share: These programs benefit from Bell's established position and the necessity of specialized support for complex military assets.

- Long-Term Viability: The long operational lifespans of military helicopters ensure sustained demand for maintenance, spare parts, and upgrades.

- Profitability: While newer programs may require significant investment, legacy support operations typically offer higher profit margins due to mature cost structures.

Textron's Cash Cows are business units or products with high market share in mature, low-growth industries. These entities generate more cash than they consume, providing stable and predictable returns. They require minimal investment to maintain their position, allowing Textron to allocate capital to other strategic areas.

The Cessna Caravan turboprops exemplify a Cash Cow due to their established market, consistent demand, and efficient operations. Similarly, Textron Aviation's aftermarket parts and services benefit from a large installed base, ensuring reliable, high-margin revenue. Bell's legacy military support programs, like those for the V-22 Osprey, also fit this profile, offering sustained income from maintenance and upgrades.

Textron Finance, by facilitating sales and generating steady income with low investment needs, acts as another classic Cash Cow. These segments collectively provide a strong foundation of profitability and cash generation for the broader Textron organization.

| Business Unit/Product | Market Characteristic | Q1 2025 Data/Commentary | Cash Cow Attribute |

| Bell Commercial Helicopters | Mature, Steady Growth (3.1%-3.8% CAGR to 2029) | Robust deliveries in Q1 2025 | Strong market presence, consistent demand |

| Textron Aviation Aftermarket | Mature, Stable Demand | Notable revenue increase in Q1 2025 | High-margin revenue from large installed base |

| Textron Finance | Established Market Position, Low Growth | Profit of $8 million in Q2 2025 | Steady income generation, minimal investment |

| Cessna Caravan Turboprops | Mature, Consistent Demand | 30 commercial turboprop deliveries in Q1 2025 | Lower promotional costs, predictable cash flow |

| Bell Military Support Programs (e.g., V-22 Osprey) | Long-Term, Consistent Demand | Substantial portion of Bell's $4.1 billion revenue in 2023 | Stable revenue from sustainment and support contracts |

Preview = Final Product

Textron BCG Matrix

The preview you're currently viewing is the identical, fully formatted Textron BCG Matrix document you will receive immediately after purchase. This ensures you know exactly what you're getting—a comprehensive strategic tool, ready for immediate application without any hidden surprises or watermarks. You can confidently plan your next steps knowing the exact content and professional design are yours upon completion of your purchase.

Dogs

Textron's Industrial segment saw its revenue decrease in Q2 2025, a direct result of selling off its Powersports division and softer sales in areas like golf equipment.

Despite the revenue drop, segment profit saw an increase, thanks to successful cost-saving measures and the impact of the divestiture.

The remaining industrial businesses operate in markets with limited growth potential and may have smaller market shares, necessitating diligent oversight to prevent them from becoming financial burdens.

Textron's divestiture of its Powersports business, notably the Arctic Cat brand, in Q2 2025 strongly suggests its classification as a 'Dog' within the BCG Matrix. This segment likely exhibited both low market growth and a low market share, a combination that typically drains resources without generating significant returns.

The strategic decision to sell this business implies it was viewed as a cash trap, tying up capital that could be better allocated elsewhere. In 2024, the powersports industry faced challenges including supply chain disruptions and shifting consumer preferences, further pressuring businesses with already weak market positions.

Within Textron Aviation's business jet offerings, older models with lower sales volumes, such as certain configurations of the Cessna Citation CJ series that haven't undergone significant modernization, might be classified as Dogs. These aircraft, while historically important, could be facing increased competition from newer, more fuel-efficient, and technologically advanced competitors, leading to declining demand.

For instance, if a specific older Citation model's annual deliveries have consistently fallen below a certain threshold, say under 10 units in recent years, and its market share in its segment has shrunk significantly, it would likely fit the Dog profile. Such aircraft often require substantial investment in parts, maintenance, and marketing to sustain their presence, yielding diminishing returns for Textron.

Specific Legacy Industrial Product Lines

Within Textron's industrial segment, specific legacy product lines may represent the company's 'Dogs' in a BCG matrix analysis. These are often niche industrial equipment categories that cater to mature or declining markets. Their specialized nature might mean they don't align with current high-growth industry trends, leading to stagnant demand.

