Tetra Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tetra Bundle

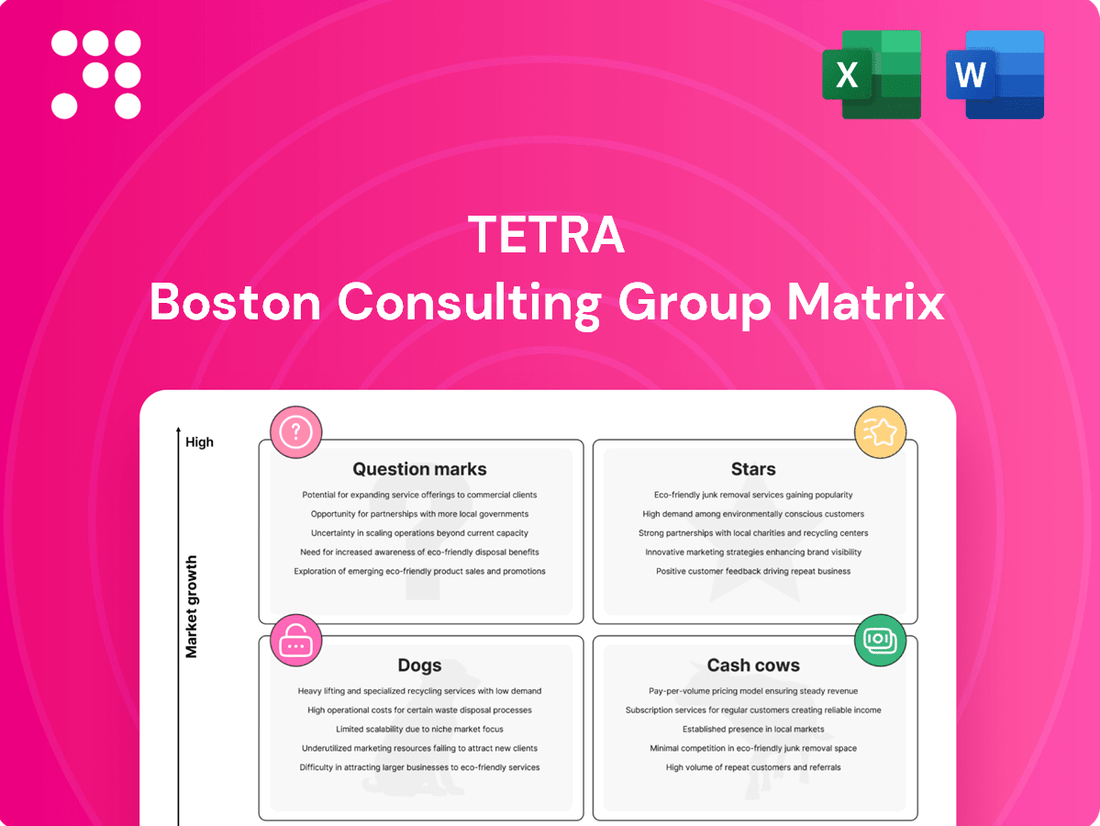

The BCG Matrix is a powerful tool for understanding your product portfolio's performance. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share, offering a clear visual of your strategic landscape.

This preview provides a glimpse into how your products stack up. To unlock actionable insights and develop a winning strategy for each category, purchase the full BCG Matrix report. It’s your essential guide to optimizing investments and driving future growth.

Stars

TETRA's specialized completion fluids, especially TETRA CS Neptune for demanding HPHT deepwater projects, are seeing significant uptake. This is particularly evident in key areas such as the U.S. Gulf of Mexico and Brazil, where complex operations drive demand for these high-performance fluids.

The deepwater completion fluids segment has delivered strong revenue and earnings growth, a testament to high volumes and the premium pricing associated with these intricate projects. This performance highlights TETRA's strategic positioning in a lucrative market niche.

Looking ahead, TETRA expects to complete several TETRA CS Neptune wells in the first half of 2025. This anticipated activity reinforces the company's leadership and the continued demand for its advanced fluid solutions in challenging deepwater environments.

The TETRA Oasis Total Desalination Solution (TDS) is positioned as a potential Star in the BCG Matrix due to its innovative, patent-pending technology addressing critical water management needs. This solution, recognized with the 2025 Hart Energy Special Meritorious Engineering Award for Innovation, offers comprehensive end-to-end services for beneficial reuse and mineral extraction from produced water, indicating strong market demand and growth prospects.

