Tetra SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tetra Bundle

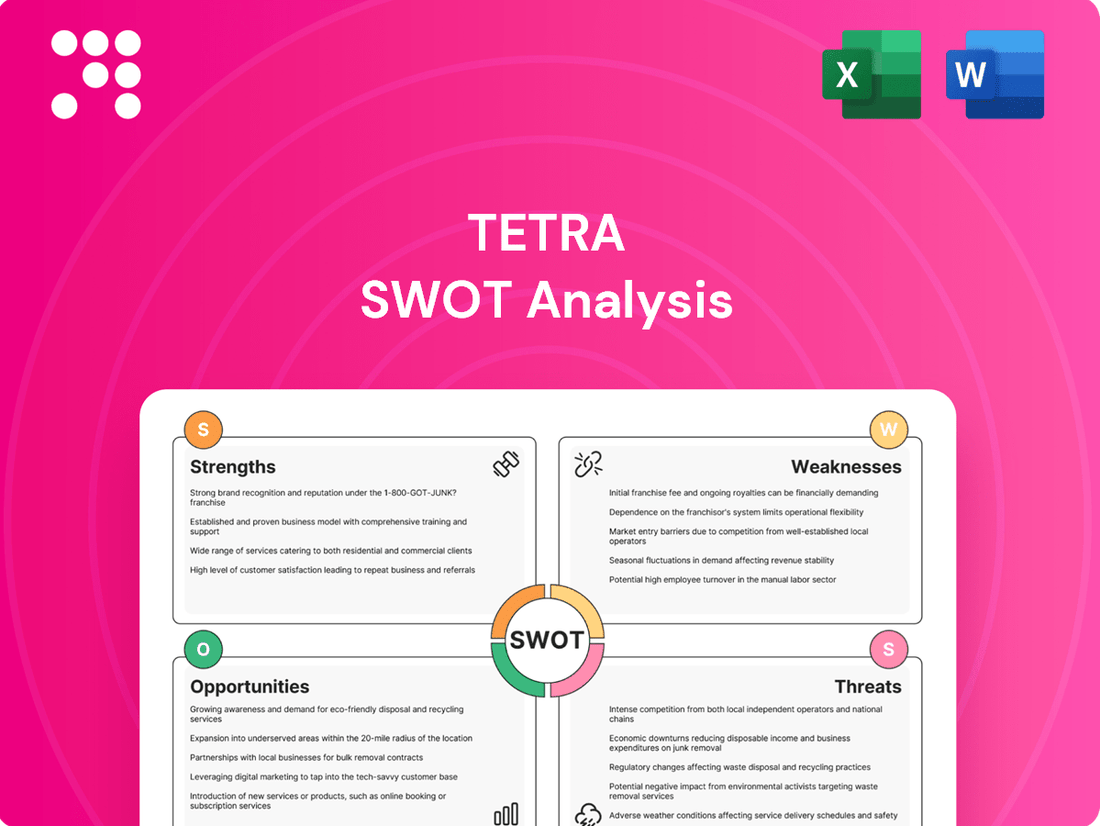

Curious about Tetra's competitive edge and potential pitfalls? Our comprehensive SWOT analysis dives deep into their market position, revealing crucial insights into their strengths, weaknesses, opportunities, and threats.

Ready to leverage this knowledge for your own strategic advantage? Unlock the full, detailed SWOT analysis today to access actionable intelligence, expert commentary, and an editable format perfect for planning and pitches.

Strengths

TETRA Technologies, Inc. boasts significant expertise in completion fluids, a crucial component for oil and gas well operations. This specialization is particularly valuable for demanding deepwater and high-pressure, high-temperature (HPHT) projects, where specialized fluids are essential for successful wellbore integrity and production. Their proprietary TETRA CS Neptune fluid, utilized in challenging U.S. Gulf of Mexico HPHT wells, exemplifies this niche capability.