These legacy products typically exhibit low market share for Textron, meaning they are not dominant players even in their limited market segments. Consequently, they generate minimal cash flow and offer very limited potential for future growth or significant returns on investment. This positions them as candidates for divestiture or careful management to minimize losses.

- Stagnant Market Demand: Certain specialized industrial machinery may face declining demand due to technological obsolescence or shifts in manufacturing practices.

- Low Textron Market Share: In these niche areas, Textron might hold a small percentage of the total market, indicating a lack of competitive advantage or scale.

- Minimal Cash Generation: These products contribute little to overall revenue and profits, often requiring significant maintenance without substantial returns.

- Limited Growth Prospects: The inherent nature of the markets they serve offers little opportunity for expansion or increased profitability in the foreseeable future.

Discontinued or Phasing-Out Defense Programs

Textron Systems, like many defense contractors, manages a portfolio that includes programs nearing obsolescence. These legacy systems, while historically profitable, often face declining demand as newer, more advanced technologies emerge. For instance, older aircraft or communication systems might be superseded by next-generation platforms, leading to a natural phase-out.

When such programs are discontinued or phased out, their contribution to Textron's market share and growth prospects effectively ceases. The strategic imperative shifts from development and expansion to efficient management and eventual divestment or wind-down. This approach frees up capital and resources for reinvestment in more promising areas of the business.

Managing these "Dogs" in the BCG matrix involves a careful assessment of remaining contract obligations and potential for profitable, albeit limited, continued sales. The focus is on minimizing further investment, maximizing returns on existing assets, and planning a strategic exit that aligns with Textron's overall business objectives and market conditions.

For example, a program that once represented a significant portion of Textron's defense revenue might see its market share shrink considerably. If a particular legacy radar system, for which Textron provided maintenance and upgrades, is no longer being procured by major defense forces, its growth potential becomes zero. Textron's strategy would then be to fulfill existing contracts and potentially offer support for a limited period before phasing out the offering entirely, rather than investing in new development for an outdated technology.

Textron's divestiture of its Powersports business, including brands like Arctic Cat, in Q2 2025 strongly suggests these were classified as 'Dogs' in the BCG Matrix. This implies they operated in low-growth markets with low market share, draining resources without substantial returns.

The strategic sale of these assets indicates they were viewed as cash traps, with capital better allocated to more promising ventures. In 2024, the powersports industry faced headwinds like supply chain issues and evolving consumer tastes, exacerbating the challenges for businesses with already weak market positions.

Similarly, certain older models within Textron Aviation's Cessna Citation line, which have seen declining sales and market share due to competition from newer, more advanced aircraft, likely fit the 'Dog' profile. These legacy products may require significant investment for maintenance and support without yielding proportional returns.

| BCG Category | Market Growth | Market Share | Textron Example | Strategic Implication |

| Dogs | Low | Low | Divested Powersports Business (e.g., Arctic Cat) | Divestiture or minimal investment to manage decline |

| Dogs | Low | Low | Older Citation Jet Models (e.g., specific CJ configurations) | Focus on fulfilling existing contracts, phased exit |

| Dogs | Low | Low | Legacy Industrial Product Lines (niche, mature markets) | Careful management to minimize losses, potential divestiture |

| Dogs | Low | Low | Obsolete Defense Programs (e.g., legacy radar systems) | Wind-down, fulfill existing contracts, reallocate resources |

Question Marks

Textron eAviation's Nexus eVTOL program is positioned within the burgeoning Advanced Air Mobility (AAM) sector. This market, while experiencing rapid growth potential, is still in its early development phases, meaning current revenue generation is minimal.

The program is currently characterized by significant investment in research and development, leading to operational losses. For instance, Textron Aviation's 2023 annual report indicated substantial R&D expenditures aimed at advancing its eAviation initiatives, including the Nexus eVTOL. Flight testing is a key milestone anticipated for 2025.

Given its current low market share and substantial capital requirements for scaling, the Nexus eVTOL program can be classified as a 'Question Mark' in the BCG Matrix. It represents a high-growth opportunity that necessitates continued strategic investment to capture future market share and transition into a 'Star' performer.