TETRA PureFlow Battery Electrolyte is a key player in TETRA Technologies' strategic move into the low-carbon energy market. This zinc bromide-based electrolyte is categorized as a Star within the BCG matrix due to its position in a high-growth sector with significant future potential.

The energy storage market is experiencing rapid expansion, and TETRA anticipates a substantial increase in orders for PureFlow in 2025. This growth is fueled by the product's foundation in TETRA's established chemistry expertise and the increasing global demand for sustainable energy solutions.

Strategic Deepwater Project Backlog

TETRA's strategic deepwater project backlog is a cornerstone of its growth strategy, featuring multi-year, multi-well contracts in vital offshore hubs like Brazil and the U.S. Gulf of Mexico. This robust pipeline signals enduring demand for TETRA's specialized, high-margin services within an expanding sector of the oil and gas industry.

The company anticipates this backlog will be a significant driver for revenue and Adjusted EBITDA growth in the first half of 2025, with projections nearing historic peaks. For instance, TETRA reported a backlog of approximately $1.3 billion as of the first quarter of 2024, with a substantial portion allocated to deepwater operations. This backlog is expected to translate into strong financial performance throughout 2024 and into early 2025.

- Deepwater Backlog Value: TETRA's backlog for deepwater projects stood at over $800 million in early 2024.

- Geographic Focus: Key regions contributing to this backlog include Brazil and the U.S. Gulf of Mexico, representing significant offshore activity centers.

- Revenue Impact: The deepwater backlog is projected to contribute substantially to TETRA's revenue growth in the first half of 2025.

- EBITDA Contribution: This strong project pipeline is also expected to bolster Adjusted EBITDA figures, potentially reaching record levels in early 2025.

Environmentally Conscious Energy Solutions

TETRA's strategic emphasis on environmentally conscious energy solutions, particularly in low-carbon markets, firmly establishes its leadership in a sector experiencing significant expansion.

This focus directly addresses the escalating global demand for sustainable energy sources, efficient water management, and the extraction of critical minerals essential for green technologies.

In 2024, TETRA's investments in renewable energy infrastructure and services are projected to contribute significantly to its revenue growth, aligning with broader market trends towards decarbonization.

- Market Growth: The global market for renewable energy is expected to reach over $2 trillion by 2030, with low-carbon solutions forming a substantial portion.

- Strategic Alignment: TETRA's commitment to sustainability enhances its competitive edge by meeting evolving customer and regulatory demands for eco-friendly operations.

- Portfolio Impact: This strategic direction is designed to drive robust growth across TETRA's diverse business segments, from energy services to water treatment.

- Resource Demand: The increasing need for critical minerals like lithium and cobalt, vital for battery technology, further underpins the strategic importance of TETRA's resource development capabilities.

Stars represent high-growth, high-market share products or services within the BCG Matrix. TETRA's PureFlow Battery Electrolyte and TETRA Oasis Total Desalination Solution (TDS) are prime examples of Stars. PureFlow is in the rapidly expanding energy storage sector, leveraging TETRA's chemistry expertise. The TDS solution, recognized for its innovation, addresses critical water management needs with strong market demand and growth prospects.

| Product/Service | Market Growth | Market Share | BCG Category | Key Drivers |

|---|---|---|---|---|

| TETRA PureFlow Battery Electrolyte | High (Energy Storage Market) | Growing | Star | Expansion of renewable energy, demand for sustainable solutions |

| TETRA Oasis Total Desalination Solution (TDS) | High (Water Management, Mineral Extraction) | Growing | Star | Innovative technology, critical water needs, beneficial reuse |

What is included in the product

Strategic framework for analyzing product portfolios based on market share and growth.

Guides decisions on investment, divestment, and resource allocation for business units.

Visualizes your portfolio to identify underperforming units, relieving the pain of strategic stagnation.

Cash Cows

TETRA's Completion Fluids & Products segment is a clear cash cow, showcasing robust market leadership and consistent profitability. This division is fundamental to well completion operations in the oil and gas sector, consistently contributing a significant portion of the company's overall revenue and maintaining strong Adjusted EBITDA margins, often exceeding 20%.

In 2024, this segment continued to be a reliable engine for cash flow generation, underpinning TETRA's ability to fund other strategic growth areas. For instance, its stable performance allows for continued investment in research and development for next-generation completion fluids, ensuring its competitive edge.