TETRA Technologies is actively diversifying beyond its traditional oil and gas services, venturing into industrial chemicals and critical minerals like bromine and lithium. This strategic expansion leverages their existing chemistry expertise and mineral acreage, particularly within the Smackover Formation, to tap into the growing low-carbon energy sector.

The company’s industrial chemicals segment demonstrated strong performance, achieving its highest revenue and adjusted EBITDA in 2024. This success highlights the viability of their diversification strategy and provides a solid foundation for future growth opportunities in emerging markets.

TETRA Technologies achieved a record first-quarter adjusted EBITDA in 2025, alongside an increase in its adjusted EBITDA margins. This strong financial performance highlights the company's operational efficiency and market position.

The company maintains a robust liquidity position, bolstered by significant cash reserves and available credit facilities. This financial flexibility is essential for supporting current operations and executing strategic growth plans.

Further enhancing its liquidity, TETRA monetized its equity investment in Kodiak Gas Services Inc. in January 2025, realizing approximately $19 million in cash. This strategic divestment strengthens the company's financial footing.

Technological Innovation in Water Management

Tetra Technologies excels in technological innovation within water management, highlighted by its TETRA Oasis Total Desalination Solution (TDS). This industry-recognized system effectively treats and recycles produced water, enabling beneficial reuse and addressing significant environmental challenges. The TDS solution offers operators a cost-effective approach to water management.

This groundbreaking technology earned Tetra the prestigious 2025 Hart Energy Special Meritorious Engineering Award for Innovation, underscoring its leadership in the field. The award specifically recognized the TDS system's advanced capabilities in producing high-quality recycled water.

- Industry Recognition: TETRA Oasis TDS awarded the 2025 Hart Energy Special Meritorious Engineering Award for Innovation.

- Environmental Impact: The technology facilitates the treatment and recycling of produced water for beneficial reuse, addressing critical environmental concerns.

- Cost-Effectiveness: Provides operators with a financially viable solution for managing and repurposing water resources.

Robust Backlog and Deepwater Activity

TETRA Technologies is positioned for a solid start to 2025, thanks to a substantial and expanding backlog of deepwater projects. This strong foundation is a significant advantage as the company navigates the evolving energy landscape.

The company's Completion Fluids & Products segment is particularly benefiting from robust offshore activity, with a notable surge in deepwater operations in the Gulf of Mexico. This sustained demand for specialized deepwater solutions directly translates into a stable and predictable revenue stream for TETRA, underscoring their operational resilience and market position.

- Growing Deepwater Backlog: TETRA's backlog of deepwater projects is a key indicator of future revenue and operational stability.

- Gulf of Mexico Strength: Increased offshore activity in the Gulf of Mexico is a primary driver for TETRA's Completion Fluids & Products segment.

- Stable Revenue Stream: The consistent demand for deepwater solutions provides TETRA with a reliable income source.

- Operational Resilience: This strong market demand highlights TETRA's ability to consistently deliver specialized services in challenging environments.

TETRA Technologies' core strength lies in its deep expertise in completion fluids, particularly for challenging deepwater and HPHT projects, exemplified by their proprietary TETRA CS Neptune fluid. The company is successfully diversifying into industrial chemicals and critical minerals like bromine and lithium, leveraging its chemistry knowledge and mineral assets, especially in the Smackover Formation, to capture growth in the low-carbon energy sector. Their industrial chemicals segment achieved record revenue and adjusted EBITDA in 2024, validating this diversification strategy.

TETRA also demonstrated impressive financial health, achieving a record first-quarter adjusted EBITDA in 2025, coupled with improved margins, indicating strong operational efficiency. A robust liquidity position, supported by substantial cash reserves and credit facilities, further empowers their strategic initiatives. The company further solidified its financial standing by monetizing its Kodiak Gas Services Inc. investment in January 2025, realizing approximately $19 million in cash.