The Beechcraft Denali turboprop, while poised to enter a growing market, currently occupies a low market share due to its delayed certification, with initial deliveries now expected in 2025. Textron's significant investment in bringing this advanced aircraft to market aims to shift it from a question mark to a star within its portfolio.

The Citation Ascend represents Textron Aviation's strategic move into the burgeoning light to mid-size business jet segment. As a new entrant, scheduled for its first delivery in 2025, it currently holds a negligible market share but is poised to leverage the strong Citation brand equity.

This aircraft is designed to capture a significant portion of the market, necessitating substantial investment in sales and marketing to transition from a question mark to a star performer. Its success hinges on its ability to attract customers seeking a blend of performance and value in the evolving business aviation landscape.

New Technology Development in Textron Systems

Textron Systems is actively investing in cutting-edge defense technologies, including unmanned aerial vehicles (UAVs) and sophisticated sensor systems. These areas represent high-growth markets within the defense sector, characterized by rapid technological advancement and evolving customer needs.

These development projects are typically capital-intensive and may initially hold a small market share. However, they possess the potential for substantial future growth and market disruption. Textron Systems' commitment to sustained investment in these areas is critical for establishing leadership and capitalizing on emerging opportunities.

- Unmanned Systems: Textron Systems is a significant player in the unmanned systems market, with offerings like the Shadow tactical UAV. The global military drone market was valued at approximately $14.6 billion in 2023 and is projected to grow substantially.

- Advanced Sensors: Development in advanced sensor technology, such as electro-optical/infrared (EO/IR) systems and electronic warfare capabilities, is key to maintaining a competitive edge in modern defense.

- R&D Investment: Textron Inc. (Textron Systems' parent company) reported research and development expenses of $649 million in 2023, indicating a strong focus on innovation across its business segments.

- Future Potential: The success of these new technology developments hinges on their ability to gain traction and achieve significant market adoption, potentially transforming Textron Systems' portfolio.

Emerging Global Markets for Existing Products

Textron's existing aircraft and defense products might be targeting emerging global markets where its current market share is low, but the market itself is experiencing robust growth. These ventures are considered question marks because they necessitate substantial investment in marketing and sales to build a presence and achieve market acceptance, with outcomes that remain uncertain.

For instance, Textron's Bell segment could be looking at expanding its presence in Southeast Asia for its commercial helicopters, a region with increasing demand for air transport and emergency services. Similarly, its Textron Aviation division might be exploring opportunities for its business jets in rapidly developing economies in Africa or South America, where wealth creation is driving demand for private aviation.

- Emerging Market Entry: Textron is likely identifying regions with high GDP growth and increasing infrastructure development, such as India or parts of Eastern Europe, for its existing product lines.

- Investment Requirements: Establishing a foothold in these new territories demands significant upfront capital for sales infrastructure, distribution networks, and localized marketing campaigns.

- Market Share Potential: While current market share is minimal, the growth trajectory of these markets presents a substantial opportunity for Textron to capture significant share over time.

- Uncertainty of Outcome: Factors like regulatory hurdles, geopolitical stability, and local competition introduce a degree of unpredictability to the success of these market entries.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require significant investment to develop and capture potential market share, with uncertain outcomes.

Textron's eAviation Nexus eVTOL and the Beechcraft Denali are prime examples, demanding substantial R&D and market development to transition from nascent products to market leaders.

Similarly, Textron Systems' investments in advanced defense technologies like UAVs and sensors, alongside Textron's expansion into emerging global markets, fall into this category, balancing high growth potential with considerable investment needs and inherent risks.

| Business Unit/Product | Market Growth | Market Share | Investment Need | Outlook |

| eAviation Nexus eVTOL | High | Low | High (R&D, scaling) | Uncertain, potential Star |

| Beechcraft Denali | Growing | Low (delayed entry) | High (certification, market entry) | Potential Star |

| Textron Systems (UAVs, Sensors) | High | Low to Moderate | High (R&D, technology development) | Potential Star |

| Emerging Market Entries | High | Low | High (sales, distribution, marketing) | Uncertain, potential Cash Cow/Star |

BCG Matrix Data Sources

Our Textron BCG Matrix leverages comprehensive data from Textron's annual reports, investor presentations, and SEC filings, alongside industry growth forecasts and market share analysis.