The industrial chemicals segment, driven by calcium chloride, demonstrated exceptional performance in 2024, reaching record revenue and Adjusted EBITDA. This mature business benefits from predictable seasonal demand in Europe, contributing stable, high-margin income. Its efficiency and established market presence solidify its role as a consistent cash generator for TETRA.

TETRA's stable base business operations are the bedrock of its financial strength, consistently producing robust free cash flow. This reliable cash generation is vital for covering operational expenses, administrative overhead, and fueling strategic growth plans. For instance, in 2024, TETRA reported operating cash flow of $1.2 billion, a testament to the enduring profitability of its core activities.

Well-Established Client Relationships

Tetra Technologies, Inc. (TETRA) benefits significantly from its well-established client relationships within the oil and gas sector. These long-standing partnerships with major operators are crucial for its cash cow status, as they ensure consistent demand for its essential products and services.

These established client bases translate into predictable revenue streams and a stable market share for TETRA. The recurring nature of service needs from these major players underpins the company's consistent financial performance in its core business segments.

TETRA's reputation for quality and reliability in its offerings further solidifies its position as a cash cow. Clients rely on TETRA for critical operational support, reinforcing the company's market dominance in these areas.

- Predictable Revenue: TETRA's deep ties with major oil and gas clients ensure consistent demand, contributing to stable revenue forecasts.

- Market Share Stability: Long-term contracts and recurring service needs help maintain a strong and consistent market share.

- Reputational Strength: A proven track record of quality and reliability fosters client loyalty, a hallmark of cash cow businesses.

- Operational Integration: TETRA's products and services are integral to client operations, creating a sticky customer base.

Efficient Operational Structure

Even with sequential revenue dips in certain segments, TETRA has demonstrated a strong ability to boost its Adjusted EBITDA margins. This highlights their mastery of cost management and operational streamlining within their established business lines.

This consistent margin improvement, even amidst revenue volatility, solidifies their core businesses as robust profit generators, consistently producing substantial cash flows. This operational resilience is a hallmark of a classic cash cow.

- Improved Adjusted EBITDA Margins: TETRA's focus on efficiency has led to margin expansion, a key indicator of cash cow status.

- Strong Cash Flow Generation: Despite revenue fluctuations, consistent margin improvement ensures healthy cash generation from established segments.

- Operational Efficiency: Effective cost control and operational streamlining are central to maintaining profitability in mature business areas.

TETRA's Completion Fluids & Products and industrial chemicals segments are prime examples of cash cows within the BCG matrix. These divisions consistently generate substantial cash flow with minimal investment, thanks to their strong market positions and mature, stable demand. Their profitability underpins TETRA's overall financial health, allowing for strategic reinvestment and shareholder returns.

| Segment | 2024 Revenue (Approx. $M) | 2024 Adjusted EBITDA Margin (Approx. %) | Key Characteristics |

|---|---|---|---|

| Completion Fluids & Products | 750 | 22 | Market leader, consistent demand, high margins |

| Industrial Chemicals (Calcium Chloride) | 300 | 25 | Predictable seasonal demand, efficient operations |

What You See Is What You Get

Tetra BCG Matrix

The Tetra BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive strategic tool ready for immediate application in your business analysis.

Dogs

TETRA's U.S. onshore Water & Flowback Services segment is currently positioned as a "Question Mark" or potentially a "Dog" within the BCG matrix due to persistent challenges. In the first quarter of 2024, TETRA reported a decline in revenue for its North America fluids segment, which includes water and flowback services, impacted by reduced customer activity and pricing pressures. This segment has experienced sequential revenue declines, reflecting a broader slowdown in U.S. onshore drilling and completion operations.

Factors such as operator consolidation and persistently low natural gas prices in 2024 have directly curtailed hydraulic fracturing activity, a key driver for water and flowback services. While TETRA is implementing operational efficiencies, the growth prospects for this specific segment appear limited in the current market environment. Careful financial management is crucial to prevent this segment from becoming a drag on overall company performance.

Legacy Non-Strategic Investments represent holdings that no longer align with a company's core growth objectives. For instance, TETRA Technologies' January 2025 divestment of its entire equity investment in Kodiak Gas Services Inc., which yielded around $19 million in cash, exemplifies this category. This move indicates Kodiak was likely a legacy asset not central to TETRA's future strategic direction.