Innovation in water management is another key strength, highlighted by the TETRA Oasis Total Desalination Solution (TDS), which earned the 2025 Hart Energy Special Meritorious Engineering Award for Innovation. This system effectively treats and recycles produced water for beneficial reuse, offering a cost-effective and environmentally sound solution for operators. The company's substantial and growing backlog of deepwater projects, particularly in the Gulf of Mexico, ensures a stable revenue stream and underscores their operational resilience.

| Strength Area | Key Differentiator | Supporting Data/Examples |

|---|---|---|

| Completion Fluids Expertise | Specialized fluids for demanding environments | TETRA CS Neptune fluid for U.S. Gulf of Mexico HPHT wells |

| Diversification Strategy | Expansion into industrial chemicals and critical minerals | Record revenue and adjusted EBITDA for industrial chemicals in 2024; focus on bromine and lithium from Smackover Formation |

| Financial Performance | Strong profitability and liquidity | Record Q1 2025 adjusted EBITDA; $19 million cash realized from Kodiak Gas Services divestment (Jan 2025) |

| Water Management Innovation | Award-winning water treatment and recycling technology | 2025 Hart Energy Special Meritorious Engineering Award for Innovation (TETRA Oasis TDS); cost-effective beneficial reuse of produced water |

| Project Backlog & Offshore Activity | Robust demand for deepwater services | Growing backlog of deepwater projects; strong offshore activity in the Gulf of Mexico driving Completion Fluids & Products segment |

What is included in the product

Analyzes Tetra’s competitive position through key internal and external factors.

Offers a clear, organized framework to identify and address strategic challenges, reducing the stress of complex decision-making.

Weaknesses

Despite TETRA's ongoing diversification, a substantial portion of its revenue and profitability is still linked to the oil and gas sector. This industry is known for its cyclical nature and price volatility, directly affecting TETRA's financial results. For instance, a slowdown in U.S. onshore activity negatively impacted their fourth-quarter 2024 performance.

Tetra Technologies' Water & Flowback Services segment faced headwinds due to a slowdown in U.S. onshore completion activity during late 2024 and early 2025. This directly impacted revenue streams for this division. For instance, during the first quarter of 2025, the company reported a sequential decrease in revenue for this segment, reflecting the challenging market conditions.

While Tetra is actively implementing cost-saving measures and investing in automation to improve efficiency and offset these pressures, the sustained health of its Water & Flowback Services hinges on the recovery and stability of U.S. onshore oil and gas operations. A prolonged slump in these activities could continue to strain the segment's financial performance.

Tetra Technologies' pursuit of growth through significant capital investments, such as its bromine and lithium projects in Arkansas, presents a notable weakness. These ventures demand substantial upfront expenditures, which can strain immediate financial flexibility.

The impact of these capital-intensive initiatives is evident in the company's financial performance. For instance, Tetra reported an adjusted free cash flow usage of $9.3 million in the fourth quarter of 2024. This outflow was largely attributed to ongoing capital investments and an increase in inventory levels, highlighting the short-term pressure on cash generation.

Competition in Key Market Segments

TETRA operates in a moderately fragmented oilfield services sector, facing significant competition from both large, integrated providers and specialized firms. This competitive landscape, particularly within drilling and completion fluids, can exert pricing pressure and make securing new contracts more challenging. For instance, in 2024, the global oilfield services market is projected to see continued competition, with major players leveraging scale and existing client relationships to their advantage.

The presence of larger competitors with broader service offerings means TETRA must continually differentiate itself, potentially impacting its ability to capture market share in key segments. This dynamic is evident as companies like Schlumberger and Halliburton continue to dominate significant portions of the oilfield services market, often benefiting from bundled service contracts.

- Intense Rivalry: TETRA contends with well-established, larger competitors in core service areas.

- Pricing Pressures: The fragmented nature of the market can lead to downward pressure on service pricing.

- Market Share Challenges: Larger, integrated players may have an advantage in securing comprehensive contracts.