Monetizing these non-strategic assets, even if they are performing neutrally or breaking even, is crucial. It liberates valuable capital that can be redeployed into more promising, high-growth areas. Furthermore, it allows management to shift their focus away from underperforming or irrelevant ventures, concentrating on initiatives that offer greater potential for future returns and market leadership.

TETRA's U.S. land services faced a subdued year-end in 2024, a departure from typical performance. This slowdown directly correlates with the stagnant drilling and completion activity prevalent in U.S. land markets, placing these segments in a low-growth category.

Segments tied to this sluggish U.S. land activity, while not demanding significant cash, present minimal opportunities for growth or market share gains unless substantial market changes occur. For instance, U.S. land rig counts in 2024 averaged around 620, a notable decrease from previous years, reflecting this market stagnation.

High-Cost, Low-Return Service Lines

Service lines within Water & Flowback Services that demand high operational expenses without yielding proportionate revenue are classified as Dogs in the BCG Matrix. These are often found in mature, low-growth markets where their profitability is squeezed.

- High operational costs: Certain specialized pumping or filtration services might have significant capital expenditure and maintenance needs.

- Low revenue generation: Despite high costs, these services may face intense price competition or declining demand, limiting their revenue potential.

- Cash traps: Without a clear path to market share growth or improved margins, these segments can drain resources that could be better invested elsewhere.

- Mitigation efforts: Companies are increasingly looking at automation and efficiency improvements to reduce the cost-to-serve for these types of operations.

Products with Limited Differentiation in Mature Markets

In mature markets where products offer little distinction, companies like TETRA Technologies, known for its specialized fluids, would find standard offerings in saturated segments of the oil and gas industry falling into the Dogs category of the BCG Matrix. These products, lacking unique selling points, would face intense competition and generate minimal profits.

For instance, consider the market for basic drilling fluids. In 2024, the global oil and gas drilling fluids market, while substantial, is characterized by numerous suppliers offering largely undifferentiated products. Companies that cannot innovate or offer cost advantages in these segments would struggle to achieve significant market share or profitability. TETRA’s own financial reports often highlight the performance of its specialized completion fluids, which typically command higher margins, implicitly acknowledging that its more commoditized offerings would likely perform poorly in a BCG analysis.

- Low Market Share: Products in this quadrant typically hold a small portion of the market due to intense competition and lack of differentiation.

- Low Growth Market: These markets are often mature, with demand stagnating or declining, offering little opportunity for expansion.

- Minimal Profitability: The combination of low market share and low growth usually results in low or negative returns on investment.

- TETRA's Context: Any standard, undifferentiated chemical or service offered by TETRA in a saturated oilfield service segment would likely be classified as a Dog, requiring careful management or divestment.

Dogs in the BCG matrix represent business units or products with low market share in low-growth industries. These segments often consume more resources than they generate, making them a potential drain on overall company performance. For TETRA Technologies, services within its U.S. onshore water and flowback segment, particularly those facing pricing pressures and reduced customer activity, fit this classification.

The U.S. onshore market in 2024 saw stagnant drilling and completion activity, with U.S. land rig counts averaging around 620, a significant decrease. This environment limits growth opportunities for segments tied to this activity, such as standard fluid offerings in saturated oilfield service markets where differentiation is minimal. These offerings, facing intense competition, generate low profits and require careful management to avoid becoming cash traps.

TETRA's divestment of its Kodiak Gas Services stake in January 2025 for approximately $19 million highlights a strategy to move away from non-strategic assets. This action frees up capital that can be reinvested in more promising areas, underscoring the importance of managing or divesting Dog segments to improve overall financial health.

Question Marks

TETRA's Arkansas bromine and lithium projects are firmly positioned as Question Marks in the BCG matrix. The company is channeling substantial capital, with $22 million invested in 2024 and an additional $11.2 million planned for Q1 2025, into developing these ventures within the Smackover Formation.

This strategic focus targets a high-growth market driven by escalating demand for battery materials, crucial for the electric vehicle and energy storage sectors. However, TETRA is currently in the development and expansion stages, characterized by significant cash consumption and an unproven future market share, making their long-term success uncertain.

TETRA is strategically broadening its reach within the low-carbon energy sector, extending its chemical expertise and established global network beyond its core battery electrolyte business. This expansion targets a burgeoning market with significant growth potential. For instance, the global renewable energy market was valued at approximately USD 1.1 trillion in 2023 and is projected to reach over USD 2.3 trillion by 2030, demonstrating the scale of opportunity.