Potential Regulatory and Environmental Risks

Tetra Technologies operates within the oil and gas sector, an industry increasingly scrutinized for its environmental impact. Evolving regulations, such as stricter methane emission standards and new policies on produced water disposal, present significant challenges. For instance, the U.S. Environmental Protection Agency (EPA) has been actively developing new rules to curb methane emissions from oil and gas operations, which could require substantial investments in leak detection and repair technologies. These regulatory shifts can directly translate into increased compliance costs and necessitate costly operational adjustments, potentially impacting Tetra's profitability and limiting its strategic flexibility in certain operational areas.

The financial implications of these environmental regulations are a key weakness. Compliance with new standards, like those targeting methane emissions or water management, often requires capital expenditures for upgraded equipment and enhanced monitoring systems. For example, companies may need to invest in advanced vapor recovery units or more sophisticated wastewater treatment facilities. These investments, coupled with potential fines for non-compliance, can add a considerable burden to operating expenses. Furthermore, the uncertainty surrounding future regulatory changes makes long-term financial planning more complex, as companies must remain adaptable to potential new requirements.

- Increased Compliance Costs: New environmental regulations, such as methane emission standards, can force companies to invest in costly new technologies and processes.

- Operational Adjustments: Policies on water disposal and other environmental factors may require significant changes to existing operational procedures, impacting efficiency.

- Financial Strain: The combined effect of compliance costs and operational changes can strain financial resources, potentially reducing profitability and cash flow.

- Regulatory Uncertainty: The dynamic nature of environmental policy creates uncertainty, making it difficult to forecast long-term operational and financial impacts.

Tetra's reliance on the oil and gas sector, despite diversification efforts, remains a vulnerability. The industry's inherent price volatility directly influences Tetra's financial outcomes, as seen in the Q4 2024 performance dip due to U.S. onshore activity slowdown. Furthermore, substantial capital investments in projects like the Arkansas lithium and bromine ventures strain immediate financial flexibility, evidenced by $9.3 million in adjusted free cash flow usage in Q4 2024, largely for capital expenditures and inventory build-up.

The company also navigates a competitive landscape with larger, integrated players who can leverage scale and existing client relationships, potentially limiting Tetra's market share capture. Additionally, evolving environmental regulations, such as stricter methane emission standards and new water disposal policies, necessitate significant investments in compliance technologies and operational adjustments, increasing costs and creating regulatory uncertainty.

| Weakness Area | Description | Impact |

|---|---|---|

| Sector Reliance | Continued dependence on oil and gas revenue. | Vulnerability to industry cyclicality and price swings. |

| Capital Intensity | High upfront costs for growth projects (e.g., Arkansas lithium). | Strains immediate financial flexibility and cash flow. |

| Competitive Landscape | Presence of larger, integrated competitors. | Pricing pressures and challenges in market share acquisition. |

| Regulatory Environment | Increasingly stringent environmental regulations. | Higher compliance costs, operational adjustments, and uncertainty. |

Preview Before You Purchase

Tetra SWOT Analysis

This is the actual Tetra SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a direct representation of the content you'll download. Unlock the complete, detailed report by completing your purchase.

Opportunities

Tetra Technologies is strategically positioning itself to capitalize on the burgeoning demand for low-carbon energy solutions and critical minerals. Their investments in bromine and lithium projects, coupled with a focus on battery electrolyte sales, directly align with the global energy transition, offering a pathway to diversify revenue beyond traditional oil and gas sectors.

This expansion into new markets is crucial for reducing Tetra's dependence on legacy energy sources and tapping into the significant growth potential driven by the electrification of transportation and renewable energy storage. The company is set to unveil more details about this strategic direction and its growth initiatives at an upcoming Investor Day in September 2025.

Growing environmental awareness and stricter regulations within the oil and gas sector are significantly boosting the need for effective produced water treatment and recycling. TETRA's innovative technologies, such as TETRA Oasis TDS, are ideally positioned to meet this rising demand by providing economical and eco-friendly options for reusing this water.