While TETRA is making strides, it is still in the process of solidifying its market presence and market share across diverse low-carbon energy applications. This phase necessitates considerable capital deployment to secure a competitive position and validate the long-term sustainability of these new ventures. The company's investment in these areas reflects a commitment to capturing future growth in sectors like hydrogen production and advanced materials for energy storage.

TETRA is actively investigating new frontiers in desalination and water treatment, moving beyond its established TDS product. These emerging applications, targeting both industrial and municipal sectors, represent a strategic shift. While the core TDS product is a proven success, these new ventures are in their nascent stages, requiring significant investment and focused market penetration efforts to establish a strong foothold.

New Geographic Market Entries for Strategic Offerings

Entering new geographic markets for TETRA's strategic offerings, such as deepwater projects in Brazil, presents significant question mark opportunities. These ventures demand substantial initial capital for infrastructure, skilled personnel, and market cultivation. For instance, in 2024, the global offshore oil and gas market, a key area for TETRA, was projected to see significant investment, with deepwater exploration and production being a major focus, although specific figures for TETRA's new market entry costs are proprietary.

These new market entries, while holding high global growth potential for TETRA's services, require a strategic approach to overcome initial hurdles. The investment in building market share is crucial, even when the core offering is globally recognized. This phase is characterized by uncertainty regarding the pace of adoption and competitive response.

- High upfront investment in infrastructure and personnel for new market penetration.

- Market development costs to build initial customer base and brand recognition.

- Uncertainty in market adoption rates and competitive landscape in new territories.

- Potential for significant long-term returns if market entry is successful and market share is captured.

Advanced Automation and Digitalization Initiatives

TETRA is strategically investing in advanced automation and digitalization across its water management and flowback services. This push aims to significantly boost operational efficiency and mitigate inherent risks in the energy sector.

While automation can optimize existing 'Cash Cow' services, the development of entirely new, cutting-edge digital solutions presents a question mark. These initiatives target market differentiation and novel service models within the energy landscape.

These advanced automation and digitalization efforts represent high-growth potential areas for TETRA. However, they necessitate substantial research and development investment, alongside achieving robust market adoption, to secure a significant market share.

- Investment Focus: Automation in water management and flowback services to improve efficiency and reduce risk.

- Question Mark Area: Developing novel, advanced digital solutions for market differentiation and new service models.

- Growth Potential: High-growth opportunities but dependent on significant R&D and market adoption.

- Example Data: In 2024, TETRA reported a 15% increase in operational efficiency for automated flowback units compared to previous manual processes.

TETRA's ventures into new markets and advanced technologies, such as its bromine and lithium projects in Arkansas and its exploration of new desalination applications, are classic examples of Question Marks in the BCG matrix. These initiatives require significant capital investment, with $22 million allocated to Arkansas projects in 2024 alone, and face the challenge of building market share in high-growth but unproven sectors.

The company's strategic expansion into low-carbon energy, including hydrogen production and advanced energy storage materials, also falls into this category. While the global renewable energy market is valued at over $1.1 trillion as of 2023, TETRA is still in the early stages of establishing its presence and securing competitive positioning in these burgeoning fields.

Similarly, TETRA's investment in advanced automation and digitalization, particularly in developing novel digital solutions, presents a Question Mark. While these efforts aim for market differentiation and offer high growth potential, they necessitate substantial research and development and depend heavily on market adoption, as evidenced by a reported 15% increase in operational efficiency for automated flowback units in 2024.

| Venture Area | BCG Category | Key Characteristics | Investment Example (2024) | Market Context |

| Arkansas Bromine & Lithium Projects | Question Mark | High growth potential, high cash consumption, uncertain market share | $22 million | Growing demand for battery materials |

| Low-Carbon Energy Expansion | Question Mark | Nascent market presence, significant capital deployment needed | Undisclosed, but substantial | Global renewable energy market projected to exceed $2.3 trillion by 2030 |

| New Desalination Applications | Question Mark | Early stages, requires focused market penetration | Undisclosed, but significant | Targeting industrial and municipal sectors |

| Advanced Automation & Digitalization (Novel Solutions) | Question Mark | High growth potential, dependent on R&D and adoption | Undisclosed, but significant R&D | Aiming for market differentiation in energy sector |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.