This approach is already gaining traction, evidenced by a successful pilot program currently running in the Permian Basin, signaling strong market acceptance for TETRA's solutions in addressing produced water challenges.

TETRA's completion fluids business is poised for significant expansion, driven by a substantial backlog of deepwater projects and heightened offshore activity. Key regions like the U.S. Gulf of Mexico and Brazil are showing particular strength, indicating robust demand for TETRA's specialized services in these demanding environments.

While oilfield services spending in North America might see subdued growth, international markets present a compelling alternative for substantial revenue generation. This geographic diversification is crucial for TETRA's growth strategy, allowing them to tap into regions with higher offshore investment and project pipelines.

Technological Advancements and Automation

Tetra's commitment to technological advancement, exemplified by their TETRA SandStorm and Auto-Drillout units, presents a significant opportunity. These innovations are designed to streamline operations, leading to cost reductions and a higher quality of service. This focus on efficiency is crucial for maintaining a competitive edge, particularly when market conditions are less favorable.

By embracing automation and advanced technology, Tetra can unlock substantial improvements in operational efficiency and cost management. For instance, the adoption of such technologies can directly impact their cost of revenue, potentially leading to improved gross margins. In 2023, companies heavily investing in automation saw an average increase in productivity of 15-20%, a benchmark Tetra can aim for.

- Enhanced Operational Efficiency: Continued investment in patented technologies like TETRA SandStorm and Auto-Drillout drives streamlined processes.

- Cost Reduction: Automation directly contributes to lowering operational expenditures, boosting profitability.

- Improved Service Delivery: Technological integration leads to more reliable and effective service offerings.

- Competitive Advantage: Leveraging technology helps Tetra stay ahead in a dynamic and often challenging market environment.

Strategic Acquisitions and Partnerships

The oilfield services industry is seeing a trend towards consolidation, with companies actively seeking strategic mergers and acquisitions. TETRA Technologies (TETRA) can leverage this environment by identifying partnerships or acquisitions that bolster its current offerings, broaden its market presence, or improve its technological expertise. This is especially relevant in sectors like water management and critical minerals, where TETRA has been expanding its focus.

For instance, in early 2024, TETRA announced its intention to acquire the remaining stake in its joint venture, TETRA-EBS, which focuses on offshore well intervention services. This move signals a commitment to consolidating and strengthening its position in key operational areas. Such strategic moves can provide TETRA with enhanced scale, access to new technologies, and a more diversified revenue stream, crucial for navigating the evolving energy landscape.

Opportunities exist to acquire companies with specialized water treatment technologies or those involved in the extraction and processing of critical minerals, aligning with TETRA's stated diversification strategy. For example, the global water treatment market is projected to reach over $1 trillion by 2027, presenting significant growth potential for integrated service providers.

- Consolidation Trend: The oilfield services sector is actively consolidating, creating opportunities for strategic M&A.

- Complementary Services: TETRA can acquire or partner with firms offering water management or critical mineral extraction technologies.

- Market Expansion: Acquisitions can broaden TETRA's geographic reach and customer base.

- Technological Enhancement: Strategic moves can integrate advanced technologies, improving operational efficiency and service offerings.

Tetra Technologies is well-positioned to benefit from the global shift towards decarbonization and the increasing demand for essential minerals. Their strategic investments in lithium and bromine projects, alongside a focus on battery electrolyte sales, directly tap into the energy transition, offering a path to diversify revenue beyond traditional oil and gas operations.

The company's expansion into new markets is critical for reducing its reliance on older energy sources and capturing the substantial growth opportunities presented by the electrification of transport and the expansion of renewable energy storage solutions. Tetra plans to share more detailed information about this strategic direction and its future growth initiatives at an upcoming Investor Day scheduled for September 2025.

Growing environmental consciousness and more stringent regulations within the oil and gas industry are significantly increasing the need for effective produced water treatment and recycling methods. Tetra's innovative solutions, such as TETRA Oasis TDS, are perfectly suited to meet this rising demand by offering cost-effective and environmentally friendly options for water reuse. This approach is already showing promise, with a successful pilot program currently underway in the Permian Basin, indicating strong market acceptance for Tetra's solutions in tackling produced water challenges.

Tetra's completion fluids business is set for considerable growth, fueled by a robust backlog of deepwater projects and increased offshore activity. Key areas like the U.S. Gulf of Mexico and Brazil are demonstrating particular strength, pointing to high demand for Tetra's specialized services in these demanding operational environments. While oilfield services spending in North America might experience slower growth, international markets offer a significant opportunity for revenue expansion.

| Opportunity Area | Key Drivers | Tetra's Position |

| Energy Transition & Critical Minerals | Global decarbonization, electrification of transport, renewable energy storage demand | Investments in lithium and bromine, battery electrolyte sales |

| Water Management Solutions | Stricter environmental regulations, need for water reuse in O&G | Innovative technologies like TETRA Oasis TDS, successful pilot in Permian Basin |

| Offshore Completion Fluids | High deepwater project backlog, increased offshore activity in key regions | Strong demand in U.S. Gulf of Mexico and Brazil |

| International Market Expansion | Subdued growth in North America oilfield services spending | Focus on regions with higher offshore investment and project pipelines |

Threats

Volatile oil and gas prices pose a significant threat to TETRA Technologies. Fluctuations in these commodity markets directly influence exploration and production (E&P) activities, which in turn can reduce the demand for TETRA's specialized services and products. For instance, during periods of low oil prices, E&P companies often scale back their operations, leading to fewer project opportunities for service providers like TETRA.

A substantial or extended downturn in oil and natural gas prices can severely impact TETRA's financial performance. This is because a significant portion of their revenue is tied to the activity levels and capital expenditure budgets of their clients in the energy sector. For example, if crude oil prices remain below $60 per barrel for an extended period, it could lead to a noticeable contraction in TETRA's top-line revenue and overall profitability.

Stricter environmental regulations, like the EPA's proposed methane emission standards, present a significant challenge for Tetra. These evolving rules can lead to increased compliance costs and may necessitate substantial investments in new technologies to meet stricter operational requirements, potentially impacting Tetra's profitability and operational flexibility.

For instance, the U.S. Environmental Protection Agency (EPA) has been actively developing new regulations targeting methane emissions from the oil and natural gas sector. These regulations, expected to be finalized in 2024 and implemented thereafter, could require companies like Tetra to adopt advanced leak detection and repair (LDAR) programs and invest in vapor recovery units, adding to operational expenses.

The drilling and completion fluids market is indeed a crowded space, with major players like Schlumberger, Halliburton, and Baker Hughes vying for market share alongside many smaller, specialized companies. This crowded landscape puts significant pressure on pricing, potentially impacting TETRA's profitability and ability to maintain its market position.

Technological Disruption and Substitution

Technological disruption poses a significant threat to TETRA. Rapid advancements in drilling and completion methods, such as enhanced oil recovery (EOR) techniques or new fracking technologies, could reduce the need for some of TETRA's core services. For instance, the International Energy Agency (IEA) reported in 2024 that innovations in horizontal drilling and hydraulic fracturing continue to unlock previously inaccessible reserves, potentially altering the demand landscape for specialized equipment and services.

Furthermore, the global energy transition presents a long-term challenge. The increasing adoption of renewable energy sources and the accelerating shift towards electric vehicles (EVs) directly impact the demand for fossil fuels. By 2025, projections indicate that EVs could account for a substantial portion of new vehicle sales, a trend that will inevitably dampen oil consumption over time. This fundamental shift could reduce the overall market size for oil and gas exploration and production services, affecting companies like TETRA.

Key areas of concern include:

- Substitution by alternative energy: The growing efficiency and cost-competitiveness of solar, wind, and other renewables directly substitute for oil and gas in power generation and other sectors.

- Advancements in drilling technology: Innovations that make extraction more efficient or require less specialized equipment could lead to market share erosion.

- Electrification of transportation: The widespread adoption of EVs reduces the demand for gasoline and diesel, impacting the need for upstream oil services.

Supply Chain Disruptions and Geopolitical Instability

Global geopolitical tensions, particularly ongoing conflicts and trade disputes, continue to pose a significant threat to supply chains. For instance, the International Monetary Fund (IMF) projected in early 2024 that global growth would remain subdued, partly due to these persistent supply chain fragilities. These disruptions directly impact the availability and cost of essential raw materials and specialized equipment required for TETRA's projects, potentially leading to increased operational expenditures.

The ramifications of these supply chain challenges can extend to project timelines. Delays in sourcing critical components can push back project execution dates, impacting revenue recognition and client satisfaction. In 2024, many industries reported extended lead times for key manufacturing inputs, a trend that directly affects companies like TETRA that rely on timely delivery of specialized equipment.

Ultimately, these combined factors of increased costs and project delays can have a tangible effect on TETRA's overall financial performance. Unforeseen price hikes for materials or the need to secure alternative, more expensive suppliers can erode profit margins. Furthermore, the financial impact of delayed project completion can lead to penalties or loss of future business opportunities, underscoring the critical need for robust supply chain risk management.

- Increased Material Costs: Global commodity prices, influenced by geopolitical events, saw volatility throughout 2024, with some key materials experiencing price surges of 10-15% compared to pre-disruption levels.

- Extended Lead Times: Reports from industry analysis firms in late 2024 indicated average lead times for specialized industrial equipment had lengthened by an average of 20-30%, impacting project scheduling.

- Project Execution Delays: Supply chain disruptions have been cited as a primary reason for project delays in the infrastructure and energy sectors, with some projects experiencing postponements of 3-6 months.

- Financial Performance Impact: The combination of higher input costs and project delays contributed to a projected 5-8% reduction in profit margins for companies heavily reliant on global supply chains in 2024.

Intensifying competition within the oilfield services sector presents a significant threat to TETRA Technologies. The presence of large, established players and numerous smaller, agile firms creates a challenging pricing environment. For example, in 2024, market analysis indicated that pricing power for many specialized services remained constrained due to overcapacity in certain segments.

Technological advancements, particularly in drilling and completion techniques, could also diminish the demand for TETRA's existing service portfolio. Innovations like advanced automation or new material science applications might reduce the reliance on traditional methods. The International Energy Agency reported in 2024 that efficiency gains in hydraulic fracturing continue to evolve, potentially altering the need for certain fluid and chemical solutions.

The ongoing global energy transition poses a long-term threat as the world shifts towards renewable energy sources. By 2025, projections from the U.S. Energy Information Administration (EIA) suggest a continued, albeit gradual, decline in oil demand growth in developed economies, impacting the overall market size for upstream oil and gas services. This fundamental shift could pressure TETRA's core business segments over time.

| Threat Category | Specific Threat | Impact on TETRA | 2024/2025 Data/Trend |

|---|---|---|---|

| Market Competition | Intense competition in oilfield services | Pricing pressure, market share erosion | Market analysis in 2024 showed constrained pricing power due to overcapacity. |

| Technological Disruption | Advancements in drilling and completion | Reduced demand for existing services | IEA reported evolving efficiency gains in hydraulic fracturing in 2024. |

| Energy Transition | Shift to renewable energy sources | Long-term decline in oil demand | EIA projected gradual decline in oil demand growth in developed economies by 2025. |

| Regulatory Environment | Stricter environmental regulations (e.g., methane) | Increased compliance costs, investment needs | EPA's proposed methane standards expected finalization in 2024. |

SWOT Analysis Data Sources

This Tetra SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research studies, and expert industry commentary to provide a thorough and insightful assessment.